Professional Documents

Culture Documents

Fundamentals of technical Analysisi (AutoRecovered)

Fundamentals of technical Analysisi (AutoRecovered)

Uploaded by

Ayoub Rahmouni0 ratings0% found this document useful (0 votes)

1 views5 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views5 pagesFundamentals of technical Analysisi (AutoRecovered)

Fundamentals of technical Analysisi (AutoRecovered)

Uploaded by

Ayoub RahmouniCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

Did you know?

Quantitative Technical Analysis provides a strategy for incorporating the

This course is part of the Introduction to Trading with Technical Analysis tools into an algorithmic format that can be automated or applied manually

Professional Certificate. in a disciplined manner. Combined, the courses provide all the information

needed to become a trader in any market around the world or an analyst

Let's take a quick look at the professional certificate as a whole. The specializing in technical reports of financial markets.

Introduction to Trading with Technical Analysis Professional Certificate is

designed to help you gain the knowledge you need to become a trader in This professional certificate is comprised of the following courses:

any market around the world or an analyst specializing in technical reports

of financial markets. 1. C01: Fundamentals of Technical Analysis (you're here

already!)

Technical analysis is a discipline that uses market data to define the state of 2. C02: Quantitative Technical Analysis

financial markets. It provides a framework to forecast the expected trend in

the market. Tools of technical analysis can be applied in any time frame. NOTE: Completing both courses is MANDATORY to achieve the edX

This makes them useful for day traders, individual investors managing Professional Certificate in Trading with Technical Analysis. A verified

retirement accounts or analysts preparing detailed reports that include learner must pass all courses in the program with a minimum grade of 70%

opinions on the likelihood of gains in a market. Because the analysis is to earn a Professional Certificate for Trading with Technical Analysis.

based solely on market data, technical analysis can be applied to individual

stocks, broad market indexes, futures contracts, cryptocurrencies, foreign

exchange or any other market. The information in these courses can be used

to develop a standalone trading methodology. It can also be used as a

supplement to fundamental analysis, using fundamentals to determine what

to buy or sell while using technicals to determine when to make the trades.

In this way, technical analysis helps an analyst add value to their reports.

Fundamentals of Technical Analysis focuses on defining the tools of

technical analysis including chart patterns and indicators.

Course Learning Objectives market action and analysts can observe patterns in the chart. As

By the end of this professional certificate, you will be able to: Understand early as the 1930s, analysts determined that certain patterns tended

the fundamentals of technical analysis. Understand quantitative technical to precede certain price moves. This course reviews those patterns,

analysis. discusses how to identify the patterns, and supplements this with

concepts from behavioral finance to explain why the patterns are

This course is designed to help you apply technical analysis as a predictive. Different chart types are presented including the most

standalone trading methodology or as a supplement to fundamental popular formats (line charts, bar charts, and candlesticks) along

analysis using tools that are based on price action and other with less well-known but equally useful formats like point and

technical principles. figure charts, Renko charts, and Ichimoku clouds. Important

charting concepts, including the definition and interpretation of

This course has been broken into 2 sections: trendlines, gaps, and other concepts, are explained from a practical

perspective.

1. Background and Charts

2. Practical Technical Theories By the end of this section, you will be able to trade based solely on

chart analysis or have the knowledge to incorporate charts into your

analysis toolbox.

In order to apply technical analysis with confidence, it is important

to understand the theory of technical analysis, why it’s a rational

approach to market analysis, and how this discipline relates to In addition to charts that were studied in the section - Background

fundamental analysis and investor psychology. To build that and Charts, technical analysts also use indicators and various

confidence, we begin with an explanation of how technical analysts theories to forecast the direction of prices through the study of past

view the market in terms of supply and demand. We detail how the market data. In this section, we focus on defining and applying

analyst develops information about the relative strength of the bulls momentum indicators to make buy and sell decisions. Instead of

and the bears through price charts and other tools. Price charts are simply explaining and illustrating popular indicators like moving

one of the primary tools of technicians. Charts provide a history of averages, RSI, MACD, and stochastics, we review historical back-

tested results of each indicator so that you can objectively evaluate Theory of Technical Analysis: Understanding why technical

analysis is a rational approach to market analysis.

their performance. Indicators based on the sentiment of various Relation to Fundamental Analysis and Investor Psychology:

groups are analyzed and breadth indicators are explained. Unique How technical analysis complements fundamental analysis and

incorporates investor behavior.

indicators are presented in detail and trading strategies for Supply and Demand: Analyzing market conditions in terms of

indicators are fully developed, once again including back-tested supply and demand dynamics.

results providing objective data on the accuracy of the indicators. In Price Charts: Developing information about market strength

through different types of price charts.

addition to indicators, theories applicable to trading are studied.

These include relative strength analysis which is an application of Chart Types Covered:

the momentum anomaly widely followed by fundamental analysts;

1. Line Charts: Simple representation of price movements over time.

the oldest comprehensive market strategy, Dow theory, which was 2. Bar Charts: Detailed chart showing open, high, low, and close

developed in the 1800s and is still applicable since stock prices still prices.

3. Candlestick Charts: Visual representation of price action using

reflect economic growth; cycles, Elliott wave theory, Fibonacci candlestick shapes to show market sentiment.

sequences, and Intermarket analysis. 4. Point and Figure Charts: Focus on price movements without

considering time.

5. Renko Charts: Filters out minor price movements to highlight

By the end of this section, you will have familiarity with popular significant trends.

technical tools and enough information to determine how you can 6. Ichimoku Clouds: Provides a comprehensive view of support,

resistance, and trend direction.

use their tools to trade the markets. You will be able to develop a

complete trading strategy that is suited to your personal preferences Important Charting Concepts:

for risk tolerance.

Trendlines: Identifying the direction of market trends.

Gaps: Understanding price gaps and their implications.

Course Learning Objectives: Patterns: Recognizing chart patterns that precede price moves (e.g.,

head and shoulders, double tops/bottoms).

1. Understand the fundamentals of technical analysis.

2. Understand quantitative technical analysis. Outcome:

3. Apply technical analysis as a standalone trading methodology or

as a supplement to fundamental analysis.

Ability to trade based on chart analysis.

Incorporate chart analysis into your broader analysis toolbox.

Section 1: Background and Charts

Section 2: Practical Technical Theories

Key Learning Points:

Key Learning Points:

Momentum Indicators: Using indicators like moving averages,

RSI, MACD, and stochastics to make trading decisions.

Historical Back-testing: Evaluating the performance of indicators

based on historical data.

Sentiment and Breadth Indicators: Analyzing market sentiment

and breadth to forecast price movements.

Unique Indicators: Introducing less common but effective

indicators and their trading strategies.

Theories and Analysis Techniques:

1. Relative Strength Analysis: Comparing the performance of

different assets to identify potential trades.

2. Dow Theory: Understanding the oldest market strategy that reflects

economic growth through stock prices.

3. Cycles: Identifying recurring price patterns and cycles in the market.

4. Elliott Wave Theory: Using wave patterns to predict market trends.

5. Fibonacci Sequences: Applying Fibonacci retracements and

extensions to identify support and resistance levels.

6. Intermarket Analysis: Studying relationships between different

markets to forecast price movements.

Outcome:

Familiarity with popular technical tools.

Ability to develop a complete trading strategy suited to your risk

tolerance.

Background and Charts.

In this sections, we'll cover the following modules:

1. Background and Basics

2. Why Technical Analysis Works

3. Constructing and Interpreting Charts

4. Chart Patterns

You might also like

- Technical Analysis PDF Free Guide DownloadDocument9 pagesTechnical Analysis PDF Free Guide DownloadHevi EmmanuelNo ratings yet

- A simple approach to technical analysis of financial markets: How to construct and interpret technical analysis charts to improve your online trading activityFrom EverandA simple approach to technical analysis of financial markets: How to construct and interpret technical analysis charts to improve your online trading activityRating: 3 out of 5 stars3/5 (1)

- Technical Analysis of StockDocument77 pagesTechnical Analysis of StockBhavesh RogheliyaNo ratings yet

- Technical Analysis: Learn To Analyse The Market Structure And Price Action And Use Them To Make Money With Tactical Trading StrategiesFrom EverandTechnical Analysis: Learn To Analyse The Market Structure And Price Action And Use Them To Make Money With Tactical Trading StrategiesRating: 4 out of 5 stars4/5 (40)

- MARKET TIMING FOR THE INVESTOR: Picking Market Tops and Bottoms with Technical AnalysisFrom EverandMARKET TIMING FOR THE INVESTOR: Picking Market Tops and Bottoms with Technical AnalysisRating: 2 out of 5 stars2/5 (2)

- CFP Mock Test Tax PlanningDocument8 pagesCFP Mock Test Tax PlanningDeep Shikha67% (3)

- TYBFM - Technical Analysis FinalDocument57 pagesTYBFM - Technical Analysis Finalvyomthakkar17No ratings yet

- Financial Trading Unit II TutorialsDocument14 pagesFinancial Trading Unit II TutorialsloganathanNo ratings yet

- The Strategic Technical Analysis of the Financial Markets: An All-Inclusive Guide to Trading Methods and ApplicationsFrom EverandThe Strategic Technical Analysis of the Financial Markets: An All-Inclusive Guide to Trading Methods and ApplicationsNo ratings yet

- Lecture #1 - FinalDocument38 pagesLecture #1 - FinalGangsta101No ratings yet

- Stock Trading Analysis BasicsDocument20 pagesStock Trading Analysis Basicspav547No ratings yet

- Gautam BlackbookDocument93 pagesGautam BlackbookRio duttNo ratings yet

- Technical Analysis For The Mathematical MindDocument1 pageTechnical Analysis For The Mathematical MindF WilliamsNo ratings yet

- Technical Analysis EnglishDocument30 pagesTechnical Analysis EnglishRAJESH KUMARNo ratings yet

- Kani ProjectDocument68 pagesKani Projectkoshi vedaNo ratings yet

- Technical AnalysisDocument29 pagesTechnical AnalysisNasir HossainNo ratings yet

- TECHNICAL ANALYSIS FOR BEGINNERS: A Beginner's Guide to Mastering Technical Analysis (2024 Crash Course)From EverandTECHNICAL ANALYSIS FOR BEGINNERS: A Beginner's Guide to Mastering Technical Analysis (2024 Crash Course)No ratings yet

- Tech AnsisDocument40 pagesTech AnsisnitinvasuNo ratings yet

- Technical AnalysisDocument36 pagesTechnical AnalysisDivya GøwdaNo ratings yet

- Chart Patterns PDFDocument43 pagesChart Patterns PDFsokat61102No ratings yet

- p1851 PDFDocument7 pagesp1851 PDFingaleharshalNo ratings yet

- Session 5 - InFO-1Document14 pagesSession 5 - InFO-1Mohamed BadawyNo ratings yet

- Mastering The Art of Technical Analysis Types Applications and Merits in Stock Trading 20231005054408fplbDocument11 pagesMastering The Art of Technical Analysis Types Applications and Merits in Stock Trading 20231005054408fplbAani RashNo ratings yet

- Introduction To Technical Analysis: Pursuing Profit in The Financial MarketsDocument9 pagesIntroduction To Technical Analysis: Pursuing Profit in The Financial MarketsChaudhary Sohail ShafiqNo ratings yet

- Securities Analysis and Portfolio Management: Prices Usually Always Move in TrendsDocument8 pagesSecurities Analysis and Portfolio Management: Prices Usually Always Move in TrendsStuti Jain100% (1)

- How To Master Technical AnalysisDocument2 pagesHow To Master Technical AnalysisVenkataNo ratings yet

- Cory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisDocument43 pagesCory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisRahul ChaudharyNo ratings yet

- Master Technical AnalysisDocument7 pagesMaster Technical AnalysissatishdinakarNo ratings yet

- Gautam Final BlackcookDocument82 pagesGautam Final BlackcookRio duttNo ratings yet

- Table of Contents Chapter 1: Understanding Technical Analysis Chapter 2: Understanding Technical Analysis There Are Basically Two DifferentDocument3 pagesTable of Contents Chapter 1: Understanding Technical Analysis Chapter 2: Understanding Technical Analysis There Are Basically Two DifferentlaxmiNo ratings yet

- R54 Technical Analysis IFT NotesDocument27 pagesR54 Technical Analysis IFT Notesmd mehmoodNo ratings yet

- Abstract Technical AnalysisDocument2 pagesAbstract Technical AnalysisSasikanth JadhavNo ratings yet

- Technical AnalysisDocument17 pagesTechnical AnalysisHarsharaj MelantaNo ratings yet

- Technical Analysis SynopsisDocument15 pagesTechnical Analysis Synopsisfinance24100% (1)

- Technical Analysis: PDF Generated At: Wed, 02 Feb 2011 16:50:34 UTCDocument183 pagesTechnical Analysis: PDF Generated At: Wed, 02 Feb 2011 16:50:34 UTCb87208582100% (12)

- UNIT 5 - Technical Analysis in InvestmentDocument22 pagesUNIT 5 - Technical Analysis in InvestmentmoltenadNo ratings yet

- MP ChatDocument1 pageMP Chatviswaa.anupindiNo ratings yet

- Technical AnalysisDocument69 pagesTechnical Analysisjubin100% (1)

- Technical AnalysisDocument94 pagesTechnical AnalysisPranav Vira100% (1)

- Module 7 Fundamental and Technical Analysis May 11 2022Document73 pagesModule 7 Fundamental and Technical Analysis May 11 2022Ciocon JewelynNo ratings yet

- Technical Analysis PDFDocument15 pagesTechnical Analysis PDFdineshonline0% (1)

- Role of Technical Analysis As A Tool For Trading DecisionsDocument43 pagesRole of Technical Analysis As A Tool For Trading DecisionsDeepak Shrivastava100% (1)

- Technical Analysis LecturesDocument4 pagesTechnical Analysis LecturesMuhammad bilalNo ratings yet

- Ratio Analysis - DD1Document41 pagesRatio Analysis - DD1Seshagiri Deenadayalu100% (1)

- Technical Analysis: General DescriptionDocument10 pagesTechnical Analysis: General DescriptionmonavenugopalNo ratings yet

- Daily Digest From BDO Securities 2Document64 pagesDaily Digest From BDO Securities 2Glenford “Glen” EbroNo ratings yet

- What Is Technical AnalysisDocument8 pagesWhat Is Technical Analysiskhanfaiz4144No ratings yet

- A Study On All The Technical Tools and Indicators Used To Predict Movement of Equity SharesDocument26 pagesA Study On All The Technical Tools and Indicators Used To Predict Movement of Equity Sharesashishmaharana188No ratings yet

- CMTDocument9 pagesCMTAndres Ortuño0% (1)

- Technical Analysis-Epg PathshalaDocument15 pagesTechnical Analysis-Epg Pathshalasidhi5420No ratings yet

- Nihar - TECHNICAL ANALYSISDocument56 pagesNihar - TECHNICAL ANALYSISNihar SavaliyaNo ratings yet

- Class 2 Pattern RecognitionDocument77 pagesClass 2 Pattern RecognitionYixing WNo ratings yet

- Trading Tactics in the Financial Market: Mathematical Methods to Improve PerformanceFrom EverandTrading Tactics in the Financial Market: Mathematical Methods to Improve PerformanceNo ratings yet

- Use of Vectors in Financial Graphs: by Dr Abdul Rahim WongFrom EverandUse of Vectors in Financial Graphs: by Dr Abdul Rahim WongNo ratings yet

- Adv Accounts New (Q) MTP Inter Oct19Document7 pagesAdv Accounts New (Q) MTP Inter Oct19Lavkush SharmaNo ratings yet

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithNo ratings yet

- Anshul Kirti: 839 N Marshall STDocument1 pageAnshul Kirti: 839 N Marshall STAnshul KirtiNo ratings yet

- Wicom Servicing Completed These Transactions During November 2014 Its FirstDocument1 pageWicom Servicing Completed These Transactions During November 2014 Its FirstLet's Talk With HassanNo ratings yet

- CSC Ch19 Exchange Traded FundsDocument9 pagesCSC Ch19 Exchange Traded Fundslily northNo ratings yet

- Economic Development/growth of Zambia Since IndeendenceDocument10 pagesEconomic Development/growth of Zambia Since IndeendenceSing'ombe SakalaNo ratings yet

- Mf702 7 AmericanDocument51 pagesMf702 7 AmericanrockstarliveNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- RATIO ANALYSIS MbaDocument23 pagesRATIO ANALYSIS MbaManoj KumawatNo ratings yet

- Operating LeaseDocument7 pagesOperating Leasesantosashleymay7No ratings yet

- VCFGCCDocument9 pagesVCFGCCKyla de SilvaNo ratings yet

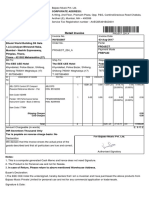

- Invoice Shipment ARIH101442 Order PROJECT 224 ADocument1 pageInvoice Shipment ARIH101442 Order PROJECT 224 ASuitable SinghNo ratings yet

- Convertible Debentures: Convert Debt Into EquityDocument4 pagesConvertible Debentures: Convert Debt Into EquityPrateek MishraNo ratings yet

- A Copper-Bottomed Crisis? The Impact of The Global Economic Meltdown On ZambiaDocument12 pagesA Copper-Bottomed Crisis? The Impact of The Global Economic Meltdown On ZambiaOxfamNo ratings yet

- Buyback of SharesDocument70 pagesBuyback of SharesIshu TiwariNo ratings yet

- Regulatory Risk AnalysisDocument2 pagesRegulatory Risk AnalysisArmand LiviuNo ratings yet

- Risk and COCDocument28 pagesRisk and COCaneeshaNo ratings yet

- Banking and The Management of Financial InstitutionsDocument32 pagesBanking and The Management of Financial InstitutionsGeorge SalahNo ratings yet

- Green InvestmentDocument97 pagesGreen InvestmentArjun Singh100% (1)

- Costing PDFDocument4 pagesCosting PDFFRANCIS JOSEPHNo ratings yet

- TPH Day4Document100 pagesTPH Day4adyani_0997100% (1)

- KertasModelUPSA 3Document5 pagesKertasModelUPSA 3Atiqa ShafiqaNo ratings yet

- Insular Life Vs Ebrado 80 Scra 181Document2 pagesInsular Life Vs Ebrado 80 Scra 181roy rubaNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- AxisCap - Max Healthcare - CR - 14 Dec 2021Document41 pagesAxisCap - Max Healthcare - CR - 14 Dec 2021vandit dharamshiNo ratings yet

- Reinsurance List 2017Document10 pagesReinsurance List 2017Abdelrahman El-shafaeeNo ratings yet

- Provisions, Contingent Liabilities and Contingent Assets: By:-Yohannes NegatuDocument52 pagesProvisions, Contingent Liabilities and Contingent Assets: By:-Yohannes NegatuEshetie Mekonene AmareNo ratings yet

- Manual GnuKhataDocument62 pagesManual GnuKhataklladoNo ratings yet

- India's BOP and Foreign ExchangeDocument7 pagesIndia's BOP and Foreign ExchangeSuria UnnikrishnanNo ratings yet