Professional Documents

Culture Documents

?find_the_high____thread_by_silkyfx___jun 13, 23_from_rattibha

?find_the_high____thread_by_silkyfx___jun 13, 23_from_rattibha

Uploaded by

abeldereje1216210 ratings0% found this document useful (0 votes)

1 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views8 pages?find_the_high____thread_by_silkyfx___jun 13, 23_from_rattibha

?find_the_high____thread_by_silkyfx___jun 13, 23_from_rattibha

Uploaded by

abeldereje121621Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

silky

@silkyfx

13 Tweets • 2023-06-13 • See on

rattibha.com

Find the High & Low of the day with ICT

In this SERIES of threads, I'll cover everything about

Standard Deviations

One of the most underappreciated ICT Concepts

available, they are used to PINPOINT the HIGH and

LOW of the day & More

Chapter 4 - ICT FLOUT Projections

What is FLOUT?

Flout is CBDR and Asian Range

Flout is the total range of the CBDR and Asian

Range that has been divided in half as 1 STDIV.

In other words Flout is CBDR+AR halved

When do we use FLOUT?

We use flout when CBDR and Asian Range are not

favorable meaning both of them arent in the pip count

sweetspot and consolidating.

Time For FLOUT

As previously mentioned FLOUT is the combination of

Asian Range and CBDR halved meaning we need to

use the beginning of CBDR and the end of Asian

Range

Therefore the time window for the Fibonacci pull would

be 4pm- 12am, New York Time

Specifications for FLOUT

Unlike CBDR and Asian range flout doesn't need a

consolidation or a Pip threshold to be used therefore

we just use the Highest High and the Lowest Low of

the range from 4pm to 12am.

Seeking Setups

If our bias is Bullish we look for confluences of FLOUT

Standard Deviations with Discount Arrays/Bullish PD

Arrays on the H1

If our bias is Bearish we look for confluences of

FLOUT Standard Deviations with Premium

Arrays/Bearish PD Arrays on the H1

Settings

Fibonacci settings are similar to the CBDR and AR but

instead of Integers (-3,-2,-1,0,1,2..) we are adding .5

values as well

The implementations of Standard Deviations should

be accompanied by liquidity pools and PD Arrays.

Ideally you want the STDIV level to be aligned with a

PDH/PDL or Intraday High/Low

As in every previous thread I need to stress how

important daily/directional bias is.

The goal of using Standard Deviations is to use them

when we have a clear bias on the daily timeframe

accompanied with time of day(killzones) in which price

will likely experience volatility.

Combining Liquidity, PD Arrays, Time of Day and

Standard deviations is what we're aiming for.

-end of thread-

The next thread i do on this series will be about

intraday profiles that help with concluding whether the

HOD/LOD has formed

Shoutout to the sponsor of this post PrimeXBT

EARN UP TO 7000$ ON YOUR FIRST DEPOSIT

WITH PROMOCODE: marketmaker

CRYPTO, FOREX, INDICES, COMMODITIES

TRADING EXCHANGE with EXTREMELY LOW

COMPETITIVE TRADING FEES and NO KYC

https://go.primexbt.com/click?pid=19240&

offer_id=12

Also check out the other 3 i made so youre all caught

up

-1

-2

-3

These pages were created and arranged by Rattibha

services (https://www.rattibha.com)

The contents of these pages, including all images,

videos, attachments and external links published

(collectively referred to as "this publication"),

were created at the request of a user (s) from X.

Rattibha provides an automated service, without human

intervention, to copy the contents of tweets from X

and publish them in an article style, and create PDF

pages that can be printed and shared, at the request

of X user (s). Please note that the views and all

contents in this publication are those of the author

and do not necessarily represent the views of

Rattibha. Rattibha assumes no responsibility for any

damage or breaches of any law resulting from the

contents of this publication.

You might also like

- ICT 2022 Mentorship - Free DownloadableDocument297 pagesICT 2022 Mentorship - Free DownloadableSlw habbos100% (6)

- Silver Bullet HourDocument7 pagesSilver Bullet HourDT92% (13)

- ICT Turtle Soup Pattern - A Run On Stops Model - ICTDocument4 pagesICT Turtle Soup Pattern - A Run On Stops Model - ICTchadleruo099No ratings yet

- Day Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingFrom EverandDay Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingRating: 5 out of 5 stars5/5 (9)

- WEBINAR PPT - Decmber 15 PDFDocument141 pagesWEBINAR PPT - Decmber 15 PDFIsIs Drone75% (61)

- Day Trading With Pivot PointsDocument143 pagesDay Trading With Pivot PointsRajendra Reddy88% (8)

- BFX StrategyDocument32 pagesBFX StrategyBara Muni80% (5)

- ICT FX4Model Framework 2023 PDFDocument13 pagesICT FX4Model Framework 2023 PDFDevie Christian100% (1)

- CFDs Made Simple: A Beginner's Guide to Contracts for Difference SuccessFrom EverandCFDs Made Simple: A Beginner's Guide to Contracts for Difference SuccessRating: 5 out of 5 stars5/5 (3)

- MCRS Fuel System Overview PDFDocument100 pagesMCRS Fuel System Overview PDFAnonymous ABPUPbK91% (11)

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceDocument43 pagesPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws Jurisprudencemae ann rodolfoNo ratings yet

- WEBINAR PPT - Decmber 15Document141 pagesWEBINAR PPT - Decmber 15fixemi100% (13)

- Day Trading With Pivot Points & Price Action: 22nd June (Saturday) VikramDocument129 pagesDay Trading With Pivot Points & Price Action: 22nd June (Saturday) VikramBhargav Sriram100% (3)

- Day Trading With Pivot Points-8th SepDocument139 pagesDay Trading With Pivot Points-8th SepLavanya Chintu100% (2)

- How to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingFrom EverandHow to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingNo ratings yet

- Ohsu, Sony EtcDocument7 pagesOhsu, Sony EtcCharm Ferrer100% (4)

- ?find - The - High - & - Thread - by - Silkyfx - Jun 13, 23 - From - RattibhaDocument8 pages?find - The - High - & - Thread - by - Silkyfx - Jun 13, 23 - From - RattibhaxavinkNo ratings yet

- InsideTheCircle Module2Document19 pagesInsideTheCircle Module2Thembokuhle100% (2)

- ?find The High & Thread by Silkyfx Jun 11, 23 From RattibhaDocument10 pages?find The High & Thread by Silkyfx Jun 11, 23 From RattibhaDouglas SerugaNo ratings yet

- Insidethecircle TradeModelDocument25 pagesInsidethecircle TradeModelArif AgustianNo ratings yet

- ICT Charter Price Action Model 5Document23 pagesICT Charter Price Action Model 5yoatoyout550No ratings yet

- IOF - Standard DevDocument15 pagesIOF - Standard DevOtsile Charisma Otsile SaqNo ratings yet

- AU Lets Get To Know CfdsDocument14 pagesAU Lets Get To Know CfdsphoenixdudeNo ratings yet

- DR MethodDocument23 pagesDR MethodYasintha Rashan DeeNo ratings yet

- Welcome Aboard Amigos!: 108altitude Handbook 2022Document16 pagesWelcome Aboard Amigos!: 108altitude Handbook 2022aa zzNo ratings yet

- The Easiest Way To Trade! by FDLDocument17 pagesThe Easiest Way To Trade! by FDLLUCIANONo ratings yet

- Crypto Wildcard by Filbert and ElDocument9 pagesCrypto Wildcard by Filbert and ElArya DewaNo ratings yet

- ICT Charter Price Action Model 3Document15 pagesICT Charter Price Action Model 3yoatoyout550No ratings yet

- SMART MONEY CONCEPTS STRATEGY - The Prop TraderDocument20 pagesSMART MONEY CONCEPTS STRATEGY - The Prop Traderyoussner327No ratings yet

- Resilience 2021-Market PulseDocument46 pagesResilience 2021-Market PulseFranklin BoremNo ratings yet

- Crypto Trading StrategiesDocument29 pagesCrypto Trading StrategiescanselkesiciiNo ratings yet

- Inside The Circle: Trade Model 1Document24 pagesInside The Circle: Trade Model 1YOUSSEF AIT TIZI67% (3)

- Orb Nr4 Candlestick Price Action Daily StrategyDocument26 pagesOrb Nr4 Candlestick Price Action Daily StrategyazzaNo ratings yet

- FX Model - KelvinFXDocument9 pagesFX Model - KelvinFXThar RharNo ratings yet

- Resilience 2021-Market PulseDocument45 pagesResilience 2021-Market PulseNishit GolchhaNo ratings yet

- ICT FX4Model FrameworkDocument20 pagesICT FX4Model FrameworkSnowNo ratings yet

- Spreadtrading Introduction2014Document45 pagesSpreadtrading Introduction2014Nitin Govind BhujbalNo ratings yet

- Forex PD Array MatrixDocument3 pagesForex PD Array MatrixThapelo KekanaNo ratings yet

- Sip Advantages: Tension Free InvestmentDocument1 pageSip Advantages: Tension Free InvestmentJeremiah RogersNo ratings yet

- DTI Ratio SpreadsDocument7 pagesDTI Ratio SpreadsFranklin HallNo ratings yet

- ?ict - Power - of - 3, - Thread - by - Silkyfx - Jun 17, 23 - From - RattibhaDocument8 pages?ict - Power - of - 3, - Thread - by - Silkyfx - Jun 17, 23 - From - RattibhaDouglas SerugaNo ratings yet

- TRADER 27 - THE GRINDER Rev. 1 1Document10 pagesTRADER 27 - THE GRINDER Rev. 1 1agathfutureNo ratings yet

- PA Model-5 - Session Trading ModelDocument25 pagesPA Model-5 - Session Trading Modelsohailswati6585No ratings yet

- I Wanted To Share Thread by Mindset BTC Nov 5, 21 From RattibhaDocument12 pagesI Wanted To Share Thread by Mindset BTC Nov 5, 21 From RattibhaLakshminarayana KilaruNo ratings yet

- PO3 AMDXtradesDocument16 pagesPO3 AMDXtradesFrom Shark To WhaleNo ratings yet

- PA Model-3 - Swing Trading ModelDocument16 pagesPA Model-3 - Swing Trading Modelsohailswati6585No ratings yet

- Module 1 - Elliott WaveDocument11 pagesModule 1 - Elliott Wavechrisgatmaitan892No ratings yet

- Bracket Orders & Trailing Stoploss (SL) Z-Connect by ZerodhaDocument167 pagesBracket Orders & Trailing Stoploss (SL) Z-Connect by Zerodhacsakhare82No ratings yet

- Pathik StrategiesDocument6 pagesPathik StrategiesMayuresh DeshpandeNo ratings yet

- Basics of TradingDocument6 pagesBasics of Tradingfor SaleNo ratings yet

- Module 1 - Beginners-Nathi-1Document8 pagesModule 1 - Beginners-Nathi-1Lubna AallyNo ratings yet

- Pierce, Stephen A - Rapid Fire Swing TradingDocument45 pagesPierce, Stephen A - Rapid Fire Swing Tradingmysticbliss100% (1)

- !TRD-A Chuck LeBeau - Exit Strategy ATR Ratchet StopDocument4 pages!TRD-A Chuck LeBeau - Exit Strategy ATR Ratchet Stopcesarx2No ratings yet

- Derpo Class 1& 2Document5 pagesDerpo Class 1& 2laale dijaanNo ratings yet

- Scrim Sessions v2Document28 pagesScrim Sessions v2Khandaker Tanvir RahmanNo ratings yet

- Scrim Sessions v2Document28 pagesScrim Sessions v2Alex PaimNo ratings yet

- Best Intraday Trading IndicatorsDocument9 pagesBest Intraday Trading IndicatorsalagusenNo ratings yet

- Bitcoin Day Trading Strategies For Beginners: Day Trading StrategiesFrom EverandBitcoin Day Trading Strategies For Beginners: Day Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Bitcoin Day Trading Strategies: Highly Profitable Bitcoin Day Trading and Scalping Strategies That Work in 2022: Profitable Trading Strategies, #1From EverandBitcoin Day Trading Strategies: Highly Profitable Bitcoin Day Trading and Scalping Strategies That Work in 2022: Profitable Trading Strategies, #1Rating: 5 out of 5 stars5/5 (1)

- Crypto Scalping Strategies: Day Trading Made Easy, #3From EverandCrypto Scalping Strategies: Day Trading Made Easy, #3Rating: 3 out of 5 stars3/5 (2)

- Handbook On CFDs Trading: How to Make Money When the Market Is Up or DownFrom EverandHandbook On CFDs Trading: How to Make Money When the Market Is Up or DownRating: 3 out of 5 stars3/5 (1)

- Godrej AdharDocument11 pagesGodrej Adharsaxena100% (4)

- What Did Hubble See On Your Birthday NASADocument1 pageWhat Did Hubble See On Your Birthday NASAputri syifaNo ratings yet

- WRAP Food Grade HDPE Recycling Process: Commercial Feasibility StudyDocument45 pagesWRAP Food Grade HDPE Recycling Process: Commercial Feasibility StudyHACHALU FAYENo ratings yet

- North America - GCT Report 2023 (Digital)Document20 pagesNorth America - GCT Report 2023 (Digital)Ali AlharbiNo ratings yet

- Quiz 5 Chap 5 AnswerDocument4 pagesQuiz 5 Chap 5 AnswerPhương NgaNo ratings yet

- Bp344 Rules: Department of ArchitectureDocument11 pagesBp344 Rules: Department of ArchitectureMarie BacasNo ratings yet

- Banking Laws 2021 2022 First SemesterDocument8 pagesBanking Laws 2021 2022 First Semester12-Welch Tobesa, IsaacNo ratings yet

- S111 EN 12 Aluminium Standard Inclinometric CasingDocument4 pagesS111 EN 12 Aluminium Standard Inclinometric CasingIrwan DarmawanNo ratings yet

- 800-04194 EQUIPSeries ACUIX IP-Install-Config PDFDocument148 pages800-04194 EQUIPSeries ACUIX IP-Install-Config PDFVictor AponteNo ratings yet

- Relevant Ethico-Legal GuidelinesDocument50 pagesRelevant Ethico-Legal GuidelinesHira UsmanNo ratings yet

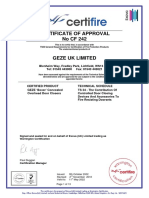

- Certificate of Approval No CF 242Document13 pagesCertificate of Approval No CF 242Florin RazvanNo ratings yet

- Local Government and Regional Administration DECENTRALIZATION - The Transfer of Authority From Central To LocalDocument14 pagesLocal Government and Regional Administration DECENTRALIZATION - The Transfer of Authority From Central To LocalMhae MogolNo ratings yet

- Minor Project II Guidelines 070920Document7 pagesMinor Project II Guidelines 070920Sandesh PaithaneNo ratings yet

- Manual Book Isuzu TBR E2 PDFDocument2 pagesManual Book Isuzu TBR E2 PDFYoPiNo ratings yet

- Keys Life Intermediate Work BookDocument4 pagesKeys Life Intermediate Work BookNoemiNo ratings yet

- 3D CAD Model DownloadsDocument10 pages3D CAD Model DownloadssahirprojectsNo ratings yet

- Transmitters To Detect Carbon Dioxide (Co)Document6 pagesTransmitters To Detect Carbon Dioxide (Co)Petar RudešNo ratings yet

- 10TMSS04R2Document32 pages10TMSS04R2mogbel1No ratings yet

- 5S, TPM, KaizenDocument4 pages5S, TPM, Kaizensohag shahNo ratings yet

- Accounting ProblemsDocument31 pagesAccounting ProblemsJanna Gunio100% (1)

- Mukesh Yadav InsurnaceDocument3 pagesMukesh Yadav InsurnaceTriangle Tower ConstructionNo ratings yet

- 2193-Article Text-2779-1-10-20171231Document11 pages2193-Article Text-2779-1-10-20171231Roisya marzuqiNo ratings yet

- کورونا وائرس کے ظہور کی پیشن گوئی احادیث نبوی میںDocument56 pagesکورونا وائرس کے ظہور کی پیشن گوئی احادیث نبوی میںWaheeduddin MahbubNo ratings yet

- FBI Special Agent in Charge Eric W. Sporre Request Criminal Prosecution Foreclosure FRAUDDocument101 pagesFBI Special Agent in Charge Eric W. Sporre Request Criminal Prosecution Foreclosure FRAUDNeil GillespieNo ratings yet

- The Art of Designing Ductile Concrete in The Past 50 Years: The Impact of The PCA Book and Mete A. Sozen, Part 1Document6 pagesThe Art of Designing Ductile Concrete in The Past 50 Years: The Impact of The PCA Book and Mete A. Sozen, Part 1masteriragaNo ratings yet

- Compressible Flow Through Convergent-Divergent Nozzle: February 2020Document9 pagesCompressible Flow Through Convergent-Divergent Nozzle: February 2020NHNo ratings yet

- Msc-mepc.6-Circ.14 - Annex 2 - Sopep - 31 March 2016Document55 pagesMsc-mepc.6-Circ.14 - Annex 2 - Sopep - 31 March 2016captaksah100% (1)