Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 views10-Bank Accounts and Its Types

10-Bank Accounts and Its Types

Uploaded by

tshakoor58Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Term LoanDocument16 pagesTerm LoanPriyaNo ratings yet

- 10-Bank Accounts and Its Types(1)Document21 pages10-Bank Accounts and Its Types(1)tshakoor58No ratings yet

- Co Financing and RefinancingDocument12 pagesCo Financing and RefinancingMaulik M RafaliyaNo ratings yet

- What Is Working Capital Loan?: Fixed Rate Term LoanDocument1 pageWhat Is Working Capital Loan?: Fixed Rate Term LoanMohitAhujaNo ratings yet

- Chapter 4 Banking - Bank LoanDocument28 pagesChapter 4 Banking - Bank LoanIndo WalelengNo ratings yet

- Chapter-5 Intermediate Term FinancingDocument11 pagesChapter-5 Intermediate Term FinancingTarek Monowar 1921659042No ratings yet

- Mortgage Loan DefinitionDocument65 pagesMortgage Loan DefinitionAnonymous iyQmvDnHnCNo ratings yet

- Benefits of Mortgage Refinancing You Must KnowDocument3 pagesBenefits of Mortgage Refinancing You Must KnowriyaNo ratings yet

- Loan Investment: Chapter - 1Document9 pagesLoan Investment: Chapter - 1Zana M. KareemNo ratings yet

- Retail 3Document27 pagesRetail 3Pravali SaraswatNo ratings yet

- Lall Interest Rate ProjectDocument19 pagesLall Interest Rate ProjectSourav SsinghNo ratings yet

- Sources of FinanceDocument10 pagesSources of FinanceOmer Uddin100% (1)

- The Fed's Great Unwind and Your PortfolioDocument4 pagesThe Fed's Great Unwind and Your PortfolioJanet BarrNo ratings yet

- Essential Guide To Financing Your StartDocument8 pagesEssential Guide To Financing Your Startgp.mishraNo ratings yet

- April 2014: The Fed's Great Unwind and Your PortfolioDocument4 pagesApril 2014: The Fed's Great Unwind and Your PortfolioIncome Solutions Wealth ManagementNo ratings yet

- Bac 308 AssignmentDocument7 pagesBac 308 AssignmentMutwiri MwikaNo ratings yet

- (Lecture 6 & 7) - Sources of FinanceDocument21 pages(Lecture 6 & 7) - Sources of FinanceAjay Kumar TakiarNo ratings yet

- Debt Financing: Promise To Repay The LoanDocument3 pagesDebt Financing: Promise To Repay The LoanMicahNo ratings yet

- (FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Document17 pages(FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Michelle GozonNo ratings yet

- LoansDocument7 pagesLoansmba departmentNo ratings yet

- Acct 226Document4 pagesAcct 226freeNo ratings yet

- You're In: Home Fixed DepositsDocument6 pagesYou're In: Home Fixed DepositsdeepthykNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiarickyNo ratings yet

- Types of LoansDocument9 pagesTypes of LoansSanjay VaruteNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Final Project ZanaDocument25 pagesFinal Project ZanaZana M. KareemNo ratings yet

- Guide To RemortgagingDocument6 pagesGuide To RemortgagingdmntssNo ratings yet

- Term LoansDocument9 pagesTerm LoansAbhishek .SNo ratings yet

- Moneysprite Mortgage GuideDocument8 pagesMoneysprite Mortgage GuideMoneyspriteNo ratings yet

- Finmarket Lecture 5Document13 pagesFinmarket Lecture 5Rosie PosieNo ratings yet

- Secured Personal Loans - Need To Know Before ApplyDocument7 pagesSecured Personal Loans - Need To Know Before ApplyKAZI THASMIA KABIRNo ratings yet

- Dhere Vikas Krishna MBA 1stDocument9 pagesDhere Vikas Krishna MBA 1stvikas dhereNo ratings yet

- Consumer Guide To Rate LocksDocument5 pagesConsumer Guide To Rate LocksJarred AlexandrovNo ratings yet

- Housing FinanceDocument4 pagesHousing FinanceKIng KumarNo ratings yet

- More Locations: Commercial BankDocument6 pagesMore Locations: Commercial BankAyushi KhuranaNo ratings yet

- Investment Management: Module-1Document28 pagesInvestment Management: Module-1Avin P RNo ratings yet

- Mortgage BasicsDocument18 pagesMortgage BasicsJie RongNo ratings yet

- 6 Things To Know Before Taking A Home LoanDocument3 pages6 Things To Know Before Taking A Home LoanDrSivasundaram Anushan SvpnsscNo ratings yet

- 101 Mortgage Broker Secrets To Get The Best MortgageDocument22 pages101 Mortgage Broker Secrets To Get The Best Mortgageweb3752100% (1)

- Financing A New BusinessDocument4 pagesFinancing A New BusinessmahimenNo ratings yet

- Meaning of Loan: Debt Assets Lender Borrower MoneyDocument10 pagesMeaning of Loan: Debt Assets Lender Borrower MoneybondhonbondNo ratings yet

- Tridel Condos and TownhousesDocument12 pagesTridel Condos and TownhouseskrishkissoonNo ratings yet

- Term LoanDocument1 pageTerm LoanVirajRautNo ratings yet

- What Is A Nonperforming Loan NPLDocument6 pagesWhat Is A Nonperforming Loan NPLJacksonNo ratings yet

- Understanding The 5 Cs of CreditDocument15 pagesUnderstanding The 5 Cs of CreditVic Angelo TuquibNo ratings yet

- Mortgage Loan CalculatorDocument2 pagesMortgage Loan CalculatorAmerica's Loan AdvisorsNo ratings yet

- A. Discuss The Advantages of Financing Capital Expenditures With DebtDocument5 pagesA. Discuss The Advantages of Financing Capital Expenditures With DebtMark SantosNo ratings yet

- Accounting, Finance and Operations - Chapter 4Document9 pagesAccounting, Finance and Operations - Chapter 4Biswajit MohantyNo ratings yet

- FAC About Loans PDFDocument5 pagesFAC About Loans PDFDenzel BrownNo ratings yet

- Advanced Financial Accounting - Interest Rates QuestionDocument12 pagesAdvanced Financial Accounting - Interest Rates Questionailiwork worksNo ratings yet

- Can I Afford A LoanDocument7 pagesCan I Afford A LoanBorisNo ratings yet

- WCM AssignmentDocument11 pagesWCM AssignmentSakshi LodhaNo ratings yet

- Instructor: Dr. LAU Sie Ting: Course Notes For Seminar 3 Chapter 5: Time Value of Money Part BDocument34 pagesInstructor: Dr. LAU Sie Ting: Course Notes For Seminar 3 Chapter 5: Time Value of Money Part B朱艺璇No ratings yet

- Basic Functions of BanksDocument6 pagesBasic Functions of BanksMa Laney0% (1)

- MORTGAGEDocument9 pagesMORTGAGEbibin100% (1)

- 5 Cs of CreditDocument8 pages5 Cs of CreditevitaveigasNo ratings yet

- Critical Questions You Must Ask Before Applying For A Home LoanDocument3 pagesCritical Questions You Must Ask Before Applying For A Home LoanClayton CalvertNo ratings yet

- Mortgage and Amortization (Math of Investment)Document2 pagesMortgage and Amortization (Math of Investment)RCNo ratings yet

- Volume01.indd 1Document8 pagesVolume01.indd 1DanniNo ratings yet

- 6235594a57248 Aparchit Super Current Affairs 350+ With Facts March Set 2Document62 pages6235594a57248 Aparchit Super Current Affairs 350+ With Facts March Set 2RohanNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- What Is AccountingDocument6 pagesWhat Is AccountingOtaku girlNo ratings yet

- Ramos Et. Al vs. Central Bank of The Philippines G.R. No. L-29352, October 4, 1971Document1 pageRamos Et. Al vs. Central Bank of The Philippines G.R. No. L-29352, October 4, 1971Ash100% (1)

- ECBC Brochurea4 Munich23 V7webDocument44 pagesECBC Brochurea4 Munich23 V7webVasilisNo ratings yet

- Eih Limited: West Bengal, India Delhi 110 054, India S.N. Sridhar, Company Secretary and Compliance OfficerDocument4 pagesEih Limited: West Bengal, India Delhi 110 054, India S.N. Sridhar, Company Secretary and Compliance Officerudeybeer7045No ratings yet

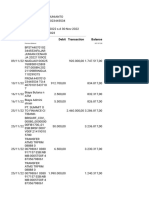

- Bank Statement of 6 Months (Boi)Document23 pagesBank Statement of 6 Months (Boi)Abhimanyu MundaNo ratings yet

- Annual Report: Banking Codes and Standards Board of IndiaDocument20 pagesAnnual Report: Banking Codes and Standards Board of IndiaHina KhanNo ratings yet

- Understanding Debentures: Key TakeawaysDocument8 pagesUnderstanding Debentures: Key TakeawaysRichard DuniganNo ratings yet

- Quiz For AbmDocument8 pagesQuiz For AbmAnne lorenz SicatNo ratings yet

- Stetment 10 PDFDocument4 pagesStetment 10 PDFvaraprasadNo ratings yet

- Internet Banking ApplicationNEWDocument2 pagesInternet Banking ApplicationNEWfert certNo ratings yet

- World Savings Day 2024Document20 pagesWorld Savings Day 2024Samlove OjoNo ratings yet

- FinnairVisa Hinnasto Fi - Fi.enDocument2 pagesFinnairVisa Hinnasto Fi - Fi.enbengaltigerNo ratings yet

- Global Credit Risk Management in Banking & Financial Market ConferenceDocument6 pagesGlobal Credit Risk Management in Banking & Financial Market ConferenceEmil LoyeeNo ratings yet

- Bank Alfalah by Ammar PDFDocument100 pagesBank Alfalah by Ammar PDFWaseem AshrafNo ratings yet

- Modern Challenges Faced by Banking Sector of Pakistan Evidence From: The First Micro Finance Bank, Js Bank and Bankislami PakistanDocument3 pagesModern Challenges Faced by Banking Sector of Pakistan Evidence From: The First Micro Finance Bank, Js Bank and Bankislami PakistanNaveed AhmadNo ratings yet

- Co Signers Statement2Document1 pageCo Signers Statement2Pharmastar Int'l Trading Corp.No ratings yet

- Eb Group 1Document38 pagesEb Group 1Danica ZabalaNo ratings yet

- Welcome To Your Shiny New Account: Mrs Jane Mace 3 Oak Tree Gardens Bromley Bromley Br1 5BqDocument4 pagesWelcome To Your Shiny New Account: Mrs Jane Mace 3 Oak Tree Gardens Bromley Bromley Br1 5Bqjanemace56No ratings yet

- Askari Bank Limited: Internship ReportDocument23 pagesAskari Bank Limited: Internship Reportfaryal098No ratings yet

- Payment Instructions: 535,296.00 INR GGC402155814Document4 pagesPayment Instructions: 535,296.00 INR GGC402155814Neelam 123No ratings yet

- Seminar 1 FinalDocument17 pagesSeminar 1 Finalanya_meyNo ratings yet

- Dreamers To Swindlers: Case Studies of The Infamous Scams That Shook The Indian Stock MarketDocument12 pagesDreamers To Swindlers: Case Studies of The Infamous Scams That Shook The Indian Stock MarketAlishaNo ratings yet

- NovemberstatementDocument2 pagesNovemberstatementbejoNo ratings yet

- Global Banking LoB OrgChartDocument1 pageGlobal Banking LoB OrgChartIvàn HernàndezNo ratings yet

- Fin 104 S. 2019 Credit Analysis CollectionDocument52 pagesFin 104 S. 2019 Credit Analysis CollectionJon Paul DonatoNo ratings yet

- Banking Law - Negotiable Instruments & It's TypesDocument3 pagesBanking Law - Negotiable Instruments & It's TypesAmogha Gadkar100% (1)

- International Financial InstitutionsDocument37 pagesInternational Financial InstitutionsYash AgarwalNo ratings yet

10-Bank Accounts and Its Types

10-Bank Accounts and Its Types

Uploaded by

tshakoor580 ratings0% found this document useful (0 votes)

2 views21 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views21 pages10-Bank Accounts and Its Types

10-Bank Accounts and Its Types

Uploaded by

tshakoor58Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 21

• A term loan is a monetary loan that is repaid

in regular payments over a set period of time.

Term loans usually last between one and ten

years, but may last as long as 30 years in some

cases. A term loan usually involves an

unfixed interest rate that will add additional

balance to be repaid.

• Usage

• Term loans can be given on an individual basis,

but are often used for small business loans. The

ability to repay over a long period of time is

attractive for new or expanding enterprises, as

the assumption is that they will increase

their profit over time. Term loans are a good way

of quickly increasing capital in order to raise a

business’ supply capabilities or range. For

instance, some new companies may use a term

loan to buy company vehicles or rent more space

for their operations.

• Consideration

• One thing to consider when getting a term loan is

whether the interest rate is fixed or floating. A fixed

interest rate means that the percentage of interest will

never increase, regardless of the financial market. Low-

interest periods are usually an excellent time to take

out a fixed rate loan. Floating interest rates will

fluctuate with the market, which can be good or bad

for you depending on what happens with the global

and national economy. Since some term loans last for

10 years, betting that the rate will stay consistently low

is a real risk.

• Also, consider whether the term loan you are

looking at uses compound interest. If it does, the

amount of interest will be periodically added to

the principal borrowed amount, meaning that the

interest keeps getting higher the longer the term

lasts. If the loan does use compound interest,

check to see if there are any penalties for early

repayment of the loan. If you get a windfall or

profits increase spectacularly, you may be able to

pay off your entire balance before it is due,

preventing you from paying additional interest by

waiting for the loan term to end.

• Some loaning institutions offer a variety of

repayment plans for your term loan. Commonly,

you may choose to pay off your debt in even

amounts, or the amount you pay will gradually

increase over the loan period. If you expect that

you will be more financially able to repay in the

future, causing an incremental increase may help

you and save you interest. If you are unsure of

your future monetary position, even payments

may help prevent defaulting on the loan if things

go badly.

• Choosing a term loan may be in your best

interest, depending on your circumstances.

Beware of extremely long repayment periods,

as generally speaking, the longer the term, the

more you will owe because the interest

accrues over a long period of time. For more

information, contact a financial advisor or

speak to your bank about loan options they

provide.

You might also like

- Term LoanDocument16 pagesTerm LoanPriyaNo ratings yet

- 10-Bank Accounts and Its Types(1)Document21 pages10-Bank Accounts and Its Types(1)tshakoor58No ratings yet

- Co Financing and RefinancingDocument12 pagesCo Financing and RefinancingMaulik M RafaliyaNo ratings yet

- What Is Working Capital Loan?: Fixed Rate Term LoanDocument1 pageWhat Is Working Capital Loan?: Fixed Rate Term LoanMohitAhujaNo ratings yet

- Chapter 4 Banking - Bank LoanDocument28 pagesChapter 4 Banking - Bank LoanIndo WalelengNo ratings yet

- Chapter-5 Intermediate Term FinancingDocument11 pagesChapter-5 Intermediate Term FinancingTarek Monowar 1921659042No ratings yet

- Mortgage Loan DefinitionDocument65 pagesMortgage Loan DefinitionAnonymous iyQmvDnHnCNo ratings yet

- Benefits of Mortgage Refinancing You Must KnowDocument3 pagesBenefits of Mortgage Refinancing You Must KnowriyaNo ratings yet

- Loan Investment: Chapter - 1Document9 pagesLoan Investment: Chapter - 1Zana M. KareemNo ratings yet

- Retail 3Document27 pagesRetail 3Pravali SaraswatNo ratings yet

- Lall Interest Rate ProjectDocument19 pagesLall Interest Rate ProjectSourav SsinghNo ratings yet

- Sources of FinanceDocument10 pagesSources of FinanceOmer Uddin100% (1)

- The Fed's Great Unwind and Your PortfolioDocument4 pagesThe Fed's Great Unwind and Your PortfolioJanet BarrNo ratings yet

- Essential Guide To Financing Your StartDocument8 pagesEssential Guide To Financing Your Startgp.mishraNo ratings yet

- April 2014: The Fed's Great Unwind and Your PortfolioDocument4 pagesApril 2014: The Fed's Great Unwind and Your PortfolioIncome Solutions Wealth ManagementNo ratings yet

- Bac 308 AssignmentDocument7 pagesBac 308 AssignmentMutwiri MwikaNo ratings yet

- (Lecture 6 & 7) - Sources of FinanceDocument21 pages(Lecture 6 & 7) - Sources of FinanceAjay Kumar TakiarNo ratings yet

- Debt Financing: Promise To Repay The LoanDocument3 pagesDebt Financing: Promise To Repay The LoanMicahNo ratings yet

- (FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Document17 pages(FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Michelle GozonNo ratings yet

- LoansDocument7 pagesLoansmba departmentNo ratings yet

- Acct 226Document4 pagesAcct 226freeNo ratings yet

- You're In: Home Fixed DepositsDocument6 pagesYou're In: Home Fixed DepositsdeepthykNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiarickyNo ratings yet

- Types of LoansDocument9 pagesTypes of LoansSanjay VaruteNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Final Project ZanaDocument25 pagesFinal Project ZanaZana M. KareemNo ratings yet

- Guide To RemortgagingDocument6 pagesGuide To RemortgagingdmntssNo ratings yet

- Term LoansDocument9 pagesTerm LoansAbhishek .SNo ratings yet

- Moneysprite Mortgage GuideDocument8 pagesMoneysprite Mortgage GuideMoneyspriteNo ratings yet

- Finmarket Lecture 5Document13 pagesFinmarket Lecture 5Rosie PosieNo ratings yet

- Secured Personal Loans - Need To Know Before ApplyDocument7 pagesSecured Personal Loans - Need To Know Before ApplyKAZI THASMIA KABIRNo ratings yet

- Dhere Vikas Krishna MBA 1stDocument9 pagesDhere Vikas Krishna MBA 1stvikas dhereNo ratings yet

- Consumer Guide To Rate LocksDocument5 pagesConsumer Guide To Rate LocksJarred AlexandrovNo ratings yet

- Housing FinanceDocument4 pagesHousing FinanceKIng KumarNo ratings yet

- More Locations: Commercial BankDocument6 pagesMore Locations: Commercial BankAyushi KhuranaNo ratings yet

- Investment Management: Module-1Document28 pagesInvestment Management: Module-1Avin P RNo ratings yet

- Mortgage BasicsDocument18 pagesMortgage BasicsJie RongNo ratings yet

- 6 Things To Know Before Taking A Home LoanDocument3 pages6 Things To Know Before Taking A Home LoanDrSivasundaram Anushan SvpnsscNo ratings yet

- 101 Mortgage Broker Secrets To Get The Best MortgageDocument22 pages101 Mortgage Broker Secrets To Get The Best Mortgageweb3752100% (1)

- Financing A New BusinessDocument4 pagesFinancing A New BusinessmahimenNo ratings yet

- Meaning of Loan: Debt Assets Lender Borrower MoneyDocument10 pagesMeaning of Loan: Debt Assets Lender Borrower MoneybondhonbondNo ratings yet

- Tridel Condos and TownhousesDocument12 pagesTridel Condos and TownhouseskrishkissoonNo ratings yet

- Term LoanDocument1 pageTerm LoanVirajRautNo ratings yet

- What Is A Nonperforming Loan NPLDocument6 pagesWhat Is A Nonperforming Loan NPLJacksonNo ratings yet

- Understanding The 5 Cs of CreditDocument15 pagesUnderstanding The 5 Cs of CreditVic Angelo TuquibNo ratings yet

- Mortgage Loan CalculatorDocument2 pagesMortgage Loan CalculatorAmerica's Loan AdvisorsNo ratings yet

- A. Discuss The Advantages of Financing Capital Expenditures With DebtDocument5 pagesA. Discuss The Advantages of Financing Capital Expenditures With DebtMark SantosNo ratings yet

- Accounting, Finance and Operations - Chapter 4Document9 pagesAccounting, Finance and Operations - Chapter 4Biswajit MohantyNo ratings yet

- FAC About Loans PDFDocument5 pagesFAC About Loans PDFDenzel BrownNo ratings yet

- Advanced Financial Accounting - Interest Rates QuestionDocument12 pagesAdvanced Financial Accounting - Interest Rates Questionailiwork worksNo ratings yet

- Can I Afford A LoanDocument7 pagesCan I Afford A LoanBorisNo ratings yet

- WCM AssignmentDocument11 pagesWCM AssignmentSakshi LodhaNo ratings yet

- Instructor: Dr. LAU Sie Ting: Course Notes For Seminar 3 Chapter 5: Time Value of Money Part BDocument34 pagesInstructor: Dr. LAU Sie Ting: Course Notes For Seminar 3 Chapter 5: Time Value of Money Part B朱艺璇No ratings yet

- Basic Functions of BanksDocument6 pagesBasic Functions of BanksMa Laney0% (1)

- MORTGAGEDocument9 pagesMORTGAGEbibin100% (1)

- 5 Cs of CreditDocument8 pages5 Cs of CreditevitaveigasNo ratings yet

- Critical Questions You Must Ask Before Applying For A Home LoanDocument3 pagesCritical Questions You Must Ask Before Applying For A Home LoanClayton CalvertNo ratings yet

- Mortgage and Amortization (Math of Investment)Document2 pagesMortgage and Amortization (Math of Investment)RCNo ratings yet

- Volume01.indd 1Document8 pagesVolume01.indd 1DanniNo ratings yet

- 6235594a57248 Aparchit Super Current Affairs 350+ With Facts March Set 2Document62 pages6235594a57248 Aparchit Super Current Affairs 350+ With Facts March Set 2RohanNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- What Is AccountingDocument6 pagesWhat Is AccountingOtaku girlNo ratings yet

- Ramos Et. Al vs. Central Bank of The Philippines G.R. No. L-29352, October 4, 1971Document1 pageRamos Et. Al vs. Central Bank of The Philippines G.R. No. L-29352, October 4, 1971Ash100% (1)

- ECBC Brochurea4 Munich23 V7webDocument44 pagesECBC Brochurea4 Munich23 V7webVasilisNo ratings yet

- Eih Limited: West Bengal, India Delhi 110 054, India S.N. Sridhar, Company Secretary and Compliance OfficerDocument4 pagesEih Limited: West Bengal, India Delhi 110 054, India S.N. Sridhar, Company Secretary and Compliance Officerudeybeer7045No ratings yet

- Bank Statement of 6 Months (Boi)Document23 pagesBank Statement of 6 Months (Boi)Abhimanyu MundaNo ratings yet

- Annual Report: Banking Codes and Standards Board of IndiaDocument20 pagesAnnual Report: Banking Codes and Standards Board of IndiaHina KhanNo ratings yet

- Understanding Debentures: Key TakeawaysDocument8 pagesUnderstanding Debentures: Key TakeawaysRichard DuniganNo ratings yet

- Quiz For AbmDocument8 pagesQuiz For AbmAnne lorenz SicatNo ratings yet

- Stetment 10 PDFDocument4 pagesStetment 10 PDFvaraprasadNo ratings yet

- Internet Banking ApplicationNEWDocument2 pagesInternet Banking ApplicationNEWfert certNo ratings yet

- World Savings Day 2024Document20 pagesWorld Savings Day 2024Samlove OjoNo ratings yet

- FinnairVisa Hinnasto Fi - Fi.enDocument2 pagesFinnairVisa Hinnasto Fi - Fi.enbengaltigerNo ratings yet

- Global Credit Risk Management in Banking & Financial Market ConferenceDocument6 pagesGlobal Credit Risk Management in Banking & Financial Market ConferenceEmil LoyeeNo ratings yet

- Bank Alfalah by Ammar PDFDocument100 pagesBank Alfalah by Ammar PDFWaseem AshrafNo ratings yet

- Modern Challenges Faced by Banking Sector of Pakistan Evidence From: The First Micro Finance Bank, Js Bank and Bankislami PakistanDocument3 pagesModern Challenges Faced by Banking Sector of Pakistan Evidence From: The First Micro Finance Bank, Js Bank and Bankislami PakistanNaveed AhmadNo ratings yet

- Co Signers Statement2Document1 pageCo Signers Statement2Pharmastar Int'l Trading Corp.No ratings yet

- Eb Group 1Document38 pagesEb Group 1Danica ZabalaNo ratings yet

- Welcome To Your Shiny New Account: Mrs Jane Mace 3 Oak Tree Gardens Bromley Bromley Br1 5BqDocument4 pagesWelcome To Your Shiny New Account: Mrs Jane Mace 3 Oak Tree Gardens Bromley Bromley Br1 5Bqjanemace56No ratings yet

- Askari Bank Limited: Internship ReportDocument23 pagesAskari Bank Limited: Internship Reportfaryal098No ratings yet

- Payment Instructions: 535,296.00 INR GGC402155814Document4 pagesPayment Instructions: 535,296.00 INR GGC402155814Neelam 123No ratings yet

- Seminar 1 FinalDocument17 pagesSeminar 1 Finalanya_meyNo ratings yet

- Dreamers To Swindlers: Case Studies of The Infamous Scams That Shook The Indian Stock MarketDocument12 pagesDreamers To Swindlers: Case Studies of The Infamous Scams That Shook The Indian Stock MarketAlishaNo ratings yet

- NovemberstatementDocument2 pagesNovemberstatementbejoNo ratings yet

- Global Banking LoB OrgChartDocument1 pageGlobal Banking LoB OrgChartIvàn HernàndezNo ratings yet

- Fin 104 S. 2019 Credit Analysis CollectionDocument52 pagesFin 104 S. 2019 Credit Analysis CollectionJon Paul DonatoNo ratings yet

- Banking Law - Negotiable Instruments & It's TypesDocument3 pagesBanking Law - Negotiable Instruments & It's TypesAmogha Gadkar100% (1)

- International Financial InstitutionsDocument37 pagesInternational Financial InstitutionsYash AgarwalNo ratings yet