Professional Documents

Culture Documents

Exemption Certification Jpi Month of July-18 to Dec-18

Exemption Certification Jpi Month of July-18 to Dec-18

Uploaded by

syasir85Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exemption Certification Jpi Month of July-18 to Dec-18

Exemption Certification Jpi Month of July-18 to Dec-18

Uploaded by

syasir85Copyright:

Available Formats

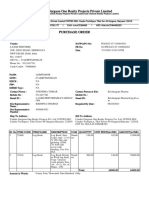

153(4) (Order to grant / refuse reduced rate of withholding on Supplies / Services / Contracts) (FOR

GENERIC EXEMPTION)

Name: JILANI POLY INDUSTRIES (PRIVATE) LIMITED Registration No 3660118

Address: JILANI CENTER, PLOT#1,92, MAIN RAVI ROAD, Tax Year : 2019

LAHORE, Lahore Ravi Town Period : 01-Jul-2018 - 31-Dec-2018

Medium : Online

Contact No: 00923228443888 Due Date : 20-Jul-2018

Valid Upto : 31-Dec-2018

Document Date 20-Jul-2018

The taxpayer is allowed to make supply of goods manufactured by it without tax deduction under clause (a) of

sub-section (1) of Section 153 of the Income Tax Ordinance, 2001. Tax already deducted before the issuance

of this certificate is not refundable and shall be deposited in the Government Treasury. This exemption

certificate is valid from the date of issuance till December 31, 2018, unless cancelled earlier. This certificate is

not valid for exemption against SERVICES RENDERED and CONTRACTS.

Withholding Tax

Description Code Rate

Payment for Goods u/s 153(1)(a) @4% 64060008 0.00 0.00 0.00

Attributes

Attribute Value

Decision Granted / Accepted

Attachments

Data for E.C (July-18 toDec-18) - JPI.xls

Muhammad Irfan Raza

Commissioner

Inland Revenue, Zone-I

LTU LAHORE, TAX HOUSE SYED MAUJ E DARYA ROAD LAHORE

This is a generic exemption order, and it does not require any party additions; this order is applicable to all

withholding agents.

Page 1 of 1 Printed on Fri, 20 Jul 2018 13:26:43

LTU LAHORE, TAX HOUSE SYED MAUJ E DARYA ROAD LAHORE

You might also like

- May Invoice PDFDocument2 pagesMay Invoice PDFAkshayNo ratings yet

- Exemption Certificate Top Link Upto Dec 2020Document1 pageExemption Certificate Top Link Upto Dec 2020khawarNo ratings yet

- Exemption Order 153 From Jul-Dec-18Document1 pageExemption Order 153 From Jul-Dec-18WaqasBashirNo ratings yet

- Order1522814 Ultra ConstructionDocument2 pagesOrder1522814 Ultra Constructionmeuh54uhNo ratings yet

- Continental Print ExemptionDocument2 pagesContinental Print ExemptionkhawarNo ratings yet

- Order 2971112Document2 pagesOrder 2971112Zeeshan KhanNo ratings yet

- Exemption Certificate - SalesDocument2 pagesExemption Certificate - SalesExecutive F&ADADUNo ratings yet

- Exemption Poly Pac Valid Up To 31.12.2020 (2) - 1Document1 pageExemption Poly Pac Valid Up To 31.12.2020 (2) - 1khawarNo ratings yet

- 19-01-24 To 30-06-24 SolDocument2 pages19-01-24 To 30-06-24 SolMuhammad KhurramNo ratings yet

- Invoice: Honasco Plastic Tech PVT LTDDocument4 pagesInvoice: Honasco Plastic Tech PVT LTDharshNo ratings yet

- Website SoDocument3 pagesWebsite Sosharma_anshu_b_techNo ratings yet

- Exemption 153 TY2021Document1 pageExemption 153 TY2021Usama AjazNo ratings yet

- 3rd Floor, Suleman Center, SC-5, (ST-17) Sector-15, Near Brooks Roundabout, KIA,, Karachi East Rasul Flour Mills (Private) LimitedDocument2 pages3rd Floor, Suleman Center, SC-5, (ST-17) Sector-15, Near Brooks Roundabout, KIA,, Karachi East Rasul Flour Mills (Private) LimitedMuhammad HamzaNo ratings yet

- Tax Invoice: Customer Details Just Dial DetailsDocument2 pagesTax Invoice: Customer Details Just Dial DetailsaashiyanacontractorsNo ratings yet

- Declaration 3765612Document2 pagesDeclaration 3765612mehboob rehmanNo ratings yet

- I Phone X 256 GB (Space Grey)Document2 pagesI Phone X 256 GB (Space Grey)Omdatt KatariaNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/ 05/2018Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/ 05/2018Hima VeeramachaneniNo ratings yet

- Tax Invoice: Supplier Details: Recipient DetailsDocument1 pageTax Invoice: Supplier Details: Recipient DetailsRajvardhan JhaNo ratings yet

- AnkitDocument4 pagesAnkitsitNo ratings yet

- Railtel Corporation of India Limited: Tax InvoiceDocument3 pagesRailtel Corporation of India Limited: Tax InvoicesunnyrunninginamazonNo ratings yet

- Invoice - 282 EnHDocument4 pagesInvoice - 282 EnHPriyank PawarNo ratings yet

- 2223TBS0002259 PDFDocument1 page2223TBS0002259 PDFHuskee CokNo ratings yet

- Railtel Corporation of India Limited: Tax InvoiceDocument3 pagesRailtel Corporation of India Limited: Tax InvoicesunnyrunninginamazonNo ratings yet

- Order 3520205374545Document2 pagesOrder 3520205374545UHY HASSAN NAEEM CO.No ratings yet

- Form I - 1Document2 pagesForm I - 1Mohamed YousufNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/06/2018Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/06/2018Megha BansalNo ratings yet

- Atria Convergence Technologies Limited, Due Date: 15/05/2022Document6 pagesAtria Convergence Technologies Limited, Due Date: 15/05/2022jagannath swamyNo ratings yet

- Atria Convergence Technologies Limited, Due Date: 15/05/2022Document2 pagesAtria Convergence Technologies Limited, Due Date: 15/05/2022jagannath swamyNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/06/2018Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/06/2018Anonymous 1aiXaCNo ratings yet

- Solid Q 50 KW InvoiceDocument1 pageSolid Q 50 KW InvoiceTrisha RawatNo ratings yet

- TASL Export Commercial Invoice (ZHEX)Document1 pageTASL Export Commercial Invoice (ZHEX)Vinod KumarNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- NDTL JLN STADIUM - Sept'23Document1 pageNDTL JLN STADIUM - Sept'23vineet.tpsNo ratings yet

- Exemption Certificate of Ghandhara Industries 2021Document2 pagesExemption Certificate of Ghandhara Industries 2021Waqar RaoNo ratings yet

- Faulty Adopters InvoiceDocument1 pageFaulty Adopters InvoicesumitsharmaNo ratings yet

- Declaration 4005106Document2 pagesDeclaration 4005106Muhammad AbdullahNo ratings yet

- Boat Car Charger InvoiceDocument1 pageBoat Car Charger InvoiceSatyam singhalNo ratings yet

- Electricity Bill of MigsunDocument6 pagesElectricity Bill of Migsunadityaraj.mba2325cNo ratings yet

- Terms and Conditions: Atria Convergence Technologies PVT - LTD, Due Date: 15/03/2018Document2 pagesTerms and Conditions: Atria Convergence Technologies PVT - LTD, Due Date: 15/03/2018Megha BansalNo ratings yet

- STP Corporate Guarantee Invoice 290324Document2 pagesSTP Corporate Guarantee Invoice 290324modib38863No ratings yet

- Invoice PDFDocument2 pagesInvoice PDFAnonymous APW3d6gfdNo ratings yet

- All Risk PolicyDocument25 pagesAll Risk PolicyPlanning DAPLNo ratings yet

- 153 Exemption Certificate 01 JUL 23 To 31 DEC 23Document2 pages153 Exemption Certificate 01 JUL 23 To 31 DEC 23athar brotherNo ratings yet

- 2324TBS0003028Document1 page2324TBS0003028yogesh nagarNo ratings yet

- Po 2023-07-31 0445631Document5 pagesPo 2023-07-31 0445631Krishna SharmaNo ratings yet

- 151 Order To Grant Refuse Reduced Rate of Withholding On Profit On DebtDocument2 pages151 Order To Grant Refuse Reduced Rate of Withholding On Profit On DebtMuhammad Imran KhanNo ratings yet

- TCC ReportDocument1 pageTCC ReportbrightNo ratings yet

- ACFrOgBNRppEQC DWGGV uJqpoY2hX9mEFUXxqkoJ3H1DDcOVUkiRfgQzPcmy8L3bTf YT4fEZDzowwmH-17Vheg6bSrFh7rQdjy72j7ezSYoejzm3H7fDYrYo-8E5YDocument1 pageACFrOgBNRppEQC DWGGV uJqpoY2hX9mEFUXxqkoJ3H1DDcOVUkiRfgQzPcmy8L3bTf YT4fEZDzowwmH-17Vheg6bSrFh7rQdjy72j7ezSYoejzm3H7fDYrYo-8E5YArif KhanNo ratings yet

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- 2223TBS0002252Document1 page2223TBS0002252Huskee CokNo ratings yet

- Return 2018 PDFDocument2 pagesReturn 2018 PDFIkramNo ratings yet

- InvoiceDocument1 pageInvoiceRAJAT GARGNo ratings yet

- 14 TechDocument1 page14 Tech11rj.thakurNo ratings yet

- 14231101105456PODocument3 pages14231101105456PONOTOFIRE PVT. LTD.No ratings yet

- Declaration 4005106Document2 pagesDeclaration 4005106Muhammad AbdullahNo ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- 42 Delpro AccessoriesDocument2 pages42 Delpro AccessoriesDurga prasadNo ratings yet

- Nipex RequirementsDocument15 pagesNipex RequirementsAF Dowell MirinNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet