Professional Documents

Culture Documents

Internal and Assignment Question Bank of Business Economics Sem2 2023-24

Internal and Assignment Question Bank of Business Economics Sem2 2023-24

Uploaded by

dhruvdalal63Copyright:

Available Formats

You might also like

- Microeconomics 21st Edition Mcconnell Solutions ManualDocument17 pagesMicroeconomics 21st Edition Mcconnell Solutions Manualzeldaguinevereiur100% (35)

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionFrom EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionRating: 4 out of 5 stars4/5 (10)

- O Level EcoDocument88 pagesO Level EcoFATIMANo ratings yet

- Assignment - Market StructureDocument5 pagesAssignment - Market Structurerhizelle19No ratings yet

- Unit - 3: Price-Output Determination Under Different Market FormsDocument47 pagesUnit - 3: Price-Output Determination Under Different Market FormsPriyanshu SharmaNo ratings yet

- Microeconomics II Work SheetDocument31 pagesMicroeconomics II Work SheetTsion GetuNo ratings yet

- Unit - 3: Price-Output Determination Under Different Market FormsDocument47 pagesUnit - 3: Price-Output Determination Under Different Market FormsHabtamu KefelegnNo ratings yet

- Market Structures by Dedicatoria, Intino, VillaramaDocument14 pagesMarket Structures by Dedicatoria, Intino, VillaramaAlpha CapacitorNo ratings yet

- EME-4 NotesDocument17 pagesEME-4 NotesAakriti DubeyNo ratings yet

- Managerial Economics: Rijan DhakalDocument117 pagesManagerial Economics: Rijan DhakalKhanal NilambarNo ratings yet

- Forms of Market (MARKS: 10) Key Concepts: of A Homogeneous ProductDocument14 pagesForms of Market (MARKS: 10) Key Concepts: of A Homogeneous Productsridharvchinni_21769No ratings yet

- ECO Forms of Market - Mahesh School - FORMS OF MARKETDocument3 pagesECO Forms of Market - Mahesh School - FORMS OF MARKETByomkesh PandaNo ratings yet

- MARKET EQUILIBRIUM EconomicsDocument20 pagesMARKET EQUILIBRIUM EconomicsmayureshbachhavchessNo ratings yet

- Economics AssignmentDocument21 pagesEconomics AssignmentMichael RopNo ratings yet

- Lecture Chapter6Document7 pagesLecture Chapter6Angelica Joy ManaoisNo ratings yet

- M212064104 - Individual Assignment - Mii1023Document7 pagesM212064104 - Individual Assignment - Mii1023KU MUHAMMAD ADLI SYAHMINo ratings yet

- Unit 5Document50 pagesUnit 5NEENA SARA THOMAS 2227432No ratings yet

- Unit 3Document61 pagesUnit 3Prashant KangtikarNo ratings yet

- Applied Economics Q1-W5Document32 pagesApplied Economics Q1-W5Nicole FerrerNo ratings yet

- 46699bosfnd p4 cp3 U2Document43 pages46699bosfnd p4 cp3 U2Arun KCNo ratings yet

- Ethics in MarketplaceDocument32 pagesEthics in MarketplaceAkanksha AroraNo ratings yet

- Main Market FormsDocument9 pagesMain Market FormsP Janaki Raman50% (2)

- E. Break-Even PointDocument2 pagesE. Break-Even PointMarfe BlancoNo ratings yet

- Mefa Unit-3Document20 pagesMefa Unit-3rosieNo ratings yet

- TECHNOPRENEURSHIPDocument13 pagesTECHNOPRENEURSHIPLeana Victoria EspanolaNo ratings yet

- Market StructureDocument19 pagesMarket StructureSri HarshaNo ratings yet

- Economics MarketsDocument10 pagesEconomics MarketsGEORGENo ratings yet

- Market Structures: BarriersDocument4 pagesMarket Structures: BarriersAdelwina AsuncionNo ratings yet

- Class 11 MARKETDocument16 pagesClass 11 MARKETTim_GnsNo ratings yet

- IE&M Module 2Document20 pagesIE&M Module 2moh882788No ratings yet

- The Firm and Market StructuresDocument36 pagesThe Firm and Market StructuresPrince Agrawal100% (1)

- Economics Notes Nec CH - 5 StuDocument11 pagesEconomics Notes Nec CH - 5 StuBirendra ShresthaNo ratings yet

- Econdev L4 Market StructuresDocument7 pagesEcondev L4 Market StructuresMark Rafael MacapagalNo ratings yet

- Module 5 (Rev)Document7 pagesModule 5 (Rev)Meian De JesusNo ratings yet

- Практичне Заняття 3- 4. Структура РинкуDocument6 pagesПрактичне Заняття 3- 4. Структура РинкуИнна БелицкаяNo ratings yet

- Review Lecture Notes Chapter 16Document4 pagesReview Lecture Notes Chapter 16- OriNo ratings yet

- Types of Market and Price DeterminationDocument4 pagesTypes of Market and Price DeterminationSaurabhNo ratings yet

- Market Structure: E5 Managerial EconomicsDocument34 pagesMarket Structure: E5 Managerial EconomicsprabodhNo ratings yet

- Final Exam (Answer) : ECO1132 (Fall-2020)Document13 pagesFinal Exam (Answer) : ECO1132 (Fall-2020)Nahid Mahmud ZayedNo ratings yet

- Session - 6 (Imperfect Competition - Revision Notes)Document2 pagesSession - 6 (Imperfect Competition - Revision Notes)Abhishek Kumar SinghNo ratings yet

- Oligopolistic Market and Game TheoryDocument23 pagesOligopolistic Market and Game TheoryAshleyNo ratings yet

- Name of The Course: Business Economics Name of The Course: Business Economics Course Code: Course CodeDocument33 pagesName of The Course: Business Economics Name of The Course: Business Economics Course Code: Course CodeVIVA MANNo ratings yet

- Microeconomics PartDocument30 pagesMicroeconomics PartEmma QuennNo ratings yet

- Market StructureDocument20 pagesMarket StructureSunny RajpalNo ratings yet

- Chapter 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsDocument1 pageChapter 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsMikkoNo ratings yet

- Economics Notes Unit 5Document5 pagesEconomics Notes Unit 5karankumar67656No ratings yet

- Forms of Market Basic ConceptsDocument4 pagesForms of Market Basic ConceptsStanzin YangdolNo ratings yet

- Summary Final MicroeconomicsDocument16 pagesSummary Final MicroeconomicsepostliahNo ratings yet

- Ch. 7 Firm Competition andDocument25 pagesCh. 7 Firm Competition ands130220073No ratings yet

- Module 3Document15 pagesModule 3vaseem aktharcpNo ratings yet

- Me Unit 4Document28 pagesMe Unit 4biswajeet2580No ratings yet

- Chapter 6 - GROUP 1 APPLIED ECONOMISDocument18 pagesChapter 6 - GROUP 1 APPLIED ECONOMISkassandra.abrocio99No ratings yet

- Module 6 - ReadingDocument7 pagesModule 6 - ReadingChristine Mae MansiaNo ratings yet

- Market Structures: Structures, All Dependent Upon The Extent To Which Buyers and SellingDocument10 pagesMarket Structures: Structures, All Dependent Upon The Extent To Which Buyers and SellingMekbib MulugetaNo ratings yet

- Market Structures unit 4Document12 pagesMarket Structures unit 4dshivansh195No ratings yet

- UntitledDocument3 pagesUntitledBhebz Erin MaeNo ratings yet

- MicroeconomicsDocument15 pagesMicroeconomicsDar SartajNo ratings yet

- Market StructureDocument60 pagesMarket StructureMonina CahiligNo ratings yet

- MArketDocument30 pagesMArketKavya AroraNo ratings yet

- Chapter FiveDocument33 pagesChapter Fivedream of lifesNo ratings yet

- AssignmentDocument6 pagesAssignmentRandz RamosNo ratings yet

- The Market Makers (Review and Analysis of Spluber's Book)From EverandThe Market Makers (Review and Analysis of Spluber's Book)No ratings yet

- Demand Estimation & ForecastingDocument15 pagesDemand Estimation & ForecastingSufana UzairNo ratings yet

- Majorship Let Reviewer in Social ScienceDocument42 pagesMajorship Let Reviewer in Social ScienceMechelle Landicho Bacay67% (3)

- Multiple Choice Questions (MCQ) Q.1 - Q.10 Carry ONE Mark EachDocument81 pagesMultiple Choice Questions (MCQ) Q.1 - Q.10 Carry ONE Mark EachShadowmaster LegendNo ratings yet

- ECON2113 MC PracticeDocument44 pagesECON2113 MC Practicefish LNo ratings yet

- 2.3. Elasticity - Measure of ResonsivenessDocument2 pages2.3. Elasticity - Measure of ResonsivenessgebreNo ratings yet

- Lesson 5 and 6 - Elasticity of Supply and DemandDocument18 pagesLesson 5 and 6 - Elasticity of Supply and DemandCharles Corporal ReyesNo ratings yet

- Math1 PDFDocument22 pagesMath1 PDFcarinaNo ratings yet

- MONOPOLY Lecture Notes - Fall 2019 PDFDocument8 pagesMONOPOLY Lecture Notes - Fall 2019 PDFBenChangNo ratings yet

- Assignment 2 답안지Document8 pagesAssignment 2 답안지잘하자No ratings yet

- Homework Economics Chapter 5 Elasticity and Its Application Oct 12 2022 Ver 101Document7 pagesHomework Economics Chapter 5 Elasticity and Its Application Oct 12 2022 Ver 101叶睿阳No ratings yet

- Income & Substitution Effect Ch05Document119 pagesIncome & Substitution Effect Ch05Wiqar A. KhanNo ratings yet

- Elasticity-Of-Demand 8552087 PowerpointDocument21 pagesElasticity-Of-Demand 8552087 PowerpointChandan NNo ratings yet

- 123doc Cau Hoi Trac Nghiem Kinh Te Vi Mo Mankiw Co Dap AnDocument112 pages123doc Cau Hoi Trac Nghiem Kinh Te Vi Mo Mankiw Co Dap AnTrang Lê ThuNo ratings yet

- Microeconomics Assignment 2Document4 pagesMicroeconomics Assignment 2Stremio HubNo ratings yet

- Module 1 Engineering EconomyDocument13 pagesModule 1 Engineering EconomyZarah Astraea Longcob100% (3)

- Exam1 Practice Exam SolutionsDocument37 pagesExam1 Practice Exam SolutionsSheehan T Khan100% (3)

- Solution Manual For Principles of Macroeconomics 8Th Edition Mankiw 1305971507 9781305971509 Full Chapter PDFDocument30 pagesSolution Manual For Principles of Macroeconomics 8Th Edition Mankiw 1305971507 9781305971509 Full Chapter PDFdoris.fuentes765100% (19)

- Crux of Indian EconomyDocument306 pagesCrux of Indian EconomyChinmay JenaNo ratings yet

- 2023 Tutorial 8Document2 pages2023 Tutorial 8gpt chatNo ratings yet

- Theory of DistributionDocument11 pagesTheory of Distributionrahulravi4uNo ratings yet

- Practice w2 MCTDocument16 pagesPractice w2 MCTYuki TanNo ratings yet

- Q1. David's Preferences Over Books: SolutionDocument8 pagesQ1. David's Preferences Over Books: SolutionNga Lê Nguyễn PhươngNo ratings yet

- CH 24 - Study QuestionsDocument7 pagesCH 24 - Study QuestionsOUM-17A0% (1)

- ECON Model PaperDocument24 pagesECON Model PaperDiniki JayakodyNo ratings yet

- 专题1 7讲解版Document80 pages专题1 7讲解版bbbbdxNo ratings yet

- 07 SGDocument16 pages07 SGmnrao62No ratings yet

- Quiz2 Selected MCQs StudentDocument21 pagesQuiz2 Selected MCQs StudentTrần ThiNo ratings yet

- Exploring Microeconomics 7th Edition Sexton Test Bank 1Document69 pagesExploring Microeconomics 7th Edition Sexton Test Bank 1john100% (45)

Internal and Assignment Question Bank of Business Economics Sem2 2023-24

Internal and Assignment Question Bank of Business Economics Sem2 2023-24

Uploaded by

dhruvdalal63Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal and Assignment Question Bank of Business Economics Sem2 2023-24

Internal and Assignment Question Bank of Business Economics Sem2 2023-24

Uploaded by

dhruvdalal63Copyright:

Available Formats

Department of Law

B.Com. LL.B. (Hons) sem -II

Business Economics –II

Internal Question Bank

Academic year 2023-24

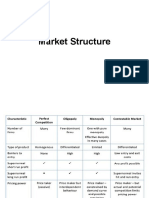

Unit – 1 Market Structure

True and False

1. A firm produce its output with the purpose of selling in the market. True

2. A monopolistically competitive firm cannot successfully maintain positive economic

profits in the long-run. True

3. A monopolistically competitive firm does not produce at its minimum ATC in the

long-run. True

4. A product market refers to a market where goods and commodities are bought and

sold. It is also known as commodity market. True

5. According to Stonier and Hauge, market means buyers and seller haven’t any close

touch with each other for particular commodity. False

6. An oligopoly firm faces a kinked demand curve on the assumption that if it decides

to raise its price, its rivals will not raise their prices, but if it lowers its price, they will

definitely react to its action and will lower their prices. True

7. Barriers to entry make it possible for monopolies to earn positive economic profits in

the long-run. True

8. Business fluctuations are traced to the divergence between natural and market rates

of interest. True

9. Excess capacity is a salient feature of equilibrium under monopolist firm. False

10. Firm in the perfect competition is price maker. False

11. In long run under perfect competitive market industry is earning super normal profit.

False

12. In monopoly the cross elasticity of demand between the product and other industries

Dr. Yashodhara A Bhatt Page 1

are infinite. False

13. In perfect competition, there prevails one single price for the homogeneous

products monopolistic competition, there are different prices of differentiated

products. True

14. Informative Advertisement create an impression on the minds of the consumers

that the advertised product superior to that of the products of the rival firms. False

15. Market-sharing cartel is the agreement reached between the oligopolistic firms regarding

quota of output to be produced and sold by each of them at the agreed price. True

16. Monopolist faces downward sloping demand curve and sell only a limited quantity of

output at each price. True

17. Perfect competition is not included in the assumptions of Clark’s marginal productivity

of distribution. False

18. Positive relation between selling costs and the volume of sales secured by a firm. False

19. Price Discrimination can occur only if it is not possible to transfer any unit of the product

from one market to another market. True

20. Price discrimination is not possible due to preference or prejudices of the buyers. False

21. Price Discrimination is profitable only if elasticity of demand in both market is equality

elastic. False

22. Price elasticity of demand for individual firm in perfect competition is perfectly inelastic.

False

23. Price leader tends to keep the price stable and is usually keen to avoid price wars.

True

24. Price leadership is an easy method of determine price in monopolist market. False

25. Price leadership model explains the upward adjustment of prices in perfect

competitive markets. False

26. Price maker of Oligopoly market tends to keep the price stable and is usually keen

to avoid price wars. True

27. Prices of commodities are sticky or rigid under the monopolist. False

Dr. Yashodhara A Bhatt Page 2

28. Selling cost on the other hand, are those costs which are incurred to increase the

sale of the product. True

29. Selling costs affect the position and the shape of the demand curve. True

30. Supernormal profit refers to high proportion of gross profit. False

31. The Chamberlin solution can be explained both in terms of output adjustment and price

adjustment. True

32. The Cournot Model is an open model because it does not allow entry of firms.

True

33. The Cournot solution is realistic because it assumes zero cost of production. False

34. The kinked demand curve model was first used by Paul M. Sweezy in 1939.True

35. The modern market system is not characterised by the existence of imperfect

market. False

36. The price leader takes a long run point of view, which is he is willing to sacrifice only

short term benefits not for long-run benefits. False

Fill in blanks

1. A cartel is a collusive agreement among a number of firms that is designed to Restrict

output and raise prices.

2. A discriminating monopolist will charge a higher price from less elastic of customer

group.

3. A factor of production, whose supply is fixed in the short run, may get additional

earnings is Quasi rent.

4. Advertising and selling costs have a strategic importance in oligopoly firms.

5. Chamberlin criticised and rejected both the Cournot and Bertrand cases on the ground

that none of them conforms perfectly to the hypothesis that each seller acts so as to render

his profit a maximum.

6. Demand curve of the firm is in perfect competitive market is horizontal line or parallel

to x-axis.

Dr. Yashodhara A Bhatt Page 3

7. Demand curve of the firm is in perfect competitive market is horizontal line or parallel

to x-axis.

8. Demand for capital is inversely related to the rate of interest, and the demand schedule

for capital or investment curve slopes downward from left to right

9. Dumping is the best example local price discrimination.

10. Excess capacity is a salient feature of equilibrium under monopolistic

competition.

11. If one firm in a duopoly increases its production by one unit beyond the monopoly

output, that firm's profit increases, the other firm's profit decreases, and the total profit

of the duopoly decreases.

12. In economics, term market does not a particular place but the whole area where buyers

and seller of product are spread over whole town, region or country.

13. In monopoly market have unique product without close substitution.

14. In Oligopoly market of firm entry barriers due to product differentiation and by a few

firms dominating the market.

15. In Oligopoly market, entry of new firms has barriers due to product differentiation and

by a few firms dominating the market.

16. In oligopoly method is concerned with the maximization of joint profit is Collusive

model.

17. Market-sharing cartel is the agreement reached between the oligopolistic firms regarding

quota of output to be produced and sold by each of them at the agreed price.

18. Oligopoly is different from both perfect competition and monopoly.

19. Perfect cartels, has been quite rare in the real world even where their formation is not

illegal.

20. Persuasive Advertisement create an impression on the minds of the consumers

that the advertised product superior to that of the products of the rival firms.

21. Price Discrimination can occur only if it is not possible to transfer any unit of the product

from one market to another market.

Dr. Yashodhara A Bhatt Page 4

22. Price discrimination is possible due to preference or prejudices of the buyers.

23. Price leadership is an easy method of pricing as it requires a simple casual inquiry as

to the prices of other firms.

24. Price leadership model explains the upward adjustment of prices in Oligopoly

market.

25. Pure monopoly is a single firm, where the cross elasticity of demand between the product

and other industries are zero

26. Pure profit earned by an entrepreneur may also include fortuitous or chance gain.

27. Selling costs affect the position and the shape of the demand curve

28. The Chamberlin solution can be explained both in terms of output adjustment and price

adjustment.

29. The demand curve of a firm is indeterminate under the oligopoly market.

30. The dominant firm is a large firm compare to other firms whose account of market

out share comparatively higher.

31. The first degree involves the maximum people exploitation of each buyer in the

interest of seller’s profit called perfect price discrimination

32. The primary market consists of manufacturers who produces and sells the products to

the wholesalers.

33. The profit maximizing firm in a monopolistic competition reaches equilibrium output

where its Average total cost is equal to price

34. In unregulated markets there are no regulations or condition laid down the government

in such markets.

35. There are three condition by which we can easily know about that firm is earning profit

or loss AC> AR, AC=AR, AC< AR

36. There is no relation between selling costs and the volume of sales secured by a firm.

37. When commodity is bought and sold only in a particular region, which is mainly

influenced by regional condition is called Regional Market.

Dr. Yashodhara A Bhatt Page 5

Answer on one or two sentences

1. State the difference between perfect competition and monopolistic market

Basis For Perfect Competition Monopolistic Competition

Comparison

Meaning A market structure, where Monopolistic Competition is a

there are many sellers selling market structure, where there are

similar goods to the buyers, numerous sellers, selling close

is perfect competition. substitute goods to the buyers.

Product Standardized Differentiated

Price Determined by demand and Every firm offer products to

supply forces, for the whole customers at its own price.

industry.

Entry and Exit No barrier Few barriers

Demand Curve Horizontal, perfectly elastic. Downward sloping, relatively

slope elastic.

Relation between AR = MR AR > MR

AR and MR

Situation Unrealistic Realistic

2. What is Barometric leadership?

Barometric price leadership is a price leadership model in which one firm is in a position

to assess and identify the right direction of price movement in the near future. It is not

necessary that this firm is very large in size. Even a small firm can become a barometric

price leader. Such firms have keen eyes and a sharp ability to gauge the correct direction

in which the prices will move in the market. Other players start following this price leader

after they are assured of the skills and correct judgment of the barometric price leader

over a certain period of time.

Dr. Yashodhara A Bhatt Page 6

3. What Is Price Leadership?

Price Leadership refers to a situation where the dominant firm sets up the price of goods

or services in the market. It generally happens when the goods are homogeneous, i.e.,

there is no difference in the goods or services provided by different firms. Therefore,

customers don’t have a preference and choose the lowest price. Such a model is usually

seen in the Oligopolistic market, where competition is less.

Price leadership occurs when a leading firm in a given industry is able to exert enough

influence in the sector that it can effectively determine the price of goods or services

for the entire market. This type of firm is sometimes referred to as the price leader

4. What is Cartel?

Cartel is a group of producers of goods or suppliers of services formed through an

agreement amongst themselves, whether or not through a formal agreement in writing,

to regulate the supply of goods or services with the basic intent to control the prices

illegally or to restrict competition in respect of the said goods or services.

A cartel is a situation when two or more firms agree to control the level of supply of

products and services to reduce competition and drive up the market price.

The term ‘cartel’ was used for the agreement in which there existed a common sales

agency which alone undertakes the selling operation of all the firms were party to the

agreement.

5. What is regulated natural monopolist practicing average cost pricing

Makes zero economic profit.

Produces an allocative inefficient level of output.

Produces the largest quantity possible while still enabling the firm to cover its total costs

The government would have to set up an effective machinery that would correctly

measure the average cost of the firm so that price can be appropriately set when the p =

AC

6. What is profit sharing cartel?

Profit Sharing cartel is a group of companies that agree to work together to maximise their

profits by sharing the revenue they generate. In this type of arrangement, each company

Dr. Yashodhara A Bhatt Page 7

contributes a portion of its revenue to a central fund, which is distributed among the

members of the cartel based on an agreed decided formula.

The purpose of a profit sharing cartel is to eliminate competition among the members of

the group and to create a shared interest in maximizing their joint profits.

7. Give the definition of Market by Prof. Stonier and prof. Hauge.

Market is an organization whereby buyers and sellers of a good are kept in close touch

with each other. There is no need for a market to be in a single building. The only essential

for a market is that all buyers and sellers should be in constant touch with each other,

either because they are in the same building or because they are able to talk to each by

telephone at a moment’s notice.

8. What is local market?

A local market refers to a physical or virtual marketplace where goods and services are

exchanged within a specific geographic area. This can include farmers' markets, flea

markets, bazaars, and other similar venues.

When the commodity or product or service is bought and sold only in a particular locality,

village or city. It is called as local market which is mainly dependent on local conditions.

9. What is meant by regulated and unregulated market?

When the government lays down certain conditions and regulations for transactions of

certain goods and services, it is known as regulated market. Regulation of markets by

government becomes essential for those goods whose supply or prise can be manipulated

against the interests the consumers.

While goods and services whose transactions are left to the market forces are left to the

market forces are called unregulated market. There are no regulations or condition laid

down the government in such markets.

10. Sate the types of market on the basis of competition.

Perfect Competition

Monopoly

Monopolistic

Oligopoly

11. State the features of Perfect Competition.

Large Numbers

Large number of buyers

Homogeneous product

Free entry and free exit

Dr. Yashodhara A Bhatt Page 8

Perfect Information about the Prevailing Price

Absence of Artificial Restriction

Non-existences of Transportation Costs

Perfectly mobility of the factor of Production

12. What is Price discrimination?

A seller makes price discrimination between different buyers when it is both possible and

profitable. According to Joan Robinson, “The act of selling the same article, produced

under single control at different prices to different buyers is known as price

discrimination.”

13. State the types of price discrimination.

Personal

Age

Local

Trade Discrimination

Trade Discrimination

International Trade level

Time discrimination

Size discrimination

Quality Variation

14. When Price Discrimination possible?

The Nature of the Commodity

Long distances or Tariff Barriers

Legal Sanction

Preference or Prejudices of the buyers

Ignorance and Laziness of buyers

15. State the features of Monopolist Market.

A large number of firms

Product differentiation

Some influence over the price

Advertisement

Freedom of entry and exit of firms

16. What is selling cost?

According to Chamberlin, "Selling costs are costs incurred order to alter the

position or shape of the demand curve for a product."

Dr. Yashodhara A Bhatt Page 9

Meyers defines selling costs as "the costs necessary to persuade a buyer to buy

one product rather than another or to buy from one seller rather than from

another. "

Boulding, "the process of persuading the buyers to buy more at each price is called

sales promotion, the total expenses involved in sales promotion are called selling

costs."

17. State the Difference between Production Costs and Selling Costs.

Production costs are those costs which are incurred by a firm to produce a given

product. These include cost of raw materials, wages, interest etc; that is to say,

production costs include all those expenses which are incurred in the manufacture of

a product and its transportation to consuming centres. Selling cost on the other

hand, are those costs which are incurred to increase the sale of the product.

18. State the assumptions of The Cournot model

There are two independent sellers. In other words, interdependence of the

duopolists is is ignored

They produce and sell a homogeneous product, mineral water.

The total output must be sold out, being perishable and non-storable.

The number of buyers is large.

Each seller knows the market demand curve for the product.

The cost of production is assumed to be zero.

Both have identical costs and identical demands.

Each seller decides about the quantity he wants to produce and sell in each period.

But each is ignorant about his rival's plan about output.

At the same time, each seller takes the supply or output of its rival as constant.

Neither of them fixes the price for its product, but each accepts the market demand

price at which the product can be sold.

The entry of firms is blocked.

Each seller aims at obtaining the maximum net revenue or profit.

19. State the features of Oligopoly Market.

Few Firms (Sellers)

Interdependence of Firms

Importance of Advertising and Selling Costs

Indeterminate Demand Curve

Presence of Monopoly Element

Dr. Yashodhara A Bhatt Page 10

Conflicting Attitudes of the Firms

Price Rigidity

20. Which are the main methods to determine price under Oligopoly Market?

Kinked-demand curve model.

Price-leadership model.

Collusive oligopoly model.

Game theory model

21. State the types of Price Leadership.

Barometric price leadership,

Dominant firm price leadership,

Low-cost price leadership.

22. Give the essential condition of price leadership.

Low Production Cost and Adequate Financial Resources

Substantial Share of the Market

Reputation for Sound Pricing Decisions

Initiative

Aggressive Pricing Policy

23. What is the nature of the demand curve of a firm under monopoly?

The demand curve or average revenue curve of a firm under monopoly is downward

sloping curve from left to right indicating that the firm can sell additional units only if it

lowers the price.

24. Which factors are affecting to save of Money?

Main factor that affecting to the savings are income, Marginal Propensity to save,

Consumption, Stability of price, government policy etc.

25. How can a monopolist defined?

A monopolistically competitive firm does not produce at its minimum ATC in the

long-run.

A monopolistically competitive firm cannot successfully maintain positive economic

profits in the long-run.

Barriers to entry make it possible for monopolies to earn positive economic profits in

the long-run.

Dr. Yashodhara A Bhatt Page 11

Unit – 2 & 3 Factor Pricing – Interest Rate Theory – Profit

Theory –Rent - Wage

True and False

37. A lower rate of interest will increase investment, output, employment, income and

savings. True

38. According to Clark, profits arise on account of dynamic changes in the society;

they cannot arise in a static society. True

39. According to Keynes investment depends on the rate of interest and the marginal

efficiency of capital. False

40. According to Keynes the classical theory of interest is indeterminate. True

41. According to the classical theory of interest rate, the supply of funds comes from

Savings, dishoarding and bank credit. False

42. All factors that affect the expected profitability of investment bring changes in the

natural rate of interest. True

43. Capital is demanded by the investors is productive. True

44. Innovation is a distinctive function of an entrepreneur for which he gets profits.

True.

45. Keynes dismisses the modern theory of interest as absolutely wrong and inadequate.

False

46. Keynes theory of interest is also known as Liquidity Trap theory. True

47. Profit is also known as the "surplus" or the "residual income" of industrial sector.

True

48. Profit is not a residual and non-contractual income. False

49. Profit is the "surplus" or the "residual income". True

50. Profit is the difference between the price and the cost of production of the

commodity. True

51. Pure profit earned by an entrepreneur may also include fortuitous or chance gain.

True

52. Surplus in economic term is the difference between the price and the cost of

production of the commodity. True

53. The bank credit is only an important source of the supply of loanable funds. False

54. The businessmen borrow capital are interest elastic and depend most on the

expected rate of profit as compared with the rate of interest. True

55. The classical theory is based on the realistic assumption of full employment.

False

Dr. Yashodhara A Bhatt Page 12

56. The demand and supply schedules for loanable funds determine the equilibrium

rate of interest. True

57. The demand for investment funds greater than the supply of saving (R2S1 > R2d1)

the rate of interest will rise to R. False

58. The demand for money (L) is not equals the supply of money (M). False

59. The demand for money is a function of the rate of interest to a degree. False

60. The demand schedule for capital or investment curve slopes downward with negative

relation. True

61. The IS-LM theory of interest is based on the realistic assumption of full

employment. False

62. The loanable funds theory is superior because money is an active factor for the

determination of interest rate. True

63. The lonable fund theory has been criticised for combining monetary factors with real

factors. True

64. The speculative demand for money is an increasing function of the rate of interest.

False

65. The speculative motive of demand for money is function of the rate of interest. True

66. The supply curve of capital or the saving curve moves upward to the left. False

67. The supply of capital depends upon savings, rather upon the will to save and the

power to save of the community. True

68. The transactions demand for money depend upon the expectations of the income, of

recipients and businessmen. True

69. There is inverse relation between demand for capital and the rate of interest. True

Fill in blanks

38. A cumulative process is a disequilibrium situation in which net investment is positive

and is constantly increasing from period to period.

39. A lower rate of interest will increase investment, output, employment, income and

savings.

40. A successful innovator earns more than a conventional entrepreneur and the

difference in their earnings is known as innovator's profit.

41. According to the liquidity preference theory the supply of money refers to the total

quantity of money in the country for all purposes at any time.

42. At a higher rate of interest, the demand for capital is low and it is high at a lower rate

of interest.

43. At a higher rate of interest, the demand for capital is low and it is high at a lower rate

Dr. Yashodhara A Bhatt Page 13

of interest.

44. At a very low rate if interest, such as 2% the speculative demand for money

becomes perfectly elastic.

45. Business fluctuations are traced to the difference between natural and market rates

of interest.

46. Corporate savings are the undistributed profits of a firm which also depend on

the current rate of interest.

47. Gross Profit = Net profit + Implicit Rent+ Implicit Interest + Implicit Wages

+Depreciation and Insurance charges.

48. Group which means, election of firms which produce closely-related goods that

is goods which are close substitutes to each other and are not identical or

homogeneous products.

49. If the demand for money increases and the liquidity preference carve shifts upward the

supply of money and the rate of interest rises.

50. In a static economy, performance of the entrepreneur does not arise the level of

profit.

51. In the cumulative process of upward or downward change, expansions and

contractions of bank credit play a crucial role.

52. Innovation is a distinctive function of an entrepreneur for which he gets profits.

53. Keynes dismisses the classical theory of interest as absolutely wrong and inadequate.

54. Keynes liquidity preference theory of the interest rate suggests that the interest rate is

determined by the supply and demand for money

55. Net Profit = Gross profit - (Implicit Rent + Implicit Interest + Implicit Wages +

Depreciation and Insurance charges).

56. Rationalisation at the managerial level or changes in industrial organisation creates

larger scope for earning profits.

57. The bank credit is an important source of the supply of loanable funds.

58. The classical theory neglects factors of the supply schedule of capital.

59. The classical theory neglects the effects of investment on the level of income.

60. The classical Theory of interest is also known as the supply and demand theory of

saving.

61. The classical Theory of interest is known as the supply and demand theory of saving.

62. The classical theory remains incomplete when it neglects these factors in the supply

schedule of capital.

63. The demand and supply schedules for lonanable funds determine the

equilibrium rate of interest.

Dr. Yashodhara A Bhatt Page 14

64. The demand of industrial sector for capital are interest elastic and depend most on

the expected rate of profit as compared with the rate of interest.

65. The demand schedule for capital or investment curve slopes downward from left to

right.

66. The income level and the-interest rate lead to simultaneous equilibrium in the real

(saving-investment) market and the money (demand and supply of money) market.

67. The Investment and Saving curve represents variable flow of the loanable funds

formulation.

68. The IS curve representing flow variable of the loanable funds formulation and the

LM curve representing the stock variables of liquidity preference formulation.

69. The kinked demand curve model was first used by Paul M. Sweezyin 1939.

70. The loanable funds theory is superior because it regards money as an active factor

71. The neo-Keynesian synthesis combines all the four factors saving, liquidity preference,

investment and the quantity of money into a well-integrated theory.

72. The potential of savers who would be induced to save if the rate of interest were

raised.

73. The potential of savers who would be induced to save if the rate of interest were

raised.

74. The precautionary motive relates to the desire to provide for contingencies

requiring sudden expenditures and for unforeseen opportunities of advantageous

purchases.

75. The supply curve of capital or the saving curve moves upward to the right.

76. The supply of capital depends upon savings, rather upon the will to save and the

power to save of the community.

77. The supply of capital is governed by the time preference and the demand for capital by

the expected productivity of capital.

78. The transactions demand for money depend upon the expectations of the income, of

recipients and businessmen.

79. The transactions motive relates to current transactions of personal and business

exchanges.

80. The transactions motive relates with the transactions of personal and business

exchanges.

81. Uncertainty-bearing is one of the main functions of an entrepreneur in the present

capitalist system which leads to profit.

82. When interest rate is lower, the speculative demand for money becomes perfectly

elastic.

Dr. Yashodhara A Bhatt Page 15

Answer on one or two sentences

26. Which are four determinants of the rate of interest according to modern theory?

The investment demand schedule

The consumption function

The liquidity preference schedule

The quantity of money

27. What is the precautionary motive?

The precautionary motive relates to the desire to provide for contingencies requiring

sudden expenditure and for unforeseen opportunities of advantageous purchases.

28. State the limitations of The Classical Theory of Interest.

According to Keynes, income is a variable and not a constant and the equality between

and investment is brought about by changes in income and not by variations in the

rate of interest, Saving-Investment Schedules not Independent, Neglects the

Effects of Investment on Income, Indeterminate Theory, Neglects other Sources of

Savings, Unrealistic Assumption of Full Employment, Neglects Monetary Factors,

Difference over the Definition of Interest

29. Define Interest according to Lonable Fund Theory.

According to Lonable Fund theory, the rate of interest is the price of credit, which is

determined by the demand and supply for loanable funds.

30. State the primary sources of Demand of Money and supply of capital.

The primary sources of Demand of Money are government, businessmen and

consumers who need them for purposes of investment, hoarding and

consumptionsavings, dishoarding and bank credit. While Private, individual and

corporate savings are the main source of saving

31. Why cash balance is not elastic?

Cash balance is not elastic the total cash balances available with the community are

fixed and equal the total supply of money at any time. There are variations in the cash

balances, they are in fact in the velocity of circulation of money rather than in the

amount of cash balances with the community

32. Which are three motives given by Keynes Theory?

The transaction motive

The precautionary motive

The speculative motive

33. Sate the factors that affect the Precautionary motive.

Dr. Yashodhara A Bhatt Page 16

The precautionary demand for money depends upon the level of income, and

business activity, opportunities for unexpected profitable deals, availability of

cash, the cost of holding liquid assets in bank reserves, etc.

34. Explain the function on Demand of Money given by Keynes M=M1+M2.

M1 = L1(Y)

M2 = L2(r)

The total liquidity preference function is expressed as M=L (Y,r).

M1 is circulating or active money

M is passive money.

M1 is a function of income and M2 of the rate of interest.

35. Which are the main limitations of Keynesian Theory?

According to Robertson bonds are not the only alternative source of money

for resources both by the individual and the entrepreneur.

The Keynesian theory fails into define definite functional relationship

between the quantity of money and the rate of interest.

The rate of interest is the return for saving without liquidity

Keynes's analysis is that he ignores the influence of real factors in determining the

interest rate.

36. What is difference among Profit and other factor’s income?

The income of other factors of production, namely rent, wages and

interest is always positive and profit may be zero or negative.

The incomes of the factors of production like rent, wages and interest

are contractual factors incomes, that these are predetermined to the

contract between the owners of these income and entrepreneur while

profit is non-contractual income because profit is uncertain and unstable.

Profit fluctuates more than the incomes of other factors of production

rent, wages and interest do change with the change in the level of

economic activity, but the changes are not as wide as in the case of profit.

37. Can profits arise in a static economy? Why?

According to Clark, profits do not arise in a static economy the reason is that in such

economy, there is no change in the demand and supply conditions, the consumers’

behaviour and the producers’ technology remain unchanged in such an economy. The

price paid to the factors on the basis of their marginal productivity tends to be equal to

the average cost, and surplus being zero, no profit accrue to the entrepreneur.

38. How to profits arise in a dynamic economy?

Dr. Yashodhara A Bhatt Page 17

According to Prof. Clark because of dynamic changes taking place in the economy there

is a divergence between price and cost and this gives rise profits positive or negative. For

example, either or account of increase in population or increase in the consumers’ income

or the changes in their tasks and preferences, an entrepreneur who has the ability to adjust

his output is sure to earn profit.

39. What is innovation?

According to Schumpeter, “Any new measure or policy adopted by an entrepreneur

to reduce his cost of production or to increase the demand for his product is

innovation."

40. What is difference between invention and innovations?

An invention means the discovery of a new process or a technique, while innovation

means practical applications or its use on commercial scale for mass production. The

innovators are not a scientist who invents new processes but he is the man who successfully

applies them in production process.

41. What are insurable risks?

These risks are foreseeable and can be covered by insurance. for example, risk of fire,

flood, theft, robbery, accident, sinking of the ship. etc. The entrepreneur makes a

suitable provision for such risks by taking insurance policy and paying a fixed

premium on it. Insurable risks, therefore, do not create any uncertainty and as such

they do not give rise to profits.

42. What si non-Insurable Risks?

These are risks which cannot be insured against; these are unpredictable and no

insurance company will ever agree to bear them. These risks have to be borne by

the entrepreneur himself. It is these non-insurable risks which create uncertainties

and that gives rise to profits.

43. Which five changes occur in a dynamic society?

Changes in the size of the population.

Changes in human wants - resulting from changes in tastes, preferences,

fashions and income of the people.

Changes in the supply of capital

Changes in the technique of production.

Changes in the form of industrial and business organisation.

44. Give the list of non-insurable risk given by Prof. Knight.

According to Knight, uncertainties or non-insurable risks may be of the following

types

Dr. Yashodhara A Bhatt Page 18

Demand Risk

Competitive Risks

Technological Risks

Business Cycle Risks

Risk of Government Policy

45. What are Exogenous Changes?

The changes which take place due to factors external to the firm or even to the

industry and are beyond its control. These changes generally affect all the firms in

the industry and in some cases all the industries in the economy and thereby

influence the rate and quantum of profit. Exogenous changes which affect profits

are economic, technological, demographic, social and political.

46. How many types of innovations define by Prof. Schumpeter?

There are five types of innovators in the economy.

Introduction of a new product.

Adoption of new technique of production.

Opening of a new market.

Conquest of the new source of supply of raw-materials or semi-manufactured

goods.

New and better methods of industrial and business organisation.

47. What is profit maximization output

A profit-maximizing output for a single-price monopoly is determined by the intersection

of the Marginal cost curves and the profit-maximizing price is found on the marginal

revenue; demand curve

48. Define barometric price leadership

In barometric price leadership, all firms agree to follow the price changes made

by a firm which is supposed to have a good knowledge of the market conditions and

thus can forecast future happenings in the market better than others. In price

leadership an experienced firm which possesses an ability to accurately predict demand

conditions and knowledge of market supply, takes leadership in fixing the price.

49. Define rent by modern economics

In modern economists use the word “rent” as an economic surplus or transfer earning

of a factor of production in excess of the minimum amount necessary to keep it in its

present use.

50. Write the assumption of Clark’s marginal productivity of distribution.

Dr. Yashodhara A Bhatt Page 19

Perfect competition exists both in product market and in input market. As a result,

price of the product and price of the input are given.

Every unit of input is homogeneous and easily substitutable.

Inputs are perfectly mobile.

There exists full employment of resources.

Employer can measure the marginal product of an input in advance.

Law of variable proportions operates.

Firm hires input with the objective of profit maximization.

51. Write the assumption of the Marginal Productivity theory of distribution?

It assumes that all units of a factor are homogeneous and substituted for each

other.

There is perfect mobility of factors as between different places and

employments.

There is perfect competition in the factor market.

There is perfect competition in product market.

There is full employment of factors and resources.

The various units of the different factors are divisible.

One factor is variable and other factors are constant.

Techniques of production are given and constant.

The entrepreneurs are motivated by profit maximization.

The theory is applicable in the long-run.

It is based on the Law of Variable Proportions.

52. What is mean of the three motives of liquidity preference?

According the liquidity preference theory of interest rate, transactions plus

precautionary motive are income elastic and the speculative motive is interest elastic

53. What is LM schedule?

The liquidity preference and money stock schedule is schedule showing the relation

between income and inter; (given the L function and the supply of M) when the desired

cash equals the actual cash.

54. State the difference between perfect competition and monopolistic market

Demand curve of perfect competition is parallel to X axis that perfect elastic,

while in monopolistic market demand curve is relatively elastic or inelastic.

Perfect competition has a large number of small firms while monopolistic

competition does not.

In perfect competitive market firm is price taker while in monopolistic price

maker.

Dr. Yashodhara A Bhatt Page 20

In perfect competition, firms produce homogeneous product, while in

monopolistic competition, firms produce slightly different goods.

In perfect competition advertisement cost is not included in total production cost,

while in monopolistic market selling cost or advertisement cost is important factor

55. Sate the types of market on the basis of competition.

56. State the features of Perfect Competition.

57. What is Price discrimination?

58. State the types of price discrimination.

59. When Price Discrimination possible?

60. In which market price discrimination is profitable and when?

61. State the features of Monopolist Market.

62. What is selling cost?

63. State the Difference between Production Costs and Selling Costs.

64. State the assumptions of The Cournot model

65. State the features of Oligopoly Market.

66. Which are the main methods to determine price under Oligopoly Market?

67. What is Price Leadership?

68. State the types of Price Leadership.

69. Give the essential condition of price leadership.

70. What is Cartel?

71. What is the nature of the demand curve of a firm under monopoly?

72. Which factors are affecting the saving?

73. State the limitations of The Classical Theory of Interest.

74. Define Interest according to Lonable Fund Theory.

75. State the primary sources of Demand of Money and supply of capital.

76. Why cash balance is not elastic?

77. Which are three motives given by Keynes Theory?

78. Sate the factors that affect the Precautionary motive.

79. Which are the main limitations of Keynesian Theory?

80. What is difference between Profit and other factor’s income?

81. Can profits arise in a static economy? Why?

82. How to profits arise in a dynamic economy?

83. What is innovation?

84. What is difference between invention and innovations?

85. What are insurable and non-insurable risks?

Dr. Yashodhara A Bhatt Page 21

86. Which five changes occur in a dynamic society?

87. What are Exogenous Changes?

88. How many types of innovations define by Prof. Schumpeter?

89. Give the list of non-insurable risk given by Prof. Knight.

90. Why is the demand curve of a firm parallel to x axisin perfect competition?

91. What are the main characteristics of monopoly market?

92. What is difference between money wage and real wage?

93. Clarify the meaning of accounting profit and economic profit?

94. Explain the concept of price leadership?

95. What is meant by equilibrium of a firm?

96. Is price discrimination possible under perfect competition? Why?

97. Give the reasons of wage differentiation in same occupation.

98. State the relationship between rent and quasi-rent.

99. What is meant by Quasi rent?

100. What are the main limitations of the Marginal Productivity theory?

Dr. Yashodhara A Bhatt Page 22

You might also like

- Microeconomics 21st Edition Mcconnell Solutions ManualDocument17 pagesMicroeconomics 21st Edition Mcconnell Solutions Manualzeldaguinevereiur100% (35)

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionFrom EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionRating: 4 out of 5 stars4/5 (10)

- O Level EcoDocument88 pagesO Level EcoFATIMANo ratings yet

- Assignment - Market StructureDocument5 pagesAssignment - Market Structurerhizelle19No ratings yet

- Unit - 3: Price-Output Determination Under Different Market FormsDocument47 pagesUnit - 3: Price-Output Determination Under Different Market FormsPriyanshu SharmaNo ratings yet

- Microeconomics II Work SheetDocument31 pagesMicroeconomics II Work SheetTsion GetuNo ratings yet

- Unit - 3: Price-Output Determination Under Different Market FormsDocument47 pagesUnit - 3: Price-Output Determination Under Different Market FormsHabtamu KefelegnNo ratings yet

- Market Structures by Dedicatoria, Intino, VillaramaDocument14 pagesMarket Structures by Dedicatoria, Intino, VillaramaAlpha CapacitorNo ratings yet

- EME-4 NotesDocument17 pagesEME-4 NotesAakriti DubeyNo ratings yet

- Managerial Economics: Rijan DhakalDocument117 pagesManagerial Economics: Rijan DhakalKhanal NilambarNo ratings yet

- Forms of Market (MARKS: 10) Key Concepts: of A Homogeneous ProductDocument14 pagesForms of Market (MARKS: 10) Key Concepts: of A Homogeneous Productsridharvchinni_21769No ratings yet

- ECO Forms of Market - Mahesh School - FORMS OF MARKETDocument3 pagesECO Forms of Market - Mahesh School - FORMS OF MARKETByomkesh PandaNo ratings yet

- MARKET EQUILIBRIUM EconomicsDocument20 pagesMARKET EQUILIBRIUM EconomicsmayureshbachhavchessNo ratings yet

- Economics AssignmentDocument21 pagesEconomics AssignmentMichael RopNo ratings yet

- Lecture Chapter6Document7 pagesLecture Chapter6Angelica Joy ManaoisNo ratings yet

- M212064104 - Individual Assignment - Mii1023Document7 pagesM212064104 - Individual Assignment - Mii1023KU MUHAMMAD ADLI SYAHMINo ratings yet

- Unit 5Document50 pagesUnit 5NEENA SARA THOMAS 2227432No ratings yet

- Unit 3Document61 pagesUnit 3Prashant KangtikarNo ratings yet

- Applied Economics Q1-W5Document32 pagesApplied Economics Q1-W5Nicole FerrerNo ratings yet

- 46699bosfnd p4 cp3 U2Document43 pages46699bosfnd p4 cp3 U2Arun KCNo ratings yet

- Ethics in MarketplaceDocument32 pagesEthics in MarketplaceAkanksha AroraNo ratings yet

- Main Market FormsDocument9 pagesMain Market FormsP Janaki Raman50% (2)

- E. Break-Even PointDocument2 pagesE. Break-Even PointMarfe BlancoNo ratings yet

- Mefa Unit-3Document20 pagesMefa Unit-3rosieNo ratings yet

- TECHNOPRENEURSHIPDocument13 pagesTECHNOPRENEURSHIPLeana Victoria EspanolaNo ratings yet

- Market StructureDocument19 pagesMarket StructureSri HarshaNo ratings yet

- Economics MarketsDocument10 pagesEconomics MarketsGEORGENo ratings yet

- Market Structures: BarriersDocument4 pagesMarket Structures: BarriersAdelwina AsuncionNo ratings yet

- Class 11 MARKETDocument16 pagesClass 11 MARKETTim_GnsNo ratings yet

- IE&M Module 2Document20 pagesIE&M Module 2moh882788No ratings yet

- The Firm and Market StructuresDocument36 pagesThe Firm and Market StructuresPrince Agrawal100% (1)

- Economics Notes Nec CH - 5 StuDocument11 pagesEconomics Notes Nec CH - 5 StuBirendra ShresthaNo ratings yet

- Econdev L4 Market StructuresDocument7 pagesEcondev L4 Market StructuresMark Rafael MacapagalNo ratings yet

- Module 5 (Rev)Document7 pagesModule 5 (Rev)Meian De JesusNo ratings yet

- Практичне Заняття 3- 4. Структура РинкуDocument6 pagesПрактичне Заняття 3- 4. Структура РинкуИнна БелицкаяNo ratings yet

- Review Lecture Notes Chapter 16Document4 pagesReview Lecture Notes Chapter 16- OriNo ratings yet

- Types of Market and Price DeterminationDocument4 pagesTypes of Market and Price DeterminationSaurabhNo ratings yet

- Market Structure: E5 Managerial EconomicsDocument34 pagesMarket Structure: E5 Managerial EconomicsprabodhNo ratings yet

- Final Exam (Answer) : ECO1132 (Fall-2020)Document13 pagesFinal Exam (Answer) : ECO1132 (Fall-2020)Nahid Mahmud ZayedNo ratings yet

- Session - 6 (Imperfect Competition - Revision Notes)Document2 pagesSession - 6 (Imperfect Competition - Revision Notes)Abhishek Kumar SinghNo ratings yet

- Oligopolistic Market and Game TheoryDocument23 pagesOligopolistic Market and Game TheoryAshleyNo ratings yet

- Name of The Course: Business Economics Name of The Course: Business Economics Course Code: Course CodeDocument33 pagesName of The Course: Business Economics Name of The Course: Business Economics Course Code: Course CodeVIVA MANNo ratings yet

- Microeconomics PartDocument30 pagesMicroeconomics PartEmma QuennNo ratings yet

- Market StructureDocument20 pagesMarket StructureSunny RajpalNo ratings yet

- Chapter 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsDocument1 pageChapter 8 - Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsMikkoNo ratings yet

- Economics Notes Unit 5Document5 pagesEconomics Notes Unit 5karankumar67656No ratings yet

- Forms of Market Basic ConceptsDocument4 pagesForms of Market Basic ConceptsStanzin YangdolNo ratings yet

- Summary Final MicroeconomicsDocument16 pagesSummary Final MicroeconomicsepostliahNo ratings yet

- Ch. 7 Firm Competition andDocument25 pagesCh. 7 Firm Competition ands130220073No ratings yet

- Module 3Document15 pagesModule 3vaseem aktharcpNo ratings yet

- Me Unit 4Document28 pagesMe Unit 4biswajeet2580No ratings yet

- Chapter 6 - GROUP 1 APPLIED ECONOMISDocument18 pagesChapter 6 - GROUP 1 APPLIED ECONOMISkassandra.abrocio99No ratings yet

- Module 6 - ReadingDocument7 pagesModule 6 - ReadingChristine Mae MansiaNo ratings yet

- Market Structures: Structures, All Dependent Upon The Extent To Which Buyers and SellingDocument10 pagesMarket Structures: Structures, All Dependent Upon The Extent To Which Buyers and SellingMekbib MulugetaNo ratings yet

- Market Structures unit 4Document12 pagesMarket Structures unit 4dshivansh195No ratings yet

- UntitledDocument3 pagesUntitledBhebz Erin MaeNo ratings yet

- MicroeconomicsDocument15 pagesMicroeconomicsDar SartajNo ratings yet

- Market StructureDocument60 pagesMarket StructureMonina CahiligNo ratings yet

- MArketDocument30 pagesMArketKavya AroraNo ratings yet

- Chapter FiveDocument33 pagesChapter Fivedream of lifesNo ratings yet

- AssignmentDocument6 pagesAssignmentRandz RamosNo ratings yet

- The Market Makers (Review and Analysis of Spluber's Book)From EverandThe Market Makers (Review and Analysis of Spluber's Book)No ratings yet

- Demand Estimation & ForecastingDocument15 pagesDemand Estimation & ForecastingSufana UzairNo ratings yet

- Majorship Let Reviewer in Social ScienceDocument42 pagesMajorship Let Reviewer in Social ScienceMechelle Landicho Bacay67% (3)

- Multiple Choice Questions (MCQ) Q.1 - Q.10 Carry ONE Mark EachDocument81 pagesMultiple Choice Questions (MCQ) Q.1 - Q.10 Carry ONE Mark EachShadowmaster LegendNo ratings yet

- ECON2113 MC PracticeDocument44 pagesECON2113 MC Practicefish LNo ratings yet

- 2.3. Elasticity - Measure of ResonsivenessDocument2 pages2.3. Elasticity - Measure of ResonsivenessgebreNo ratings yet

- Lesson 5 and 6 - Elasticity of Supply and DemandDocument18 pagesLesson 5 and 6 - Elasticity of Supply and DemandCharles Corporal ReyesNo ratings yet

- Math1 PDFDocument22 pagesMath1 PDFcarinaNo ratings yet

- MONOPOLY Lecture Notes - Fall 2019 PDFDocument8 pagesMONOPOLY Lecture Notes - Fall 2019 PDFBenChangNo ratings yet

- Assignment 2 답안지Document8 pagesAssignment 2 답안지잘하자No ratings yet

- Homework Economics Chapter 5 Elasticity and Its Application Oct 12 2022 Ver 101Document7 pagesHomework Economics Chapter 5 Elasticity and Its Application Oct 12 2022 Ver 101叶睿阳No ratings yet

- Income & Substitution Effect Ch05Document119 pagesIncome & Substitution Effect Ch05Wiqar A. KhanNo ratings yet

- Elasticity-Of-Demand 8552087 PowerpointDocument21 pagesElasticity-Of-Demand 8552087 PowerpointChandan NNo ratings yet

- 123doc Cau Hoi Trac Nghiem Kinh Te Vi Mo Mankiw Co Dap AnDocument112 pages123doc Cau Hoi Trac Nghiem Kinh Te Vi Mo Mankiw Co Dap AnTrang Lê ThuNo ratings yet

- Microeconomics Assignment 2Document4 pagesMicroeconomics Assignment 2Stremio HubNo ratings yet

- Module 1 Engineering EconomyDocument13 pagesModule 1 Engineering EconomyZarah Astraea Longcob100% (3)

- Exam1 Practice Exam SolutionsDocument37 pagesExam1 Practice Exam SolutionsSheehan T Khan100% (3)

- Solution Manual For Principles of Macroeconomics 8Th Edition Mankiw 1305971507 9781305971509 Full Chapter PDFDocument30 pagesSolution Manual For Principles of Macroeconomics 8Th Edition Mankiw 1305971507 9781305971509 Full Chapter PDFdoris.fuentes765100% (19)

- Crux of Indian EconomyDocument306 pagesCrux of Indian EconomyChinmay JenaNo ratings yet

- 2023 Tutorial 8Document2 pages2023 Tutorial 8gpt chatNo ratings yet

- Theory of DistributionDocument11 pagesTheory of Distributionrahulravi4uNo ratings yet

- Practice w2 MCTDocument16 pagesPractice w2 MCTYuki TanNo ratings yet

- Q1. David's Preferences Over Books: SolutionDocument8 pagesQ1. David's Preferences Over Books: SolutionNga Lê Nguyễn PhươngNo ratings yet

- CH 24 - Study QuestionsDocument7 pagesCH 24 - Study QuestionsOUM-17A0% (1)

- ECON Model PaperDocument24 pagesECON Model PaperDiniki JayakodyNo ratings yet

- 专题1 7讲解版Document80 pages专题1 7讲解版bbbbdxNo ratings yet

- 07 SGDocument16 pages07 SGmnrao62No ratings yet

- Quiz2 Selected MCQs StudentDocument21 pagesQuiz2 Selected MCQs StudentTrần ThiNo ratings yet

- Exploring Microeconomics 7th Edition Sexton Test Bank 1Document69 pagesExploring Microeconomics 7th Edition Sexton Test Bank 1john100% (45)