Professional Documents

Culture Documents

FTTCC_QUARTERLY-DAILYData-CNH_StocksWeight_20220930

FTTCC_QUARTERLY-DAILYData-CNH_StocksWeight_20220930

Uploaded by

antcloudCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTTCC_QUARTERLY-DAILYData-CNH_StocksWeight_20220930

FTTCC_QUARTERLY-DAILYData-CNH_StocksWeight_20220930

Uploaded by

antcloudCopyright:

Available Formats

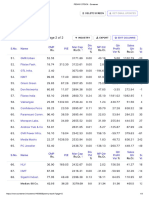

FTSE Russell Publications

FTSE Total China Connect 19 November 2022

Indicative Index Weight Data as at Closing on 30 September 2022

Index Index Index

Constituent Country Constituent Country Constituent Country

weight (%) weight (%) weight (%)

360 DigiTech ADS (N Shares) 0.05 CHINA Baoshan Iron & Steel (A) (SC SH) 0.13 CHINA CanSino Biologics (A) (SC SH) 0.01 CHINA

360 Security (A) (SC SH) 0.06 CHINA BBMG (A) (SC SH) 0.03 CHINA CanSino Biologics (H) 0.02 CHINA

3PEAK (A) (SC SH) 0.03 CHINA BBMG (H) 0.01 CHINA CECEP Solar Energy (A) (SC SZ) 0.03 CHINA

3SBio (P Chip) 0.04 CHINA Beigene (P Chip) 0.21 CHINA CECEP Wind-Power (A) (SC SH) 0.03 CHINA

ADAMA (A) (SC SZ) 0.01 CHINA Beijing Capital (A) (SC SH) 0.02 CHINA Central China Securities (A) (SC SH) 0.02 CHINA

Addsino (A) (SC SZ) 0.02 CHINA Beijing Capital Development (A) (SC SH) 0.01 CHINA Central China Securities (H) <0.005 CHINA

Advanced Micro-Fabrication Equipment (A) (SC 0.09 CHINA Beijing Capital International Airport (H) 0.03 CHINA CGN Power (A) (SC SZ) 0.03 CHINA

SH) Beijing Dabeinong Technology Group (A) (SC 0.04 CHINA CGN Power (H) 0.08 CHINA

Aecc Aero Engine Control (A) (SC SZ) 0.04 CHINA SZ) Changchun High & New Technology Industry 0.09 CHINA

AECC Aviation Power (A) (SC SH) 0.15 CHINA Beijing Easpring Material Technology (A) (SC 0.04 CHINA Group (A) (SC SZ)

Agile Group Holdings (P Chip) 0.01 CHINA SZ) Changjiang Securities (A) (SC SZ) 0.04 CHINA

Agricultural Bank of China (A) (SC SH) 0.35 CHINA Beijing E-Hualu Info Technology (A) (SC SZ) 0.01 CHINA Changzhou Xingyu Automotive Lighting 0.05 CHINA

Agricultural Bank of China (H) 0.31 CHINA Beijing Enlight Media (A) (SC SZ) 0.03 CHINA Systems (A) (SC SH)

Aier Eye Hospital Group (A) (SC SZ) 0.26 CHINA Beijing Enterprises Holdings (Red Chip) 0.05 CHINA Chaozhou Three-Circle Group (A) (SC SZ) 0.07 CHINA

Air China (A) (SC SH) 0.08 CHINA Beijing Enterprises Water Group (Red Chip) 0.03 CHINA Chengdu Kanghong Pharmaceuticals Group (A) 0.01 CHINA

Air China (H) 0.04 CHINA Beijing Jetsen Technology (A) (SC SZ) 0.01 CHINA (SC SZ)

Akeso (P Chip) 0.05 CHINA Beijing Jingneng Clean Energy (H) 0.01 CHINA Chengdu XGimi Technology (A) (SC SH) 0.01 CHINA

Alibaba Group Holding (P Chip) 4.97 CHINA Beijing Kingsoft Office Software (A) (SC SH) 0.12 CHINA Chengdu Xingrong Investment (A) (SC SZ) 0.02 CHINA

Alibaba Health Information Technology (P Chip) 0.07 CHINA Beijing Kunlun Tech (A) (SC SZ) 0.02 CHINA China Baoan Group (A) (SC SZ) 0.04 CHINA

Alibaba Pictures Group (P Chip) 0.02 CHINA Beijing New Building Materia(A) (SC SZ) 0.05 CHINA China Cinda Asset Management (H) 0.03 CHINA

A-Living Services (H) 0.02 CHINA Beijing Originwater Technology (A) (SC SZ) 0.02 CHINA China Citic Bank (A) (SC SH) 0.06 CHINA

All Winner Technology (A) (SC SZ) 0.01 CHINA Beijing Roborock Technology (A) (SC SH) 0.03 CHINA China Citic Bank (H) 0.12 CHINA

Alpha Group (A) (SC SZ) 0.01 CHINA Beijing Shiji Information Technology (A) (SC 0.03 CHINA China Coal Energy (A) (SC SH) 0.07 CHINA

Aluminum Corp of China (A) (SC SH) 0.07 CHINA SZ) China Coal Energy (H) 0.06 CHINA

Aluminum Corp of China (H) 0.04 CHINA Beijing Shougang (A) (SC SZ) 0.04 CHINA China Communications Services (H) 0.03 CHINA

Amlogic (Shanghai) (A) (SC SH) 0.03 CHINA Beijing Shunxin Agriculture (A) (SC SZ) 0.02 CHINA China Conch Environment Protection Holdings 0.02 CHINA

Angang Steel (A) (SC SZ) 0.02 CHINA Beijing Sinnet Technology (A) (SC SZ) 0.02 CHINA (P Chip)

Angang Steel (H) 0.01 CHINA Beijing SJ Environmental Protectn & New 0.01 CHINA China Conch Venture Holdings (P Chip) 0.08 CHINA

Angel Yeast (A) (SC SH) 0.05 CHINA Material (A) (SC SZ) China Construction Bank (A) (SC SH) 0.07 CHINA

Angelalign Technology (P Chip) 0.01 CHINA Beijing SL Pharmaceutical (A) (SC SZ) 0.01 CHINA China Construction Bank (H) 1.8 CHINA

Anhui Anke Biotechnology (Group) (A) (SC SZ) 0.02 CHINA Beijing Tiantan Biological Products (A) (SC SH) 0.04 CHINA China Cssc Holdings (A) (SC SH) 0.13 CHINA

Anhui Conch Cement (A) (SC SH) 0.15 CHINA Beijing Tongrentang (A) (SC SH) 0.08 CHINA China East Education Holdings (P Chip) <0.005 CHINA

Anhui Conch Cement (H) 0.13 CHINA Beijing Ultrapower Software (A) (SC SZ) 0.01 CHINA China Eastern Airlines (H) 0.02 CHINA

Anhui Expressway (A) (SC SH) 0.01 CHINA Beijing United Information Technology (A) (SC 0.07 CHINA China Eastern Airlines(A) (SC SH) 0.07 CHINA

Anhui Expressway (H) 0.01 CHINA SH) China Energy Engineering (A) (SC SH) 0.1 CHINA

Anhui Gujing Distillery (A) (SC SZ) 0.15 CHINA Beijing Wantai Biological Pharmacy Enterprise 0.05 CHINA China Energy Engineering (H) 0.02 CHINA

(A) (SC SH) China Everbright (RED CHIP) 0.02 CHINA

Anhui Gujing Distillery (B) 0.06 CHINA

Beijing Yanjing Brewery(A) (SC SZ) 0.03 CHINA China Everbright Bank (A) (SC SH) 0.15 CHINA

Anhui Kouzi Distillery (A) (SC SH) 0.01 CHINA

Beijing Yuanliu Hongyuan Electronic 0.03 CHINA China Everbright Bank (H) 0.03 CHINA

Anhui Wenergy (A) (SC SZ) 0.01 CHINA

Technology (A) (SC SH) China Everbright International (Red Chip) 0.05 CHINA

Anhui Yingjia Distillery (A) (SC SH) 0.02 CHINA

Beijing Zhongke Sanhuan High-Tech (A) (SC 0.02 CHINA China Feihe (P Chip) 0.09 CHINA

Anhui Zhongding Sealing Parts (A) (SC SZ) 0.02 CHINA SZ)

Anker Innovations Technology (A) (SC SZ) 0.01 CHINA China Galaxy Securities (A) (SC SH) 0.03 CHINA

Beijing-Shanghai High Speed Railway (A) (SC 0.17 CHINA China Galaxy Securities (H) 0.06 CHINA

Anta Sports Products (P Chip) 0.4 CHINA SH)

Apeloa Pharmaceutical (A) (SC SZ) 0.03 CHINA China Gas Holdings (Red Chip) 0.12 CHINA

Bengang Steel Plates (A) (SC SZ) <0.005 CHINA

Asymchem Laboratories Tian Jin (A) (SC SZ) 0.04 CHINA China Great Wall Securities (A) (SC SZ) 0.03 CHINA

Bethel Automotive Safety Systems (A) (SC SH) 0.05 CHINA

Autel Intelligent Technology (A) (SC SH) 0.01 CHINA China Greatwall Technology Group (A) (SC SZ) 0.04 CHINA

Betta Pharmaceuticals (A) (SC SZ) 0.01 CHINA

Autohome ADS (N Shares) 0.06 CHINA China Hongqiao Group (P Chip) 0.06 CHINA

BGI Genomics (A) (SC SZ) 0.01 CHINA

Avary Holding Shenzhen (A) (SC SZ) 0.03 CHINA China International Capital (A) (SC SH) 0.04 CHINA

Bilibili (P Chip) 0.13 CHINA

AVIC Capital (A) (SC SH) 0.04 CHINA China International Capital (H) 0.07 CHINA

Bloomage Biotechnology (A) (SC SH) 0.06 CHINA

AVIC Electromechanical (A) (SC SZ) 0.06 CHINA China International Marine Containers (A) (SC 0.02 CHINA

Blue Moon Group Holdings (P Chip) 0.02 CHINA SZ)

AviChina Industry & Technology (H) 0.03 CHINA BlueFocus Intelligent Communications Group 0.01 CHINA

AVICOPTER (A) (SC SH) 0.03 CHINA China International Marine Containers (H) 0.01 CHINA

(A) (SC SZ)

BAIC Motor (H) 0.02 CHINA China International Travel Service (A) (SC SH) 0.51 CHINA

Bluestar Adisseo (A) (SC SH) 0.01 CHINA

Baidu (P Chip) 1.09 CHINA China Jinmao Holdings Group (Red Chip) 0.04 CHINA

BOC International (China) (A) (SC SH) 0.01 CHINA

Bank of Beijing (A) (SC SH) 0.11 CHINA China Jushi (A) (SC SH) 0.07 CHINA

BOE Technology Group (A) (SC SZ) 0.16 CHINA

Bank of Changsha (A) (SC SH) 0.03 CHINA China Lesso Group Holdings (P Chip) 0.03 CHINA

Boe Technology Group (B) 0.01 CHINA

Bank of Chengdu (A) (SC SH) 0.03 CHINA China Life Insurance (H) 0.32 CHINA

Bosideng International Holdings (Red Chip) 0.04 CHINA

Bank of China (A) (SC SH) 0.18 CHINA China Literature (P Chip) 0.04 CHINA

Boya Bio pharmaceutical Group (A) (SC SZ) 0.02 CHINA

Bank of China (H) 0.83 CHINA China Longyuan Power Group (H) 0.14 CHINA

Bright Dairy & Food (A) (SC SH) 0.02 CHINA

Bank of Communications (A) (SC SH) 0.24 CHINA China Medical System Holdings (P Chip) 0.05 CHINA

BTG Hotels (Group) (A) (SC SH) 0.03 CHINA

Bank of Communications (H) 0.13 CHINA China Meheco Group (A) (SC SH) 0.02 CHINA

Business-intelligence of Oriental Nations (A) 0.01 CHINA

Bank of Guiyang (A) (SC SH) 0.03 CHINA China MeiDong Auto Holdings (P Chip) 0.02 CHINA

(SC SZ)

Bank of HangZhou (A) (SC SH) 0.11 CHINA China Mengniu Dairy (P Chip) 0.41 CHINA

BYD (A) (SC SZ) 0.6 CHINA

Bank of Jiangsu (A) (SC SH) 0.05 CHINA China Merchants Bank (A) (SC SH) 0.91 CHINA

BYD (H) 0.68 CHINA

Bank Of Nanjing (A) (SC SH) 0.14 CHINA China Merchants Bank (H) 0.59 CHINA

Byd Electronic (P Chip) 0.06 CHINA

Bank of Ningbo (A) (SC SZ) 0.27 CHINA China Merchants Energy Shipping (A) (SC SH) 0.08 CHINA

By-health (A) (SC SZ) 0.04 CHINA

Bank of Qingdao (A) (SC SZ) 0.02 CHINA China Merchants Exp. Net. & Tcho. Hold. (A) 0.02 CHINA

C&S Paper (A) (SC SZ) 0.02 CHINA

(SC SZ)

Bank of Shanghai (A) (SC SH) 0.11 CHINA Caida Securities (A) (SC SH) 0.02 CHINA

China Merchants Port Group (A) (SC SZ) 0.01 CHINA

Bank of Suzhou (A) (SC SZ) 0.01 CHINA Caitong Securities (A) (SC SH) 0.04 CHINA

China Merchants Port Holdings (Red Chip) 0.06 CHINA

Bank of ZhengZhou (A) (SC SZ) 0.02 CHINA Camel Group (A) (SC SH) 0.01 CHINA

Source: FTSE Russell 1 of 6

19 November 2022

Index Index Index

Constituent Country Constituent Country Constituent Country

weight (%) weight (%) weight (%)

China Merchants Property Operation & Service 0.02 CHINA CMST Development (A) (SC SH) 0.01 CHINA Great Wall Motor (A) (SC SH) 0.1 CHINA

(A) (SC SZ) CNGR Advanced Material (A) (SC SZ) 0.02 CHINA Great Wall Motor Company (H) 0.12 CHINA

China Merchants Securities (A) (SC SH) 0.12 CHINA CNOOC Energy Technology & Services (A) (SC 0.03 CHINA Greattown Holdings (A) (SC SH) 0.01 CHINA

China Merchants Securities (H) 0.01 CHINA SH) Greentown China Holdings (P Chip) 0.05 CHINA

China Merchants Shekou Industrial Zone 0.15 CHINA CNPC Capital (A) (SC SZ) 0.02 CHINA GRG Banking Equipment (A) (SC SZ) 0.03 CHINA

Holdings (A) (SC SZ) Contec Medical Systems (A) (SC SZ) <0.005 CHINA Guangdong Baolihua New Energy (A) (SC SZ) 0.01 CHINA

China Minmetals Rare Earth (A) (SC SZ) 0.03 CHINA Contemporary Amperex Technology (A) (SC 1.28 CHINA Guangdong East Power (A) (SC SZ) 0.02 CHINA

China Minsheng Banking (A) (SC SH) 0.16 CHINA SZ) Guangdong Electric Power Development (A) 0.01 CHINA

China Minsheng Banking (H) 0.06 CHINA COSCO SHIPPING Development (A) (SC SH) 0.03 CHINA (SC SZ)

China Molybdenum (A) (SC SH) 0.06 CHINA COSCO SHIPPING Development (H) 0.02 CHINA Guangdong Electric Power Development (B) 0.01 CHINA

China Molybdenum (H) 0.05 CHINA COSCO SHIPPING Energy Transportation (A) 0.08 CHINA Guangdong Golden Dragon Development (A) 0.02 CHINA

China National Accord Medicines (A) (SC SZ) 0.01 CHINA (SC SH) (SC SZ)

China National Accord Medicines (B) <0.005 CHINA COSCO SHIPPING Energy Transportation (H) 0.04 CHINA Guangdong Haid Group (A) (SC SZ) 0.13 CHINA

China National Building Materials (H) 0.12 CHINA COSCO Shipping Holdings (A) (SC SH) 0.18 CHINA Guangdong Hec Technology Holding (A) (SC 0.03 CHINA

China National Chemical Engineering (A) (SC 0.06 CHINA COSCO Shipping Holdings (H) 0.13 CHINA SH)

SH) COSCO SHIPPING Ports (Red Chip) 0.04 CHINA Guangdong Investment (Red Chip) 0.08 CHINA

China National Nuclear Power (A) (SC SH) 0.13 CHINA Country Garden Holdings (P Chip) 0.08 CHINA Guangdong KinLong Hardware Products (A) 0.03 CHINA

China National Software & Service (A) (SC SH) 0.04 CHINA Country Garden Services Holdings (P Chip) 0.09 CHINA (SC SZ)

China Non-Ferrous Metal Construction (A) (SC 0.01 CHINA CRRC (A) (SC SH) 0.15 CHINA Guangdong Shengyi Science Technology (A) 0.04 CHINA

SZ) CRRC (H) 0.04 CHINA (SC SH)

China Northern Rare Earth (Group) High-Tech 0.13 CHINA CSG Holding (A) (SC SZ) 0.02 CHINA Guangdong South New Media (A) (SC SZ) 0.01 CHINA

(A) (SC SH) CSG Holding (B) 0.01 CHINA Guangdong Weihua (A) (SC SZ) 0.05 CHINA

China Oilfield Services (A) (SC SH) 0.03 CHINA CSPC Pharmaceutical Group (P Chip) 0.28 CHINA Guangdong Xinbao Electrical Appliances 0.02 CHINA

China Oilfield Services (H) 0.06 CHINA Da An Gene (A) (SC SZ) 0.03 CHINA Holdings (A) (SC SZ)

China Overseas Land & Inv (Red Chip) 0.33 CHINA Dada Nexus ADS (N Shares) 0.01 CHINA Guanghui Energy (A) (SC SH) 0.11 CHINA

China Pacific Insurance (Group) (A) (SC SH) 0.18 CHINA Dali Foods Group (P Chip) 0.03 CHINA Guangshen Railway (A) (SC SH) 0.01 CHINA

China Pacific Insurance (Group) (H) 0.16 CHINA Dalian Port (PDA) (A) (SC SH) 0.03 CHINA Guangshen Railway Co (H) 0.01 CHINA

China Petroleum & Chemical (A) (SC SH) 0.19 CHINA Daqin Railway (A) (SC SH) 0.13 CHINA Guangxi Guiguan Electric Power (A) (SC SH) 0.03 CHINA

China Petroleum & Chemical (H) 0.37 CHINA Daqo New Energy ADS (N Shares) 0.1 CHINA Guangxi Liugong Machinery(A) (SC SZ) 0.01 CHINA

China Power International Development (Red 0.07 CHINA Dashenlin Pharmaceutical Group (A) (SC SH) 0.01 CHINA Guangzhou Automobile Group (A) (SC SH) 0.05 CHINA

Chip) Datang International Power Generation (A) (SC 0.03 CHINA Guangzhou Automobile Group (H) 0.07 CHINA

China Railway Group (A) (SC SH) 0.14 CHINA SH) Guangzhou Baiyunshan Pharmaceutical 0.05 CHINA

China Railway Group (H) 0.07 CHINA Datang International Power Generation (H) 0.02 CHINA Holdings (A) (SC SH)

China Railway Signal & Communication (A) (SC 0.04 CHINA Deppon Logistics (A) (SC SH) 0.01 CHINA Guangzhou Baiyunshan Pharmaceutical 0.02 CHINA

SH) DHC Software (A) (SC SZ) 0.02 CHINA Holdings (H)

China Railway Signal & Communication (H) 0.01 CHINA Dian Diagnostics Group (A) (SC SZ) 0.02 CHINA Guangzhou Haige Communications Group (A) 0.02 CHINA

China Reinsurance (Group) (H) 0.01 CHINA (SC SZ)

Digital China Information Service (A) (SC SZ) 0.01 CHINA

China Resources Beer (Holdings) (Red Chip) 0.36 CHINA Guangzhou Kingmed Diagnostics Group (A) 0.04 CHINA

Do-Fluoride Chemicals (A) (SC SZ) 0.04 CHINA

China Resources Cement Holdings (Red Chip) 0.03 CHINA (SC SH)

Dong Fang Electric(A) (SC SH) 0.07 CHINA

China Resources Double-Crane 0.02 CHINA Guangzhou Shiyuan Electronic Technology (A) 0.02 CHINA

Dongfang Electric (H) 0.02 CHINA (SC SZ)

Pharmaceutical (A) (SC SH) Dongfeng Motor Group (H) 0.05 CHINA

China Resources Gas Group (Red Chip) 0.09 CHINA Guangzhou Tinci Materials Technology (A) (SC 0.11 CHINA

Dongguan Development Holdings (A) (SC SZ) 0.01 CHINA SZ)

China Resources Land (Red Chip) 0.36 CHINA Dongxing Securities (A) (SC SH) 0.03 CHINA

China Resources Microelectronics (A) (SC SH) 0.06 CHINA Guangzhou Wondfo Biotech (A) (SC SZ) 0.02 CHINA

Double Medical Technology (A) (SC SZ) 0.01 CHINA Guangzhou Yuexiu Financial Holdings Group 0.02 CHINA

China Resources Mixc Lifestyle Services (Red 0.07 CHINA East Money Information (A) (SC SZ) 0.3 CHINA

Chip) (A) (SC SZ)

Eastern Air Logistics (A) (SC SH) 0.03 CHINA Guangzhou Zhujiang Brewery (A) (SC SZ) 0.02 CHINA

China Resources Pharmaceutical Group (Red 0.04 CHINA

Eastroc Beverage (Group) (A) (SC SH) 0.03 CHINA Guizhou Bailing Group Pharmaceutical (A) (SC 0.01 CHINA

Chip)

Easyhome New Retail Group (A) (SC SZ) 0.01 CHINA SZ)

China Resources Power Holdings (RED CHIP) 0.1 CHINA

Ecovacs Robotics (A) (SC SH) 0.05 CHINA Guizhou Panjiang Refined Coal (A) (SC SH) 0.02 CHINA

China Resources Sanjiu Medical & 0.05 CHINA

Pharmaceutical (A) (SC SZ) ENN Ecological Holdings (A) (SC SH) 0.06 CHINA Guizhou Xinbang Pharmaceutical (A) (SC SZ) 0.01 CHINA

China Ruyi Holdings (P Chip) 0.02 CHINA ENN Energy Holdings (P Chip) 0.34 CHINA Guolian Securities (A) (SC SH) 0.02 CHINA

China Securities (A) (SC SH) 0.15 CHINA Eternal Asia Supply Chain Management (A) 0.02 CHINA Guosen Securities (A) (SC SZ) 0.06 CHINA

(SC SZ) Guosheng Financial Holding (A) (SC SZ) 0.02 CHINA

China Securities (H) 0.02 CHINA

EVE Energy (A) (SC SZ) 0.21 CHINA Guotai Junan Securities (A) (SC SH) 0.13 CHINA

China Shenhua Energy (A) (SC SH) 0.29 CHINA

Everbright Securities (A) (SC SH) 0.07 CHINA Guotai Junan Securities (H) 0.03 CHINA

China Shenhua Energy (H) 0.34 CHINA

Everbright Securities (H) <0.005 CHINA Guoxuan High-tech (A) (SC SZ) 0.07 CHINA

China South Publishing & Media Group (A) (SC 0.02 CHINA

SH) Fanda Carbon New Material (A) (SC SH) 0.03 CHINA Guoyuan Securities (A) (SC SZ) 0.04 CHINA

China Southern Airlines (A) (SC SH) 0.1 CHINA Far East Horizon (P Chip) 0.03 CHINA H World Group ADS (N Shares) 0.24 CHINA

China Southern Airlines Company Limited (H) 0.03 CHINA FAW Car (A) (SC SZ) 0.02 CHINA Haidilao International Holding (P Chip) 0.07 CHINA

China Southern Power Grid Energy Efficiency 0.02 CHINA Fiberhome Telecommunication Technologies 0.02 CHINA Haier Smart Home (A) (SC SH) 0.2 CHINA

(A) (SC SZ) (A) (SC SH) Haier Smart Home (H) 0.24 CHINA

China State Construction Engineering (A) (SC 0.28 CHINA FIH Mobile (P Chip) 0.01 CHINA Haisco Pharmaceutical Group (A) (SC SZ) 0.02 CHINA

SH) Financial Street Holding (A) (SC SZ) 0.02 CHINA Haitian International Holdings (P Chip) 0.04 CHINA

China State Construction International (Red 0.06 CHINA First Capital Securities (A) (SC SZ) 0.03 CHINA Haitong Securities (A) (SC SH) 0.11 CHINA

Chip) Flat Glass Group (A) (SC SH) 0.03 CHINA Haitong Securities (H) 0.06 CHINA

China Suntien Green Energy (H) 0.02 CHINA Flat Glass Group (H) 0.04 CHINA Hangzhou Binjiang Real Estate Group (A) (SC 0.04 CHINA

China Taiping Insurance Holdings (Red Chip) 0.04 CHINA Focus Media Information Technology (A) (SC 0.1 CHINA SZ)

China Three Gorges Renewables (Group) (A) 0.18 CHINA SZ) Hangzhou Changchuan Technology (A) (SC 0.05 CHINA

(SC SH) Foshan Haitian Flavouring and Food (A) (SC 0.44 CHINA SZ)

China Tower (H) 0.17 CHINA SH) Hangzhou First Applied Material (A) (SC SH) 0.05 CHINA

China Traditional Chinese Medicine Holdings 0.03 CHINA Fosun International (P Chip) 0.05 CHINA Hangzhou Great Star Industrial (A) (SC SZ) 0.03 CHINA

(Red Chip) Founder Securities (A) (SC SH) 0.07 CHINA Hangzhou Hangyang (A) (SC SZ) 0.03 CHINA

China TransInfo Technology (A) (SC SZ) 0.01 CHINA Foxconn Industrial Internet (A) (SC SH) 0.14 CHINA Hangzhou Lion Electronics (A) (SC SH) 0.04 CHINA

China United Network Communications (A) (SC 0.12 CHINA Fujian Anjoy Foods (A) (SC SH) 0.06 CHINA Hangzhou Robam Appliances (A) (SC SZ) 0.03 CHINA

SH) Fujian Nanfang Textile (A) (SC SH) 0.02 CHINA Hangzhou Shunwang Technology (A) (SC SZ) 0.01 CHINA

China Vanke (A) (SC SZ) 0.23 CHINA Fujian Sunner Development (A) (SC SZ) 0.03 CHINA Hangzhou Silan Microelectronics (A) (SC SH) 0.06 CHINA

China Vanke (H) 0.12 CHINA Full Truck Alliance ADS (N Shares) 0.14 CHINA Hangzhou Tigermed Consulting (A) (SC SZ) 0.09 CHINA

China West Construction Group (A) (SC SZ) 0.01 CHINA Fuyao Glass Group Industries (A) (SC SH) 0.09 CHINA Hangzhou Tigermed Consulting (H) 0.03 CHINA

China World Trade Center (A) (SC SH) 0.01 CHINA Fuyao Glass Industry Group (H) 0.08 CHINA Han's Laser Technology (A) (SC SZ) 0.03 CHINA

China Yangtze Power (A) (SC SH) 0.68 CHINA Fuzhou Rockchip Electronics (A) (SC SH) 0.01 CHINA Hansoh Pharmaceutical Group (P Chip) 0.05 CHINA

China Zhenhua Group Science & Technology 0.08 CHINA Gan & Lee Pharmaceuticals (A) (SC SH) 0.01 CHINA Haohua Chemical Science & Technology (A) 0.04 CHINA

(A) (SC SZ) Ganfeng Lithium (A) (SC SZ) 0.16 CHINA (SC SH)

China Zheshang Bank (A) (SC SH) 0.03 CHINA GANFENG LITHIUM (H) 0.05 CHINA Harbin Boshi Automation (A) (SC SZ) 0.02 CHINA

ChinaLin Securities (A) (SC SZ) 0.02 CHINA G-bits Network Technology Xiamen (A) (SC 0.02 CHINA Harbin High-Tech Group (A) (SC SH) 0.01 CHINA

Chinese Universe Publishing and Media (A) 0.01 CHINA SH) HBIS (A) (SC SZ) 0.03 CHINA

(SC SH) GCL System Integration Technology (A) (SC 0.02 CHINA Hefei Meiya Optoelectronic Technology (A) (SC 0.02 CHINA

Chongqing Brewery (A) (SC SH) 0.07 CHINA SZ) SZ)

Chongqing Changan Automobile (A) (SC SZ) 0.14 CHINA GD Power Development (A) (SC SH) 0.1 CHINA Heilongjiang Agriculture (A) (SC SH) 0.03 CHINA

Chongqing Changan Automobile (B) 0.02 CHINA GDS Holdings (P Chip) 0.07 CHINA Henan Shuanghui Investment & Development 0.1 CHINA

Chongqing Department Store(A) (SC SH) 0.01 CHINA Geely Automobile Holdings (P Chip) 0.25 CHINA (A) (SC SZ)

Chongqing Fuling Zhacai Group (A) (SC SZ) 0.03 CHINA GEM (A) (SC SZ) 0.05 CHINA Hengan Intl Group (P Chip) 0.1 CHINA

Chongqing Rural Commercial Bank (A) (SC SH) 0.02 CHINA Gemdale (A) (SC SH) 0.07 CHINA Hengdian Group DMEGC Magnetics (A) (SC 0.04 CHINA

Chongqing Rural Commercial Bank (H) 0.03 CHINA Genscript Biotech (P Chip) 0.07 CHINA SZ)

Chongqing Water Group (A) (SC SH) 0.01 CHINA GF Securities (A) (SC SZ) 0.11 CHINA Hengli Petrochemical (A) (SC SH) 0.07 CHINA

Chongqing Zhifei Biological Products (A) (SC 0.18 CHINA GF Securities (H) 0.04 CHINA Hengtong Optic-Electric (A) (SC SH) 0.06 CHINA

SZ) Gigadevice Semiconductor Beijing (A) (SC SH) 0.08 CHINA Hengyi Petrochemical (A) (SC SZ) 0.03 CHINA

CIFI Holdings (Group) (P Chip) 0.01 CHINA Ginlong Technologies (A) (SC SZ) 0.11 CHINA Hithink RoyalFlush Information Network (A) (SC 0.05 CHINA

CITIC (Red Chip) 0.15 CHINA Glarun Technology (A) (SC SH) 0.02 CHINA SZ)

Citic Pacific Special Steel Group (A) (SC SZ) 0.12 CHINA GoerTek (A) (SC SZ) 0.12 CHINA Holitech Technology (A) (SC SZ) 0.01 CHINA

Citic Securities (A) (SC SH) 0.28 CHINA GOME Retail Holdings (P Chip) 0.01 CHINA Hongfa Technology (A) (SC SH) 0.05 CHINA

CITIC Securities (H) 0.13 CHINA Grandjoy Holdings Group (A) (SC SZ) 0.02 CHINA Hopson Development Holdings (P Chip) 0.03 CHINA

Source: FTSE Russell 2 of 6

19 November 2022

Index Index Index

Constituent Country Constituent Country Constituent Country

weight (%) weight (%) weight (%)

Hoshine Silicon Industry (A) (SC SH) 0.08 CHINA Jinke Properties Group (A) (SC SZ) 0.01 CHINA New Hope Liuhe (A) (SC SZ) 0.08 CHINA

Hua Hong Semiconductor (Red Chip) 0.03 CHINA Jinke Smart Services Group (H) 0.02 CHINA New Oriental Education & Technology Group (P 0.11 CHINA

Hua Xia Bank (A) (SC SH) 0.1 CHINA Jinxin Fertility Group (P Chip) 0.02 CHINA Chip)

Huabao Flavours & Fragrances (A) (SC SZ) 0.01 CHINA Jiugui Liquor (A) (SC SZ) 0.05 CHINA Newland Digital Technology (A) (SC SZ) 0.02 CHINA

Huadian Power International (A) (SC SH) 0.05 CHINA Jiumaojiu International Holdings (P Chip) 0.03 CHINA Nine Dragons Paper Industries (P Chip) 0.03 CHINA

Huadian Power International (H) 0.02 CHINA Jizhong Energy Resources (A) (SC SZ) 0.03 CHINA Ninestar (A) (SC SZ) 0.08 CHINA

Huadong Medicine (A) (SC SZ) 0.09 CHINA JL Mag Rare-Earth (A) (SC SZ) 0.01 CHINA Ningbo Deye Technology (A) (SC SH) 0.12 CHINA

Huafa Industrial Share (A) (SC SH) 0.03 CHINA Joincare Pharmaceutical (A) (SC SH) 0.03 CHINA Ningbo Joyson Electronic (A) (SC SH) 0.02 CHINA

Huagong Tech (A) (SC SZ) 0.02 CHINA JOINN Laboratories (China) (H) 0.01 CHINA Ningbo Orient Wires & Cables (A) (SC SH) 0.06 CHINA

Huaibei Mining Holdings (A) (SC SH) 0.05 CHINA Joinn Laboratories China (A) (SC SH) 0.03 CHINA Ningbo Port (A) (SC SH) 0.04 CHINA

Hualan Biological Engineering (A) (SC SZ) 0.04 CHINA Jointo Energy Investment Hebei (A) (SC SZ) 0.01 CHINA Ningbo Ronbay New Energy Technology (A) 0.05 CHINA

Huali Industrial Group (A) (SC SZ) 0.02 CHINA Jointown Pharmaceutical Group (A) (SC SH) 0.03 CHINA (SC SH)

Huaneng Lancang River Hydropower (A) (SC 0.06 CHINA Jonjee Hi-Tech Industrial And Commercial 0.03 CHINA Ningbo Sanxing Electric (A) (SC SH) 0.02 CHINA

SH) Holding (A) (SC SH) Ningbo Shan Shan (A) (SC SH) 0.06 CHINA

Huaneng Power International (A) (SC SH) 0.07 CHINA Joyoung (A) (SC SZ) 0.01 CHINA Ningbo Tuopu Group (A) (SC SH) 0.09 CHINA

Huaneng Power International (H) 0.06 CHINA JOYY ADS (N Shares) 0.04 CHINA Ningxia Baofeng Energy Group (A) (SC SH) 0.05 CHINA

Huapont-Nutrichem (A) (SC SZ) 0.01 CHINA Juewei Food (A) (SC SH) 0.02 CHINA NIO ADS (N Shares) 0.69 CHINA

Huatai Securities (A) (SC SH) 0.12 CHINA Juneyao Airlines (A) (SC SH) 0.02 CHINA Nongfu Spring (H) 0.34 CHINA

Huatai Securities (H) 0.06 CHINA Kanzhun ADS (N Shares) 0.08 CHINA North Huajin Chemical Industries (A) (SC SZ) 0.01 CHINA

Huaxi Securities (A) (SC SZ) 0.02 CHINA KE Holdings Inc ADS (N Shares) 0.37 CHINA North Industries Group Red Arrow (A) (SC SZ) 0.02 CHINA

Huaxin Cement (A) (SC SH) 0.03 CHINA Keboda Technology (A) (SC SH) 0.01 CHINA Northeast Securities Co Ltd (A) (SC SZ) 0.02 CHINA

Huaxin Cement (H) 0.01 CHINA Keda Industrial (A) (SC SH) 0.04 CHINA Nsfocus Information Technology (A) (SC SZ) 0.01 CHINA

Huayu Automotive Systems (A) (SC SH) 0.07 CHINA Kingboard Chemical Holdings (P Chip) 0.07 CHINA Oceanwide Real Estate Group (A) (SC SZ) 0.01 CHINA

Hubei Biocause Pharmaceutical (A) (SC SZ) 0.01 CHINA Kingboard Laminates Holdings (P Chip) 0.03 CHINA Offcn Education Technology (A) (SC SZ) 0.01 CHINA

HuBei Energy Group (A) (SC SZ) 0.04 CHINA Kingclean Electric (A) (SC SH) 0.01 CHINA Offshore Oil Engineering (A) (SC SH) 0.03 CHINA

Hubei Jumpcan Pharmaceutical (A) (SC SH) 0.01 CHINA Kingdee International Software Group (P Chip) 0.11 CHINA OFILM Group (A) (SC SZ) 0.02 CHINA

Hubei Xingfa Chemicals Group (A) (SC SH) 0.05 CHINA Kingfa Sci & Tech (A) (SC SH) 0.03 CHINA Oppein Home Group (A) (SC SH) 0.04 CHINA

Huizhou Desay SV Automotive (A) (SC SZ) 0.09 CHINA Kingsoft Cloud Holdings ADS (N Shares) 0.01 CHINA Opple Lighting (A) (SC SH) 0.01 CHINA

Humanwell Healthcare Group (A) (SC SH) 0.04 CHINA Kingsoft Corp (P Chip) 0.08 CHINA Org Technology (A) (SC SZ) 0.02 CHINA

Hunan Goke Microelectronics (A) (SC SZ) 0.02 CHINA Kuaishou Technology (P Chip) 0.42 CHINA Orient Securities (A) (SC SH) 0.08 CHINA

Hunan Gold (A) (SC SZ) 0.02 CHINA Kuang-Chi Technologies (A) (SC SZ) 0.04 CHINA Orient Securities (H) 0.01 CHINA

Hunan Valin Steel (A) (SC SZ) 0.03 CHINA Kunlun Energy (Red Chip) 0.09 CHINA Oriental Energy (A) (SC SZ) 0.02 CHINA

Hundsun Technologies (A) (SC SH) 0.08 CHINA Kweichow Moutai (A) (SC SH) 3.08 CHINA Ourpalm (A) (SC SZ) 0.01 CHINA

Huolinhe Opencut Coal Industry (A) (SC SZ) 0.02 CHINA KWG Group Holdings (P Chip) 0.01 CHINA Ovctek China (A) (SC SZ) 0.05 CHINA

Hygeia Healthcare Holdings (P Chip) 0.06 CHINA Lakala Payment (A) (SC SZ) 0.01 CHINA Pangang Group Vanadium Titanium & 0.05 CHINA

Hytera Communications (A) (SC SZ) 0.01 CHINA Lao Feng Xiang (A) (SC SH) 0.02 CHINA Resources (A) (SC SZ)

Iflytek (A) (SC SZ) 0.1 CHINA Lao Feng Xiang (B) 0.02 CHINA People.cn (A) (SC SH) 0.01 CHINA

Imeik Technology Development (A) (SC SZ) 0.11 CHINA Laobaixing Pharmacy Chain (A) (SC SH) 0.02 CHINA People's Insurance Company (Group) of China 0.08 CHINA

Industrial and Commercial Bank of China (A) 0.44 CHINA Lee & Man Paper Manufacturing (P Chip) 0.02 CHINA (H)

(SC SH) Legend Holdings (H) 0.01 CHINA People's Insurance Group of China (A) (SC SH) 0.07 CHINA

Industrial and Commercial Bank of China (H) 1.23 CHINA Lens Technology (A) (SC SZ) 0.06 CHINA Perfect World Pictures (A) (SC SZ) 0.02 CHINA

Industrial Bank (A) (SC SH) 0.45 CHINA Leo Group (A) (SC SZ) 0.02 CHINA PetroChina (A) (SC SH) 0.17 CHINA

Industrial Securities (A) (SC SH) 0.06 CHINA Lepu Medical Technology (Beijing) (A) (SC SZ) 0.05 CHINA Petrochina (H) 0.28 CHINA

Ingenic Semiconductor (A) (SC SZ) 0.04 CHINA Levima Advanced Materials (A) (SC SZ) 0.04 CHINA Pharmaron Beijing (A) (SC SZ) 0.03 CHINA

Inmyshow Digital Technology Group (A) (SC 0.01 CHINA Leyard Optoelectronic (A) (SC SZ) 0.02 CHINA Pharmaron Beijing (H) 0.03 CHINA

SH) Li Auto ADS (N Shares) 0.4 CHINA PICC Property & Casualty (H) 0.23 CHINA

Inner Mongolia Eerduosi Resourses (A) (SC 0.03 CHINA Li Ning (P Chip) 0.58 CHINA Pinduoduo ADS (N Shares) 0.77 CHINA

SH) LianChuang Electronic Technology (A) (SC SZ) 0.02 CHINA Ping An Bank (A) (SC SZ) 0.3 CHINA

Inner Mongolia Erdos Resources (B) 0.03 CHINA Lianhe Chemical Technology (A) (SC SZ) 0.02 CHINA Ping An Healthcare and Technology (P Chip) 0.02 CHINA

Inner Mongolia Junzheng Energy and Chemical 0.04 CHINA Lingyi iTech (Guangdong) (A) (SC SZ) 0.04 CHINA Ping An Insurance (Group) Company Of China 0.59 CHINA

(A) (SC SH) Liuzhou Iron & Steel (A) (SC SH) 0.01 CHINA (A) (SC SH)

Inner Mongolia Yili Industrial(A) (SC SH) 0.28 CHINA Livzon Pharmaceutical Group (H) 0.01 CHINA Ping An Insurance (H) 0.99 CHINA

Inner Mongolia Yitai Coal (B) 0.05 CHINA Livzon Pharmaceutical Inc(A) (SC SZ) 0.02 CHINA Pingdingshan Tianan Coal Mining (A) (SC SH) 0.04 CHINA

Inner Mongolia Yuan Xing Energy (A) (SC SZ) 0.04 CHINA Lomon Billions (A) (SC SZ) 0.05 CHINA Poly Developments and Holdings (A) (SC SH) 0.28 CHINA

Inner Mongolian Baotou Steel Union (A) (SC 0.09 CHINA Longfor Group Holdings (P Chip) 0.18 CHINA Poly Property Services (H) 0.02 CHINA

SH) Pop Mart International Group (P Chip) 0.04 CHINA

LONGi Green Energy Technology (A) (SC SH) 0.48 CHINA

Innovent Biologics (P Chip) 0.14 CHINA Porton Pharma Solutions (A) (SC SZ) 0.03 CHINA

Longshine Technology (A) (SC SZ) 0.03 CHINA

Inspur Electronic Information Industry (A) (SC 0.04 CHINA Postal Savings Bank of China (A) (SC SH) 0.12 CHINA

Luenmei Quantum (A) (SC SH) 0.01 CHINA

SZ) Postal Savings Bank of China (H) 0.18 CHINA

Lufax Holding Ltd ADS (N Shares) 0.06 CHINA

Intco Medical Technology (A) (SC SZ) 0.02 CHINA Power Construction Corporation of China (A) 0.1 CHINA

Luolai Lifestyle Technology (A) (SC SZ) 0.01 CHINA

iQIYI ADS (N Shares) 0.03 CHINA (SC SH)

Luoyang Xinqianglian Slewing Bearing (A) (SC 0.03 CHINA

iRay Technology (A) (SC SH) 0.04 CHINA Pylon Technologies (A) (SC SH) 0.07 CHINA

SZ)

JA Solar Technology (A) (SC SZ) 0.2 CHINA Qingdao Hanhe Cable (A) (SC SZ) 0.01 CHINA

Luxi Chemical Group Co. Ltd. (A) (SC SZ) 0.03 CHINA

Jafron Biomedical (A) (SC SZ) 0.05 CHINA Qingdao Port International (A) (SC SH) 0.01 CHINA

Luxshare Precision Industry (A) (SC SZ) 0.27 CHINA

Jason Furniture Hangzhou (A) (SC SH) 0.04 CHINA Qingdao Rural Commercial Bank (A) (SC SZ) 0.01 CHINA

Luye Pharma Group (P Chip) 0.02 CHINA

JD Health International (P Chip) 0.14 CHINA Qingdao TGOOD Electric (A) (SC SZ) 0.02 CHINA

Luzhou Laojiao (A) (SC SZ) 0.44 CHINA

JD Logistics (P Chip) 0.1 CHINA Qinghai Salt Lake Industry (A) (SC SZ) 0.17 CHINA

Maanshan Iron & Steel (A) (SC SH) 0.02 CHINA

JD.com (P Chip) 1.99 CHINA Qinhuangdao Port (A) (SC SH) 0.01 CHINA

Maanshan Iron & Steel (H) 0.01 CHINA

Jiajiayue Group (A) (SC SH) 0.01 CHINA Raytron Technology (A) (SC SH) 0.02 CHINA

Maccura Biotechnology (A) (SC SZ) 0.01 CHINA

Jiangling Motors (A) (SC SZ) 0.01 CHINA Red Star Macalline Group (A) (SC SH) 0.01 CHINA

Mango Excellent Media (A) (SC SZ) 0.06 CHINA

Jiangsu Changjiang Electronics Technology (A) 0.05 CHINA Red Star Macalline Group (H) 0.01 CHINA

Maxscend Microelectronics (A) (SC SZ) 0.06 CHINA

(SC SH) RemeGen (H) 0.02 CHINA

Meinian Onehealth Healthcare Holdings (A) (SC 0.02 CHINA

Jiangsu Cnano Technology (A) (SC SH) 0.04 CHINA Risesun Real Estate Development (A) (SC SZ) 0.01 CHINA

SZ)

Jiangsu Expressway (A) (SC SH) 0.02 CHINA RLX Technology ADS (N Shares) 0.03 CHINA

Meituan Dianping (P Chip) 2.89 CHINA

Jiangsu Expressway (H) 0.03 CHINA Rongsheng Petro Chemical (A) (SC SZ) 0.05 CHINA

Metallurgical Corp of China (A) (SC SH) 0.06 CHINA

Jiangsu GoodWe Power Supply Technology (A) 0.04 CHINA S.F. Holding (A) (SC SZ) 0.3 CHINA

Metallurgical Corp. of China (H) 0.02 CHINA

(SC SH) SAIC Motor (A) (SC SH) 0.18 CHINA

MicroPort Scientific Corp (P Chip) 0.03 CHINA

Jiangsu Guoxin (A) (SC SZ) 0.01 CHINA Sailun (A) (SC SH) 0.04 CHINA

Ming Yang Smart Energy Group (A) (SC SH) 0.07 CHINA

Jiangsu Hengli Hydraulic (A) (SC SH) 0.07 CHINA Sangfor Technologies (A) (SC SZ) 0.02 CHINA

Ming Yuan Cloud Group Holdings (P Chip) 0.01 CHINA

Jiangsu Hengrui Medicine (A) (SC SH) 0.29 CHINA Sansteel Minguang (A) (SC SZ) 0.02 CHINA

MINISO Group Holding ADS (N Shares) 0.02 CHINA

Jiangsu King's Luck Brewery Joint-Stock (A) 0.07 CHINA Sansure Biotech (A) (SC SH) 0.01 CHINA

(SC SH) Minth Group (P Chip) 0.05 CHINA

Montage Technology (A) (SC SH) 0.08 CHINA Sany Heavy Industry (A) (SC SH) 0.15 CHINA

Jiangsu Linyang Electronics (A) (SC SH) 0.02 CHINA SDIC Power Holdings (A) (SC SH) 0.1 CHINA

Jiangsu Wujiang China Eastern (A) (SC SZ) 0.1 CHINA Montnets Rongxin Technology Group (A) (SC 0.01 CHINA

SZ) Sealand Securities (A) (SC SZ) 0.02 CHINA

Jiangsu Yanghe Brewery Joint-Stock (A) (SC 0.31 CHINA Seazen Group (P Chip) 0.02 CHINA

SZ) Muyuan Foodstuff (A) (SC SZ) 0.38 CHINA

NanJi E-Commerce (A) (SC SZ) 0.01 CHINA Seazen Holdings (A) (SC SH) 0.05 CHINA

Jiangsu Yangnong Chemical (A) (SC SH) 0.04 CHINA

Nanjing Hanrui Cobalt (A) (SC SZ) 0.02 CHINA SG Micro (A) (SC SZ) 0.07 CHINA

Jiangsu Yoke Technology (A) (SC SZ) 0.04 CHINA

Nanjing Iron & Steel (A) (SC SH) 0.02 CHINA Shaanxi Coal Industry (A) (SC SH) 0.29 CHINA

Jiangsu Yuyue Medical Equipment & Supply (A) 0.04 CHINA

Nanjing King-friend Biochemical 0.02 CHINA Shaanxi International Trust & Investment(A) 0.01 CHINA

(SC SZ)

Pharmaceutical (A) (SC SH) (SC SZ)

Jiangsu Zhangjiagang Rural Commercial Bank <0.005 CHINA

Nanjing Securities (A) (SC SH) 0.04 CHINA Shandong Blue Sail Plastic & Rubber (A) (SC 0.01 CHINA

(A) (SC SZ)

Nanyang Topsec Technologies Group (A) (SC 0.01 CHINA SZ)

Jiangsu Zhongnan Construction Group (A) (SC 0.01 CHINA

SZ) Shandong Buchang Pharmaceuticals (A) (SC 0.01 CHINA

SZ)

NARI Technology Development (A) (SC SH) 0.22 CHINA SH)

Jiangsu Zhongtian Technologies (A) (SC SH) 0.1 CHINA

National Silicon Industry Group (A) (SC SH) 0.04 CHINA Shandong Chenming Paper (A) (SC SZ) 0.01 CHINA

Jiangxi Copper (A) (SC SH) 0.04 CHINA

NAURA Technology Group (A) (SC SZ) 0.19 CHINA Shandong Chenming Paper Holdings (B) 0.01 CHINA

Jiangxi Copper (H) 0.05 CHINA

NavInfo (A) (SC SZ) 0.04 CHINA Shandong Chenming Paper Holdings (H) <0.005 CHINA

Jiangxi Special Electric Motor (A) (SC SZ) 0.04 CHINA

NetEase (P Chip) 0.92 CHINA Shandong Denghai Seeds (A) (SC SZ) 0.02 CHINA

Jiangxi Zhengbang Technology (A) (SC SZ) 0.02 CHINA

New China Life Insurance (A) (SC SH) 0.07 CHINA Shandong Dong-E E-Jiao(A) (SC SZ) 0.03 CHINA

Jilin Aodong Medicine Industry Groups (A) (SC 0.02 CHINA

New China Life Insurance (H) 0.06 CHINA Shandong Gold Mining (A) (SC SH) 0.08 CHINA

SZ)

Source: FTSE Russell 3 of 6

19 November 2022

Index Index Index

Constituent Country Constituent Country Constituent Country

weight (%) weight (%) weight (%)

Shandong Gold Mining (H) 0.04 CHINA Shenzhen Everwin Precision Technology (A) 0.02 CHINA Suzhou Gold Mantis Construction Decoration 0.02 CHINA

Shandong Himile Mechanical Science & 0.02 CHINA (SC SZ) (A) (SC SZ)

Technology (A) (SC SZ) Shenzhen Expressway (A) (SC SH) 0.01 CHINA Suzhou Maxwell Technologies (A) (SC SZ) 0.11 CHINA

Shandong Hi-speed Company (A) (SC SH) 0.02 CHINA Shenzhen Expressway (H) 0.02 CHINA Suzhou TA&A Ultra Clean Technology (A) (SC 0.05 CHINA

Shandong Hualu-Hengsheng Chemical (A) (SC 0.08 CHINA Shenzhen Gas (A) (SC SH) 0.02 CHINA SZ)

SH) Shenzhen Hepalink Pharmaceutical (A) (SC 0.01 CHINA Taiji Computer (A) (SC SZ) 0.01 CHINA

Shandong Humon Smelting (A) (SC SZ) 0.01 CHINA SZ) TAL Education Group ADS (N Shares) 0.07 CHINA

Shandong Linglong Tyre (A) (SC SH) 0.02 CHINA Shenzhen Hepalink Pharmaceutical Group (H) <0.005 CHINA Tangshan Jidong Cement (A) (SC SZ) 0.03 CHINA

Shandong Nanshan Aluminium (A) (SC SH) 0.05 CHINA Shenzhen Huaqiang Industry(A) (SC SZ) 0.02 CHINA Tangshan Port Group (A) (SC SH) 0.02 CHINA

Shandong Pharmaceutical Glass (A) (SC SH) 0.02 CHINA Shenzhen Infogem Technologies (A) (SC SZ) 0.01 CHINA Tangshan Sanyou Chemical Industries (A) (SC 0.02 CHINA

Shandong Publishing & Media (A) (SC SH) 0.01 CHINA Shenzhen Inovance Technology (A) (SC SZ) 0.2 CHINA SH)

Shandong Shida Shenghua Chemical Group 0.02 CHINA Shenzhen International Hdgs (Red Chip) 0.04 CHINA Tbea (A) (SC SH) 0.11 CHINA

(A) (SC SH) Shenzhen Investment (Red Chip) 0.01 CHINA TCL (A) (SC SZ) 0.07 CHINA

Shandong Sun Paper Industry Joint Stock (A) 0.04 CHINA Shenzhen Jinjia Color Printing Group (A) (SC 0.02 CHINA Tencent Holdings (P Chip) 6.78 CHINA

(SC SZ) SZ) Tencent Music Entertainment Group ADS (N 0.08 CHINA

Shandong Weigao Group Medical Polymer (H) 0.1 CHINA Shenzhen Kaifa Technology (A) (SC SZ) 0.02 CHINA Shares)

Shanghai 2345 Network Holding Group (A) (SC 0.01 CHINA Shenzhen Kangtai Biological Products (A) (SC 0.04 CHINA Three Squirrels (A) (SC SZ) <0.005 CHINA

SZ) SZ) Thunder Software Technology (A) (SC SZ) 0.05 CHINA

Shanghai AJ (A) (SC SH) 0.01 CHINA Shenzhen Kedali Industry (A) (SC SZ) 0.03 CHINA Tiandi Science & Technology (A) (SC SH) 0.02 CHINA

Shanghai Bailian Group (B) <0.005 CHINA Shenzhen Kingdom Sci-Tech (A) (SC SH) 0.01 CHINA TianJin 712 Communication & Broadcasting (A) 0.02 CHINA

Shanghai Bairun Investment Holding Group (A) 0.03 CHINA Shenzhen Kinwong Electronic (A) (SC SH) 0.01 CHINA (SC SH)

(SC SZ) Shenzhen Mindray Bio-Medical Electronics (A) 0.47 CHINA Tianjin Chase Sun Pharmaceutical (A) (SC SZ) 0.02 CHINA

Shanghai Baosight Software (A) (SC SH) 0.04 CHINA (SC SZ) Tianjin Guangyu Development (A) (SC SZ) 0.03 CHINA

Shanghai Baosight Software (B) 0.05 CHINA Shenzhen Mtc (A) (SC SZ) 0.02 CHINA Tianjin Zhonghuan Semiconductor (A) (SC SZ) 0.19 CHINA

Shanghai Construction (A) (SC SH) 0.02 CHINA Shenzhen Neptunus Bioengineering (A) (SC 0.01 CHINA Tianma Microelectronics (A) (SC SZ) 0.03 CHINA

Shanghai DaZhong Public Utilities Group (A) 0.01 CHINA SZ) Tianqi Lithium (A) (SC SZ) 0.19 CHINA

(SC SH) Shenzhen New Industries Biomedical 0.01 CHINA Tianshui Huatian Technology (A) (SC SZ) 0.03 CHINA

Shanghai Electric Group (A) (SC SH) 0.05 CHINA Engineering (A) (SC SZ) Tibet Cheezheng Tibetan Medicine (A) (SC SZ) 0.01 CHINA

Shanghai Electric Group (H) 0.02 CHINA Shenzhen New Nanshan Holding (Group) (A) 0.01 CHINA Tibet Summit Resources (A) (SC SH) 0.02 CHINA

Shanghai Electric Power (A) (SC SH) 0.03 CHINA (SC SZ) Tingyi (Cayman Islands) Holding Corp. (P Chip) 0.11 CHINA

Shanghai Environment Group (A) (SC SH) 0.01 CHINA Shenzhen Overseas Chinese Town Holdings 0.05 CHINA Titan Wind Energy (Suzhou) (A) (SC SZ) 0.03 CHINA

Shanghai Flyco Electrical Appliance (A) (SC 0.02 CHINA (A) (SC SZ) Toly Bread (A) (SC SH) 0.01 CHINA

SH) Shenzhen Salubris Pharmaceuticals (A) (SC 0.03 CHINA Tongcheng-Elong Holdings (P Chip) 0.08 CHINA

Shanghai Fosun Pharmaceutical Group (A) (SC 0.08 CHINA SZ)

TongFu Microelectronics (A) (SC SZ) 0.03 CHINA

SH) Shenzhen SC New Energy Technology (A) (SC 0.05 CHINA

Tongkun Group (A) (SC SH) 0.04 CHINA

Shanghai Fosun Pharmaceutical Group (H) 0.04 CHINA SZ)

Tongling Nonferrous Metals (A) (SC SZ) 0.04 CHINA

Shanghai Friendess Electronics Technology (A) 0.03 CHINA Shenzhen Senior Technology Material (A) (SC 0.03 CHINA

SZ) Tongwei (A) (SC SH) 0.28 CHINA

(SC SH)

Shenzhen Sunway Communication (A) (SC SZ) 0.02 CHINA Topchoice Medical Investment (A) (SC SH) 0.05 CHINA

Shanghai Fudan Microelectronics Group (A) 0.03 CHINA

Shenzhen Transsion Holdings (A) (SC SH) 0.06 CHINA Topsports International Holdings (P Chip) 0.04 CHINA

(SC SH)

Shenzhen Yantian Port Holding (A) (SC SZ) 0.02 CHINA Towngas China (P Chip) 0.02 CHINA

Shanghai Fudan Microelectronics Group (H) 0.04 CHINA

ShenZhen YUTO Packaging Technology (A) 0.03 CHINA Transfar Zhilian (A) (SC SZ) 0.01 CHINA

Shanghai Huayi Group (B) <0.005 CHINA

(SC SZ) Travelsky Technology (H) 0.05 CHINA

Shanghai Industrial Holdings (Red Chip) 0.02 CHINA

Shenzhen Zhongjin Lingnan Nonfemet (A) (SC 0.02 CHINA Trina Solar (A) (SC SH) 0.18 CHINA

Shanghai International Airport (A) (SC SH) 0.18 CHINA

SZ) Trip.com ADS (N Shares) 0.48 CHINA

Shanghai International Port (A) (SC SH) 0.08 CHINA

Shenzhou International Group Holdings (P 0.2 CHINA Tsingtao Brewery (H) 0.19 CHINA

Shanghai Jin Jiang International Hotels (A) (SC 0.07 CHINA

SH) Chip) Tsingtao Brewing (A) (SC SH) 0.1 CHINA

Shanghai Jin Jiang International Hotels (B) 0.01 CHINA Shijiazhuang Changshan Beiming Technology 0.01 CHINA Tuya (N Shares) <0.005 CHINA

Shanghai Jinqiao Export Processing Zone Dev 0.01 CHINA (A) (SC SZ) Unigroup Guoxin Microelectronics (A) (SC SZ) 0.16 CHINA

(A) (SC SH) Shijiazhuang Yiling Pharmaceutical (A) (SC SZ) 0.05 CHINA Uni-President China Holdings Ltd. (P Chip) 0.03 CHINA

Shanghai Jinqiao Export Processing Zone Dev 0.01 CHINA Shimao Services Holdings (P Chip) 0.01 CHINA Unisplendour (A) (SC SZ) 0.03 CHINA

(B) Shimge Pump Industry Group (A) (SC SZ) 0.02 CHINA Universal Scientific Industrial (Shanghai) (A) 0.02 CHINA

Shanghai Junshi Biosciences (A) (SC SH) 0.02 CHINA Shougang Fushan Resources Group (Red 0.02 CHINA (SC SH)

Shanghai Junshi Biosciences (H) 0.02 CHINA Chip) Vinda International Holdings (P Chip) 0.02 CHINA

Shanghai Lingang Holdings (A) (SC SH) 0.03 CHINA Shui On Land (P Chip) 0.01 CHINA Vipshop Holdings ADS (N Shares) 0.12 CHINA

Shanghai Lujiazui Fin & Trade Dev (B) 0.03 CHINA Siasun Robot&Automation (A) (SC SZ) 0.02 CHINA Visual China Group (A) (SC SZ) 0.01 CHINA

Shanghai Lujiazui Fin&trade(A) (SC SH) 0.02 CHINA Sichuan Chuantou Energy (A) (SC SH) 0.07 CHINA Walvax Biotechnology (A) (SC SZ) 0.08 CHINA

Shanghai M&G Stationery (A) (SC SH) 0.03 CHINA Sichuan Hebang Biotechnology (A) (SC SH) 0.04 CHINA Wanda Film Holding (A) (SC SZ) 0.03 CHINA

Shanghai Mechanical and Electrical Industry (B) 0.01 CHINA Sichuan Kelun Pharmaceutical (A) (SC SZ) 0.04 CHINA Wang Xiang Qianchao(A) (SC SZ) 0.02 CHINA

Shanghai Pharmaceuticals Holding (A) (SC SH) 0.06 CHINA Sichuan New Energy Power (A) (SC SZ) 0.04 CHINA Wanhua Chemical Group (A) (SC SH) 0.38 CHINA

Shanghai Pharmaceuticals Holding (H) 0.04 CHINA Sichuan Road & Bridge (A) (SC SH) 0.06 CHINA Weibo ADS (N Shares) 0.04 CHINA

Shanghai Pudong Development Bank (A) (SC 0.27 CHINA Sichuan Swellfun (A) (SC SH) 0.04 CHINA Weichai Power (A) (SC SZ) 0.09 CHINA

SH) Sichuan Teway Food Group (A) (SC SH) 0.01 CHINA Weichai Power (H) 0.06 CHINA

Shanghai Putailai New Energy Technology (A) 0.1 CHINA Sichuan Yahua Industrial Group (A) (SC SZ) 0.03 CHINA Weifu High-Technology (A) (SC SZ) 0.02 CHINA

(SC SH) Sieyuan Electric (A) (SC SZ) 0.04 CHINA Weifu High-Technology (B) 0.01 CHINA

Shanghai RAAS Blood Products (A) (SC SZ) 0.05 CHINA Sino Biopharm (P Chip) 0.15 CHINA Weihai Guangwei Composites (A) (SC SZ) 0.05 CHINA

Shanghai Rural Commercial Bank (A) (SC SH) 0.02 CHINA Sinolink Securities (A) (SC SH) 0.04 CHINA Wens Foodstuff Group (A) (SC SZ) 0.05 CHINA

Shanghai Shibei Hi-Tech (B) <0.005 CHINA Sinoma International Engineering (A) (SC SH) 0.02 CHINA Western Mining (A) (SC SH) 0.03 CHINA

Shanghai Shimao (A) (SC SH) 0.01 CHINA SINOMA SCIENCE & TECHNOLOGY (A) (SC 0.04 CHINA Western Securities (A) (SC SZ) 0.03 CHINA

Shanghai Tunnel Engineering(A) (SC SH) 0.02 CHINA SZ) Western Superconducting Technologies (A) 0.06 CHINA

Shanghai Wai Gaoqiao Free-Trade Zone 0.01 CHINA Sinomine Resource Group (A) (SC SZ) 0.05 CHINA (SC SH)

Development (B) Sino-Ocean Group Holding (Red Chip) 0.01 CHINA Westone Information Industry (A) (SC SZ) 0.03 CHINA

Shanghai Waigaoqiao Free Trade Zone 0.01 CHINA Sinopec Engineering (Group) (H) 0.02 CHINA Will Semiconductor Shanghai (A) (SC SH) 0.09 CHINA

Development (A) (SC SH) Sinopec Oilfield Service (A) (SC SH) 0.01 CHINA Wingtech Technology (A) (SC SH) 0.08 CHINA

Shanghai Wangsu Science & Technology (A) 0.01 CHINA Sinopec Oilfield Service (H) 0.01 CHINA Winner Medical (A) (SC SZ) 0.01 CHINA

(SC SZ) Sinopec Shanghai Petrochemical (A) (SC SH) 0.02 CHINA Winning Health Technology Group (A) (SC SZ) 0.02 CHINA

Shanghai Yuyuan Tourist Mart (Group) (A) (SC 0.03 CHINA Sinopec Shanghai Petrochemical (H) 0.02 CHINA Wolong Electric Drive Group (A) (SC SH) 0.02 CHINA

SH) Sinopharm Group (H) 0.08 CHINA Wonders Information (A) (SC SZ) 0.01 CHINA

Shanghai Zhangjiang High(A) (SC SH) 0.02 CHINA Sinosoft (A) (SC SH) 0.01 CHINA Wuchan Zhongda Group (A) (SC SH) 0.03 CHINA

Shanghai Zhenhua Heavy Industries (B) 0.01 CHINA Sinotrans (A) (SC SH) 0.02 CHINA Wuhan Guide Infrared (A) (SC SZ) 0.05 CHINA

Shanxi Lu'an Environmental Energy 0.07 CHINA Sinotrans (H) 0.02 CHINA Wuhu Sanqi Interactive Entertainment Network 0.03 CHINA

Development (A) (SC SH) Sinotruk Hong Kong (Red Chip) 0.02 CHINA Tec (A) (SC SZ)

Shanxi Meijin Energy (A) (SC SZ) 0.05 CHINA Skshu Paint (A) (SC SH) 0.04 CHINA Wuliangye Yibin (A) (SC SZ) 0.86 CHINA

Shanxi Securities (A) (SC SZ) 0.02 CHINA Skyworth Digital (A) (SC SZ) 0.01 CHINA Wus Printed Circuit (Kunshan) (A) (SC SZ) 0.02 CHINA

Shanxi Taigang Stainless Steel (A) (SC SZ) 0.03 CHINA Smoore International Holdings (P Chip) 0.07 CHINA Wuxi Apptec (A) (SC SH) 0.24 CHINA

Shanxi Xinghuacun Fen Wine Factory (A) (SC 0.48 CHINA Songcheng Performance Development (A) (SC 0.04 CHINA WuXi AppTec (H) 0.09 CHINA

SH) SZ) WuXi Biologics (P Chip) 0.72 CHINA

Shanxi Xishan Coal and Electricity Power (A) 0.08 CHINA Soochow Securities (A) (SC SH) 0.04 CHINA Wuxi Shangji Automation (A) (SC SH) 0.06 CHINA

(SC SZ) Southwest Securities (A) (SC SH) 0.03 CHINA XCMG Construction Machinery (A) (SC SZ) 0.05 CHINA

Shanxi Zhangze Electric Power (A) (SC SZ) 0.01 CHINA StarPower Semiconductor (A) (SC SH) 0.06 CHINA Xiamen C & D (A) (SC SH) 0.05 CHINA

Shanying International Holdings (A) (SC SH) 0.01 CHINA STO Express (A) (SC SZ) 0.03 CHINA Xiamen Faratronic (A) (SC SH) 0.05 CHINA

Shenghe Resources Holding (A) (SC SH) 0.03 CHINA Sun Art Retail Group (P Chip) 0.01 CHINA Xiamen Intretech (A) (SC SZ) 0.01 CHINA

Shennan Circuits (A) (SC SZ) 0.02 CHINA Sunac Services Holdings (P Chip) 0.01 CHINA Xiamen ITG Group (A) (SC SH) 0.02 CHINA

Shenwan Hongyuan Group (A) (SC SZ) 0.11 CHINA Sungrow Power Supply (A) (SC SZ) 0.22 CHINA Xiamen Tungsten (A) (SC SH) 0.04 CHINA

Shenwan Hongyuan Group (H) 0.01 CHINA Suning Universal (A) (SC SZ) 0.01 CHINA Xiaomi (P Chip) 0.56 CHINA

Shenzhen Agricultural Products Group (A) (SC 0.01 CHINA Sunny Optical Technology Group (P Chip) 0.21 CHINA Xin Jiang Tianshan Cement (A) (SC SZ) 0.02 CHINA

SZ)

Sunwoda Electronic (A) (SC SZ) 0.05 CHINA Xinfengming Group (A) (SC SH) 0.01 CHINA

Shenzhen Airport (A) (SC SZ) 0.02 CHINA

Suofeiya Home Collection (A) (SC SZ) 0.01 CHINA Xinhua Winshare Publishing and Media (A) (SC <0.005 CHINA

Shenzhen Aisidi (A) (SC SZ) 0.01 CHINA

Suzhou Anjie Technology (A) (SC SZ) 0.01 CHINA SH)

Shenzhen Capchem Technology (A) (SC SZ) 0.04 CHINA Xinhua Winshare Publishing and Media (H) 0.01 CHINA

Suzhou Dongshan Precision Manufacturing (A) 0.05 CHINA

Shenzhen Dynanonic (A) (SC SZ) 0.06 CHINA (SC SZ) Xinjiang Goldwind Science & Technology (H) 0.03 CHINA

Shenzhen Energy Group (A) (SC SZ) 0.03 CHINA

Source: FTSE Russell 4 of 6

19 November 2022

Index Index Index

Constituent Country Constituent Country Constituent Country

weight (%) weight (%) weight (%)

Xinjiang Goldwind Science&Technology (A) (SC 0.05 CHINA YTO Express Group (A) (SC SH) 0.08 CHINA Zhejiang Runtu (A) (SC SZ) 0.01 CHINA

SZ) Yuan Longping High-tech Agriculture (A) (SC 0.02 CHINA Zhejiang Sanhua Intelligent Control (A) (SC SZ) 0.03 CHINA

Xinjiang Zhongtai Chemical (A) (SC SZ) 0.02 CHINA SZ) Zhejiang Satellite Petrochemical (A) (SC SZ) 0.07 CHINA

Xinxing Ductile Iron Pipes(A) (SC SZ) 0.02 CHINA Yuexiu Property (Red Chip) 0.05 CHINA Zhejiang Semir Garment (A) (SC SZ) 0.01 CHINA

Xinyangfeng Agricultural Technology (A) (SC 0.02 CHINA Yum China Holdings (P Chip) 0.67 CHINA Zhejiang Supcon Technology (A) (SC SH) 0.05 CHINA

SZ) YUNDA Holding (A) (SC SZ) 0.03 CHINA Zhejiang Supor Cookware (A) (SC SZ) 0.03 CHINA

Xinyi Solar Holdings (P Chip) 0.15 CHINA Yunnan Aluminium (A) (SC SZ) 0.04 CHINA Zhejiang Wanfeng Auto Wheel (A) (SC SZ) 0.02 CHINA

XPeng (P Chip) 0.2 CHINA Yunnan Baiyao Group (A) (SC SZ) 0.11 CHINA Zhejiang Wanliyang (A) (SC SZ) 0.01 CHINA

XTEP International Holdings (P Chip) 0.04 CHINA Yunnan Botanee Bio-Technology Group (A) 0.04 CHINA Zhejiang Weiming Environment Protection (A) 0.02 CHINA

Xuji Electric (A) (SC SZ) 0.02 CHINA (SC SZ) (SC SH)

Yadea Group Holdings (P Chip) 0.05 CHINA Yunnan Copper Industry (A) (SC SZ) 0.02 CHINA Zhejiang Weixing New Building Materials (A) 0.04 CHINA

Yangling Metron New Material (A) (SC SZ) 0.04 CHINA Yunnan Energy New Material (A) (SC SZ) 0.18 CHINA (SC SZ)

Yango Group (A) (SC SZ) 0.01 CHINA Yunnan Tin (A) (SC SZ) 0.03 CHINA Zhejiang Wolwo Bio-Pharmaceutical (A) (SC 0.03 CHINA

Yangquan Coal Industry (Group) (A) (SC SH) 0.06 CHINA Yunnan Yuntianhua (A) (SC SH) 0.06 CHINA SZ)

Yangtze Optical Fibre and Cable (A) (SC SH) 0.01 CHINA Zai Lab ADS (N Shares) 0.11 CHINA Zhejiang Yongtai Technology (A) (SC SZ) 0.03 CHINA

Yangtze Optional Fibre and Cable Joint Stock 0.01 CHINA Zangge Holding (A) (SC SZ) 0.05 CHINA Zhengzhou Coal Mining Machinery Group (A) 0.03 CHINA

Lt (H) Zhangzhou Pientzehuang Pharmaceutical (A) 0.21 CHINA (SC SH)

Yangzhou Yangjie Electronic Technology (A) 0.03 CHINA (SC SH) Zheshang Securities (A) (SC SH) 0.02 CHINA

(SC SZ) Zhaojin Mining Industry (H) 0.02 CHINA Zhihu ADS (N Shares) 0.01 CHINA

Yangzijiang Financial Holding (S Chip) 0.02 CHINA Zhejiang Century huatong Automotive Part (A) 0.04 CHINA ZhongAn Online P & C Insurance (H) 0.06 CHINA

Yangzijiang Shipbuilding Holdings (S Chip) 0.06 CHINA (SC SZ) Zhongji Innolight (A) (SC SZ) 0.02 CHINA

Yankuang Energy Group (A) (SC SH) 0.09 CHINA Zhejiang China Commodities City Group (A) 0.03 CHINA Zhongshan Broad Ocean Motor (A) (SC SZ) 0.01 CHINA

Yankuang Energy Group (H) 0.23 CHINA (SC SH) Zhongshan Public Utilities Group (A) (SC SZ) 0.01 CHINA

Yanlord Land Group (S Chip) 0.01 CHINA Zhejiang Chint Electrics (A) (SC SH) 0.05 CHINA Zhongsheng Group Holdings (P Chip) 0.09 CHINA

Yantai Changyu Pioneer Wine (A) (SC SZ) 0.01 CHINA Zhejiang Dahua Technology (A) (SC SZ) 0.05 CHINA Zhongtai Securities (A) (SC SH) 0.02 CHINA

Yantai Changyu Pioneer Wine (B) 0.01 CHINA Zhejiang Dingli Machinery (A) (SC SH) 0.02 CHINA Zhufu Holding (A) (SC SZ) 0.03 CHINA

Yantai Eddie Precision Machinery (A) (SC SH) 0.02 CHINA Zhejiang Expressway (H) 0.03 CHINA Zhuzhou CRRC Times Electric (A) (SC SH) 0.04 CHINA

Yantai Jereh Oilfield Services Group (A) (SC 0.04 CHINA Zhejiang Hailiang (A) (SC SZ) 0.02 CHINA Zhuzhou CRRC Times Electric (H) 0.07 CHINA

SZ) Zhejiang HangKe Technology (A) (SC SH) 0.02 CHINA Zhuzhou Hongda Electronics (A) (SC SZ) 0.02 CHINA

Yantai Valiant Fine Chemicals (A) (SC SZ) 0.02 CHINA Zhejiang Hisoar Pharmaceutical (A) (SC SZ) 0.01 CHINA Zhuzhou Kibing Group (A) (SC SH) 0.02 CHINA

Yatsen Holding ADS (N Shares) 0.01 CHINA Zhejiang Huace Film & TV (A) (SC SZ) 0.01 CHINA Zijin Mining Group (A) (SC SH) 0.21 CHINA

Yealink Network Technology (A) (SC SZ) 0.07 CHINA Zhejiang Huafon Spandex (A) (SC SZ) 0.03 CHINA Zijin Mining Group (H) 0.19 CHINA

Yifan Xinfu Pharmaceutical (A) (SC SZ) 0.02 CHINA Zhejiang Huahai Pharmaceutical (A) (SC SH) 0.04 CHINA Zoomlion Heavy Industry Science and 0.05 CHINA

Yifeng Pharmacy Chain (A) (SC SH) 0.05 CHINA Zhejiang Huayou Cobalt (A) (SC SH) 0.13 CHINA Technology (A) (SC SZ)

Yihai International Holding (P Chip) 0.03 CHINA Zhejiang Jingsheng Mechanical & Electrical (A) 0.12 CHINA Zoomlion Heavy Industry Science and 0.02 CHINA

Yihai Kerry Arawana Holdings (A) (SC SZ) 0.11 CHINA (SC SZ) Technology (H)

Yintai Gold (A) (SC SZ) 0.05 CHINA Zhejiang Jiuzhou Pharmaceutical (A) (SC SH) 0.04 CHINA ZTE (A) (SC SZ) 0.11 CHINA

Yixintang Pharmaceutical Group (A) (SC SZ) 0.02 CHINA Zhejiang Juhua (A) (SC SH) 0.05 CHINA ZTE (H) 0.05 CHINA

Yongxing Special Stainless Steel (A) (SC SZ) 0.06 CHINA Zhejiang Kaishan Compressor (A) (SC SZ) 0.02 CHINA ZTO Express (Cayman) (P Chip) 0.36 CHINA

Yonyou Network Technology (A) (SC SH) 0.08 CHINA Zhejiang Medicine (A) (SC SH) 0.02 CHINA

Youngor Group (A) (SC SH) 0.04 CHINA Zhejiang NHU (A) (SC SZ) 0.09 CHINA

Youngy (A) (SC SZ) 0.04 CHINA Zhejiang Quartz Crystal Optoelectronic Tech 0.02 CHINA

Youzu Interactive (A) (SC SZ) 0.01 CHINA (A) (SC SZ)

Source: FTSE Russell 5 of 6

19 November 2022

Data Explanation

Weights

Weights data is indicative, as values have been rounded up or down to two

decimal points. Where very small values are concerned, which would display as

0.00 using this rounding method, these weights are shown as <0.005.

Timing of data

Constituents & Weights are generally published in arrears and contain the data as

at the most recent quarter-end. However, some spreadsheets are updated on a

more frequent basis. Please refer to the data date shown.

19 Novem ber 2022

© 2022 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”).

The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3)

FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE

Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC

(“FTSE FI”) and (7) The Yield Book Inc (“YB”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB.

“FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”

and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks

and/or service marks owned or licensed by the applicable member of the LSE Group or their respective

licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent,

FTSE FI, YB. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as

a benchmark administrator.

All information is provided for information purposes only. Every effort is made to ensure that all information

given in this document is accurate, but no responsibility or liability can be accepted by any member of the

LSE Group nor their respective directors, officers, employees, partners or licensors for any errors or for any

loss from use of this publication or any of the information or data contained herein.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make

any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the results

to be obtained from the use of the FTSE Russell Indexes or FTSE Russell Data or the fitness or suitability of

the Indexes or Data for any particular purpose to which they might be put.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors

provide investment advice and nothing in this document should be taken as constituting financial or

investment advice. No member of the LSE Group nor their respective directors, officers, employees, partners

or licensors make any representation regarding the advisability of investing in any asset. A decision to invest Data definitions available from www.ftserussell.com

in any such asset should not be made in reliance on any information herein. Indexes cannot be invested in

To learn more, visit www.ftserussell.com;

directly. Inclusion of an asset in an index is not a recommendation to buy, sell or hold that asset. The general

email info@ftserussell.com;

information contained in this publication should not be acted upon without obtaining specific legal, tax, and

or call your regional Client Services Team office:

investment advice from a licensed professional.

Europe, Middle East & Africa

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by

any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of London: + 44 (0) 20 7866 1810

the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from

FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB, and/or their respective licensors. Americas

New York: +1 866 551 0617

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes

only. Index returns shown may not represent the results of the actual trading of investable assets. Certain Asia Pacific

returns shown may reflect back-tested performance. All performance presented prior to the index inception Hong Kong: + 852 2164 3333

date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical.

Tokyo: + 81 (3) 4563 6346

The back-test calculations are based on the same methodology that was in effect when the index was

officially launched. However, back-tested data may reflect the application of the index methodology with the

benefit of hindsight, and the historic calculations of an index may change from month to month based on

revisions to the underlying economic data used in the calculation of the index.

Source: FTSE Russell 6 of 6

You might also like

- 特变电工画册(英文定稿)Document52 pages特变电工画册(英文定稿)Diego MantillaNo ratings yet

- SPCC Sphe DC04Document1 pageSPCC Sphe DC04thanchikien2016No ratings yet

- Certificate Analysis: A R M IDocument2 pagesCertificate Analysis: A R M IswabrijNo ratings yet

- Sprint Nextel Corp. (S) SIRIUS XM Radio Inc. (SIRI) Citigroup, Inc. (C) - 0.01 0.01 - 0.02 Beta Logistic Logistic 0.2325 0.5336 0.6226 - 0.117 0.063Document3 pagesSprint Nextel Corp. (S) SIRIUS XM Radio Inc. (SIRI) Citigroup, Inc. (C) - 0.01 0.01 - 0.02 Beta Logistic Logistic 0.2325 0.5336 0.6226 - 0.117 0.063Vivi MoralesNo ratings yet

- OriginalDocument9 pagesOriginalsudarsanNo ratings yet

- 20240103-Africa ManufacturingDocument107 pages20240103-Africa Manufacturingbatsy4evNo ratings yet

- SL Company Sector Market Cap (Rs - CR) Long Term Debt (Rs - CR) Debt Minus Cash (Rs - CR.) Debt Equity Ratio (D/E)Document2 pagesSL Company Sector Market Cap (Rs - CR) Long Term Debt (Rs - CR) Debt Minus Cash (Rs - CR.) Debt Equity Ratio (D/E)kiransunkuNo ratings yet

- Abb-2qcy2012ru 10th AugDocument12 pagesAbb-2qcy2012ru 10th AugAngel BrokingNo ratings yet

- Aworlds Quarterly-Dailydata-Eur Stocksweight 20230929Document18 pagesAworlds Quarterly-Dailydata-Eur Stocksweight 20230929srcomsecNo ratings yet

- Design Basis 2Document25 pagesDesign Basis 2Krishnan KrishNo ratings yet

- Consolidation Worksheet Part 3Document2 pagesConsolidation Worksheet Part 3Glowing RoseNo ratings yet

- Geislms Quarterly-Dailydata-Usd Stocksweight 20220930Document37 pagesGeislms Quarterly-Dailydata-Usd Stocksweight 20220930rodrigo juniorNo ratings yet

- PSB Note June'21Document30 pagesPSB Note June'21Raj Kothari MNo ratings yet

- Sbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanDocument9 pagesSbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanvvpvarunNo ratings yet

- Sushma ViewReportIncomeTaxAssessmentDocument2 pagesSushma ViewReportIncomeTaxAssessmentKashvi DevNo ratings yet

- Galax Enterprises TIN Number:-07226889000Document2 pagesGalax Enterprises TIN Number:-07226889000Amit KumarNo ratings yet

- SGS Payslip September 2022Document1 pageSGS Payslip September 2022KOKILA VIJAYAKUMARNo ratings yet

- Basket File VP-DJ Shariah China A-Shares 100 ETF 27052024Document2 pagesBasket File VP-DJ Shariah China A-Shares 100 ETF 27052024seeme55runNo ratings yet

- China CFD Product List 2022Document30 pagesChina CFD Product List 2022Natanael KrindgesNo ratings yet

- Invitation - Asia Conference 2024 (0314)Document19 pagesInvitation - Asia Conference 2024 (0314)phatNo ratings yet

- ENGINEERINGDocument2 pagesENGINEERINGRefinaldi TanjungNo ratings yet

- Diluted Eps Including Extraordinary Items: Industry Average Industry MedianDocument12 pagesDiluted Eps Including Extraordinary Items: Industry Average Industry MedianHussainRihabNo ratings yet

- Big Data and Prediction ModelsDocument7 pagesBig Data and Prediction Modelsshishir 2K17No ratings yet

- INFDocument4 pagesINFVijay AnandNo ratings yet

- Composition DC04 SPHE SPCE SPCCDocument1 pageComposition DC04 SPHE SPCE SPCCthanchikien2016No ratings yet

- Certificate of Analysis: Brammer Standard Company, IncDocument4 pagesCertificate of Analysis: Brammer Standard Company, IncIshmael WoolooNo ratings yet

- Acpc 2015 Asu2a 28Document3 pagesAcpc 2015 Asu2a 28sumanta.kundu318020No ratings yet

- PDFDocument3 pagesPDFSADFASNo ratings yet

- Product Information: AS098 Nitric Acid, 69%, For Trace AnalysisDocument2 pagesProduct Information: AS098 Nitric Acid, 69%, For Trace AnalysisDam ThaiNo ratings yet

- Ats Om Bugdet LkoDocument4 pagesAts Om Bugdet LkoKrishna PremeeNo ratings yet

- NSE Stocks 22 Nov 2021Document735 pagesNSE Stocks 22 Nov 2021Ajay VaswaniNo ratings yet

- CS Daily 14 MarDocument45 pagesCS Daily 14 Marph.alvinNo ratings yet

- AD1 - FIN 5001 ProjectDocument6 pagesAD1 - FIN 5001 ProjectVinay PandeyNo ratings yet

- Architecting Global Integration 15.40Document19 pagesArchitecting Global Integration 15.40Steven Leif EsselNo ratings yet

- 8778563Document4 pages8778563muthum44499335No ratings yet

- Q-56 Programming Charges Po DT 31.07.2019Document1 pageQ-56 Programming Charges Po DT 31.07.2019Subham Kumar MishraNo ratings yet

- Lifting Lug Calculation For Top FlangeDocument172 pagesLifting Lug Calculation For Top FlangeAstle DsouzaNo ratings yet

- API - RP - 2A - 21st 2000 Vs 2007 - Joint OnlyDocument19 pagesAPI - RP - 2A - 21st 2000 Vs 2007 - Joint Onlysm8575No ratings yet

- Trial Balance: 1-Apr-2018 To 25-Feb-2019Document11 pagesTrial Balance: 1-Apr-2018 To 25-Feb-2019Venkatesh BoyinaNo ratings yet

- Datasheet CDB620-001 1042256 enDocument5 pagesDatasheet CDB620-001 1042256 enBogdan VasileNo ratings yet

- StockDocument39 pagesStockImam Mahedi HasanNo ratings yet

- 11 - Chapter 5 PDFDocument48 pages11 - Chapter 5 PDFXyzNo ratings yet

- Bsti Standard CatalogDocument288 pagesBsti Standard CatalogAziz Bin Josim0% (1)

- Ba Ia VolatilityDocument18 pagesBa Ia VolatilitySaikiran JadavNo ratings yet

- Tata GroupDocument58 pagesTata GroupSaurabh G100% (1)

- Wts AEM Automotive SMD Fuses 2016.12Document22 pagesWts AEM Automotive SMD Fuses 2016.12AlexNo ratings yet

- Libro 1Document6 pagesLibro 1mthyeremyNo ratings yet

- AbcDocument22 pagesAbcamirNo ratings yet

- F LCH Portfolio Holding DetailsDocument48 pagesF LCH Portfolio Holding DetailsRamdisaNo ratings yet

- Iso ManualDocument69 pagesIso ManualAwasthiNo ratings yet

- Swstick FabsDocument7 pagesSwstick FabsManjunath GowdaNo ratings yet

- Us20160256153a1 PDFDocument67 pagesUs20160256153a1 PDFÁngel EncaladaNo ratings yet

- ## Creating Table & Inserting Values!!!: Assignment 3: LAB A (SQL-Joins)Document3 pages## Creating Table & Inserting Values!!!: Assignment 3: LAB A (SQL-Joins)Shubham KumarNo ratings yet

- Database EVADocument1,494 pagesDatabase EVAAlex GavilánNo ratings yet

- Abb 1Q Cy 2013Document11 pagesAbb 1Q Cy 2013Angel BrokingNo ratings yet

- BSTIDocument240 pagesBSTIRizwan GalibNo ratings yet

- BSTI CatalougeDocument344 pagesBSTI CatalougeJahid HasnainNo ratings yet

- Ar 08.31.22Document4 pagesAr 08.31.22Alexa Mae BuenafeNo ratings yet

- (Aman Pathak) RESEARCH METHODOLOGYDocument4 pages(Aman Pathak) RESEARCH METHODOLOGYAman PathakNo ratings yet

- Project For SharekhanDocument52 pagesProject For SharekhanSahil Aggarwal100% (2)

- Global Data Center Newsletter - 2023.06.15Document22 pagesGlobal Data Center Newsletter - 2023.06.15indr4m4 7u5ufNo ratings yet

- Demat System in India SumeshDocument77 pagesDemat System in India Sumeshsumesh89433% (3)

- First Learn - Then Earn (Indian Stock Market)Document31 pagesFirst Learn - Then Earn (Indian Stock Market)stardennisNo ratings yet

- A Simple Test of Baron S Model of IPO UnderpricingDocument11 pagesA Simple Test of Baron S Model of IPO UnderpricingZhang PeilinNo ratings yet

- A Ranking of The 40 Highest-Paid HR Executives Listed in SEC Filings.Document1 pageA Ranking of The 40 Highest-Paid HR Executives Listed in SEC Filings.singamroopaNo ratings yet

- Avenue Supermarts LTD.: Margin Reset UnderwayDocument9 pagesAvenue Supermarts LTD.: Margin Reset UnderwayAshokNo ratings yet

- Analisis Return Saham Sebelum Dan Selama Pandemi Covid-19 (LQ45)Document8 pagesAnalisis Return Saham Sebelum Dan Selama Pandemi Covid-19 (LQ45)verenNo ratings yet

- Team4 FmassignmentDocument10 pagesTeam4 FmassignmentruchirNo ratings yet

- Chapter 16 Equity InvestmentsDocument19 pagesChapter 16 Equity InvestmentsBukhani MacabanganNo ratings yet

- Stocks ValuationDocument102 pagesStocks ValuationKatherine Cabading InocandoNo ratings yet

- Stock Market Prediction Using Machine Learning Classifiers and Social Media, NewsDocument24 pagesStock Market Prediction Using Machine Learning Classifiers and Social Media, NewsMarcus ViniciusNo ratings yet

- Stock ExchangeDocument43 pagesStock ExchangeGaurav JindalNo ratings yet

- Portfolio Management-Unicon Investment SolutionsDocument62 pagesPortfolio Management-Unicon Investment SolutionsRamesh AnkithaNo ratings yet

- Bravo Cross Asset Manager Presentation PDFDocument32 pagesBravo Cross Asset Manager Presentation PDFakarastNo ratings yet

- William J O'Neil1 LindaDocument22 pagesWilliam J O'Neil1 LindaLinda Salim100% (1)

- Cost of Equity - IMIDocument54 pagesCost of Equity - IMIEeshank KarnwalNo ratings yet

- Abstracts NNC 2013Document69 pagesAbstracts NNC 2013Suniel KumarNo ratings yet

- McDonald-Company ProfileDocument3 pagesMcDonald-Company Profilegdpi09No ratings yet

- Chapter26 DividendPolicyDocument12 pagesChapter26 DividendPolicyTeh Chu LeongNo ratings yet

- PENNY STOCK - ScreenerDocument3 pagesPENNY STOCK - Screenerdhruvprep16015No ratings yet

- A Project On FuturesDocument37 pagesA Project On FuturesAvula Shravan YadavNo ratings yet

- Topic 2 - Homework2 SolutionDocument7 pagesTopic 2 - Homework2 SolutionTsz Wei CHANNo ratings yet

- Speculative TransactionDocument13 pagesSpeculative TransactionMin Ha-riNo ratings yet

- Economic Calendar Economic CalendarDocument5 pagesEconomic Calendar Economic CalendarAtulNo ratings yet

- Market Efficiency: T C S B D V .3, PP. 959-970Document13 pagesMarket Efficiency: T C S B D V .3, PP. 959-970Citra Permata YuriNo ratings yet

- PPT-5 Corporate Action-Dividends, Bonus, Splits EtcDocument16 pagesPPT-5 Corporate Action-Dividends, Bonus, Splits EtcAmrita GhartiNo ratings yet

- Q3AM Momentum White PaperDocument13 pagesQ3AM Momentum White Paperq3assetmanagementNo ratings yet

- Bombay Stock ExchangeDocument18 pagesBombay Stock Exchangethe crashNo ratings yet