Professional Documents

Culture Documents

Module 7

Module 7

Uploaded by

bhuvana600048Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 7

Module 7

Uploaded by

bhuvana600048Copyright:

Available Formats

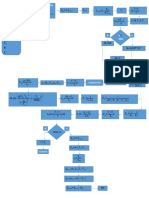

Module TDS & TCS UNDER GST CMA

7 FINAL

D # ¥ u d e r G s =

""°'""&""|

±¥#¥¥

st

st¥ ¥¥¥ rea÷;

rea÷;¥

¥

stiffftp.q#tieeqi

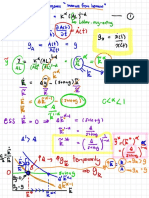

Notified ① Goods/Services (E10,000 E l ro d

+

I[]""""""°""&÷

/¥ ⇒.).........)

③

eutI

£ 9,800 + Elmo

× 2.1. - 4 0

÷

20

'

" "'

" 7 t w o TDs credit

"÷..

"i. -3044 ¥

= I 1,000

E 1,000

ftp.#Gst=tioooxf8g

=

.. [I,

[III. Te s

=

I 153

off 100

9

M¥ -4""

**÷÷÷÷÷÷÷* ⇒n#

Undertaking ⑤ Supplier c a n take i t s credit

,,

body " "

9 * 0 0 9 adjust against 4 "

'I payable. Also I t c

availed

.'. N e t =

o n

can

commission

E l i n o r - I E 100

be

¥ p o i u ±

lies deducted s h a l l b e remitted Govt. lots of the

* TDs to

by

month following every m o n t h .

* I f there

any delay i n T D s lies remittance, interest payable

is

@ 1 8 f . p . a from 11M of n e n t m o n t h t i l l t h e actual d a t e o f payment.

* TDs Irs deducted xhall be refl ected i n Electronic cash ledger

of supplier and c a n b e a t t i r e d for payment of t a x , interest,

penalty, f e e etc.,

www.tharunraj.com Page 112

Module TDS & TCS UNDER GST CMA

7 FINAL

www.tharunraj.com Page 113

You might also like

- 미즐러 (5판) 번역본Document798 pages미즐러 (5판) 번역본화학No ratings yet

- Study of NPA in UCO BankDocument63 pagesStudy of NPA in UCO BankSunil Shekhar Nayak0% (1)

- Lesson 3 - Time Value of MoneyDocument122 pagesLesson 3 - Time Value of MoneyJannine Joyce Bergonio33% (3)

- Ath - T: .Tl/Tartyacotta+Swhan1Xcot7ADocument9 pagesAth - T: .Tl/Tartyacotta+Swhan1Xcot7ALeejo9779No ratings yet

- דף נוסחאות דוריןDocument18 pagesדף נוסחאות דוריןyotam27No ratings yet

- OM2 Curs 07Document8 pagesOM2 Curs 07ana popescuNo ratings yet

- Head RD MDS 540Document2 pagesHead RD MDS 540claudioNo ratings yet

- Light Previous Years Shobhit NirwanDocument12 pagesLight Previous Years Shobhit NirwanPramod ChoudharyNo ratings yet

- 13 Sept, FRM P1 - Time SeriesDocument17 pages13 Sept, FRM P1 - Time Seriesprashantarora18No ratings yet

- If I Were A Rich ManDocument11 pagesIf I Were A Rich ManHansPeterJanssens100% (1)

- Alfred Reed Concertino MarimbaDocument12 pagesAlfred Reed Concertino MarimbaAndres MarquezNo ratings yet

- ฟังก์ชันค่าเวกเตอร์ - แคลคูลัสของฟังก์ชันค่าเวกเตอร์ Ep2Document15 pagesฟังก์ชันค่าเวกเตอร์ - แคลคูลัสของฟังก์ชันค่าเวกเตอร์ Ep2SeeWhaTNo ratings yet

- Tiruchirappal: Lbgl23L42Document7 pagesTiruchirappal: Lbgl23L42raja MNo ratings yet

- Kof UtsDocument1 pageKof UtsmikhamcNo ratings yet

- Linear Circuits FormulaeDocument4 pagesLinear Circuits Formulaeraijin4lifeNo ratings yet

- Shoulder & Upper Extremity Pain 3Document1 pageShoulder & Upper Extremity Pain 3mcbjam14No ratings yet

- Equilibrium Lec2Document29 pagesEquilibrium Lec2Keshav SharmaNo ratings yet

- Img 249Document1 pageImg 249cv.kmv2No ratings yet

- 5 Winning Chart PatternsDocument31 pages5 Winning Chart PatternsnmliNo ratings yet

- Map 1Document1 pageMap 1ARCHikeshNo ratings yet

- MAP 1 Location Plan of K-II DwarkaDocument1 pageMAP 1 Location Plan of K-II DwarkaKaran RajputNo ratings yet

- Week 4Document3 pagesWeek 4Hui ShanNo ratings yet

- PM Curs 6-Merged PDFDocument49 pagesPM Curs 6-Merged PDFRaduNo ratings yet

- PG TRB Commerce Question Paper 2004Document22 pagesPG TRB Commerce Question Paper 2004julie jasmineNo ratings yet

- 621-Moment 1682809370503Document3 pages621-Moment 1682809370503Prantik MaityNo ratings yet

- Screenshot 2564-11-29 at 20.49.24Document7 pagesScreenshot 2564-11-29 at 20.49.24Atirut SengmuangNo ratings yet

- SCHNEIDERS (00143) Periodic Billing Statement-Cut & Paste - Period Ending 09.20.2015 - RedactedDocument1 pageSCHNEIDERS (00143) Periodic Billing Statement-Cut & Paste - Period Ending 09.20.2015 - Redactedlarry-612445No ratings yet

- 0319物理笔记 MomentumDocument7 pages0319物理笔记 Momentumcoscos2001No ratings yet

- Valentino ChocolatesDocument2 pagesValentino ChocolatesMarine HoutmannNo ratings yet

- Self Coil: Mutual SirenDocument12 pagesSelf Coil: Mutual SirenRajat Verma X D 39No ratings yet

- Umang DoshiDocument2 pagesUmang Doshiriteshpol.akpNo ratings yet

- ENGRCEE30 Midterm 1 2016Document6 pagesENGRCEE30 Midterm 1 2016magiccarp.pokemonNo ratings yet

- Brahms F-DurDocument8 pagesBrahms F-DurElena BlancoNo ratings yet

- No Si Si: Especificaciones de La TuberiaDocument1 pageNo Si Si: Especificaciones de La TuberiaDigna Bettin CuelloNo ratings yet

- Ffflur: JJ.,-10 - RBDocument1 pageFfflur: JJ.,-10 - RBmayank sharmaNo ratings yet

- Af Fel/S: ''F-. ' - .: - . - Ii.::JDocument2 pagesAf Fel/S: ''F-. ' - .: - . - Ii.::JtimonNo ratings yet

- 2023S1 Topic7SummaryDocument6 pages2023S1 Topic7Summarysakura.j.kagawaNo ratings yet

- Form P2H Pompa PDFDocument3 pagesForm P2H Pompa PDFSuparji Anto100% (1)

- Mechanics of Machies IIDocument25 pagesMechanics of Machies IIArise TettehNo ratings yet

- ฟังก์ชันค่าเวกเตอร์ - ความยาวส่วนโค้ง Ep3Document5 pagesฟังก์ชันค่าเวกเตอร์ - ความยาวส่วนโค้ง Ep3SeeWhaTNo ratings yet

- 물리 개념노트Document11 pages물리 개념노트김숙기No ratings yet

- Ci AllDocument5 pagesCi AllNoonNo ratings yet

- Integration (IITian Notes - Kota)Document251 pagesIntegration (IITian Notes - Kota)djrhgvjdNo ratings yet

- Quick SortDocument9 pagesQuick Sortarubarafi17No ratings yet

- Key วิชาสามัญเคมี 63Document5 pagesKey วิชาสามัญเคมี 63May PassarapornNo ratings yet

- RLTT-LZT - Int: TF B-V41 EeeDocument4 pagesRLTT-LZT - Int: TF B-V41 EeeAbigail TabandaNo ratings yet

- DigramDocument1 pageDigramtanoknoktabalbagNo ratings yet

- Year 2020 Paper 1Document18 pagesYear 2020 Paper 1Budiman YahyaNo ratings yet

- Diwali Gift ExpenseDocument6 pagesDiwali Gift ExpensePankaj KapilNo ratings yet

- July 13 PDFDocument7 pagesJuly 13 PDFShimu ShahrearNo ratings yet

- ฟังก์ชันค่าเวกเตอร์ - เวกเตอร์สัมผัสและเวกเตอร์ปกติ Ep4Document6 pagesฟังก์ชันค่าเวกเตอร์ - เวกเตอร์สัมผัสและเวกเตอร์ปกติ Ep4SeeWhaTNo ratings yet

- Class 12 Phy HindiDocument20 pagesClass 12 Phy HindiRahul HansdaNo ratings yet

- مواصفة ماسورة 48سم استاند 14Document1 pageمواصفة ماسورة 48سم استاند 14Philip Mounir ShenoudaNo ratings yet

- Kavanaugh Summer of 1982 CalendarDocument5 pagesKavanaugh Summer of 1982 CalendarFox News100% (12)

- Kavanaugh Summer 1982 Calendar Pages1Document5 pagesKavanaugh Summer 1982 Calendar Pages1Katie PavlichNo ratings yet

- T.Effij: (I-: I - CRDocument2 pagesT.Effij: (I-: I - CRRikaraNo ratings yet

- Physics Formula ListDocument4 pagesPhysics Formula ListVernon50% (4)

- Dayama G-Nasingbeb: DoyatotuebedDocument5 pagesDayama G-Nasingbeb: DoyatotuebedQuartZ YTCNo ratings yet

- F rm.,990-T: Exempt Organization Business Income Tax Return 'Document7 pagesF rm.,990-T: Exempt Organization Business Income Tax Return 'Matias SmithNo ratings yet

- DeepakDocument2 pagesDeepakmahendrarao148No ratings yet

- Examination Centers Feb 24Document1 pageExamination Centers Feb 24bhuvana600048No ratings yet

- EXAM CENTER RevDocument3 pagesEXAM CENTER Revbhuvana600048No ratings yet

- Income Under The Head House Property2Document80 pagesIncome Under The Head House Property2bhuvana600048No ratings yet

- 30 Tally Erp 9 ManualDocument151 pages30 Tally Erp 9 Manualperi9274No ratings yet

- FOREIGN DOLL CORP May 2023 TD StatementDocument4 pagesFOREIGN DOLL CORP May 2023 TD Statementlesly malebrancheNo ratings yet

- China FTSE 50Document6 pagesChina FTSE 50romilozaNo ratings yet

- Home Loan - Master BCC BR 106 380Document158 pagesHome Loan - Master BCC BR 106 380binalamitNo ratings yet

- Revenue Realisation Concept ReportDocument13 pagesRevenue Realisation Concept ReportAbhishek SharmaNo ratings yet

- Sponsor A Dog Saved From The Meat TradeDocument2 pagesSponsor A Dog Saved From The Meat TradeVegan FutureNo ratings yet

- Assignment On Public Speaking On News: Course Name: Bussiness English and Communication Course Code: F-101Document3 pagesAssignment On Public Speaking On News: Course Name: Bussiness English and Communication Course Code: F-101Ashraful Islam ShowrovNo ratings yet

- Finacle Book For Bank Auditors-9Document1 pageFinacle Book For Bank Auditors-9avinash mangalNo ratings yet

- Audit (ISA)Document1 pageAudit (ISA)Wirdha Annisa HasibuanNo ratings yet

- IRCTC LTD, Booked Ticket PriDocument2 pagesIRCTC LTD, Booked Ticket Primallikarjun_kNo ratings yet

- Member Contract PDFDocument1 pageMember Contract PDFJazzmondNo ratings yet

- THE Insurance Code of The Philippines (Pres. Decree No. 1460, As Amended.) General ProvisionsDocument13 pagesTHE Insurance Code of The Philippines (Pres. Decree No. 1460, As Amended.) General ProvisionsDonna TreceñeNo ratings yet

- MTG101Document3 pagesMTG101tarhumNo ratings yet

- SBM Proc Fees 231116Document9 pagesSBM Proc Fees 231116Andreea CNo ratings yet

- Lease Bonus Paidby The Lessee Treatment)Document2 pagesLease Bonus Paidby The Lessee Treatment)Denver TanhuanNo ratings yet

- Bajaj Allianz Summer TrainingDocument46 pagesBajaj Allianz Summer TrainingAman BajajNo ratings yet

- HDFC Life Insurance Company LTD.: VisionDocument4 pagesHDFC Life Insurance Company LTD.: VisionCOOK EAT REPEATNo ratings yet

- Digitalization of Rural India: Digital Village: July 2020Document12 pagesDigitalization of Rural India: Digital Village: July 2020pourushbaraNo ratings yet

- Victor Muniz V Wells Fargo ComplaintDocument42 pagesVictor Muniz V Wells Fargo Complaintkmccoynyc100% (2)

- Mis ReportDocument33 pagesMis Reportginish12No ratings yet

- Institute of Chartered Accountants of Nigeria Taxation APRIL 2019 Pilot Questions Section A Multiple-Choice QuestionsDocument16 pagesInstitute of Chartered Accountants of Nigeria Taxation APRIL 2019 Pilot Questions Section A Multiple-Choice QuestionsEmmanuel ObafemmyNo ratings yet

- Employers ListDocument1 pageEmployers ListmmmkmgrNo ratings yet

- Chapter - 04, Process of Assurance - Evidence and ReportingDocument5 pagesChapter - 04, Process of Assurance - Evidence and Reportingmahbub khanNo ratings yet

- InnovaDocument16 pagesInnovaNoiseFireNo ratings yet

- Mano SettuDocument7 pagesMano SettuRobert RajuNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNanu PatelNo ratings yet

- Ketan Parekh ScamDocument9 pagesKetan Parekh ScamKetan VichareNo ratings yet

- Journal of Accounting and Economics: Paul J. Beck, Ganapathi S. NarayanamoorthyDocument24 pagesJournal of Accounting and Economics: Paul J. Beck, Ganapathi S. NarayanamoorthyabhinavatripathiNo ratings yet

- Union Bank of India ReportDocument66 pagesUnion Bank of India ReportAmit SinghNo ratings yet