Professional Documents

Culture Documents

AA252.CMA(AL-II) Question CMA January-2023 Exam.

AA252.CMA(AL-II) Question CMA January-2023 Exam.

Uploaded by

Shawn MehdiCopyright:

Available Formats

You might also like

- Chap 3 Cookie Creations BBA 2201 Unit III - ACCT Principles IDocument9 pagesChap 3 Cookie Creations BBA 2201 Unit III - ACCT Principles IChristy SnowNo ratings yet

- ICAEW MI - Question BankDocument350 pagesICAEW MI - Question BankDương NgọcNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Tulip Me Qs 2021Document10 pagesTulip Me Qs 2021Jacqueline Kanesha JamesNo ratings yet

- K00200 - 20211027174042 - Group Assignment Paf3113 A211Document5 pagesK00200 - 20211027174042 - Group Assignment Paf3113 A211huuuuuuuaaaaaaaNo ratings yet

- 01 s303 CmapaDocument3 pages01 s303 Cmapaimranelahi3430No ratings yet

- LT453.AITV(AL-II) Question CMA January-2023 Exam.Document4 pagesLT453.AITV(AL-II) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- FR 222(IL-I) Question CMA January-2023 Exam.Document11 pagesFR 222(IL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- P1.PROO - .L Question CMA September 2022 ExaminationDocument7 pagesP1.PROO - .L Question CMA September 2022 ExaminationS.M.A AwalNo ratings yet

- FR 222.IFAIL I Question CMA May 2022 ExaminationDocument9 pagesFR 222.IFAIL I Question CMA May 2022 Examinationrumelrashid_seuNo ratings yet

- CM341.AFR(AL-I) Question CMA January-2023 Exam.Document5 pagesCM341.AFR(AL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- LT234.TAX(IL-II) Question CMA January-2023 Exam.Document7 pagesLT234.TAX(IL-II) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- CM231.MAC (IL-II) Question CMA May-2023 Exam.Document7 pagesCM231.MAC (IL-II) Question CMA May-2023 Exam.Md FahadNo ratings yet

- FR111.FFA(F.L) Question CMA January-2023 Exam.Document9 pagesFR111.FFA(F.L) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- Lt234.Tvp (Il-II) Question Cma May-2023 Exam.Document7 pagesLt234.Tvp (Il-II) Question Cma May-2023 Exam.Arif HossainNo ratings yet

- B8af108 Audit Summer 2018 Exam PaperDocument6 pagesB8af108 Audit Summer 2018 Exam PaperEizam Ben JetteyNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Document5 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Syazliana KasimNo ratings yet

- B8af108 Audit Summer 2023 Solutions - Final Signed OffDocument16 pagesB8af108 Audit Summer 2023 Solutions - Final Signed OffgerlaniamelgacoNo ratings yet

- P1 Question June 2019Document6 pagesP1 Question June 2019S.M.A AwalNo ratings yet

- CA Inter FM SM RTP May 2024 Castudynotes ComDocument44 pagesCA Inter FM SM RTP May 2024 Castudynotes ComGeo P BNo ratings yet

- AA133.AUDIL II Question CMA May 2022 ExaminationDocument7 pagesAA133.AUDIL II Question CMA May 2022 Examinationkm nafizNo ratings yet

- Management Accounting For Financial ServicesDocument2 pagesManagement Accounting For Financial ServicesJAVEDNo ratings yet

- Paper17 Set1Document7 pagesPaper17 Set1Sa7hkr17h GaurNo ratings yet

- AFIN210-D-1-2020-1 - Costing PDFDocument5 pagesAFIN210-D-1-2020-1 - Costing PDFnathan0% (1)

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- FR222.IFAIL I Question CMA January 2022 ExaminationDocument8 pagesFR222.IFAIL I Question CMA January 2022 Examinationtdebnath_3No ratings yet

- BBA 311-Financial Management Set 1Document10 pagesBBA 311-Financial Management Set 1Innocent BwalyaNo ratings yet

- AFW2020 S1 2011 Final ExamDocument8 pagesAFW2020 S1 2011 Final ExamVenessa YongNo ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- FR342.AFR(a.l-i) Question CMA January-2023 Exam.Document5 pagesFR342.AFR(a.l-i) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- August 2022 R: Page 1 of 7Document6 pagesAugust 2022 R: Page 1 of 7Salai SivagnanamNo ratings yet

- CM231.MAC(IL-II) Question CMA January-2023 Exam.Document8 pagesCM231.MAC(IL-II) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- MSL302 Capital Budgeting Decisions Term Paper Report: Submitted byDocument10 pagesMSL302 Capital Budgeting Decisions Term Paper Report: Submitted bychioqueNo ratings yet

- Paper 19Document6 pagesPaper 19mohanraj parthasarathyNo ratings yet

- End Term Exam - Cost and Management AccountingDocument3 pagesEnd Term Exam - Cost and Management AccountingAshish TiwariNo ratings yet

- This Test Is Only For Students of MS Consultancy ManagementDocument2 pagesThis Test Is Only For Students of MS Consultancy ManagementrudypatilNo ratings yet

- Cma p1 Mock Exam 2 ADocument34 pagesCma p1 Mock Exam 2 ATalalTANo ratings yet

- 21s CgaDocument2 pages21s CgaALISA ASIFNo ratings yet

- ACC314 Business Finance Management Main (JAN) E1 20-21Document8 pagesACC314 Business Finance Management Main (JAN) E1 20-21Rukshani RefaiNo ratings yet

- Fr111.Ffa (F.L) Question Cma May-2023 Exam.Document7 pagesFr111.Ffa (F.L) Question Cma May-2023 Exam.sshahed007No ratings yet

- P8 Syl2012 InterDocument23 pagesP8 Syl2012 Internivedita_h42404No ratings yet

- CM121.Question September-2023 Exam.Document8 pagesCM121.Question September-2023 Exam.Arif HossainNo ratings yet

- PE Exam March 2012Document31 pagesPE Exam March 2012Shahzada Khayyam NisarNo ratings yet

- IUB Mid Autumn 2021Document2 pagesIUB Mid Autumn 2021Navid Al Faiyaz ProviNo ratings yet

- SpecimenPaper MADocument14 pagesSpecimenPaper MANatalie Andria WeeramanthriNo ratings yet

- FR111.FFAF - .L Question CMA May 2022 Examination PDFDocument8 pagesFR111.FFAF - .L Question CMA May 2022 Examination PDFMohammed Javed UddinNo ratings yet

- AA133.AUD (IL-II) Question CMA January-2024 Exam.Document7 pagesAA133.AUD (IL-II) Question CMA January-2024 Exam.Nayem UddinNo ratings yet

- School Business School Module Code Module Name Module DirectorDocument10 pagesSchool Business School Module Code Module Name Module DirectorZiarehman SharNo ratings yet

- School Business School Module Code Module Name Module DirectorDocument10 pagesSchool Business School Module Code Module Name Module DirectorZiarehman SharNo ratings yet

- Ukam3043 Management Accounting IiiDocument9 pagesUkam3043 Management Accounting IiiBay Jing TingNo ratings yet

- P1 Auditing August 2020Document26 pagesP1 Auditing August 2020paul sagudaNo ratings yet

- Financial Accounting and Reporting IFRS March 2023 ExamDocument9 pagesFinancial Accounting and Reporting IFRS March 2023 Examrwinchella2803No ratings yet

- 2014 December Management Accounting L2Document17 pages2014 December Management Accounting L2Dixie CheeloNo ratings yet

- 71484bos57500 p5Document30 pages71484bos57500 p5KingNo ratings yet

- p1 Question June 2018Document5 pagesp1 Question June 2018S.M.A AwalNo ratings yet

- Ac5011 Ma Tca QuestionsDocument14 pagesAc5011 Ma Tca QuestionsyinlengNo ratings yet

- Test Version 3Document6 pagesTest Version 3vclarNo ratings yet

- Short Form Questions: Winter Exam-2016Document7 pagesShort Form Questions: Winter Exam-2016Kashif NiaziNo ratings yet

- Financial Reporting II ACC 402/602, Section 1001-1002 Practice Exam 1Document12 pagesFinancial Reporting II ACC 402/602, Section 1001-1002 Practice Exam 1Joel Christian MascariñaNo ratings yet

- CPG PDFDocument20 pagesCPG PDFRehman MuzaffarNo ratings yet

- Advanced Audit & Assurance PDFDocument17 pagesAdvanced Audit & Assurance PDFmohed100% (1)

- LT344.CGSP(AL-I) Question CMA January-2023 Exam.Document2 pagesLT344.CGSP(AL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- LT125.CBL (IL-I) Solution CMA January-2023 ExamDocument1 pageLT125.CBL (IL-I) Solution CMA January-2023 ExamShawn MehdiNo ratings yet

- CM121.COA(IL-I) Question CMA January-2023 Exam.Document7 pagesCM121.COA(IL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- CM231.MAC(IL-II) Question CMA January-2023 Exam.Document8 pagesCM231.MAC(IL-II) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- Advanced MGTDocument136 pagesAdvanced MGTShawn MehdiNo ratings yet

- Reference: Principles of ManagementDocument1 pageReference: Principles of ManagementShawn MehdiNo ratings yet

- Cover PageDocument1 pageCover PageShawn MehdiNo ratings yet

- Table of Content: Topic NameDocument1 pageTable of Content: Topic NameShawn MehdiNo ratings yet

- Steps in Control Process in ManagementDocument10 pagesSteps in Control Process in ManagementShawn MehdiNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementShawn MehdiNo ratings yet

- ConclutionDocument1 pageConclutionShawn MehdiNo ratings yet

- Controlling Function of ManagementDocument1 pageControlling Function of ManagementShawn MehdiNo ratings yet

- Regulatory EnvironmentDocument34 pagesRegulatory EnvironmentDhanushika SamarawickramaNo ratings yet

- Definition of Operational Risk: 1.1. RealityDocument13 pagesDefinition of Operational Risk: 1.1. RealityTrúc Trần Đặng ThanhNo ratings yet

- Bus 215 NotesDocument18 pagesBus 215 Notesctyre34No ratings yet

- Hartford Payroll Audit ReportDocument10 pagesHartford Payroll Audit ReportkevinhfdNo ratings yet

- Fundraising Policies & ProceduresDocument19 pagesFundraising Policies & ProceduresScott KramerNo ratings yet

- IMA Student Chapter "Award of Excellence" "Outstanding Student Chapter"Document16 pagesIMA Student Chapter "Award of Excellence" "Outstanding Student Chapter"JudeNo ratings yet

- Dualitas Ceo Dan Rapat DewanDocument287 pagesDualitas Ceo Dan Rapat DewanVergadilian IDNo ratings yet

- Audit Case StudyDocument9 pagesAudit Case StudyMaria Fatima AlambraNo ratings yet

- APC Ch9solDocument15 pagesAPC Ch9solKrisha Lei Sanchez90% (10)

- Managerial Accounting Ch.20Document9 pagesManagerial Accounting Ch.20hyewon6parkNo ratings yet

- Project Report On: Larsen & Toubro Limited (L&T)Document40 pagesProject Report On: Larsen & Toubro Limited (L&T)Rohit D GhuleNo ratings yet

- Tax Evasion and Avoidance CrimesDocument15 pagesTax Evasion and Avoidance CrimesRyan KingNo ratings yet

- International Business Review: Carlos Serrano-Cinca, Begon A Gutie Rrez-NietoDocument14 pagesInternational Business Review: Carlos Serrano-Cinca, Begon A Gutie Rrez-NietoPrakash SinghNo ratings yet

- Key Dates DSCR Minimum Average: 405584025.xls: SummaryDocument27 pagesKey Dates DSCR Minimum Average: 405584025.xls: SummaryKhandaker Amir EntezamNo ratings yet

- Correctional Services ReportDocument24 pagesCorrectional Services ReportjspectorNo ratings yet

- Auditing Notes Unisa - AUE4861 2017 TL 102 0 BDocument118 pagesAuditing Notes Unisa - AUE4861 2017 TL 102 0 BNolan TitusNo ratings yet

- Cornerstones 5e MA CH08 SM FINAL PDFDocument24 pagesCornerstones 5e MA CH08 SM FINAL PDFtarat0% (1)

- IFS Food 6.1 Implementation Workbook - Sample PDFDocument40 pagesIFS Food 6.1 Implementation Workbook - Sample PDFfrmgsNo ratings yet

- Senior Internal Audit Lead, Africa & Middle EastDocument2 pagesSenior Internal Audit Lead, Africa & Middle EastbrianoduorNo ratings yet

- Assessment of Charitable Trusts and Institutions: Peeyush Sharma & Co.Document45 pagesAssessment of Charitable Trusts and Institutions: Peeyush Sharma & Co.Vipul DesaiNo ratings yet

- Syllabus MK VHW (New Version) 20130211Document5 pagesSyllabus MK VHW (New Version) 20130211RyanSudiroNo ratings yet

- Paper 12-Company Accounts & Audit: Suggested Answers - Syl 2016 - December 2019 - Paper 12Document19 pagesPaper 12-Company Accounts & Audit: Suggested Answers - Syl 2016 - December 2019 - Paper 12Sannu VijayeendraNo ratings yet

- FraudDocument26 pagesFraudAnisNo ratings yet

- BACKLOG PRAC Time Table TYBCOM APRIL 2023Document2 pagesBACKLOG PRAC Time Table TYBCOM APRIL 2023lakshyaNo ratings yet

- Aud689 Group PresentationDocument11 pagesAud689 Group Presentationareep94No ratings yet

- Swargam AnushkaDocument11 pagesSwargam AnushkaAnushka SwargamNo ratings yet

- Strategic Management Midterm ReviewerDocument15 pagesStrategic Management Midterm ReviewerAlthea SantillanNo ratings yet

- Companies Rules Volume IIDocument585 pagesCompanies Rules Volume IIPlatonicNo ratings yet

- HISABDocument1 pageHISABJay AgarwalNo ratings yet

AA252.CMA(AL-II) Question CMA January-2023 Exam.

AA252.CMA(AL-II) Question CMA January-2023 Exam.

Uploaded by

Shawn MehdiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AA252.CMA(AL-II) Question CMA January-2023 Exam.

AA252.CMA(AL-II) Question CMA January-2023 Exam.

Uploaded by

Shawn MehdiCopyright:

Available Formats

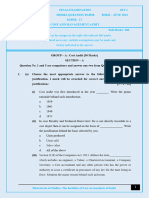

CMA JANUARY 2023 EXAMINATION

ADVANCED LEVEL II

COST & MANAGEMENT AUDIT

Course Code : AA252 Total Marks : 100

Reading Time : 15 minutes Writing Time : 180 minutes

Instructions to Candidates

You MUST NOT write anything during the reading time.

There are 5 (five) questions.

You should attempt ALL questions.

Answers should be properly structured and relevant.

Carefully read ALL the requirements and sub-questions before attempting a specific

question.

ALL answers must be written in the answer book.

AVOID WRITING/MARKING on the question paper at any time which may cause

disciplinary action.

Start answering each question from a fresh sheet.

Answers should be clearly numbered with the sub-question number.

Allowable Materials

Writing Stationaries

Non-programmable Calculator

Assessment Structure

Expected

Sub-

Marks Time

question

Required

Question 1 Essay/Computational/Case 3 20 35 minutes

Question 2 Essay/Computational/Case 3 20 35 minutes

Question 3 Essay/Computational/Case 3 20 35 minutes

Question 4 Essay/Computational/Case 2 20 35 minutes

Question 5 Essay/Computational/Case 3 20 35 minutes

Revision 5 minutes

Total 100 180 minutes

RESTRICTED USE

This paper MUST NOT BE REMOVED from the examination venue

Do not turn the page until instructed

QUESTION 1 [5 + 5 + 10 = 20 MARKS]

(a) How cost auditor can play important role to improve the current economic condition of

Bangladesh.

(b) Discuss the qualities that should be ensured by the cost audit firm to perform cost audit

and deliver quality report as well.

(c) ABC Co Ltd., a soft drinks powder manufacturing company currently using five Filling

and Sealing machines to manufacture soft drinks powder. Among five, two machines

have been fully depreciated but still in good condition to continue production normally.

As the depreciation life of two machines has been expired, these machines are

consuming significant repair maintenance cost and labor hour of maintenance

department. The management of ABC Co Ltd has assigned you to assess the cost

benefit analysis on two old machines.

You, as a cost and management accountant specify your work plan and what will you

consider to perform the cost benefit analysis?

QUESTION 2 [5 + 5 + 10 = 20 MARKS]

(a) Write down the qualifications and disqualifications of Cost Auditor.

(b) Discuss briefly about the fundamental principles of a Cost Auditor.

(c) A nationalized bank which has extended overdraft facility to a manufacturing company

on the security of the Stock (Both Raw and Finished). The banks received monthly

receiving stock statements from the company and determine its value. The Bank

assesses the risk on recovery of outstanding overdraft based on 80% of value of stock

in hand. Due to economic turmoil in the world and local, the business of the company

is declining. The Bank wants to assess the risk of non-recovery and appointed you as

cost auditor to certify the value of stock in hand.

Required:

Write down your engagement plan including audit program to conduct the audit

assignment.

QUESTION 3 [4 + 10 + 6 = 20 MARKS]

(a) Management Audit and Operational Audit are complementary and supplementary to

one another”. Discuss in brief.

(b) In the Financial Accounts of Flex Ltd. for the year ended June 30, 2021 the profit was

BDT 8,50,00,000. The profit as per Cost Accounting records for the same period was

less. The following details are extracted from the accounting schedules and Cost

Accounting records of the company.

Amount in thousand

Particulars Financial A/c Cost A/c

Opening: Semi Finished Goods 45,800 50,900

: Finished Goods 99,300 95,750

Closing : Semi Finished Goods 48,200 52,400

: Finished Goods 1,05,450 97,100

Transport subsidy 520

Expenses on CSR 72

Profit on sale of Fixed Assets 220

Chemical used internally 425 400

Favorable Exch. Rate variation 350

Post-retirement Medical grant 715

Purchase Tax Refund 580

Litigation Recovery-Prior year 175

You are required to prepare a Reconciliation Statement and arrive at the Profit as per

Cost Records for the year ended June 30, 2021

(c) Discus about the responsibilities of Management with regard to Risk Management as

well as corporate governance.

CMA January 2023 Examination, AA252 [Page 2 of 3]

QUESTION 4 [10+10 = 20 MARKS]

(a) Elite Electronics Co (EEC) has made an agreement with TAMARU of Japan for import

of kits of Automatic Washing Machine in completely knocked down (CKD) condition.

The terms of agreement are:

(i) TAMARU will supply some items keeping 15% margin on cost. These imported

items are of value of 50% of FOB price of Washing Machine and balance 50%

will be locally manufactured.

(ii) EEC will pay a lump sum of BDT 200 lakhs for technical know-how and drawing

for manufacturing of 2 lakhs washing machines.

(iii) EEC will also pay a royalty at 8% of selling price fixed by it in the local market

less landed cost of imported kits and cost of locally procured components.

The following related information is also available:

(i) FOB price for washing machine is BDT 8,000.

(ii) Insurance & freight is BDT 200 per set of imported items

(iii) Effective custom duty is @ 30% on CIF price

(iv) Assembling & other overhead costs will be BDT 1,000 per set.

(v) Expected profit is 15% on selling price

You are required to calculate the selling price of Washing machine

(b) Purchase of Materials BDT 3,00,000 (inclusive vat of BDT 15,715); Fee on Board BDT

12,000; Import Duty paid BDT 15,000; Freight inward BDT 20,000; Insurance paid for

import by sea BDT10,000; Rebates allowed BDT 4,000; Subsidy received from the

Government for importation of these materials BDT 20,000. Compute the landed cost

of material (i.e. value of receipt of material).

QUESTION 5 [(5+5+10) = 20 MARKS]

(a) Cost audit should be mandatory before commencement of Annual Financial Audit of a

manufacturing company. Discuss

(b) What are the preliminary information you, as a Cost Auditor, will collect from

the company which is subject to cost audit for the first time?

(c) The Directors of North-West Power Company Ltd. have been keen to increase the

disclosure in the company's annual report about its non-financial KPIs. The Directors

believe that providing this information will improve investors' understanding of the

company's business model and the way that North-West generates value, as well as

helping investors to identify how well the company is performing against its objectives.

However, the audit committee of the company has expressed concern that the KPIs

selected are not appropriate. The audit committee has asked auditor to carry out an

independent review as to whether the KPIs are appropriate.

Required:

What factors or characteristics should the auditor consider when assessing the

appropriateness of the company’s KPIs?

END OF QUESTION

CMA January 2023 Examination, AA252 [Page 3 of 3]

You might also like

- Chap 3 Cookie Creations BBA 2201 Unit III - ACCT Principles IDocument9 pagesChap 3 Cookie Creations BBA 2201 Unit III - ACCT Principles IChristy SnowNo ratings yet

- ICAEW MI - Question BankDocument350 pagesICAEW MI - Question BankDương NgọcNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Tulip Me Qs 2021Document10 pagesTulip Me Qs 2021Jacqueline Kanesha JamesNo ratings yet

- K00200 - 20211027174042 - Group Assignment Paf3113 A211Document5 pagesK00200 - 20211027174042 - Group Assignment Paf3113 A211huuuuuuuaaaaaaaNo ratings yet

- 01 s303 CmapaDocument3 pages01 s303 Cmapaimranelahi3430No ratings yet

- LT453.AITV(AL-II) Question CMA January-2023 Exam.Document4 pagesLT453.AITV(AL-II) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- FR 222(IL-I) Question CMA January-2023 Exam.Document11 pagesFR 222(IL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- P1.PROO - .L Question CMA September 2022 ExaminationDocument7 pagesP1.PROO - .L Question CMA September 2022 ExaminationS.M.A AwalNo ratings yet

- FR 222.IFAIL I Question CMA May 2022 ExaminationDocument9 pagesFR 222.IFAIL I Question CMA May 2022 Examinationrumelrashid_seuNo ratings yet

- CM341.AFR(AL-I) Question CMA January-2023 Exam.Document5 pagesCM341.AFR(AL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- LT234.TAX(IL-II) Question CMA January-2023 Exam.Document7 pagesLT234.TAX(IL-II) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- CM231.MAC (IL-II) Question CMA May-2023 Exam.Document7 pagesCM231.MAC (IL-II) Question CMA May-2023 Exam.Md FahadNo ratings yet

- FR111.FFA(F.L) Question CMA January-2023 Exam.Document9 pagesFR111.FFA(F.L) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- Lt234.Tvp (Il-II) Question Cma May-2023 Exam.Document7 pagesLt234.Tvp (Il-II) Question Cma May-2023 Exam.Arif HossainNo ratings yet

- B8af108 Audit Summer 2018 Exam PaperDocument6 pagesB8af108 Audit Summer 2018 Exam PaperEizam Ben JetteyNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Document5 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Syazliana KasimNo ratings yet

- B8af108 Audit Summer 2023 Solutions - Final Signed OffDocument16 pagesB8af108 Audit Summer 2023 Solutions - Final Signed OffgerlaniamelgacoNo ratings yet

- P1 Question June 2019Document6 pagesP1 Question June 2019S.M.A AwalNo ratings yet

- CA Inter FM SM RTP May 2024 Castudynotes ComDocument44 pagesCA Inter FM SM RTP May 2024 Castudynotes ComGeo P BNo ratings yet

- AA133.AUDIL II Question CMA May 2022 ExaminationDocument7 pagesAA133.AUDIL II Question CMA May 2022 Examinationkm nafizNo ratings yet

- Management Accounting For Financial ServicesDocument2 pagesManagement Accounting For Financial ServicesJAVEDNo ratings yet

- Paper17 Set1Document7 pagesPaper17 Set1Sa7hkr17h GaurNo ratings yet

- AFIN210-D-1-2020-1 - Costing PDFDocument5 pagesAFIN210-D-1-2020-1 - Costing PDFnathan0% (1)

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- FR222.IFAIL I Question CMA January 2022 ExaminationDocument8 pagesFR222.IFAIL I Question CMA January 2022 Examinationtdebnath_3No ratings yet

- BBA 311-Financial Management Set 1Document10 pagesBBA 311-Financial Management Set 1Innocent BwalyaNo ratings yet

- AFW2020 S1 2011 Final ExamDocument8 pagesAFW2020 S1 2011 Final ExamVenessa YongNo ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- FR342.AFR(a.l-i) Question CMA January-2023 Exam.Document5 pagesFR342.AFR(a.l-i) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- August 2022 R: Page 1 of 7Document6 pagesAugust 2022 R: Page 1 of 7Salai SivagnanamNo ratings yet

- CM231.MAC(IL-II) Question CMA January-2023 Exam.Document8 pagesCM231.MAC(IL-II) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- MSL302 Capital Budgeting Decisions Term Paper Report: Submitted byDocument10 pagesMSL302 Capital Budgeting Decisions Term Paper Report: Submitted bychioqueNo ratings yet

- Paper 19Document6 pagesPaper 19mohanraj parthasarathyNo ratings yet

- End Term Exam - Cost and Management AccountingDocument3 pagesEnd Term Exam - Cost and Management AccountingAshish TiwariNo ratings yet

- This Test Is Only For Students of MS Consultancy ManagementDocument2 pagesThis Test Is Only For Students of MS Consultancy ManagementrudypatilNo ratings yet

- Cma p1 Mock Exam 2 ADocument34 pagesCma p1 Mock Exam 2 ATalalTANo ratings yet

- 21s CgaDocument2 pages21s CgaALISA ASIFNo ratings yet

- ACC314 Business Finance Management Main (JAN) E1 20-21Document8 pagesACC314 Business Finance Management Main (JAN) E1 20-21Rukshani RefaiNo ratings yet

- Fr111.Ffa (F.L) Question Cma May-2023 Exam.Document7 pagesFr111.Ffa (F.L) Question Cma May-2023 Exam.sshahed007No ratings yet

- P8 Syl2012 InterDocument23 pagesP8 Syl2012 Internivedita_h42404No ratings yet

- CM121.Question September-2023 Exam.Document8 pagesCM121.Question September-2023 Exam.Arif HossainNo ratings yet

- PE Exam March 2012Document31 pagesPE Exam March 2012Shahzada Khayyam NisarNo ratings yet

- IUB Mid Autumn 2021Document2 pagesIUB Mid Autumn 2021Navid Al Faiyaz ProviNo ratings yet

- SpecimenPaper MADocument14 pagesSpecimenPaper MANatalie Andria WeeramanthriNo ratings yet

- FR111.FFAF - .L Question CMA May 2022 Examination PDFDocument8 pagesFR111.FFAF - .L Question CMA May 2022 Examination PDFMohammed Javed UddinNo ratings yet

- AA133.AUD (IL-II) Question CMA January-2024 Exam.Document7 pagesAA133.AUD (IL-II) Question CMA January-2024 Exam.Nayem UddinNo ratings yet

- School Business School Module Code Module Name Module DirectorDocument10 pagesSchool Business School Module Code Module Name Module DirectorZiarehman SharNo ratings yet

- School Business School Module Code Module Name Module DirectorDocument10 pagesSchool Business School Module Code Module Name Module DirectorZiarehman SharNo ratings yet

- Ukam3043 Management Accounting IiiDocument9 pagesUkam3043 Management Accounting IiiBay Jing TingNo ratings yet

- P1 Auditing August 2020Document26 pagesP1 Auditing August 2020paul sagudaNo ratings yet

- Financial Accounting and Reporting IFRS March 2023 ExamDocument9 pagesFinancial Accounting and Reporting IFRS March 2023 Examrwinchella2803No ratings yet

- 2014 December Management Accounting L2Document17 pages2014 December Management Accounting L2Dixie CheeloNo ratings yet

- 71484bos57500 p5Document30 pages71484bos57500 p5KingNo ratings yet

- p1 Question June 2018Document5 pagesp1 Question June 2018S.M.A AwalNo ratings yet

- Ac5011 Ma Tca QuestionsDocument14 pagesAc5011 Ma Tca QuestionsyinlengNo ratings yet

- Test Version 3Document6 pagesTest Version 3vclarNo ratings yet

- Short Form Questions: Winter Exam-2016Document7 pagesShort Form Questions: Winter Exam-2016Kashif NiaziNo ratings yet

- Financial Reporting II ACC 402/602, Section 1001-1002 Practice Exam 1Document12 pagesFinancial Reporting II ACC 402/602, Section 1001-1002 Practice Exam 1Joel Christian MascariñaNo ratings yet

- CPG PDFDocument20 pagesCPG PDFRehman MuzaffarNo ratings yet

- Advanced Audit & Assurance PDFDocument17 pagesAdvanced Audit & Assurance PDFmohed100% (1)

- LT344.CGSP(AL-I) Question CMA January-2023 Exam.Document2 pagesLT344.CGSP(AL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- LT125.CBL (IL-I) Solution CMA January-2023 ExamDocument1 pageLT125.CBL (IL-I) Solution CMA January-2023 ExamShawn MehdiNo ratings yet

- CM121.COA(IL-I) Question CMA January-2023 Exam.Document7 pagesCM121.COA(IL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- CM231.MAC(IL-II) Question CMA January-2023 Exam.Document8 pagesCM231.MAC(IL-II) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- Advanced MGTDocument136 pagesAdvanced MGTShawn MehdiNo ratings yet

- Reference: Principles of ManagementDocument1 pageReference: Principles of ManagementShawn MehdiNo ratings yet

- Cover PageDocument1 pageCover PageShawn MehdiNo ratings yet

- Table of Content: Topic NameDocument1 pageTable of Content: Topic NameShawn MehdiNo ratings yet

- Steps in Control Process in ManagementDocument10 pagesSteps in Control Process in ManagementShawn MehdiNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementShawn MehdiNo ratings yet

- ConclutionDocument1 pageConclutionShawn MehdiNo ratings yet

- Controlling Function of ManagementDocument1 pageControlling Function of ManagementShawn MehdiNo ratings yet

- Regulatory EnvironmentDocument34 pagesRegulatory EnvironmentDhanushika SamarawickramaNo ratings yet

- Definition of Operational Risk: 1.1. RealityDocument13 pagesDefinition of Operational Risk: 1.1. RealityTrúc Trần Đặng ThanhNo ratings yet

- Bus 215 NotesDocument18 pagesBus 215 Notesctyre34No ratings yet

- Hartford Payroll Audit ReportDocument10 pagesHartford Payroll Audit ReportkevinhfdNo ratings yet

- Fundraising Policies & ProceduresDocument19 pagesFundraising Policies & ProceduresScott KramerNo ratings yet

- IMA Student Chapter "Award of Excellence" "Outstanding Student Chapter"Document16 pagesIMA Student Chapter "Award of Excellence" "Outstanding Student Chapter"JudeNo ratings yet

- Dualitas Ceo Dan Rapat DewanDocument287 pagesDualitas Ceo Dan Rapat DewanVergadilian IDNo ratings yet

- Audit Case StudyDocument9 pagesAudit Case StudyMaria Fatima AlambraNo ratings yet

- APC Ch9solDocument15 pagesAPC Ch9solKrisha Lei Sanchez90% (10)

- Managerial Accounting Ch.20Document9 pagesManagerial Accounting Ch.20hyewon6parkNo ratings yet

- Project Report On: Larsen & Toubro Limited (L&T)Document40 pagesProject Report On: Larsen & Toubro Limited (L&T)Rohit D GhuleNo ratings yet

- Tax Evasion and Avoidance CrimesDocument15 pagesTax Evasion and Avoidance CrimesRyan KingNo ratings yet

- International Business Review: Carlos Serrano-Cinca, Begon A Gutie Rrez-NietoDocument14 pagesInternational Business Review: Carlos Serrano-Cinca, Begon A Gutie Rrez-NietoPrakash SinghNo ratings yet

- Key Dates DSCR Minimum Average: 405584025.xls: SummaryDocument27 pagesKey Dates DSCR Minimum Average: 405584025.xls: SummaryKhandaker Amir EntezamNo ratings yet

- Correctional Services ReportDocument24 pagesCorrectional Services ReportjspectorNo ratings yet

- Auditing Notes Unisa - AUE4861 2017 TL 102 0 BDocument118 pagesAuditing Notes Unisa - AUE4861 2017 TL 102 0 BNolan TitusNo ratings yet

- Cornerstones 5e MA CH08 SM FINAL PDFDocument24 pagesCornerstones 5e MA CH08 SM FINAL PDFtarat0% (1)

- IFS Food 6.1 Implementation Workbook - Sample PDFDocument40 pagesIFS Food 6.1 Implementation Workbook - Sample PDFfrmgsNo ratings yet

- Senior Internal Audit Lead, Africa & Middle EastDocument2 pagesSenior Internal Audit Lead, Africa & Middle EastbrianoduorNo ratings yet

- Assessment of Charitable Trusts and Institutions: Peeyush Sharma & Co.Document45 pagesAssessment of Charitable Trusts and Institutions: Peeyush Sharma & Co.Vipul DesaiNo ratings yet

- Syllabus MK VHW (New Version) 20130211Document5 pagesSyllabus MK VHW (New Version) 20130211RyanSudiroNo ratings yet

- Paper 12-Company Accounts & Audit: Suggested Answers - Syl 2016 - December 2019 - Paper 12Document19 pagesPaper 12-Company Accounts & Audit: Suggested Answers - Syl 2016 - December 2019 - Paper 12Sannu VijayeendraNo ratings yet

- FraudDocument26 pagesFraudAnisNo ratings yet

- BACKLOG PRAC Time Table TYBCOM APRIL 2023Document2 pagesBACKLOG PRAC Time Table TYBCOM APRIL 2023lakshyaNo ratings yet

- Aud689 Group PresentationDocument11 pagesAud689 Group Presentationareep94No ratings yet

- Swargam AnushkaDocument11 pagesSwargam AnushkaAnushka SwargamNo ratings yet

- Strategic Management Midterm ReviewerDocument15 pagesStrategic Management Midterm ReviewerAlthea SantillanNo ratings yet

- Companies Rules Volume IIDocument585 pagesCompanies Rules Volume IIPlatonicNo ratings yet

- HISABDocument1 pageHISABJay AgarwalNo ratings yet