Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 views'O' Level Accounting Capital and Revenue Expenditure

'O' Level Accounting Capital and Revenue Expenditure

Uploaded by

anesu5601Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Wells Fargo Bank StatementDocument1 pageWells Fargo Bank StatementKirill DelyNo ratings yet

- Corp Financial ReportingDocument7 pagesCorp Financial ReportingJustin L De ArmondNo ratings yet

- Types of Expenses Capital Expenditure Revenue ExpenditureDocument8 pagesTypes of Expenses Capital Expenditure Revenue ExpenditureChong Kuan PeiNo ratings yet

- MEFADocument24 pagesMEFASai Teja MadhaNo ratings yet

- Chapter 2Document3 pagesChapter 2Jk DVSNo ratings yet

- Final Accounts: Manufacturing, Trading and P&L A/cDocument51 pagesFinal Accounts: Manufacturing, Trading and P&L A/cAnit Jacob Philip100% (1)

- Revenue ExpendituresDocument8 pagesRevenue ExpendituresAdvertising Alaska Holiday100% (1)

- Chapter 4 - Income Measurement & Accrual Accounting: Recognition & Measurement in Financial StatementsDocument5 pagesChapter 4 - Income Measurement & Accrual Accounting: Recognition & Measurement in Financial StatementsHareem Zoya WarsiNo ratings yet

- Cee 4Document13 pagesCee 4Abdullah RamzanNo ratings yet

- 5 6172302118171443573 PDFDocument3 pages5 6172302118171443573 PDFPavan RaiNo ratings yet

- Chapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRDocument14 pagesChapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRSaket_srv2100% (1)

- Annual ReportDocument5 pagesAnnual Reportmengjun0987654311No ratings yet

- Facilitators Guide For Accenture-IGNOU Diploma Program: Unit 4Document20 pagesFacilitators Guide For Accenture-IGNOU Diploma Program: Unit 4Vinay SinghNo ratings yet

- Reconciliation of Cost & Financial AccountsDocument13 pagesReconciliation of Cost & Financial AccountsRahulNo ratings yet

- 2211posting 061cab6e3d56f89 03363994Document12 pages2211posting 061cab6e3d56f89 03363994Saleh RaoufNo ratings yet

- Capital Vs Revenue Exp..... Point PresentationDocument16 pagesCapital Vs Revenue Exp..... Point PresentationVinay Kumar100% (1)

- Mba775 - ACF 6 - Adjustments To Earnings Before Using DCF ModelsDocument14 pagesMba775 - ACF 6 - Adjustments To Earnings Before Using DCF Modelsshubhtandon123No ratings yet

- ACCOUNTING: Inflation AccountingDocument34 pagesACCOUNTING: Inflation Accountingmehul100% (2)

- Chapter 2 WileyDocument29 pagesChapter 2 Wileyp876468No ratings yet

- Preparation of financial statements1Document40 pagesPreparation of financial statements1swarnajit paulNo ratings yet

- Fundamentals of Accounting PDFDocument52 pagesFundamentals of Accounting PDFomid sangarNo ratings yet

- Introduction To Financial Accounting (FFA/FAB) : DR Ahmad AlshehabiDocument55 pagesIntroduction To Financial Accounting (FFA/FAB) : DR Ahmad AlshehabiKye SimpsonNo ratings yet

- The Balance SheetDocument101 pagesThe Balance SheethakomoNo ratings yet

- FCA-CSzBS - II UnitDocument34 pagesFCA-CSzBS - II UnitSURIYA VARSHANNo ratings yet

- Balance Sheet: by Dr. ArchanaDocument19 pagesBalance Sheet: by Dr. ArchanaHan JeeNo ratings yet

- Introa5 7Document41 pagesIntroa5 7Ameya RanadiveNo ratings yet

- Accounting For Managers Ch02Document31 pagesAccounting For Managers Ch02Abdul Naseer KhacsarNo ratings yet

- Module D - Final Accounts of Banks & Companies - PresentationDocument102 pagesModule D - Final Accounts of Banks & Companies - PresentationASHISH GUPTANo ratings yet

- Lesson 5Document31 pagesLesson 5Glenda DestrizaNo ratings yet

- Class 15Document14 pagesClass 15Majid IqbalNo ratings yet

- Preparation of Final AccountDocument32 pagesPreparation of Final AccountCHARLES FURTADONo ratings yet

- Basic Accounting TermsDocument12 pagesBasic Accounting TermsNathan DavidNo ratings yet

- Chapter 23 Current Cost AccountingDocument24 pagesChapter 23 Current Cost AccountingElaine Fiona VillafuerteNo ratings yet

- 03 Completing The Accounting Cycle of A Merchandising BusinessDocument62 pages03 Completing The Accounting Cycle of A Merchandising BusinessApril SasamNo ratings yet

- Acc Adjustments PDFDocument15 pagesAcc Adjustments PDFHana YusriNo ratings yet

- Account TitlesDocument4 pagesAccount TitlesChristian VelascoNo ratings yet

- CE 309 FINANCIAL STATEMENT ANALYSIS Lecture Sept 2013Document98 pagesCE 309 FINANCIAL STATEMENT ANALYSIS Lecture Sept 2013kundayi shavaNo ratings yet

- Liquidity of Short-Term Assets Related Debt-Paying Ability: Mehwish KiranDocument33 pagesLiquidity of Short-Term Assets Related Debt-Paying Ability: Mehwish KiranAlina ZubairNo ratings yet

- Module Business Finance Chapter 2Document25 pagesModule Business Finance Chapter 2Atria Lenn Villamiel BugalNo ratings yet

- Chapter 2Document12 pagesChapter 2Ashekin MahadiNo ratings yet

- AFIN102 Notes Pack 3Document52 pagesAFIN102 Notes Pack 3boy.poo90No ratings yet

- Session 2a Handout PDFDocument7 pagesSession 2a Handout PDFChin Hung YauNo ratings yet

- Abm01 - Module 4.2Document25 pagesAbm01 - Module 4.2Love JcwNo ratings yet

- Basic Accounting Principles: The Financial StatementsDocument55 pagesBasic Accounting Principles: The Financial Statementsthella deva prasadNo ratings yet

- Fabm 1 ReviewerDocument4 pagesFabm 1 Reviewersolisleslie.0707No ratings yet

- Part 6.a - AccountingDocument38 pagesPart 6.a - AccountingzhengcunzhangNo ratings yet

- Acc721: Framework For Accounting & ReportingDocument14 pagesAcc721: Framework For Accounting & ReportingJason InufiNo ratings yet

- Accountingnit Jamshedpur NotesDocument47 pagesAccountingnit Jamshedpur NotesSuraj KumarNo ratings yet

- Chapter 9 - Current Liabilities: Contingencies, and The Time Value of MoneyDocument8 pagesChapter 9 - Current Liabilities: Contingencies, and The Time Value of MoneyHareem Zoya WarsiNo ratings yet

- Ch2 - Financial Statement Analysis - NTHDocument107 pagesCh2 - Financial Statement Analysis - NTHAnh NguyễnNo ratings yet

- Chapter 12Document8 pagesChapter 12Hareem Zoya WarsiNo ratings yet

- L 5 Cost of CapitalDocument16 pagesL 5 Cost of CapitalMansi SainiNo ratings yet

- Financial ManagementDocument53 pagesFinancial ManagementOmNo ratings yet

- CHAPTER 4 BACT Equation Expanded To Show Operating ActivitiesDocument50 pagesCHAPTER 4 BACT Equation Expanded To Show Operating Activities2051611No ratings yet

- Basic TerminologiesDocument20 pagesBasic TerminologiesMOHAMED USAIDNo ratings yet

- Assets Are The Items Your Company Owns That Can Provide FutureDocument11 pagesAssets Are The Items Your Company Owns That Can Provide FuturestudentNo ratings yet

- Basic Financial Literacy_CSR_UpdateDocument46 pagesBasic Financial Literacy_CSR_UpdatehtayminkineNo ratings yet

- Accounting Fundamentals: By: Prof Jayraj JavheriDocument41 pagesAccounting Fundamentals: By: Prof Jayraj JavherijayrajNo ratings yet

- Capital Budgeting SOBD-4Document30 pagesCapital Budgeting SOBD-4shrutisirsa1No ratings yet

- Session 5 - Financial Statement AnalysisDocument42 pagesSession 5 - Financial Statement AnalysisVaibhav JainNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- Unit 1 FMDocument14 pagesUnit 1 FMRICKY KALITANo ratings yet

- Calculations - Mr. Prem Ranjan & SudhaDocument72 pagesCalculations - Mr. Prem Ranjan & SudhaVinay Kumar100% (1)

- SME Rating (Methodology)Document6 pagesSME Rating (Methodology)radhika1991No ratings yet

- Afterpay Research PDFDocument33 pagesAfterpay Research PDFNikhil JoyNo ratings yet

- Dalio Ebook FINAL PDFDocument48 pagesDalio Ebook FINAL PDFvuhieptran100% (1)

- Kosamattam Finance Limited Prospectus AprilDocument287 pagesKosamattam Finance Limited Prospectus Aprilmehtarahul999No ratings yet

- Jpmorgan Trust IIDocument180 pagesJpmorgan Trust IIgunjanbihaniNo ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- I7oB nKtGDi6RyT0Document6 pagesI7oB nKtGDi6RyT0Gretta BrownNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument1 pageStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceRohan TiwariNo ratings yet

- FM 1Document3 pagesFM 1anon-940489No ratings yet

- GP FundDocument45 pagesGP FundHaroon KhanNo ratings yet

- Commission StructureDocument3 pagesCommission StructureRandom ManiacNo ratings yet

- Concept of Capital and Revenue TransactionsDocument5 pagesConcept of Capital and Revenue TransactionsYakkstar 21No ratings yet

- FDP On Tax Planning, Financial Planning & Filing of ItrDocument4 pagesFDP On Tax Planning, Financial Planning & Filing of ItrAman KumarNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Chapter-1 Indian Banking System PDFDocument53 pagesChapter-1 Indian Banking System PDFbhuvaneswarimpNo ratings yet

- Test Bank For Government and Not For Profit Accounting 8th by GranofDocument20 pagesTest Bank For Government and Not For Profit Accounting 8th by GranofHorace Renfroe100% (47)

- Solutions 2021 MockExamDocument15 pagesSolutions 2021 MockExamdayeyoutai779No ratings yet

- A Study On Impact of Phone Pe Payment With Special Reference To YouthDocument110 pagesA Study On Impact of Phone Pe Payment With Special Reference To YouthAJAY RATHORENo ratings yet

- FM II 2022 Assignment IDocument7 pagesFM II 2022 Assignment IAmanuel AbebawNo ratings yet

- Bank StatementDocument24 pagesBank StatementJames PeterNo ratings yet

- Centronics Corporation v. Genicom CorporationDocument1 pageCentronics Corporation v. Genicom CorporationcrlstinaaaNo ratings yet

- LM Busmath q2 Module 2 Wk2 CasillaDocument30 pagesLM Busmath q2 Module 2 Wk2 CasillaDonna CasillaNo ratings yet

- Lecture Notes - Business Finance 2Document3 pagesLecture Notes - Business Finance 2Aslan AlpNo ratings yet

- New Developments in Islamic Economics: Article InformationDocument19 pagesNew Developments in Islamic Economics: Article Informationsajid bhattiNo ratings yet

- Name: Nikhil P. PalanDocument7 pagesName: Nikhil P. PalanVinit BhindeNo ratings yet

- Wellington Global Innovation Fund Factsheet July 2022Document2 pagesWellington Global Innovation Fund Factsheet July 2022snehalNo ratings yet

- Special Topics in Financial ManagementDocument36 pagesSpecial Topics in Financial ManagementChristel Mae Boseo100% (1)

'O' Level Accounting Capital and Revenue Expenditure

'O' Level Accounting Capital and Revenue Expenditure

Uploaded by

anesu56010 ratings0% found this document useful (0 votes)

1 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views2 pages'O' Level Accounting Capital and Revenue Expenditure

'O' Level Accounting Capital and Revenue Expenditure

Uploaded by

anesu5601Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

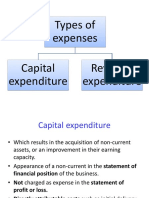

Capital and Revenue Expenditure

• In accounting it is paramount to separate between revenue and capital expenditure

• Naturally all business expenditure can be classified as either revenue or capital expenditure

Capital Expenditure

• Capital expenditure is not to be confused with the capital account or capital in general

• Capital expenditure is when a business spends money to either:

✓ Buy a fixed asset or

✓ Add value to an existing fixed asset

• It would thus include the following:

➢ the cost of acquiring fixed assets i.e. the purchase price of the fixed asset itself

➢ the cost of bringing the fixed asset into the business e.g. carriage inwards,

loading and unloading costs, import duty etc

➢ the legal costs of buying buildings

➢ Any other cost incurred to get a fixed asset ready for use for example

installation and tuning costs

• Visit this topic to learn about the accounting treatment of capital expenditure

Revenue expenditure

• Expenditure which is not spent on increasing the value of fixed assets, but on running the

business on a day-to-day basis

• Examples would include:

o Fuel costs

o Repainting a building

o Art restoration

o Purchases

o Rent payments

o Wages and Salaries

o Advertising costs

o Selling and Distribution costs

o Administration costs etc

• Visit this topic to learn more about the accounting treatment of revenue expenditure

Joint expenditure

• It is not at all uncommon for a single sum spend to include both revenue and capital

expenditure

• For example, a business hires a construction company to restore and extend its premises

• In such instances an endeavour must made to separate those costs that can be classified as

revenue expenditure and those to be deemed as capital expenditure

• Once this is done the cost can be treated according to their nature

• Now that we have explained the differences between capital and

revenue expenditure

• It is time to look at how these are recorded in the books

• Obviously the treatment is not the same

Accounting Treatment of Capital Expenditure

• Capital expenditure must be recorded in the General Ledger usually as an non-current asset

• Typical entries are:

I. To record the purchase of an asset:

a. Dr Asset Account with the total amount of the purchase

‘We stronger together’

b. Cr Cash/Bank/Creditor's Account

II. To record Additional Expenses:

a. Dr Asset Account

b. Cr Cash/Bank or Creditor's Account

• The balances of capital expenditure account is shown in the Statement of

Financial Position at the end of each period

• Only a portion of this expenditure is transferred to the Income Statement/Profit

and loss account

• This portion usually relates to

depreciation and represents a portion

of the non-current asset that has been

"consumed" or used up in generating

revenue for the current period

Accounting treatment of Revenue Expenditure

• Capital expenditure recorded in the various ledgers depending on their nature

• For example, credit purchases are recorded in the Purchases Ledger

• Rent is recorded in the General Ledger etc

• At the end of each period the total expenses for the period are charged against

revenue for the period in the Profit and Loss Account and appear as expenses in

the Income Statement

• Typical entries are:

I. To record rent paid for the period:

a. Dr Rent Expense Account

b. Cr Cash or Bank

II. At the end of the period transfer the rent amount to the profit and loss account:

a. Dr Profit and Loss Account

b. Cr Rent Expense Account

Effects of incorrect classification and treatment

• Since their accounting treatment is different failure to properly classify and

record profit has an effect on profit

• Treating capital expenditure as revenue expenditure will:

o Result in the understatement of non-current assets and

o Reduce the profit figure resulting in it being understated

• Treating revenue expenditure as capital expenditure will:

o Result in non-current assets being overstated

o Profit for the period being overstated

‘We stronger together’

You might also like

- Wells Fargo Bank StatementDocument1 pageWells Fargo Bank StatementKirill DelyNo ratings yet

- Corp Financial ReportingDocument7 pagesCorp Financial ReportingJustin L De ArmondNo ratings yet

- Types of Expenses Capital Expenditure Revenue ExpenditureDocument8 pagesTypes of Expenses Capital Expenditure Revenue ExpenditureChong Kuan PeiNo ratings yet

- MEFADocument24 pagesMEFASai Teja MadhaNo ratings yet

- Chapter 2Document3 pagesChapter 2Jk DVSNo ratings yet

- Final Accounts: Manufacturing, Trading and P&L A/cDocument51 pagesFinal Accounts: Manufacturing, Trading and P&L A/cAnit Jacob Philip100% (1)

- Revenue ExpendituresDocument8 pagesRevenue ExpendituresAdvertising Alaska Holiday100% (1)

- Chapter 4 - Income Measurement & Accrual Accounting: Recognition & Measurement in Financial StatementsDocument5 pagesChapter 4 - Income Measurement & Accrual Accounting: Recognition & Measurement in Financial StatementsHareem Zoya WarsiNo ratings yet

- Cee 4Document13 pagesCee 4Abdullah RamzanNo ratings yet

- 5 6172302118171443573 PDFDocument3 pages5 6172302118171443573 PDFPavan RaiNo ratings yet

- Chapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRDocument14 pagesChapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRSaket_srv2100% (1)

- Annual ReportDocument5 pagesAnnual Reportmengjun0987654311No ratings yet

- Facilitators Guide For Accenture-IGNOU Diploma Program: Unit 4Document20 pagesFacilitators Guide For Accenture-IGNOU Diploma Program: Unit 4Vinay SinghNo ratings yet

- Reconciliation of Cost & Financial AccountsDocument13 pagesReconciliation of Cost & Financial AccountsRahulNo ratings yet

- 2211posting 061cab6e3d56f89 03363994Document12 pages2211posting 061cab6e3d56f89 03363994Saleh RaoufNo ratings yet

- Capital Vs Revenue Exp..... Point PresentationDocument16 pagesCapital Vs Revenue Exp..... Point PresentationVinay Kumar100% (1)

- Mba775 - ACF 6 - Adjustments To Earnings Before Using DCF ModelsDocument14 pagesMba775 - ACF 6 - Adjustments To Earnings Before Using DCF Modelsshubhtandon123No ratings yet

- ACCOUNTING: Inflation AccountingDocument34 pagesACCOUNTING: Inflation Accountingmehul100% (2)

- Chapter 2 WileyDocument29 pagesChapter 2 Wileyp876468No ratings yet

- Preparation of financial statements1Document40 pagesPreparation of financial statements1swarnajit paulNo ratings yet

- Fundamentals of Accounting PDFDocument52 pagesFundamentals of Accounting PDFomid sangarNo ratings yet

- Introduction To Financial Accounting (FFA/FAB) : DR Ahmad AlshehabiDocument55 pagesIntroduction To Financial Accounting (FFA/FAB) : DR Ahmad AlshehabiKye SimpsonNo ratings yet

- The Balance SheetDocument101 pagesThe Balance SheethakomoNo ratings yet

- FCA-CSzBS - II UnitDocument34 pagesFCA-CSzBS - II UnitSURIYA VARSHANNo ratings yet

- Balance Sheet: by Dr. ArchanaDocument19 pagesBalance Sheet: by Dr. ArchanaHan JeeNo ratings yet

- Introa5 7Document41 pagesIntroa5 7Ameya RanadiveNo ratings yet

- Accounting For Managers Ch02Document31 pagesAccounting For Managers Ch02Abdul Naseer KhacsarNo ratings yet

- Module D - Final Accounts of Banks & Companies - PresentationDocument102 pagesModule D - Final Accounts of Banks & Companies - PresentationASHISH GUPTANo ratings yet

- Lesson 5Document31 pagesLesson 5Glenda DestrizaNo ratings yet

- Class 15Document14 pagesClass 15Majid IqbalNo ratings yet

- Preparation of Final AccountDocument32 pagesPreparation of Final AccountCHARLES FURTADONo ratings yet

- Basic Accounting TermsDocument12 pagesBasic Accounting TermsNathan DavidNo ratings yet

- Chapter 23 Current Cost AccountingDocument24 pagesChapter 23 Current Cost AccountingElaine Fiona VillafuerteNo ratings yet

- 03 Completing The Accounting Cycle of A Merchandising BusinessDocument62 pages03 Completing The Accounting Cycle of A Merchandising BusinessApril SasamNo ratings yet

- Acc Adjustments PDFDocument15 pagesAcc Adjustments PDFHana YusriNo ratings yet

- Account TitlesDocument4 pagesAccount TitlesChristian VelascoNo ratings yet

- CE 309 FINANCIAL STATEMENT ANALYSIS Lecture Sept 2013Document98 pagesCE 309 FINANCIAL STATEMENT ANALYSIS Lecture Sept 2013kundayi shavaNo ratings yet

- Liquidity of Short-Term Assets Related Debt-Paying Ability: Mehwish KiranDocument33 pagesLiquidity of Short-Term Assets Related Debt-Paying Ability: Mehwish KiranAlina ZubairNo ratings yet

- Module Business Finance Chapter 2Document25 pagesModule Business Finance Chapter 2Atria Lenn Villamiel BugalNo ratings yet

- Chapter 2Document12 pagesChapter 2Ashekin MahadiNo ratings yet

- AFIN102 Notes Pack 3Document52 pagesAFIN102 Notes Pack 3boy.poo90No ratings yet

- Session 2a Handout PDFDocument7 pagesSession 2a Handout PDFChin Hung YauNo ratings yet

- Abm01 - Module 4.2Document25 pagesAbm01 - Module 4.2Love JcwNo ratings yet

- Basic Accounting Principles: The Financial StatementsDocument55 pagesBasic Accounting Principles: The Financial Statementsthella deva prasadNo ratings yet

- Fabm 1 ReviewerDocument4 pagesFabm 1 Reviewersolisleslie.0707No ratings yet

- Part 6.a - AccountingDocument38 pagesPart 6.a - AccountingzhengcunzhangNo ratings yet

- Acc721: Framework For Accounting & ReportingDocument14 pagesAcc721: Framework For Accounting & ReportingJason InufiNo ratings yet

- Accountingnit Jamshedpur NotesDocument47 pagesAccountingnit Jamshedpur NotesSuraj KumarNo ratings yet

- Chapter 9 - Current Liabilities: Contingencies, and The Time Value of MoneyDocument8 pagesChapter 9 - Current Liabilities: Contingencies, and The Time Value of MoneyHareem Zoya WarsiNo ratings yet

- Ch2 - Financial Statement Analysis - NTHDocument107 pagesCh2 - Financial Statement Analysis - NTHAnh NguyễnNo ratings yet

- Chapter 12Document8 pagesChapter 12Hareem Zoya WarsiNo ratings yet

- L 5 Cost of CapitalDocument16 pagesL 5 Cost of CapitalMansi SainiNo ratings yet

- Financial ManagementDocument53 pagesFinancial ManagementOmNo ratings yet

- CHAPTER 4 BACT Equation Expanded To Show Operating ActivitiesDocument50 pagesCHAPTER 4 BACT Equation Expanded To Show Operating Activities2051611No ratings yet

- Basic TerminologiesDocument20 pagesBasic TerminologiesMOHAMED USAIDNo ratings yet

- Assets Are The Items Your Company Owns That Can Provide FutureDocument11 pagesAssets Are The Items Your Company Owns That Can Provide FuturestudentNo ratings yet

- Basic Financial Literacy_CSR_UpdateDocument46 pagesBasic Financial Literacy_CSR_UpdatehtayminkineNo ratings yet

- Accounting Fundamentals: By: Prof Jayraj JavheriDocument41 pagesAccounting Fundamentals: By: Prof Jayraj JavherijayrajNo ratings yet

- Capital Budgeting SOBD-4Document30 pagesCapital Budgeting SOBD-4shrutisirsa1No ratings yet

- Session 5 - Financial Statement AnalysisDocument42 pagesSession 5 - Financial Statement AnalysisVaibhav JainNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- Unit 1 FMDocument14 pagesUnit 1 FMRICKY KALITANo ratings yet

- Calculations - Mr. Prem Ranjan & SudhaDocument72 pagesCalculations - Mr. Prem Ranjan & SudhaVinay Kumar100% (1)

- SME Rating (Methodology)Document6 pagesSME Rating (Methodology)radhika1991No ratings yet

- Afterpay Research PDFDocument33 pagesAfterpay Research PDFNikhil JoyNo ratings yet

- Dalio Ebook FINAL PDFDocument48 pagesDalio Ebook FINAL PDFvuhieptran100% (1)

- Kosamattam Finance Limited Prospectus AprilDocument287 pagesKosamattam Finance Limited Prospectus Aprilmehtarahul999No ratings yet

- Jpmorgan Trust IIDocument180 pagesJpmorgan Trust IIgunjanbihaniNo ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- I7oB nKtGDi6RyT0Document6 pagesI7oB nKtGDi6RyT0Gretta BrownNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument1 pageStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceRohan TiwariNo ratings yet

- FM 1Document3 pagesFM 1anon-940489No ratings yet

- GP FundDocument45 pagesGP FundHaroon KhanNo ratings yet

- Commission StructureDocument3 pagesCommission StructureRandom ManiacNo ratings yet

- Concept of Capital and Revenue TransactionsDocument5 pagesConcept of Capital and Revenue TransactionsYakkstar 21No ratings yet

- FDP On Tax Planning, Financial Planning & Filing of ItrDocument4 pagesFDP On Tax Planning, Financial Planning & Filing of ItrAman KumarNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Chapter-1 Indian Banking System PDFDocument53 pagesChapter-1 Indian Banking System PDFbhuvaneswarimpNo ratings yet

- Test Bank For Government and Not For Profit Accounting 8th by GranofDocument20 pagesTest Bank For Government and Not For Profit Accounting 8th by GranofHorace Renfroe100% (47)

- Solutions 2021 MockExamDocument15 pagesSolutions 2021 MockExamdayeyoutai779No ratings yet

- A Study On Impact of Phone Pe Payment With Special Reference To YouthDocument110 pagesA Study On Impact of Phone Pe Payment With Special Reference To YouthAJAY RATHORENo ratings yet

- FM II 2022 Assignment IDocument7 pagesFM II 2022 Assignment IAmanuel AbebawNo ratings yet

- Bank StatementDocument24 pagesBank StatementJames PeterNo ratings yet

- Centronics Corporation v. Genicom CorporationDocument1 pageCentronics Corporation v. Genicom CorporationcrlstinaaaNo ratings yet

- LM Busmath q2 Module 2 Wk2 CasillaDocument30 pagesLM Busmath q2 Module 2 Wk2 CasillaDonna CasillaNo ratings yet

- Lecture Notes - Business Finance 2Document3 pagesLecture Notes - Business Finance 2Aslan AlpNo ratings yet

- New Developments in Islamic Economics: Article InformationDocument19 pagesNew Developments in Islamic Economics: Article Informationsajid bhattiNo ratings yet

- Name: Nikhil P. PalanDocument7 pagesName: Nikhil P. PalanVinit BhindeNo ratings yet

- Wellington Global Innovation Fund Factsheet July 2022Document2 pagesWellington Global Innovation Fund Factsheet July 2022snehalNo ratings yet

- Special Topics in Financial ManagementDocument36 pagesSpecial Topics in Financial ManagementChristel Mae Boseo100% (1)