Professional Documents

Culture Documents

Valuation

Valuation

Uploaded by

b.amankumar.ak75Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation

Valuation

Uploaded by

b.amankumar.ak75Copyright:

Available Formats

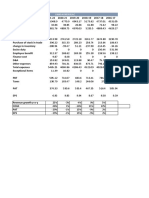

Particulars Mar-20 Mar-21 ### Mar-23

Income

Revenue from operations 39783 47028 52446 60580

Other income 632 410 258 512

Total Income 40415 47438 52704 61092

Expenses

Cost of Material Consumed 11976 15432 16446 20212

Purchases of stock in trade 6391 7121 9311 11579

Changes in inventories of finished goods(including stock in

trade and work in progress) -108 -405 -22 -75

Employee benefit expenditure 1820 2358 2545 2854

Finance costs 118 117 106 114

Depreciation and amoertisation expense 1002 1074 1091 1137

other expense 9843 10896 11309 11861

Total expense 31042 36593 40786 47682

Profit before exceptional items and tax 9373 10845 11918 13409

exceptional items (net) -200 -239 -44 -64

Profit before tax from continuing operations 9173 10606 11874 13345

Tax expense

Current tax -2243 -2520 -2840 -3001

Deferred tax credit/(Change) -166 -86 -147 -200

Profit after tax from continuing operations(A) 6764 8000 8887 10144

Profit /(Loss) from discontinued operations before tax -6 -1 3 -1

Tax expenses of discontinued operations -2 2

Profit or loss from discontinued operations after tax (B) -8 -1 5 -1

PROFIT FOR THE YEAR(A+B) 6756 7999 8892 10143

OTHER COMPREHENSIVE INCOME FOR THE YEAR(C) -89 21 115 -26

TOTAL COMPREHENSIVE INCOME FOR THE YEAR(A+B+C) 6667 8020 9007 10117

BASIC EPS(Face value of rupees 1 each) 31.17 34.03 37.79 43.07

avg closing prices 2047 2299 2323 2507

price to earnings 65.6721 67.55804 61.471 58.20757

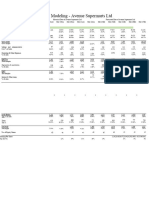

3/31/2024 Common size statement

Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Average Assumptions

61896 Sales growth 18.21% 11.52% 15.51% 2.17% 11.85% 7%

811 1.59% 0.87% 0.49% 0.85% 1.31% 1.02% 1.02%

62707 101.59% 100.87% 100.49% 100.85% 101.31% 101.02% 101.02%

19257 30.10% 32.81% 31.36% 33.36% 31.11% 31.75% 31.75%

10514 16.06% 15.14% 17.75% 19.11% 16.99% 17.01% 17.01%

-11 -0.27% -0.86% -0.04% -0.12% -0.02% -0.26% -0.26%

3009 4.57% 5.01% 4.85% 4.71% 4.86% 4.80% 4.80%

334 0.30% 0.25% 0.20% 0.19% 0.54% 0.30% 0.30%

1216 2.52% 2.28% 2.08% 1.88% 1.96% 2.14% 2.14%

14464 24.74% 23.17% 21.56% 19.58% 23.37% 22.48% 22.48%

48783 78.03% 77.81% 77.77% 78.71% 78.81% 78.23% 78.22%

13920 23.56% 23.06% 22.72% 22.13% 22.49% 22.79% 22.80%

6 -0.50% -0.51% -0.08% -0.11% 0.01% -0.24% 0.01%

13926 23.06% 22.55% 22.64% 22.03% 22.50% 22.56% 22.81%

-3521 -5.64% -5.36% -5.42% -4.95% -5.69% -5.41%

-25.23%

-123 -0.42% -0.18% -0.28% -0.33% -0.20% -0.28%

10282 17.00% 17.01% 16.95% 16.74% 16.61% 16.86%

-0.02% 0.00% 0.01% 0.00% 0.00% 0.00%

-0.01% 0.00% 0.00% 0.00% 0.00% 0.00%

-0.02% 0.00% 0.01% 0.00% 0.00% 0.00%

10282 16.98% 17.01% 16.95% 16.74% 16.61% 16.86%

25 -0.22% 0.04% 0.22% -0.04% 0.04% 0.01%

10307 16.76% 17.05% 17.17% 16.70% 16.65% 16.87%

43.74 0.08% 0.07% 0.07% 0.07% 0.07% 0.07%

2398 5.15% 4.89% 4.43% 4.14% 3.87% 4.50%

54.8239598

2025

Projections Here from March 2023 to March 2024 ,sales are increased with very

minimum growth rate which is 2.17% comparing to previous year

66228.72

growth rates which are more than 10% every year and due to this

675.532944 the average is also very high which is 11.85% but from 2 percent to

66904.252944 approx 12 %growth is may not happen thats why i am assuming

growth rate which is 7% and it is neither very high nor very low.

21027.6186

11266.872171

-172.194672

3178.97856

198.68616

1417.294608

14888.216256

51805.471683

15098.781261

8

15106.78 (Projected Profit Before tax)

-3811.440912 (Tax

expense) Tax Expense

11295.34 (PAT) % Of Profit Projection

2020 2021 2022 2023 2024 2025

-26.26% -24.57% -25.16% -23.99% -26.17% -25.23%

Computation of EPS Computation of Intrinsic value

PAT or Net

profit / No of

outstanding Formula:projected eps*avg p/e

shares

Average P/E 61.55 INTERPRETATION

PAT=11295.34 PEPS 48.07 2505 is current market price of stock 2958 is

No of intrinsic value of stock,since cmp is less than

outstanding Intrinsic value 2958.25 intrinsic value of stock ,it is preferable to bu

shares=235 stock why because the stock had a potential

till 2958.

PEPS :- 48.0652766

Projection

ON

rket price of stock 2958 is

tock,since cmp is less than

tock ,it is preferable to buy the

the stock had a potential to go

You might also like

- Coffee Shop - Industry ReportsDocument17 pagesCoffee Shop - Industry ReportsCristina Garza0% (1)

- CFA Level 1 Quantitative Analysis E Book - Part 1Document26 pagesCFA Level 1 Quantitative Analysis E Book - Part 1Zacharia VincentNo ratings yet

- Tata MotorsDocument24 pagesTata MotorsApurvAdarshNo ratings yet

- DR Lal Path Labs Financial Model - Ayushi JainDocument45 pagesDR Lal Path Labs Financial Model - Ayushi JainTanya SinghNo ratings yet

- Titan Co Financial ModelDocument15 pagesTitan Co Financial ModelAtharva OrpeNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Sales ForcastingDocument3 pagesSales Forcastingb.amankumar.ak75No ratings yet

- Assignment - F&A For ManagementDocument16 pagesAssignment - F&A For Managementvimalrparmar001No ratings yet

- TEMLDocument57 pagesTEMLANNA BABU KOONAMAVU RCBSNo ratings yet

- Excel Bav Vinamilk C A 3 Chúng TaDocument47 pagesExcel Bav Vinamilk C A 3 Chúng TaThu ThuNo ratings yet

- thu-BAV VNMDocument45 pagesthu-BAV VNMLan YenNo ratings yet

- IM ProjectDocument24 pagesIM ProjectDäzzlîñg HärîshNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Cafe - Industry ReportsDocument17 pagesCafe - Industry ReportsCristina GarzaNo ratings yet

- Ruchi SoyaDocument10 pagesRuchi SoyaANJALI SHARMANo ratings yet

- FM 2 AssignmentDocument337 pagesFM 2 AssignmentAvradeep DasNo ratings yet

- MI Cash ModelDocument17 pagesMI Cash ModelMax LiNo ratings yet

- AnalysisDocument3 pagesAnalysisMohamed MamdouhNo ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- AVIS CarsDocument10 pagesAVIS CarsSheikhFaizanUl-HaqueNo ratings yet

- Oil & Gas Development Company LTD: Income Statement 2014 2015 2016Document8 pagesOil & Gas Development Company LTD: Income Statement 2014 2015 2016mohammad bilalNo ratings yet

- Ten Years Performance at A GlanceDocument1 pageTen Years Performance at A GlancerahulNo ratings yet

- Ratio Analysis TanyaDocument10 pagesRatio Analysis Tanyatanya chauhanNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- Financial Statements and Analysis: Income Statement Balance Sheet Cashflow Statement Financial RatiosDocument93 pagesFinancial Statements and Analysis: Income Statement Balance Sheet Cashflow Statement Financial RatiosAayushi ChandwaniNo ratings yet

- Shoppers Stop Financial Model - 24july2021Document23 pagesShoppers Stop Financial Model - 24july2021ELIF KOTADIYANo ratings yet

- Avis and Herz CarDocument11 pagesAvis and Herz CarSheikhFaizanUl-HaqueNo ratings yet

- Beximco Pharmaceuticals LTDDocument14 pagesBeximco Pharmaceuticals LTDIftekar Hasan SajibNo ratings yet

- Industry Financial Report: Release Date: December 2016Document17 pagesIndustry Financial Report: Release Date: December 2016Iqra JawedNo ratings yet

- Business Finance PeTa Shell Vs Petron FinalDocument5 pagesBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Heg LTDDocument9 pagesHeg LTDsmitNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDocument19 pagesKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNo ratings yet

- DCF TemplateDocument21 pagesDCF TemplateShrikant ShelkeNo ratings yet

- Itc Limited: Equity AnalysisDocument15 pagesItc Limited: Equity AnalysisrskatochNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Aztecsoft Financial Results Q2 09Document5 pagesAztecsoft Financial Results Q2 09Mindtree LtdNo ratings yet

- Income Statement: Particulars Revenue Gross ProfitDocument6 pagesIncome Statement: Particulars Revenue Gross ProfitRohanMohapatraNo ratings yet

- Financial Statements Analysis of Apollo and FortisDocument9 pagesFinancial Statements Analysis of Apollo and FortisAnurag DoshiNo ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- Comparative Statement of Profit and LossDocument2 pagesComparative Statement of Profit and LossAnindya BatabyalNo ratings yet

- Analisis KeuanganDocument13 pagesAnalisis KeuanganMichael SaragiNo ratings yet

- Sample Excel FileDocument60 pagesSample Excel FileFunny ManNo ratings yet

- Aliza Rizvi 22010100: Exhibit 8: Assumptions For Discounted Cash Flow AnalysisDocument3 pagesAliza Rizvi 22010100: Exhibit 8: Assumptions For Discounted Cash Flow AnalysisAliza RizviNo ratings yet

- Y2020 Budget PL-NMDocument1 pageY2020 Budget PL-NMBảo AnNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- BV ProjectDocument45 pagesBV Projectgoyalmuskan412No ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisAshmikaNo ratings yet

- Tarun Financial Model - InFOSYSDocument49 pagesTarun Financial Model - InFOSYSANJALI SHARMANo ratings yet

- Din Textile ReportDocument10 pagesDin Textile ReportcontactNo ratings yet

- Persistent KPIT - Merger ModelDocument86 pagesPersistent KPIT - Merger ModelAnurag JainNo ratings yet

- Mod1 How Numbers Tells The Story Words (1473)Document3 pagesMod1 How Numbers Tells The Story Words (1473)Pritam Kumar NayakNo ratings yet

- Working File - SIMDocument7 pagesWorking File - SIMmaica G.No ratings yet

- Book 1Document2 pagesBook 1Noman AmjadNo ratings yet

- Powergrid: Yash Bhuthada SAP ID - 74011919001Document32 pagesPowergrid: Yash Bhuthada SAP ID - 74011919001YASH BHUTADANo ratings yet

- Sapm AssignmentDocument4 pagesSapm Assignment401-030 B. Harika bcom regNo ratings yet

- AnalysisDocument34 pagesAnalysisIndraneel MahantiNo ratings yet

- Confidence Cement LTD: Income StatementDocument20 pagesConfidence Cement LTD: Income StatementIftekar Hasan SajibNo ratings yet

- Final PPT HedgeDocument12 pagesFinal PPT Hedgeb.amankumar.ak75No ratings yet

- 1719825781542XPYGlmEEus5WqJbGDocument15 pages1719825781542XPYGlmEEus5WqJbGb.amankumar.ak75No ratings yet

- 1719825815331U32D7Ol7Cc59RNUoDocument15 pages1719825815331U32D7Ol7Cc59RNUob.amankumar.ak75No ratings yet

- Sales ForcastingDocument3 pagesSales Forcastingb.amankumar.ak75No ratings yet

- Monetory Policy AssignmentDocument6 pagesMonetory Policy AssignmentAwais AhmadNo ratings yet

- Research Paper On FCIDocument12 pagesResearch Paper On FCIAnkit RastogiNo ratings yet

- The Role of The Cash BookDocument67 pagesThe Role of The Cash BookMercy NamboNo ratings yet

- Boost Africa TradersDocument14 pagesBoost Africa TradersDesire JoshuaNo ratings yet

- Financial Accounting Information For Decisions 6th Edition Wild Solutions ManualDocument44 pagesFinancial Accounting Information For Decisions 6th Edition Wild Solutions Manualfinnhuynhqvzp2c100% (26)

- National Thermal Power Corporation Limited: Manual On Procurement and Stores Accounting November 2002Document110 pagesNational Thermal Power Corporation Limited: Manual On Procurement and Stores Accounting November 2002SamNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument13 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJustine Dawn Garcia Santos-TimpacNo ratings yet

- Bill of ExchangeDocument13 pagesBill of ExchangeShiwaniSharmaNo ratings yet

- Tour Report On Chittagong Stock ExchangeDocument5 pagesTour Report On Chittagong Stock ExchangeRajuRahmotulAlamNo ratings yet

- Final PPT SbiDocument33 pagesFinal PPT SbiMuskan MNo ratings yet

- Investors' Attitude Towards Investment Decisions in Equity MarketDocument3 pagesInvestors' Attitude Towards Investment Decisions in Equity MarketEditor IJTSRDNo ratings yet

- Exercise Salam and Parallel Salam FinancingDocument2 pagesExercise Salam and Parallel Salam Financingwokyoh91No ratings yet

- Leg Ethics 2nd Page-1Document149 pagesLeg Ethics 2nd Page-1Stacy Shara OtazaNo ratings yet

- Spouses Tan V VillapazDocument2 pagesSpouses Tan V VillapazEunixia Gaye Labastida100% (1)

- ACC 106 - Table of Specifications Final Exam CoverageDocument1 pageACC 106 - Table of Specifications Final Exam CoverageEunice Lyafe PanilagNo ratings yet

- Compliance Portal - Non-Filing of Return - User Guide - V1.0Document94 pagesCompliance Portal - Non-Filing of Return - User Guide - V1.0Swathi PriyaNo ratings yet

- GboDocument5 pagesGborosechaithuNo ratings yet

- CENG 6108 Lesson 1 IntroductionDocument57 pagesCENG 6108 Lesson 1 IntroductionhaileNo ratings yet

- Module 2 Investment Property and FundsDocument6 pagesModule 2 Investment Property and FundsCharice Anne VillamarinNo ratings yet

- 2310 Usd To Myr - Google SearchDocument1 page2310 Usd To Myr - Google SearchDemi UMTNo ratings yet

- Payment ConfirmationDocument1 pagePayment ConfirmationcyrilpjoodNo ratings yet

- Investigating The Consumers' Perception Towards Usage of Plastic Money in Bangladesh: An Application of Confirmatory Factor AnalysisDocument9 pagesInvestigating The Consumers' Perception Towards Usage of Plastic Money in Bangladesh: An Application of Confirmatory Factor AnalysisHardik ShahNo ratings yet

- Ipm Final Model Paper Spring 15Document12 pagesIpm Final Model Paper Spring 15UMAIR AHMEDNo ratings yet

- Alm Guidelines by RBIDocument10 pagesAlm Guidelines by RBIPranav ViraNo ratings yet

- CH 8 Fixed Income Securities - Bond Charecrtisitcs 1Document44 pagesCH 8 Fixed Income Securities - Bond Charecrtisitcs 1sanketNo ratings yet

- Sovereign Bonds - The FundamentalsDocument1 pageSovereign Bonds - The FundamentalsJasvinder JosenNo ratings yet

- Dow SlidesManiaDocument17 pagesDow SlidesManiaApinnNo ratings yet

- Chapter 14 Documentary Stamp TaxDocument3 pagesChapter 14 Documentary Stamp TaxEngel Racraquin BristolNo ratings yet

- FinAct ARDocument15 pagesFinAct ARnanaNo ratings yet