Professional Documents

Culture Documents

stratax reviewer

stratax reviewer

Uploaded by

Sarah DizonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

stratax reviewer

stratax reviewer

Uploaded by

Sarah DizonCopyright:

Available Formats

INCOME TAXATION

Sectors:

1. Government - BIR (agent of executive branch)

2. Education/Academe (Higher educational institution)

3. Private/Commerce & Industry

4. Public

Branches of the government:

1. Executive - headed by the president; administration/collection of taxes (DOF-BIR)

2. Legislative - senate and congress; levy of tax laws

3. Judiciary

Penalties of the BIR: (no filing/late filing; no payment/late payment)

1. Interest - 12% annual (prorated)

2. Surcharge - 25% (fixed) - 50% willful act/intention

3. Compromise penalty - minimum of 1,000 per form/tax return and per month

0 tax - file only need; ex: minimum wage earner, below 250,000 annual compensation

Statement of Management Responsibility - signed by the president/chairman (if magkaiba, dapat both) & treasurer; fs is

the responsibility of the steward of the business/management

70% understated - negligence of the auditor

Self-assessment - system of tax in the Philippines; individuals declare and assess their taxes > pay

Tax map - surprise audit of the BIR, pupunta sa lugar to check documents; penalty if nahuli (pupunta sa revenue district

office 21A, 21B, 21C)

30 days allowance - to register a business (permit then BIR)

Permit - sinasabi if business is legal; closure if nahuli

Wrong venue - nagfile sa maling lugar; equivalent to no filing

INCOME TAXATION OVERVIEW

Classification of taxes:

1. As to subject matter

a. Personal tax - poll tax or cedula/community tax certificate or capitation tax (pag di binayad, di pwedeng

makulong kase di required and immaterial)

b. Property tax - real estate tax or amilyar

c. Excise tax - privilege tax

i. Privilege to do business - business tax

ii. Privilege to earn income - sales/revenue - costs - administrative & general expenses = net

income

2. As to incidence

a. Direct

b. Indirect - VAT (passed-on tax)

3. As to imposing authority

a. National - paid to BIR

b. Local - paid to barangay

Receipt should have:

1. Trade name; Proprietor

2. Complete address

3. VAT/Non-VAT

4. TIN

Sales invoice - goods

Official receipt - service

Income tax

1. Privilege tax

2. Direct tax

3. National tax

Statutory taxpayer - stated in the statute of the law

Economic taxpayer - shoulder the burden

Types of taxpayer according to BIR:

1. Individual - proprietor/employee/professional

2. Non-individual - corporation

INDIVIDUAL NON-INDIVIDUAL

SYSTEM OF progressive - the higher the taxable income, fixed - proportionate (basta may net income)

TAXATION the higher the tax rate, thus the higher the tax

old rate 30% of taxable net income (RCIT: Regular

0%-35% - January 1, 2018 to December 31, Corporate Income Tax)

2022 (TRAIN: Tax Reform for Acceleration and new rate - July 1, 2020 (retrospective)

Inclusion Law) 25% (general)

20% - total asset < 100million (excluding land); annual

annual taxable income >250,000 or below = no net taxable income < 5million

income tax

MCIT: Minimum Corporate Income Tax - old rate: 2%

of taxable gross income

new rate 1% - July 1, 2020 to June 30, 2023

CREATE: Corporate Recovery and Tax Incentives for

Enterprises

effectivity (general provision): April 11, 2021 (15 days

from date of publication)

signed March 26, 2021

published March 27, 2021

repeal of IAET (improperly accumulated earnings tax)

SOURCES Compensation income - employee-employer Business income

OF relationship; with 13th month pay

INCOME

Business income - customers, clients, and

suppliers; professional fees

Purely earning compensation income - one

employer (BIR Form 2316); two or more

employees

Purely earning business income

Mixed-income earner

ANNUAL BIR Form 1700 - purely earning compensation BIR Form 1702RT (regular tax) - 25% RCIT; 2% MCIT

INCOME income of more than one employer whichever is higher

TAX consolidation of income

RETURN BIR Form 1702Mx (mixed) - special tax rates

BIR Form 1701A - 40% OSD; 8% GIT (in lieu of PEZA; if meron CORTE (Certificate of Registered

RT 0% - 35% and percentage tax Tax Exempted Activity)

Annex - indicate assets, liabilities, equity, 5% of gross income

income, revenue, expenses

BIR Form 1702Ex (exempted) - file only

BIR Form 1701 - itemized deduction

(graduated rate) (attachment of FS or AFS)

default 4 pages

Components of complete audited annual financial statements: -available to all stakeholders

1. Balance Sheet or Statement of Financial Position

2. Statement of Comprehensive Income - results of operation

3. Statement of Changes in Equity

4. Cash Flows Statement

5. Notes to Financial Statement

Minimum Corporate Income Tax (MCIT) - imposed on the 4th year following the 1st year of operations of the business

Sole proprietorship - ease of formation (DTI); unlimited liability for the sole; no business entity concept

Corporation - too many requirements (SEC - Online Submission Tool); limited liability for stockholders; business entity

concept - artificial or judicial being (law)

One Person Corporation (OPC) - exception sa 5 to 15 incorporators

Components of equity:

1. Share capital

2. Share premium

3. Retained earnings - unappropriated if silent

Schemes of taxation

1. Regular taxation - ordinary or nominal income (ITR)

2. Final taxation - passive income; bago makuha pera, naless na ung tax

a. Is Interest income

b. Your Yields

c. Relative Royalties

d. Playing Prizes - effort

e. With Winnings - luck

f. Dota/ Dividend income

g. Solitaire Share of Partner

3. Exempt taxation - non-profit non-stock

BIR Form 2303 - certificate of registration; crucial information about the taxpayer

Revenue District Office (RDO) - top

RDO 21A - North Pampanga (Angeles, Porac, Mabalacat; office: sindalan (right)

RDO 21B - South Pampanga (San Fernando, San Simon); office: sindalan (left)

RDO 21C - Clark Freeport Zone

General ways to file

1. Manual filing - mano mano susulatan and ssubmit sa office ng BIR (8am-5pm)

2. eBIRForm program - downloadable (www.bir.gov.ph)

3. Electronic filing and payment system (EFPS) - option to enroll or mandated (TAMP: withholding agent, top

corporations, special tax, bid for government); highest level for filing; di na pede gumamit ng ibang filing unless

may problem > magpareceive ng letter sa RDO tas request magpaalam na eBIR > attach the letter kapag inaudit

ni BIR para iwas penalty

TIN - 9 digits; last 3 numbers branch; isang tin sa buong lifetime

Trade name, address, name - basis: articles of incorporation (corporation); DTI certificate (sole)

BIR Form 2316

- ginagawa ng employer so no need to file

- under substituted filing (no need to register and file > may magssubstitute)

- filed by the employer sa Alphalist

- submitted manually sa BIR

- deadline: February 28 of the following year

4 pages - default ITR

File name sa nareceive na email - tin-bir form-date covered

April 15 - deadline of ITR default

BUSINESS TAXATION

Business Taxation - based on the privilege of the taxpayer to do business

- STATUTORY TAXPAYER: Seller

SELLER CAN BE EITHER: (BIR Form 2303)

1. Vat-registered Value Added Tax - 12%

Annual revenue or sales threshold: 3,000,000 (if below, the seller will have the option to

choose between VAT or percentage)

Continuous, di na pede magdowngrade

2. NONVAT-registered Percentage tax - previously 3%; CREATE reduced to 1% from July 1, 2020

to June 30, 2023

Sales = Invoice price

VALUE ADDED TAX (passed-on tax) PERCENTAGE TAX

VAT Payable = Output VAT - Input VAT (Balance Sheet Percentage Tax Payable = Sales * PTR

Accounts) (Taxes and Licenses Expense)

Output VAT - liability Input VAT - asset

For calendar year: quarterly BIR Form 2551Q

monthly BIR Form 2550M (deadline: 20 days after the

month)

January, February, April, May, July, August, October, &

November

quarterly BIR Form 2550Q (deadline: 25 days after the

month)

1st Qtr (March), 2nd Qtr (June), 3rd Qtr (September), &

4th Qtr (December)

For fiscal year:

monthly - first 2 months of each quarter

VAT threshold - 3 million anually

TRANSACTIONS IN BUSTAX IN GENERAL

1. Vatable Sales 12% Output VAT on Vatable Sales - 12% Input VAT on Vatable Purchases

2. Zero-Rated Sales Export Sales; 0% Output VAT - 12% Input VAT on Vatable Purchases (excess input can be

refunded from BIR 3 years from the date of payment)

3. Exempt Sales Zero (not part of BusTax but is a part of InTax return in computing net income)

Withholding tax payable - 10th of the following month (deadline)

NOTES (STRATEGIES)

1. Barangay Micro Business Enterprises (BMBEs)

Total assets (excluding land) will not exceed 3 million

Nature of business: service or trading, not practice of profession

Exempted from income tax

Exemption coverage of minimum wage law (employees still need to receive SSS, PhilHealth, and Pag-ibig

benefits)

Special credit window financing

Training and assistance program

2. Maximize de minimis (BIR Form 1601C - withholding tax on compensation of employees filed by the employer)

and 90,000 exempted 13th month pay and other benefits

3. Substantiation of allowable deductions

Expense must be needed in the ordinary course of the business; related to business; receipted

Proper receipt: Official receipt (authority to print); Sales Invoice

Complete details: Name, TIN, Address, Business Style

Withholding tax expanded payable (BIR Form 0619E and 0619EQ): Rental 5%; Agency Fee 2%;

Professional 10%

4. For NONVAT individual, consider exploring options

Itemized deduction (default)

1st quarter of the taxable year: 40% OSD on sales/revenue in lieu of itemized deduction

8% GIT in lieu of RT and percentage tax

5. Follow up on 2307: income tax or 2306: business tax (tax credit: binabawas sa tax due)

6. Be mindful of limits for deductability

Interest expense (interest arbitrage) - allowable deduction for IE shall be reduced by an amount equal to

20% of international income subject to final income

Bad debts - deductible when written off subject to certain requirements

Charitable contributions - ordinarily may not exceed 5% of taxable income; however, contributions to

certain institutions are 100% deductible subject to certain conditions

Entertainment expenses - shall not exceed ½% or 0.005 of net sales (goods) or 1% or 0.01 for net

revenue (services)

Special deductions - CREATE for some registered entities additional 50% for training expenses (direct

related to operations with certain conditions)

Fines and penalties - interest penalties are deductible; surcharge and compromise penalties imposed for

non-payment or late payment of taxes are not deductible

NOLCO - 3 consecutive taxable years; RA 11494 or Bayanihan to Recover as one Act (NOLCO for TY 2020

and 2021) may be carried over for the next 5 consecutive taxable years following such loss

ILLUSTRATION 1: MWE

Individual taxpayer - minimum wage earner - exempt from income tax (basic, holiday, night differential, overtime,

hazard)

a) SSS, PhilHealth, and Pag-ibig Employee share -

nontaxable

13th month pay and other benefits - 90,000 threshold

De minimis benefits - exempt from income tax

Basic pay (MWE) -exempted

b) Basic pay and additional pay (MWE)

ILLUSTRATION 2: INDNIVIDUAL; NONVAT (LESS THAN 3 MILLION SALES OR RECEIPTS FOR THE YEAR)

OPTION 1: Graduated rate + Percentage OPTION 2: 8% GIT

OPTION 3: 40% OSD + Percentage

ILLUSTRATION 2-A: INDNIVIDUAL; NONVAT (LESS THAN 3 MILLION SALES OR RECEIPTS FOR THE YEAR)

OPTION 1: Graduated rate + Percentage OPTION 2: 8% GIT

OPTION 3: 40% OSD + Percentage

You might also like

- Conceptual QuestionsDocument43 pagesConceptual Questionsbinod gaire0% (1)

- Sabc 1702Q1Document3 pagesSabc 1702Q1Marienhela MeriñoNo ratings yet

- Tax Structure and Basic ConceptsDocument64 pagesTax Structure and Basic Conceptstushar_shetti100% (1)

- Annual Income Tax Return: Yes No Yes NoDocument14 pagesAnnual Income Tax Return: Yes No Yes NoJoyce Ann CortezNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- Quarterly Income Tax Return: Yes NoDocument3 pagesQuarterly Income Tax Return: Yes NoSusan P LauronNo ratings yet

- BIR Form 1702QDocument3 pagesBIR Form 1702QMique VillanuevaNo ratings yet

- 1702 RTDocument4 pages1702 RTMaricor TambalNo ratings yet

- 1701A Jan 2018 v5 With RatesDocument5 pages1701A Jan 2018 v5 With RatesGretchen CaasiNo ratings yet

- Company TaxDocument23 pagesCompany TaxCyndy NgwenNo ratings yet

- Taxation LawDocument11 pagesTaxation LawCee HonasanNo ratings yet

- Income Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)Document5 pagesIncome Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)gdmurugan2k7No ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet

- 1702-RT Jan 2018 ENCS Final v3 PDFDocument4 pages1702-RT Jan 2018 ENCS Final v3 PDFR A GelilangNo ratings yet

- Taxation SlideDocument26 pagesTaxation SlidePei Jia WahNo ratings yet

- (10389) Income Tax Presentation - Learner Copy v4 2023Document72 pages(10389) Income Tax Presentation - Learner Copy v4 2023Hirschmitha GeneshNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoRichelle Ann RodriguezNo ratings yet

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXJp AlvarezNo ratings yet

- 1702-EX Jan 2018 ENCS Final v3 PDFDocument3 pages1702-EX Jan 2018 ENCS Final v3 PDFLuz SudarioNo ratings yet

- TAX 06 - RIT Gross IncomeDocument3 pagesTAX 06 - RIT Gross IncomeEdith DalidaNo ratings yet

- Regular Income TaxationDocument12 pagesRegular Income TaxationMa. Alessandra BautistaNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Direct Tax Chapter 1 To 10 AmendedDocument45 pagesDirect Tax Chapter 1 To 10 AmendedAsad RizviNo ratings yet

- Annual Income Information Form For General Professional PartnershipsDocument2 pagesAnnual Income Information Form For General Professional PartnershipsAlvin Dela CruzNo ratings yet

- Ryan RemsDocument56 pagesRyan Remsmimi supasNo ratings yet

- Pro Pyme GeneralDocument11 pagesPro Pyme GeneralSofia OgaldeNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoDerwin AraNo ratings yet

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- Taxation 4Document8 pagesTaxation 4Bossx BellaNo ratings yet

- NOLCODocument8 pagesNOLCOChristopher SantosNo ratings yet

- TaxDocument19 pagesTaxjhevesNo ratings yet

- Corporate - Income - Tax (CIT) 2022Document44 pagesCorporate - Income - Tax (CIT) 2022Thảo Nhi Đinh TrầnNo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document14 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)TatianaNo ratings yet

- Filing of Income Tax ReturnDocument11 pagesFiling of Income Tax Returnkirko100% (1)

- Cordillera A Computer Technology College: "Excellence Is Our Business and Our Commitment"Document7 pagesCordillera A Computer Technology College: "Excellence Is Our Business and Our Commitment"Carmina DongcayanNo ratings yet

- Tax Updates BGC Jekell Dec13, 2019Document115 pagesTax Updates BGC Jekell Dec13, 2019Darlene GanubNo ratings yet

- FABM2 Module 09 (Q2-W3-5)Document9 pagesFABM2 Module 09 (Q2-W3-5)Christian Zebua50% (4)

- Far Eastern University: An Institute of Accounts Business and FinanceDocument5 pagesFar Eastern University: An Institute of Accounts Business and FinanceAcademic StuffNo ratings yet

- Endorsement Slip: Income TaxationDocument21 pagesEndorsement Slip: Income TaxationJessaNo ratings yet

- TAX-CPAR Lecture Filing and Penalties Version 2Document23 pagesTAX-CPAR Lecture Filing and Penalties Version 2YamateNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXRen A EleponioNo ratings yet

- VAPP Webinar HandoutsDocument17 pagesVAPP Webinar HandoutsMarlon De NiñaNo ratings yet

- Reviewer (Tax) : National Internal Revenue Taxes Computation For Mixed Income Earner Who Availed 8%Document7 pagesReviewer (Tax) : National Internal Revenue Taxes Computation For Mixed Income Earner Who Availed 8%LeeshNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Chapter 7: Introduction To Regular Income TaxDocument5 pagesChapter 7: Introduction To Regular Income TaxArna Kaira Kjell DiestraNo ratings yet

- Basic Concept & Residential Status of ItDocument15 pagesBasic Concept & Residential Status of ItKANNAN MNo ratings yet

- PH Tax RMC No 19 2015 NoexpDocument1 pagePH Tax RMC No 19 2015 NoexpRodel Ryan YanaNo ratings yet

- Bir 1701Document4 pagesBir 1701Vanesa Calimag ClementeNo ratings yet

- Taxrev Finals PartDocument11 pagesTaxrev Finals PartThrizaCzarinaQ.GarciaNo ratings yet

- U1A OverviewDocument7 pagesU1A Overview4mggxj68cyNo ratings yet

- Simplified Tax For Micro and Small Enterprises (Mses) : Hotel Jen, Pasay City July 16-18, 2018Document10 pagesSimplified Tax For Micro and Small Enterprises (Mses) : Hotel Jen, Pasay City July 16-18, 2018Prashant GuptaNo ratings yet

- 1701 Mixed TemplateDocument11 pages1701 Mixed TemplateDaniel B. MalillinNo ratings yet

- Tax On Personnel Under Job Order and Contract of ServicesDocument14 pagesTax On Personnel Under Job Order and Contract of ServicesghNo ratings yet

- National Taxation (Income & Business Tax) OCTOBER 1, 2014Document39 pagesNational Taxation (Income & Business Tax) OCTOBER 1, 2014Eliza Corpuz GadonNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

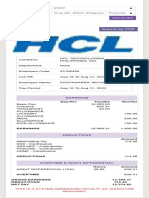

- FEB-23-Salary SlipDocument1 pageFEB-23-Salary SlipIt's your BhootNo ratings yet

- Major Heads - Railways AccounbtsDocument3 pagesMajor Heads - Railways AccounbtsSri Nagesh KumarNo ratings yet

- Sample Structure 10lpa - VI - VIIIDocument1 pageSample Structure 10lpa - VI - VIIIKiran IconNo ratings yet

- Human Resource Management Chapter 9 ReviewerDocument5 pagesHuman Resource Management Chapter 9 ReviewerNikkson CayananNo ratings yet

- Form PDF 654140500171020Document61 pagesForm PDF 654140500171020Sameer Shekhar ShuklaNo ratings yet

- Inclusions in Gross Income: BAM 127: Income Taxation For BA Module #14Document18 pagesInclusions in Gross Income: BAM 127: Income Taxation For BA Module #14Mylene Santiago100% (1)

- P&a GT Payroll Philippines 2Document1 pageP&a GT Payroll Philippines 2Allyzza DimaapiNo ratings yet

- Ontario Health Insurance Plan (OHIP) Document List: Choose One: Canadian Citizens Choose One: Choose OneDocument1 pageOntario Health Insurance Plan (OHIP) Document List: Choose One: Canadian Citizens Choose One: Choose OneShinetonNo ratings yet

- Intercontinental Broadcasting Corp. vs. Noemi B. Amarilla, Et Al., G.R. No. 162775, October 27, 2006Document2 pagesIntercontinental Broadcasting Corp. vs. Noemi B. Amarilla, Et Al., G.R. No. 162775, October 27, 2006xxxaaxxxNo ratings yet

- Prl. District & Sessions Court, Bengaluru Rural District, City Civil Court Complex, Bengaluru 560 009 Notification No. ADM/126/2023 Dated 09.02.2024Document9 pagesPrl. District & Sessions Court, Bengaluru Rural District, City Civil Court Complex, Bengaluru 560 009 Notification No. ADM/126/2023 Dated 09.02.2024sharanabasupolicepatilNo ratings yet

- Salary Slip NovemberDocument1 pageSalary Slip NovemberGowtham ReddyNo ratings yet

- Fawcett Institute Provides One On One Training To Individuals Who Pay TuitionDocument1 pageFawcett Institute Provides One On One Training To Individuals Who Pay TuitionTaimur Technologist0% (1)

- Te Areohanui Robinson Payslip 01.04.24 To 14.04.24Document2 pagesTe Areohanui Robinson Payslip 01.04.24 To 14.04.24sayhimatesNo ratings yet

- Zhang SaisaiDocument280 pagesZhang SaisaiDavid VilladiegoNo ratings yet

- Meezan Daily Income PlanDocument2 pagesMeezan Daily Income PlanFahad JadoonNo ratings yet

- Circular 566Document2 pagesCircular 566tadilakshmikiranNo ratings yet

- Acc 109 Quiz 1 P3Document2 pagesAcc 109 Quiz 1 P3GargaritanoNo ratings yet

- 13 - NYC 2019 COA Report Part3 - Status of PY's RecommedationDocument8 pages13 - NYC 2019 COA Report Part3 - Status of PY's RecommedationVERA FilesNo ratings yet

- COBA Newsletter 0408 (GH-31)Document16 pagesCOBA Newsletter 0408 (GH-31)Albany Times UnionNo ratings yet

- Payroll Calculator SpreadsheetDocument7 pagesPayroll Calculator SpreadsheetbagumbayanNo ratings yet

- Direct Tax CodeDocument2 pagesDirect Tax Codenikhilam.comNo ratings yet

- ch08 2023 Determing Pay and BenefitsDocument20 pagesch08 2023 Determing Pay and BenefitsAbram TinNo ratings yet

- Hindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New DelhiDocument2 pagesHindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New DelhiUtkarsh KadamNo ratings yet

- Unit - 3 Tax PlanningDocument37 pagesUnit - 3 Tax PlanningYash JainNo ratings yet

- 3-Pit ExercisesDocument4 pages3-Pit Exercisesngothanhthuy829No ratings yet

- All QuizzesDocument15 pagesAll QuizzesLouise100% (1)

- FT Magazine UKDocument22 pagesFT Magazine UKAbdurrahman SarıNo ratings yet

- Research Paper On Labour Laws in IndiaDocument6 pagesResearch Paper On Labour Laws in Indiagw07z0j5100% (1)

- Reviewer Taxation Modules 1 - 3Document11 pagesReviewer Taxation Modules 1 - 3afeiahnaniNo ratings yet