Professional Documents

Culture Documents

financial-results-for-the-quarter-and-financial-year-ended-march-31-2024

financial-results-for-the-quarter-and-financial-year-ended-march-31-2024

Uploaded by

SindhuXerox shopCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

financial-results-for-the-quarter-and-financial-year-ended-march-31-2024

financial-results-for-the-quarter-and-financial-year-ended-march-31-2024

Uploaded by

SindhuXerox shopCopyright:

Available Formats

61

TATA

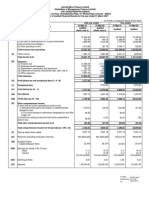

Standalone Statement of Profit and Loss for the quarter/twelve months ended on 3lst March 2024

Crore

Financial year Financial year

Quarter ended Quarter ended Quarter ended

Particulars ended on ended on

on 31.03.2024 on 31.12.2023 on 31.03.2023

31.03.2024 31.03.2023

Audited Audited Audited

Audited Audited

(refer note 9) (refer note 2) (refer note 2)

Revenue from operations

a) Gross sales/ income from operations 36.066.59 34.199.01 37.653.34 1.39,197.60 1.4 1.443.88

b) Other operating revenues 568.19 482.89 394.73 1.789.83 1.469.44

Total revenue from operations [ l(a) + I(b) ] 36,634.78 34.681.90 38.048.07 1.40.987.43 1.42, 9 I 3.32

2 Other income 48L.06 328.59 485.03 3.122.91 2.530.44

3 Total income I I +2 I 37,115.84 35,010.49 38,533.10 1,44,110.34 1,45,443.76

4 Expenses

a) Cost of materials consumed 11.725.34 11.171.10 12.053.75 48.018.48 59,948.72

b) Purchases of stock-in-trade 2.288.32 2.281.13 2.244.84 9.702.30 7.424.21

Changes in inventories of finished and semi-finished goods, stock-in-

ce) 1.186.31 (922.43 1.521.63 369.85 (1,329.69)

trade and work-in-progress

d) Employee benefits expense 1.956.99 1.866.53 1.978.90 7.402.31 7.220.74

e) Finance costs 941.65 1.057.91 1.095.58 4.178.61 3,974.63

0 Depreciation and amortisation expense 1.527.84 1.507.61 1.504.04 5.969.79 5,956.32

g) Other expenses 11.431.49 12.035.93 11.593.82 45.661.17 41.378.66

Total expenses [ 4(a) to 4(g)] 31,057.94 28,997.78 31,992.56 1,21,302.51 1,24,573.59

5 Profit/ (Loss) before exceptional items & tax[33-4 ] 6,057.90 6,012.71 6,540.54 22,807.83 20,870.17

6 Exceptional items

a) Profit / (loss) on sale of non-current investments 338.56 338.56

Provision for impairment of investments/ doubtful loans and

b) (10.40) (1.044.00) (12.971.36) ( 1.056.39)

advances / other financial assets (net)

c) Provision for impairment of non-current assets (net) (178.91) (178.91)

d) Employee separation compensation (51.01) 7.38 4.58 (98.83) (91.94

e) Restructuring and other provisions (404.65) (0.04) (404.67) (1.69)

Gain/(loss) on non-current investments classified as fair value

3.25 2.67 1.88 18.09 30.99

through profit and loss (net)

Total exceptional items [ 6a) to 6(f)] (641.72) 10.05 (699.02) (13.635.68) (780.47

7 Profit/(Loss) before tax[5 + 6 ] 5,416.18 6,022.76 5,841.52 9,172.15 20,089.70

8 Tax Expense

a) Current tax 1.269.14 1.666.4 7 1.489.15 4.954.21 4.918.39

b) Deferred tax 96.74 (296.75) 179.89 (589.46) 486.06

Total tax expense [ 8(a) + 8(b)] 1.365.88 1.369.72 1.669 04 4.364.75 5.404.45

9 Net Profit/ (Loss) for the period I 7-8] 4,050.30 4,653.04 4,172.48 4,807.40 14,685.25

IO Other comprehensive income

A (i) Items that will not be reclassified to profit or loss 188.13 229.75 139.60 795.22 73.23

,,Income tax relating to items that will not be reclassified to profit

(12.06) (18.79) (46.69) (60.16) (44.31)

or loss

B (i) Items that will be reclassified to profit or loss (3.29) (57.45) (49.77) (58.83 79.78

,,Income tax relating to items that will be reclassified to profit or

1.16 14.42 12.30 15.14 (20.12)

loss

Total other comprehensive income 173.94 167.93 55.44 691.37 88.58

1I Total Comprehensive Income for the period [9 + 10 ] 4,224.24 4,820.97 4,227.92 5,498.77 14,773.83

12 Paid-up equity share capital [Face value ? I per share] 1.248.60 1.229.98 1.222.40 1.248.60 1.222.40

13 Paid-up debt capital 12.823.10 10.126.53 15.058.49 12.823.10 15.058.49

I4 Reserves excluding revaluation reserves 1.36.445.05 1.35.386.48

I5 Securities premium reserve 31.290.24 31,290.24 31.290.24 31.290.24 31.290.24

16 Eamings per equity share

Basic earnings per share {not annualised)- in Rupees

3.24 3.73 3.34 3.85 11.76

(after exceptional items)

Diluted earnings per share (not annualised)- in Rupees

3.24 3.73 3.34 3.85 11.76

(after exceptional items)

(a) Paid up debt capital represents debentures

TATA STEEL LIMITED

eqrtere Orce bombay tout 2a Hom» Mody reet Fort Mum1ba1 400 001 In(i

Tel 91 22 6665 8282 Fax91 22 6665 7724

Corporate Identihcation Number L27100MH 1907PLC000260 Website www.tatasteel.com

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- MU PLC Annual Report 2002 Financial StatementsDocument21 pagesMU PLC Annual Report 2002 Financial StatementsNurlisaAlnyNo ratings yet

- Kashato Shirts 1Document63 pagesKashato Shirts 1Danica De Vera100% (2)

- Assignment AdvaccDocument6 pagesAssignment AdvaccAccounting Materials0% (1)

- Financial Results for the Quarter and Financial Year Ended March 31 2024Document15 pagesFinancial Results for the Quarter and Financial Year Ended March 31 2024kaushaljoshi85No ratings yet

- Sebi ReleaseDocument10 pagesSebi Releaseabhinashgiri2023No ratings yet

- Sebi ReleaseDocument8 pagesSebi ReleaseKingNo ratings yet

- Sebi Release EditDocument2 pagesSebi Release Editkarthikpranesh7No ratings yet

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GameNo ratings yet

- 2016 Annual ReportDocument7 pages2016 Annual ReportHeadshot's GameNo ratings yet

- Tata Motors Group Q4 Annual Financial Results FY19 20Document10 pagesTata Motors Group Q4 Annual Financial Results FY19 20Anil Kumar AkNo ratings yet

- Berger Paints 11Document1 pageBerger Paints 11Hiya ChoudharyNo ratings yet

- Sun Pharma 1Document9 pagesSun Pharma 1sakuchabukswarNo ratings yet

- Bajaj Auto Limited: Page 1 of 7Document7 pagesBajaj Auto Limited: Page 1 of 7DPH ResearchNo ratings yet

- Financial Results Consolidated Q1fy23Document4 pagesFinancial Results Consolidated Q1fy23Raj veerNo ratings yet

- Mahindra & Mahindra Limited: Rs. in CroresDocument4 pagesMahindra & Mahindra Limited: Rs. in CroresGeorge Chalissery RajuNo ratings yet

- Q4 Results of Bal 2022-23Document11 pagesQ4 Results of Bal 2022-23dewerNo ratings yet

- Q1-Results Bal 2019-20Document5 pagesQ1-Results Bal 2019-20Krish PatelNo ratings yet

- Audited Financial Results For The Quarter and Year Ended 31st March, 2021Document21 pagesAudited Financial Results For The Quarter and Year Ended 31st March, 2021Vilas ShahNo ratings yet

- Financial Result Q4fy22 ConsolidatedDocument6 pagesFinancial Result Q4fy22 ConsolidatedTharunyaNo ratings yet

- (In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanDocument9 pages(In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanAnamika NandiNo ratings yet

- BSE Limited National Stock Exchange of India LimitedDocument9 pagesBSE Limited National Stock Exchange of India LimitedArvind PurohitNo ratings yet

- Audited Consolidated Financial Results 31 03 2023 5e87d66fb7Document9 pagesAudited Consolidated Financial Results 31 03 2023 5e87d66fb7LaraNo ratings yet

- Devyani International Q3 ResultsDocument9 pagesDevyani International Q3 ResultsSaurabh AggarwalNo ratings yet

- GHCL Limited (CIN: L24100GJ1983PLC006513)Document10 pagesGHCL Limited (CIN: L24100GJ1983PLC006513)soumyasibaniNo ratings yet

- MM Q3 F22 Financial Results PackDocument12 pagesMM Q3 F22 Financial Results PackBharathNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Dabur 5Document1 pageDabur 5faheem.ashrafNo ratings yet

- Q3FY22Document7 pagesQ3FY22Pratik PatilNo ratings yet

- Regd - Office: Bombay House, 24, Homi Mody Street, Mumbai 400 001Document6 pagesRegd - Office: Bombay House, 24, Homi Mody Street, Mumbai 400 001HolaNo ratings yet

- Q4 20 - DhunseriDocument8 pagesQ4 20 - Dhunserica.anup.kNo ratings yet

- SPIL Q2FY22 Financial ResultsDocument10 pagesSPIL Q2FY22 Financial ResultsKARANNo ratings yet

- Ufrq1 Fy2023-24Document24 pagesUfrq1 Fy2023-24mallemalavarunNo ratings yet

- Itc Annual ReportDocument6 pagesItc Annual ReportAditya AgrawalNo ratings yet

- ITC Financial Result Q4 FY2022 SfsDocument6 pagesITC Financial Result Q4 FY2022 SfsMoksh PorwalNo ratings yet

- 2000 5000 Corp Action 20220525Document62 pages2000 5000 Corp Action 20220525Contra Value BetsNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document10 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Sourya MitraNo ratings yet

- R D Offlc Mbic Oad, Va o A 3 003: of MaDocument10 pagesR D Offlc Mbic Oad, Va o A 3 003: of MaRavi AgarwalNo ratings yet

- Q2 Results Bal 2021 22Document11 pagesQ2 Results Bal 2021 22Suraj PatilNo ratings yet

- Quarter AnnualDocument8 pagesQuarter AnnualNeetu JainNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Results Trident16446Document6 pagesResults Trident16446mohitNo ratings yet

- Statement Profit Loss StandaloneDocument1 pageStatement Profit Loss Standalonesubham not a nameNo ratings yet

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyNo ratings yet

- Asian Paints 11Document1 pageAsian Paints 11Hiya ChoudharyNo ratings yet

- Aditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Document6 pagesAditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Bhavesh PatelNo ratings yet

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerNo ratings yet

- Audited Financial Results For The Quarter and Year Ended March 31, 2023Document6 pagesAudited Financial Results For The Quarter and Year Ended March 31, 2023vikaspawar78No ratings yet

- HawkinsDocument1 pageHawkinsNatarajNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document8 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006pradeepNo ratings yet

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006No ratings yet

- Tata Steel LimitedDocument7 pagesTata Steel LimitedmomNo ratings yet

- Financial Results 310324 PDFDocument14 pagesFinancial Results 310324 PDFvikramgandhi89No ratings yet

- ITC Financial Result Q4 FY2023 SfsDocument6 pagesITC Financial Result Q4 FY2023 Sfsaanchal prasadNo ratings yet

- TML Standalone Results Sept 2023 1Document5 pagesTML Standalone Results Sept 2023 1NagendranNo ratings yet

- Financial Results Consolidated Q2 FY 2023 2024Document10 pagesFinancial Results Consolidated Q2 FY 2023 2024surendran naiduNo ratings yet

- Financial Results 31 Mar 2010 HSBC Invest DirectDocument2 pagesFinancial Results 31 Mar 2010 HSBC Invest Directbhavnesh_muthaNo ratings yet

- FR 09112023Document10 pagesFR 09112023vikramgandhi89No ratings yet

- ABCL Consol Standalone Q1 FY24Document6 pagesABCL Consol Standalone Q1 FY24ru007744No ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For The Quarter / Year Ended On 31st March 2012Document9 pagesStandalone Financial Results For The Quarter / Year Ended On 31st March 2012smartashok88No ratings yet

- Chapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFDocument24 pagesChapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFChristian GoNo ratings yet

- Case Study 1 - Signal Cable CompanyDocument5 pagesCase Study 1 - Signal Cable CompanyTengku SuriaNo ratings yet

- Cbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Document6 pagesCbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Sukhman DhillonNo ratings yet

- Chapter 2Document15 pagesChapter 2Megan Ho100% (2)

- CA-Inter-Accounts Iqtdar-MalikDocument31 pagesCA-Inter-Accounts Iqtdar-MalikSUMANTO BARMANNo ratings yet

- Abmbrc Assignment 1Document14 pagesAbmbrc Assignment 1walsondevNo ratings yet

- IIKP - Financial Statement - 2020 - Source (Cekdollarmu - Eu.org)Document51 pagesIIKP - Financial Statement - 2020 - Source (Cekdollarmu - Eu.org)Dina Puspa AmandaNo ratings yet

- Accounting MidTermDocument16 pagesAccounting MidTermPrincess Claris Araucto33% (3)

- Post-Class Quiz #2Document9 pagesPost-Class Quiz #2Nghi AnNo ratings yet

- ASP - 3H - 02 - Abdul Qodir - Tugas3Document5 pagesASP - 3H - 02 - Abdul Qodir - Tugas3abdul qodirNo ratings yet

- CH - 24 PPT FMDocument33 pagesCH - 24 PPT FMnishulalwaniNo ratings yet

- Business Strategy Using Financial Statements: Asset Analysis-Long-Lived Asset and DepreciationDocument41 pagesBusiness Strategy Using Financial Statements: Asset Analysis-Long-Lived Asset and DepreciationMeena KhattakNo ratings yet

- FABM2121 Fundamentals Grade 12 1st Quarter ExamDocument36 pagesFABM2121 Fundamentals Grade 12 1st Quarter ExamAhlfea JugalbotNo ratings yet

- AC1025 - Lecture Tute 05 V2Document13 pagesAC1025 - Lecture Tute 05 V2etextbooks lkNo ratings yet

- Notes Holding CompanyDocument4 pagesNotes Holding CompanySaurav NasaNo ratings yet

- Soal P 7.2, 7.3, 7.5Document3 pagesSoal P 7.2, 7.3, 7.5boba milkNo ratings yet

- Group Assignment B - Amni - Merc - LioniDocument5 pagesGroup Assignment B - Amni - Merc - LioniAmniNo ratings yet

- Laporan Keuangan 31 Dec 09 - Annual report-JS PDFDocument52 pagesLaporan Keuangan 31 Dec 09 - Annual report-JS PDFstuffidNo ratings yet

- Assets: Assets To Be Realized: Assets RealizedDocument10 pagesAssets: Assets To Be Realized: Assets RealizedKylabsssNo ratings yet

- Kertas Kerja PD Dunia Boneka NovemberDocument32 pagesKertas Kerja PD Dunia Boneka NovemberZEXNNo ratings yet

- Consolidation Subsequent To Acquisition Date: Solutions Manual, Chapter 5Document83 pagesConsolidation Subsequent To Acquisition Date: Solutions Manual, Chapter 5Gillian Snelling100% (1)

- Lesson 1 DBA 255Document65 pagesLesson 1 DBA 255Anne Marieline BuenaventuraNo ratings yet

- Accounting Equation MCQDocument8 pagesAccounting Equation MCQKulNo ratings yet

- ICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPDocument28 pagesICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPHankhnilNo ratings yet

- Rice Company Was Incorporated On January 1Document6 pagesRice Company Was Incorporated On January 1Marjorie PalmaNo ratings yet

- CH 5 HW Solutions-1Document41 pagesCH 5 HW Solutions-1Jan SpantonNo ratings yet

- Working Capital Management - Cash Conversion CycleDocument3 pagesWorking Capital Management - Cash Conversion CycleRutvik KalgutkarNo ratings yet