Professional Documents

Culture Documents

balancesheet (14)

balancesheet (14)

Uploaded by

abhisek0 ratings0% found this document useful (0 votes)

1 views5 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views5 pagesbalancesheet (14)

balancesheet (14)

Uploaded by

abhisekCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 5

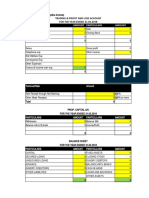

Particulars Values

NON CURRENT ASSETS

Financial Assets at FVTPL 120000

Beginning of Financial Year 60000

Additions (+) 60000

Disposals (-) 60000

Fair value Gains (+) 60000

Derivative Financial Instruments 240000

Derivatives held for hedging 180000

Cash-Flow Hedges 120000

Interest Rate Swaps 60000

Currency Forwards 60000

Fair Value Hedge 60000

Currency Forwards 60000

Derivatives not held for hedging 60000

Currency Forwards 60000

Financial Assets at FVOCI 120000

Beginning of Financial Year 60000

Additions (+) 60000

Fair value Gains (+) 60000

Disposals (-) 60000

Other Investments at amortised cost 120000

Beginning of Financial Year 60000

Additions (+) 60000

Fair value Gains (+) 60000

Disposals (-) 60000

Trade and Other Receivables 240000

Finance Lease Recivables 60000

Loan to Associate 60000

Loan to Subsidiaries 60000

Staff Loans 60000

Investment Properties 240000

Beginning of Financial Year 60000

Additions (+) 60000

Fairvalue Gains (+) 60000

Disposals (-) 60000

Transfer from inventories 60000

Transfer from Property, Plant and Equipment 60000

Property, Plant and Equipment 120000

Building, Plant and Equipment, Motor Vehicles 0

Beginning of Financial Year 60000

Additions (+) 60000

Disposals (-) 60000

Depreciation (-) 60000

Transfer to investment properties (-) 60000

Revaluation Adjustments 60000

Land 120000

Freehold Land 60000

Leasehold Land 60000

Intangible Assets 180000

Goodwill 60000

Beginning of Financial Year 60000

Additions (+) 60000

Impairments (-) 60000

Trademarks and licenses 60000

Beginning of Financial Year 60000

Additions (+) 60000

Impairments (-) 60000

Computer software and licenses 60000

Beginning of Financial Year 60000

Additions (+) 60000

Impairments (-) 60000

Deferred Income Tax Assets 0

Deferred tax assets (+) 60000

Deferred tax Liabilities (-) 60000

Investment in a Joint Venture 60000

Equity investment at cost at beginning of year 60000

Share of profit in associates (+) 60000

Dividend received (-) 60000

Investments in Associates 60000

Equity investment at cost at beginning of year 60000

Share of profit in associates (+) 60000

Dividend received (-) 60000

TOTAL NON CURRENT ASSETS 1500000

CURRENT ASSETS

Cash and cash equivalents 60000

Cash at bank 60000

Cash in hand 60000

Short term bank deposits 60000

Bank deposits pledged (-) 60000

Bank overdafts (-) 60000

Derivatve financial instruments 240000

Derivatives held for hedging 180000

Cash-Flow Hedges 120000

Interest Rate Swaps 60000

Currency Forwards 60000

Fair Value Hedge 60000

Currency Forwards 60000

Derivatives not held for hedging 60000

Currency Forwards 60000

Trade and other receivables 540000

Trade receivabes 120000

Associates 60000

Subsidiaries 60000

Non-related parties 60000

Allowances (-) 60000

Loan to associates 60000

Finance lease receivables 60000

Staff loans 60000

Government grant receivables 60000

Deposits 60000

Prepayments 60000

Other receivables 60000

Inventories 180000

Raw materials 60000

Work-in-progress 60000

Finished goods 60000

Non-current asset classified as held for sale 180000

Discontinued operations 60000

Plant, property and equipments held for sale 60000

Discontinues cash generating units 60000

TOTAL CURRENT ASSETS 1200000

TOTAL ASSETS 2700000

SHAREHOLDERS' EQUITY

Share capital 260000

Beginning of financial year 260000

Shares issued (+) 60000

Shares issue expenses (-) 60000

Treasury shares -30000

Treasury shares purchased (-) 90000

Treasury shares reissued (+) 60000

Other reserves 840000

Share option reserve 120000

Beginning of the financial year 60000

Employee share option scheme 60000

Capital reserve 180000

Beginning of the financial year 60000

Gain on re-issue 60000

Excess tax on employee share option scheme 60000

Fair value reserve 120000

Beginning of the financial year 60000

Fair value gains/(losses) 60000

Hedging reserve 180000

Beginning of the financial year 60000

Fair value gains/(losses) 60000

Tax on reclassification adjustments 60000

Currency translation reserve 120000

Beginning of the financial year 60000

Net currency translation differences 60000

Equity component of convertible bonds 60000

Asset revaluation resrve 60000

Beginning of the financial year 60000

Revaluation gains 60000

Tax on revaluation gains 60000

Retained profits 60000

Beginning of financial year 60000

Net profit for the financial year 60000

Dividends paid during the financial year 60000

TOTAL SHAREHOLDERS’ EQUITY 1130000

NON CURRENT LIABILITIES

Borrowings 300000

Bank borrowings 60000

Convrtible bonds 60000

Redeemable preference share 60000

Lease liabilities 60000

Security granted 60000

Provisions 360000

Legal claims 120000

Beginning of financial year 60000

Provision made 60000

Provision utilised 60000

Amortisation of discount 60000

Deferred tax liabilities 0

Deferred tax assets (+) 60000

Deferred tax Liabilities (-) 60000

TOTAL NON CURRENT LIABILITIES 660000

CURRENT LIABILITIES

Trade and Other payables 480000

Trade payables to:- 180000

Non-related parties 60000

Associates 60000

Other related parties 60000

Refund liabilities 60000

Financial discounts 60000

Deferred grant income 60000

Accrual of operating expenses 60000

Accruals of volume discounts 60000

Current income tax liabilities 120000

Beginning of financial year 60000

Income tax paid 60000

Tax expense 60000

Under-provision in prior financial years 60000

Borrowings 150000

Bank overdrafts 60000

Bank borrowings 60000

Lease liabilities 30000

Provisions 160000

Warranty 70000

Restructuring 90000

TOTAL CURRENT LIABILITIES 910000

TOTAL LIABILITIES 1570000

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES 2700000

You might also like

- McKinsey Valuation DCF ModelDocument18 pagesMcKinsey Valuation DCF Modelnsksharma46% (13)

- Cheat Sheet For Valuation (2) - 1Document2 pagesCheat Sheet For Valuation (2) - 1RISHAV BAIDNo ratings yet

- Accounting TheoryDocument192 pagesAccounting TheoryABDULLAH MOHAMMEDNo ratings yet

- Particulars Details Amount Cash Flow From Operating ActivitiesDocument2 pagesParticulars Details Amount Cash Flow From Operating ActivitiesJagriti SukhijaNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementTangga MasNo ratings yet

- Session - Double Entry SystemDocument8 pagesSession - Double Entry SystemIIT IIM Anubhav AnubhavNo ratings yet

- non-ifrs-profitloss (3)Document5 pagesnon-ifrs-profitloss (3)abhisekNo ratings yet

- Transaction Amount Assets Cash BankDocument17 pagesTransaction Amount Assets Cash Bankakansha.associate.workNo ratings yet

- Your Company Name: Balance Sheet Projection Fiscal Year End DateDocument5 pagesYour Company Name: Balance Sheet Projection Fiscal Year End DateBohdan KozarNo ratings yet

- Financial Statements 1Document3 pagesFinancial Statements 1graflegalscNo ratings yet

- Excel ExercisesDocument10 pagesExcel ExercisesJerirose LuceroNo ratings yet

- Cashflow ForecastDocument3 pagesCashflow ForecastlithyemNo ratings yet

- Balance Sheet and Income StatementDocument7 pagesBalance Sheet and Income StatementAlexNo ratings yet

- Financial Plotting - NewDocument16 pagesFinancial Plotting - NewDrishti SrivatavaNo ratings yet

- Your Company Name: Balance Sheet Projection - Quaterly Fiscal Year End DateDocument10 pagesYour Company Name: Balance Sheet Projection - Quaterly Fiscal Year End DateVochariNo ratings yet

- Format of P&LDocument7 pagesFormat of P&Lbiresh30No ratings yet

- SbabalancesheettemplateDocument2 pagesSbabalancesheettemplateraperdNo ratings yet

- Balance SheetDocument4 pagesBalance Sheetapi-3726455No ratings yet

- balancesheet (15)Document5 pagesbalancesheet (15)abhisekNo ratings yet

- Ecavo EvaluationDocument5 pagesEcavo EvaluationHement PawarNo ratings yet

- Eq Laporan Neraca 2020 12 18 00 29 11Document3 pagesEq Laporan Neraca 2020 12 18 00 29 11RudiE EqualNo ratings yet

- Profit and Loss and Balance SheetDocument2 pagesProfit and Loss and Balance SheetmuditNo ratings yet

- Business Plan 52536Document9 pagesBusiness Plan 52536feri marrNo ratings yet

- Final AccountsDocument35 pagesFinal AccountstusharNo ratings yet

- Balance Sheet - QuarterlyDocument3 pagesBalance Sheet - QuarterlyNu SNo ratings yet

- $ - $0 $0 $0 $0 $0 Initial Cash Flow: Income (Inflow)Document4 pages$ - $0 $0 $0 $0 $0 Initial Cash Flow: Income (Inflow)AmeerNo ratings yet

- AfM 6 - Standard Form of Financial AccountsDocument4 pagesAfM 6 - Standard Form of Financial AccountsjaymursalieNo ratings yet

- Book 1Document9 pagesBook 1biswasouNo ratings yet

- Free Balance Sheet Template - Zoho BooksDocument2 pagesFree Balance Sheet Template - Zoho BooksloosernavNo ratings yet

- Two-Year Comparative Income StatementDocument1 pageTwo-Year Comparative Income Statement123prasad1234No ratings yet

- Two-Year Comparative Income Statement: (Name)Document1 pageTwo-Year Comparative Income Statement: (Name)Nizwa KhalifaNo ratings yet

- Basic Balance SheetDocument3 pagesBasic Balance SheetJean Marc LouisNo ratings yet

- Account AccountDocument12 pagesAccount AccountblackghostNo ratings yet

- EN - Free Excel Templates Nonprofit AccountingDocument19 pagesEN - Free Excel Templates Nonprofit AccountingCarlos FlammenschwertNo ratings yet

- Evaluation SummaryDocument8 pagesEvaluation SummaryHement PawarNo ratings yet

- Financial Statement AnalysisDocument26 pagesFinancial Statement AnalysisRam PhalNo ratings yet

- Company Name Profit and Loss Statement For The Period 2018-2019Document4 pagesCompany Name Profit and Loss Statement For The Period 2018-2019Abdul HadiNo ratings yet

- Financial Aspect GTDocument21 pagesFinancial Aspect GTRyan ParejaNo ratings yet

- Share Holders' Funds: Description CUDocument1 pageShare Holders' Funds: Description CUkrishna chaitanyaNo ratings yet

- FRA TemplateDocument14 pagesFRA TemplatevidyaNo ratings yet

- Template 2Document17 pagesTemplate 2vidyaNo ratings yet

- Nota Cuenta 2014 2013: Activos Activos CorrientesDocument2 pagesNota Cuenta 2014 2013: Activos Activos CorrientesFranzuaPerezNo ratings yet

- Part A Fin STMT TemplatesDocument15 pagesPart A Fin STMT Templatesvrushali_acharyaNo ratings yet

- EstimateDocument1 pageEstimateikan flyNo ratings yet

- Balance GeneralDocument2 pagesBalance GeneralLinn Victor Espinoza CastelloNo ratings yet

- Balance-Sheet-Template vSHAREDocument3 pagesBalance-Sheet-Template vSHARESiyabongaNo ratings yet

- Cash Flow Statement 2021-04-01 To 2021-04-27Document2 pagesCash Flow Statement 2021-04-01 To 2021-04-27SheikhNo ratings yet

- 2023 National-2Document13 pages2023 National-2sumaiya shafiqNo ratings yet

- profitloss (20)Document2 pagesprofitloss (20)abhisekNo ratings yet

- Cma DataDocument7 pagesCma Datasandeep thakurNo ratings yet

- Long Term Cash Flow ForecastDocument1 pageLong Term Cash Flow ForecastJoe WatkinsNo ratings yet

- LOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetDocument5 pagesLOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetJomidy Midtanggal100% (1)

- HYPERVERS+TECHNOLOGIES+INC. Balance+SheetDocument2 pagesHYPERVERS+TECHNOLOGIES+INC. Balance+SheetshahzadnadirgillaniNo ratings yet

- SESSION 3 Practice TemplateDocument7 pagesSESSION 3 Practice Templateyimin liuNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Computing Development Strategies Pro Forma Balance Sheet - 12/31/00Document12 pagesComputing Development Strategies Pro Forma Balance Sheet - 12/31/00shahboozoNo ratings yet

- Financial Statement Analysis: The Information MazeDocument43 pagesFinancial Statement Analysis: The Information MazeJay DaveNo ratings yet

- Sakshita Food LLP Balance Sheet As On 31/03/222 Particulars Current Year Previous Year I. Contribution and Liabilities A Partners' FundsDocument4 pagesSakshita Food LLP Balance Sheet As On 31/03/222 Particulars Current Year Previous Year I. Contribution and Liabilities A Partners' FundsAshish JainNo ratings yet

- Financial StatementDocument1 pageFinancial StatementdenivelNo ratings yet

- Investment PDFDocument15 pagesInvestment PDFLenrey Cobacha100% (1)

- SQE - Financial Accounting and Reporting - Second Year - March 31, 2011Document11 pagesSQE - Financial Accounting and Reporting - Second Year - March 31, 2011Jerimiah MirandaNo ratings yet

- Aicpa Draft-Inventory-Valuation-GuidanceDocument50 pagesAicpa Draft-Inventory-Valuation-GuidanceOmar OteroNo ratings yet

- International Accounting 2: Hoang Trong HiepDocument212 pagesInternational Accounting 2: Hoang Trong HiepHAO HUYNH MINH GIANo ratings yet

- Introduction To Business ValuationDocument9 pagesIntroduction To Business Valuationscholta00No ratings yet

- Principles of Security AnalysisDocument6 pagesPrinciples of Security AnalysisSheila Mae MalesidoNo ratings yet

- Suggested Answer CAP II Dec 2017Document109 pagesSuggested Answer CAP II Dec 2017Sushant MaskeyNo ratings yet

- Intermediate Accounting 15Th Edition Full ChapterDocument41 pagesIntermediate Accounting 15Th Edition Full Chapterjennifer.calhoun425100% (26)

- Ias 41 ReportDocument10 pagesIas 41 ReportKarlo PalerNo ratings yet

- Practice ProblemsDocument14 pagesPractice ProblemsJeselle HyungSikNo ratings yet

- Lesson 3 Accounting For LeasesDocument11 pagesLesson 3 Accounting For LeasesKurrent Toy100% (1)

- IAS 12 GuideDocument52 pagesIAS 12 Guidezubair_zNo ratings yet

- Investment in AssociateDocument11 pagesInvestment in AssociateElla MontefalcoNo ratings yet

- Cover & Table of Contents - Intermediate Accounting (14th Edition)Document36 pagesCover & Table of Contents - Intermediate Accounting (14th Edition)AviNo ratings yet

- Ugbs Accounting For Investment in Associate and Joint VentureDocument30 pagesUgbs Accounting For Investment in Associate and Joint VentureStudy GirlNo ratings yet

- Disposal of Investment PropertyDocument4 pagesDisposal of Investment Propertyglaide lojeroNo ratings yet

- Assessment Test 2 Joint ArrangementsDocument8 pagesAssessment Test 2 Joint ArrangementsJas TanNo ratings yet

- Sun Pharma Phillipines Inc.Document42 pagesSun Pharma Phillipines Inc.Anjelika ViescaNo ratings yet

- Ias 41 Ias 11Document24 pagesIas 41 Ias 11KM RobinNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Kering Press Release 2021 FY Results 17022022 19cf2236a3Document17 pagesKering Press Release 2021 FY Results 17022022 19cf2236a3zinzin shoonletNo ratings yet

- Cognizant Ifrs17 Whitepaper WebviewDocument35 pagesCognizant Ifrs17 Whitepaper WebviewVinay JainNo ratings yet

- ADV2Document3 pagesADV2Rommel RoyceNo ratings yet

- Grameenphone Audited Financial Statements 2022Document60 pagesGrameenphone Audited Financial Statements 2022S.R. EMONNo ratings yet

- Acca SBR 675 685 PDFDocument11 pagesAcca SBR 675 685 PDFYudheesh P 1822082No ratings yet

- Ch3 IAS40 Investment PropertyDocument31 pagesCh3 IAS40 Investment Propertyxu l100% (1)

- Practical AccountingDocument13 pagesPractical AccountingDecereen Pineda RodriguezaNo ratings yet

- The Main New Irish Gaap Standard: Implications For The Hotel SectorDocument20 pagesThe Main New Irish Gaap Standard: Implications For The Hotel Sectorwattersed1711No ratings yet