Professional Documents

Culture Documents

TAX ASSIGNMENT 2024 SUGGESTED SOLUTION MRVALENTINE

TAX ASSIGNMENT 2024 SUGGESTED SOLUTION MRVALENTINE

Uploaded by

Rybah CurrieCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAX ASSIGNMENT 2024 SUGGESTED SOLUTION MRVALENTINE

TAX ASSIGNMENT 2024 SUGGESTED SOLUTION MRVALENTINE

Uploaded by

Rybah CurrieCopyright:

Available Formats

QUESTION ONE

a) Briefly explain the following as per ITA, R.E. 2019

i) Imposition of income tax

ii) Scope of chargeability of income tax

iii) Total income

b) Briefly explain the determination of residential status of the person as per ITA, R.E. 2019

c) Dr Majimarefu has been a professor of marketing and head of Executive Development

Programme of University of Mbeya, Tanzania. The University has a housing scheme, under

which it provides accommodation to its staff who then suffer a 5% deduction on their salaries

as rent. The market value for the rent was 200,000/=

• Dr. Majimarefu was however employed under unspecified term in which provided among

other things a salary of 2,000,000/= per month.

• The total bill for 2021 for electricity, telephone and facilities was 680,000/=. This was fully

paid by the employer.

• He was appointed by the Centre for the promotion of Exports from Developing countries

to carry out a market survey in Tanzania on the market for developed countries and

products for exports to Europe. He was paid the full cost of study and an additional fee of

2,500,000/=. This study was carried out during the months of March and April, 2021.

• On a part time basis, he was offering consultancy services to Ughonile Business

Consultants. For this, he was paid 20,000/= per hour. During 2021 he spent 25 hours with

the Ughonile firm.

• His birthday coincided with Easter, 2021. During the 2021 Easter celebrations, the

University awarded him a birthday present worth 460,000/=. However, this present had a

market value of 500,000/= . In additional to that, another present was valued at 300,000/=

was awarded to him by his fellow workers.

• He was required to appear in the quarterly meeting of the university senate. The University

paid him 300,000/= for such attendance. During 2021, he attended all such meeting held,

while was still in the employment.

• A distribution of surplus made from short courses and consultancy carried out at the

University during 2020 was made in May 2021. For this purpose, he was paid a sum of

680,000/=

3

• He was provided with a brand-new car which was whole used for domestic purpose by his

wife. This car was purchased by the university for 6,000,000/=. Moreover, the running

expenses of the car totaling to 800,000/= were fully met by the University. The engine

capacity if 2500cc

• As part of the contract of employment, the employer was required to contribute an amount

equivalent to 150,000/= per month to a private pension scheme established in the

Netherlands. The scheme was not approved by the Commissioner.

• The total contribution to the approved retirement fund is 20% of the basic salary in which

the employer contributes 10% and the balance is contributed by the employee.

• The University also provides medical services to its employees, who are treated at Mission

Mbalizi Hospital. The total bill due to services rendered to Dr. Majimarefu and family

amount to 3,000,000/=. In addition, the company reimbursed him 600,000/= being medical

expenses personally incurred by him in another hospital which is not known by the

employer.

• He received interest from NBC of 800,000/= and a dividend from a local company of

600,000/= during 2021. No withholding tax was deducted at the source.

• The employer met the expenses of 2,000,000/= for transporting him and his belongings

back home to the Netherlands.

• Dr. Majimarefu is one of the trustees in KASHESHE TRUST, a non resident trust. On 15th

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

October 2021 he received 500,000/= as distribution for the trust.

• During the year Dr. Majimarefu sold 10 hectors of land, which was at Forest Mpya and

received 25,000,000/=. He purchased this land for 15,000,000/= in 2015. Mzee Abdallah

had used this land for agricultural purposes for two years before had decided to sell it to

Dr. Majimarefu

• Dr. Majimarefu was given an interest free loan of 8,000,000/= payable in two calendar

years on monthly installment (assume the statutory interest rate if 15% p.a)

• On 31st October 2021, Dr. Majimarefu terminated his contract of service and University of

Mbeya decided to pay him 20,000,000/= as terminal benefit to him. The contract was for

unspecified term and provide for compensation.

Required:

4

By applying relevant provisions of ITA revised 2019, compute Dr. Majimarefu for financial year

2021

a) Income for investment

b) Income from business

c) Income from employment

d) Total Income Taxable income for financial year 2021

e) Justify the tax treatment made on each of the items appeared on computation of (a),(b)

and (c) above by quoting the relevant provisions of ITA.

SUGGESTED SOLUTION

a) Explanation of Key Concepts as per ITA, R.E. 2022

i) Imposition of Income Tax:

Imposition of income tax involves the process by which the government assesses and collects taxes

on individuals' and entities' earnings, gains, and other taxable income. The charge to tax is

explained under Section 4 of ITA, R.E. 2022 where 'charging' means imposition of income tax; or

levy or subjection of particular source of income or person to income tax Charge to tax under

section 4 is limited to:

a) Total income for a year of income

b) Repatriated income of a domestic permanent establishment (defined under section 3) for a year

of income

c) Final withholding tax/payments during the year (those which satisfies the needs of the

Commissioner and thus needs no further assessment, i.e. are regarded as final, e.g. interest from

savings bank account)

ii) Scope of Chargeability of Income Tax:

The scope of chargeability of income tax refers to the range and extent to which income is subject

to tax under the ITA. This includes all income derived from Tanzania and, in certain cases, income

from abroad. The Act defines taxable income as per section 6 as “income of a person for a year of

income from any employment, business or investment”. It also sets out specific provisions for

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

different types of taxpayers, including individuals, partnerships, companies, and trusts, ensuring

that all relevant income sources are captured within the tax net.

iii) Total Income:

Total income, as defined by the ITA, as per section 5(1) “The total income of a person shall be the

sum of the person's chargeable income for the year of income from each employment, business

and investment less any reduction allowed for the year of income under section 61 relating to

retirement contributions to approved retirement funds.”

This means is the aggregate of all taxable income sources an individual or entity receives

in a tax year, after allowing for permissible deductions and exemptions. This includes employment

income, business income, investment income, and any other income deemed taxable by the Act.

Calculating total income is crucial for determining the amount of tax payable.

b) Determination of Residential Status of a Person as per ITA, R.E. 2022

The determination of a person's residential status under the ITA is essential for establishing their

tax liability. A resident taxpayer is generally subject to tax on worldwide income, while a non-

resident taxpayer is taxed only on income sourced within Tanzania. The ITA outlines several

criteria for determining residency:

i. Individual Residency: is explain under section 66 (1) “An individual is considered a

resident if they have a permanent home in Tanzania, spend 183 days or more in Tanzania

during the tax year, or are present in Tanzania during the tax year and in each of the two

preceding years for periods averaging more than 122 days a year.”

ii. Company Residency: A company is resident in Tanzania if it is incorporated in Tanzania

or if its management and control are exercised in Tanzania this is accordance to section

66(4).

iii. Other Entities: For entities such as trusts under section 66(3) and partnerships under

section 66(2), residency is typically determined by the location of management and control

or where the trust or partnership is established or operates from.

These criteria ensure that the tax system fairly assesses individuals and entities based on their

connection to Tanzania, thereby capturing the appropriate income for taxation.

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

(b) MBEYA UNIVERSITY IS TREATEAD AS PUBLIC ORGANIZATION

Name of tax payer: Majengo LTD

Source of Income: Investment, Business and Employment income

Residential status: Residential

YOI: 2022

Statement of computation of chargeable income from Investment, Business and Employment

income for YOI 2012

Category Description Amount (TZS)

(a) Investment Income

Interest from NBC 800,000

Dividend from a local company 600,000

Trust distribution (KASHESHE TRUST) 500,000

Capital gain from land sale 10,000,000

Total Investment Income 11,900,000

(b) Business Income Description Amount (TZS)

Consultancy with Ughonile Business Consultants 500,000

Total Business Income 500,000

(c) Employment

Income Description Amount (TZS)

Basic Salary (2,000,000 TZS/month * 10 months) 20,000,000

Rent deduction (5% of salary) NILL

Electricity, telephone, facilities (employer paid) NILL

Market survey fee NILL

Birthday present from university NILL

Birthday present from colleagues NILL

Senate meeting attendance fee 1200,000

Short courses surplus distribution 680,000

Private pension scheme contribution by employer 1,800,000

Medical services (employer paid) NILL

Medical expenses reimbursement 600,000

Transport expenses for relocation NILL

Interest-free loan benefit (8,000,000 TZS at 15%) 1,200,000

Terminal benefit 20,000,000

Total Employment Income 44,580,000

(d) Total Taxable

Income Description Amount (TZS)

Total Investment Income 11,900,000

Total Business Income 500,000

Total Employment Income 44,580,000

Total Taxable Income 56,980,000

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

(e) Justification of Tax Treatment

TYPE OF ITA quotation

TRANSACTION PROVISION

1. Interest from 9(2)(a) any dividend, distribution of a trust, gains of an insured from

NBC: life insurance, gains from an interest in an unapproved

retirement fund, interest, natural resource payment, rent or

royalty;

2. Dividend from a 9(2)(a) any dividend, distribution of a trust, gains of an insured from

local company: life insurance, gains from an interest in an unapproved

retirement fund, interest, natural resource payment, rent or

royalty;

3. Trust 9(2)(a) any dividend, distribution of a trust, gains of an insured from

distribution: life insurance, gains from an interest in an unapproved

retirement fund, interest, natural resource payment, rent or

royalty;

4. Capital gain from 9(2)(b) net gains from the realisation of investment assets of the

land sale: investment as calculated under Division III of this Part;

5. Consultancy 8(1)(a) service fees;

income:

6. Salary and 7(2)(a) "Payments of wages, salary, payment in lieu of leave, fees,

benefits: commissions, bonuses, gratuity or any subsistence travelling

entertainment or other allowance received in respect of

employment or service rendered"

7. Rent deduction: 7(3)(f) benefit derived from the use of residential premises by an

employee of the Government or any institution whose budget

is fully or substantially out of Government budget subvention;

8. Electricity, 7(3)(l) housing allowance, transport allowance, responsibility

telephone, allowance, extra duty allowance, overtime allowance,

facilities: hardship allowance and honoraria payable to an employee of

the Government or its institution whose budget is fully or

substantially paid out of Government budget subvention.

9. Market survey 7(2)(a) "Payments of wages, salary, payment in lieu of leave, fees,

fee: commissions, bonuses, gratuity or any subsistence travelling

entertainment or other allowance received in respect of

employment or service rendered"

10. Birthday 7(3)(j) payment that it is unreasonable or administratively

presents: impracticable for the employer to account for or to allocate to

their recipients;

11. Meeting fees 7(2)(a) "Payments of wages, salary, payment in lieu of leave, fees,

and surplus commissions, bonuses, gratuity or any subsistence travelling

distribution: entertainment or other allowance received in respect of

employment or service rendered"

12. Medical 7(2)(b) "Payments providing any discharge or reimbursement of

services and expenditure incurred by the individual or an associate of the

reimbursements: individual"

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

13. Transport 7(3)(g) payment providing passage of the individual, spouse of the

expenses for individual and up to four of their children to or from a place

relocation: of employment which correspond to the actual travelling cost

where the

14. Interest-free 7(2)(f) other payment made in respect of employment including

loan benefit: benefits in kind quantified in accordance with section 27;

15. Terminal 7(5)(b) if the contract is for an unspecified term and provides for

benefit: compensation on the termination thereof, such compensation

shall be deemed to have accrued in the period immediately

following such termination at a rate equal to the rate per

annum of the gains or profits from such contract received

immediately prior to such termination

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

QUESTION TWO

a) Briefly explain types of returns of income and states their contents

b) By giving three examples each, differentiate between final withholding payment and non-

final withholding payment

c) Explain the person not required to file the returns of income (ROI)

d) Differentiate between the statement of estimated tax payable (SOETP) and the final return

(FR)

e) KANYABUHURA CO. LTD (KCL) is a manufacturer of juice. KCL also has a fixed

deposit Account with the NBC (T) Limited, which earns the company interest income of

TShs. 1,600,000 during the year. The company’s estimate of its income for the YOI 20

12 is 9,500,000. The accounting period of LEL is the calendar year, the company received its

first payment of instalments of interest on the 20th of May 2012 of Tshs. 500,000 and withhold

ing tax payment was Tshs. 50,000.

Required: Determine

i) Tax instalment payable on the 31th March 2012

ii) Tax payable on the second instalments

iii) Due date for submitting the final returns

SUGGESTED SOLUTION

(a) Types of Returns of Income and Their Contents

Tax return is a statement filled to TRA which declares the estimated income and tax payable or the

final income and tax payable for each year of income.

Under the income tax law, a company is required to submit tax returns even if it has no taxable

income, the following are the types of return as provide by TRA websites

I. Estimated Return of Tax

Purpose: The estimated return of tax allows taxpayers to declare their anticipated income and tax

liability for the upcoming tax year. It helps the Tanzania Revenue Authority (TRA) ensure timely

tax payments throughout the year.

Contents:

Taxpayer Information: Name, TIN (Taxpayer Identification Number), address, and other

relevant identification details.

Estimated Income: Projected income for the tax year from all sources, including

employment, business, investment, and other income.

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

Estimated Deductions and Allowances: Expected deductions such as retirement

contributions, allowable business expenses, and other eligible deductions.

Estimated Taxable Income: The difference between estimated income and estimated

deductions.

Estimated Tax Liability: The tax amount calculated based on the estimated taxable

income using the applicable tax rates.

Payment Schedule: Details of the quarterly instalment payments to be made based on the

estimated tax liability.

II. Final Return of Tax

Purpose: The final return of tax is a comprehensive declaration of actual income, deductions, and

tax liabilities at the end of the tax year. It reconciles estimated tax payments with the actual tax

due.

Contents:

• Taxpayer Information: Name, TIN, address, and other relevant identification details.

• Actual Income: Detailed report of all income received during the tax year from

employment, business activities, investments, and other sources.

• Actual Deductions and Allowances: List of actual deductions claimed, including

documented expenses, contributions, and other allowable deductions.

• Taxable Income: Actual taxable income calculated by subtracting actual deductions from

actual income.

• Tax Computation: Calculation of the total tax liability based on the actual taxable income

and applicable tax rates.

• Estimated Payments Made: Summary of estimated tax payments made during the year.

• Tax Due or Refundable: Calculation of the balance, showing either additional tax due or

a refund owed to the taxpayer based on the difference between the actual tax liability and

the estimated payments made.

• Supporting Documentation: Attachments and schedules that provide detailed

breakdowns of income, expenses, deductions, and other relevant financial information.

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

(b) Differences Between Final Withholding Payment and Non-Final Withholding Payment

Final Withholding Payment

A final withholding payment is a tax deducted at source that constitutes the final tax liability on

that income. No further tax is payable on the amount received. Examples include:

i. Dividends from domestic companies

ii. Interest from financial institutions

iii. Rental income from immovable property for individual.

Non-Final Withholding Payment

A non-final withholding payment is an advance payment of tax deducted at source. The taxpayer

must report this income in their tax return and may be subject to further tax or eligible for a refund.

Examples include:

i. Rental income for companies

ii. Payments to contractors

iii. Professional fees

(c) Persons Not Required to File Returns of Income (ROI)

Certain individuals and entities are not required to file returns of income under specific conditions:

Individuals whose total income does not exceed the minimum taxable threshold

Individuals whose income consists solely of salary and wages where taxes have been fully

withheld at source (final withholding).

Pensioners whose only income is from pensions that are exempt from tax.

Non-resident individuals and entities not earning income within the country.

(d) Differences Between Statement of Estimated Tax Payable (SOETP) and Final Return

(FR)

No Statement of Estimated Tax Payable Final Return (FR)

(SOETP)

1 Filed periodically (e.g., quarterly) Filed annually at the end of the financial year.

2 Provides an estimate of income and tax Reports actual income and tax liability for the

liability for the period entire year.

3 Includes estimated payments to be Includes detailed breakdown of all income

made sources and deductions.

4 Used for advance tax planning and Reconciles estimated tax payments with actual

payments tax liability.

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

(e) Tax Computation for KANYABUHURA CO. LTD (KCL)

Data given

Estimate of Income for YOI 2012: 9,500,000 TZS

Interest Income: 1,600,000 TZS (is part of total income mentioned for the year)

Total income of YOI 2012: 9,500,000

Therefore,

Estimated Annual Tax Liability = Estimated Annual profit x tax

Annual Tax Liability = 9,500,000 /=×0.30

= 2,850,000/=

i) Tax Instalment Payable on 31st March 2012

according to income tax act chap 334 RE 2022, section 88(3) The estimated tax liability for the

first quarter is calculated as A – C/B

Were

A is the estimated tax payable by the instalment payer for the year of income at the time of the

instalment

B is the number of instalments remaining for the year of income including the current instalment;

C is the sum of any- (a) income tax paid during the year of income, but prior to the due date for

payment of the instalment, (b) income tax withheld under Subdivision A of Division II during the

year of income, but prior to the due date for payment of the instalment, (c) income tax paid in

accordance with section 83(3).

Tax Instalment Payable on 31st March 2012 = 2,850,000 /4

= 712,500/=

Tax Instalment Payable on 31st March 2012 is 712,500/=

ii) Tax Payable on the Second Instalment

Considering the interest income earned and the withholding tax already paid:

Second Instalment Payment = 2,850,000 – (712,500 + 50,000(FWP))/3

= 712,500/=

Tax Instalment Payable on 31st June 2012 is 695,833.33/=

iii) Due Date for Submitting the Final Returns

The final returns for the calendar year should be submitted after the end of the financial year,

typically by 31st June 2013.

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

QUESTION THREE

a) Briefly explain the following as per ITA,2004 (R.E. 2019)

i) Depreciable assets

ii) Commercial vehicle

iii) Initial allowance

iv) General principle of deduction

v) Trading stock allowance

vi) Exempt controlled resident Entity

b) Majengo Company Limited, a resident enterprise was engaged in diverse commercial

activities in the City centre of Mbeya. Below is the Income Statement of the aforementioned

company for the financial year ended on 31st December, 2022:

INCOME STATEMENT ( IN TZS)

Sales 9,025,780,000

Other income 650,000,000

Total income 9,675,780,000

Less: Cost of goods sold 7,182,000,000

Gross profit 2,493,780,000

Less: Expenses

Administrative expenses

Salaries and wages 403,000,000

Contribution to Wanangwa Pension Fund 224,000,000

(non-approved)

Traveling expenses 34,220,000

Repair and maintenance 91,990,000

Rent 34,800,000

Stationery and office consumables 44,300,000

Training expenses 211,500,000

Depreciation 150,100,000

Motor car expenses 61,000,000

Utility 21,000,000

Fines and penalty 15,002,000

General expenses 335,000,000

Office expenses 150,000,000

Selling expenses 701,042,000

Interest on loan 745,460,000

Audit fees 210,780,000

General expenses 250,000,000

Legal fees 170,000,000

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

Total expenses 3,853,194,000

Net profit before tax 1,359,414,000

Additional information:

i) It is estimated that ½ of the general expenses represents motor car expenses for the car

used by a director in another business owned by the wife of the Director of Finance.

ii) Legal fees include TZS.40,250,000 being legal fees incurred on signing the business

deal of supplies of commodities to a new client.

iii) The purchase cost included TZS.2,340,000 which was in respect of returnable

containers.

iv) The company also incurred TZS.1,500,000 for research in the effort of improving sales

of toilet soap manufactured by the company and TZS.3,000,000 for changing the doors for

the procurement office. All these costs included the cost of repair and maintenance.

v) General expenses figure includes TZS.1,490,000 being interest paid as a penalty for not

paying city levy on time.

vi) Business promotion includes TZS.25,000,000 used to buy a public speaker to be fixed

on a car for making product awareness to the customers.

vii) The depreciation allowance was calculated in respect of the following assets:

Two computers and their accessories which were used by the company secretary and

The accountants, were purchased at TZS.5,900,000 for each set.

viii). Five 13 seaters minibuses which were used as delivery van were purchased,

each at TZS.25,500,000.

ix). Two 50 seaters busses were added during the year at a value of TZS.180,000,000 in

total.

x). One pickup van for TZS.65,000,000 and one brand new Toyota car for

TZS.48,000,000 were put in use on 22nd March 2022.

xi). Furniture and fittings costing in total TZS.27,500,000.

xii). Purchased two heavy-duty Fuso trucks costing TZS.80,000,000 each during the year

and used them from 1st September 2022.

REQUIRED:

Calculate taxable income as well as the tax liabilities of the company for the year 2022.

SUGGESTED SOLUTION

(a) Definitions as per ITA, 2004 (R.E. 2019)

i) Depreciable Assets

"Depreciable asset" means an asset employed wholly and exclusively in the production of income

from a business, and which is likely to lose value because of wear and tear, obsolescence or the

passage of time but excludes goodwill, mineral or petroleum rights and other interest in land, a

membership interest in an entity and trading stock;

ii) Commercial Vehicle

under third schedule paragraph 10 “commercial vehicle” means - (a) a road vehicle designed to

carry loads of more than half a tonne or more than thirteen passengers; or (b) a vehicle used in a

transportation or vehicle rental business.

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

iii) Initial Allowance

According to income tax third schedule paragraph 2, Initial allowance is a one-time deduction

available in the first year an asset is put into use.

It is an additional depreciation deduction allowed under the Income Tax Act to incentivize

investment in capital assets.

iv) General Principle of Deduction

Subject to Income Tax Act CAP 332(R.E 2022) section 11(2), General Principle of Deduction

states that “for purposes of calculating a person's income for a year of income from any business

or investment, there shall be deducted all expenditure incurred during the year of income, by the

person wholly and exclusively in the production of income from the business or investment.”

v) Trading Stock Allowance

The trading stock allowance under the Income Tax Act (ITA) section 13(1) is explain as a

deduction used to calculate a business's income for a year.

The allowance is determined as follows ITA SECTION 13(2):

1. Components:

• Opening Value: The trading stock's value at the beginning of the year (equal to the

previous year's closing value).

• Expenditure: Costs incurred during the year included in the trading stock.

• Closing Value: The lower of the trading stock's cost or market value at year-end.

2. Calculation:

Allowance = Opening Value + Expenditure − Closing Value

3. Adjustments:

• If the closing value is based on market value (and it's lower than the cost), the

trading stock's cost is reset to this market value for accounting purposes.

This allowance ensures accurate income reporting by considering changes in the value of trading

stock throughout the year.

vi) Exempt Controlled Resident Entity

“Exempt-controlled resident entity” is an entity which is resident during the year of income and at

any time during the year of income 25 per cent or more of the underlying ownership of the entity

is held by entities exempt under the Second Schedule, approved retirement funds, charitable

organisations, non-resident persons or associates of such entities or persons.

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

(b) Calculation of Taxable Income and Tax Liabilities for Majengo Company Limited for 2022

Name of tax payer: Majengo LTD

Source of Income: Business

Resdential status: Residential

YOI: 2022

Statement of Adjustment

Description Amount (TZS) Amount (TZS)

Net Loss Before Tax (1,359,414,000)

Add Back Non-Allowable Expenses

Fines and penalties 15,002,000

Interest paid as penalty 1,490,000

returnable containers. 2,340,000

Business promotion 25,000,000

general expenses (585,000,000 X 1/2) 292,500,000

Contribution to Wanangwa Pension Fund

224,000,000

(non-approved)

Door change cost 3,000,000

Depreciation (As per IFRS) 150,100,000

Total Additions 713,432,000

Less Allowable Deductions

Depreciation (as per tax rules) (W1) 76,300,000 (176,300,000 )

ADJUSTED LOSS ( 822,282,000)

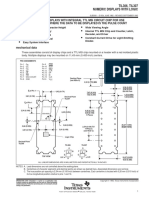

W1: DEPRECIATION ALLOWANCE FOR THE YEAR

DESCRIPTIONS CLASS I CLASS II CLASS III

TWDVs - - -

Additions:

Two Computer 11,800,000

five min buses @25,500,000 127,500,000

two 50 seater buses - 180,000,000

Pick UP 65,000,000

Toyota 30,000,000

funiture and fittings 27,500,000

Two FUSO @80,000,000 160,000,000

DB 234,300,000 340,000,000 27,500,000

Depreciation rate 37.5% 25% 12.5%

Depreciation 87,862,500 85,000,000 3,437,500

TWDVe 146,437,500 255,000,000 24,062,500

TOTAL DEPRECIATION 176,300,000

TAX CLASS ASSIGNMENT SOLUTION (96% MARKED TO BE CORRECT)

You might also like

- Midterm Departmental ExaminationDocument6 pagesMidterm Departmental ExaminationCrizzalyn Cruz100% (1)

- C5V01 LA-E892P R1A - 0418A - AcerDocument57 pagesC5V01 LA-E892P R1A - 0418A - AcerRoberto MouraNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- 3-Model-Question-BBS-3rd-Taxation-in-NepalDocument6 pages3-Model-Question-BBS-3rd-Taxation-in-Nepaldailymotiv292No ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Document5 pagesRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharNo ratings yet

- Taxation Attempt All Questions (10 10 100)Document6 pagesTaxation Attempt All Questions (10 10 100)Mff DeadsparkNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- Save Tax Income ZakiaDocument5 pagesSave Tax Income Zakiakisiige ephraim brianNo ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Tutorial 9 PIT1 Summer 2023 Sample AnswerDocument6 pagesTutorial 9 PIT1 Summer 2023 Sample Answernewgen2173No ratings yet

- KL Taxtaion I May June 2012Document2 pagesKL Taxtaion I May June 2012asdfghjkl007No ratings yet

- THE State University of Zanzibar: Lecturer: Cpa Masoud Rashid Course: Taxation Group No: 3Document24 pagesTHE State University of Zanzibar: Lecturer: Cpa Masoud Rashid Course: Taxation Group No: 3tembo groupNo ratings yet

- Taxation Direct and IndirectDocument6 pagesTaxation Direct and Indirectdivyakashyapbharat1No ratings yet

- Pe, Idt, Tax Planning, Avoidace &aversion.Document5 pagesPe, Idt, Tax Planning, Avoidace &aversion.euniceNo ratings yet

- Division B - Descriptive Questions Question No. 1 Is CompulsoryDocument5 pagesDivision B - Descriptive Questions Question No. 1 Is CompulsoryUrvashi RNo ratings yet

- Guide To CW QnsDocument12 pagesGuide To CW QnsMwebembezi Mark EricNo ratings yet

- Quick Tax Guide 2023-2024Document26 pagesQuick Tax Guide 2023-2024RobertKimtaiNo ratings yet

- New Employment Inc QnsDocument13 pagesNew Employment Inc QnsLoveness JoseehNo ratings yet

- Employt Revision Qns. 2023Document8 pagesEmployt Revision Qns. 2023Mbeiza MariamNo ratings yet

- Kenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationDocument5 pagesKenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationJoe 254No ratings yet

- BM208_OCT_2013Document6 pagesBM208_OCT_2013qbjdc7k89yNo ratings yet

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- Tax Planning and Compliance: Page 1 of 5Document5 pagesTax Planning and Compliance: Page 1 of 5Srikrishna DharNo ratings yet

- 0456Document4 pages0456Usman Shaukat Khan100% (1)

- Andrew TaxationDocument5 pagesAndrew Taxationkisiige ephraim brianNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Extra Reading Time: 15 Minutes Writing Time: 03 Hours Maximum Marks: 100 Roll No.Document4 pagesExtra Reading Time: 15 Minutes Writing Time: 03 Hours Maximum Marks: 100 Roll No.Dj BravoNo ratings yet

- Tutorial 9 - PIT1-Summer 2023-Sample AnswerDocument4 pagesTutorial 9 - PIT1-Summer 2023-Sample Answerkien tran100% (1)

- Public Chapter 4Document19 pagesPublic Chapter 4samuel debebeNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- KEY WORDS - Income TaxationDocument23 pagesKEY WORDS - Income TaxationQueenVictoriaAshleyPrietoNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- Tax Jul Aug 2023 - QuestionDocument6 pagesTax Jul Aug 2023 - QuestionMd HasanNo ratings yet

- Prevalidation TaxDocument5 pagesPrevalidation TaxJon Dumagil Inocentes, CPANo ratings yet

- Income Tax May23 Free ResourcesDocument29 pagesIncome Tax May23 Free ResourcesPurna PatelNo ratings yet

- Trust TutorialDocument3 pagesTrust TutorialpremsuwaatiiNo ratings yet

- Scanner Ipcc Paper 4Document34 pagesScanner Ipcc Paper 4Meet GargNo ratings yet

- Assignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdDocument11 pagesAssignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdSweethaa ArumugamNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Tax Planning and Compliance - JA-2022 - QuestionDocument6 pagesTax Planning and Compliance - JA-2022 - QuestionsajedulNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- TAX-701U (Income Tax - Corporations) With UpdatesDocument11 pagesTAX-701U (Income Tax - Corporations) With UpdatesBernadette Panican100% (3)

- Business Taxation 5445Document9 pagesBusiness Taxation 5445Muhammad Saleem MushtaqNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- Theory Type Questions - For Reference OnlyDocument13 pagesTheory Type Questions - For Reference OnlyHaseeb Ahmed ShaikhNo ratings yet

- Tax SuggestedDocument28 pagesTax SuggestedHemaNo ratings yet

- Ctaa032 Test 2 Question 2021Document6 pagesCtaa032 Test 2 Question 2021rendanitshisevhe4No ratings yet

- Taxation - Direct and IndirectDocument6 pagesTaxation - Direct and IndirectSahiba SadanaNo ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Tutorial Sheet 3Document6 pagesTutorial Sheet 3lemiemwanduNo ratings yet

- May 2021 Test 1 QuestionDocument6 pagesMay 2021 Test 1 Questionxfs5k9m8stNo ratings yet

- Assignment - Com Tax Sys ChinaDocument10 pagesAssignment - Com Tax Sys ChinaTanvir SiddiqueNo ratings yet

- M.B.A (2016 Pattern)Document39 pagesM.B.A (2016 Pattern)Radha ChoudhariNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- MR Roshan Ramchandra Patil X 3 PDFDocument2 pagesMR Roshan Ramchandra Patil X 3 PDFVishesh DaveNo ratings yet

- Problem Areas in Legal EthicsDocument23 pagesProblem Areas in Legal Ethicsybun0% (1)

- Credit Risk Analyst Interview Questions and Answers 1904Document13 pagesCredit Risk Analyst Interview Questions and Answers 1904MD ABDULLAH AL BAQUINo ratings yet

- Bai Tap CMQT clc59Document21 pagesBai Tap CMQT clc59Hằng LêNo ratings yet

- Brief History of Left Wing Extremism in IndiaDocument4 pagesBrief History of Left Wing Extremism in IndiaBibhash Mishra100% (1)

- Muslim LawDocument11 pagesMuslim LawSamantha M LoyalaNo ratings yet

- G.R. No. 82631 - Southeast Asian Fisheries Development Center VDocument5 pagesG.R. No. 82631 - Southeast Asian Fisheries Development Center VBluebells33No ratings yet

- Lanka Phosphate LTD: ANNUAL REPORT 2019/20Document52 pagesLanka Phosphate LTD: ANNUAL REPORT 2019/20fert certNo ratings yet

- Stübing v. GermanyDocument11 pagesStübing v. GermanyCarina SantosNo ratings yet

- The Monetary System: © 2008 Cengage LearningDocument31 pagesThe Monetary System: © 2008 Cengage LearningLuthfia ZulfaNo ratings yet

- Syquia vs. LopezDocument2 pagesSyquia vs. LopezAra KimNo ratings yet

- TIL306, TIL307 Numeric Displays With LogicDocument9 pagesTIL306, TIL307 Numeric Displays With LogicNadjNo ratings yet

- Sanjay Malik Sant Sevak Das V The State AnrDocument9 pagesSanjay Malik Sant Sevak Das V The State AnrSanjiv RathiNo ratings yet

- Absentee (Petition For Presumptive Death)Document3 pagesAbsentee (Petition For Presumptive Death)Nino Louis BelarmaNo ratings yet

- Manual 034 Determination of Storage Periods For API Excipients Intermediates and Raw MaterialsDocument3 pagesManual 034 Determination of Storage Periods For API Excipients Intermediates and Raw MaterialsNgoc Sang HuynhNo ratings yet

- Kachner Second ApeealDocument21 pagesKachner Second ApeealChaitali Dere100% (1)

- Failures TeddyDocument7 pagesFailures Teddysayanroy36No ratings yet

- Answer Petition SampleDocument7 pagesAnswer Petition SampleAmado Vallejo III100% (1)

- Financing DecisionsDocument14 pagesFinancing DecisionsNandita ChouhanNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Resolution of The Board of Directors ofDocument2 pagesResolution of The Board of Directors ofEdy GunawanNo ratings yet

- NBL F21 Half Year ResultsDocument2 pagesNBL F21 Half Year ResultsLazarus Kadett NdivayeleNo ratings yet

- RobertDocument9 pagesRobertHeavyNo ratings yet

- VSAT Installation and MaintenanceDocument50 pagesVSAT Installation and Maintenancesafa75% (4)

- Resume LatestDocument3 pagesResume LatestBrein120No ratings yet

- Osha3788 PDFDocument2 pagesOsha3788 PDFoscarvega1029No ratings yet

- Official PN FormDocument1 pageOfficial PN Formmelvin terrazolaNo ratings yet

- The Paradox of Being A Probationer Tales of Joy and SorrowDocument10 pagesThe Paradox of Being A Probationer Tales of Joy and SorrowInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mbof912d Assignment 1 PDFDocument8 pagesMbof912d Assignment 1 PDFArneet SarnaNo ratings yet