Professional Documents

Culture Documents

67. Rhombus Energy, Inc. v. CIR

67. Rhombus Energy, Inc. v. CIR

Uploaded by

Alyssa Marie SobereCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

67. Rhombus Energy, Inc. v. CIR

67. Rhombus Energy, Inc. v. CIR

Uploaded by

Alyssa Marie SobereCopyright:

Available Formats

RHOMBUS ENERGY, INC., petitioner v. COMMISSIONER OF INTERNAL REVENUE, respondent.

GR. No. 206362 2018, Aug 1 BERSAMIN, J.

Sobere

SUBJECT MATTER: Requirements for refund of creditable withholding tax

DOCTRINE:

Requisites for Entitlement to the Refund of Creditable Withholding Tax:

1. That the claim for refund was filed within the two-year reglementary period pursuant to Section 229

of the NIRC;

2. When it is shown on the ITR that the income payment received is being declared part of the

taxpayer's gross income; and

3. When the fact of withholding is established by a copy of the withholding tax statement, duly issued

by the payor to the payee, showing the amount paid and income tax withheld from that amount.

Irrevocability Rule: Once the option to carry over and apply the excess quarterly income tax against

income tax due for the taxable quarters of the succeeding taxable years has been made, such option shall

be considered irrevocable for that taxable period and no application for cash refund or issuance of a tax

credit certificate shall be allowed therefor.

SUMMARY

Facts:

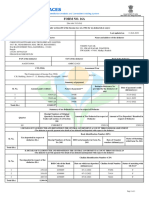

[ EXCESS CWT INDICATED AS “TO BE REFUNDED” ] Petitioner Rhombus filed its Annual ITR for

taxable year 2005. Rhombus indicated that its excess creditable withholding tax (CWT) for the year 2005

was “To be refunded.”

o However, Rhombus filed its Quarterly Income Tax Returns for the first, second, and third

quarters of taxable year 2006, showing prior year's excess credits of P1,500,653.00.

[ FILED FOR CLAIM FOR REFUND ] Rhombus filed with Revenue Region No. 8 an administrative claim

for refund of its alleged excess/unutilized CWT for the year 2005 in the amount of P1,500,653.

o Rhombus filed its Annual ITR for taxable year 2006, showing prior year’s excess credits of P0.

[ PETITION FOR REVIEW PENDING CIR’S ACTION ] Pending CIR’s action on its claim for refund or

issuance of a tax credit certificate of its excess/unutilized CWT for the year 2005 and before the lapse of

the period for filing an appeal, Rhombus filed the instant Petition for Review.

CIR’S DEFENSES:

1. Assuming without admitting that Rhombus filed a claim for refund, the same is subject to

investigation by the BIR;

2. Rhombus failed to demonstrate that the tax was erroneously or illegally collected;

3. Taxes paid and collected are presumed to have been made in accordance with laws and

regulations, hence, not refundable;

4. It is incumbent upon Rhombus to show that it has complied with the provisions of Section

204(C), in relation to Section 229 of the Tax Code, as amended, upon which its claim for refund

was premised;

5. In an action for tax refund, the burden is upon the taxpayer to prove that he is entitled thereto,

and failure to discharge said burden is fatal to the claim; and

6. Claims for refund are construed strictly against the claimant, as the same partake of the nature

of exemption from taxation.

CTA First Division: Granted Rhombus’ Petition for Review.

CTA En Banc: Reversed and set aside CTA First Division’s decision. Reasons –

a. Once the carry-over option is taken, actually or constructively, it becomes irrevocable. It

mentioned no exception or qualification to the irrevocability rule. The controlling factor for the

operation of the irrevocability rule is that the taxpayer chose an option, and so it could no longer

make another one.

b. After the taxpayer opts to carry-over its excess tax credit to the following taxable period, the

question of whether or not it actually gets to apply said tax credit is irrelevant.

c. Sec 76 of NIRC is clear and explicit: once the option to carry over has been made, no

application for tax refund or issuance of a tax credit certificate shall be allowed therefor.

d. ITCAB: Rhombus opted to carry-over its unutilized creditable withholding tax of P1,500,653.00

for taxable year 2005 to the first, second and third quarters of taxable year 2006 when it had

BC2025 | LAW 129-B | CRUZ

actually carried-over said excess creditable withholding tax to the first, second and third quarters

in its Quarterly Income Tax Returns for taxable year 2006, said option to carry-over becomes

irrevocable. Whether or not Rhombus actually gets to apply said excess tax credit is irrelevant

and would not change the carry-over option already made

Issue: Whether the taxpayer Rhombus is barred by the irrevocability rule in claiming for the refund of its

excess and/or unutilized creditable withholding tax? – NO; RHOMBUS ALLOWED TO CLAIM REFUND OF

THEIR EXCESS CREDITABLE WITHHOLDING TAX.

Ratio:

The Court granted Rhombus' claim for refund and directed the Commissioner of Internal Revenue to refund or

issue a tax credit certificate in favor of Rhombus in the amount of P1,500,653.00 representing excess creditable

withholding tax for the year 2005.

[ OPTIONS OF THE CORPORATION ] Sec 76, NIRC: …If the sum of the quarterly tax payments made

during the said taxable year is not equal to the total tax due on the entire taxable income of that year, the

corporation shall either:

(a) Pay the balance of the tax still due; or

(b) Carry over the excess credit; or

(c) Be credited or refunded with the excess amount paid, as the case may be.

[ IRREVOCABILITY RULE ] Sec 76, NIRC: … Once the option to carry over and apply the excess

quarterly income tax against income tax due for the taxable quarters of the succeeding taxable years has

been made, such option shall be considered irrevocable for that taxable period and no application for

cash refund or issuance of a tax credit certificate shall be allowed therefor.

ITCAB:

Rhombus clearly signified its intention to be refunded of its excess creditable tax withheld for calendar

year 2005 in its Annual ITR for the said year. It, under Line 31, of the said ITR marked "x" on the box “To

be refunded.”

Moreover, Rhombus’ 2006 and 2007 Annual ITRs do not have any entries in Line 28A “Prior

Year’s Excess Credits” proves that Rhombus did not carry-over its 2005 excess/unutilized

creditable withholding tax to the succeeding taxable years or quarters.

CTA En Banc did not dispute Rhombus exercising the option “to be refunded,” but still Rhombus not

entitled to the refund because it reported the prior year’s excess credits in its quarterly ITRs for the year

2006.

SC: CTA En Banc misappreciated the fact that Rhombus had already exercised the option for its

unutilized creditable withholding tax for the year 2005 to be refunded when it filed its annual ITR

for the taxable year 2005.

Irrevocability rule already took effect when the option was exercised!

Applying the Irrevocability Rule: Rhombus’ marking of the box "To be refunded" in its

2005 annual ITR constituted its exercise of the option, and from then onwards

Rhombus became precluded from carrying-over the excess creditable withholding tax.

The fact that the prior year's excess credits were reported in its 2006 quarterly ITRs did

not reverse the option to be refunded exercised in its 2005 annual ITR.

Requisites for Entitlement to the Refund:

1. That the claim for refund was filed within the two-year reglementary period pursuant to Section 229 of the

NIRC;

2. When it is shown on the ITR that the income payment received is being declared part of the taxpayer's

gross income; and

3. When the fact of withholding is established by a copy of the withholding tax statement, duly issued by the

payor to the payee, showing the amount paid and income tax withheld from that amount.

ITCAB: Rhombus met the requisites.

1. Rhombus filed its Annual ITR for the year 2005 on Apr 17, 2006. It had until Apr 17, 2008, within which to

file both its administrative and judicial claim for refund or issuance of a tax credit certificate. Rhombus

filed its administrative claim on Dec 29, 2006 and judicial claim on Dec 7, 2007—within the 2-year

prescriptive limit.

2. Rhombus presented Certificates of Creditable Tax Withheld at Source issued by its sole customer

Distileria Bago, Inc.

3. Rhombus declared in its return the income related to the creditable withholding taxes of

Php28,523,295.45. It presented the ff. documents:

BC2025 | LAW 129-B | CRUZ

a. Annual Income tax Return for the year ended December 31, 2005 with attached audited financial

statements and Account Information Form

b. Certificates of Creditable Tax Withheld at Source issued to Rhombus for the first three quarters

of taxable year 2005

Revealed that the creditable income taxes of Php28,523,295.45 were withheld from

Rhombus’ energy service fees of Php9,313,272.54 and from the sale of its generation

facility amounting to Php472,283,838.00.

Energy fees paid by Distileria Bago, Inc. in the amount of Php9,313,272.54 from which

creditable withholding tax in the aggregate amount of Php186,265.45 was withheld was

reported by Rhombus as part of its "Sales/Revenues/Receipts/Fees"

c. Summary of invoices issued for taxable year 2005

d. The sales invoices issued for taxable year 2005

ANTECEDENT FACTS:

[ CHANGE OF HOME RDO ] Jul 18, 2007: Petitioner Rhombus Energy, Inc. (Rhombus) was initially

registered and was under the jurisdiction of BIR RDO No. 50 (South Makati). However, due to its change of

address, it filed an application for change of home RDO, and was transferred under the jurisdiction of BIR

RDO No. 47.

[ EXCESS CWT INDICATED AS “TO BE REFUNDED” ] Apr 17, 2006: Before the change of home RDO in

2007, it filed its Annual ITR for taxable year 2005. Rhombus indicated that its excess creditable withholding

tax (CWT) for the year 2005 was “To be refunded.”

o Excess CWT: P1,500,653

o Rhombus filed its Quarterly Income Tax Returns for the first, second, and third quarters of taxable

year 2006, showing prior year's excess credits of P1,500,653.00.

[ FILED FOR CLAIM FOR REFUND ] Dec 29, 2006: Rhombus filed with Revenue Region No. 8 an

administrative claim for refund of its alleged excess/unutilized CWT for the year 2005 in the amount of

P1,500,653.

o Rhombus filed its Annual ITR for taxable year 2006, showing prior year’s excess credits of P0.

[ PETITION FOR REVIEW PENDING CIR’S ACTION ] Pending CIR’s action on its claim for refund or

issuance of a tax credit certificate of its excess/unutilized CWT for the year 2005 and before the lapse of the

period for filing an appeal, Rhombus filed the instant Petition for Review.

o CIR defenses:

a. Assuming without admitting that Rhombus filed a claim for refund, the same is subject to

investigation by the BIR;

b. Rhombus failed to demonstrate that the tax was erroneously or illegally collected;

c. Taxes paid and collected are presumed to have been made in accordance with laws and

regulations, hence, not refundable;

d. It is incumbent upon Rhombus to show that it has complied with the provisions of Section

204(C), in relation to Section 229 of the Tax Code, as amended, upon which its claim for

refund was premised;

e. In an action for tax refund, the burden is upon the taxpayer to prove that he is entitled

thereto, and failure to discharge said burden is fatal to the claim; and

f. Claims for refund are construed strictly against the claimant, as the same partake of the

nature of exemption from taxation.

o CTA First Division: Granted Rhombus’ Petition for Review.

o CTA En Banc: Reversed and set aside CTA First Division’s decision.

a. Once the carry-over option is taken, actually or constructively, it becomes irrevocable. It

mentioned no exception or qualification to the irrevocability rule. The controlling factor for

the operation of the irrevocability rule is that the taxpayer chose an option, and so it could

no longer make another one.

b. After the taxpayer opts to carry-over its excess tax credit to the following taxable period,

the question of whether or not it actually gets to apply said tax credit is irrelevant.

c. Sec 76 of NIRC is clear and explicit: once the option to carry over has been made, no

application for tax refund or issuance of a tax credit certificate shall be allowed therefor.

d. ITCAB: Rhombus opted to carry-over its unutilized creditable withholding tax of

P1,500,653.00 for taxable year 2005 to the first, second and third quarters of taxable year

2006 when it had actually carried-over said excess creditable withholding tax to the first,

BC2025 | LAW 129-B | CRUZ

second and third quarters in its Quarterly Income Tax Returns for taxable year 2006, said

option to carry-over becomes irrevocable. Whether or not Rhombus actually gets to apply

said excess tax credit is irrelevant and would not change the carry-over option already

made

Whether the taxpayer Rhombus is barred by the irrevocability rule in claiming for the refund of its excess

and/or unutilized creditable withholding tax? – NO; RHOMBUS ALLOWED TO CLAIM REFUND OF THEIR

EXCESS CREDITABLE WITHHOLDING TAX.

The Court granted Rhombus' claim for refund and directed the Commissioner of Internal Revenue to refund or

issue a tax credit certificate in favor of Rhombus in the amount of P1,500,653.00 representing excess creditable

withholding tax for the year 2005.

[ IRREVOCABILITY RULE ] Sec 76 NIRC: Final Adjusted Return. – Every corporation liable to tax under Section

27 shall file a final adjustment return covering the total taxable income for the preceding calendar of fiscal year. If

the sum of the quarterly tax payments made during the said taxable year is not equal to the total tax due on the

entire taxable income of that year, the corporation shall either:

(a) Pay the balance of the tax still due; or

(b) Carry over the excess credit; or

(c) Be credited or refunded with the excess amount paid, as the case may be.

In case the corporation is entitled to a tax credit or refund of the excess estimated quarterly income taxes paid, the

excess amount shown on its final adjustment return may be carried over and credited against the estimated

quarterly income tax liabilities for the taxable quarters of the succeeding taxable years. Once the option to carry

over and apply the excess quarterly income tax against income tax due for the taxable quarters of the succeeding

taxable years has been made, such option shall be considered irrevocable for that taxable period and no application

for cash refund or issuance of a tax credit certificate shall be allowed therefor.

Jurisprudential Application of the Irrevocability Rule:

Republic v. Team (Phils.) Energy Corporation:

Hence, the controlling factor for the operation of the irrevocability rule is that the taxpayer chose an option;

and once it had already done so, it could no longer make another one. Consequently, after the taxpayer

opts to carry-over its excess tax credit to the following taxable period, the question of whether or not it

actually gets to apply said tax credit is irrelevant.

Section 76 of the NIRC of 1997 is explicit in stating that once the option to carry over has been made, "no

application for tax refund or issuance of a tax credit certificate shall be allowed therefor.

The phrase "for that taxable period" [in Sec 76, last sentence] merely identifies the excess income tax,

subject of the option, by referring to the taxable period when it was acquired by the taxpayer. [Not the

prescriptive period for the irrevocability rule, as decided by the CA herein]

Intent of the legislature in the last sentence to keep the taxpayer from flip-flopping on its

options, and avoid confusion and complication as regards said taxpayer’s excess tax credit.

There is no prescriptive period for the carrying over.

SC herein also disagrees with the CA that to deny the claim for refund of BPI, because of the irrevocability

rule, would be tantamount to unjust enrichment on the part of the government. No unjust enrichment

because there would be no forfeiture of any amount in favor of the government. The amount being claimed

as a refund would remain in the account of the taxpayer until utilized in succeeding taxable years, as

provided in Section 76 of the NIRC of 1997.

Excess income tax credit of BPI, which it acquired in 1998 and opted to carry over, may be repeatedly

carried over to succeeding taxable years, i.e., to 1999, 2000, 2001, and so on and so forth, until actually

applied or credited to a tax liability of BPI.

ITCAB:

Rhombus clearly signified its intention to be refunded of its excess creditable tax withheld for calendar year

2005 in its Annual ITR for the said year. It, under Line 31, of the said ITR marked "x" on the box “To be

refunded.”

Moreover, Rhombus’ 2006 and 2007 Annual ITRs do not have any entries in Line 28A “Prior

Year’s Excess Credits” proves that Rhombus did not carry-over its 2005 excess/unutilized

creditable withholding tax to the succeeding taxable years or quarters.

CTA En Banc did not dispute Rhombus exercising the option “to be refunded,” but still Rhombus not

entitled to the refund because it reported the prior year’s excess credits in its quarterly ITRs for the year

2006.

SC: CTA En Banc misappreciated the fact that Rhombus had already exercised the option for its

BC2025 | LAW 129-B | CRUZ

unutilized creditable withholding tax for the year 2005 to be refunded when it filed its annual ITR

for the taxable year 2005.

Irrevocability rule already took effect when the option was exercised!

Applying the Irrevocability Rule: Rhombus’ marking of the box "To be refunded" in its

2005 annual ITR constituted its exercise of the option, and from then onwards Rhombus

became precluded from carrying-over the excess creditable withholding tax. The fact that

the prior year's excess credits were reported in its 2006 quarterly ITRs did not reverse

the option to be refunded exercised in its 2005 annual ITR.

Requisites for Entitlement to the Refund:

4. That the claim for refund was filed within the two-year reglementary period pursuant to Section 229 of the

NIRC;

5. When it is shown on the ITR that the income payment received is being declared part of the taxpayer's

gross income; and

6. When the fact of withholding is established by a copy of the withholding tax statement, duly issued by the

payor to the payee, showing the amount paid and income tax withheld from that amount.

ITCAB: Rhombus met the requisites.

4. Rhombus filed its Annual ITR for the year 2005 on Apr 17, 2006. It had until Apr 17, 2008, within which to

file both its administrative and judicial claim for refund or issuance of a tax credit certificate. Rhombus

filed its administrative claim on Dec 29, 2006 and judicial claim on Dec 7, 2007—within the 2-year

prescriptive limit.

5. Rhombus presented Certificates of Creditable Tax Withheld at Source issued by its sole customer Distileria

Bago, Inc.

6. Rhombus declared in its return the income related to the creditable withholding taxes of

Php28,523,295.45. It presented the ff. documents:

e. Annual Income tax Return for the year ended December 31, 2005 with attached audited financial

statements and Account Information Form

f. Certificates of Creditable Tax Withheld at Source issued to Rhombus for the first three quarters of

taxable year 2005

Revealed that the creditable income taxes of Php28,523,295.45 were withheld from

Rhombus’ energy service fees of Php9,313,272.54 and from the sale of its generation

facility amounting to Php472,283,838.00.

Energy fees paid by Distileria Bago, Inc. in the amount of Php9,313,272.54 from which

creditable withholding tax in the aggregate amount of Php186,265.45 was withheld was

reported by Rhombus as part of its "Sales/Revenues/Receipts/Fees"

g. Summary of invoices issued for taxable year 2005

h. The sales invoices issued for taxable year 2005

DISPOSITIVE: WHEREFORE, the Court REVERSES and SETS ASIDE the decision promulgated on October 11,

2012 and the resolution issued on March 13, 2013 by the Court of Tax Appeals En Banc in CTA EB Case No. 803;

REINSTATES the decision rendered on March 23, 2011 and the resolution issued on June 30, 2011 by the Court of

Tax Appeals, First Division, in CTA Case No. 7711; and DIRECTS the Commissioner of the Bureau of Internal

Revenue to refund to or to issue a tax credit certificate in favor of petitioner Rhombus Energy, Inc. in the amount of

P1,500,653.00 representing excess creditable withholding tax for the year 2005. No pronouncement on costs of suit.

SO ORDERED.

BC2025 | LAW 129-B | CRUZ

You might also like

- American Chemical Corporation Case StudyDocument11 pagesAmerican Chemical Corporation Case StudyRahul Pandey100% (6)

- Mini Case 1 The Financial Detective Suggested Answers PDFDocument36 pagesMini Case 1 The Financial Detective Suggested Answers PDFYani RahmaNo ratings yet

- RR 2-98 Section 2.57 (B) - CWTDocument3 pagesRR 2-98 Section 2.57 (B) - CWTZenaida LatorreNo ratings yet

- Silicon Philippines vs. Cir DigestDocument1 pageSilicon Philippines vs. Cir DigestAnny YanongNo ratings yet

- 2020 Global Finance Business Management Analyst Program - IIMDocument4 pages2020 Global Finance Business Management Analyst Program - IIMrishabhaaaNo ratings yet

- Rhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestDocument2 pagesRhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestEmir Mendoza100% (1)

- Rhombus Energy v. CIRDocument2 pagesRhombus Energy v. CIRBernadette RacadioNo ratings yet

- RHOMBUS Vs CIRDocument3 pagesRHOMBUS Vs CIRMarife MinorNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document25 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Rhombus Energy v. CIRDocument9 pagesRhombus Energy v. CIRlili cruzNo ratings yet

- Republic v. TeamDocument2 pagesRepublic v. TeamannedefrancoNo ratings yet

- Commissioner vs. Ironcon BuilderDocument5 pagesCommissioner vs. Ironcon Buildermyles15No ratings yet

- Philam v. CIRDocument3 pagesPhilam v. CIRJohn AguirreNo ratings yet

- RCBC Vs CIRDocument2 pagesRCBC Vs CIRAnneNo ratings yet

- Digested Cases RevisedDocument13 pagesDigested Cases Revisedᜉᜂᜎᜊᜒᜀᜃ ᜎᜓᜌᜓᜎNo ratings yet

- Part 2Document3 pagesPart 2Vince Q. MatutinaNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument22 pagesPetitioner Vs Vs Respondent: Second DivisionClaire SantosNo ratings yet

- 7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestDocument2 pages7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestHarleneNo ratings yet

- Systra Phils Inc v. CIRDocument1 pageSystra Phils Inc v. CIRBRYAN JAY NUIQUENo ratings yet

- Validity of The Waivers: CTA-First Division Partially Granted The Petition For ReviewDocument2 pagesValidity of The Waivers: CTA-First Division Partially Granted The Petition For ReviewMarcella Maria KaraanNo ratings yet

- Tax Digests - FandialanDocument5 pagesTax Digests - FandialanjoyfandialanNo ratings yet

- 2async023 REMEDIESDocument27 pages2async023 REMEDIESBogs QuitainNo ratings yet

- CIR v. PNBDocument3 pagesCIR v. PNBAngelique Padilla UgayNo ratings yet

- CIR v. Next Mobile, 776 SCRA 343Document4 pagesCIR v. Next Mobile, 776 SCRA 343Je S BeNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE vs. COVANTADocument3 pagesCOMMISSIONER OF INTERNAL REVENUE vs. COVANTAPia Janine ContrerasNo ratings yet

- Taxation Review - Remedies - AdditionalDocument16 pagesTaxation Review - Remedies - AdditionalJimbo HotdogNo ratings yet

- Taxation Review - Remedies - AdditionalDocument16 pagesTaxation Review - Remedies - AdditionalJimbo HotdogNo ratings yet

- Tax REv NotesDocument23 pagesTax REv NotesCti Ahyeza DMNo ratings yet

- Commissioner of Internal Revenue v. Covanta Energy Philippine Holdings, Inc. DigestDocument3 pagesCommissioner of Internal Revenue v. Covanta Energy Philippine Holdings, Inc. DigestCharmila Siplon100% (1)

- TAX267 - PresentationDocument16 pagesTAX267 - PresentationSyafiqNo ratings yet

- A. Tax Assessment - Xiii. RCBC vs. CIR, GR No. 170257, 7 September 2011Document2 pagesA. Tax Assessment - Xiii. RCBC vs. CIR, GR No. 170257, 7 September 2011VINCENTREY BERNARDONo ratings yet

- Tax DigestDocument7 pagesTax DigestLeo Angelo LuyonNo ratings yet

- CIR v. BPI G.R. No. 178490 July 7, 2009 Chico-Nazario, J. DoctrineDocument2 pagesCIR v. BPI G.R. No. 178490 July 7, 2009 Chico-Nazario, J. DoctrinebrendamanganaanNo ratings yet

- Research On NIRCDocument6 pagesResearch On NIRCFrancis RubioNo ratings yet

- Rhombus Energy v. CirDocument15 pagesRhombus Energy v. CirSteven TylerNo ratings yet

- Voluntary Assessment and Payment Program (VAPP) : Bureau of Internal Revenue Revenue Region No. 38 - North, Quezon CityDocument29 pagesVoluntary Assessment and Payment Program (VAPP) : Bureau of Internal Revenue Revenue Region No. 38 - North, Quezon CityEdward GanNo ratings yet

- G.R. No. 206526 January 28, 2015 Winebrenner & Iñigo Insurance BROKERS, INC., Petitioner, Commissioner of Internal RevenueDocument8 pagesG.R. No. 206526 January 28, 2015 Winebrenner & Iñigo Insurance BROKERS, INC., Petitioner, Commissioner of Internal RevenueAnathema DeviceNo ratings yet

- CIR vs. Mirant DigestDocument2 pagesCIR vs. Mirant DigestAldrin Tang100% (2)

- 197 Winebrenner V CirDocument15 pages197 Winebrenner V Cirmae annNo ratings yet

- Revenue Regulations No. 05-99: Requirements For Deductibility of Bad Debts From Gross IncomeDocument5 pagesRevenue Regulations No. 05-99: Requirements For Deductibility of Bad Debts From Gross IncomeelmersgluethebombNo ratings yet

- Tax Remedies: Arellano University School of LawDocument5 pagesTax Remedies: Arellano University School of LawvivivioletteNo ratings yet

- 22.d CIR vs. BPI (G.R. No. 178490 July 7, 2009) - H DigestDocument2 pages22.d CIR vs. BPI (G.R. No. 178490 July 7, 2009) - H DigestHarleneNo ratings yet

- 2Document2 pages2maeNo ratings yet

- Liquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119Document3 pagesLiquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119brendamanganaanNo ratings yet

- Tax Assessment - X. CIR Vs Philippine Daily InquirerDocument3 pagesTax Assessment - X. CIR Vs Philippine Daily InquirerLouisse OcampoNo ratings yet

- Citibank vs. CA, 280 SCRA 459Document1 pageCitibank vs. CA, 280 SCRA 459SURITA, FLOR DE MAE PNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- Rhombus Energy vs. CIRDocument7 pagesRhombus Energy vs. CIREmNo ratings yet

- Tax Investigations and Remedies by Prof. Eric R. RecaldeDocument15 pagesTax Investigations and Remedies by Prof. Eric R. RecaldeLoraine RingonNo ratings yet

- G.R. No. 206526 January 28, 2015 Winebrenner & Iñigo Insurance Brokers, Inc., Petitioner, Commissioner of Internal Revenue, RespondentDocument10 pagesG.R. No. 206526 January 28, 2015 Winebrenner & Iñigo Insurance Brokers, Inc., Petitioner, Commissioner of Internal Revenue, RespondentWayne ViernesNo ratings yet

- Cir vs. Ironcon BuildersDocument1 pageCir vs. Ironcon BuildersGEiA Dr.No ratings yet

- Bufferd v. Commissioner, 506 U.S. 523 (1993)Document10 pagesBufferd v. Commissioner, 506 U.S. 523 (1993)Scribd Government DocsNo ratings yet

- REFUNDS SEC 229 and SEC 76Document12 pagesREFUNDS SEC 229 and SEC 76Kent DarantinaoNo ratings yet

- Departmental Interpretation and Practice Notes No. 12 (Revised)Document6 pagesDepartmental Interpretation and Practice Notes No. 12 (Revised)Difanny KooNo ratings yet

- Commissioner of Internal Revenue, Petitioner vs. Univation Motor Philippines, Inc. (Formerly NISSAN MOTOR PHILIPPINES, INC.), RespondentDocument93 pagesCommissioner of Internal Revenue, Petitioner vs. Univation Motor Philippines, Inc. (Formerly NISSAN MOTOR PHILIPPINES, INC.), RespondentJv FerminNo ratings yet

- C BAC7 MODULE 3 Tax RemediesDocument9 pagesC BAC7 MODULE 3 Tax RemediesJOSHUA M. ESCOTONo ratings yet

- G.R. No. 118794Document2 pagesG.R. No. 118794AbbyNo ratings yet

- Tax Case No 33-35Document8 pagesTax Case No 33-35Jeah N MelocotonesNo ratings yet

- Tax 01-Lesson 02 - Tax RemediesDocument42 pagesTax 01-Lesson 02 - Tax RemediesShannise Dayne Chua0% (1)

- Paseo Realty v. CADocument2 pagesPaseo Realty v. CAMary BoaquiñaNo ratings yet

- TAX Digests - Prescription of RemediesDocument6 pagesTAX Digests - Prescription of RemediesFrancisCarloL.FlameñoNo ratings yet

- Digested CasesDocument36 pagesDigested CasesJepoy Nisperos ReyesNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 186. Figuerres v. CADocument3 pages186. Figuerres v. CAAlyssa Marie SobereNo ratings yet

- CIR v. Next Mobile Inc_DigestDocument1 pageCIR v. Next Mobile Inc_DigestAlyssa Marie SobereNo ratings yet

- 232. LRTA v. Quezon CityDocument8 pages232. LRTA v. Quezon CityAlyssa Marie SobereNo ratings yet

- 70. China Chang Jiang Energy Corp. v. Rosal Infrastructure Builders and CADocument4 pages70. China Chang Jiang Energy Corp. v. Rosal Infrastructure Builders and CAAlyssa Marie SobereNo ratings yet

- 218. China Banking Corporation v. City TreasurerDocument4 pages218. China Banking Corporation v. City TreasurerAlyssa Marie SobereNo ratings yet

- 70. Lee v. IlaganDocument3 pages70. Lee v. IlaganAlyssa Marie SobereNo ratings yet

- 270. Lambert v. FoxDocument3 pages270. Lambert v. FoxAlyssa Marie SobereNo ratings yet

- 357. Home Insurance Company v. Eastern Shipping LinesDocument4 pages357. Home Insurance Company v. Eastern Shipping LinesAlyssa Marie SobereNo ratings yet

- 330. Republic_SRA v. TancincoDocument2 pages330. Republic_SRA v. TancincoAlyssa Marie SobereNo ratings yet

- 235. Carolina Que Villongco et al v. Cecilia Que Yabut et alDocument5 pages235. Carolina Que Villongco et al v. Cecilia Que Yabut et alAlyssa Marie SobereNo ratings yet

- Punongbayan v. PunongbayanDocument4 pagesPunongbayan v. PunongbayanAlyssa Marie SobereNo ratings yet

- Sun Bros. v. VelascoDocument3 pagesSun Bros. v. VelascoAlyssa Marie SobereNo ratings yet

- Obillos v. CIR - DigestDocument2 pagesObillos v. CIR - DigestAlyssa Marie SobereNo ratings yet

- 140. Premium Marble Resources Inc. v. CA and International Corporate BankDocument3 pages140. Premium Marble Resources Inc. v. CA and International Corporate BankAlyssa Marie SobereNo ratings yet

- City of Makati v. CIR - DigestDocument5 pagesCity of Makati v. CIR - DigestAlyssa Marie SobereNo ratings yet

- Y-I Leisure Phils Inc. v. YuDocument5 pagesY-I Leisure Phils Inc. v. YuAlyssa Marie SobereNo ratings yet

- Mambulao Lumber Company v. PNBDocument6 pagesMambulao Lumber Company v. PNBAlyssa Marie SobereNo ratings yet

- Valarao v. CADocument4 pagesValarao v. CAAlyssa Marie SobereNo ratings yet

- Silk Road (Conviction)Document1 pageSilk Road (Conviction)Alyssa Marie SobereNo ratings yet

- Aviles v. ArcegaDocument3 pagesAviles v. ArcegaAlyssa Marie SobereNo ratings yet

- Luzon Brokerage v. Maritime (1978 Resolution of 2nd MR)Document3 pagesLuzon Brokerage v. Maritime (1978 Resolution of 2nd MR)Alyssa Marie SobereNo ratings yet

- Accounting in Action: Three Activities Who Uses Accounting DataDocument12 pagesAccounting in Action: Three Activities Who Uses Accounting DataShahriar MahirNo ratings yet

- Module 6: What You Will LearnDocument30 pagesModule 6: What You Will Learn刘宝英No ratings yet

- A Review of Lease Accounting 리스회계의 개관 및 IFRS 16의 시사점Document34 pagesA Review of Lease Accounting 리스회계의 개관 및 IFRS 16의 시사점Trang HuỳnhNo ratings yet

- Tanjiro:Inosuke & Nezuko:ZenitsuDocument4 pagesTanjiro:Inosuke & Nezuko:ZenitsuJaimellNo ratings yet

- DISBURSEMENT VOUCHER NewDocument3 pagesDISBURSEMENT VOUCHER NewJasper JacobNo ratings yet

- Investment Planning Mock TestDocument20 pagesInvestment Planning Mock Testjayaram_polaris100% (2)

- Ias32 SN PDFDocument8 pagesIas32 SN PDFShiza ArifNo ratings yet

- INSTALLMENT METRHOD Liq. StatementDocument3 pagesINSTALLMENT METRHOD Liq. Statementmhel cabigonNo ratings yet

- Akdpn3820e Q3 2023-24Document3 pagesAkdpn3820e Q3 2023-24truth.astrology0751No ratings yet

- Aurangjeb BankingDocument8 pagesAurangjeb BankingJaved akhtarNo ratings yet

- Financial Investment Project - EditedDocument15 pagesFinancial Investment Project - Editedwafula stanNo ratings yet

- Accounting FormulaDocument4 pagesAccounting FormulaAndrea AbayaNo ratings yet

- Audit Report NotesDocument7 pagesAudit Report NotesSer Yev Javier NuguidNo ratings yet

- Ise 307 - Chapter 7Document51 pagesIse 307 - Chapter 7Ali MakkiNo ratings yet

- Sample Case StudiesDocument29 pagesSample Case StudiesAbc SNo ratings yet

- Lagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFDocument3 pagesLagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFSarah Nicole S. LagrimasNo ratings yet

- Audit of Investment-LectureDocument15 pagesAudit of Investment-LecturemoNo ratings yet

- CH 14Document23 pagesCH 14xxxxxxxxxNo ratings yet

- Section B Group 4 Assignment BNL StoresDocument3 pagesSection B Group 4 Assignment BNL StoresMohit VermaNo ratings yet

- Hyperion Global Growth Companies Fund: Product Disclosure StatementDocument9 pagesHyperion Global Growth Companies Fund: Product Disclosure StatementJang CoiNo ratings yet

- Fs - Aguilar Golden Harvest MPC 2020Document37 pagesFs - Aguilar Golden Harvest MPC 2020Ma Teresa B. CerezoNo ratings yet

- Hotel Exemple PresentationDocument34 pagesHotel Exemple PresentationChafik KeycusNo ratings yet

- Mergers Acquisitions Strategy Execution Post Merger Management BrochureDocument4 pagesMergers Acquisitions Strategy Execution Post Merger Management BrochurePavan C RNo ratings yet

- Background: Wachtell, Lipton, Rosen & KatzDocument5 pagesBackground: Wachtell, Lipton, Rosen & KatzFooyNo ratings yet

- Class Xii CH 8,7,6 MCQ AccountancyDocument12 pagesClass Xii CH 8,7,6 MCQ AccountancyTamilselvan .kNo ratings yet

- REVISION 2022 Part A - CH. 4Document4 pagesREVISION 2022 Part A - CH. 4ADAM ABDUL RAZACKNo ratings yet

- Resume CH 7 - 0098 - 0326Document5 pagesResume CH 7 - 0098 - 0326nur eka ayu danaNo ratings yet