Professional Documents

Culture Documents

Alles & Datar (1998)

Alles & Datar (1998)

Uploaded by

camihoangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alles & Datar (1998)

Alles & Datar (1998)

Uploaded by

camihoangCopyright:

Available Formats

Strategic Transfer Pricing

Michael Alles * Srikant Datar

CBA 4M-202, University of Texas at Austin, Austin, Texas 78712

Harvard Business School, Accounting and Control Area, Soldier's Field, Boston, Massachusetts 02163

M\ , ost research into cost systems has focused on their motivational implications. This paper

takes a different approach, by developing a model where two oligopolistic firms strate-

gically select their cost-based transfer prices. Duopoly models frequently assume that firms game

on their choice of prices. Product prices, however, are ultimately based on the firms' transfer

prices that communicate manufacturing costs to marketing departments. It is for this reason that

transfer prices will have a strategic component to them. We derive implications for cost system

choice and transfer pricing, including showing that firms may cross subsidize their products-a

result consistent with the empirical evidence.

(Transfer Pricing; Full Cost Allocation; Incentives; Costing)

1. Introduction sentially the same as variable costs. Many economists,

Our objective in this paper is to develop a model of the therefore, advocate variable cost pricing. They further

firm that reconciles economic theory with the evidence state that managers should disregard fixed costs, allocated

that firms make pricing decisions on the basis of cost- costs, and ful costs (which are the sum of variable and

plus transfer prices rather than marginal costs. allocated costs). These cost constructions are said to be

Tang (1992) provides empirical evidence of the transfer irrelevant in arriving at selling prices." While economic

pricing methods used by firms. He reports that of the theory states that marginal revenue will equal marginal

transfer price methods used by 143 Fortune 500 firms, 46.2 costs, not that marginal costs equal prices, it is the case

percent are cost based. Of these, only 7.7 percent use vari- that the input into the pricing decision is marginal costs-

able costs of production, 53.8 percent use full production which cost-plus transfer prices are not equal to.

costs, and 38.5 percent use fuHl production cost plus a We believe one reason that much of the economic lit-

mark up or subsidy. In his survey of the pricing decisions erature omits an explicit role for cost accounting is that

of the largest 3,500 British companies, Mills (1988) statesthe problem is assumed away by taking as the firm's

objective function, revenue minus actual marginal costs

that: "Cost-based methods, usually reliant on full / absorp-

(assuming that the interests of "the firm" and its owners

tion costing principles, were the principal basis for deter-

mining prices under normal conditions. These cost-based coincide). However, in decentralized firms what is typ-

prices were usually modified by non-cost considerations ically maximized by the firm's marketing department is

of which reference to competitors' prices was the most im- revenue less the transfer price, or the costs reported by

portant of a number used" (p. 38, emphasis added). the internal costing system. This equals actual profits

Despite this large body of evidence that firms don't use only if transfer prices equal marginal costs. Since these

marginal cost pricing, accounting models of cost-plus pric- internal costs are chosen by firms, we address the ques-

ing have not been developed. As Govindarajan and An- tion of whether firms have an incentive to set transfer

thony (1983, p. 30) state, "Most of the academic literatureprices equal to marginal costs.' In particular, we show

on pricing is derived from the 'profit maximization'

model. It assumes that a firm attempts to maximize profits1 If production is carried out by another division of the firm, it is ap-

by setting prices such that marginal revenue equals mar- propriate to use the term transfer price for the means by which product

ginal cost. Marginal costs, as used in this model, are es- costs are communicated to marketing. If products are purchased from

0025-1909 /98/4404/ 0451$05.00

Copyright C) 1998, Institute for Operations Research

and the Management Sciences MANAGEMENT SCIENCE/Vol. 44, No. 4, April 1998 451

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

that the amount by which firms mark up their transfer The structure of the paper is as follows: We begin in

prices over marginal costs is directly a function of their ?2 by placing our model in context with the prior liter-

market power. Consequently, the magnitude of over- ature on transfer pricing. Section 3 describes the ele-

head allocations is also a function of the firm's market ments of the model, the product markets, the strategic

power, rather than of the size of its fixed costs. environment, and the nature of the actual and reported

In this paper, we formalize the link between the de- cost systems. The model is solved in ?4 and the strategic

termination of marginal product costs and the ultimate distortion is interpreted in relation to the familiar cost-

use of that information for pricing. The point is often ing concepts of drivers and indirect cost rates. We show

made that using appropriate cost drivers to compute that cost-plus transfer pricing is optimal in strategic

more accurate marginal costs is desirable from a prod- equilibrium when pricing products, and also that stra-

uct pricing standpoint and yields a competitive advan- tegic transfer pricing is consistent with empirical evi-

tage.2 We take the view that the firm's choice of a cost dence that cost systems are characterized by cross-

system is an endogenous and strategic variable. This subsidization of products. Section 5 offers some con-

perspective implies that we not assume that the use of cluding comments.

more accurate marginal costs for pricing purposes is

better, but rather that we examine whether using accu-

rate marginal costs is an equilibrium outcome. 2. Related Literature

An alternative way of stating this idea is that, from a Many standard accounting texts, such as Horngren,

pricing standpoint, there is a strategic component to trans-

Foster, and Datar (1994) or Kaplan and Atkinson (1989),

fer pricing. The objective is to explicitly place the firm'sexplicitly speculate that strategic factors may influence

choice of cost-based transfer prices within the context the choice of costs on which product prices are based.

of its overall competitive environment. The implication Consider the following from the latter text: "Some cor-

of our results is that in oligopolistic contexts, firms will porations deliberately allocate all corporate overhead

prefer to know their marginal costs as accurately as pos- expenses to operating departments with allocation ba-

sible, but that strategic considerations will dictate using ses that have little to do with the consumption or causes

marginal cost-plus transfer pricing when pricing prod- of the overhead costs. Senior managers apparently want

ucts. By using a multiproduct model, we also show that operating managers to be aware of centrally determined

firms may cross-subsidize their products in order to and controlled costs. Perhaps the fully allocated costs are

maximize their ability to raise prices in the strategic en- meant to encourage more aggressive pricing decisions by the

vironment. decentralized managers" (p. 247, emphasis added). "Cost-

plus pricing policies also provide stability to pricing de-

external sources, then there is no transfer price, and a costing system

cisions.. . . Such stability may well be desired by man-

tells marketing how much more it costs the firm to make the product agers, especially in oligopolistic industries that might

available for sale. We shall use the terms transfer prices and reported otherwise be susceptible to short-term price cutting that

costs interchangeably, since our results apply to either setting. reduces prices below long-run marginal cost" (p. 187).

2 (See Cooper 1989 and Shank and Govindarajan 1988). In most real- An NAA study of cost allocation (Fremgen and Liao

istic circumstances, perfectly accurate costs are unobservable to the

1981, p. 19) also explicitly considers the role of strategic

firm. In this paper, when we use phrases such as accurate or actual

factors in the calculation of product costs when pricing.

product costs, we mean marginal costs as known to the firm, as ac-

curately as its information-gathering technology allows, rather than In decentralized firms (comprising production and

some ideal measurement error-free number. This actual marginal cost marketing divisions), costs are reported to the market-

is contrasted to the cost number which is reported, either directly ing division through the use of transfer prices from pro-

through a product costing system or through a transfer pricing system,

duction. The transfer pricing literature (see Ronen and

to the marketing division for making pricing decisions. The question

Mckinney 1970, Harris, Kriebel, and Raviv 1982, Eccles

analyzed in this paper is whether the transfer price will equal the

actual marginal cost, which is distinct from the question of whether

1985, Ronen and Balachandran 1988, Christensen and

the firm has obtained the most accurate possible cost information in Demski 1990, Holmstrom and Tirole 1991, Mookherjee

the first place. and Reichelstein 1991, Edlin and Reichelstein 1995, and

452 MANAGEMENT SCIENCE/ Vol. 44, No. 4, April 1998

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

Vaysman 1996) argues that asymmetric information and the marketing division has to decide on the price

and divergence of preferences results in transfer prices to be charged for each of the goods the firm manufac-

being set that differ from marginal costs. tures.

Harris, Kriebel, and Raviv (1982), however, show that Each firm is run by a CEO who is assumed to maxi-

transfer prices will be below marginal cost, a result that mize the actual profits of the firm on behalf of the share-

is also possible in the model of Ronen and Balachandran holders. The CEO implements a cost system to deter-

(1988). This is inconsistent with the empirical evidence mine actual costs as a function of the production pro-

of Tang (1992). Moreover, these analytic models do not cess, and then on the basis of these actual costs he

address the implications of transfer prices for the pric- chooses the transfer prices to be used when transferring

ing function of the marketing department. Indeed, in products to the marketing department. We assume that

Ronen and Balachandran (1988), the owner markets the the CEO also puts in place benchmarking programs to

product, and revenue is a function of output. The trans- determine the actual costs of the firm's competitors,

fer price that the owner pays the agents responsible for since this information is critical in imperfectly compet-

production has no impact on the subsequent pricing de- itive markets.3 After determining the actual costs of the

cision. Their model does not address the empirical evi- firm and its competitors, the cost system defines the

dence. transfer price for the transfer of products from manu-

By contrast, our model of transfer pricing explicitly facturing to marketing.

deals with the effects on the pricing decision of setting The cost-based transfer pricing system is the means

a transfer price above marginal cost. Our results pro- of communication within the decentralized organiza-

vide theoretical support for the empirical practices doc- tion. The marketing manager is assumed to maximize

umented by Tang (1992). In our model, transfer prices profits reported by the marketing division, those profits

exceed marginal costs to promote strategic price inter- computed on the basis of the transfer prices. Given that

actions among firms competing in oligopolistic markets. marketing managers are rewarded on the basis of trans-

In contrast, much of the transfer pricing literature fo- fer price-based profits, they have no reason to concern

cuses on internal performance evaluation, motivation, themselves with whether the actual costs of production

control, and generally, the aligning of interests within equal their transfer prices. The question we analyze is

the decentralized firm. whether it is optimal for the transfer prices chosen to be

Our paper focuses on the extemal role of cost and something other than the marginal costs of manufac-

transfer pricing systems. We recognize that the firm's turing.

choice of transfer prices is an important element in its The timeline of the game is as follows. In the first

price-setting mechanism. Further, prices are not chosen stage of the game, the two firms' CEOs simultaneously

in isolation, but in a strategic setting that explicitly con- select the transfer prices for their marketing personnel

siders the firm's competitors. to use. The optimal transfer prices arise endogenously

as equilibrium outcomes.4 In the second stage, the

3. The Model

3Homgren, Foster, and Datar (1994, p. 428) describe the importance

There are two multiproduct firms that compete across

of cost information when deciding on pricing and product emphasis:

two independent markets. In each firm, product pricing "A business with knowledge of its rivals' technology, plant size, and

decisions for both products are delegated to a separate operating policies is better able to estimate its rivals' costs, which is

marketing division. Decentralization is necessitated by valuable information in setting competitive prices." Caterpillar, Gen-

eral Motors, Hewlett Packard, and Xerox are cited for their use of

forces outside this model, such as costly communica-

techniques such as competitive benchmarking to estimate the costs of

tion, limited span of control, and the need to use local

their competitors.

knowledge to respond quickly to market shocks or the

4 Note that this model contrasts with those studied in the industrial

actions of competitors. A decision has to be made in organization literature on the demand for the decentralization of the

each firm on how to cost products when they are trans-

firm, such as Fershtman and Judd (1987), where the agents' contracts

ferred from the producing to the marketing division, serve as commitment devices. They demonstrate that oligopolists can

MANAGEMENT SCIENCE/Vol. 44, No. 4, April 1998 453

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

marketing managers compete in Bertrand fashion on above the perfectly competitive level. We model the

the product markets, making pricing decisions to max- tastes of consumers as lying uniformly on the unit in-

imize the marketing division's profits. In practice, costs terval [0, 1] with each firm at either end, and those con-

are only one input into the pricing process. Demand sumers preferring a firm's product located near that

conditions, the requirements of specific customers, and firm. Thus a consumer one third the way along the unit

other such factors all play a role. This model is consis- interval prefers the product of the firm on the left more

tent with this more complex environment, since costs than a consumer who is two thirds the way along (but

are one of the more important of these inputs. The spe- less than a consumer one quarter away from firm one).

cific pricing model used here leaves out these other fac- Each consumer demands exactly one unit of each prod-

tors only in order to focus sharply on the role of costs. uct. In this model, the firm has market power to the

The major assumptions in our model are that (i) there extent that these preferences mean that the consumer is

is an absence of incentive issues, (ii) lack of uncertainty willing to pay a higher price to purchase a product that

about the costs of either firm, or of demand, and (iii) more closely fits her preferences-in other words, the

common knowledge that marketing managers maxi- product from the firm closer to her in product space.

mize transfer price-based divisional profits. This third The disutility to the consumer of not getting exactly

assumption flows from the assumed decentralized firm what she wants is measured by the distance to a firm

structure and the consequent need to communicate cost times t-the cost of being one unit away in preference

information to the marketing manager. Each firm need space from the product that exactly fits the consumer's

not observe its competitor's choice of transfer prices, needs. Whenever t > 0 the firm enjoys brand loyalty

and consequently, there is no necessity for each firm to and market power, since each consumer closer to the

commit to its transfer price. Rather, given the common firm in product space will patronize that firm even if its

knowledge that some transfer prices must be chosen, prices are slightly higher than the other firm, as long as

that price difference does not exceed t times the differ-

each firm will react to its prediction of what that transfer

price will be. Hence, the transfer prices chosen will be ence in preference locations between the two firms. If t

equilibrium outcomes. = 0, then consumers are not willing to pay a higher

The marketing managers of each firm have two prod- price for their preferred product and so pure price com-

5

ucts to price and sell. We assume that the firms are mul- petition results.5

tiproduct since costing is trivial in a single product set- In the appendix we show that this model leads to the

ting. To link the costing practices of the firm to its mar-demand function

ket power, we use a variant of a Hotelling model of

spatial competition, which is a special case of the ge- Dij = tPij + 2t Pkj,

neric demand function Di1 = Ao - A,Pii + A2Pkj for ar-

bitrary constants Ai > 0, where Di1 is the demand forand unlike the generic demand function given above,

the role of market power in leading to differentiated

the product j of firm i at its price Pij and its competitor's

price Pkj (see Tirole 1988 for a discussion of these demand is explicit. The market power of each firm to

models). charge differential prices, measured by t, is assumed to

In this model of oligopolistic competition, the de- be known with certainty to all parties and, for the sake

mand for a firm's product is a function of both its price

and its quality or brand identity. These nonprice factors 5 In other words, if the firm on the left of the unit interval offers a

allow a firm to differentiate its products to some extent product at price P1 while the firm on the right charges P2, then a con-

from the product of its competitor and so raise prices sumer one quarter the way along the unit interval is willing to buy

from the left firm as long as P1 + 4t P2 + 4t. But a consumer one

third the way on the unit interval values the left firm's products rel-

atively less and so is less tolerant of the left firm's higher price. He

increase firm profits by hiring a manager who is given an incentive will pay P1 only as long as P1 + 3t P2 + 2 t. Clearly, when t -O 0, the

contract that may place unequal weights on revenues and costs. How- firm's ability to charge differential prices declines. We discuss later

ever, this literature provides no insight into transfer pricing. how the firm can influence the size of its market power t.

454 MANAGEMENT SCIENCE/Vol. 44, No. 4, April 1998

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

of simplicity and with little loss of generality, we as- and production of Good 1 uses 3 machine hours, while

sume that t is the same for both firms and both products. Good 2 uses only 1 hour, then a* = 0.75. Using the

The customers' valuation of the product is also assumed fractional form of the cost drivers allows us to deter-

to be high enough that all consumers are willing to pur- mine easily whether or not the cost system is cross-

chase the good at equilibrium prices. subsidizing across products.

The cost measurement system identifies production The actual variable manufacturing overhead incurred

costs consisting of direct variable costs and fixed and in the production of one unit of each of the two products

variable overhead costs. The costs of the marketing de- is given by $fi. Continuing our example, if the indirect

partment are reported directly to the marketing man- cost rate is $5.50 per machine hour, then f= ($5.50)(3

ager. Before the marketing manager can select the prices + 1) = $22.00. Thus, the indirect cost rate is $5.50 and

for the firm's two products, however, he needs to know Product 1 requires 3 machine hours. The actual variable

what production costs he will be charged for the prod- manufacturing overhead applied to Product 1 is then,

ucts transferred to his division. This is necessary infor-

mation for the marketing manager because it enables $16.50 = (3)($5.50) = (3 ($5.50)(3 + 1) = ac4f.

him to calculate the profit he has to maximize by his

choice of the product prices. This information is con- Hence, the actual marginal manufacturing cost of prod-

veyed to him through the transfer price. We shall refer uct j for firm i, given by C* above, can be rewritten as:

to the manufacturing costs of the firm's production de-

partment as its actual production costs and the transfer Ci = c + c4fa , C2 = + (1 - a)f*

prices reported to the marketing division as its reported C2i = CP + 2 C = CP + (1 - a)f

production costs. Hence, we define TC* to be the total

?41 a2 E [0, 1],

actual cost function of the production department of

firm i = 1, 2. We further assume constant marginal costs: f*,f2 ?0.

flif -.

Now the firm has to choose transfer prices that will

TCi*(xi1, xi2) = G* + C*xjj + Cx2. be used to report production costs to the marketing de-

G 0 is the total fixed manufacturing costs of firm i. partment. Corresponding to the actual cost driver and

C* is firm i's actual marginal costs to manufacture prod-overhead rate a* and f defined above, the firm has to

uct j; xij is the quantity of product j produced by firm i.select cost drivers and allocation rates for its cost re-

The actual marginal manufacturing cost C* equals the porting system. These choice variables are denoted by

direct manufacturing labor and material costs of pro- ai and fi in contrast to the technologically determined

duction, cp, and variable manufacturing overhead.6 rates

We ac and f *.7 This allows us to write the transfer

assume that the variable manufacturing overhead is a

function of some cost driver that determines the pro- 7While the choice of the cost driver will affect the values of both com-

portion of the variable costs generated by the produc- ponents of the cost system, for a given cost driver, the choice of fi is

tion of each of the two products. The unit level cost independent of ai since the indirect cost rate is unrestricted. Of course,

driver is assumed to be such activities as direct manu- the indirect cost rate, being on a per unit basis, requires an estimate of

the total quantities of products that are to be manufactured. For this

facturing labor hours or machine hours. The production

reason, thefi are only determined in equilibrium, along with total de-

of one unit of Good 1 requires the consumption of the

mand. By contrast, the f *s introduced earlier, representing the actual

fraction a* of the actual cost driver. The production ofindirect cost rates of the products, do not include an application of

one unit of Good 2 consumes 1 - a* of the actual cost overhead, and consequently are independent of volume. The fraction

driver. For example, if machine hours is the cost driver, of each cost driver incurred by each product ai and a* is a function of

the chosen and actual cost drivers, respectively, and is always inde-

pendent of volume. For example, the actual cost driver may be ma-

6 the sake of expositional clarity, we assume that the direct man- chine hours, while the costs are allocated using labor hours. How

ufacturing and marketing costs are constant across firms and products. much of each driver is used by each product is a function of the pro-

Relaxing this assumption would not change any of our results. duction technology.

MANAGEMENT SCIENCE/Vol. 44, No. 4, April 1998 455

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

LEMMA. Given the transfer prices, TPij, the unique prod-

price TPij, which is the reported per unit manufacturing

cost of product j of firm i, analogous to the uct

actual

pricesmar-

chosen by the marketing manager in equilibrium

ginal costs of production. to maximize the marketing department's profits in the pricing

subgame are:

TPll = cp + a1lfi TP12 = Cp + (1- al)f-

Pi, = t + cp + cm + 2aifi + ajf

TP21 = Cp + a2f2, TP22 = Cp + (1 - a2)f2, p ~~~3

a1, a2 E [0, 1],

Pi2 = t + cp + Cm + 2(1- ai)fi + (1- aj

3

fl,f2 : 0.

It is important to note that our model does not impose Di,= + t [ajfj - aifi],

any constraints on the firm's choice of reported costs or

transfer prices. The firm can choose any reported costs 11

Di2 = + 6[(1 -a)fj- (1-ai)fi],

that it wishes, including reporting actual marginal man-

ufacturing costs to its marketing department. All we as-

for any given cai, fi, aj, and fj chosen by the firm's

sume is that the transfer price is cost based. Note that

the direct costs of the production department cp are ac- PROOF. See the appendix. W

curately reported by the cost system, there being no am- In the costing stage of the game, given their knowl-

biguity with regard to these numbers. To complete the edge of both the second stage strategies and of total ac-

model, the marginal costs of the marketing department tual marginal costs, the firms' CEOs select the parame-

are assumed to be given by cm, and, before selecting ters of their cost systems, the ai andfi, to maximize each

firm's overall profits:

prices, would be added to the transfer price TPij by the

marketing manager to give the total cost of the product,

THEOREM 1. The unique pure strategy Nash equilibrium

Cij = TPij + Cm.

in the choice of cost systems is given by:

4f* + f2

4. Strategic Transfer Pricing fi = 2t + 1 +

In the pricing stage of the game the marketing managers

choose the prices for the two products to maximize the + 4f2

f2 = 2t +

marketing division's profits, which are calculated using 5

the transfer prices, TPij, chosen by the firm's CEO. Con-

4(1aff + at+2

sequently, the product prices also become a function of

those transfer prices. Since both firms are organized in

the same way, each CEO can predict what prices will

result from this stage of the game, and how those prices (1 - 2)f2 =t~alf2

+ 4(1 =- al)f

t ++ cf

(1 - cf

a*j)f2

5

are a function of his choice of transfer prices. Conse-

quently, in the costing stage of the game, the CEO will (xA -a!lf + 4a!2f2

choose those transfer prices to maximize the firm's ac- 5

tual profits, subject to the pricing decisions made by the

marketing managers. In other words, within each firm (1ae2)f2 = t + (1 - al)f 1 + 4(1 - a2)f 2

the CEO acts as a Stackelberg leader with respect to his

marketing manager, strategically choosing transfer PROOF. See the appendix. Cl

prices to influence the product pricing decisions sub- The transfer prices TP11, TP12, TP21, and TP22 are cal-

sequently made by the marketing manager. As a con- culated by adding cp to the last four expressions of The-

sequence, the product prices are functions of ai and f orem 1. It follows from Theorem 1 that the cost-based

rather than the actual cost variables a 7 and fi. transfer prices cp + aifi are, in general, not equal to cp

456 MANAGEMENT SCIENCE/Vol. 44, No. 4, April 1998

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

tablish

+ aifi, the actual marginal costs. It is in this a brand

sense thatidentity. By having market power t

costs for pricing purposes are chosen strategically. Note = t(G) as a function of fixed costs, an implication of

that the marketing department's manager would not Theorem 1 is that it is not fixed costs that differentiate

firms and make fixed cost recovery feasible, but rather

use the actual cost parameters a* and fS when pricing,

even if he knew them, since he is compensated on the their successful application to create market power, t.

basis of divisional profits calculated using the transfer Note that,

prices. We can make two other observations about the

~v 1 K CkJ -CiJ[ Cki -Ciilo

strategic transfer prices:

At 2t [ 3 3t ]

1. Given the values of fi and f2, we have:

for a firm not at a great cost disadvantage relative to its

fi-f= 2t+ - competitor. Hence, unless the firm is already in a hope-

5

less competitive position in a market, it pays for it to

This is always positive for the firm with the lower actual invest in the creation of market power to gain the lee-

indirect cost rate, and for both firms if t is large enough. way to raise prices without fear of customer defections.

When the actual rates are the same across the two firms Our results suggest that the firm will increase fixed costs

the markup equals t, making the point that the amount Gi until (Flij / 8t)t'(Gi) = 1. To the extent that success

by which the firms mark up their transfer prices over differs, we would expect firms to differ in the extent of

marginal costs is directly a function of their market fixed costs they allocate when setting transfer prices.

power.8 Conversely, we would expect firms that apply a greater

2. Fixed costs Gi play no direct role in the determi- proportion of fixed overhead costs (including sales and

nation of either transfer prices or final product prices administrative overhead) when setting transfer prices

meaning that allocations are not "tidy." What Theorem to be also the firms that enjoy greater market power and

1 shows is that the magnitude of overhead allocations product differentiation.

is a function of the market power of the firm and not To further our intuition of these results, it is useful to

the size of its fixed costs. ask why the firm's CEO does not set transfer prices

equal to marginal costs and how the firm benefits by

The difference fi - f > 0 can be achieved either by

not doing so. If he did and the marketing manager max-

adding a markup to the variable indirect manufacturing

imized actual profits, we can make the following obser-

cost rate, as in cost-plus transfer pricing, or by the ap-

vations about how the firm's product prices and de-

plication of some portion of fixed overhead. Survey ev-

idence by Govindarajan and Anthony (1983) shows that

mand will differ from those given in Theorem 19:

1. The difference in transfer prices across the two

while 83 percent of firms apply some fixed costs when

firms is smaller than the difference of the actual mar-

costing for pricing purposes, they vary in the amount,

ginal costs of the firms.

with 33 percent allocating only fixed production over-

head and another 41 percent allocating both fixed pro-

duction overhead and fixed selling, general, and admin-

9 To derive these observations, note that:

istrative expenses.

1. By direct computation, afif - a2f2 = 3 (a - f a2f2).

Firms incur fixed costs on, for example, research and

2. Let D! and Pij represent the demand and price, respectively,

development, advertising, and plant and equipment to when the firms report marginal cost transfer prices. Taking Firm 1 as

strategically differentiate their products from those of

an example, D*1 = + (1 / 6t)[a2f* - alf*], while D1i = -

their competitors. Our results suggest an interesting ex-+ (1/1Ot)[a2f* - alcf].

3. P*1 = t + c + ct, + 3[2ac4f* + a2*f ]; P1, = 2t + c + C71, + ?[3a*

tension of our model to an earlier technology choice stage

+ + 2a2*f]. Consequently, Pl* - P* = l[alcf - a24f] > 5[alf*

of the game, in which the firm incurs fixed costs to es-

- *4f2] = Pul - P21. Finally, P1l - P* = t - (1 / 15)[a4fl - ac2f 2]; P21

-P = t + (1/15)[acf* - a2*f] w -[Pll + P21] = ?[P* + P21] + t.

The firm with the higher actual marginal costs bears the greater

8We assume that t > I (fj - f*) / 10 1 in order to ensure nonnegative

costs and demand. increase in price and the corresponding decrease in demand. D

MANAGEMENT SCIENCE/ Vol. 44, No. 4, April 1998 457

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

2. The market share of each firm in each product is costs, Gi. Choosing ai appropriately enables reported

more equal to the market share of the other firm than costs to appear to be closer to each other, across firms,

when marginal costs are used to set prices. than actual marginal costs are. Once cost differences are

3. In any given market, the difference in prices is mitigated, a mark up can be used to raise costs and con-

smaller than it would be under the regime with mar- sequently prices. The strategic choices of ai andfi make

ginal costing, but the average price level is higher. each firm's marketing division act as if their costs are

These results give insights into the nature of the stra- more similar and higher than they actually are. This di-

tegic interaction between the firms. To maximize profits, minishes the marketing managers' incentives to under-

each firm's marketing manager wants to raise prices for cut each other's prices, since they will only do so if they

his products to as much as the market will bear. There think their costs are significantly lower than the other

is a limit to this process, however. While both firms gain firms. Further, note that because of the cost to the con-

from an increase in prices, there is the countervailing sumer of changing retailers-represented by t-there is

incentive to gain market share by undercutting the other a limit to the increase in market share a firm can obtain

firm's price if it is too high. In our model, though, in by undercutting the other's price. This stops prices un-

addition to product prices, by choosing their cost sys- raveling to marginal costs.

tems strategically the firms' CEOs have another control The leveling and markup effects affect the relation

variable-the choice of transfer prices-that they can between costs across the two products within a given

use to dampen the marketing managers' incentive to firm, which leads to the following result:

undercut. Instead of being based on marginal costs,

COROLLARY 1. When no onefirm has an absolute advan-

prices can be based on transfer prices that are chosen to

tage in all markets, then each firm will find it in its interest

reduce cost differences across firms. Across firms, the

to cross-subsidize the product it has a comparative advantage

transfer prices are closer together than the actual mar-

in at the expense of its other product. Hence, if, for firms i

ginal costs. The differences in the resulting product

prices are also then smaller than they would be if they and j, C* > C1* and C* < C*2, then Cil < Cjl and CQ2

> Cj2.

were based on marginal costs and so there is less of an

incentive on the part of the marketing managers to un- PROOF. See the appendix. W

dercut each other and start a price war. With prices Many oligopolistic industries are characterized by

closer together, consumers become indifferent to the comparative rather than absolute advantage. Our re-

firm from which they purchase, and market shares tend sults show that when strategic interactions occur among

to come closer together. When the relative price differ- firms in these industries, cross-subsidization is an in-

ence across firms decreases, the average price level can evitable consequence of the need to reduce cost differ-

be raised without disrupting market shares. ences between the firms-cost differences being a cat-

It is the transfer prices that are committed to market- alyst for the marketing managers to undercut each other

ing that sets bounds on how much each marketing di- when pricing. The transfer prices for the relatively

vision is willing to undercut price in this oligopolistic lower cost product is increased while the transfer price

environment. The strategic equilibrium we describe for the product whose cost is higher than that of the

cannot be reached if transfer prices are not available as competitive firm is lowered. The lower cost product is

endogenous control variables. cross-subsidizing the higher cost product. Evidence that

It is easy to show that if the two firms are similar ormany cost systems do indeed cross-subsidize high cost

enjoy large market power, both firms will unambigu- products has been well documented in the literature

ously gain from strategically reporting costs to market- (see, for example, Cooper 1987, Wruck 1988).1o

ing. The intuition underlying this observation is that the

strategic distortion of transfer prices is marked by two

10 In recent years there has been increasing attention paid to obtaining

phenomena: a leveling effect, working through the

better product costs through the use of techniques such as Activity-

choice of a cost driver ai, and a mark up achieved byBased Costing (ABC). Wruck (1988) discusses the link between the

setting fi > fi that can be used to recover the fixed activity-based costing system in the Electric Motor Works production

458 MANAGEMENT SCIENCE/Vol. 44, No. 4, April 1998

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

If a firm has an absolute advantage in all markets, marketing divisions. To choose prices to maximize prof-

then the cost of all its products has to be increased its, the marketing division of each firm needs to obtain

through the use of transfer prices, and the overall costs product cost information from the firm's cost system.

of its competitor decreased. However, while this pro- As a result, the cost information that is reported by the

cedure will allow higher market prices to be attained, transfer prices to the marketing division for product

the greatest benefits will naturally accrue to the more pricing purposes becomes a component of the strategic

efficient firm. interaction between the firms.

We motivated the strategic choice of transfer prices In this setting, we show that there is a "strategic com-

as resulting from the interaction of firms in an oligo- ponent" to the manufacturing costs reported to the mar-

polistic environment. If this is indeed the case, then we keting division for pricing purposes. In a cost-based

would expect that when no strategic interactions exist, transfer pricing context, this is equivalent to marking

as in the case of perfectly competitive industries or mo- up transfer prices over the marginal costs of the pro-

nopolies, transfer prices would be equal to marginal duction division.

costs rather than differing from them in order to try Our

and analysis provides an explanation for the "paradox-

gain a competitive advantage. This intuition can be for- ical" behavior of firms in basing their pricing decisions on

malized as follows, with only a simpler model with one cost-plus transfer prices rather than marginal costs. Our

product and linear costs needed to obtain the result: results, that transfer prices may exceed marginal manu-

facturing costs, are consistent with survey evidence on the

COROLLARY 2. Both a monopolist and a perfectly com-

costing and transfer pricing practices of firms.11

petitive firm will choose transfer prices equal to marginal

Our results draw a clear distinction between the

costs.

knowledge a firm wants of its actual cost, and the use

PROOF. See the appendix. D that is made of this information, when determining

In either of these market settings, the firm's profits transfer prices. We emphasize that costing is only a

are only affected by its own actions, strategic interac- means toward the end of profit maximization, and not

tions with other firms being absent. Consequently, mo- the end in itself.12

nopolies and perfect competition induces firms to report 12 We thank two anonymous referees, George Foster, Mahendra

their correct marginal manufacturing costs to their mar-Gupta, Russell Lundholm, Nahum Melumad, Paul Newman, Eric No-

keting managers. reen, Stefan Reichelstein, Joshua Ronen, Reed Smith, Mark Wolfson,

Amir Ziv and seminar participants at Stanford University, Berkeley,

UBC, MIT, Wharton, UT Austin, Columbia, NYU, and Washington

University for their comments. All errors are our responsibility alone.

5. Concluding Comments

We began our analysis with the recognition that firms Appendix

are decentralized, with pricing decisions delegated to A.1. Proof of the Lemma

Without loss of generality, let the first firm be located at the origin

the unit interval and let Pij be the price the ith firm charges for the jt

division of Siemens AG and the transfer prices to the sales division.

Despite the ABC system, transfer prices include the absorption of fixed

overhead costs, which are then adjusted for the profitability of the " Ferreira and Merchant (1985) in their study of the NuTone Housing

order and the expected profitability of the customer. As a result, the Group of Scovill, Inc., describe a costing system consistent with our

transfer prices are "biased" relative to the "accurate" ABC costs and results. NuTone deliberately uses overstated labor time standards that

there is considerable cross-subsidization across orders and customers. result in large year end labor efficiency variances and overstated prod-

Cooper (1987), in his well-known case on the German apparel fas- uct prices. This policy has lasted for several decades with the full

tener maker Mueller Lehmkuhl GmbH, also documents an instance of knowledge and support of management. One executive defended the

strategic product costing. In this instance, the net effect of cost-plus practice in the following terms: "We make a lot of special quotes, and

pricing was to dampen the incentives for destructive competition in sometimes the pressure to squeeze profit margins on these quotes are

the oligopolistic European fastener industry. This case is characterized too strong. That's where our inflated standards play an important role;

by both a cross-subsidization across products and a markup of all they give us a cushion to protect our margins when we are making price

products-a phenomenon predicted by our model. decisions" (emphasis added).

MANAGEMENT SCIENCE/ Vol. 44, No. 4, April 1998 459

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

librium

good, and Dij the corresponding demand. Then, given thatand

allthe fact that Firm 2 is also strategically selecting its transfer

custom-

ers are served at prevailing prices, consumers along the unit interval prices. With profit maximization the only rational belief regarding firm

will purchase good j from the first firm at price Plj, given the cost t behavior

of in the pricing stage of the game, a probability weight of 1

changing retailers, until the distance from the origin is great enough can be assigned to the price and demand functions derived in Theorem

that good j from the second firm at price P2j becomes equally attractive. 1. Hence, the CEO will determine his best response by solving the

These assumptions imply that demand is a function of the consumer's profit maximization problems of both firms,

distance in preference space from the firm. Hence, we have the follow-

ing relation, where demand, Dij, is reinterpreted as the distance from max Il(al, a2, fl, f2)

alcfi

the origin to the marginal consumer:

= [P, - C - Cm]Dji + [P12 -C1- Cm]Dl2-G*

Pii + DiJt = Pkj + (1-Dij)t * Dij = kj 2 ijt

max H(a1, a2, fl, f2)

a2Jf2

In the pricing stage of the game, each marketing manager chooses the

prices for the firm's products in order to maximize the reported profits

= [P21 - C2 - Cm]D21 + [P22 -C2- cm]D22 - G*

of his division, which are calculated using the transfer prices chosen

by the CEO. Since a firm's transfer prices are not observable, each CEO

Taking the partial derivatives of nl with respect to a1 andf,

assumes that its rival's marketing manager will profit maximize on Firm l's reaction curves,

the basis of whatever transfer prices were chosen in the first stage.

An equilibrium is attained because each firm's CEO anticipates that

the other is rational, and so uses the other firm's reaction curve to V,l 8tgf2(2a2 - 1)-41(2a, - 1) + 3ff*l(2a* - 1)],

Oa, 18t

predict its strategy. Each CEO's expectations will be confirmed in equi-

librium. We take as given that the marketing manager will select prod-an* 1

uct prices in order to maximize reported profits. The reported profit -Of,

= - [3t + (1 + 2aja2 - a, - a2)f2

18t

in any product is given by:

+ 3(1 + 2a1aj - a, - ai)fi - 4(1 + 2al - 2a,)fi].

ni, = (Pij - Ci)Dij(Pi, Pkj).

The marketing manager takes into account the direct costs cm of the Using his knowledge of Firm 2's actual marginal costs to also obtain

marketing department (and perhaps any fixed costs), as well as the the reaction functions of his competitor, Firm l's CEO solves the re-

transfer price of the product, when maximizing the marketing de- sulting set of four (non-linear) equations to determine the optimal

partment's profit. Hence, the product costs are given by Cij = TPij choice of cost parameters:

+ cm. The two product markets can be considered independently at

this stage of the game. This implies that for profit maximization, the

- 2t + 4f* +f

price chosen by the marketing manager of firm i is determined by the

reaction function:

4(a1-2)fl + (at2-2)ft2

p Pkj + t + Cij

15f 2

1 2

It is easily seen then that the second stage Bertrand Nash equilibria,

The choice of these parameters determines the output choice of the

the unique sequentially rational outcome in the pricing game, for firm

marketing manager. Second order conditions can be shown to be sat-

i, where k * i, is given by:

isfied for these results, which can also be readily rewritten in the man-

ner shown in Theorem 2.

Pij(al, a2, fi, f2) = + 2Ct1 + Ckj follows from the concavity of the profit functions in

Uniqueness

3

each firm's own actual costs. This is the only Nash equilibrium. Actual

costing, where transfer prices equal the marginal manufacturing costs

Dij(al, a2, fi, f2) = + 6t [Ckj - Cij],

is not an equilibrium in this game, since each firm would have an

incentive to change the costs reported to its marketing department if

nij(al, a2, fi, f2) = t + C Ci1] the other firm used marginal cost transfer prices (as can be seen from

the fact that the first order conditions given above do not equal zero

Uniqueness follows from the concavity of the profit function (in its when both firms use actual costs). Ol

own cost). LI

A.3. Proof of Corollary 1

A.2. Proof of the Theorem From Theorem 1, the reported manufacturing costs for a product is

Taking Firm 1 as an example, the CEO's object is to select a1 andfiweighted

to average of both firms' actual marginal costs for that produc

maximize first stage profits, anticipating both the second stageplus

equi-

the markup t. Hence,

460 MANAGEMENT SCIENCE/ Vol. 44, No. 4, April 1998

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

ALLES AND DATAR

Strategic Transfer Pricing

and R. S. Kaplan, Activity-Based Systems: Measuring the Costs of

a,fi = t + 4a tf + la j*fj,

Resource Usage, Accounting Horizons, 6 (1992), 1-13.

(1 - ai)fi = t + 4(1 -0 a)ft + 5(1 -0 a)fj. and P. B. Turney, "Tektronix Portable Instruments Division,"

Analogous expressions can be derived for Firm 2. Hence, when each

Harvard Business School Case 9-188-142,3,4, Cambridge, MA,

1988.

firm has a comparative advantage in a product (i.e., a*f > a**f

and , "Internally Focused Activity-Based Cost Systems," in

t (1 - at*)f* < (1 - a )f7, for firm i and firm j), then each firm will

Robert Kaplan (Ed.), Measures for Manufacturing Excellence, Har-

cross subsidize the product it has a cost disadvantage in at the expense

vard Business School Press, Cambridge, MA, 1990.

of the product that it does have a comparative advantage in, meaning

Eccles, R., The Transfer Pricing Problem: A Theory for Practice, Lexington

that Cil < C* and Ci2 > C*, and the converse for firm j. L

Press, 1985.

A.4. Proof of Corollary 2 Edlin, A. S. and S. Reichelstein, "Specific Investment Under Negoti-

1. Consider a monopolist with linear costs, C*(x) = G* + C*x, and ated Transfer Pricing: An Efficiency Result," Accounting Rev., 70

facing linear demand, P(x) = A - Bx, where x is output. Now assume (1995), 275-291.

that the firm's marketing manager maximizes his department's profits Ferreira, L. and K. A. Merchant, "Scovill Inc.: NuTone Housing

on the basis of the transfer price, TP. It is easily shown that the optimal Group," Harvard Business School Case (9-186-136), Cambridge,

response of the manager is to sell up to where marginal revenue equals MA, 1985.

his reported marginal cost. Thus, Fershtman, C. and K. L. Judd, "Equilibrium incentives in Oligopoly,"

American Economic Rev., 77 (1987), 927-940.

A - TP

x = Fremgen, J. M. and S. Liao, The Allocation of Corporate Indirect Costs,

2B

National Association of Accountants, New York, 1981.

Actual profits are then: Govindarajan, V. and R. Anthony, "How Firms Use Cost Data in Price

Decisions," Management Accounting, 65 (1983), 30-37.

(A B[A 2B ] C)(A 2B) - Harris, M., C. H. Kriebel, and A. Raviv, "Asymmetric Information,

Incentives and Intrafirm Resource Allocation," Management Sci.,

28 (1982), 604-620.

= 1 (A - C*)2 - ? (TP - C*)2 - G*. Holmstrom, B. and J. Tirole, "Transfer Pricing and Organizational

4B 4B

Form," J. Law, Economics and Organizations, 7 (1991), 201-228.

We immediately have that the monopolist's CEO has no incentive to

Homgren, C., G. Foster, and S. Datar, Cost Accounting: A Managerial

choose transfer prices that differ from actual marginal costs. (TP = C*)

Emphasis, Prentice Hall, Englewood Cliffs, NJ, 1994.

2. The case of a perfectly competitive firm is even simpler, since in

Kaplan, R. S. and A. Atkinson, Advanced Management Accounting, Pren-

a given market actual profits are a function only of the difference be-

tice Hall, Englewood Cliffs, NJ, 1989.

tween the price and actual marginal costs, I* = (P - C*)x. Firm profits

Mills, R. W., "Pricing Decisions in U.K. Manufacturing and Service

are independent of the choice of transfer prices since the marketing

Companies," Management Accounting (U.K.), 66 (1988), 38-39.

manager's decision is to sell as much as the firm can produce, when-

Mookherjee, D. and S. Reichelstein, "Analysis of Alternative Transfer

ever TP + Cm < P. Over this range the firm then has no incentive to

Pricing Rules," Working Paper, University of California, Berke-

distort transfer prices, given that its actual profits are independent of

ley, CA, 1991.

its choice. LI

Ronen, J. and K. Balachandran, "An Approach to Transfer Pricing Un-

References der Uncertainty," J. Accounting Research, 26 (1988), 300-314.

Alles, M. G., "Incentive Aspects of Costing," Unpublished Doctoral and Mckinney, "Transfer Pricing for Divisional Autonomy," J.

Dissertation, Graduate School of Business, Stanford University, Accounting Res., 8 (1970), 99-112.

Stanford, CA, 1991. Shank, J. K. and V. Govindarajan, "Transaction Based Costing for the

Banker, R. D. and G. Potter, "Economic Comparison of Single Cost Complete Product Line: A Field Study," J. Cost Management, 2

Driver and Activity-Based Costing Systems," J. Management Ac- (1988), 31-38.

counting Res., (1993), 15-32. Tang, R. Y. W., "Transfer Pricing in the 1990's," Management Account-

Christensen, J. and J. Demski, "Transfer Pricing in a Limited Com- ing, 73 (1992), 22-26.

munication Setting," Working Paper, Yale University, New Ha- Tirole, J., The Theory of Industrial Organization, MIT Press, Cambridge,

ven, CT, 1990. MA, 1988.

Cooper, R., "Mueller Lehmkuhl GmbH," Harvard Business School Vaysman, I., "A Model of Cost-Based Transfer Pricing," Rev. Account-

Case 9-187-048, Cambridge, MA, 1987. ing Studies, 1 (1996), 73-108.

, "The Rise of Activity Based Costing-Part Three: How Many Wruck, K. H., "Siemens Electric Motor Works (A) & (B)," Harvard

Cost Drivers Do You Need, and How Do You Select Them?, J. Business School Cases 9-189-089, 9-189-090, Cambridge, MA,

Cost Management, 2 (1989), 34-46. 1988.

Accepted by Bala Balachandran; received August 1994. This paper has been with the authors 9 months for 3 revisions.

MANAGEMENT SCIENCE/Vol. 44, No. 4, April 1998 461

This content downloaded from

130.226.87.9 on Tue, 15 Mar 2022 12:18:22 UTC

All use subject to https://about.jstor.org/terms

You might also like

- Test Bank For Microeconomics 3rd Edition Austan Goolsbee Steven Levitt Chad Syverson IsDocument4 pagesTest Bank For Microeconomics 3rd Edition Austan Goolsbee Steven Levitt Chad Syverson IsPaul Rooks100% (33)

- Michael Porter's Value Chain: Unlock your company's competitive advantageFrom EverandMichael Porter's Value Chain: Unlock your company's competitive advantageRating: 4 out of 5 stars4/5 (1)

- Transfer Pricing EssayDocument8 pagesTransfer Pricing EssayFernando Montoro SánchezNo ratings yet

- Langfield-Smith7e IRM Ch03Document37 pagesLangfield-Smith7e IRM Ch03Rujun WuNo ratings yet

- ECON 1000 NotesDocument24 pagesECON 1000 NotesDonnyNo ratings yet

- BF00565413Document36 pagesBF00565413Gabriel SilvaNo ratings yet

- CH 6Document11 pagesCH 6Nesru SirajNo ratings yet

- Cost Behaviour, Cost Drivers and Cost Estimation: Answers To Review QuestionsDocument29 pagesCost Behaviour, Cost Drivers and Cost Estimation: Answers To Review QuestionsSilo KetenilagiNo ratings yet

- Weitzman REStud 1974Document16 pagesWeitzman REStud 1974Fany Serrano RmrzNo ratings yet

- Conclusion Chapter 5 AnalysisDocument4 pagesConclusion Chapter 5 AnalysisMIGUEL ALVIOLANo ratings yet

- Weitzman 1976Document16 pagesWeitzman 1976Marysol AyalaNo ratings yet

- Purchasing II PDFDocument107 pagesPurchasing II PDFfeteneNo ratings yet

- This Study Resource Was: Running Head: Pricing Strategies 1Document4 pagesThis Study Resource Was: Running Head: Pricing Strategies 1Mae-ann Enoc SalibioNo ratings yet

- Strate 1Document86 pagesStrate 1Rabaa DooriiNo ratings yet

- Cost PROFITDocument20 pagesCost PROFITmihretaddissuNo ratings yet

- Cost and Management - AccountingDocument19 pagesCost and Management - Accountingbelwalkarm07gmail.com saibaba123No ratings yet

- Elements of CostingDocument171 pagesElements of Costingiisjaffer100% (1)

- Ijresm V2 I2 40Document3 pagesIjresm V2 I2 40Marshall CountyNo ratings yet

- 21522sm Finalnew Vol2 Cp3 CHAPTER 3Document39 pages21522sm Finalnew Vol2 Cp3 CHAPTER 3Prin PrinksNo ratings yet

- A Strategic Pricing Framework: Journal of Services Marketing March 1990Document13 pagesA Strategic Pricing Framework: Journal of Services Marketing March 1990tutus RiyonoNo ratings yet

- The OECD Guidelines Provide Techniques For Determining Transfer PricingDocument3 pagesThe OECD Guidelines Provide Techniques For Determining Transfer PricingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Module 1 L2Document69 pagesModule 1 L2Joan SagaNo ratings yet

- Week 7 8Document10 pagesWeek 7 8rosieselew091No ratings yet

- ABC CostingDocument64 pagesABC Costingvtnhan@gmail.com100% (1)

- Transfer Pricing Research PaperDocument7 pagesTransfer Pricing Research Papergvzcrpym100% (1)

- Cost Analysis A Powerful Tool For Financial OptimizationDocument10 pagesCost Analysis A Powerful Tool For Financial Optimizationmuskaansaniya06No ratings yet

- Ie Centralised Procurement Strategies Transfer PricingDocument4 pagesIe Centralised Procurement Strategies Transfer PricingHarryNo ratings yet

- Cost Allocation& JBDocument12 pagesCost Allocation& JBfitsumNo ratings yet

- A Model of Negotiated Transfer PricingDocument36 pagesA Model of Negotiated Transfer PricinghenfaNo ratings yet

- Cost Analysis For Mid TermDocument5 pagesCost Analysis For Mid TermMuhammad YousifNo ratings yet

- Marginal Cost Performance Ijariie11856Document7 pagesMarginal Cost Performance Ijariie11856pradeep pNo ratings yet

- Chap 003Document5 pagesChap 003abhinaypradhanNo ratings yet

- Accouting Research Chapters 1-3Document17 pagesAccouting Research Chapters 1-3WenjunNo ratings yet

- ASSIGNMENT TEMPLATE_ENG & BM_JANUARY 2024Document14 pagesASSIGNMENT TEMPLATE_ENG & BM_JANUARY 2024nazuhahussin2No ratings yet

- 04 2004 The Adoption of Total CostDocument43 pages04 2004 The Adoption of Total CostdrkimjoeNo ratings yet

- Mtech Cost Management of Engineering Projects L N Ce r18 0Document118 pagesMtech Cost Management of Engineering Projects L N Ce r18 0Gopikrishnan100% (1)

- The Value Chain and Cost Analysis 6Document5 pagesThe Value Chain and Cost Analysis 6Md.Yousuf AkashNo ratings yet

- Making Effective Pricing Decisions Kostis IndounasDocument10 pagesMaking Effective Pricing Decisions Kostis IndounasjppresaNo ratings yet

- Cost PlusDocument5 pagesCost PlusArare AbdisaNo ratings yet

- 1 PBDocument6 pages1 PBMuhamad IsmailNo ratings yet

- Transfer Pricing TextDocument9 pagesTransfer Pricing TextVuittonzarNo ratings yet

- Noble & Gruca MKSC 1999Document22 pagesNoble & Gruca MKSC 1999Amanda RoseroNo ratings yet

- Boughton 1987Document8 pagesBoughton 1987Morakinyo TaiwoNo ratings yet

- Managerial Implications of Target Costing: CR Vol. 15, No. 1,2005Document9 pagesManagerial Implications of Target Costing: CR Vol. 15, No. 1,2005محمد زرواطيNo ratings yet

- BDHR - Bab 12Document40 pagesBDHR - Bab 12NataliaNo ratings yet

- Class 5-Activity Based CostingDocument17 pagesClass 5-Activity Based CostingLamethysteNo ratings yet

- Chapter 14 ECON NOTESDocument12 pagesChapter 14 ECON NOTESMarkNo ratings yet

- Accounting Summary Session 5 - Tilburg University (Entrepreneurship and Business Innovation)Document3 pagesAccounting Summary Session 5 - Tilburg University (Entrepreneurship and Business Innovation)harald d'oultremontNo ratings yet

- 12 - Chapter15 PresentationDocument36 pages12 - Chapter15 Presentationsiwarr93No ratings yet

- Doupnik ch11Document33 pagesDoupnik ch11Catalina Oriani0% (1)

- First Speaker: Your Honor, Allow Me To Present Our First EvidenceDocument4 pagesFirst Speaker: Your Honor, Allow Me To Present Our First EvidenceNeriza PonceNo ratings yet

- An Investigation of Clean Surplus Value-Added Pricing Models Using Time Series Methods For The UK 1983-1996Document27 pagesAn Investigation of Clean Surplus Value-Added Pricing Models Using Time Series Methods For The UK 1983-1996vinhvinhNo ratings yet

- Dissertation Transfer PricingDocument7 pagesDissertation Transfer PricingHelpMeWithMyPaperAnchorage100% (1)

- Exhibit 5. Buffer Management WorksheetDocument19 pagesExhibit 5. Buffer Management WorksheetJeison PachonNo ratings yet

- MCS 2003Document19 pagesMCS 2003Book wormNo ratings yet

- Study Guide Module 5 Price ManagementDocument6 pagesStudy Guide Module 5 Price ManagementSamantha SmithNo ratings yet

- Ev3 1economicsDocument3 pagesEv3 1economicswillyriverag15No ratings yet

- Merchandising CostingDocument11 pagesMerchandising CostingVishwajeet BhartiNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Unit 2.1: Demand AnalysisDocument46 pagesUnit 2.1: Demand Analysisaakash goswamiNo ratings yet

- SECTION 4-Marginal FunctionDocument11 pagesSECTION 4-Marginal FunctionLê Uyển MiNo ratings yet

- Paper As A Renewable Source of Kindle For Fires Emily ComedisDocument2 pagesPaper As A Renewable Source of Kindle For Fires Emily ComedisArnold Jan BalderamaNo ratings yet

- Not Includednot Allocated Price Differences in CKM3Document4 pagesNot Includednot Allocated Price Differences in CKM3Serap AkyolNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- Asia Refined Oil Products MethodologyDocument39 pagesAsia Refined Oil Products MethodologyTruth SeekerNo ratings yet

- Framework Agreements PDFDocument11 pagesFramework Agreements PDFSaji VarkeyNo ratings yet

- Top 10 NISM Series VIII - Equity Derivatives Demo QuestionsDocument12 pagesTop 10 NISM Series VIII - Equity Derivatives Demo QuestionsSATISH BHARADWAJNo ratings yet

- Question Bank RawDocument178 pagesQuestion Bank RawLê Na100% (2)

- BTEC Unit 4 Financial Control Year Two AssignmentDocument8 pagesBTEC Unit 4 Financial Control Year Two Assignmentjtofts67% (3)

- Extracting Full Value From New Product LaunchesDocument37 pagesExtracting Full Value From New Product LaunchesGuido SoldingerNo ratings yet

- Midterm Exam Code - 01Document7 pagesMidterm Exam Code - 01Phương MaiNo ratings yet

- Cost and Management AccountingDocument12 pagesCost and Management AccountingRohit SoniNo ratings yet

- Oil & Gas in The United Kingdom June 2022: Marketline Industry ProfileDocument55 pagesOil & Gas in The United Kingdom June 2022: Marketline Industry ProfileAbhishek SharmaNo ratings yet

- Spare Part DevelopmentDocument10 pagesSpare Part DevelopmentSurajPandeyNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH08 PPTDocument36 pagesRoss Fundamentals of Corporate Finance 13e CH08 PPTJessica LiNo ratings yet

- Print Invoice - AWB000109Document1 pagePrint Invoice - AWB0001099sccsz8ktpNo ratings yet

- What Is A Wedge?: Key TakeawaysDocument2 pagesWhat Is A Wedge?: Key TakeawaysAli Abdelfatah MahmoudNo ratings yet

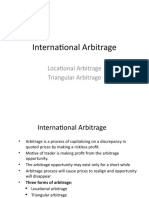

- International Arbitrage: Locational Arbitrage Triangular ArbitrageDocument26 pagesInternational Arbitrage: Locational Arbitrage Triangular ArbitrageAbdallah ClNo ratings yet

- Hilega Milega ConseptsDocument8 pagesHilega Milega Consepts01anku67% (3)

- Kato Summers Opened Take A Dive 17 Years Ago TheDocument1 pageKato Summers Opened Take A Dive 17 Years Ago TheMuhammad ShahidNo ratings yet

- Two Prime Institutional Investment GuideDocument31 pagesTwo Prime Institutional Investment GuideFabioNo ratings yet

- Economics Demand SupplyDocument6 pagesEconomics Demand SupplykhurramNo ratings yet

- Pipe Bender: Supplier Name: AddressDocument9 pagesPipe Bender: Supplier Name: AddressEverAngelNo ratings yet

- Industry AnalysisDocument2 pagesIndustry AnalysisThanh Nguyen NgocNo ratings yet

- Icp CompendiumDocument3 pagesIcp Compendiumak4784449No ratings yet

- Trading Tips Manual For EducationDocument18 pagesTrading Tips Manual For EducationJeeva 07No ratings yet

- File Test 2Document5 pagesFile Test 2freedriver datuNo ratings yet