Professional Documents

Culture Documents

202407140711_Garware_Hi-Tech_Films_Limited

202407140711_Garware_Hi-Tech_Films_Limited

Uploaded by

Dharam GamiCopyright:

Available Formats

You might also like

- Profit at RiskDocument2 pagesProfit at Risktimothy454No ratings yet

- Admiralty Manual of Navigation (2003 Edition) PDFDocument131 pagesAdmiralty Manual of Navigation (2003 Edition) PDFMuak K100% (2)

- (Tos) Third Periodical TestDocument4 pages(Tos) Third Periodical TestMissJalene Obrador72% (32)

- Fine Organic Industries - R - 17012020Document8 pagesFine Organic Industries - R - 17012020Sameer NaikNo ratings yet

- Champion Commercial Company LimitedDocument7 pagesChampion Commercial Company LimitedCedric KerkettaNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- Abdos Credit Rating CARE 2020Document5 pagesAbdos Credit Rating CARE 2020Puneet367No ratings yet

- Maxcure Nutravedics LTDDocument8 pagesMaxcure Nutravedics LTDcurryhome006No ratings yet

- Bharat Gears LimitedDocument7 pagesBharat Gears LimitedjagadeeshNo ratings yet

- Chromachemie Laboratory Private LimitedDocument7 pagesChromachemie Laboratory Private Limitedkrushna.maneNo ratings yet

- Anuh Pharma LimitedDocument7 pagesAnuh Pharma Limitedadhyan kashyapNo ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- Girnar Software Pvt. LTDDocument7 pagesGirnar Software Pvt. LTDnabh.21bms0336No ratings yet

- Shilchar Technologies LimitedDocument5 pagesShilchar Technologies Limitedjaikumar608jainNo ratings yet

- Uflex 24feb2021Document9 pagesUflex 24feb2021Abha SinghNo ratings yet

- Parijat Industries-R-23032018Document7 pagesParijat Industries-R-23032018dear14us1984No ratings yet

- Enrich Hair and Skin Solutions PVT LTDDocument6 pagesEnrich Hair and Skin Solutions PVT LTDAbhishek BajoriaNo ratings yet

- PVR Limited: Rating Reaffirmed: Summary of Rating ActionDocument7 pagesPVR Limited: Rating Reaffirmed: Summary of Rating Actionpratik567No ratings yet

- Agrocel Industries Private LimitedDocument7 pagesAgrocel Industries Private LimitedNitin KumarNo ratings yet

- Mohan Meakin LimitedDocument8 pagesMohan Meakin LimitedBithal PrasadNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Piramal Enterprises LimitedDocument10 pagesPiramal Enterprises LimitedDeepak VermaNo ratings yet

- Angel One LimitedDocument8 pagesAngel One Limiteddhapu283No ratings yet

- Orner Ffice: Weathering Industry Challenges Through Product Innovation and Distribution ReachDocument10 pagesOrner Ffice: Weathering Industry Challenges Through Product Innovation and Distribution Reachprabirkumarghosh02No ratings yet

- Rinac India LimitedDocument7 pagesRinac India Limitedankityad129No ratings yet

- Sandfits Foundries Private LimitedDocument7 pagesSandfits Foundries Private Limitedvignesh seenirajNo ratings yet

- United Breweries Limited: Summary of Rated InstrumentsDocument8 pagesUnited Breweries Limited: Summary of Rated InstrumentsKaushikDasguptaNo ratings yet

- Remsons Industries LimitedDocument8 pagesRemsons Industries Limitedeurostarimpex1No ratings yet

- V-Guard Industries - R - 10052019Document8 pagesV-Guard Industries - R - 10052019Yogi173No ratings yet

- Hikal Limited - R - 21122020Document8 pagesHikal Limited - R - 21122020CA.Chandra SekharNo ratings yet

- Globe Commodities LimitedDocument8 pagesGlobe Commodities Limitedanshul.mishra1089No ratings yet

- MRF LimitedDocument6 pagesMRF LimitedIshan GuptaNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Silver Crest Clothing Private LimitedDocument7 pagesSilver Crest Clothing Private Limitedsyedyaseenpasha9292No ratings yet

- PR Jindal Worldwide 7jul23Document10 pagesPR Jindal Worldwide 7jul23indiafincorp.inNo ratings yet

- Result Presentation For December 31, 2015 (Result)Document18 pagesResult Presentation For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Press Release Nahar Poly Films LimitedDocument5 pagesPress Release Nahar Poly Films LimitedHarshit SinghNo ratings yet

- Kumar Arch Tech - R-06082020Document7 pagesKumar Arch Tech - R-06082020Denish GalaNo ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation Limiteddynamicessential1No ratings yet

- Kitex Garments LimitedDocument8 pagesKitex Garments LimitedSamsuzzoha ZohaNo ratings yet

- 202407120730_Udaipur_Cement_Works_LimitedDocument8 pages202407120730_Udaipur_Cement_Works_Limitedbafiyi5575No ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Blend Q4 Fy20Document6 pagesBlend Q4 Fy20Ni007ckNo ratings yet

- Suguna Foods Private Limited ReportDocument8 pagesSuguna Foods Private Limited ReportSHRAYANS NAHATANo ratings yet

- Prabhat Dairy - R-13022019Document8 pagesPrabhat Dairy - R-13022019RahulNo ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- SJS Enterprises LimitedDocument7 pagesSJS Enterprises LimitedCA Ankur BariaNo ratings yet

- AY SecuritiesDocument8 pagesAY Securitiesanshul.mishra1089No ratings yet

- CTR Manufacturing Industries Private LimitedDocument7 pagesCTR Manufacturing Industries Private Limitedkrushna.maneNo ratings yet

- GAIL (India) LimitedDocument7 pagesGAIL (India) Limitedvirupakshudu kodiyalaNo ratings yet

- Ashirvad Pipes Private LimitedDocument7 pagesAshirvad Pipes Private LimitedAdarsh ChamariaNo ratings yet

- Big Bags International PVT LTDDocument7 pagesBig Bags International PVT LTDnayabrasul208No ratings yet

- Stellantis FY2023 Results PresentationDocument53 pagesStellantis FY2023 Results PresentationYahyaNo ratings yet

- SGS Tekniks Manufacturing PVT LTDDocument7 pagesSGS Tekniks Manufacturing PVT LTDgcgary87No ratings yet

- Press Release DFM Foods Limited: Details of Facilities in Annexure-1Document4 pagesPress Release DFM Foods Limited: Details of Facilities in Annexure-1Puneet367No ratings yet

- Investor Presentation - Glenmark Pharma Announces Proposed Divestment of Majority Stake in Glenmark Life SciencesDocument7 pagesInvestor Presentation - Glenmark Pharma Announces Proposed Divestment of Majority Stake in Glenmark Life SciencesSHREYA NAIRNo ratings yet

- Berger Paints India Limited: Rationale and Key Rating DriversDocument6 pagesBerger Paints India Limited: Rationale and Key Rating DriversHemant ChaudhariNo ratings yet

- The Bombay Dyeing & Manufacturing Company LimitedDocument5 pagesThe Bombay Dyeing & Manufacturing Company LimitedvaishnaviNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- VaughanDocument16 pagesVaughanMalik RizwanNo ratings yet

- Takeoff and Landing PerformanceDocument177 pagesTakeoff and Landing PerformanceАндрей ЛубяницкийNo ratings yet

- Stp60nf03l - N-Channel 30v - 0.008 Ohm - 60a To-220 Stripfet Power Mosfet - StmicroelectronicsDocument6 pagesStp60nf03l - N-Channel 30v - 0.008 Ohm - 60a To-220 Stripfet Power Mosfet - StmicroelectronicsJulio César Rosas GonzálezNo ratings yet

- Foreign Part A: Fire Suppression System S/N Description Unit Foam Proportioning Unit Vertical Bladder Type Ul ListedDocument6 pagesForeign Part A: Fire Suppression System S/N Description Unit Foam Proportioning Unit Vertical Bladder Type Ul ListedNakoraNo ratings yet

- Approval Material Spek Jadwal Passenger Lift FUJI - DPRD BANGLI - 10 Agustus 22Document6 pagesApproval Material Spek Jadwal Passenger Lift FUJI - DPRD BANGLI - 10 Agustus 22budy1234No ratings yet

- Pak Saudia RelationsDocument397 pagesPak Saudia RelationsMuhammad Saleem Ahmad RanjhaNo ratings yet

- Review Paper: There Are 5 Branches That We Choose To TasteDocument3 pagesReview Paper: There Are 5 Branches That We Choose To TasteAllysa BatoliñoNo ratings yet

- My Happy Marriage Volume 03 LNDocument252 pagesMy Happy Marriage Volume 03 LNnailsnailsgoodinbed100% (2)

- Clay & Shale Industries in OntarioDocument193 pagesClay & Shale Industries in OntarioJohn JohnsonNo ratings yet

- Buchenwald - Through The Eyes of An ArtistDocument27 pagesBuchenwald - Through The Eyes of An ArtistDennis M. Gilman100% (1)

- 4.1 Basic Physics and Band Diagrams For MOS CapacitorsDocument5 pages4.1 Basic Physics and Band Diagrams For MOS CapacitorsvinodNo ratings yet

- ATT EL52203 UserManualDocument102 pagesATT EL52203 UserManualdalton95198285No ratings yet

- Building Structural SystemDocument12 pagesBuilding Structural Systemannisa ersi adlyaNo ratings yet

- Filipino Have A Tendency To SelfDocument1 pageFilipino Have A Tendency To SelfAubrey RecierdoNo ratings yet

- Basic Calculation of A Buck Converter 'S Power Stage: Application NoteDocument9 pagesBasic Calculation of A Buck Converter 'S Power Stage: Application NoteNestor GlezNo ratings yet

- Man As A Geologic Agent - Sherlock - 1922Document404 pagesMan As A Geologic Agent - Sherlock - 1922geoecologistNo ratings yet

- Model Based Control Design: Alf IsakssonDocument17 pagesModel Based Control Design: Alf IsakssonSertug BaşarNo ratings yet

- Actors On Stage Sketching Characters On The StreetDocument11 pagesActors On Stage Sketching Characters On The StreetOscar GalliNo ratings yet

- Gothra PattikaDocument172 pagesGothra PattikaParimi VeeraVenkata Krishna SarveswarraoNo ratings yet

- Jābirian Alchemy: (Translated From French by Keven Brown)Document26 pagesJābirian Alchemy: (Translated From French by Keven Brown)SahabatunikNo ratings yet

- Module 1: DC Circuits and AC Circuits: Mesh and Nodal AnalysisDocument28 pagesModule 1: DC Circuits and AC Circuits: Mesh and Nodal AnalysisSRIRAM RNo ratings yet

- TAC640 Service ManualDocument15 pagesTAC640 Service ManualCARMAIN100% (1)

- UNHCR WASH Standards and IndicatorsDocument1 pageUNHCR WASH Standards and IndicatorsMohammad Bahram MonibNo ratings yet

- AtacandDocument4 pagesAtacandljubodragNo ratings yet

- 2010 Lighting and Electrical CatalogDocument90 pages2010 Lighting and Electrical CatalogTravis Erwin100% (1)

- Underwriting Training - CollateralDocument60 pagesUnderwriting Training - CollateralHimani SachdevNo ratings yet

- Polymers 15 01581Document24 pagesPolymers 15 01581Tehreem IshtiaqNo ratings yet

202407140711_Garware_Hi-Tech_Films_Limited

202407140711_Garware_Hi-Tech_Films_Limited

Uploaded by

Dharam GamiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

202407140711_Garware_Hi-Tech_Films_Limited

202407140711_Garware_Hi-Tech_Films_Limited

Uploaded by

Dharam GamiCopyright:

Available Formats

Press Release

Garware Hi-Tech Films Limited

July 04, 2024

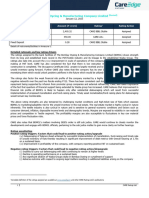

Facilities Amount (₹ crore) Rating1 Rating Action

Long-term bank facilities 149.01 CARE AA-; Stable Revised from CARE A+; Stable

Short-term bank facilities 198.19 CARE A1+ Reaffirmed

Long-term bank facilities - - Withdrawn

Details of instruments/facilities in Annexure-1.

Rationale and key rating drivers

The upgrade in ratings of the bank facilities of Garware Hi-Tech Films Limited (GHFL) is driven by improvement in business and

financial risk profile, led by growing share in valued added business. Operating performance improved in FY24 due to strong y-o-

y revenue growth of 16%, despite global economic pressures in FY24 and sustained healthy profitability marked by operating

margins and return on capital employed (ROCE), which are expected to sustain going forward. The rating upgrade also factors in

company’s robust financial risk and a debt free profile, repayment of external term loans thus reducing the overall gearing to

0.02x as on March 31, 2024 (FY23: 0.15), coupled with strong liquidity position led by surplus liquid funds of Rs. 383.80 crores

and nil working capital utilization. In the absence of large debt funded capex, GHFL is likely to remain net debt free going ahead

while sustaining its profitability levels.

Ratings continue to factor in the company’s established track record and extensive experience of the promoters in the plastic film

industry, a state-of-the-art manufacturing facility managed by well-qualified technical team, and a well-established distribution

network of ~5000 global tinters.

However, these strengths are tempered by profit margins susceptible to volatile input prices associated with key raw materials,

which are derivatives of crude oil and foreign currency fluctuations. GHFL caters to end-user industries that are highly sensitive

to overall growth and stability of the global economy due to dependency on the cyclicity of auto industry and government

regulations.

CARE Ratings has withdrawn the rating assigned to long-term bank facilities of GHFL pertaining to outstanding term loans with

immediate effect, based on the confirmation from the lender regarding nil outstanding against the rated facility.

Rating sensitivities: Factors likely to lead to rating actions

Positive factors

• Further revenue diversification through high contribution from new and or high value-added products resulting

in healthy revenue growth and healthy ROCE above 25% on a sustained basis.

Negative factors

• Large debt funded capex adversely affecting debt coverage and leverage indicators with gearing deteriorating

above 0.50x and total debt to gross cash accruals (TD/GCA) increasing above 2.50x.

• Decline in interest coverage below 7.00x on sustained basis.

Analytical approach: Consolidated

To arrive at ratings assigned to bank facilities of GHFL, CARE Ratings Limited (CARE Ratings) has adopted the consolidated

approach, consolidating two wholly owned subsidiaries of GHFL. Details of entities considered for consolidation as on March 31,

2024, are given in Annexure-6.

Outlook: Stable

The company is expected to sustain its strong business risk profile with healthy profitability levels and robust financial risk profile

with net debt free position. The healthy cash accruals and strong cash and bank balances shall support its robust liquidity.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications.

1 CARE Ratings Ltd.

Press Release

Detailed description of key rating drivers:

Key strengths

Experienced promoters and long track record of operations

Promoted by the Late Padmabhushan Dr. Bhalchandra (Abasaheb) Garware and Dr. S. B. Garware, GHFL has an established track

record of more than five decades of operations in the polyester film industry. GHFL is one of the premier sun-protection window

film manufacturers with an extensive global distribution network. Owing to decades of experience of promoters, the company has

expanded its product range and areas of operations over the years. While Chairman Dr. S. B. Garware and its next generation

are fully involved in strategic decision-making and product development, they are well-assisted by a team of experienced

professionals and a dedicated R&D team.

Integrated operations and ability to manufacture a variety of polyester films

GHFL's ability to produce and modify properties of more than 3,000 SKUs helps to adequately cater to diverse needs of its

customers. To maintain the quality and consistency of polyester film products, GHFL had undertaken capital expenditure for

integrating backwards. Through the chip-to-film integration, GHFL has developed a capability to customise properties of polyester

chips beforehand to derive a desired variety of films and make them suitable for applications such as sun-control films, paint

protection films, electrical grade, high shrink films and thermal lamination films.

Strong global brand and development of domestic market

GHFL’s international accreditations and certifications for different products namely European Chemicals Agency, EU Regulation

and others have resulted in strong marketing of its products. The company has developed patented technology for manufacturing

UV stabilised dyed films, making it one of the premier window film manufacturers globally. GHFL has developed a strong

distribution network with presence in around 90+ countries through more than 5000+ tinters spread across the globe, insulating

it from regional risks. According to the management, GHFL has a market share of 8%-10% globally in sun-control films. GHFL

generated 77.6% revenue from export sales in FY24, higher than 67.1% in FY23, as the company has been focusing on exploring

new markets. North America is the biggest market, with 46.4% revenue being generated there.

The company is also developing a niche market in India for their sun control film (SCF) and paint protection film (PPF) products.

The company is currently targeting the B2C model by setting up Garware Application Studios (GAS) in Tier-1 and Tier-2 cities and

has associated with more than 126 channel partners and 650+ OEM dealerships in India.

Constant scale-up in margin accretive value-added segment

Over the years, GHFL transformed itself from a high-volume-low-margin commoditised polyester film company with products

catering mainly to the industrial applications, to a leading consumer product company with a major share in value-added margin

accretive products. Value-add products portfolio mainly comprises SCF, shrink films, PPF and low-oligomer products, which are

used in industrial applications. The share of value-added products increased from 48% of overall revenues in FY17 to 89% as on

FY24.

Improved operating performance in FY24

The TOI in FY24 increased by ~16% to ₹1,692.09 crore (₹1,461.67 crore in FY23) driven by higher revenues from value-added

segments. A higher focus on premium segments of SCF and PPF resulted in better sales value and margins. Segment-wise, PPF

contributed 27% of revenues in FY24 (5% in FY23) while 38% was generated from SCF segment (44% in FY23), and 35% from

Industrial Product Division (IPD) segment (51% in FY23). Increase in TOI is accompanied by stabilisation in profit before interest,

lease rentals, depreciation, and taxation (PBILDT), which were 17.56% in FY24 (17.16% in FY23). The IPD segment, which

recorded muted performance in FY24 impacted by oversupply, is expected to improve as price recovery has started in the segment

and margins are expected to improve going forward.

Comfortable capital structure and strong debt coverage indicators

GHFL has repaid all its term loans in FY24, which has resulted in becoming debt free with debt remaining in the form of lease

liability only. Debt coverage indicators such as TD/GCA and interest coverage improved to 0.08x and 25.23x (PY: 0.82x & 14.76x),

respectively in FY24. Debt metrics is expected to improve further going forward as the company is earning stable profits and it

has no plans for debt funded capex.

Liquidity: Strong

GHFL’s liquidity is strong, having a sufficient cushion available in its working capital limits with ‘Nil’ utilisation of its fund-based

limits in 12-months ended May 2024. GCA stood healthy at ₹247.95 crore in FY24 with free liquidity of ₹383.80 crore as on March

31, 2024. It has no debt funded capex envisaged in the near-to-medium term, which further supports its strong liquidity.

2 CARE Ratings Ltd.

Press Release

Key weaknesses

Profitability margins susceptible to volatility in raw material prices and forex fluctuations

Derivatives of crude oil - Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG) are major raw materials for GHFL.

Prices of these raw materials generally move in tandem with crude oil prices. Historically, significant volatility has been observed

in the crude oil prices. In FY24 also, crude oil prices had lot of volatility majorly due to supply cuts announced by the Organisation

of Petroleum Exporting Countries and its allies (OPEC+) and the Israel-Hamas war. Among other reasons, Ukraine's attack on

Russian refineries and OPEC extending its supply cuts till mid-2024 have also dictated the movement of crude oil prices.

Consequently, in FY24, average price of PTA and MEG for the company also remained volatile.

GHFL is also exposed to foreign exchange fluctuation risk on its sales (as export form ~77.6% of its total sales) and receivables.

Though, it exports across countries, its currency exposure is limited to USD (largest exposure), EUR (Euro) and Great Brittan

Pound (GBP). Owing to large proportion of export income as against miniscule foreign currency expenses, GHFL is exposed to

foreign exchange fluctuation risk. However, GHFL manages this risk largely by availing forward contracts to hedge its purchases

and sales.

Sensitivity of operations to government regulations and geography-specific risks

Given the environmental hazards of plastics, the poly-film industry remains sensitive to government regulations or actions that

could negatively impact demand for GHFL’s products. Regulatory risk specific to a geography also exist, including the imposition

of regulations towards automotive films. The Government of India, Regional Transportation Office (RTO) had approved Sun

Control Film for car as long as: (a) minimum visibility of 50% on the side window, and (b) minimum visibility of 70% for the front

and back glasses are necessary. Australian states and territories demand the visible light transmission (VLT) level of approximately

35% on a light vehicle's side windows.

Environment, social, and governance (ESG) risks

Parameter Compliance and action by the company

Environmental GHFL ensures zero waste through innovations and treatments. They recycle processed water

through effluent treatment plants and post Reverse Osmosis treatment in a state-of-the-art facility.

Sewage Treatment Plants are also used to treat and reutilise 100% of domestic effluent for

gardening.

Through Rainwater Harvesting, GHFL is working at upgrading groundwater levels and land

remediation to reduce consumption of water for gardening and plantation. Along with this, 100%

of the treated water coming from the Reverse Osmosis Plant is used back in the system as fresh

raw water.

GHFL lowers its energy consumption sustainably by replacing existing lamps with LED lamps and

existing motors with new higher energy efficient ones.

Social GHFL has set up community centres to raise awareness among all age groups by conducting social,

cultural, educational, and sports awareness activities that enable comprehensive development of

an entire community.

GHFL is associated with National Bal Bhavan to actively promote their ‘Build the India of your

Dreams with Values’ programme. As part of the project, children at Garware Bal Bhavan participate

in activities and campaigns that enable a giant step towards building the India of their dreams.

Governance The company emphasises on fair, transparent and ethical governance practices as a prerequisite

for sustainable growth. It has a strong legacy of adopting laws, regulations and good practices to

enhance long-term economic value of stakeholders. The company has established codes of conduct,

policies for prevention of insider trading and fair disclosures to regulatory authorities. Their goal is

to ensure independence, accountability, and integrity in all dealings. GHFL’s board comprises six

independent directors of the total 11 directors on board.

3 CARE Ratings Ltd.

Press Release

Applicable criteria

Definition of Default

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Rating Watch

Manufacturing Companies

Financial Ratios – Non financial Sector

Withdrawal Policy

Short Term Instruments

Consolidation

About the company and industry

Industry classification

Macro-economic Sector Industry Basic industry

indicator

Industrials Capital goods Industrial products Plastic products - industrial

Incorporated in 1957, GHFL is engaged in manufacturing polyester films, which are used in variety of end-applications such as

window tint application, automobile paint protection films, packaging, electrical & motor and cable insulations, shrink film for label

application, and architectural film among others. GHFL has been a leading exporter of polyester films and holds patented

technology for manufacturing UV-stabilised dyed films, these products are sold under the brand name 'Sun Control Films' and

'Global Window Films' in domestic and exports markets. Key application includes automobiles, FMCG and commercial/residential

buildings. GHFL's fully integrated (chips-to-film) manufacturing facilities are at Waluj and Chikalthana (Aurangabad, Maharashtra),

where it has capability to manufacture Sun Control Films (SCF) of 4,200 lakh sq. ft. per annum, Paint Protection Films (PPF) of

300 lakh sq. ft. per annum, industrial application poly-films of 42,000 Metric Tonnes Per Annum (MTPA) and thermal lamination

films 3,600 MTPA.

Consolidated Brief Financials (₹ crore) FY23 (A) FY24 (Abridged)

Total operating income 1,461.67 1,692.09

PBILDT 250.85 297.17

PAT 166.14 203.29

Overall gearing (times) 0.15 0.02

Interest coverage (times) 14.76 25.23

A: Audited UA: Unaudited; Note: these are latest available financial results

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating history for last three years: Annexure-2

Covenants of rated instrument / facility: Annexure-3

Complexity level of instruments rated: Annexure-4

Lender details: Annexure-5

4 CARE Ratings Ltd.

Press Release

Annexure-1: Details of facilities

Date of Maturity Size of the Rating Assigned

Name of the Coupon

Issuance (DD- Date (DD-MM- Issue along with

Instrument Rate (%)

MM-YYYY) YYYY) (₹ crore) Rating Outlook

Fund-based - LT-

- - - 86.32 CARE AA-; Stable

Cash Credit

Fund-based - LT-

- - - 62.69 CARE AA-; Stable

Cash Credit

Fund-based - LT-

- - - 0.00 Withdrawn

Term Loan

Fund-based - LT-

- - - 0.00 Withdrawn

Term Loan

Non-fund-based -

- - - 198.19 CARE A1+

ST-BG/LC

Annexure-2: Rating history for last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

and and and and

Sr. No. Instrument/Bank Amount

Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating

assigned assigned assigned assigned

(₹ crore)

in 2024- in 2023- in 2022- in 2021-

2025 2024 2023 2022

1)CARE 1)CARE 1)CARE

Fund-based - LT- A+; Stable A+; Stable A+; Stable

1 LT - - -

Term Loan (04-Jul- (07-Jul- (06-Jul-

23) 22) 21)

1)CARE 1)CARE 1)CARE

Non-fund-based - CARE A1+ A1+ A1

2 ST 198.19 -

ST-BG/LC A1+ (04-Jul- (07-Jul- (06-Jul-

23) 22) 21)

1)CARE 1)CARE 1)CARE

Fund-based - LT- A+; Stable A+; Stable A+; Stable

3 LT - - -

Term Loan (04-Jul- (07-Jul- (06-Jul-

23) 22) 21)

1)CARE 1)CARE 1)CARE

CARE

Fund-based - LT- A+; Stable A+; Stable A+; Stable

4 LT 86.32 AA-; -

Cash Credit (04-Jul- (07-Jul- (06-Jul-

Stable

23) 22) 21)

1)CARE 1)CARE 1)CARE

CARE

Fund-based - LT- A+; Stable A+; Stable A+; Stable

5 LT 62.69 AA-; -

Cash Credit (04-Jul- (07-Jul- (06-Jul-

Stable

23) 22) 21)

LT: Long term; ST: Short term

Annexure-3: Detailed explanation of covenants of rated instruments/facilities: Not applicable

5 CARE Ratings Ltd.

Press Release

Annexure-4: Complexity level of instruments rated

Sr. No. Name of the Instrument Complexity Level

1 Fund-based - LT-Cash Credit Simple

2 Fund-based - LT-Term Loan Simple

3 Non-fund-based - ST-BG/LC Simple

Annexure-5: Lender details

To view lender-wise details of bank facilities please click here

Annexure-6: List of entities consolidated

Sr No Name of the entity Extent of consolidation Rationale for consolidation

Wholly Owned Subsidiary with

1 Garware Hi-Tech Films International Limited Full

strong linkages

Step Down Subsidiary with strong

2 Global Hi-Tech Films Inc. Full

linkages

Note on complexity levels of rated instruments: CARE Ratings has classified instruments rated by it based on complexity.

Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for clarifications.

6 CARE Ratings Ltd.

Press Release

Contact us

Media Contact Analytical Contacts

Mradul Mishra Ranjan Sharma

Director Senior Director

CARE Ratings Limited CARE Ratings Limited

Phone: +91-22-6754 3596 Phone: +91-22-6754 3453

E-mail: mradul.mishra@careedge.in E-mail: ranjan.sharma@careedge.in

Relationship Contact Hardik Manharbhai Shah

Director

Saikat Roy CARE Ratings Limited

Senior Director

Phone: +91-22-6754 3591

CARE Ratings Limited

Phone: 91 22 6754 3404 E-mail: hardik.shah@careedge.in

E-mail: saikat.roy@careedge.in

Arti Roy

Associate Director

CARE Ratings Limited

Phone: +91-22-6754 3657

E-mail: arti.roy@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise capital

and enable investors to make informed decisions. With an established track record of rating companies over almost three decades,

CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise, backed by the

methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in developing bank debt

and capital market instruments, including commercial papers, corporate bonds and debentures, and structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions with

the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it has

no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as per the

terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and

triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

7 CARE Ratings Ltd.

You might also like

- Profit at RiskDocument2 pagesProfit at Risktimothy454No ratings yet

- Admiralty Manual of Navigation (2003 Edition) PDFDocument131 pagesAdmiralty Manual of Navigation (2003 Edition) PDFMuak K100% (2)

- (Tos) Third Periodical TestDocument4 pages(Tos) Third Periodical TestMissJalene Obrador72% (32)

- Fine Organic Industries - R - 17012020Document8 pagesFine Organic Industries - R - 17012020Sameer NaikNo ratings yet

- Champion Commercial Company LimitedDocument7 pagesChampion Commercial Company LimitedCedric KerkettaNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- Abdos Credit Rating CARE 2020Document5 pagesAbdos Credit Rating CARE 2020Puneet367No ratings yet

- Maxcure Nutravedics LTDDocument8 pagesMaxcure Nutravedics LTDcurryhome006No ratings yet

- Bharat Gears LimitedDocument7 pagesBharat Gears LimitedjagadeeshNo ratings yet

- Chromachemie Laboratory Private LimitedDocument7 pagesChromachemie Laboratory Private Limitedkrushna.maneNo ratings yet

- Anuh Pharma LimitedDocument7 pagesAnuh Pharma Limitedadhyan kashyapNo ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- Girnar Software Pvt. LTDDocument7 pagesGirnar Software Pvt. LTDnabh.21bms0336No ratings yet

- Shilchar Technologies LimitedDocument5 pagesShilchar Technologies Limitedjaikumar608jainNo ratings yet

- Uflex 24feb2021Document9 pagesUflex 24feb2021Abha SinghNo ratings yet

- Parijat Industries-R-23032018Document7 pagesParijat Industries-R-23032018dear14us1984No ratings yet

- Enrich Hair and Skin Solutions PVT LTDDocument6 pagesEnrich Hair and Skin Solutions PVT LTDAbhishek BajoriaNo ratings yet

- PVR Limited: Rating Reaffirmed: Summary of Rating ActionDocument7 pagesPVR Limited: Rating Reaffirmed: Summary of Rating Actionpratik567No ratings yet

- Agrocel Industries Private LimitedDocument7 pagesAgrocel Industries Private LimitedNitin KumarNo ratings yet

- Mohan Meakin LimitedDocument8 pagesMohan Meakin LimitedBithal PrasadNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Piramal Enterprises LimitedDocument10 pagesPiramal Enterprises LimitedDeepak VermaNo ratings yet

- Angel One LimitedDocument8 pagesAngel One Limiteddhapu283No ratings yet

- Orner Ffice: Weathering Industry Challenges Through Product Innovation and Distribution ReachDocument10 pagesOrner Ffice: Weathering Industry Challenges Through Product Innovation and Distribution Reachprabirkumarghosh02No ratings yet

- Rinac India LimitedDocument7 pagesRinac India Limitedankityad129No ratings yet

- Sandfits Foundries Private LimitedDocument7 pagesSandfits Foundries Private Limitedvignesh seenirajNo ratings yet

- United Breweries Limited: Summary of Rated InstrumentsDocument8 pagesUnited Breweries Limited: Summary of Rated InstrumentsKaushikDasguptaNo ratings yet

- Remsons Industries LimitedDocument8 pagesRemsons Industries Limitedeurostarimpex1No ratings yet

- V-Guard Industries - R - 10052019Document8 pagesV-Guard Industries - R - 10052019Yogi173No ratings yet

- Hikal Limited - R - 21122020Document8 pagesHikal Limited - R - 21122020CA.Chandra SekharNo ratings yet

- Globe Commodities LimitedDocument8 pagesGlobe Commodities Limitedanshul.mishra1089No ratings yet

- MRF LimitedDocument6 pagesMRF LimitedIshan GuptaNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Silver Crest Clothing Private LimitedDocument7 pagesSilver Crest Clothing Private Limitedsyedyaseenpasha9292No ratings yet

- PR Jindal Worldwide 7jul23Document10 pagesPR Jindal Worldwide 7jul23indiafincorp.inNo ratings yet

- Result Presentation For December 31, 2015 (Result)Document18 pagesResult Presentation For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Press Release Nahar Poly Films LimitedDocument5 pagesPress Release Nahar Poly Films LimitedHarshit SinghNo ratings yet

- Kumar Arch Tech - R-06082020Document7 pagesKumar Arch Tech - R-06082020Denish GalaNo ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation Limiteddynamicessential1No ratings yet

- Kitex Garments LimitedDocument8 pagesKitex Garments LimitedSamsuzzoha ZohaNo ratings yet

- 202407120730_Udaipur_Cement_Works_LimitedDocument8 pages202407120730_Udaipur_Cement_Works_Limitedbafiyi5575No ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Blend Q4 Fy20Document6 pagesBlend Q4 Fy20Ni007ckNo ratings yet

- Suguna Foods Private Limited ReportDocument8 pagesSuguna Foods Private Limited ReportSHRAYANS NAHATANo ratings yet

- Prabhat Dairy - R-13022019Document8 pagesPrabhat Dairy - R-13022019RahulNo ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- SJS Enterprises LimitedDocument7 pagesSJS Enterprises LimitedCA Ankur BariaNo ratings yet

- AY SecuritiesDocument8 pagesAY Securitiesanshul.mishra1089No ratings yet

- CTR Manufacturing Industries Private LimitedDocument7 pagesCTR Manufacturing Industries Private Limitedkrushna.maneNo ratings yet

- GAIL (India) LimitedDocument7 pagesGAIL (India) Limitedvirupakshudu kodiyalaNo ratings yet

- Ashirvad Pipes Private LimitedDocument7 pagesAshirvad Pipes Private LimitedAdarsh ChamariaNo ratings yet

- Big Bags International PVT LTDDocument7 pagesBig Bags International PVT LTDnayabrasul208No ratings yet

- Stellantis FY2023 Results PresentationDocument53 pagesStellantis FY2023 Results PresentationYahyaNo ratings yet

- SGS Tekniks Manufacturing PVT LTDDocument7 pagesSGS Tekniks Manufacturing PVT LTDgcgary87No ratings yet

- Press Release DFM Foods Limited: Details of Facilities in Annexure-1Document4 pagesPress Release DFM Foods Limited: Details of Facilities in Annexure-1Puneet367No ratings yet

- Investor Presentation - Glenmark Pharma Announces Proposed Divestment of Majority Stake in Glenmark Life SciencesDocument7 pagesInvestor Presentation - Glenmark Pharma Announces Proposed Divestment of Majority Stake in Glenmark Life SciencesSHREYA NAIRNo ratings yet

- Berger Paints India Limited: Rationale and Key Rating DriversDocument6 pagesBerger Paints India Limited: Rationale and Key Rating DriversHemant ChaudhariNo ratings yet

- The Bombay Dyeing & Manufacturing Company LimitedDocument5 pagesThe Bombay Dyeing & Manufacturing Company LimitedvaishnaviNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- VaughanDocument16 pagesVaughanMalik RizwanNo ratings yet

- Takeoff and Landing PerformanceDocument177 pagesTakeoff and Landing PerformanceАндрей ЛубяницкийNo ratings yet

- Stp60nf03l - N-Channel 30v - 0.008 Ohm - 60a To-220 Stripfet Power Mosfet - StmicroelectronicsDocument6 pagesStp60nf03l - N-Channel 30v - 0.008 Ohm - 60a To-220 Stripfet Power Mosfet - StmicroelectronicsJulio César Rosas GonzálezNo ratings yet

- Foreign Part A: Fire Suppression System S/N Description Unit Foam Proportioning Unit Vertical Bladder Type Ul ListedDocument6 pagesForeign Part A: Fire Suppression System S/N Description Unit Foam Proportioning Unit Vertical Bladder Type Ul ListedNakoraNo ratings yet

- Approval Material Spek Jadwal Passenger Lift FUJI - DPRD BANGLI - 10 Agustus 22Document6 pagesApproval Material Spek Jadwal Passenger Lift FUJI - DPRD BANGLI - 10 Agustus 22budy1234No ratings yet

- Pak Saudia RelationsDocument397 pagesPak Saudia RelationsMuhammad Saleem Ahmad RanjhaNo ratings yet

- Review Paper: There Are 5 Branches That We Choose To TasteDocument3 pagesReview Paper: There Are 5 Branches That We Choose To TasteAllysa BatoliñoNo ratings yet

- My Happy Marriage Volume 03 LNDocument252 pagesMy Happy Marriage Volume 03 LNnailsnailsgoodinbed100% (2)

- Clay & Shale Industries in OntarioDocument193 pagesClay & Shale Industries in OntarioJohn JohnsonNo ratings yet

- Buchenwald - Through The Eyes of An ArtistDocument27 pagesBuchenwald - Through The Eyes of An ArtistDennis M. Gilman100% (1)

- 4.1 Basic Physics and Band Diagrams For MOS CapacitorsDocument5 pages4.1 Basic Physics and Band Diagrams For MOS CapacitorsvinodNo ratings yet

- ATT EL52203 UserManualDocument102 pagesATT EL52203 UserManualdalton95198285No ratings yet

- Building Structural SystemDocument12 pagesBuilding Structural Systemannisa ersi adlyaNo ratings yet

- Filipino Have A Tendency To SelfDocument1 pageFilipino Have A Tendency To SelfAubrey RecierdoNo ratings yet

- Basic Calculation of A Buck Converter 'S Power Stage: Application NoteDocument9 pagesBasic Calculation of A Buck Converter 'S Power Stage: Application NoteNestor GlezNo ratings yet

- Man As A Geologic Agent - Sherlock - 1922Document404 pagesMan As A Geologic Agent - Sherlock - 1922geoecologistNo ratings yet

- Model Based Control Design: Alf IsakssonDocument17 pagesModel Based Control Design: Alf IsakssonSertug BaşarNo ratings yet

- Actors On Stage Sketching Characters On The StreetDocument11 pagesActors On Stage Sketching Characters On The StreetOscar GalliNo ratings yet

- Gothra PattikaDocument172 pagesGothra PattikaParimi VeeraVenkata Krishna SarveswarraoNo ratings yet

- Jābirian Alchemy: (Translated From French by Keven Brown)Document26 pagesJābirian Alchemy: (Translated From French by Keven Brown)SahabatunikNo ratings yet

- Module 1: DC Circuits and AC Circuits: Mesh and Nodal AnalysisDocument28 pagesModule 1: DC Circuits and AC Circuits: Mesh and Nodal AnalysisSRIRAM RNo ratings yet

- TAC640 Service ManualDocument15 pagesTAC640 Service ManualCARMAIN100% (1)

- UNHCR WASH Standards and IndicatorsDocument1 pageUNHCR WASH Standards and IndicatorsMohammad Bahram MonibNo ratings yet

- AtacandDocument4 pagesAtacandljubodragNo ratings yet

- 2010 Lighting and Electrical CatalogDocument90 pages2010 Lighting and Electrical CatalogTravis Erwin100% (1)

- Underwriting Training - CollateralDocument60 pagesUnderwriting Training - CollateralHimani SachdevNo ratings yet

- Polymers 15 01581Document24 pagesPolymers 15 01581Tehreem IshtiaqNo ratings yet