Professional Documents

Culture Documents

Pre-Market Report 27-05

Pre-Market Report 27-05

Uploaded by

Sumit nihalaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pre-Market Report 27-05

Pre-Market Report 27-05

Uploaded by

Sumit nihalaniCopyright:

Available Formats

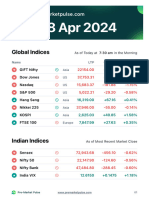

Pre-Market Report by Sharemarket IPO Guru

Mon, 27 May 2024

Global Indices As of Today at 7:50 am in the Morning

Name LTP Change Change%

GIFT Nifty Asia 23,034.0 -5.5 -0.02%

Dow Jones US 39,069.59 +4.33 +0.01%

Nasdaq US 16,920.79 +184.76 +1.10%

S&P 500 US 5,304.72 +36.88 +0.70%

Hang Seng Asia 18,586.00 -22.94 -0.12%

Nikkei 225 Asia 38,754.00 +139.50 +0.36%

KOSPI Asia 2,702.98 +15.38 +0.57%

FTSE 100 Europe 8,317.59 -21.64 -0.26%

Indian Indices As of Most Recent Market Close

Sensex 75,410.39 -7.65 -0.01%

Nifty 50 22,957.10 -10.55 -0.05%

Nifty Bank 48,971.65 +203.05 +0.42%

India VIX 21.7100 +0.3300 +1.54%

Sharemarket IPO Guru 01

Market Bulletin

1. Sensex and Nifty are set for a flat start today.

2. Asian markets rose, supported by expectations from upcoming

economic data from China and India.

3. U.S. markets closed higher last week; Nasdaq achieved a fifth

consecutive week of gains.

4. Friday's close: Sensex slightly down by 0.01%, Nifty down by 0.05%.

5. Key focus areas for the week: Q4 earnings, Lok Sabha election turnout,

macroeconomic data, foreign fund inflows, and oil prices.

6. Bank of Japan to continue cautious approach to inflation targeting.

7. Key stocks to watch: Adani Group, Ireda, JSW Infrastructure, Tata

Technologies due to index changes and fund-raising plans.

8. Flls turned net buyers after heavy selling earlier in May, influenced by

Chinese market performance.

9. U.S. capital goods orders increased in April, surpassing expectations.

10. U.S. consumer inflation expectations improved in late May.

11. Crude oil prices stabilized after a significant drop last week.

Sharemarket IPO Guru 02

Technical Analysis

50 Nifty

1. Achieved milestone of 23,000 on May 23 but closed at 22,957; formed

a small-bodied bullish candlestick with a long upper shadow.

2. Expected volatility due to upcoming Lok Sabha elections on June 4.

3. Resistance levels: 23,009, 23,037, 23,082; support levels: 22,919, 22,891,

22,845.

4. Maintained higher highs for 10 consecutive days; RSI at 67.26 indicates

positive momentum.

5. Formed strong bullish candlestick patterns on weekly charts,

continuing bullish trend after Bullish Piercing Line pattern.

Bank Nifty

1. Formed a bullish candlestick pattern on the daily and weekly charts.

2. Resistance levels: 49,046, 49,142, 49,298 (pivot points), 49,336, 49,975

(Fibonacci retracement).

3. Support levels: 48,734, 48,638, 48,482 (pivot points), 48,265, 48,017

(Fibonacci retracement).

4. Maintained higher highs and higher lows formation for the second

consecutive session.

5. RSI at 60.68, indicating positive momentum.

Sharemarket IPO Guru 03

Nifty Call Options Data

1. Maximum Call open interest at the 24,000 strike, acting as key

resistance.

2. Followed by 23,500 and 23,000 strikes.

3. Maximum Call writing at 24,000, followed by 23,500 and 23,900 strikes.

4. Maximum Call unwinding at 22,700, followed by 22,500 and

22,900 strikes.

Nifty Put Options Data

1. Maximum open interest at 23,000 strike, acting as key level.

2. Followed by 22,500 and 22,000 strikes.

3. Maximum Put writing at 23,000, followed by 22,500 and 22,900 strikes.

4. Put unwinding at 21,700, followed by 24,000 strikes.

Technical Analysis Source:

https://www.moneycontrol.com/news/business/markets/trade-setup-for-

Monday-15-things-to-know-before-opening-bell-23-12637641.html

Sharemarket IPO Guru 04

Key Stocks to Watch

1. Divi's Laboratories: Revenue up 18.1% to ₹2,303 crore, net profit up 67%

to ₹538 crore. EBITDA margin at 31.7%, cash at ₹3,200 crore end of Fy24.

2. NTPC: Revenue up 7.6% to ₹47,622 crore, net profit up 26.9% to 6,168

crore. Targeting new thermal orders of 15.2 GW.

3. Hindustan Copper: Margin nears 40%, net profit down 6%. Revenue

flat at ₹565 crore, copper prices increasing.

4. Aurobindo Pharma: Revenue up 17.1% to ₹7,580.5 crore. Margins above

20% for second straight quarter, one-time loss of ₹122 crore.

5. Manappuram Finance: Net Interest Income up 33.2% to ₹1,580 crore,

net profit up 35.7% to ₹563.5 crore. Gold tonnage highest in nine quarters.

6. Indiabulls Housing Finance: AUM down 2.5% to ₹65,335 crore, net profit

up 23.1%. Provisions up 2.5x to ₹290 crore.

7. Karnataka Bank: Net profit down 22.5% to ₹274.2 crore. Employee

expenses up 27.1%, provisions up 27.9%.

8. SPARC: Net loss widens to ₹105.8 crore, revenue down to ₹16.56 crore.

CFO Chetan Rajpara resigns.

9. Torrent Pharma: Revenue up 10.2% to ₹2,745 crore, EBITDA margin at

32.2%. India revenue up 10%, US sales down 6%.

10. Glenmark: Revenue up 2% to ₹3,062 crore, net loss widens to 1,218

crore. India revenue up 12.9%.

11. Sundaram Finance: Disbursements up 18.1% at ₹6,209 crore, net profit

up 60% to ₹506.3 crore. AUM up 27.3% to ₹43,987 crore.

Sharemarket IPO Guru 05

Key Stocks

Key Stocks to Watch

to Watch

12. Affle India: Revenue up 42.3% to ₹506.2 crore, net profit up 40% to

₹87.5 crore. EBITDA margin flat at 19.3%.

13. MM Forgings: Board meet on May 29 to consider bonus issue, dividend

along with quarterly earnings.

FII were net sellers with total sales amounting to

FII

Rs -944.8 Cr on 24, May 2024

DII were net buyers with total sales amounting to

DII

Rs 2320.3 Cr on 24, May 2024

PCR of indices

Indices PCR Change

Nifty 1.02 -0.19

Bank Nifty 1.12 -0.1

Fin Nifty 1.06 -0.25

A PCR above 1 indicates that the put volume has exceeded the

call volume. It indicates an increase in the bearish sentiment.

A PCR below 1 indicates that the call volume exceeds the put volume.

It signifies a bullish market ahead.

Sharemarket IPO Guru 06

Feedback

Do you have any feedback or suggestions? We'd love

to hear from you. Please feel free to send an email to

info@sharemarketipo.in

Contact Us

info@sharemarketipo.in

+91 6355 164 289

sharemarketipo.in

Privacy:

We respect your privacy. Your personal details and phone number are secure with us and will not be shared

with anyone.

Disclaimer:

By utilising "SHARE MARKET IPO" it's important to acknowledge that our service does not offer investment tricks,

tips, or specific buy or sell recommendations. Our reports are crafted for informational purposes only. While we

strive for accuracy, the contents of the PDF may contain errors; therefore, we strongly encourage you to

conduct your own research before making any investment decisions. "Pre-Market Pulse" accepts no

responsibility for the outcomes of your investment choices. It is your responsibility to perform due diligence.

The information we provide is sourced from publicly available data; we do not engage in independent

research or endorse any specific investment strategies. If at any point you decide that "Pre-Market Pulse" does

not align with your informational needs, you have the option to discontinue receiving our reports and exit our

community.

Terms & Conditions:

By subscribing to "SHARE MARKET IPO" you're choosing to stay informed with the latest market news. We

diligently work to deliver regular reports on market trends, but please understand that there may occasionally

be days when we are unable to send a report. Recognizing the need for flexibility, we offer a refund policy that

allows for cancellations within three days of your purchase. It's crucial to note that "Pre-Market Pulse" does not

provide financial analysis or expert advice; our service is focused on consolidating and presenting the latest

market news. Your subscription to our services indicates your agreement to these terms. We reserve the right

to modify these terms at any time, and your continued engagement with "Pre-Market Pulse" reflects your

acceptance of any such changes.

Source:

Information sourced from Investing.com, Moneycontrol, and many other online publications.

Sharemarket IPO Guru 07

You might also like

- High Probability Scalping Strategies: Day Trading Strategies, #3From EverandHigh Probability Scalping Strategies: Day Trading Strategies, #3Rating: 4.5 out of 5 stars4.5/5 (5)

- (GEMATMW) InvestagramsDocument3 pages(GEMATMW) InvestagramsCourtney TulioNo ratings yet

- Reading Order Flow For Unusual Options Activity PDFDocument26 pagesReading Order Flow For Unusual Options Activity PDFbonobomonkey50% (4)

- Bear Bull Traders ManualDocument37 pagesBear Bull Traders ManualVince Field100% (2)

- Alphatrends Understanding Market Structure PDFDocument1 pageAlphatrends Understanding Market Structure PDFSino33% (3)

- Stochastic Oscillator PDFDocument3 pagesStochastic Oscillator PDFSandeep MishraNo ratings yet

- Scalping Strategy-1Document11 pagesScalping Strategy-1Natarajan100% (3)

- Pre-Market Report 07-05Document7 pagesPre-Market Report 07-05biplabmajumderNo ratings yet

- Pre-Market Report 06-05Document7 pagesPre-Market Report 06-05biplabmajumderNo ratings yet

- Pre-Market Report 31-05Document7 pagesPre-Market Report 31-05Sumit nihalaniNo ratings yet

- Pre-Market Report 22-05Document7 pagesPre-Market Report 22-05Sumit nihalaniNo ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Pre -market report 26-06Document8 pagesPre -market report 26-06Sumit nihalaniNo ratings yet

- Pre - Market Report 11-06Document7 pagesPre - Market Report 11-06Movies Dfdtqtt1tNo ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Pre-Market PulseDocument9 pagesPre-Market PulserohitcmauryaNo ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulsejoew71437No ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsedeondalmeida17No ratings yet

- Wed, 5 Jun 2024: Global IndicesDocument7 pagesWed, 5 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulseytmandar29No ratings yet

- Tue, 4 Jun 2024: Global IndicesDocument7 pagesTue, 4 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Pre-Market PulseDocument7 pagesPre-Market Pulsesamplemail3000No ratings yet

- Pre Market PulseDocument8 pagesPre Market PulsemueenudheenNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- MOSt Market Outlook 13 TH May 2024Document10 pagesMOSt Market Outlook 13 TH May 2024sandeepfafsNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsefollowfury.servicesNo ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 26 June 2012Document9 pagesDaily Equty Report by Epic Research - 26 June 2012Drew PetersonNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 27 June 2012Document10 pagesDaily Equty Report by Epic Research - 27 June 2012Ryan WalterNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 21 ST March 2024Document10 pagesMOSt Market Outlook 21 ST March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 7 TH February 2024Document10 pagesMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNo ratings yet

- Most Market Out Look 27 TH February 24Document12 pagesMost Market Out Look 27 TH February 24Realm PhangchoNo ratings yet

- MOSt Market Outlook 7 TH May 2024Document10 pagesMOSt Market Outlook 7 TH May 2024sandeepfafsNo ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 28 TH March 2024Document10 pagesMOSt Market Outlook 28 TH March 2024Sandeep JaiswalNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- Most Market Out Look 03072024Document11 pagesMost Market Out Look 03072024Debaleena Bakshi GuptaNo ratings yet

- Daily Equty Report by Epic Research - 29 June 2012Document10 pagesDaily Equty Report by Epic Research - 29 June 2012Arthur GentryNo ratings yet

- Daily Stock Market Briefing 10-06-2024Document11 pagesDaily Stock Market Briefing 10-06-2024Sanchit BagaiNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Derivatives Daily: Market SummaryDocument8 pagesDerivatives Daily: Market Summaryprasun1761No ratings yet

- MOSt Market Outlook 15 TH February 2024Document10 pagesMOSt Market Outlook 15 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Stock Market Briefing 07-06Document11 pagesDaily Stock Market Briefing 07-06Sanchit BagaiNo ratings yet

- Investing in Markets and Stockmarket by CapitalHeight.Document4 pagesInvesting in Markets and Stockmarket by CapitalHeight.Damini CapitalNo ratings yet

- Weekly Market UpdateDocument1 pageWeekly Market UpdateNeeta ShindeyNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- K 1 M 04 Z 0 W 7 e 3 K 1 J 0Document4 pagesK 1 M 04 Z 0 W 7 e 3 K 1 J 0RamCharyNo ratings yet

- 23 Daily Stock Market BriefingDocument10 pages23 Daily Stock Market BriefingMp HrNo ratings yet

- Daily Updates - March 27Document2 pagesDaily Updates - March 27rksapsecgrc010No ratings yet

- Daily Market Briefing 21-03-2024Document5 pagesDaily Market Briefing 21-03-2024Shaikh ParvezNo ratings yet

- MOSt Market Outlook 9 TH May 2024Document10 pagesMOSt Market Outlook 9 TH May 2024sandeepfafsNo ratings yet

- MOSt Market Outlook 16 TH May 2023Document10 pagesMOSt Market Outlook 16 TH May 2023Smit ParekhNo ratings yet

- Options Trading Strategies - Book Review - Guy Cohen, The Bible of Options StrategiesDocument3 pagesOptions Trading Strategies - Book Review - Guy Cohen, The Bible of Options StrategiesHome Options Trading33% (6)

- Priti Gupta Final SIP TECHNICAL ANALYSIS BLACK BOOKDocument71 pagesPriti Gupta Final SIP TECHNICAL ANALYSIS BLACK BOOKAnkit KumarNo ratings yet

- How To Become A Professional TraderDocument4 pagesHow To Become A Professional TraderColeen gaboyNo ratings yet

- Us Stocks DecDocument138 pagesUs Stocks DecRambhakt HanumanNo ratings yet

- Class Activity - Stock ValuationDocument2 pagesClass Activity - Stock ValuationKHIZAR SAQIBNo ratings yet

- What Is Dow TheoryDocument3 pagesWhat Is Dow TheorySumant SharmaNo ratings yet

- F&O Stocks With Lot SizeDocument22 pagesF&O Stocks With Lot SizeAditya GuptaNo ratings yet

- Nikhil Sharma 2020612Document72 pagesNikhil Sharma 2020612Mithu pardaanNo ratings yet

- Nifty All Listed Companies Mcap31032021 - 0Document86 pagesNifty All Listed Companies Mcap31032021 - 0K91BFS63No ratings yet

- Trading Ebook How To Make Money Shorting Stocks in Up and Down MarketsDocument7 pagesTrading Ebook How To Make Money Shorting Stocks in Up and Down Marketsmithun7No ratings yet

- IDirect TechnicalOutlook 2023Document34 pagesIDirect TechnicalOutlook 2023Subashgokul SNo ratings yet

- Eliot Waves E Book Part1 PDFDocument13 pagesEliot Waves E Book Part1 PDFByron Arroba0% (1)

- Beginners Guide For Investment in The Stock Market PDFDocument2 pagesBeginners Guide For Investment in The Stock Market PDFFinnotes orgNo ratings yet

- Point & FigureDocument89 pagesPoint & FigureJaideep Poddar100% (1)

- Ind Nifty EnergyDocument2 pagesInd Nifty EnergyAmit SharmaNo ratings yet

- Ind Nifty PharmaDocument2 pagesInd Nifty PharmaPrashant DalviNo ratings yet

- NSE-20230410-thewealthvriksh.comDocument44 pagesNSE-20230410-thewealthvriksh.comdhawansandeepNo ratings yet

- NSE CompaniesDocument174 pagesNSE Companiesragh14.balaNo ratings yet

- How To Catch A Falling KnifeDocument20 pagesHow To Catch A Falling KnifeamanryzeNo ratings yet

- Bollinger Band (Part 2)Document5 pagesBollinger Band (Part 2)Miguel Luz RosaNo ratings yet

- Technical TradingDocument9 pagesTechnical Tradingviníciusg_65No ratings yet

- What Are Some Basic Points Which We Must Know Before Go For Options TradingDocument7 pagesWhat Are Some Basic Points Which We Must Know Before Go For Options TradingAnonymous w6TIxI0G8lNo ratings yet

- A Beginners Guide To The Stock Market Everything You Need To Start Making Money Today by Kratter, Matthew R. (Kratter, Matthew R.)Document70 pagesA Beginners Guide To The Stock Market Everything You Need To Start Making Money Today by Kratter, Matthew R. (Kratter, Matthew R.)Simple ReaderNo ratings yet

- Free Chart Patterns BookDocument5 pagesFree Chart Patterns BookrasomasadewantoNo ratings yet