Professional Documents

Culture Documents

S2 Moonlight shop fitters

S2 Moonlight shop fitters

Uploaded by

sphamandlasandile615Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S2 Moonlight shop fitters

S2 Moonlight shop fitters

Uploaded by

sphamandlasandile615Copyright:

Available Formats

Solution: Moonlight shop fitters

Supplementary statement of Profit/Loss and other comprehensive income for Ally

and Sally for the year ended 20 June 20.3

Provisional net profit 44 318

Plus: Other Income

Commission received 7 500

51 818

Less expenses (12 936)

Credit losses 780

Provision for credit losses adjustment 2 350

Maintenance 1 000

Interest on loan 4 500

Sundry expenses 356

Depreciation (750 + 3 200) 3 950

38 882

Calculation of depreciation:

Vehicles: 33 000 – 1000 = 32 000 x 10% = 3 200

Furniture and fittings: 15 000 x 5% = 750

Appropriation account

June30 Salaries to partners 22 400 June30 Profit and loss 38 882

(9 800 + 12 600)

Bonus to partners 12 188

(5 400 + 6 788)

Current:Ally 2 454

(4 294 x 4/7)

Current : Sally 1 840

(4 294 x 3/7)

38 882 38 882

Current account: Ally

June30 Drawings 5 500 July 1 Balance b/d 3 200

Salaries 9 800

Bonus 5 400

Balance c/d 15 354 Interest on capital -

Appropriation 2 454

20 854 20 854

Balance b/d 15 354

Current account: Sally

July 1 Balance b/d 395 June Salaries 12 600

30

Drawings 3 176 Bonus 6 788

Balance c/d 17 657 Interest on capital -

Appropriation 1 840

21 228 21 228

Balance b/d 17 657

OR

Current accounts in tabular form:

Ally Sally

Balance b/d 3 200 (395)

Drawings (5 500) (3 176)

Salaries 9 800 12 600

Bonus to partners 5 400 6 788

Appropriation (remaining profits) 2 454 1 840

15 354 17 657

You might also like

- Txtdqqq6du1f-P7 June17 MockExamAnswers PDFDocument32 pagesTxtdqqq6du1f-P7 June17 MockExamAnswers PDFIddy MohamedNo ratings yet

- Workshop 2 Qs As Introduction To A FDocument18 pagesWorkshop 2 Qs As Introduction To A FYeoh Tze ShinNo ratings yet

- Practice Question On Group AccountsDocument12 pagesPractice Question On Group Accountsemerald75% (4)

- Biovail Case Study Analysis and SolutionDocument3 pagesBiovail Case Study Analysis and SolutionHervino WinandaNo ratings yet

- Jiranna Financials 22Document20 pagesJiranna Financials 22Ellen MarkNo ratings yet

- Internship Report On PTCLDocument62 pagesInternship Report On PTCL✬ SHANZA MALIK ✬100% (2)

- Basic Cost ConceptsDocument20 pagesBasic Cost ConceptsBhushan Volvoikar0% (2)

- BBC Short Term International Assignment Policy - Feb 2015Document8 pagesBBC Short Term International Assignment Policy - Feb 2015Ludica OjaNo ratings yet

- Answer For Quiz 1 - Partnership AccountsDocument1 pageAnswer For Quiz 1 - Partnership AccountsArman ShahNo ratings yet

- CH 19-Answers To Textbook Ques 1025243368Document4 pagesCH 19-Answers To Textbook Ques 1025243368ayten.ayman.eleraky100% (2)

- Partnership Financial StatementsDocument13 pagesPartnership Financial StatementsRaiqueNo ratings yet

- Cash Flow ProblemsDocument2 pagesCash Flow ProblemsMeiMisakiNo ratings yet

- Ibra Fa 1Document8 pagesIbra Fa 1Michael KitongaNo ratings yet

- Exercise 2 (Cashflow Statements)Document2 pagesExercise 2 (Cashflow Statements)Prince TshepoNo ratings yet

- 3.1.cash Flows Class QuestionsDocument3 pages3.1.cash Flows Class Questionsmali CNo ratings yet

- 2021 Seminar Paper Marking SchemeDocument12 pages2021 Seminar Paper Marking Schemesayuru423geenethNo ratings yet

- Partnership 格式Document2 pagesPartnership 格式iamfine253No ratings yet

- Study Guide 6.6Document1 pageStudy Guide 6.6nhloniphointelligenceNo ratings yet

- Study Guide 6.3.1Document2 pagesStudy Guide 6.3.1nhloniphointelligenceNo ratings yet

- 2021 KZN Acc Step Ahead G11 Solutions-1Document67 pages2021 KZN Acc Step Ahead G11 Solutions-1sanelisomlangeni24No ratings yet

- Preparation of Financial Statements: "Sorted" Income Statement For The Year Ended 30 September 2018Document11 pagesPreparation of Financial Statements: "Sorted" Income Statement For The Year Ended 30 September 2018IlovejjcNo ratings yet

- Answer 30 Bridge January 2021Document2 pagesAnswer 30 Bridge January 2021skye SNo ratings yet

- Accounting Assignment 2Document8 pagesAccounting Assignment 2Shaun JacobsNo ratings yet

- P64571RA Lcci Level 4 Certificate in Financial Accounting ASE20101 RB Sep 2020Document8 pagesP64571RA Lcci Level 4 Certificate in Financial Accounting ASE20101 RB Sep 2020Musthari KhanNo ratings yet

- 2019 Unit 3 Outcome 2 Solution BookDocument10 pages2019 Unit 3 Outcome 2 Solution BookLachlan McFarlandNo ratings yet

- Financial Accounting 3a Assignment 2 2022Document9 pagesFinancial Accounting 3a Assignment 2 2022sartynaftalNo ratings yet

- CPA 1 FA Aug 2019Document10 pagesCPA 1 FA Aug 2019Asaba GloriaNo ratings yet

- E4 8Document1 pageE4 8Emirza RahmanNo ratings yet

- Abc FR259Document5 pagesAbc FR259Krishna 11No ratings yet

- Computation 23-24Document3 pagesComputation 23-24Sagar BhureNo ratings yet

- POA-Problem 2.3Document1 pagePOA-Problem 2.3nnmnghi1409No ratings yet

- Manual A2 FinalDocument43 pagesManual A2 FinalkazamNo ratings yet

- Groups With AssociatesDocument5 pagesGroups With AssociatesTawanda Tatenda HerbertNo ratings yet

- Task 3.11 MemoDocument4 pagesTask 3.11 MemoNomfundo ShabalalaNo ratings yet

- 04 Assignments Practical Questions NEWDocument21 pages04 Assignments Practical Questions NEWBhupendra MendoleNo ratings yet

- KMKTDocument7 pagesKMKTsyahmiafndiNo ratings yet

- Accounting Grade 11 Revision Solutions Term 2 - 2024Document16 pagesAccounting Grade 11 Revision Solutions Term 2 - 2024Ongeziwe BokiNo ratings yet

- MRSM 2018 - JawapanDocument14 pagesMRSM 2018 - JawapanbeaveralterNo ratings yet

- Solution Far410 Dec - 2019 - 1 - PDFDocument8 pagesSolution Far410 Dec - 2019 - 1 - PDF2022478048No ratings yet

- Computation of Total Income (Revised) Income From Business or Profession (Chapter IV D) 515400Document3 pagesComputation of Total Income (Revised) Income From Business or Profession (Chapter IV D) 515400ashishrpgNo ratings yet

- Answer 13 Tom and JerryDocument2 pagesAnswer 13 Tom and Jerryskye SNo ratings yet

- Accounting 2020 P1 MemoDocument11 pagesAccounting 2020 P1 MemoodiantumbaNo ratings yet

- Mock Exam FRPM SolutionDocument45 pagesMock Exam FRPM SolutionangelitayosecasetiawanNo ratings yet

- PYQ January 2018Document4 pagesPYQ January 2018Nur Amira NadiaNo ratings yet

- Workshop 5 QsDocument7 pagesWorkshop 5 QsNaresh SehdevNo ratings yet

- Final Accounts - 2 Solved ProblemsDocument6 pagesFinal Accounts - 2 Solved ProblemsrijaNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsDaniel PeterNo ratings yet

- Bacc 126 Assignment 1 Aug - Dec 2023Document11 pagesBacc 126 Assignment 1 Aug - Dec 2023TarusengaNo ratings yet

- FAR 2 SledgerDocument6 pagesFAR 2 Sledgerkrystallanedenice.manansalaNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- Answer To RQ 3 - Week 6 PDFDocument1 pageAnswer To RQ 3 - Week 6 PDFcalebNo ratings yet

- Adobe Scan 01-Nov-2022Document5 pagesAdobe Scan 01-Nov-2022Suthersan SoundarrajNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Fol Haws Catering Service Exercise-1Document16 pagesFol Haws Catering Service Exercise-1Guiana WacasNo ratings yet

- bài tập - conso 2Document4 pagesbài tập - conso 2Phạm Việt BáchNo ratings yet

- Anoop Fy 18-19 ComputationDocument3 pagesAnoop Fy 18-19 ComputationGaurav RawatNo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- Far570 Group ProjectDocument4 pagesFar570 Group ProjectN FrzanahNo ratings yet

- Particulars Cash Liabilities LL, Loan Balances Non-Cash Assets JJ, Capital 50%Document7 pagesParticulars Cash Liabilities LL, Loan Balances Non-Cash Assets JJ, Capital 50%Razmen Ramirez PintoNo ratings yet

- Unit 12-Question 12-C Sol (2023)Document2 pagesUnit 12-Question 12-C Sol (2023)shirleygebenga020829No ratings yet

- FAC1601-oct2013 Suggested SolutiionDocument9 pagesFAC1601-oct2013 Suggested SolutiionhlisoNo ratings yet

- GR11 Accounting Practice Exam Memorandum June Paper 1 PDFDocument6 pagesGR11 Accounting Practice Exam Memorandum June Paper 1 PDFGood LifeNo ratings yet

- Rui Company FS FINALDocument20 pagesRui Company FS FINALNikkiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- A. B. C. D.: View Answer Workspace Discuss in ForumDocument24 pagesA. B. C. D.: View Answer Workspace Discuss in ForumDashrathsinh RathodNo ratings yet

- 150 199 PDFDocument49 pages150 199 PDFSamuelNo ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- 01 & 02 - Introduction To Sales ManagementDocument57 pages01 & 02 - Introduction To Sales ManagementShivanshu Sachan100% (1)

- Corporate Accounting FraudDocument10 pagesCorporate Accounting FraudUmar IftikharNo ratings yet

- Rangkuman Halaman 84-91 CBA AkmanDocument5 pagesRangkuman Halaman 84-91 CBA AkmanHaryo BagaskaraNo ratings yet

- 12 Task Performance 1Document3 pages12 Task Performance 1Razel AntiniolosNo ratings yet

- Tax 2 4Document9 pagesTax 2 4amlecdeyojNo ratings yet

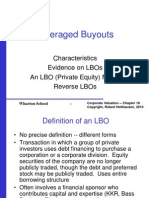

- LBO PowerpointDocument36 pagesLBO Powerpointfalarkys100% (1)

- HRM Unit-4 Motivational StrategiesDocument64 pagesHRM Unit-4 Motivational Strategiesrdeepak99No ratings yet

- Maruti Suzuki India LTD.: 1. Property, Plant and EquipmentDocument6 pagesMaruti Suzuki India LTD.: 1. Property, Plant and EquipmentaasdffNo ratings yet

- Stock Valuation With Solve Online-23Document25 pagesStock Valuation With Solve Online-23Shreya SahaNo ratings yet

- 2021 Douglas County Budget PresentationDocument43 pages2021 Douglas County Budget PresentationinforumdocsNo ratings yet

- 2 DDMDocument5 pages2 DDMSilvani Margaretha SimangunsongNo ratings yet

- Perc MCQ For EconomicsDocument9 pagesPerc MCQ For EconomicscleoNo ratings yet

- Chapter 02 - The Recording ProcessDocument59 pagesChapter 02 - The Recording ProcessMinh NguyệtNo ratings yet

- Dr. Felipe Medalla Financial SectorDocument104 pagesDr. Felipe Medalla Financial SectorLianne Carmeli B. Fronteras100% (1)

- Application of Demand and SupplyDocument60 pagesApplication of Demand and SupplyJody Singco CangrejoNo ratings yet

- Cid 2005852 PDFDocument210 pagesCid 2005852 PDFkrida puspitasariNo ratings yet

- Purchase of Property From Developer (Property With Title)Document7 pagesPurchase of Property From Developer (Property With Title)Lee Jun Zhe100% (1)

- CH 7 Measuring GrowthDocument15 pagesCH 7 Measuring GrowthAdam XuNo ratings yet

- Information System On Global Businesses Today.Document46 pagesInformation System On Global Businesses Today.gunners888No ratings yet

- Case 5: Merger Analysis Computer Concepts/computechDocument9 pagesCase 5: Merger Analysis Computer Concepts/computechLouis De MoffartsNo ratings yet

- "Financial Performance in Iti Limited, Palakkad": Submitted ToDocument13 pages"Financial Performance in Iti Limited, Palakkad": Submitted Tohafishm1No ratings yet

- U.S. Farms: Numbers, Size, and OwnershipDocument11 pagesU.S. Farms: Numbers, Size, and OwnershipCharles JonesNo ratings yet