Professional Documents

Culture Documents

4

4

Uploaded by

Ameti SrinidhiCopyright:

Available Formats

You might also like

- Assignment On Analysis of Annual Report ofDocument9 pagesAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Nucleon CaseDocument6 pagesNucleon CaseshagunparmarNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Investment Contract June 27 2019 3 PDFDocument8 pagesInvestment Contract June 27 2019 3 PDFMohammad RazNo ratings yet

- 3Document1 page3Ameti SrinidhiNo ratings yet

- 5Document1 page5Ameti SrinidhiNo ratings yet

- 1Document1 page1Ameti SrinidhiNo ratings yet

- 2Document1 page2Ameti SrinidhiNo ratings yet

- MGM China BloombergDocument148 pagesMGM China BloombergDaniel HernàndezNo ratings yet

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6No ratings yet

- FM Assignment 22021241198Document14 pagesFM Assignment 22021241198Sanchit GoteNo ratings yet

- Cálculo IndicadoresDocument5 pagesCálculo IndicadoresDaniel RodriguezNo ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsDino DizonNo ratings yet

- Symphony - DCF Valuation - Group6Document17 pagesSymphony - DCF Valuation - Group6Faheem ShanavasNo ratings yet

- OT Assignment Subham 2Document19 pagesOT Assignment Subham 2S SubhamNo ratings yet

- AccccDocument28 pagesAccccSumit WadhwaNo ratings yet

- Valuasi MYOR Dengan Metode DCFDocument7 pagesValuasi MYOR Dengan Metode DCFAqila NaufalNo ratings yet

- Financial Statements - TATA - MotorsDocument5 pagesFinancial Statements - TATA - MotorsKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- Home Depot DCFDocument16 pagesHome Depot DCFAntoni BallaunNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- Financial Management Report Spring 2021Document7 pagesFinancial Management Report Spring 2021Haider AbbasNo ratings yet

- Analysis by CompanyDocument12 pagesAnalysis by CompanyNadia ZahraNo ratings yet

- Bajaaj Auto With GraphsDocument46 pagesBajaaj Auto With Graphssatyamankushe99No ratings yet

- Financial Modelling ExcelDocument6 pagesFinancial Modelling ExcelAanchal Mahajan100% (1)

- Company Analysis KRBL Mayank GargDocument27 pagesCompany Analysis KRBL Mayank GargGaneshTatiNo ratings yet

- Saqib NazirDocument3 pagesSaqib Nazirsakhan5001No ratings yet

- V MartDocument44 pagesV MartPankaj SankholiaNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Mahindra & MahindraDocument11 pagesMahindra & Mahindramohitchordiya74No ratings yet

- Machine A Cash FlowsDocument1 pageMachine A Cash FlowsRadhakrishna IndalkarNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- 33 - 2022 - Aiboc - Revision in DADocument3 pages33 - 2022 - Aiboc - Revision in DAsengaraaradhanaNo ratings yet

- Trabajo Practico FLPDocument8 pagesTrabajo Practico FLPVictor Enrique Ildefonso PalapnNo ratings yet

- QUIZ 2 Sufyan Sarwar 02-112192-060Document1 pageQUIZ 2 Sufyan Sarwar 02-112192-060Sufyan SarwarNo ratings yet

- ProjectionDocument3 pagesProjectionPrabhu SNo ratings yet

- S. S. Crushers: Particulars Amount Cost of The ProjectDocument11 pagesS. S. Crushers: Particulars Amount Cost of The Projectpatan nazeerNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- Time Series Data 2021 22 PDFDocument8 pagesTime Series Data 2021 22 PDFPrashant BorseNo ratings yet

- ROI CalculationDocument18 pagesROI CalculationShivamNo ratings yet

- Percent To Sales MethodDocument8 pagesPercent To Sales Methodmother25janNo ratings yet

- 23 004 F 307 Powerpoint PDFDocument8 pages23 004 F 307 Powerpoint PDFFarzana Fariha LimaNo ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- V MartDocument47 pagesV MartHarshit JainNo ratings yet

- Stastical Calculations of Gul AhmedDocument18 pagesStastical Calculations of Gul AhmedM.Junaid -ur-RehmanNo ratings yet

- PA2 - Wk6Document13 pagesPA2 - Wk6Ranjan KoiralaNo ratings yet

- TEMLDocument57 pagesTEMLANNA BABU KOONAMAVU RCBSNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- 2FinancialAnalysisFY20222three FinalDocument3 pages2FinancialAnalysisFY20222three FinalDump AccNo ratings yet

- Financial Statement Analysis: Indian Hotels Co. LTDDocument4 pagesFinancial Statement Analysis: Indian Hotels Co. LTDaayush vermaNo ratings yet

- Hotland Mora - Financial Management 1 - Financial Distress Altman Z-scoreDocument2 pagesHotland Mora - Financial Management 1 - Financial Distress Altman Z-scoreRexly ElanNo ratings yet

- CorrelationDocument21 pagesCorrelationraviNo ratings yet

- SEZ DataDocument10 pagesSEZ DataraviNo ratings yet

- Maruti Suzuki: Submitted byDocument17 pagesMaruti Suzuki: Submitted byMukesh KumarNo ratings yet

- My Assignment (LMT) - Corporate FinanceDocument13 pagesMy Assignment (LMT) - Corporate Financeesmailkarimi456No ratings yet

- Absa and KCB RatiosDocument8 pagesAbsa and KCB RatiosAmos MutendeNo ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisAshmikaNo ratings yet

- Nguyễn Thị Kim ChiDocument8 pagesNguyễn Thị Kim Chitsunami133100100020No ratings yet

- The Ultimate Guide To Auto Cad 2022 3D Modeling For 3d Drawing And ModelingFrom EverandThe Ultimate Guide To Auto Cad 2022 3D Modeling For 3d Drawing And ModelingNo ratings yet

- Allahabad BankDocument9 pagesAllahabad BankMegha JainNo ratings yet

- Full Download Test Bank For Investments An Introduction 13th Edition Herbert B Mayo PDF Full ChapterDocument18 pagesFull Download Test Bank For Investments An Introduction 13th Edition Herbert B Mayo PDF Full Chaptergomeerrorist.g9vfq6100% (22)

- Study On Internal and External Sources of Finance Finance EssayDocument6 pagesStudy On Internal and External Sources of Finance Finance EssayKarishma Satheesh Kumar0% (1)

- Insurance BrokersDocument4 pagesInsurance Brokersashish srivastavaNo ratings yet

- Tristan'S Garments FactoryDocument6 pagesTristan'S Garments FactoryOtep Ricaña GeminaNo ratings yet

- Badger Daylighting PitchDocument16 pagesBadger Daylighting PitchAnonymous Ht0MIJNo ratings yet

- Corporate Finance Homework 3Document4 pagesCorporate Finance Homework 3Thao PhamNo ratings yet

- EarlyBird PresentationDocument8 pagesEarlyBird PresentationbrisbourneNo ratings yet

- In International Trade TransactionsDocument3 pagesIn International Trade TransactionsJose SanchezNo ratings yet

- Muhammad Ali Jinnah UniversityDocument23 pagesMuhammad Ali Jinnah UniversityAsraAkramNo ratings yet

- CH 01 Intro To Financial StatementsDocument26 pagesCH 01 Intro To Financial StatementsRyan GublerNo ratings yet

- Internship Saudi Pak Investment CompanyDocument39 pagesInternship Saudi Pak Investment Companyikhan5100% (2)

- True/False: List of Attempted Questions and AnswersDocument155 pagesTrue/False: List of Attempted Questions and AnswersAli Gulzar100% (1)

- Analysis of Book Rich Dad Poor DadDocument7 pagesAnalysis of Book Rich Dad Poor DadAnas KhurshidNo ratings yet

- Option Trading SecretsDocument21 pagesOption Trading Secretsgelu0406100% (1)

- Raising Capitals: Fundamentals of Corporate Finance Ross, Westerfield & Jordan 8 EditionDocument21 pagesRaising Capitals: Fundamentals of Corporate Finance Ross, Westerfield & Jordan 8 EditionSheikh RakinNo ratings yet

- Valuation - Final NotesDocument62 pagesValuation - Final NotesPooja GuptaNo ratings yet

- SEC Complaint FormDocument16 pagesSEC Complaint FormTim BryantNo ratings yet

- Dear Student Assignment Questions-MBA - I / Semester - I MBA - I / Semester - II MBA - II / Semester - IIIDocument19 pagesDear Student Assignment Questions-MBA - I / Semester - I MBA - I / Semester - II MBA - II / Semester - IIIsukumayaNo ratings yet

- Literature Review On Cash Management PaperDocument5 pagesLiterature Review On Cash Management Paperc5pgpgqk100% (1)

- GameStop Flash Mob Vs Wall Street - Financial TimesDocument2 pagesGameStop Flash Mob Vs Wall Street - Financial TimesAP LodgeNo ratings yet

- Secretarial Practice 2Document2 pagesSecretarial Practice 2psawant77No ratings yet

- Capital Raising by Richard C WilsonDocument101 pagesCapital Raising by Richard C Wilsonjohnnemanic100% (1)

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocument9 pagesChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Infrastructure FinanceDocument7 pagesInfrastructure FinanceKaran VasheeNo ratings yet

- 10 New Financial Markets TestDocument1 page10 New Financial Markets TestNishad AlamNo ratings yet

- Nifty 50: Index MethodologyDocument16 pagesNifty 50: Index MethodologyObhiejitNo ratings yet

- Theory DepreciationDocument6 pagesTheory DepreciationKhushi AgarwalNo ratings yet

4

4

Uploaded by

Ameti SrinidhiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4

4

Uploaded by

Ameti SrinidhiCopyright:

Available Formats

Infosys

Banking Management

ALTMAN Z-SCORE - Altman’s Z-Score model is a numerical measurement that is used to predict the chances of a business going bankrupt in the next

two years. The model was developed by American finance professor

EdwardAltman in 1968 as a measure of the financial stability of companies

Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + l.0X5

X1 = working capital/total assets (%)

X2 = retained earnings/total assets (%)

X3 = EBIT/total assets (%)

X4 = market value of equity/book value of debt (%)

X5 = sales/total assets (times)

CALCULATIONS:

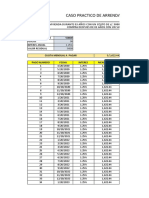

X1

YEAR CURRENT ASSESTS CURRENT LIABILITIES WORKING CAPITAL TOTAL ASSESTS WC/TA

2020 12,600.37 12,010.27 590.1 74,137.75 0.007959508

2021 10,719.56 9,257.85 1461.71 62,177.11 0.023508812

2022 11,507.79 8,959.29 2548.5 62,636.22 0.040687321

2023 8,638.23 6,724.36 1913.87 54,700.16 0.03498838

2024 8,309.37 7,569.29 740.08 49,578.94 0.014927306

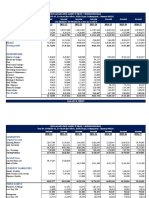

X2

YEAR RETAINED EARNINGS TOTAL ASSETS RE/TA

2020 51,981.79 74,137.75 0.701151438

2021 46,726.01 62,177.11 0.751498582

2022 48,413.30 62,636.22 0.772928188

2023 42,759.53 54,700.16 0.781707585

2024 37,507.37 49,578.94 0.756518191

X3

YEAR OPERATING PROFIT Depreciation and EBIT(OP+DEP) TOTAL ASSETS EBIT/TA

Amortisation Expenses

2020 25,847.33 1215.06 27062.39 74,137.75 0.365028477

2021 26,576.07 1097.29 27673.36 62,177.11 0.445073115

2022 20,632.93 913.96 21546.89 62,636.22 0.344000484

2023 12,206.95 828.17 13035.12 54,700.16 0.238301314

2024 15,856.41 813.51 16669.92 49,578.94 0.336229859

X4

BOOK VALUE OF MKT OF

YEAR 0UTSTANDING SHARES SHARE PRICE MKT of EQUITY TOTAL ASSETS TOTAL LIABILITIES BOOK EQUITY DEBT BV OF DEBT IN CR. EQ/BV OF DB

2020 2,02,22,023 927.85 18763004040.55 74,137.75 10,357.18 63780.57 10357.18 103571800000.00 0.181159389

2021 2,02,12,022 1622.25 32788952689.50 62,177.11 8,870.41 53306.7 8870.41 88704100000.00 0.369644162

2022 2,02,02,021 1723.5 34818183193.50 62,636.22 9,994.47 52641.75 9994.47 99944700000.00 0.348374483

2023 2,01,92,020 2134.8 43105924296.00 54,700.16 14,175.13 40525.03 14175.13 141751300000.00 0.304095442

2024 2,01,82,019 2471.2 49873805352.80 49,578.94 6,596.96 42981.98 6596.96 65969600000.00 0.756011941

X5

YEAR TOTAL SALES TOTAL ASSETS TS/TA

2020 68,252 74,137.75 0.92061062

2021 76,404 62,177.11 1.228812339

2022 95,701 62,636.22 1.527885942

2023 1,17,627 54,700.16 2.150395904

2024 1,30,978 49,578.94 2.641807187

ALTMAN Z SCORE

YEAR X1*1.2 X2*1.4 X3*3.3 X4*0.6 X5*1.0 ALTMAN Z SCORE

2020 0.009551409 0.981612013 1.204593975 0.108695634 0.92061062 3.225063651

2021 0.028210575 1.052098015 1.468741278 0.221786497 1.228812339 3.999648704

2022 0.048824785 1.082099463 1.135201597 0.20902469 1.527885942 4.003036477

2023 0.041986056 1.09439062 0.786394336 0.182457265 2.150395904 4.255624181

2024 0.017912767 1.059125467 1.109558534 0.453607165 2.641807187 5.28201112

DECISION RULE: YEAR Z SCORE DECISION

2020 3.225063651 Firm is financially sound

If Z>2.99,Firm is 2021 3.999648704 Firm is financially sound

Financially sound.

If Z<1.81,Firm is 2022 4.003036477 Firm is financially sound

Financially Distressed or

Bankrupt.

2023 4.255624181 Firm is financially sound

2024 5.28201112 Firm is financially sound

You might also like

- Assignment On Analysis of Annual Report ofDocument9 pagesAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Nucleon CaseDocument6 pagesNucleon CaseshagunparmarNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Investment Contract June 27 2019 3 PDFDocument8 pagesInvestment Contract June 27 2019 3 PDFMohammad RazNo ratings yet

- 3Document1 page3Ameti SrinidhiNo ratings yet

- 5Document1 page5Ameti SrinidhiNo ratings yet

- 1Document1 page1Ameti SrinidhiNo ratings yet

- 2Document1 page2Ameti SrinidhiNo ratings yet

- MGM China BloombergDocument148 pagesMGM China BloombergDaniel HernàndezNo ratings yet

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6No ratings yet

- FM Assignment 22021241198Document14 pagesFM Assignment 22021241198Sanchit GoteNo ratings yet

- Cálculo IndicadoresDocument5 pagesCálculo IndicadoresDaniel RodriguezNo ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsDino DizonNo ratings yet

- Symphony - DCF Valuation - Group6Document17 pagesSymphony - DCF Valuation - Group6Faheem ShanavasNo ratings yet

- OT Assignment Subham 2Document19 pagesOT Assignment Subham 2S SubhamNo ratings yet

- AccccDocument28 pagesAccccSumit WadhwaNo ratings yet

- Valuasi MYOR Dengan Metode DCFDocument7 pagesValuasi MYOR Dengan Metode DCFAqila NaufalNo ratings yet

- Financial Statements - TATA - MotorsDocument5 pagesFinancial Statements - TATA - MotorsKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- Home Depot DCFDocument16 pagesHome Depot DCFAntoni BallaunNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- Financial Management Report Spring 2021Document7 pagesFinancial Management Report Spring 2021Haider AbbasNo ratings yet

- Analysis by CompanyDocument12 pagesAnalysis by CompanyNadia ZahraNo ratings yet

- Bajaaj Auto With GraphsDocument46 pagesBajaaj Auto With Graphssatyamankushe99No ratings yet

- Financial Modelling ExcelDocument6 pagesFinancial Modelling ExcelAanchal Mahajan100% (1)

- Company Analysis KRBL Mayank GargDocument27 pagesCompany Analysis KRBL Mayank GargGaneshTatiNo ratings yet

- Saqib NazirDocument3 pagesSaqib Nazirsakhan5001No ratings yet

- V MartDocument44 pagesV MartPankaj SankholiaNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Mahindra & MahindraDocument11 pagesMahindra & Mahindramohitchordiya74No ratings yet

- Machine A Cash FlowsDocument1 pageMachine A Cash FlowsRadhakrishna IndalkarNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- 33 - 2022 - Aiboc - Revision in DADocument3 pages33 - 2022 - Aiboc - Revision in DAsengaraaradhanaNo ratings yet

- Trabajo Practico FLPDocument8 pagesTrabajo Practico FLPVictor Enrique Ildefonso PalapnNo ratings yet

- QUIZ 2 Sufyan Sarwar 02-112192-060Document1 pageQUIZ 2 Sufyan Sarwar 02-112192-060Sufyan SarwarNo ratings yet

- ProjectionDocument3 pagesProjectionPrabhu SNo ratings yet

- S. S. Crushers: Particulars Amount Cost of The ProjectDocument11 pagesS. S. Crushers: Particulars Amount Cost of The Projectpatan nazeerNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- Time Series Data 2021 22 PDFDocument8 pagesTime Series Data 2021 22 PDFPrashant BorseNo ratings yet

- ROI CalculationDocument18 pagesROI CalculationShivamNo ratings yet

- Percent To Sales MethodDocument8 pagesPercent To Sales Methodmother25janNo ratings yet

- 23 004 F 307 Powerpoint PDFDocument8 pages23 004 F 307 Powerpoint PDFFarzana Fariha LimaNo ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- V MartDocument47 pagesV MartHarshit JainNo ratings yet

- Stastical Calculations of Gul AhmedDocument18 pagesStastical Calculations of Gul AhmedM.Junaid -ur-RehmanNo ratings yet

- PA2 - Wk6Document13 pagesPA2 - Wk6Ranjan KoiralaNo ratings yet

- TEMLDocument57 pagesTEMLANNA BABU KOONAMAVU RCBSNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- 2FinancialAnalysisFY20222three FinalDocument3 pages2FinancialAnalysisFY20222three FinalDump AccNo ratings yet

- Financial Statement Analysis: Indian Hotels Co. LTDDocument4 pagesFinancial Statement Analysis: Indian Hotels Co. LTDaayush vermaNo ratings yet

- Hotland Mora - Financial Management 1 - Financial Distress Altman Z-scoreDocument2 pagesHotland Mora - Financial Management 1 - Financial Distress Altman Z-scoreRexly ElanNo ratings yet

- CorrelationDocument21 pagesCorrelationraviNo ratings yet

- SEZ DataDocument10 pagesSEZ DataraviNo ratings yet

- Maruti Suzuki: Submitted byDocument17 pagesMaruti Suzuki: Submitted byMukesh KumarNo ratings yet

- My Assignment (LMT) - Corporate FinanceDocument13 pagesMy Assignment (LMT) - Corporate Financeesmailkarimi456No ratings yet

- Absa and KCB RatiosDocument8 pagesAbsa and KCB RatiosAmos MutendeNo ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisAshmikaNo ratings yet

- Nguyễn Thị Kim ChiDocument8 pagesNguyễn Thị Kim Chitsunami133100100020No ratings yet

- The Ultimate Guide To Auto Cad 2022 3D Modeling For 3d Drawing And ModelingFrom EverandThe Ultimate Guide To Auto Cad 2022 3D Modeling For 3d Drawing And ModelingNo ratings yet

- Allahabad BankDocument9 pagesAllahabad BankMegha JainNo ratings yet

- Full Download Test Bank For Investments An Introduction 13th Edition Herbert B Mayo PDF Full ChapterDocument18 pagesFull Download Test Bank For Investments An Introduction 13th Edition Herbert B Mayo PDF Full Chaptergomeerrorist.g9vfq6100% (22)

- Study On Internal and External Sources of Finance Finance EssayDocument6 pagesStudy On Internal and External Sources of Finance Finance EssayKarishma Satheesh Kumar0% (1)

- Insurance BrokersDocument4 pagesInsurance Brokersashish srivastavaNo ratings yet

- Tristan'S Garments FactoryDocument6 pagesTristan'S Garments FactoryOtep Ricaña GeminaNo ratings yet

- Badger Daylighting PitchDocument16 pagesBadger Daylighting PitchAnonymous Ht0MIJNo ratings yet

- Corporate Finance Homework 3Document4 pagesCorporate Finance Homework 3Thao PhamNo ratings yet

- EarlyBird PresentationDocument8 pagesEarlyBird PresentationbrisbourneNo ratings yet

- In International Trade TransactionsDocument3 pagesIn International Trade TransactionsJose SanchezNo ratings yet

- Muhammad Ali Jinnah UniversityDocument23 pagesMuhammad Ali Jinnah UniversityAsraAkramNo ratings yet

- CH 01 Intro To Financial StatementsDocument26 pagesCH 01 Intro To Financial StatementsRyan GublerNo ratings yet

- Internship Saudi Pak Investment CompanyDocument39 pagesInternship Saudi Pak Investment Companyikhan5100% (2)

- True/False: List of Attempted Questions and AnswersDocument155 pagesTrue/False: List of Attempted Questions and AnswersAli Gulzar100% (1)

- Analysis of Book Rich Dad Poor DadDocument7 pagesAnalysis of Book Rich Dad Poor DadAnas KhurshidNo ratings yet

- Option Trading SecretsDocument21 pagesOption Trading Secretsgelu0406100% (1)

- Raising Capitals: Fundamentals of Corporate Finance Ross, Westerfield & Jordan 8 EditionDocument21 pagesRaising Capitals: Fundamentals of Corporate Finance Ross, Westerfield & Jordan 8 EditionSheikh RakinNo ratings yet

- Valuation - Final NotesDocument62 pagesValuation - Final NotesPooja GuptaNo ratings yet

- SEC Complaint FormDocument16 pagesSEC Complaint FormTim BryantNo ratings yet

- Dear Student Assignment Questions-MBA - I / Semester - I MBA - I / Semester - II MBA - II / Semester - IIIDocument19 pagesDear Student Assignment Questions-MBA - I / Semester - I MBA - I / Semester - II MBA - II / Semester - IIIsukumayaNo ratings yet

- Literature Review On Cash Management PaperDocument5 pagesLiterature Review On Cash Management Paperc5pgpgqk100% (1)

- GameStop Flash Mob Vs Wall Street - Financial TimesDocument2 pagesGameStop Flash Mob Vs Wall Street - Financial TimesAP LodgeNo ratings yet

- Secretarial Practice 2Document2 pagesSecretarial Practice 2psawant77No ratings yet

- Capital Raising by Richard C WilsonDocument101 pagesCapital Raising by Richard C Wilsonjohnnemanic100% (1)

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocument9 pagesChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Infrastructure FinanceDocument7 pagesInfrastructure FinanceKaran VasheeNo ratings yet

- 10 New Financial Markets TestDocument1 page10 New Financial Markets TestNishad AlamNo ratings yet

- Nifty 50: Index MethodologyDocument16 pagesNifty 50: Index MethodologyObhiejitNo ratings yet

- Theory DepreciationDocument6 pagesTheory DepreciationKhushi AgarwalNo ratings yet