Professional Documents

Culture Documents

International Finance_Krishna Degree college_Dr. K.Rajeswari

International Finance_Krishna Degree college_Dr. K.Rajeswari

Uploaded by

Naga Raj S0 ratings0% found this document useful (0 votes)

1 views8 pagesIf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views8 pagesInternational Finance_Krishna Degree college_Dr. K.Rajeswari

International Finance_Krishna Degree college_Dr. K.Rajeswari

Uploaded by

Naga Raj SIf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

B.

COM 6TH SEM SYLLABUS ORIENTATION PROGRAM

Organised by

SRI KRISHNA DEGREE COLLEGE

Subject Discussion

By

Dr.K. Rajeswari

Associate Professor

Department of Commerce and Management

Nagarjuna Degree College

Yelahanka, Bengaluru

For International Finance

Date:09/06/2022

International Finance

Unit – 1

Global Financial Environment

Evolution of International Monetary System, Bimetallism,

Classical Gold Standard, Interwar Period, Bretton Woods

System, Flexible Exchange Rate Regime, the current Exchange

Rate Agreements, European Monetary System, Fixed vs.

Flexible Exchange Rate Regime.

Unit-I

1. What is the meaning of International Finance? Sec - A

2. What is the difference between Fixed and Flexible Exchange

Rate? Sec - B

3. Explain in detail the Evolution of International Monetary

System? Sec- C

Unit – 2

International Financial Decisions

International Capital Budgeting, Influence of Inflation on

Capital Budgeting Decisions, Evaluation of Foreign Projects,

Home Currency Approach and Foreign Currency Approach,

International Financing Decisions, Source of Finance, ADRs,

GDRS, ECBs, FCCBs, Masala Bonds, International Working

Capital Management, Netting, Leads and Lags

Unit- II

1. Define Netting. Sec - A

2. What are Masala Bonds? Sec – A

3. Write a short note on ADRs and ECBs. Sec - B

4. What are the factors affecting International Capital Budgeting?

Sec – C

Unit – 3

Exchange Rate Determination

Purchasing Power Parity Theory, Interest Rate Parity Theory,

International Fischer’s Effect and Pure Expectations Theory

Unit- III

1. Give the meaning of international fisher’s effect theory? Sec- A

2. What are the advantages and disadvantages of purchasing power

parity theory? Sec – C

Unit – 4

Foreign Exchange Risk and Risk Hedging

Strategies

Transaction Risk, Translation Risk, Economic Risk. Risk

Hedging Strategies: Internal, Netting, Leads and Lags.

External, Forwards, Futures, Options, Money-market Hedging,

Currency Swaps

Unit- IV

1. Define Hedging. Sec – A

2. Explain the difference between Forward and Future Contracts.

Sec – B

3. Define money marketing? What are the functions and

limitations of money market? Sec – C

Unit – 5

Interest Rate Risk and Risk Hedging Strategies

Interest Rate Swaps, Forward Rate Agreements, Interest Rate

Futures, Interest Rate Options, Caps, Floors and Collars,

Swaption

Unit- V

1. What is interest rate SWAP? Sec – A

2. What is interest rate caps? Sec – A

3. Write a short note on Interest Rate Options. Sec- B

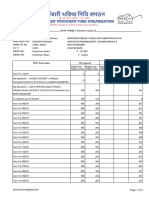

Marks Allocation - Unit wise

Chapter Sec- A Sec- B Sec-C Total

Chapter-I 2 Mark (1Q) 5 Mark (1Q) 15 Mark (1Q) 22

Chapter-II 4 Mark (2Q) 5 Mark (1Q) 15 Mark (1Q) 24

Chapter-III 2 Mark (1Q) - 15 Mark (1Q) 17

Chapter-IV 2 Mark (1Q) 5 Mark (1Q) 15 Mark (1Q) 22

Chapter-V 4 Mark (2Q) 5 Mark (1Q) - 09

Question Paper Pattern

Section – A

7 Questions (5*2=10)

Section – B

4 Questions (3*5 = 15)

Section – C

4 Questions (3*15 = 45)

Thank You

You might also like

- Promissory Note - TemplateDocument2 pagesPromissory Note - TemplateBryan Arias85% (20)

- European Countries Capitals and Currencies PDFDocument1 pageEuropean Countries Capitals and Currencies PDFsurabhi chakravorty50% (2)

- Indian Financial System MCQS: Answer:-D. Corporation BondsDocument8 pagesIndian Financial System MCQS: Answer:-D. Corporation BondsAnkit PradhanNo ratings yet

- FERM (Lesson Plan) MBA-IV Sem. (2022-24)Document5 pagesFERM (Lesson Plan) MBA-IV Sem. (2022-24)shahbajkhan.mba2224cNo ratings yet

- FA 3rd Semester SyllabusDocument31 pagesFA 3rd Semester SyllabusKiranchandwaniNo ratings yet

- International Business ManagementDocument9 pagesInternational Business Managementshailendrashakya001No ratings yet

- AFM MCQ - MergedDocument27 pagesAFM MCQ - MergedMinal AgarwalNo ratings yet

- Financial Markets TosDocument3 pagesFinancial Markets Tosjoy mesanaNo ratings yet

- Lecturer Contact Information: Twilamae - Logan@uwmona - Edu.jmDocument9 pagesLecturer Contact Information: Twilamae - Logan@uwmona - Edu.jmSta KerNo ratings yet

- International Financial Management 17 5Document1 pageInternational Financial Management 17 5Jay KrishnaNo ratings yet

- Edu 2017 Spring Qfi Core SyllabiDocument11 pagesEdu 2017 Spring Qfi Core SyllabiJeffNo ratings yet

- WQU Financial Markets Module 1 Compiled Content PDFDocument29 pagesWQU Financial Markets Module 1 Compiled Content PDFJaeN_Programmer67% (3)

- Ramaiah University of Applied Sciences: 19BNA505A International FinanceDocument11 pagesRamaiah University of Applied Sciences: 19BNA505A International FinancemohithNo ratings yet

- Financial DerivativesDocument140 pagesFinancial DerivativesgeethkeetsNo ratings yet

- SSRN Id4668578Document344 pagesSSRN Id4668578agattyNo ratings yet

- PDF Test Bank For International Business A Managerial Perspective 9Th Edition Ricky W Griffin Mike W Pustay Online Ebook Full ChapterDocument62 pagesPDF Test Bank For International Business A Managerial Perspective 9Th Edition Ricky W Griffin Mike W Pustay Online Ebook Full Chaptermary.bergren632100% (2)

- Paper-CH 3.3: Semester-III Macro Economics: TH RDDocument3 pagesPaper-CH 3.3: Semester-III Macro Economics: TH RDAbhishekSinghNo ratings yet

- M.A (Economics)Document254 pagesM.A (Economics)anshulNo ratings yet

- SYLLABUSDocument12 pagesSYLLABUSbanhdacua2502No ratings yet

- International Trade FinanceDocument4 pagesInternational Trade FinanceRishi CharanNo ratings yet

- Samarpan Seience and Commerce CollegeDocument2 pagesSamarpan Seience and Commerce CollegeDigvijay sinh ZalaNo ratings yet

- Ug EconomicsDocument39 pagesUg EconomicsUPSC private videoNo ratings yet

- Courses & Syllabi Of: To Be Taught at Affiliated Colleges Under Annual SystemDocument51 pagesCourses & Syllabi Of: To Be Taught at Affiliated Colleges Under Annual SystemumairysheikhNo ratings yet

- ChatGPT 17Document2 pagesChatGPT 17ashaykosare.007No ratings yet

- This Course Syllabus Provides A General Plan For The Course Deviations May Be NecessaryDocument6 pagesThis Course Syllabus Provides A General Plan For The Course Deviations May Be NecessaryfendyNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Economics) WarningDocument2 pagesAllama Iqbal Open University, Islamabad (Department of Economics) Warningvjf40623No ratings yet

- Corporate Finance: How Investment and Financing Decisions Create ValueDocument10 pagesCorporate Finance: How Investment and Financing Decisions Create ValueMidest EnergyNo ratings yet

- ABM 118 Investment ManagementDocument114 pagesABM 118 Investment ManagementJulieto ZubradoNo ratings yet

- International II - Course MaterialDocument88 pagesInternational II - Course MaterialDhugo abduNo ratings yet

- New Paper Pattern As Per Revised Paper Pattern (Bbi) 75-25Document3 pagesNew Paper Pattern As Per Revised Paper Pattern (Bbi) 75-25sameer_kiniNo ratings yet

- Course Title: International Trade FinanceDocument4 pagesCourse Title: International Trade FinanceYash MittalNo ratings yet

- Ibm 321 International Economics - 1Document100 pagesIbm 321 International Economics - 1Brian GitauNo ratings yet

- Uka Tarsadia University: Semester - IIIDocument6 pagesUka Tarsadia University: Semester - IIIKajal BhammarNo ratings yet

- 01 - Forex-Question BankDocument52 pages01 - Forex-Question BankSs DonthiNo ratings yet

- IFMDocument2 pagesIFMtraderescortNo ratings yet

- Principles of Microeconomics Course OutlineDocument7 pagesPrinciples of Microeconomics Course OutlineChance...No ratings yet

- Financial EngineeringDocument3 pagesFinancial Engineeringluvnica6348No ratings yet

- Asheesh Sir Course OutlineDocument3 pagesAsheesh Sir Course Outlinesanyam20007No ratings yet

- Intermediate Accounting Vol 1 Canadian 2nd Edition Lo Test BankDocument24 pagesIntermediate Accounting Vol 1 Canadian 2nd Edition Lo Test BankDarrylWoodsormni100% (17)

- International Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Document4 pagesInternational Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Tanu GuptaNo ratings yet

- Chartered University College: Lesson PlanDocument4 pagesChartered University College: Lesson PlanDenver SimpsonNo ratings yet

- Sri Venkateswara University:: Tirupati Syllabus Bba - Sixth SemesterDocument13 pagesSri Venkateswara University:: Tirupati Syllabus Bba - Sixth SemesterSreenivasulu reddyNo ratings yet

- Vinayaka Missions University, Salem. MBA - 2008 Regulation - IV Semester Elective: International Finance Question Bank Unit 1 PART - A (2 Marks)Document8 pagesVinayaka Missions University, Salem. MBA - 2008 Regulation - IV Semester Elective: International Finance Question Bank Unit 1 PART - A (2 Marks)Tarun Kumar ThakurNo ratings yet

- Important QuestionsDocument7 pagesImportant Questionsanshdixit0704No ratings yet

- Accounting and Finance Set 2Document6 pagesAccounting and Finance Set 2Folegwe FolegweNo ratings yet

- Fin 314 SyllabusDocument5 pagesFin 314 SyllabusDamian VictoriaNo ratings yet

- Jaiib RBWM May 2023 Recollected Questions AnswersDocument9 pagesJaiib RBWM May 2023 Recollected Questions Answersprabhat.kr149No ratings yet

- Economics Non HounoursDocument24 pagesEconomics Non HounoursJnanashree BorahNo ratings yet

- International Financial Management: Course Coordinator: Dr. Jayanta Kumar Seal Course Credit: 2Document4 pagesInternational Financial Management: Course Coordinator: Dr. Jayanta Kumar Seal Course Credit: 2Om PrakashNo ratings yet

- Course Objectives: The Objective of This Course Is To: L T P/S SW/F W Total Credit UnitsDocument3 pagesCourse Objectives: The Objective of This Course Is To: L T P/S SW/F W Total Credit UnitsShubham AgarwalNo ratings yet

- SFG 2024 Level 2 Test 19 Solutions Eng195534Document33 pagesSFG 2024 Level 2 Test 19 Solutions Eng195534Ankit SaxenaNo ratings yet

- Xavier Institute of Management and Research MMS-2020-2022 - Batch - II Semester Financial Management - Course OutlineDocument4 pagesXavier Institute of Management and Research MMS-2020-2022 - Batch - II Semester Financial Management - Course OutlineNicole Ayesha D'SilvaNo ratings yet

- Risk Management FinalDocument47 pagesRisk Management FinalManu YadavNo ratings yet

- Syllabus BCOMP 2020-2021Document28 pagesSyllabus BCOMP 2020-2021Souvik MalikNo ratings yet

- Humanities I Year 30 PercentDocument12 pagesHumanities I Year 30 PercentD REENA ASRITHANo ratings yet

- Fassh Bbe Sem 2Document11 pagesFassh Bbe Sem 2Areena KumariNo ratings yet

- Sem 2 SyllabusDocument49 pagesSem 2 SyllabushankschraderimpNo ratings yet

- Financial Management Important QuestionsDocument3 pagesFinancial Management Important QuestionsSaba TaherNo ratings yet

- Fc602: International Finance: ReferencesDocument4 pagesFc602: International Finance: Referencessabas53400No ratings yet

- Course Guide-Financial Market-2020 PDFDocument6 pagesCourse Guide-Financial Market-2020 PDFMellanie SerranoNo ratings yet

- BlackRock's Guide to Fixed-Income Risk ManagementFrom EverandBlackRock's Guide to Fixed-Income Risk ManagementBennett W. GolubNo ratings yet

- Bank Asset and Liability Management: Strategy, Trading, AnalysisFrom EverandBank Asset and Liability Management: Strategy, Trading, AnalysisNo ratings yet

- UntitledDocument65 pagesUntitledNaga Raj SNo ratings yet

- Academic Council Agenda - 20.06.2024Document49 pagesAcademic Council Agenda - 20.06.2024Naga Raj SNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNaga Raj SNo ratings yet

- Prayukthi Group of Institutions: II Term Hall Ticket - December 2022 Class: I & Ii PUCDocument1 pagePrayukthi Group of Institutions: II Term Hall Ticket - December 2022 Class: I & Ii PUCNaga Raj SNo ratings yet

- 1puc History (Scheme)Document5 pages1puc History (Scheme)Naga Raj SNo ratings yet

- ACCCA Donation NoDocument1 pageACCCA Donation NoNaga Raj SNo ratings yet

- Geography - 24 SchemeDocument7 pagesGeography - 24 SchemeNaga Raj SNo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareNaga Raj SNo ratings yet

- 1puc Electronics (Scheme)Document7 pages1puc Electronics (Scheme)Naga Raj SNo ratings yet

- Yrk Mohan 2ND Puc Chemistry 2023 Model QuestionsDocument5 pagesYrk Mohan 2ND Puc Chemistry 2023 Model QuestionsNaga Raj S100% (1)

- 1 PUC Accountancy (Scheme)Document13 pages1 PUC Accountancy (Scheme)Naga Raj SNo ratings yet

- Sanskrit - 09Document9 pagesSanskrit - 09Naga Raj SNo ratings yet

- Cce PF Cce PR: JL o Æ ÀÊ-V - MSÊ¿ JL o ) Æ LV - MSÊ¿Document8 pagesCce PF Cce PR: JL o Æ ÀÊ-V - MSÊ¿ JL o ) Æ LV - MSÊ¿Naga Raj SNo ratings yet

- Third Party Funds Transfer: 50200027607972, R T NAGAR-BENGALURUDocument1 pageThird Party Funds Transfer: 50200027607972, R T NAGAR-BENGALURUNaga Raj SNo ratings yet

- Science MCQDocument10 pagesScience MCQNaga Raj SNo ratings yet

- Optimism: The Biology of HopeDocument6 pagesOptimism: The Biology of HopeNaga Raj SNo ratings yet

- Vàèwãaiàä Sá É - A : Pà Áðlpà Ëæqsà Pàët Àjãpáë ÀäaqàDocument7 pagesVàèwãaiàä Sá É - A : Pà Áðlpà Ëæqsà Pàët Àjãpáë ÀäaqàNaga Raj SNo ratings yet

- Pà Áðlpà Ëæqsà Pàët Àjãpáë Àäaqà : General Instructions To The CandidateDocument5 pagesPà Áðlpà Ëæqsà Pàët Àjãpáë Àäaqà : General Instructions To The CandidateNaga Raj SNo ratings yet

- As PDFDocument35 pagesAs PDFNaga Raj SNo ratings yet

- Article 018Document16 pagesArticle 018Naga Raj SNo ratings yet

- Jss College of Arts, Commerce & Science (Autonomous) : GOVERNING BODY (2017-19)Document2 pagesJss College of Arts, Commerce & Science (Autonomous) : GOVERNING BODY (2017-19)Naga Raj SNo ratings yet

- 11 BibliographyDocument9 pages11 BibliographyNaga Raj SNo ratings yet

- 09 - Appendix 2 PDFDocument188 pages09 - Appendix 2 PDFNaga Raj SNo ratings yet

- 08 - Chapter 3Document80 pages08 - Chapter 3Naga Raj SNo ratings yet

- Ettana Mamara Ettana KogileDocument6 pagesEttana Mamara Ettana KogileNaga Raj SNo ratings yet

- Assignment 1.1 International Monetary SystemDocument2 pagesAssignment 1.1 International Monetary SystemAnfernee Yu JecoNo ratings yet

- Cash Drop Form NewDocument7 pagesCash Drop Form NewAbu AhmedNo ratings yet

- International Economics 2: Assoc. Prof. Dr. Ngo Thi Tuyet MaiDocument55 pagesInternational Economics 2: Assoc. Prof. Dr. Ngo Thi Tuyet MaiNguyễn Hữu SơnNo ratings yet

- Marketrip EbookDocument21 pagesMarketrip EbookFaurisio MedinaNo ratings yet

- Numismatic Collection of The Deutsche Bundesbank DataDocument4 pagesNumismatic Collection of The Deutsche Bundesbank DataikotiukNo ratings yet

- Sample MCQ Topics 1-5Document12 pagesSample MCQ Topics 1-5horace000715No ratings yet

- Chapter 6. Exchange Rate DeterminationDocument22 pagesChapter 6. Exchange Rate DeterminationTuấn LêNo ratings yet

- Measuring Exchange Rate MovementsDocument26 pagesMeasuring Exchange Rate MovementsNouman AhmadNo ratings yet

- Guide To RBI's Statistical SupplementDocument12 pagesGuide To RBI's Statistical SupplementShrishailamalikarjunNo ratings yet

- Usd To Idr - Google SearchDocument1 pageUsd To Idr - Google SearchBettyNo ratings yet

- لیست کشورهایی که می توانند در آمازون فروشنده بشوندDocument8 pagesلیست کشورهایی که می توانند در آمازون فروشنده بشوندFarbodNo ratings yet

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Forex Trading Course - Turn $1,260 Into $12,300 in 30 Days by David CDocument74 pagesForex Trading Course - Turn $1,260 Into $12,300 in 30 Days by David Capi-3748231No ratings yet

- Exchange Rate Literature ReviewDocument8 pagesExchange Rate Literature Reviewc5qp29ca100% (1)

- Daily India Spot Market Rates Gold and Silver 999 WatchDocument6 pagesDaily India Spot Market Rates Gold and Silver 999 WatchSomendraNo ratings yet

- Module 4Document39 pagesModule 4yashNo ratings yet

- Afu 8504 - International Finance - Parity Relationships - Tutorial QuestionsDocument3 pagesAfu 8504 - International Finance - Parity Relationships - Tutorial Questionssudeis omaryNo ratings yet

- Forex WalkthroughDocument342 pagesForex WalkthroughPhuthuma Beauty SalonNo ratings yet

- Currency Derivatives Mcq-1Document7 pagesCurrency Derivatives Mcq-1Padyala SriramNo ratings yet

- Exchange ArithmeticDocument12 pagesExchange ArithmeticRohit AggarwalNo ratings yet

- SAP Currency TransactionsDocument1 pageSAP Currency TransactionsYazeed_GhNo ratings yet

- Lecture 10-Foreign Exchange MarketDocument42 pagesLecture 10-Foreign Exchange MarketfarahNo ratings yet

- Swift CodeDocument2 pagesSwift CodeEmmarold OdwongosNo ratings yet

- International Trade Finance NotesDocument206 pagesInternational Trade Finance NotesSrivani AlooruNo ratings yet

- UN - DSA For Jan 2016Document55 pagesUN - DSA For Jan 2016asdgfhmukytjky100% (4)

- C C TH NG Tin Tæng Qu T ®æc ®ióm Cña XeDocument14 pagesC C TH NG Tin Tæng Qu T ®æc ®ióm Cña XeNguyen Nguyễn Phương LinhNo ratings yet

- Fxrate 01 06 2023Document2 pagesFxrate 01 06 2023ShohanNo ratings yet

- Safescan 2665 Productsheet ENDocument2 pagesSafescan 2665 Productsheet ENSlobodanRadovićNo ratings yet