Professional Documents

Culture Documents

Estimating costs AND dd

Estimating costs AND dd

Uploaded by

Krishna Bharti0 ratings0% found this document useful (0 votes)

2 views6 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views6 pagesEstimating costs AND dd

Estimating costs AND dd

Uploaded by

Krishna BhartiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

Estimating costs

Estimating costs is a crucial aspect of financial planning and project

management, as it helps businesses forecast the expenses associated

with a project or operation. Accurate cost estimation enables better

budgeting, pricing, and financial decision-making. Here are the key

steps and methods for estimating costs:

Key Steps in Estimating Costs

1. Define the Scope: Clearly outline the scope of the project or

operation, including all tasks, activities, and deliverables. A well-

defined scope ensures that all necessary costs are considered.

2. Identify Cost Categories: Break down costs into categories such as

direct costs (labor, materials, equipment), indirect costs (overhead,

administration), and fixed and variable costs.

3. Gather Data: Collect historical data, vendor quotes, market rates,

and other relevant information to inform cost estimates. This may

involve consulting past projects, industry benchmarks, or expert

opinions.

4. Choose Estimation Method: Select the appropriate cost estimation

method(s) based on the project's nature, complexity, and available

information. Common methods include expert judgment,

analogous estimating, parametric estimating, bottom-up

estimating, and three-point estimating.

5. Calculate Costs: Use the chosen method(s) to calculate the costs

for each task or component of the project. Ensure to consider all

cost factors, including contingencies and potential risks.

6. Review and Validate: Cross-check estimates with historical data,

industry benchmarks, and expert reviews to validate accuracy.

Adjust estimates as necessary to account for any overlooked

elements or inaccuracies.

7. Document Estimates: Clearly document all cost estimates,

assumptions, data sources, and methodologies used. This

documentation is essential for transparency and future reference.

8. Update Estimates: Continuously monitor and update cost

estimates throughout the project lifecycle to reflect changes in

scope, market conditions, or unforeseen events.

Common Cost Estimation Methods

1. Expert Judgment: Leveraging the experience and expertise of

individuals or teams familiar with similar projects to provide cost

estimates. This method is useful when data is limited or when quick

estimates are needed.

2. Analogous Estimating: Using historical data from similar projects

to estimate costs for the current project. This method is faster but

may be less accurate if significant differences exist between

projects.

3. Parametric Estimating: Using statistical models and historical data

to estimate costs based on key variables or parameters (e.g., cost

per square foot in construction). This method can provide more

accurate estimates when relevant data is available.

4. Bottom-Up Estimating: Estimating the costs of individual tasks or

components in detail and then aggregating them to obtain the

total project cost. This method is time-consuming but provides a

high level of accuracy.

5. Three-Point Estimating: Incorporating uncertainty by using three

estimates for each cost: optimistic (O), pessimistic (P), and most

likely (M). The final estimate is calculated using a weighted average

or a formula such as:

6. Estimated Cost=�+4�+�6Estimated Cost=6O+4M+P

7. This method helps account for risks and uncertainties.

Considerations in Cost Estimation

Inflation: Account for potential changes in costs due to inflation or

market fluctuations.

Contingency: Include a contingency reserve to cover unforeseen

costs or risks.

Scope Changes: Be prepared to adjust estimates if there are

changes in project scope or requirements.

Currency Fluctuations: For international projects, consider the

impact of currency exchange rates on costs.

Regulatory Requirements: Ensure compliance with any relevant

regulations or standards that may affect costs.

By following these steps and methods, businesses can develop more

accurate and reliable cost estimates, aiding in effective budgeting,

pricing, and financial planning.

Determining demand

Determining demand is a critical component of pricing strategy and

overall business planning. Accurately estimating demand helps

businesses set prices, forecast sales, manage inventory, and plan

production. Here are the key steps and methods for determining

demand:

Key Steps in Determining Demand

1. Market Research: Conduct research to understand the market

landscape, customer preferences, and buying behaviors. This

includes surveys, interviews, focus groups, and analyzing

secondary data sources like industry reports and market studies.

2. Historical Data Analysis: Analyze past sales data to identify trends,

seasonality, and patterns. Historical data provides insights into

how demand has fluctuated over time and can help predict future

demand.

3. Competitor Analysis: Examine competitors' products, pricing, and

market share. Understanding competitor strategies and

performance can provide clues about market demand and

potential gaps in the market.

4. Customer Segmentation: Segment the market into distinct groups

based on demographics, psychographics, behavior, and other

relevant criteria. Different segments may have different demand

levels and price sensitivities.

5. Economic Indicators: Monitor economic indicators such as

consumer confidence, disposable income, unemployment rates,

and GDP growth. These factors can influence overall demand in

the market.

6. Qualitative Insights: Gather qualitative insights from sales teams,

customer service, and other frontline staff who interact with

customers regularly. These insights can provide valuable

information about customer needs and demand fluctuations.

7. Test Marketing: Conduct test marketing or pilot programs to gauge

demand for a new product or service in a controlled setting before

a full-scale launch.

Common Methods for Determining Demand

1. Surveys and Questionnaires:

Directly ask customers about their purchasing intentions,

preferences, and willingness to pay. Surveys can be conducted

online, via phone, or in person.

2. Market Experiments:

Test different pricing, marketing, or product variations in a small,

controlled segment of the market to observe customer reactions

and demand levels.

3. Time Series Analysis:

Use statistical techniques to analyze historical sales data over

time to identify trends, seasonal patterns, and cyclical behaviors

that can forecast future demand.

4. Regression Analysis:

Use regression models to analyze the relationship between

demand and various factors such as price, income, marketing

spend, and economic indicators. This method helps quantify

how changes in these factors influence demand.

5. Consumer Panels:

Utilize panels of consumers who regularly provide feedback and

data on their purchasing habits and preferences over time. This

continuous data stream helps track demand trends.

6. Point-of-Sale (POS) Data:

Analyze real-time sales data from POS systems to monitor

demand patterns, identify best-selling products, and detect

shifts in consumer behavior.

7. Econometric Models:

Develop complex mathematical models that incorporate various

economic variables to forecast demand. These models often use

historical data and theoretical relationships between variables.

8. Demand Forecasting Software:

Use specialized software tools that leverage advanced

algorithms and machine learning to predict future demand

based on historical data and other relevant inputs.

Practical Considerations

Seasonality: Adjust for seasonal variations that affect demand. For

example, retail demand may spike during holiday seasons.

New Product Launches: Consider the impact of new product

introductions on existing product demand.

Market Saturation: Account for the potential saturation of the

market, which can limit demand growth.

Substitute and Complementary Products: Analyze how the

availability and pricing of substitute and complementary products

affect demand for your product.

Example: Applying Methods to Determine Demand for a New Product

Imagine a company planning to launch a new smartphone. Here's how

it might determine demand:

1. Surveys: Conduct surveys asking potential customers about their

interest in the new smartphone and their willingness to pay for

specific features.

2. Historical Data: Analyze sales data from previous smartphone

models to identify trends and customer preferences.

3. Competitor Analysis: Examine competitor smartphones' sales

data, features, and pricing strategies.

4. Test Marketing: Launch the smartphone in a few selected cities to

gauge initial customer reactions and sales.

5. Regression Analysis: Use regression models to estimate how

changes in features, marketing spend, and price might affect

demand.

6. Economic Indicators: Monitor economic conditions, such as

consumer spending trends and technological adoption rates, that

could impact smartphone demand.

By combining these methods, the company can develop a

comprehensive understanding of potential demand for the new

smartphone, enabling more informed pricing, production, and

marketing decisions.

You might also like

- Dalrymple S Sales Management Concepts and CaseDocument521 pagesDalrymple S Sales Management Concepts and CaseMinh TuấnNo ratings yet

- MAES London Pricing Sheet Lets Make It HereDocument3 pagesMAES London Pricing Sheet Lets Make It HereNimesh DesaiNo ratings yet

- Demand Forecasting and Consumer SurveyDocument18 pagesDemand Forecasting and Consumer Surveyjimmybhogal00771% (7)

- Necessity For Forecasting DemandDocument29 pagesNecessity For Forecasting DemandAshwini AshwathNo ratings yet

- Economics IADocument12 pagesEconomics IAJerilee SoCute Watts30% (10)

- SCM Demand ForecastingDocument1 pageSCM Demand ForecastingsyedtalhamanzarNo ratings yet

- Demand Forecasting: 1. Survey Methods 2. Statistical Methods 3. Expert Opinion MethodsDocument3 pagesDemand Forecasting: 1. Survey Methods 2. Statistical Methods 3. Expert Opinion MethodsKuthubudeen T MNo ratings yet

- Unit 1Document7 pagesUnit 1narutomoogrNo ratings yet

- ForecastingDocument21 pagesForecastingSyed Umair100% (1)

- 2.3 ForecastingDocument36 pages2.3 ForecastingAkshay ChakravartyNo ratings yet

- Accn303 Group Assignment-1Document9 pagesAccn303 Group Assignment-1ColeNo ratings yet

- Methods of Demand ForecastingDocument4 pagesMethods of Demand ForecastingSreya PrakashNo ratings yet

- Big data_how use it in estimation itDocument2 pagesBig data_how use it in estimation itAmadosi J. EmmanuelNo ratings yet

- Supply Chain Demand Management and ForecastingDocument2 pagesSupply Chain Demand Management and ForecastingKarthikNo ratings yet

- Demand ForecastingDocument28 pagesDemand ForecastingRamteja SpuranNo ratings yet

- Methods of Demand ForecastingDocument7 pagesMethods of Demand ForecastingRajasee ChatterjeeNo ratings yet

- Economcs AssignmentDocument3 pagesEconomcs AssignmentnadiaNo ratings yet

- Cia EconomicsDocument8 pagesCia EconomicsSivaramkrishnanNo ratings yet

- Lecture Note Managerial Economics (UM20MB503) Unit 3 Topic: Demand ForecastingDocument6 pagesLecture Note Managerial Economics (UM20MB503) Unit 3 Topic: Demand ForecastingRASHNo ratings yet

- B2B MarketingDocument70 pagesB2B Marketingrohit kumar jadraNo ratings yet

- Answer MBA 102 Section A & BDocument9 pagesAnswer MBA 102 Section A & BAshish ShankarNo ratings yet

- Market AnalysisDocument6 pagesMarket AnalysisSikandar AkramNo ratings yet

- Demand ForecastingDocument29 pagesDemand ForecastingAvinash SahuNo ratings yet

- Formulation 1Document45 pagesFormulation 1rahulsinghbaloria1234567No ratings yet

- Sales Forecasting TechniquesDocument10 pagesSales Forecasting Techniquesdhruvidesai2711No ratings yet

- Lesson 3Document17 pagesLesson 3Pamela MorcillaNo ratings yet

- StatisticsDocument5 pagesStatisticspriyanka sharmaNo ratings yet

- Demand Forecasting Is A Process of Predicting Future Demand For CompanyDocument7 pagesDemand Forecasting Is A Process of Predicting Future Demand For CompanyHasrat AliNo ratings yet

- Goods Services: Market SectorDocument7 pagesGoods Services: Market SectorOmei KhairiNo ratings yet

- Demand ForecastingDocument12 pagesDemand ForecastingankitasahewalaNo ratings yet

- Demand Forecasting' Compiled by Anjay Mishra, Nec College,: A Reference Note of Kathmandu NepalDocument4 pagesDemand Forecasting' Compiled by Anjay Mishra, Nec College,: A Reference Note of Kathmandu NepalUjjwal ShresthaNo ratings yet

- Demand ForecastingDocument14 pagesDemand ForecastingsanthoshNo ratings yet

- Demand ForecastingDocument9 pagesDemand ForecastingAdil ShresthaNo ratings yet

- HR ForecastingDocument5 pagesHR ForecastingObaidullah HamaasNo ratings yet

- IED RAM Module 4Document17 pagesIED RAM Module 4Jagyandutta NaikNo ratings yet

- Managerial Economics (Unit-3)Document92 pagesManagerial Economics (Unit-3)Ankur AgrawalNo ratings yet

- Introduction to Business EconomicsDocument4 pagesIntroduction to Business Economicsyash18759860No ratings yet

- Unit 3Document11 pagesUnit 3Gaurav SinghNo ratings yet

- Demandforecasting NewDocument28 pagesDemandforecasting NewNancy KhuranaNo ratings yet

- Big Data_how Use It in Const Estimation WorksitDocument2 pagesBig Data_how Use It in Const Estimation WorksitAmadosi J. EmmanuelNo ratings yet

- Explain The Meaning of The Term Demand ForecastingDocument7 pagesExplain The Meaning of The Term Demand ForecastingzbenipalNo ratings yet

- Demand For CastingDocument17 pagesDemand For CastingRajveer SinghNo ratings yet

- Chap 5Document8 pagesChap 5roby ashariNo ratings yet

- Specific MarketDocument29 pagesSpecific MarketGenesis Anne MagsicoNo ratings yet

- Om 11Document16 pagesOm 11गब्बर जाटNo ratings yet

- Unit Ii - LogisticsDocument9 pagesUnit Ii - LogisticsKarthika ViswanathNo ratings yet

- BI (Unit-4)Document7 pagesBI (Unit-4)vedant.kanu03No ratings yet

- Production Planing Module From AzariyasDocument94 pagesProduction Planing Module From AzariyaskshambelmekuyeNo ratings yet

- Introduction To Market Survey and Opportunity Identification - Unit 3Document8 pagesIntroduction To Market Survey and Opportunity Identification - Unit 3Yashwanth S D E&CNo ratings yet

- Demand ForecastingDocument7 pagesDemand Forecastingkiruba kiruNo ratings yet

- The Following Are The Various Methods of Sales ForecastingDocument7 pagesThe Following Are The Various Methods of Sales ForecastingRafaiza Mano100% (1)

- Marketing - Unit 4Document54 pagesMarketing - Unit 4Priyanka SinghalNo ratings yet

- Operations Management Diary - Session 8 Date - 31/10/2018, Name - Divya Singh, PGDM Number - 18182, Section CDocument5 pagesOperations Management Diary - Session 8 Date - 31/10/2018, Name - Divya Singh, PGDM Number - 18182, Section Cashish sunnyNo ratings yet

- Unit3-Demand ForecastingDocument12 pagesUnit3-Demand ForecastingSri HimajaNo ratings yet

- Demand ForecastingDocument1 pageDemand ForecastinghmughalgNo ratings yet

- What Do You Mean by Demand Forecasting? What Are Its Various Types?Document4 pagesWhat Do You Mean by Demand Forecasting? What Are Its Various Types?Madhan kumarNo ratings yet

- Business Research in Strategy and Decision-MakingDocument4 pagesBusiness Research in Strategy and Decision-Makingkhandelwal2121No ratings yet

- ForecastingDocument2 pagesForecastingEthan John PaguntalanNo ratings yet

- Demand Forecasting:: Need and SignificanceDocument2 pagesDemand Forecasting:: Need and SignificanceAkarshNo ratings yet

- Unit 2 - Demand Forecasting MethodsDocument3 pagesUnit 2 - Demand Forecasting Methodsdeepu BNo ratings yet

- UntitledDocument9 pagesUntitledjatin maneNo ratings yet

- Use of Vectors in Financial Graphs: by Dr Abdul Rahim WongFrom EverandUse of Vectors in Financial Graphs: by Dr Abdul Rahim WongNo ratings yet

- WCM Principle 4 HeijunkaDocument33 pagesWCM Principle 4 HeijunkaSaurabh KothawadeNo ratings yet

- Final Feasibility Study 1Document57 pagesFinal Feasibility Study 1Donna Lee Bug-atanNo ratings yet

- Possible Discussion Questions Cbme021Document18 pagesPossible Discussion Questions Cbme021Madiba PhihlelaNo ratings yet

- ANA Email Marketing Solution Maturity ModelDocument2 pagesANA Email Marketing Solution Maturity ModelDemand MetricNo ratings yet

- Unit 3 Revision Learning Aim CDocument11 pagesUnit 3 Revision Learning Aim CC1 BandsNo ratings yet

- Ad Intro by KrutiDocument14 pagesAd Intro by KrutiKruti ShahNo ratings yet

- Case Study Leasedrive: The CompanyDocument1 pageCase Study Leasedrive: The CompanyRaja Churchill DassNo ratings yet

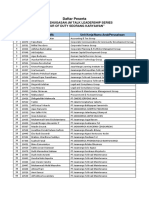

- Daftar Peserta JM Talk Leadership Series2Document8 pagesDaftar Peserta JM Talk Leadership Series2Doddy LombardoNo ratings yet

- Economics For EngineersDocument55 pagesEconomics For EngineersHimanshu MishraNo ratings yet

- Big Assignment.Document2 pagesBig Assignment.AstridNo ratings yet

- Sociology Research ProjectDocument3 pagesSociology Research Projectapi-26474362No ratings yet

- 3-ch05 and 06Document61 pages3-ch05 and 06herueuxNo ratings yet

- Withdrawal of A Partner Good Copy For Group1Document8 pagesWithdrawal of A Partner Good Copy For Group1Yusuf Hussein100% (1)

- Abm01 - Module 5-6.1 (Bus. Transaction)Document19 pagesAbm01 - Module 5-6.1 (Bus. Transaction)Love JcwNo ratings yet

- SM Final Notes RCEEDocument100 pagesSM Final Notes RCEESumatthi Devi ChigurupatiNo ratings yet

- Class Notes of Theoretical Framework of EntrepreneurshipDocument36 pagesClass Notes of Theoretical Framework of EntrepreneurshipYufan WuNo ratings yet

- Books of Prime Entry: Accounting 9706Document12 pagesBooks of Prime Entry: Accounting 9706Chirag JogiNo ratings yet

- Project Proposal - Ravish Chhabra - 18020841125Document2 pagesProject Proposal - Ravish Chhabra - 18020841125Mainali GautamNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- HUL Vs Patanjali (Market Study)Document26 pagesHUL Vs Patanjali (Market Study)Vibhuti0% (1)

- TWSS Basic Excel TDocument198 pagesTWSS Basic Excel TManan GuptaNo ratings yet

- John Kotter - MindmapDocument1 pageJohn Kotter - MindmapHanif HalimzNo ratings yet

- FMCG Case StudyDocument5 pagesFMCG Case StudyDini PutriNo ratings yet

- Solved 1 Assess The Marketing Philosophy of Commercial Bank of EthiopiaDocument2 pagesSolved 1 Assess The Marketing Philosophy of Commercial Bank of EthiopiaBirhan AlemuNo ratings yet

- SCMchapter 4Document39 pagesSCMchapter 4KgnasNo ratings yet

- ch03Document62 pagesch03Mona ElzaherNo ratings yet

- Shutting Down or Continuing To Operate A Plant - Hallas CompanyDocument3 pagesShutting Down or Continuing To Operate A Plant - Hallas CompanyFernando III PerezNo ratings yet