Professional Documents

Culture Documents

Black Scholes SHEET

Black Scholes SHEET

Uploaded by

sakshiagarwal5892Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Black Scholes SHEET

Black Scholes SHEET

Uploaded by

sakshiagarwal5892Copyright:

Available Formats

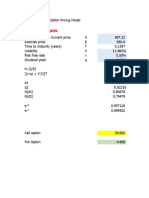

Template - Black-Scholes Option Value

Input Data

Stock Price now (P) 100

Exercise Price of Option (EX) 43

Number of periods to Exercise in years (t) 5

Compounded Risk-Free Interest Rate (rf) 7.20%

Standard Deviation (annualized s) 0.50%

Output Data

Present Value of Exercise Price (PV(EX)) 30.0001

s*t^.5 0.0112

d1 107.6919

d2 107.6808

Delta N(d1) Normal Cumulative Density Function 1.0000

Bank Loan N(d2)*PV(EX) 30.0001

Value of Call 69.9999

Value of Put 0.0000

Template - Black-Scholes Option Value

Input Data

Stock Price now (P) 100

Exercise Price of Option (EX) 43

Number of periods to Exercise in years (t) 4

Compounded Risk-Free Interest Rate (rf) 7.20%

Standard Deviation (annualized s) 0.50%

Output Data

Present Value of Exercise Price (PV(EX)) 32.2397

s*t^.5 0.0100

d1 113.2020

d2 113.1920

Delta N(d1) Normal Cumulative Density Function 1.0000

Bank Loan N(d2)*PV(EX) 32.2397

Value of Call 67.7603

Value of Put 0.0000

Template - Black-Scholes Option Value

Input Data

Stock Price now (P) 100

Exercise Price of Option (EX) 43

Number of periods to Exercise in years (t) 3

Compounded Risk-Free Interest Rate (rf) 7.20%

Standard Deviation (annualized s) 0.50%

Output Data

Present Value of Exercise Price (PV(EX)) 34.6466

s*t^.5 0.0087

d1 122.3991

d2 122.3905

Delta N(d1) Normal Cumulative Density Function 1.0000

Bank Loan N(d2)*PV(EX) 34.6466

Value of Call 65.3534

Value of Put 0.0000

Template - Black-Scholes Option Value

Input Data

Stock Price now (P) 100

Exercise Price of Option (EX) 43

Number of periods to Exercise in years (t) 2

Compounded Risk-Free Interest Rate (rf) 7.20%

Standard Deviation (annualized s) 0.50%

Output Data

Present Value of Exercise Price (PV(EX)) 37.2332

s*t^.5 0.0071

d1 139.7236

d2 139.7165

Delta N(d1) Normal Cumulative Density Function 1.0000

Bank Loan N(d2)*PV(EX) 37.2332

Value of Call 62.7668

Value of Put 0.0000

Template - Black-Scholes Option Value

Input Data

Stock Price now (P) 100

Exercise Price of Option (EX) 43

Number of periods to Exercise in years (t) 1

Compounded Risk-Free Interest Rate (rf) 7.20%

Standard Deviation (annualized s) 0.50%

Output Data

Present Value of Exercise Price (PV(EX)) 40.0128

s*t^.5 0.0050

d1 183.1965

d2 183.1915

Delta N(d1) Normal Cumulative Density Function 1.0000

Bank Loan N(d2)*PV(EX) 40.0128

Value of Call 59.9872

Value of Put 0.0000

You might also like

- R BasicsDocument8 pagesR Basicsroy.scar219688% (8)

- Lab 2Document30 pagesLab 2jianneNo ratings yet

- Black Scholes WorkingDocument15 pagesBlack Scholes WorkingChRehanAliNo ratings yet

- Black Scholes TemplateDocument12 pagesBlack Scholes Templaterizwan_1990No ratings yet

- Black Scholes Continous DividendDocument4 pagesBlack Scholes Continous DividendSyahrizkaNo ratings yet

- Black-Scholes Option-Pricing Formula: Stock Call Intrinsic Price Price ValueDocument8 pagesBlack-Scholes Option-Pricing Formula: Stock Call Intrinsic Price Price Valuemehta_mayurNo ratings yet

- Black Scholes Discrete DividendsDocument4 pagesBlack Scholes Discrete DividendsSyahrizkaNo ratings yet

- HW2Document6 pagesHW2baoxinhe6No ratings yet

- HW2Document6 pagesHW2baoxinhe6No ratings yet

- PT Bhuwanatala Indah Permai TBK: Input DataDocument4 pagesPT Bhuwanatala Indah Permai TBK: Input DataAri Prasetyo UtomoNo ratings yet

- BS DanielDocument6 pagesBS Danielsandy30694No ratings yet

- HW6Document16 pagesHW6baoxinhe6No ratings yet

- 吳祐勳111071606期末作業Document26 pages吳祐勳111071606期末作業陳俊傑No ratings yet

- Project IpDocument51 pagesProject IpDwarkesh savaliaNo ratings yet

- Assignment 1 (B) : OutputDocument22 pagesAssignment 1 (B) : OutputArpit TyagiNo ratings yet

- p4 j13 FormulaeDocument5 pagesp4 j13 FormulaeaamirNo ratings yet

- Mamadou Thiam Tutorial03Document6 pagesMamadou Thiam Tutorial03mamadou.thiamNo ratings yet

- % Bsformula.mDocument30 pages% Bsformula.mapi-616455436No ratings yet

- XL 34Document5 pagesXL 34Sarmistha SarmaNo ratings yet

- 09 European Option Pricing With SolutionsDocument20 pages09 European Option Pricing With SolutionszaurNo ratings yet

- Practical: 1 Unit Impulse Response: Num (0 0 1) Den (1 0.2 1) Impulse (Num, Den) Grid TitleDocument20 pagesPractical: 1 Unit Impulse Response: Num (0 0 1) Den (1 0.2 1) Impulse (Num, Den) Grid TitlealwaysharshNo ratings yet

- Fds SlipsDocument6 pagesFds Slipskaranka103No ratings yet

- B - S ModelDocument3 pagesB - S ModelMos MasNo ratings yet

- HW5Document11 pagesHW5baoxinhe6No ratings yet

- FinalDocument2 pagesFinalDhyey ShuklaNo ratings yet

- Sem 5Document25 pagesSem 5koulickchakraborty5555No ratings yet

- 1 Tutorial: Linear RegressionDocument8 pages1 Tutorial: Linear RegressionpulademotanNo ratings yet

- Data Mining Lab: AssessmentDocument5 pagesData Mining Lab: AssessmentJenil MehtaNo ratings yet

- Type of Option Exercise (Strike) Price (K) Time To Maturity (In Years) (T) Annual Risk Free Rate (R) Option Price $ 2.84 Stock Price (S)Document2 pagesType of Option Exercise (Strike) Price (K) Time To Maturity (In Years) (T) Annual Risk Free Rate (R) Option Price $ 2.84 Stock Price (S)GolamMostafaNo ratings yet

- HW3Document17 pagesHW3baoxinhe6No ratings yet

- HW8Document8 pagesHW8baoxinhe6No ratings yet

- Practical 1: # 2D Linear Convolution, Circular Convolution Between Two 2D MatricesDocument21 pagesPractical 1: # 2D Linear Convolution, Circular Convolution Between Two 2D MatricesJustin Sebastian100% (1)

- ResearchDocument2 pagesResearchDhyey ShuklaNo ratings yet

- Department of Computer Science & Engineering: Practical File Digital Image ProcessingDocument10 pagesDepartment of Computer Science & Engineering: Practical File Digital Image Processing5179294No ratings yet

- SOA MFE 76 Practice Ques SolsDocument70 pagesSOA MFE 76 Practice Ques SolsGracia DongNo ratings yet

- Assignment 3Document8 pagesAssignment 3MadhavNo ratings yet

- 1 Valuing OptionsDocument35 pages1 Valuing OptionsShweta TiwariNo ratings yet

- HW 1Document3 pagesHW 1api-465474049No ratings yet

- Finding The Spectrum of A Sinusoidal Signal: ProgramDocument63 pagesFinding The Spectrum of A Sinusoidal Signal: ProgramSrikanth VaranasiNo ratings yet

- Exp 1&2Document6 pagesExp 1&2ShahanasNo ratings yet

- Practical 6Document2 pagesPractical 6VatsalNo ratings yet

- Answer 4.1Document22 pagesAnswer 4.1Ankit AgarwalNo ratings yet

- Practical 1: Aim: Implement Factorial Algorithm Using Iterative and Recursive Manner. CodeDocument32 pagesPractical 1: Aim: Implement Factorial Algorithm Using Iterative and Recursive Manner. CodeNeemNo ratings yet

- Simulation of Plane Sinusoidal Wave Propagation Through Lossy Dielectric Material Using Finite Difference Time Domain (FDTD) Modeling in PythonDocument8 pagesSimulation of Plane Sinusoidal Wave Propagation Through Lossy Dielectric Material Using Finite Difference Time Domain (FDTD) Modeling in PythonPalwinder Singh DhanjalNo ratings yet

- Pro1 To 4 and 6 To 7Document13 pagesPro1 To 4 and 6 To 7Prajwal P GNo ratings yet

- CT Shail PDFDocument85 pagesCT Shail PDFhocaNo ratings yet

- Lab Report-02Document15 pagesLab Report-02Faria Sultana MimiNo ratings yet

- CodingDocument2 pagesCodingDhyey ShuklaNo ratings yet

- Pandas AttributeDocument2 pagesPandas AttributeManish JainNo ratings yet

- Function Day2Document16 pagesFunction Day2qwert asdNo ratings yet

- AB Group 10 Assignment 2Document8 pagesAB Group 10 Assignment 2Sanket AndhareNo ratings yet

- Python ProgramsDocument16 pagesPython ProgramsSahilNo ratings yet

- SIEMLATHDocument4 pagesSIEMLATH大西孝No ratings yet

- "A" "B" "C" "D" "E" "F" "G" 'G' 'A' 'A' 'G' 'B' 'A' 'C' 'A' 'A' 'C' 'A' 'D' 'E' 'A' 'F' 'A' 'B' 'D' 'D' 'F' "Red"Document5 pages"A" "B" "C" "D" "E" "F" "G" 'G' 'A' 'A' 'G' 'B' 'A' 'C' 'A' 'A' 'C' 'A' 'D' 'E' 'A' 'F' 'A' 'B' 'D' 'D' 'F' "Red"this thatNo ratings yet

- Modelo Black ScholesDocument8 pagesModelo Black Scholesnachorm11No ratings yet

- Stat 610 Homework 7Document3 pagesStat 610 Homework 7saishaNo ratings yet

- 298 Final EquationsDocument1 page298 Final EquationsKevin GellenbeckNo ratings yet

- DSP 72Document42 pagesDSP 72SakethNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CFP Class 4Document5 pagesCFP Class 4moneshivangi29No ratings yet

- Class Questions SolutionsDocument15 pagesClass Questions Solutionsmoneshivangi29No ratings yet

- Case - DDocument2 pagesCase - Dmoneshivangi29No ratings yet

- EDBM Workbook PDFDocument59 pagesEDBM Workbook PDFsnehachandan91No ratings yet

- Change Agent - Week 3Document5 pagesChange Agent - Week 3moneshivangi29No ratings yet