Professional Documents

Culture Documents

Pre-Market Report 31-05

Pre-Market Report 31-05

Uploaded by

Sumit nihalaniCopyright:

Available Formats

You might also like

- High Probability Scalping Strategies: Day Trading Strategies, #3From EverandHigh Probability Scalping Strategies: Day Trading Strategies, #3Rating: 4.5 out of 5 stars4.5/5 (5)

- Adidascorporatestrategy 1Document35 pagesAdidascorporatestrategy 1flinks100% (3)

- Pre-Market Report 22-05Document7 pagesPre-Market Report 22-05Sumit nihalaniNo ratings yet

- Pre-Market Report 27-05Document7 pagesPre-Market Report 27-05Sumit nihalaniNo ratings yet

- Pre-Market Report 07-05Document7 pagesPre-Market Report 07-05biplabmajumderNo ratings yet

- Pre-Market Report 06-05Document7 pagesPre-Market Report 06-05biplabmajumderNo ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Pre - Market Report 11-06Document7 pagesPre - Market Report 11-06Movies Dfdtqtt1tNo ratings yet

- Pre -market report 26-06Document8 pagesPre -market report 26-06Sumit nihalaniNo ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Pre-Market PulseDocument9 pagesPre-Market PulserohitcmauryaNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulsejoew71437No ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulseytmandar29No ratings yet

- Pre-Market PulseDocument7 pagesPre-Market Pulsesamplemail3000No ratings yet

- Pre Market PulseDocument8 pagesPre Market PulsemueenudheenNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsedeondalmeida17No ratings yet

- Tue, 4 Jun 2024: Global IndicesDocument7 pagesTue, 4 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Wed, 5 Jun 2024: Global IndicesDocument7 pagesWed, 5 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsefollowfury.servicesNo ratings yet

- MOSt Market Outlook 13 TH May 2024Document10 pagesMOSt Market Outlook 13 TH May 2024sandeepfafsNo ratings yet

- Daily Equty Report by Epic Research - 26 June 2012Document9 pagesDaily Equty Report by Epic Research - 26 June 2012Drew PetersonNo ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 27 June 2012Document10 pagesDaily Equty Report by Epic Research - 27 June 2012Ryan WalterNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Investing in Markets and Stockmarket by CapitalHeight.Document4 pagesInvesting in Markets and Stockmarket by CapitalHeight.Damini CapitalNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Most Market Out Look 27 TH February 24Document12 pagesMost Market Out Look 27 TH February 24Realm PhangchoNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 7 TH February 2024Document10 pagesMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 21 ST March 2024Document10 pagesMOSt Market Outlook 21 ST March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- 9 Trading Tips For Successful Day To Day Trading For Traders by CapitalHeight.Document4 pages9 Trading Tips For Successful Day To Day Trading For Traders by CapitalHeight.Damini CapitalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- MOSt Market Outlook 14 TH February 2024Document10 pagesMOSt Market Outlook 14 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 15 TH February 2024Document10 pagesMOSt Market Outlook 15 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 16 TH May 2023Document10 pagesMOSt Market Outlook 16 TH May 2023Smit ParekhNo ratings yet

- MOSt Market Outlook 28 TH March 2024Document10 pagesMOSt Market Outlook 28 TH March 2024Sandeep JaiswalNo ratings yet

- Commodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Document4 pagesCommodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Narnolia Securities LimitedNo ratings yet

- MOSt Market Outlook 7 TH May 2024Document10 pagesMOSt Market Outlook 7 TH May 2024sandeepfafsNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- MOSt Market Outlook 3 RD April 2024Document10 pagesMOSt Market Outlook 3 RD April 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 10 July 2012Document8 pagesDaily Equty Report by Epic Research - 10 July 2012Raphael AndersonNo ratings yet

- Weekly Market UpdateDocument1 pageWeekly Market UpdateNeeta ShindeyNo ratings yet

- MOSt Market Outlook 9 TH May 2024Document10 pagesMOSt Market Outlook 9 TH May 2024sandeepfafsNo ratings yet

- Daily Newsletter Feb2Document10 pagesDaily Newsletter Feb2amjadyusuf118No ratings yet

- K 1 M 04 Z 0 W 7 e 3 K 1 J 0Document4 pagesK 1 M 04 Z 0 W 7 e 3 K 1 J 0RamCharyNo ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- 5.3 Break-Even Analysis Test PDFDocument2 pages5.3 Break-Even Analysis Test PDFGermanRobertoFong100% (1)

- Invoice DHL No. JKTR002114131Document3 pagesInvoice DHL No. JKTR002114131Tri Wahyuni100% (2)

- Introduction To Indian Detergent MarketDocument3 pagesIntroduction To Indian Detergent MarketAditya PrasadNo ratings yet

- Ans Ch28 Igcse Business Studies TCDDocument3 pagesAns Ch28 Igcse Business Studies TCDBarbsNo ratings yet

- Danila 1Document16 pagesDanila 1Chan Hui YanNo ratings yet

- Marketing of Financial Services: A Project On Morgan StanleyDocument5 pagesMarketing of Financial Services: A Project On Morgan Stanleysanket sunilNo ratings yet

- Preparing Your Business Plan: by JaxworksDocument14 pagesPreparing Your Business Plan: by Jaxworksjlmp2005No ratings yet

- PR - Order in The Matter of M/s Orchid Cultivation Projects India LimitedDocument1 pagePR - Order in The Matter of M/s Orchid Cultivation Projects India LimitedShyam SunderNo ratings yet

- Summer Training Report (Saran Sir) FinalDocument81 pagesSummer Training Report (Saran Sir) Finalaman1203No ratings yet

- Exercise 7 Marketing EnvironmentDocument5 pagesExercise 7 Marketing EnvironmentAnwesha NathNo ratings yet

- Chapter 9 - PPT (New)Document43 pagesChapter 9 - PPT (New)Syarifah NourazlinNo ratings yet

- 40% Upfront Installment Payment Plan: Note:-Service Tax & All Other Charges As ApplicableDocument4 pages40% Upfront Installment Payment Plan: Note:-Service Tax & All Other Charges As ApplicableDhruv SainiNo ratings yet

- Topic 3 Mas 2Document12 pagesTopic 3 Mas 2Jamaica DavidNo ratings yet

- Nimblr TA: Technical Analysis Breakouts On Intraday Breakouts On IntradayDocument8 pagesNimblr TA: Technical Analysis Breakouts On Intraday Breakouts On Intradayaman.4uNo ratings yet

- Fixed Exchange Rate and Flexible Exchange RateDocument10 pagesFixed Exchange Rate and Flexible Exchange RateAnanya456No ratings yet

- HUE Advertising and PhotographyDocument22 pagesHUE Advertising and Photographyhueads100% (2)

- Marketing Plan: Marketiing Management Term ReportDocument13 pagesMarketing Plan: Marketiing Management Term ReportHayat Omer MalikNo ratings yet

- Sub: Stretegic Financial Managment (Semvi) Class: Tybms Paper: Model Questions FinanceDocument12 pagesSub: Stretegic Financial Managment (Semvi) Class: Tybms Paper: Model Questions FinanceNetflix ChillNo ratings yet

- Chunk 1 Applied Econ - 1ST SemDocument39 pagesChunk 1 Applied Econ - 1ST SemMary Ann EstudilloNo ratings yet

- Mardown, Discounts and BreakevenDocument43 pagesMardown, Discounts and BreakevenMady PunsalanNo ratings yet

- Urban Strategies For The Future Urban Development of Skopje and TurinDocument486 pagesUrban Strategies For The Future Urban Development of Skopje and TurinognenmarinaNo ratings yet

- Utility TheoryDocument21 pagesUtility Theoryfiza akhterNo ratings yet

- Local Bill PDFDocument1 pageLocal Bill PDFzahidNo ratings yet

- Busininess Math Chapter 3 1 PDFDocument57 pagesBusininess Math Chapter 3 1 PDFAngela Miles DizonNo ratings yet

- InvoiceDocument1 pageInvoiceKaran RamchandaniNo ratings yet

- OligopolyDocument16 pagesOligopolyLemar B CondeNo ratings yet

- Competitors AnalysisDocument4 pagesCompetitors AnalysistrimyneNo ratings yet

- LAW21Document4 pagesLAW21ygNo ratings yet

Pre-Market Report 31-05

Pre-Market Report 31-05

Uploaded by

Sumit nihalaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pre-Market Report 31-05

Pre-Market Report 31-05

Uploaded by

Sumit nihalaniCopyright:

Available Formats

Pre-Market Report by Sharemarket IPO Guru

Fri, 31 May 2024

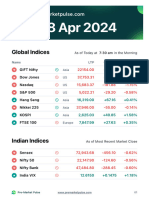

Global Indices As of Today at 7:49 am in the Morning

Name LTP Change Change%

GIFT Nifty Asia 22,686.5 +23.5 +0.10%

Dow Jones US 38,111.48 -330.06 -0.86%

Nasdaq US 16,737.08 -183.50 -1.08%

S&P 500 US 5,235.48 -31.47 -0.60%

Hang Seng Asia 18,450.00 +219.81 +1.21%

Nikkei 225 Asia 38,169.00 +156.50 +0.41%

KOSPI Asia 2,643.61 +8.17 +0.31%

FTSE 100 Europe 8,231.05 +47.98 +0.59%

Indian Indices As of Most Recent Market Close

Sensex 73,885.60 -617.30 -0.83%

Nifty 50 22,488.65 -216.05 -0.95%

Nifty Bank 48,682.35 +181.00 +0.37%

India VIX 24.1750 0.0000 0.00%

Sharemarket IPO Guru 01

Market Bulletin

1. Sensex and Nifty expected to open flat, tracking mixed global cues.

2. Asian markets mostly up, while US markets fell due to tech stock selloff.

3. US GDP growth revised down, jobless claims higher than expected.

4. Increased likelihood of a Fed rate cut in September.

5. Sensex and Nifty fell sharply on Thursday amid F&O expiry, extending

losses for the fifth session.

6. Japanese and South Korean markets rose; Hong Kong futures indicated

a lower opening.

7. US tech stocks saw significant selloff; Salesforce and Dell shares

dropped sharply.

8. China's manufacturing activity contracted unexpectedly in May.

9. Oil prices fell due to unexpected US gasoline stock build and Fed

comments on rate cuts.

10. India's real GDP growth rose to 7.60% in 2023-24 (vs 7.0% in 2022-23):

RBI.

11. NSE launched India's first EV sector index 'Nifty EV & New Age

Automotive'. It will track listed EV manufacturing and related companies.

12. Dollar weakened against major currencies after US GDP revision.

Sharemarket IPO Guru 02

Technical Analysis

50 Nifty

1. Market Performance: Nifty fell nearly 1%, closing at 22,489, forming a

bearish candlestick pattern.

2. Support Levels: Immediate supports are at 22,400 and 22,300.

3. Resistance Levels: Potential rebound could test resistance at

22,700-22,800.

4. Technical Indicators: Tested and defended 20-day SMA and 50%

Fibonacci retracement (21,821 to 23,111).

5. Patterns: Lower highs and lower lows for three consecutive days, with

a negative bias in RSI on daily and weekly charts.

Bank Nifty

1. Market Performance: Bank Nifty rose 0.37% to 48,682, forming a bullish

candlestick pattern.

2. Support Levels: Immediate supports are at 48,300 and 48,000.

3. Resistance Levels: Facing a hurdle at 49,000.

4. Technical Indicators: Rebounded from near the 20-day SMA, trading

above all key moving averages.

5. Patterns: Strongly defended 20-day EMA and mid-Bollinger Band,

indicating bullish strength.

Sharemarket IPO Guru 03

Nifty Call Options Data

1. Maximum Call open interest at 22,500 strike (2.31 crore contracts).

2. Significant Call writing at 22,500 strike (2.1 crore contracts added).

3. Other notable strikes: 22,600 (1.56 crore contracts), 23,000

(1.52 crore contracts).

4. Maximum Call unwinding at 23,500 strike (26.55 lakh contracts shed).

Nifty Put Options Data

1. Maximum Put open interest at 22,500 strike (1.24 crore contracts).

2. Significant Put writing at 22,500 strike (43.65 lakh contracts added).

3. Other notable strikes: 22,000 (94.07 lakh contracts), 22,300

(94.07 lakh contracts).

4. Maximum Put unwinding at 22,700 strike (39.37 lakh contracts shed).

Technical Analysis Source:

https://www.moneycontrol.com/news/business/markets/trade-setup-for-

Friday-15-things-to-know-before-opening-bell-23-12637641.html

Sharemarket IPO Guru 04

Key Stocks to Watch

1. Apollo Hospitals: EBITDA margin and net profit better than estimates.

Hospital occupancy at 65%, revenue up 16%.

2. Muthoot Finance: Net Interest Income at ₹2,134.8 crore. AUM growth of

20% year-on-year.

3. Bharat Dynamics: Net profit up 89% to ₹288.8 crore. Revenue up 7% to

854.1 crore.

4. Welspun Corp: Net profit up 19.7% to ₹287.3 crore. EBITDA margin at

7.4% from 10.3%.

5. Snowman Logistics: Net profit down 58.8% to ₹2.1 crore. Revenue up

12.6% to 126.5 crore.

6. Praj Industries: Net profit up 4.3% to ₹91.9 crore. Order intake at *924

crore.

7. Jio Financial Services: Launches Jio Finance app in Beta version,

integrating digital banking and UPI transactions.

8. Insurance Companies: Seek lower GST on insurance products from

18% to 12%.

9. Suven Pharma: Net profit down 56.9% to ₹53.4 crore. EBITDA margin

at 29% from 46.5%.

10. Mrs. Bectors Food: Revenue up 17.5% to ₹406.4 crore. Net profit up

21.3% to ₹33.6 crore.

11. Bharat Rasayan: Net profit at ₹67.1 crore from 30.3 crore. EBITDA

margin at 22.4% from 19.3%.

12. Gujarat Alkalies: Net loss of ₹46.2 crore. Revenue down 12% to 1,001.6

crore.

Sharemarket IPO Guru 05

13. Swan Energy: Net profit at ₹26.6 crore. Revenue up 49.8% to 1,398 crore.

14. Kewal Kiran Clothing: Net profit up 20% to ₹37.6 crore. Parent to invest

₹166.5 crore in Kraus Casuals.

15. KIMS: Arm to set up a super specialty hospital in Bengaluru.

16. Mold-Tek Packaging: Net profit down 21.7% to 18 crore. Selected as a

preferred supplier for Grasim Paints.

FII were net sellers with total sales amounting to

FII

Rs -3050.2 Cr on 30, May 2024

DII were net buyers with total sales amounting to

DII

Rs 3432.9 Cr on 30, May 2024

PCR of indices

Indices PCR Change

Nifty 0.52 -0.12

Bank Nifty 0.81 +0.16

Fin Nifty 0.6 -0.08

A PCR above 1 indicates that the put volume has exceeded the

call volume. It indicates an increase in the bearish sentiment.

A PCR below 1 indicates that the call volume exceeds the put volume.

It signifies a bullish market ahead.

Sharemarket IPO Guru 06

Feedback

Do you have any feedback or suggestions? We'd love

to hear from you. Please feel free to send an email to

info@sharemarketipo.in

Contact Us

info@sharemarketipo.in

+91 6355 164 289

sharemarketipo.in

Privacy:

We respect your privacy. Your personal details and phone number are secure with us and will not be shared

with anyone.

Disclaimer:

By utilising "SHARE MARKET IPO" it's important to acknowledge that our service does not offer investment tricks,

tips, or specific buy or sell recommendations. Our reports are crafted for informational purposes only. While we

strive for accuracy, the contents of the PDF may contain errors; therefore, we strongly encourage you to

conduct your own research before making any investment decisions. "Pre-Market Pulse" accepts no

responsibility for the outcomes of your investment choices. It is your responsibility to perform due diligence.

The information we provide is sourced from publicly available data; we do not engage in independent

research or endorse any specific investment strategies. If at any point you decide that "Pre-Market Pulse" does

not align with your informational needs, you have the option to discontinue receiving our reports and exit our

community.

Terms & Conditions:

By subscribing to "SHARE MARKET IPO" you're choosing to stay informed with the latest market news. We

diligently work to deliver regular reports on market trends, but please understand that there may occasionally

be days when we are unable to send a report. Recognizing the need for flexibility, we offer a refund policy that

allows for cancellations within three days of your purchase. It's crucial to note that "Pre-Market Pulse" does not

provide financial analysis or expert advice; our service is focused on consolidating and presenting the latest

market news. Your subscription to our services indicates your agreement to these terms. We reserve the right

to modify these terms at any time, and your continued engagement with "Pre-Market Pulse" reflects your

acceptance of any such changes.

Source:

Information sourced from Investing.com, Moneycontrol, and many other online publications.

Sharemarket IPO Guru 07

You might also like

- High Probability Scalping Strategies: Day Trading Strategies, #3From EverandHigh Probability Scalping Strategies: Day Trading Strategies, #3Rating: 4.5 out of 5 stars4.5/5 (5)

- Adidascorporatestrategy 1Document35 pagesAdidascorporatestrategy 1flinks100% (3)

- Pre-Market Report 22-05Document7 pagesPre-Market Report 22-05Sumit nihalaniNo ratings yet

- Pre-Market Report 27-05Document7 pagesPre-Market Report 27-05Sumit nihalaniNo ratings yet

- Pre-Market Report 07-05Document7 pagesPre-Market Report 07-05biplabmajumderNo ratings yet

- Pre-Market Report 06-05Document7 pagesPre-Market Report 06-05biplabmajumderNo ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Pre - Market Report 11-06Document7 pagesPre - Market Report 11-06Movies Dfdtqtt1tNo ratings yet

- Pre -market report 26-06Document8 pagesPre -market report 26-06Sumit nihalaniNo ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Pre-Market PulseDocument9 pagesPre-Market PulserohitcmauryaNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulsejoew71437No ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulseytmandar29No ratings yet

- Pre-Market PulseDocument7 pagesPre-Market Pulsesamplemail3000No ratings yet

- Pre Market PulseDocument8 pagesPre Market PulsemueenudheenNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsedeondalmeida17No ratings yet

- Tue, 4 Jun 2024: Global IndicesDocument7 pagesTue, 4 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Wed, 5 Jun 2024: Global IndicesDocument7 pagesWed, 5 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsefollowfury.servicesNo ratings yet

- MOSt Market Outlook 13 TH May 2024Document10 pagesMOSt Market Outlook 13 TH May 2024sandeepfafsNo ratings yet

- Daily Equty Report by Epic Research - 26 June 2012Document9 pagesDaily Equty Report by Epic Research - 26 June 2012Drew PetersonNo ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 27 June 2012Document10 pagesDaily Equty Report by Epic Research - 27 June 2012Ryan WalterNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Investing in Markets and Stockmarket by CapitalHeight.Document4 pagesInvesting in Markets and Stockmarket by CapitalHeight.Damini CapitalNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Most Market Out Look 27 TH February 24Document12 pagesMost Market Out Look 27 TH February 24Realm PhangchoNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 7 TH February 2024Document10 pagesMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 21 ST March 2024Document10 pagesMOSt Market Outlook 21 ST March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- 9 Trading Tips For Successful Day To Day Trading For Traders by CapitalHeight.Document4 pages9 Trading Tips For Successful Day To Day Trading For Traders by CapitalHeight.Damini CapitalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- MOSt Market Outlook 14 TH February 2024Document10 pagesMOSt Market Outlook 14 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 15 TH February 2024Document10 pagesMOSt Market Outlook 15 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 16 TH May 2023Document10 pagesMOSt Market Outlook 16 TH May 2023Smit ParekhNo ratings yet

- MOSt Market Outlook 28 TH March 2024Document10 pagesMOSt Market Outlook 28 TH March 2024Sandeep JaiswalNo ratings yet

- Commodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Document4 pagesCommodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Narnolia Securities LimitedNo ratings yet

- MOSt Market Outlook 7 TH May 2024Document10 pagesMOSt Market Outlook 7 TH May 2024sandeepfafsNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- MOSt Market Outlook 3 RD April 2024Document10 pagesMOSt Market Outlook 3 RD April 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 10 July 2012Document8 pagesDaily Equty Report by Epic Research - 10 July 2012Raphael AndersonNo ratings yet

- Weekly Market UpdateDocument1 pageWeekly Market UpdateNeeta ShindeyNo ratings yet

- MOSt Market Outlook 9 TH May 2024Document10 pagesMOSt Market Outlook 9 TH May 2024sandeepfafsNo ratings yet

- Daily Newsletter Feb2Document10 pagesDaily Newsletter Feb2amjadyusuf118No ratings yet

- K 1 M 04 Z 0 W 7 e 3 K 1 J 0Document4 pagesK 1 M 04 Z 0 W 7 e 3 K 1 J 0RamCharyNo ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- 5.3 Break-Even Analysis Test PDFDocument2 pages5.3 Break-Even Analysis Test PDFGermanRobertoFong100% (1)

- Invoice DHL No. JKTR002114131Document3 pagesInvoice DHL No. JKTR002114131Tri Wahyuni100% (2)

- Introduction To Indian Detergent MarketDocument3 pagesIntroduction To Indian Detergent MarketAditya PrasadNo ratings yet

- Ans Ch28 Igcse Business Studies TCDDocument3 pagesAns Ch28 Igcse Business Studies TCDBarbsNo ratings yet

- Danila 1Document16 pagesDanila 1Chan Hui YanNo ratings yet

- Marketing of Financial Services: A Project On Morgan StanleyDocument5 pagesMarketing of Financial Services: A Project On Morgan Stanleysanket sunilNo ratings yet

- Preparing Your Business Plan: by JaxworksDocument14 pagesPreparing Your Business Plan: by Jaxworksjlmp2005No ratings yet

- PR - Order in The Matter of M/s Orchid Cultivation Projects India LimitedDocument1 pagePR - Order in The Matter of M/s Orchid Cultivation Projects India LimitedShyam SunderNo ratings yet

- Summer Training Report (Saran Sir) FinalDocument81 pagesSummer Training Report (Saran Sir) Finalaman1203No ratings yet

- Exercise 7 Marketing EnvironmentDocument5 pagesExercise 7 Marketing EnvironmentAnwesha NathNo ratings yet

- Chapter 9 - PPT (New)Document43 pagesChapter 9 - PPT (New)Syarifah NourazlinNo ratings yet

- 40% Upfront Installment Payment Plan: Note:-Service Tax & All Other Charges As ApplicableDocument4 pages40% Upfront Installment Payment Plan: Note:-Service Tax & All Other Charges As ApplicableDhruv SainiNo ratings yet

- Topic 3 Mas 2Document12 pagesTopic 3 Mas 2Jamaica DavidNo ratings yet

- Nimblr TA: Technical Analysis Breakouts On Intraday Breakouts On IntradayDocument8 pagesNimblr TA: Technical Analysis Breakouts On Intraday Breakouts On Intradayaman.4uNo ratings yet

- Fixed Exchange Rate and Flexible Exchange RateDocument10 pagesFixed Exchange Rate and Flexible Exchange RateAnanya456No ratings yet

- HUE Advertising and PhotographyDocument22 pagesHUE Advertising and Photographyhueads100% (2)

- Marketing Plan: Marketiing Management Term ReportDocument13 pagesMarketing Plan: Marketiing Management Term ReportHayat Omer MalikNo ratings yet

- Sub: Stretegic Financial Managment (Semvi) Class: Tybms Paper: Model Questions FinanceDocument12 pagesSub: Stretegic Financial Managment (Semvi) Class: Tybms Paper: Model Questions FinanceNetflix ChillNo ratings yet

- Chunk 1 Applied Econ - 1ST SemDocument39 pagesChunk 1 Applied Econ - 1ST SemMary Ann EstudilloNo ratings yet

- Mardown, Discounts and BreakevenDocument43 pagesMardown, Discounts and BreakevenMady PunsalanNo ratings yet

- Urban Strategies For The Future Urban Development of Skopje and TurinDocument486 pagesUrban Strategies For The Future Urban Development of Skopje and TurinognenmarinaNo ratings yet

- Utility TheoryDocument21 pagesUtility Theoryfiza akhterNo ratings yet

- Local Bill PDFDocument1 pageLocal Bill PDFzahidNo ratings yet

- Busininess Math Chapter 3 1 PDFDocument57 pagesBusininess Math Chapter 3 1 PDFAngela Miles DizonNo ratings yet

- InvoiceDocument1 pageInvoiceKaran RamchandaniNo ratings yet

- OligopolyDocument16 pagesOligopolyLemar B CondeNo ratings yet

- Competitors AnalysisDocument4 pagesCompetitors AnalysistrimyneNo ratings yet

- LAW21Document4 pagesLAW21ygNo ratings yet