Professional Documents

Culture Documents

PDCFA-Code E1-December 2014

PDCFA-Code E1-December 2014

Uploaded by

fathimacpali0 ratings0% found this document useful (0 votes)

4 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views3 pagesPDCFA-Code E1-December 2014

PDCFA-Code E1-December 2014

Uploaded by

fathimacpaliCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Question code

KERALA STATE RUTRONIX

Accounting Tally & Peachtree

(PDCFA)

E1

Time : 2 hours Maximum Marks : 100

Note: Write the answers for Questions from 1 to 30 in the MCQ answer sheet

Part - l Choose the most appropriate answer (10 x 1 Mark = 10 Marks)

1) Proprietors capital a/c is a ……………. account.

a) Personal b) Real c) Nominal d) None of these

2) Debit means ……………. in asset.

a) Increase b) Decrease c) Both a & b d) Loss

3) Nominal a/c is also known as ……………. a/c.

a) Real b) Ficticious c) Intangible d) Personal

4) ……………. is an incomplete system of recording business transactions.

a) Double entry b) Single Entry c) Compound Entry d) None of these

5) In Peach Tree, ……………. is a person or company providing merchandise or service to retail stores.

a) Vendor b) Supplier c) Both a & b d) Whole saler

6) In Tally, to declare a voucher as post-dated press …………….

a) Ctrl+T b) Alt+T c) Ctrl+P d) Ctrl+D

7) The Data folder of the company created in Tally consist of ……………. digits.

a) 3 digits b) 4 digits c) 6 digits d) 5 digits

st st

8) If the financial year is from 1 April 2013 and the book begins from 1 Jan 2014, then what will

be the closing date?

st st st

a) 31 December 2014 b) 31 March 2014 c) 31 December 2013 d) None of these

9) In Tally, to get company information, press ……………. from the gateway of Tally.

a) F3 b) Ctrl+F3 c) Alt+F3 d) Ctrl+D

10) The default directory for storing Tally data will be …………….

a) C:\Tally\Data b) D:\Tally\Data c) C:\Tally\Companies d) F:\Tally\Data

Part - II Fill in the blanks (10 x 1 Mark = 10 Marks)

11) Net loss will be debited to ……………. a/c.

12) A brief description of the transactions recorded in the journal is called …………….

13) Bank account is a ……………. account.

14) In Peach Tree, the navigation aids are located at the ……………. of the window.

15) Bad Debt comes under ……………. group in Tally.

16) The most important sub division of journal is …………….

17) A ……………. is a copy of customers account in a Bank.

18) Cash account always have a ……………. balance.

19) ……………. is treated as both journal and ledger.

20) The status bar of Peach Tree window displays ……………. and …………….

Part - III State whether True or False (10 x 1 Mark = 10 Marks)

21) Voucher is a source document.

22) Purchase book is used for recording all credit purchase of goods.

23) Book-keeping provide a permanent record of each transactions.

E1 December 2014- Page 1 of 3

24) In Ledger, transactions are recorded in analytical manner.

25) Purchase return book is used for recording returns inward.

26) Accounts receivable are displayed in Balance Sheet.

27) Capital a/c always show debit balance.

28) F7 is used for payments in Tally.

29) Sales comes under current asset group in Tally.

30) We cannot select cash in journal voucher.

(Part lV, Part V F¶nhbpsS D¯c§Ä aebmf¯nepw FgpXmw)

Part - IV Answer the following (Any Five) (5 x 10 Marks = 50 Marks)

31) Explain the window elements of Peach Tree.

32) Difference between Accounting and Book-keeping.

33) Explain the accounting vouchers used in Tally.

34) The sundry debtors and creditors on 31/03/2014, amounted to Rs.24,000/- and Rs.18,000/-

respectively. Write off Rs.2,000/- as Bad Debt, make a provision for doubtful debts at 5% on

debtors and provision for discount on debtors and creditors at 2% , Pass Journal Entries.

35) Explain the Debit Note and Credit Note Vouchers used in Tally.

36) Explain Sales Order processing and Purchase Order processing in Tally.

37) Explain Double entry book-keeping. What are the advantages of Double entry system?

Part - V Answer the following (Any One) (1 x 20 Marks = 20 Marks)

38) Journalize the following

a) Ankur started business with cash Rs.40,000/-

b) Opened Bank a/c Rs.15,000/-

c) Bought Machinery Rs.4,000/-

d) Withdrew Cash from bank for office use Rs.3,000/-

e) Purchased Goods Rs.9,000/-

f) Sold Goods for Cash Rs.5,000/-

g) Cash Paid in to Bank Rs.2,500/-

h) Drew from Bank for Personal use Rs.500/-

i) Purchased Goods on Credit from Rajan Rs.3,000/-

j) Sold Goods on Credit to Mohan Rs.2,000/-

k) Cheque issued to Rajan Rs.1,000/-

l) Goods returned by Mohan Rs.250/-

m) Paid Rent by Cheque Rs.1,100/-

n) Received Commission Rs.600/-

o) Bank Charges for the month Rs.50/-

p) Interest on Deposit credited Rs.80/-

q) Mohan’s cheque was returned dishonoured

r) Paid salary Rs. 1,500/-

s) Goods returned to Rajan Rs.300/-

t) Withdrew from Bank Rs.1,500/-

E1 December 2014- Page 2 of 3

st

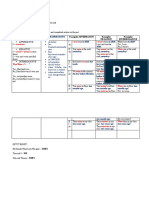

39) From the following Trial Balance of Mr.Appu as on 31 March 2014, prepare Trading & Profit

& Loss account for the year ended 31-03-2014 and a Balance Sheet as on that date.

Particulars L/F Dr. Amount Cr. Amount

Capital 36,500

Drawings 1,200

Wages 4,200

Sundry Exp. 1,450

Insurance 540

Salaries 3,460

Rent Workshop Rs.1,300 & Office Rs.700 2,000

Purchase & Sales 36,000 70,000

Advertising 1,700

Carriage 350

Returns inward& Outward 250 700

Discount 190

Sundry Drs & Crs 9,800 4,360

Travellers salary & Commission 3,100

Bank Balance 700

Plant & Machinery 9,800

Loose Tools 1,000

Business Premises 40,000

Loan on Mortgage of premises 20,000

Stock of Books & Stationery 500

Commission earned 400

Opening Stock 16,200

Trade Expenses 1,300

1,32,850 1,32,850

Closing stock is valued at Rs.18,000/-

E1 December 2014- Page 3 of 3

You might also like

- AssigmentDocument8 pagesAssigmentMuhammad Rafique0% (1)

- Interpretasi Thorax FotoDocument38 pagesInterpretasi Thorax FotoSinta SintaaNo ratings yet

- PDCFA(Code_E1-_August_2012)-Document3 pagesPDCFA(Code_E1-_August_2012)-fathimacpaliNo ratings yet

- 25 Question PaperDocument4 pages25 Question PaperPacific Tiger0% (1)

- Abd Question Paper BankDocument96 pagesAbd Question Paper BankRahul Ghosale100% (1)

- M.B.A (2016 Pattern )Document141 pagesM.B.A (2016 Pattern )Amol AwateNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Ent S6 ExamDocument3 pagesEnt S6 Examashrafsmith272No ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- Mid SemDocument4 pagesMid Semf20220077No ratings yet

- M.B.A (2013 Pattern)Document110 pagesM.B.A (2013 Pattern)Niharika MehtreNo ratings yet

- M.B.A. (2013 Pattern) 2017 PDFDocument125 pagesM.B.A. (2013 Pattern) 2017 PDFAkdev 118No ratings yet

- Ayeesha - Principles of Management AccountingDocument5 pagesAyeesha - Principles of Management AccountingMahesh KumarNo ratings yet

- (WWW - Entrance-Exam - Net) - DOEACC B Level Course-Accounting and Financial Management Sample Paper 7Document4 pages(WWW - Entrance-Exam - Net) - DOEACC B Level Course-Accounting and Financial Management Sample Paper 7ishupandit620No ratings yet

- M.B.A. QPDocument184 pagesM.B.A. QPyogeshNo ratings yet

- AOR - Paper III Book Keeping Accounts and Professional Ethics ALLDocument27 pagesAOR - Paper III Book Keeping Accounts and Professional Ethics ALLDawood KSNo ratings yet

- Financial Accounting (D.com-II)Document6 pagesFinancial Accounting (D.com-II)Basit RehmanNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- 943 Question PaperDocument3 pages943 Question PaperPacific TigerNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- B.SC & Bca Degree Examination: Fourth SemesterDocument11 pagesB.SC & Bca Degree Examination: Fourth SemesterStudents Xerox ChidambaramNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- ADBM - Financial AccountingDocument10 pagesADBM - Financial AccountingMahima SheromiNo ratings yet

- Financial AccoutningDocument7 pagesFinancial AccoutningMr Aruladithiya DevarajNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Accounting FinalDocument3 pagesAccounting FinalFahad Khan TareenNo ratings yet

- Acc 111Document10 pagesAcc 111adrian CharlesNo ratings yet

- Afm 2810001 May 2019Document3 pagesAfm 2810001 May 2019PILLO PATELNo ratings yet

- CO517 - Financial AccountingDocument4 pagesCO517 - Financial Accountingmiciker416No ratings yet

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Document5 pagesBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22No ratings yet

- Inter May, 2008Document4 pagesInter May, 2008M JEEVARATHNAM NAIDUNo ratings yet

- MCO (P) 94: MCOP94 (SIM Scheme) Commerce Course IV: Accounting Theory and PracticeDocument4 pagesMCO (P) 94: MCOP94 (SIM Scheme) Commerce Course IV: Accounting Theory and PracticeMustafa PendariNo ratings yet

- Acc 7 Second Mid TermDocument8 pagesAcc 7 Second Mid Termhailtonfernandes97No ratings yet

- DFIN1303 - Mock Test Answers by AdithyaDocument4 pagesDFIN1303 - Mock Test Answers by AdithyaRandi AdithyaNo ratings yet

- Model Question Papers - XIDocument86 pagesModel Question Papers - XIalbishamomin60No ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Time: 2 Hours) (Max. Marks: 50 Instructions To The CandidatesDocument16 pagesTime: 2 Hours) (Max. Marks: 50 Instructions To The CandidatesSiddhant PowleNo ratings yet

- Bbse II 2021 - EseDocument7 pagesBbse II 2021 - Esesmlingwa100% (1)

- Question August 2010Document50 pagesQuestion August 2010zia4000No ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- Financial Accounting (CBCS Hons)Document7 pagesFinancial Accounting (CBCS Hons)Devil GamerNo ratings yet

- 11th AccountDocument3 pages11th Accountnmzrv8jfq8No ratings yet

- BBA-1.4-A.D.M Finance 2015 NewDocument3 pagesBBA-1.4-A.D.M Finance 2015 NewAnonymous NSNpGa3T93No ratings yet

- Accounting (IAS) Level 3: LCCI International QualificationsDocument16 pagesAccounting (IAS) Level 3: LCCI International QualificationsGloria WanNo ratings yet

- Accounting For Managers Question Paper PDFDocument4 pagesAccounting For Managers Question Paper PDFSmruti Ranjan Nayak100% (1)

- Tally PaperDocument3 pagesTally Papergitu219No ratings yet

- ECO-14 - ENG-J18 - Compressed-1Document6 pagesECO-14 - ENG-J18 - Compressed-1YzNo ratings yet

- Summer ExamDocument17 pagesSummer Examoliverchukwudi97No ratings yet

- Finl Exm Et 2, 2024Document6 pagesFinl Exm Et 2, 2024Vishavpreet SinghNo ratings yet

- 202AF13A Financial AccountingDocument14 pages202AF13A Financial AccountingkalpanaNo ratings yet

- Trimester - 1 EMBA Examinations - October 2020Document2 pagesTrimester - 1 EMBA Examinations - October 2020amitabh kumarNo ratings yet

- CAPE Accounting Unit 1 2013 P2Document8 pagesCAPE Accounting Unit 1 2013 P2Sachin BahadoorsinghNo ratings yet

- All Subjects For B.Com TPP 6th SemDocument3 pagesAll Subjects For B.Com TPP 6th SemBaavaraja.KNo ratings yet

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Document4 pagesPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameNo ratings yet

- Accounting For Managers Model Question Paper-1: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-1: First Semester MBA Degree ExaminationRohan ChauguleNo ratings yet

- Commerce Innovations in Accounting Paper 4.5 A: (Accounting and Finance)Document3 pagesCommerce Innovations in Accounting Paper 4.5 A: (Accounting and Finance)Sanaullah M SultanpurNo ratings yet

- HSC Commerce 2016 March BKDocument5 pagesHSC Commerce 2016 March BKManish SharmaNo ratings yet

- May. 2007 Q.P.Document4 pagesMay. 2007 Q.P.M JEEVARATHNAM NAIDUNo ratings yet

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- PreTest Electronics 2022Document2 pagesPreTest Electronics 2022Joan VillarcaNo ratings yet

- Nature of Exchange Rate Risk & ExposureDocument67 pagesNature of Exchange Rate Risk & ExposureDebNo ratings yet

- Full Ebook of Daily Routines To Jump Start Math Class Elementary School 1St Edition John J Sangiovanni 2 Online PDF All ChapterDocument24 pagesFull Ebook of Daily Routines To Jump Start Math Class Elementary School 1St Edition John J Sangiovanni 2 Online PDF All Chapterandereabat100% (4)

- Manufacturing Process For A PenDocument7 pagesManufacturing Process For A PenFeIipe MunozNo ratings yet

- Ch. 9 - Basic Router TroubleshootingDocument15 pagesCh. 9 - Basic Router TroubleshootingArad RezaNo ratings yet

- I'Ll Eat When I'm Dead - ExtractDocument25 pagesI'Ll Eat When I'm Dead - ExtractQuercus BooksNo ratings yet

- Gaming Industry E Mail Id OnlyDocument4 pagesGaming Industry E Mail Id OnlySundararajan SrinivasanNo ratings yet

- Kinetic Theory of GasesDocument8 pagesKinetic Theory of GasesGupta GuptaNo ratings yet

- Perbandingan Algoritma Naïve Bayes Dan KNN Dalam Analisis Sentimen Masyarakat Terhadap Pelaksanaan PPPK GuruDocument7 pagesPerbandingan Algoritma Naïve Bayes Dan KNN Dalam Analisis Sentimen Masyarakat Terhadap Pelaksanaan PPPK GuruNur Fajar SetiawanNo ratings yet

- Testing Laboratory DetailsDocument12 pagesTesting Laboratory DetailsSanjay KumarNo ratings yet

- Measures of Central Tendency and Dispersion (Week-07)Document44 pagesMeasures of Central Tendency and Dispersion (Week-07)Sarmad Altaf Hafiz Altaf HussainNo ratings yet

- User Manual: Promia 50 Application - Material HandlingDocument110 pagesUser Manual: Promia 50 Application - Material Handlingred_shobo_85100% (2)

- Agriculture AhmedabadDocument33 pagesAgriculture AhmedabadKrupam Thetenders.com100% (1)

- Juri All AnswersDocument72 pagesJuri All AnswersMadiha AleemNo ratings yet

- K80000 Technical Datasheet PDFDocument1 pageK80000 Technical Datasheet PDFKhalid ZghearNo ratings yet

- MSDS - Arena VerdeDocument12 pagesMSDS - Arena VerdeSoledad OrtegaNo ratings yet

- MYY&MZZ Manual Transmission (Ver4)Document32 pagesMYY&MZZ Manual Transmission (Ver4)Vahid Reza MohammadiNo ratings yet

- Global Issues Data Response Questions AdviceDocument9 pagesGlobal Issues Data Response Questions Adviceapi-261914272No ratings yet

- HYUNDAI WIA Heavy Duty Cutting Horizontal Machining CenterDocument27 pagesHYUNDAI WIA Heavy Duty Cutting Horizontal Machining CentersrinivignaNo ratings yet

- Design of Experiments (DOE) TutorialDocument4 pagesDesign of Experiments (DOE) Tutorialmpedraza-1No ratings yet

- CMS Farming SystemDocument3 pagesCMS Farming SystemCarylSaycoNo ratings yet

- Compaction Trends Shale CleanSands Gulf of MexicoDocument8 pagesCompaction Trends Shale CleanSands Gulf of MexicoAfonso ElvaNo ratings yet

- Strategic Human Resource Management Canadian 2Nd Edition Noe Solutions Manual Full Chapter PDFDocument58 pagesStrategic Human Resource Management Canadian 2Nd Edition Noe Solutions Manual Full Chapter PDFrowanariel26r2100% (9)

- War of 1812Document56 pagesWar of 1812Stephen Gibb100% (1)

- Project ProposalDocument4 pagesProject ProposalQueenie Diane MontañoNo ratings yet

- Resume of Bandita Adhikary 2Document4 pagesResume of Bandita Adhikary 2Kumar VarunNo ratings yet

- Experience Gokul BoopathiDocument4 pagesExperience Gokul BoopathiKeerthi VarshiniNo ratings yet

- The Past Simple of The Verb TO BEDocument2 pagesThe Past Simple of The Verb TO BERuxandra03No ratings yet

- .. Thesis Title .Document31 pages.. Thesis Title .Tanut VongsoontornNo ratings yet