Professional Documents

Culture Documents

Substantive Procedures Summary-Inventory

Substantive Procedures Summary-Inventory

Uploaded by

Thandoe Dube0 ratings0% found this document useful (0 votes)

2 views4 pagesInventory substantive procedures.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInventory substantive procedures.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views4 pagesSubstantive Procedures Summary-Inventory

Substantive Procedures Summary-Inventory

Uploaded by

Thandoe DubeInventory substantive procedures.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

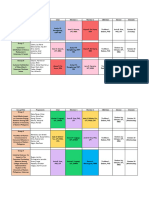

Substantive Procedures

Inventory cycle

Assertion Inventory(Account balance)

Existence Perform an inventory count.

Select a sample of records from the

ledger and then trace to the

ground/actual products.

Rights Enquire of management as to whether

any inventory is held on consignment

for other parties.

Obtain a listing of inventory of goods in

transit at the financial year-end and

inspect relevant orders/contracts to

determine whether ownership has

passed to the client by scrutiny of the

terms of purchase e.g. FOB, CIF.

Establish whether inventory is in any

way encumbered (e.g. offered as

security) by

discussion with management

inspection of bank confirmations

review of directors’ minutes

Review of correspondence/contracts

with suppliers and credit providers.

When performing the pricing

procedures for the valuation assertion

inspect invoices to ensure that they are

made out to the client.

Valuation and allocation arithmetic accuracy

Compare the quantities of inventory

items on the auditor’s copies of the

inventory sheets to the client’s priced

inventory sheets (to confirm that the

client has not altered the quantities).

Test the arithmetical accuracy of the

inventory sheets by reperforming all

extensions (quantity x cost) and casting

the extension column (total inventory

value).

Review inventory sheets for any

negative “inventory item values”

(should not be any). Compare the total

inventory value per the inventory sheets

to the general ledger and trial balance.

pricing inventory purchased locally

Using the sample selected for inventory

items which were test counted at the

inventory count (or another sample):

Trace to relevant suppliers invoices to

establish whether the correct purchase

prices have been used in obtaining the

cost in terms of the cost formula used by

the company, e.g. for FIFO, if there are

10 items on hand, and the most recent

invoice was for 8 items at R200 each and

the invoice prior to that was for 12 items

at R190 each, the 10 items on hand

would be valued at 8 x R200 - R1600 2 x

R190 - R380

Re-perform the weighted average

calculation (if this basis is used by the

client) and compare result to the

weighted average price used by the

client,

By enquiry of the costing clerk and

inspection of invoices from

transporters, establish that relevant

carriage costs have been included in unit

cost calculations.

pricing imported inventory purchases

For a sample of imported high value

items, obtain the relevant suppliers

invoices /shipping contracts and costing

schedule, and reperform the unit cost

calculations for the sample of imported

items and verify that:

The correct exchange rate was used to

convert the foreign currency to dollars

(rate at date of transaction should be

used.

This rate should be confirmed by

enquiry of a financial institution.)

The appropriate import and customs

duties and shipping charges were

included (obtained from shipping agents

invoices)

The allocation of the above costs to the

individual inventory items purchased is

reasonable, and accurately performed.

lower of cost/net realisable value

Using a sample verify the selling price of

inventory items by:

Reference to sales lists

Reference to the most recent sales

invoice for the particular item.

Compare sales prices on invoices for a

small sample of sales made in the post

reporting date period to the cost prices

on the inventory sheets. This provides

evidence of the most up to date

realisable value.

inventory obsolescence allowance

Discuss with management:

The process used to determine the

obsolescence allowance and evaluate

the process for reasonableness and

consistency with prior years, e.g. is a

fixed percentage used each year (only

acceptable if there is strong historical

evidence to support it) or is a detailed

analysis carried out?

Any procedures in place for the approval

of the final allowance, e.g. is the

allowance approved by the financial

director after consultation with the

warehouse manager?

Any specific events which may have

occurred during the year which may

have an impact on the allowance – e.g.

a flood may have damaged some

inventory items.

Any specific inventory items which may

already be obsolete (or soon will be) and

how this has been recognised in

calculating the allowance for

obsolescence.

Perform analytical procedures to give a

general overview as to the

reasonableness of the allowance by

comparison of current year figures

and/or ratios to prior year figures/ratios

Reperform the aging of inventory by

tracing back to source documents.

Compare allowances raised in prior

years to actual write offs in subsequent

years (to determine “accuracy” of

management’s allowances).

Review working papers from year-end

test counts to ensure that inventory

items identified as

damaged/obsolete/slow moving have

been included in the allowance.

Reperform any calculations of the

inventory obsolescence allowance and

discuss the reasonableness of the

allowance in terms of evidence

gathered, with management.

Completeness Perform physical inventory count

Select a few items from the ground,

trace these to the ledger.

Classification By enquiry of management and

inspection of inventory (at the count)

and/or observation of the

manufacturing process, confirm that

inventory included in the account

balance, satisfies the definition of

inventory, i.e. the asset is held for sale in

the ordinary course of the company’s

business or in the process of production

for such sale in the form of materials or

supplies to be consumed in the

production process.

Read on presentation assertion and use of audit software (Auditing notes)

You might also like

- FAC1601 Assignment 4 Q & ADocument14 pagesFAC1601 Assignment 4 Q & ANkhangweni RambudaNo ratings yet

- 1 Audit Program ExpensesDocument14 pages1 Audit Program Expensesmaleenda100% (3)

- Audit Programme Trade Payables Name of Client Sheridan AV Year-End Name of Auditor (S)Document5 pagesAudit Programme Trade Payables Name of Client Sheridan AV Year-End Name of Auditor (S)Miljane PerdizoNo ratings yet

- Final Visit Inventory AuditDocument7 pagesFinal Visit Inventory Auditjeams vidalNo ratings yet

- Audit Scope Accounts Involved Audit ProcedureDocument12 pagesAudit Scope Accounts Involved Audit Procedurekarenmae intangNo ratings yet

- Specific Further Audit ProceduresDocument4 pagesSpecific Further Audit ProceduresCattleyaNo ratings yet

- Auditing CycleDocument2 pagesAuditing CycletemedebereNo ratings yet

- Substantive Procedures - Class of Transactions: Sales and Sales ReturnDocument16 pagesSubstantive Procedures - Class of Transactions: Sales and Sales ReturnCyrra BalignasayNo ratings yet

- A. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionDocument5 pagesA. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionRosanaDíazNo ratings yet

- Audit Program For Inventories and Cost of Goods Sold. The Objectives: A. Consider Internal Control Over Inventories and Cost of Goods Sold (Test of Control) 1Document3 pagesAudit Program For Inventories and Cost of Goods Sold. The Objectives: A. Consider Internal Control Over Inventories and Cost of Goods Sold (Test of Control) 1HayjackNo ratings yet

- Substantive Procedures - Class of Transactions: Sales and Sales ReturnDocument16 pagesSubstantive Procedures - Class of Transactions: Sales and Sales ReturnFlow RiyaNo ratings yet

- Substantive Procedures - Class of Transactions: Sales and Sales ReturnDocument16 pagesSubstantive Procedures - Class of Transactions: Sales and Sales ReturnUsama ToheedNo ratings yet

- Substantive procedures-Expenditure cycleDocument4 pagesSubstantive procedures-Expenditure cycleThandoe DubeNo ratings yet

- Completeness CompletenessDocument6 pagesCompleteness CompletenessShavi GurugeNo ratings yet

- LECTURE 2 Applied AuditingDocument9 pagesLECTURE 2 Applied AuditingJoanna GarciaNo ratings yet

- Group Three AuditDocument3 pagesGroup Three Auditmacdonald buzuziNo ratings yet

- AP.3401 Audit of InventoriesDocument8 pagesAP.3401 Audit of InventoriesMonica GarciaNo ratings yet

- Test and ControlsDocument5 pagesTest and ControlsKristen HathcockNo ratings yet

- Audit of Inventories: The Use of Assertions in Obtaining Audit EvidenceDocument9 pagesAudit of Inventories: The Use of Assertions in Obtaining Audit EvidencemoNo ratings yet

- Audit of The Inventory and Warehousing CycleDocument10 pagesAudit of The Inventory and Warehousing Cyclenanda rafsanjaniNo ratings yet

- Sample Substantive Procedures AllDocument13 pagesSample Substantive Procedures AllCris LuNo ratings yet

- AP.3501 Audit of InventoriesDocument7 pagesAP.3501 Audit of InventoriesMarinoNo ratings yet

- Audit in InventoriesDocument17 pagesAudit in InventoriesAldrin Arcilla SimeonNo ratings yet

- Audit SlideDocument22 pagesAudit SlideVaradan K RajendranNo ratings yet

- 3.1 Audit of Purchases and PayablesDocument1 page3.1 Audit of Purchases and PayablesNavsNo ratings yet

- Bradmark Questions CH 10 AnswerDocument10 pagesBradmark Questions CH 10 AnswermaspnsNo ratings yet

- Part 2 Examination - Paper 2.6 (INT) Audit and Internal ReviewDocument12 pagesPart 2 Examination - Paper 2.6 (INT) Audit and Internal ReviewkhengmaiNo ratings yet

- InventoryDocument4 pagesInventoryPrio DebnathNo ratings yet

- Trade-Payable DiscussionsDocument7 pagesTrade-Payable DiscussionsShena RieNo ratings yet

- Auditing Problems Ocampo/Cabarles AP.1901-Audit of Inventories OCTOBER 2015Document8 pagesAuditing Problems Ocampo/Cabarles AP.1901-Audit of Inventories OCTOBER 2015AngelouNo ratings yet

- Auditing Problems Ap.402 Audit of Inventories: The Use of Assertions in Obtaining Audit EvidenceDocument10 pagesAuditing Problems Ap.402 Audit of Inventories: The Use of Assertions in Obtaining Audit EvidenceMarjorie PonceNo ratings yet

- F-Ap-3 - Inventory Held For Capital ExpenditureDocument5 pagesF-Ap-3 - Inventory Held For Capital ExpenditureAung Zaw HtweNo ratings yet

- Understanding Internal ControlsDocument31 pagesUnderstanding Internal ControlsVenus Lyka LomocsoNo ratings yet

- Audit AssertionsDocument1 pageAudit AssertionsDevice Factory UnlockNo ratings yet

- Tugas Audit 2 - Chapter 21Document3 pagesTugas Audit 2 - Chapter 21dedNo ratings yet

- Example of Inventory Assertions (CFE 2018)Document2 pagesExample of Inventory Assertions (CFE 2018)nguyenvy845No ratings yet

- Davita - Dewardani - 182321069 Tugas Pengauditan KeuanganDocument4 pagesDavita - Dewardani - 182321069 Tugas Pengauditan KeuanganHAHAHA HIHIHINo ratings yet

- Auditing and Assurance Services 17Th Edition Arens Solutions Manual Full Chapter PDFDocument54 pagesAuditing and Assurance Services 17Th Edition Arens Solutions Manual Full Chapter PDFstephenthanh1huo100% (16)

- Inventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDocument4 pagesInventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayNo ratings yet

- 4.1 Inventory ProceduresDocument1 page4.1 Inventory ProceduresChristine JotojotNo ratings yet

- AP 1901 Inventories PDFDocument8 pagesAP 1901 Inventories PDFToni Rhys ArguellesNo ratings yet

- Audit of InventoryDocument11 pagesAudit of InventoryMr.AccntngNo ratings yet

- ACCA Notes On Cycle SystemDocument12 pagesACCA Notes On Cycle Systemc7rw76krwtNo ratings yet

- Vouching Summary NotesDocument6 pagesVouching Summary NotesVikram KumarNo ratings yet

- Vouching Summary PDFDocument7 pagesVouching Summary PDFAjay GiriNo ratings yet

- Audit and Assurance June 2009 Past Paper Answers (ACCA)Document15 pagesAudit and Assurance June 2009 Past Paper Answers (ACCA)Serena JainarainNo ratings yet

- Sol18 Sebagian2Document11 pagesSol18 Sebagian2Chotimatul ChusnaaNo ratings yet

- AP.2901 Inventories.Document9 pagesAP.2901 Inventories.Alarich CatayocNo ratings yet

- The Auditnet GuidesDocument16 pagesThe Auditnet GuidesChinh Le DinhNo ratings yet

- MidtermDocument7 pagesMidtermOscar awardsNo ratings yet

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Alizeh IfthikharNo ratings yet

- Audit Program-Accrued ExpensesDocument10 pagesAudit Program-Accrued ExpensesPutu Adi NugrahaNo ratings yet

- Revenue CycleDocument10 pagesRevenue CycleMart BanaresNo ratings yet

- Audit Risks PDFDocument21 pagesAudit Risks PDFPAGAL pantiNo ratings yet

- Roles and ResponsibilitesDocument9 pagesRoles and Responsibilites杰米No ratings yet

- BDocument5 pagesBRudella LizardoNo ratings yet

- Presentation Audit of Acquisition and Payment CycleDocument38 pagesPresentation Audit of Acquisition and Payment CycleSyaffiq UbaidillahNo ratings yet

- F. Inventory - 2023 DoneDocument36 pagesF. Inventory - 2023 DoneAllan CamachoNo ratings yet

- Financial AuditingDocument3 pagesFinancial AuditingHuong LienNo ratings yet

- Audit of The Inventory and Warehouse CycleDocument4 pagesAudit of The Inventory and Warehouse Cyclemrs leeNo ratings yet

- Total Quality notes -WPS OfficeDocument2 pagesTotal Quality notes -WPS OfficeThandoe DubeNo ratings yet

- PRE ENGAGEMENT EXERCISEDocument7 pagesPRE ENGAGEMENT EXERCISEThandoe DubeNo ratings yet

- Cresent FCF SolutionDocument3 pagesCresent FCF SolutionThandoe DubeNo ratings yet

- 7 Lease vs BuyDocument12 pages7 Lease vs BuyThandoe DubeNo ratings yet

- Substantive Procedures-Payroll CycleDocument2 pagesSubstantive Procedures-Payroll CycleThandoe DubeNo ratings yet

- The Five Generic Competitive StrategiesDocument20 pagesThe Five Generic Competitive Strategiesspark_123100% (8)

- Some Economic Applications1Document25 pagesSome Economic Applications1kayesalingay3No ratings yet

- Business Research Titles REVISEDDocument4 pagesBusiness Research Titles REVISEDDarleen Joy UdtujanNo ratings yet

- P3 4Document3 pagesP3 4Nam Nguyen100% (1)

- Establishing A Brand ScorecardDocument15 pagesEstablishing A Brand ScorecardDemand MetricNo ratings yet

- External Factor EvaluationDocument3 pagesExternal Factor EvaluationEunice Bawaan DomineNo ratings yet

- LLP BSPLDocument17 pagesLLP BSPLKiran KumarNo ratings yet

- Xauusd Cheat SheetDocument2 pagesXauusd Cheat SheetdeshrijitNo ratings yet

- Harshal PatilDocument72 pagesHarshal Patilsid visputeNo ratings yet

- 7 F 93 CB 558 CDocument20 pages7 F 93 CB 558 CPabloCaicedoArellanoNo ratings yet

- Bandwagon Effect: of Iphone in IndiaDocument10 pagesBandwagon Effect: of Iphone in IndiaDept EnglishNo ratings yet

- Journal of Small Business and EnterpriseDocument33 pagesJournal of Small Business and EnterpriselulitNo ratings yet

- Summary MacroDocument64 pagesSummary Macrojayesh.guptaNo ratings yet

- Chapter 4 Systems Design Process CostingDocument3 pagesChapter 4 Systems Design Process CostingQurat SaboorNo ratings yet

- Ciadmin, Journal Manager, 1009-3986-1-CEDocument8 pagesCiadmin, Journal Manager, 1009-3986-1-CEAngelica De LaraNo ratings yet

- Trial BalanceDocument2 pagesTrial BalanceClaude CaduceusNo ratings yet

- Deferred Charge: DEFINITION of 'Regulatory Asset'Document6 pagesDeferred Charge: DEFINITION of 'Regulatory Asset'Joie CruzNo ratings yet

- Investment Analysis and Portfolio Management - FinalDocument2 pagesInvestment Analysis and Portfolio Management - FinalsagsachdevNo ratings yet

- Venture Capital: How To Raise Funds For StartupsDocument3 pagesVenture Capital: How To Raise Funds For StartupsJames RandsonNo ratings yet

- Intermediate Accounting 1Document22 pagesIntermediate Accounting 1Nemalai VitalNo ratings yet

- Accounting Fundamentals: The Accounting Equation and The Double-Entry SystemDocument70 pagesAccounting Fundamentals: The Accounting Equation and The Double-Entry SystemAllana Mier100% (1)

- Basmagaa EconomyDocument27 pagesBasmagaa Economyeng doaNo ratings yet

- EMS Radio Lesson 28042020Document5 pagesEMS Radio Lesson 28042020Oakgona KgoniNo ratings yet

- HMUA ContractDocument1 pageHMUA ContractErl UmacobNo ratings yet

- Market Study (TOR) For Selected VegetablesDocument3 pagesMarket Study (TOR) For Selected VegetableszalabiNo ratings yet

- Chapter - 02 - Strategic Marketing PlanningDocument61 pagesChapter - 02 - Strategic Marketing PlanningDuy Bảo TrầnNo ratings yet

- International Financial Reporting StandardsDocument3 pagesInternational Financial Reporting Standardsmarkobare2019No ratings yet

- Research Opportunities and Challenges of Buy Now Pay Later Service For Commercial Banks in VietnamDocument23 pagesResearch Opportunities and Challenges of Buy Now Pay Later Service For Commercial Banks in Vietnamk60.2112280025No ratings yet