Professional Documents

Culture Documents

corporate reporting assignment(ISL)

corporate reporting assignment(ISL)

Uploaded by

hadep96625Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

corporate reporting assignment(ISL)

corporate reporting assignment(ISL)

Uploaded by

hadep96625Copyright:

Available Formats

INTERNATIONAL STEEL LIMITED (ISL)

PERFORMANCE ANALYSIS

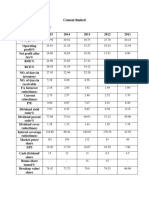

KEY INDICATORS 2023 2022 2021 2020 2019 2018

PROFITABILITY RATIO

Gross profit ratio % 13.82 13.54 19.33 8.76 11.22 15.52

Profit before tax to sales % 6.76 8.75 14.75 0.92 6.4 11.81

Profits after tax to sales % 4.58 5.92 10.7 1.03 4.63 8.88

EBITDA margin to sales % 11.79 11.77 17.96 8.31 10.49 14.62

Operating leverages % 0.99 -0.46 4.74 2.06 -0.95 0.56

Return on shareholders equity % 16.23 25.06 39.53 3.89 20.69 36.91

Operating profit on capital employed % 29.84 34.93 43.79 14.29 23.13 31.24

Return on total assets % 8.3 9.68 17.9 1.15 6.7 12.26

LIQUIDITY RATIO

Current ratio Times 1.25 1.2 1.38 0.94 1.09 1.13

Quick/Asid test ratio Times 0.26 0.16 0.33 0.3 0.29 0.21

Cash to current liability 0.017 0.01 0.018 0.005 0.022 0.007

Cash flow from operations to sales 0.29 -0.04 0.12 0.04 0.06 0.01

Cash flow from operation to capital expenditures 15.85 -1.88 15.62 0.89 1.53 0.05

Free cash flow to the firm Rs. Millions 22,907 -5,222 6,247 3,230 2,006 -5,308

Free cash flow to the equity holders Rs. Millions 18,526 -6,826 4,246 -188 487 -2,496

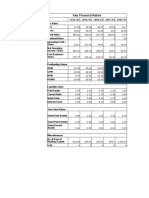

TURNOVER RATIOS

Inventory turnover ratio Times 3.83 2.62 3.3 2.9 3.32 2.83

Debtor turnover ratio(KE) Times 54.31 12.68 22.73 17.85 12.21 15.08

Debtor turnover(KE) Times 15 29 16 20 30 24

Debtor turnover ratio Times 70.32 92.63 71.37 51.04 76 69.79

Creditor turnover ratio Times 28.32 67.59 15.88 11.38 22.41 13.59

Total assets turnover ratio Times 1.81 1.64 1.67 1.12 1.45 1.38

Fixed assets turnover ratio Times 3.72 4.36 3.64 2.32 2.89 2.69

Capital employed turnover ratio Times 3.07 3.43 2.75 2.49 2.73 2.35

OPERATING CYCLE

Inventory turnover Days 95 139 111 126 110 129

Debtor turnover Days 5 4 5 7 5 5

Creditor turnover Days 13 5 23 32 16 27

Operating cycle Days 88 138 93 101 98 107

INVESTMENT /MARKET RATIO

Earning per share-basic and diluted Rs. 8.09 12.44 17.16 1.14 6.12 10.03

Price earning ratio Times 5.01 4.77 5.44 45.31 6.49 10.14

Market value per share at the end of the year Rs. 40.53 59.36 93.41 51.65 39.71 101.7

Market value per share high during the year Rs. 62.7 103.25 102.5 62.28 116.5 149.75

Market value per share low during the year Rs. 36.71 53.1 51.95 27.61 33.94 86

Break-up value per share-inncluding revaluation surplus Rs. 49.85 49.65 43.42 29.25 29.64 27.18

Break-up value per share-excluding revaluation surplus Rs. 44.82 44.1 40.62 26.37 26.94 25.02

Price to book ratio Times 0.81 1.2 2.15 1.77 1.34 3.74

Cash dividend % 55 65 100 - 30 45

Dividend yield % 13.57 10.95 10.71 - 7.55 4.42

Dividend cover Times 1.47 1.91 1.72 - 2.04 2.23

Dividend payout % 67.99 52.25 58.28 - 49.02 44.85

Dividend per share Rs. 5.5 6.5 10 - 3 4.5

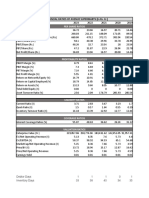

CAPITAL STRUCTURE RATIO

Financial leverage ratio % 0.86 1.51 1.1 2.25 1.91 1.39

Total debt : Equity ratio 19.81 50.5 39.61 59.41 58.42 58.42

Net assets per share Rs. 49.85 49.65 43.42 29.25 29.61 27.18

Interest cover Times 3.43 7.44 14.79 1.21 3.89 11.76

EMPLOYEE PRODUCTIVITY RATIO

Production per employee Tons 441 584 718 588 785 893

Revenue per employee Rs. millions 112 130 102 68 81 85

You might also like

- (4X - A5) - 08161373182 - Shelf-Life Obgyn 2015 PDFDocument358 pages(4X - A5) - 08161373182 - Shelf-Life Obgyn 2015 PDFcmbhganteng83% (6)

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Grammar: Pre-Intermediate Progress Test Unit 9 Test ADocument6 pagesGrammar: Pre-Intermediate Progress Test Unit 9 Test AKeita Straume100% (2)

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet

- Double Ur Perfectmoney 100% Working TricksDocument4 pagesDouble Ur Perfectmoney 100% Working Tricksblackhat0637100% (1)

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ankita CFDocument3 pagesAnkita CFRahul YadavNo ratings yet

- Mehran Sugar Mills - Six Years Financial Review at A GlanceDocument3 pagesMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaNo ratings yet

- Corporate Reporting Assignment (IIL)Document2 pagesCorporate Reporting Assignment (IIL)Areeba IftikharNo ratings yet

- State Bank of India: Key Financial Ratios - in Rs. Cr.Document4 pagesState Bank of India: Key Financial Ratios - in Rs. Cr.zubairkhan7No ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- Annual Accounts 2021Document11 pagesAnnual Accounts 2021Shehzad QureshiNo ratings yet

- RanbaxyDocument2 pagesRanbaxyamit_sachdevaNo ratings yet

- Valuation Index GroupDocument2 pagesValuation Index Groupbaongan23062003No ratings yet

- Marico RatiosDocument8 pagesMarico RatiosAmarnath DixitNo ratings yet

- Performance Management 2024 Spring Final EssayDocument9 pagesPerformance Management 2024 Spring Final EssayNgọc Linh LêNo ratings yet

- RatiosDocument2 pagesRatiosKishan KeshavNo ratings yet

- Kapco LTD: For The Year Ended 2007Document10 pagesKapco LTD: For The Year Ended 2007Zeeshan AdeelNo ratings yet

- Ashok Leyland Limited: RatiosDocument6 pagesAshok Leyland Limited: RatiosAbhishek BhattacharjeeNo ratings yet

- NFL Annual Report 2019 Compressed PDFDocument130 pagesNFL Annual Report 2019 Compressed PDFZUBAIRNo ratings yet

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Document4 pagesInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1No ratings yet

- RatiosDocument2 pagesRatiosnishantNo ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Document6 pagesKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghNo ratings yet

- Attock Cement LimitedDocument9 pagesAttock Cement Limitedmuhammad farhanNo ratings yet

- Key Financial RatiosDocument16 pagesKey Financial Ratioskriss2coolNo ratings yet

- Gul Ahmad Textiles LimitedDocument3 pagesGul Ahmad Textiles LimitedmadihaNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- Christ University Christ UniversityDocument3 pagesChrist University Christ Universityvijaya senthilNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- BaljiDocument4 pagesBaljiBalaji SuburajNo ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- Ratio Analysis of Bata IndiaDocument2 pagesRatio Analysis of Bata IndiaSanket BhondageNo ratings yet

- Working Excel - BASFDocument3 pagesWorking Excel - BASFVikin JainNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Bosch 5confrDocument2 pagesBosch 5confrSsNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Shinansh TiwariDocument11 pagesShinansh TiwariAnuj VermaNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Per Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05Document4 pagesPer Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05alihayatNo ratings yet

- Campbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesDocument2 pagesCampbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesBhavesh MotwaniNo ratings yet

- Campbell SoupsDocument2 pagesCampbell SoupsBhavesh MotwaniNo ratings yet

- Reliance Industries LTD (RIL IN) - GrowthDocument8 pagesReliance Industries LTD (RIL IN) - GrowthMayank kapoorNo ratings yet

- Balance Sheet (In Crores) - MSN LABORATARIESDocument3 pagesBalance Sheet (In Crores) - MSN LABORATARIESnawazNo ratings yet

- Profit and Loss Account of Akzo NobelDocument15 pagesProfit and Loss Account of Akzo NobelKaizad DadrewallaNo ratings yet

- Group3 - DIY - Garware Wall Ropes - Stock PitchDocument5 pagesGroup3 - DIY - Garware Wall Ropes - Stock PitchBhushanam BharatNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- 1 - Abhinav - Raymond Ltd.Document5 pages1 - Abhinav - Raymond Ltd.rajat_singlaNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- Financial Ratios of Federal BankDocument35 pagesFinancial Ratios of Federal BankVivek RanjanNo ratings yet

- Key Performance Indicators (Kpis) : FormulaeDocument4 pagesKey Performance Indicators (Kpis) : FormulaeAfshan AhmedNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- MarutiDocument2 pagesMarutiVishal BhanushaliNo ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsHarsh PuseNo ratings yet

- Data Patterns Income&CashFlow - 4 Years - 19052020Document8 pagesData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNo ratings yet

- Relaxo Footwear - Updated BSDocument54 pagesRelaxo Footwear - Updated BSRonakk MoondraNo ratings yet

- AkzoNobel Last Five YearsDocument2 pagesAkzoNobel Last Five YearsNawair IshfaqNo ratings yet

- CBRMDocument14 pagesCBRMSurajSinghalNo ratings yet

- Final Cfa UltjDocument190 pagesFinal Cfa UltjYunita PutriNo ratings yet

- Nobel PrizeDocument10 pagesNobel PrizeHarsh Mittal-36No ratings yet

- LO4Document3 pagesLO4Saima ArshadNo ratings yet

- Handball (also-WPS OfficeDocument14 pagesHandball (also-WPS OfficeMonaifah SaidaliNo ratings yet

- South Africa and IndiaDocument28 pagesSouth Africa and IndiaLittleWhiteBakkieNo ratings yet

- Dube and Shereni AbstractDocument2 pagesDube and Shereni AbstractNdabezinhleNo ratings yet

- Corpuz vs. PeopleDocument2 pagesCorpuz vs. PeopleAli NamlaNo ratings yet

- Dopt OM No. 19.11.2009Document2 pagesDopt OM No. 19.11.2009Veda PrakashNo ratings yet

- The Thin Red Line: European Philosophy and The American Soldier at WarDocument8 pagesThe Thin Red Line: European Philosophy and The American Soldier at Warnummer2No ratings yet

- p3 Business Analysis Case StudyDocument9 pagesp3 Business Analysis Case StudyMangulalNo ratings yet

- Grant Thornton Tax Alert 2009 CIT FinalizationDocument2 pagesGrant Thornton Tax Alert 2009 CIT Finalizationngoba_cuongNo ratings yet

- Irr Republic Act No. 7832Document12 pagesIrr Republic Act No. 7832ritchellNo ratings yet

- Activity 3.1Document4 pagesActivity 3.1Javen Lei Miranda MarquezNo ratings yet

- National Coal Co. v. CIR 46 Phil 583Document6 pagesNational Coal Co. v. CIR 46 Phil 583Dennis VelasquezNo ratings yet

- AIFs in GIFT IFSC Booklet October 2020Document12 pagesAIFs in GIFT IFSC Booklet October 2020Karthick JayNo ratings yet

- Personality, Attitudes, and Work BehaviorsDocument3 pagesPersonality, Attitudes, and Work BehaviorsNoella ColesioNo ratings yet

- Herrera v. Luy Kim GuanDocument4 pagesHerrera v. Luy Kim GuanMarizPatanaoNo ratings yet

- Capital Asset Pricing Model: Objectives: After Reading This Chapter, You ShouldDocument17 pagesCapital Asset Pricing Model: Objectives: After Reading This Chapter, You ShouldGerrar10No ratings yet

- Temporal DragDocument19 pagesTemporal DragRegretteEtceteraNo ratings yet

- Top Secret America - A Washington Post Investigation - A Hidden World, Growing Beyond ControlDocument51 pagesTop Secret America - A Washington Post Investigation - A Hidden World, Growing Beyond ControlMark CottellNo ratings yet

- Internal Customer SatisfactionDocument23 pagesInternal Customer Satisfactionnavinchopra1986No ratings yet

- Panama Canal Case Study: Tanmay SinghDocument5 pagesPanama Canal Case Study: Tanmay SinghGauravTiwariNo ratings yet

- France S Approach To The Indo Pacific RegionDocument4 pagesFrance S Approach To The Indo Pacific RegionDievca ToussaintNo ratings yet

- Presentation To IEEDocument17 pagesPresentation To IEEomairakhtar12345No ratings yet

- Unit - Ii Indian Partnership Act, 1932Document17 pagesUnit - Ii Indian Partnership Act, 1932shobhanaNo ratings yet

- MAnfredo Tafuri's Theory of The Architectural Avant-GardeDocument36 pagesMAnfredo Tafuri's Theory of The Architectural Avant-GardeTomas Aassved HjortNo ratings yet

- He Thong Phong Khong Viet NamDocument45 pagesHe Thong Phong Khong Viet NamminhcomputerNo ratings yet