Professional Documents

Culture Documents

Chapter 2 Supply Under GST

Chapter 2 Supply Under GST

Uploaded by

anon_996890467Copyright:

Available Formats

You might also like

- Being The Principal Powerpoint Ead 501Document15 pagesBeing The Principal Powerpoint Ead 501api-337555351100% (9)

- General JournalDocument2 pagesGeneral JournalJacob SnyderNo ratings yet

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- Chinese Creation MythDocument4 pagesChinese Creation MythprominusNo ratings yet

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Supply Under GSTDocument6 pagesSupply Under GSTpujitha vegesnaNo ratings yet

- CH 2 Supply Under GSTDocument8 pagesCH 2 Supply Under GSTRudra JhaNo ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- SUPPLY Past Papers INTERDocument10 pagesSUPPLY Past Papers INTERKaylee WrightNo ratings yet

- Bos 59410Document23 pagesBos 59410Bharath Krishna MVNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument5 pages© The Institute of Chartered Accountants of IndiaRahul ToshanNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- MCQs of GST Book 1Document136 pagesMCQs of GST Book 1AnjuRoseNo ratings yet

- Paper11 Set1 MTP Dec 23Document9 pagesPaper11 Set1 MTP Dec 23avani.patel.smollanNo ratings yet

- MCQ ch2 Supply Under GSTDocument13 pagesMCQ ch2 Supply Under GSTAman AgarwalNo ratings yet

- Idt QDocument10 pagesIdt QriyaNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- CA Final DT Q MTP 2 Nov23 Castudynotes ComDocument10 pagesCA Final DT Q MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Paper11 Set1Document8 pagesPaper11 Set1mvsvvksNo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- MCQ's IDTDocument45 pagesMCQ's IDTangadsharmaNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- GSTDocument193 pagesGSTdevikrish897No ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- Case Studies On GST - CA Kamal GargDocument309 pagesCase Studies On GST - CA Kamal Gargvaishnav isaiNo ratings yet

- 21 53 Solved Scanner Cs Executive Programme Module II Economic and Labour Law Part A June 2009Document10 pages21 53 Solved Scanner Cs Executive Programme Module II Economic and Labour Law Part A June 2009mbeadarshNo ratings yet

- Mock Test Cma June 20 Set 2 PDFDocument7 pagesMock Test Cma June 20 Set 2 PDFamit jangraNo ratings yet

- NOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question PaperDocument8 pagesNOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question Papersheena2saNo ratings yet

- Full Syllabus GST Test - 1 Without AnswersDocument19 pagesFull Syllabus GST Test - 1 Without Answersrajbhanushali3981No ratings yet

- Intermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)Document12 pagesIntermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)AnjaliNo ratings yet

- Paper-2 International Tax Practice-NOV 20Document22 pagesPaper-2 International Tax Practice-NOV 20dhawaljaniNo ratings yet

- Multiple Choice QuestionsDocument25 pagesMultiple Choice Questionsqwerty qwertNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- Tax MCQ 5Document17 pagesTax MCQ 5siddhant.gupta.delhiNo ratings yet

- Paper7 Set1 AnsDocument21 pagesPaper7 Set1 AnsPranjal BariNo ratings yet

- Formatted Legal Regulatory Aspects of Banking LRB 5Document6 pagesFormatted Legal Regulatory Aspects of Banking LRB 5Suraj ThakurNo ratings yet

- GST Post Q 20 May PDF - 29979560Document4 pagesGST Post Q 20 May PDF - 29979560priya02sharma22No ratings yet

- Pub-Sec Practice QsnsDocument4 pagesPub-Sec Practice QsnstatendaNo ratings yet

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 6Document17 pagesIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 6JOLLYNo ratings yet

- GSTDocument13 pagesGSTpriyababu4701No ratings yet

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationDocument6 pagesMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationvijaykumartaxNo ratings yet

- GST For Ca Nov 21Document23 pagesGST For Ca Nov 21shruti guptaNo ratings yet

- Direct Tax or Indirect TaxDocument8 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxNo ratings yet

- GST Full Length QPDocument7 pagesGST Full Length QPJyoti ManwaniNo ratings yet

- Deemed ExportsDocument6 pagesDeemed ExportsA B cNo ratings yet

- MTP 20 46 Answers 1712895168Document12 pagesMTP 20 46 Answers 1712895168gauravsurana87935No ratings yet

- b2-c1 Grande Finale Solving 2023 May (Set 2)Document17 pagesb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82No ratings yet

- Input Tax Credit One Question One SolutionDocument8 pagesInput Tax Credit One Question One Solutionhitendrapatil6778No ratings yet

- Place of SupplyDocument66 pagesPlace of SupplydataprotaxNo ratings yet

- GST - Ch. 6, 8 - 13 - NS - Dec. 23Document2 pagesGST - Ch. 6, 8 - 13 - NS - Dec. 23Madhav TailorNo ratings yet

- Paper7 Set2 AnsDocument21 pagesPaper7 Set2 Ansmonukroy1234No ratings yet

- Final Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDocument13 pagesFinal Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDiwakar GiriNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- RFQ10644 7 AbhishekhcliccDocument19 pagesRFQ10644 7 Abhishekhcliccncgohil78No ratings yet

- Indirect Tax and GST - Unit IIIDocument43 pagesIndirect Tax and GST - Unit IIIPRATIK JAINNo ratings yet

- Cma RTP Dec 18Document34 pagesCma RTP Dec 18amit jangraNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- How To Perfectly Hide IP Address in PC and SmartphoneDocument17 pagesHow To Perfectly Hide IP Address in PC and SmartphoneFulad AfzaliNo ratings yet

- The Eleusinian MysteriesDocument104 pagesThe Eleusinian MysteriesKieran McKennaNo ratings yet

- KasambahayDocument7 pagesKasambahayJanice Dulotan CastorNo ratings yet

- Prudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Document13 pagesPrudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Ebbe DyNo ratings yet

- Lesson Plan in Teaching Mapeh 8Document9 pagesLesson Plan in Teaching Mapeh 8Kimverly zhaira DomaganNo ratings yet

- Lgbtqi DefinitionsDocument2 pagesLgbtqi Definitionsapi-90812074No ratings yet

- PR1 Covid 19 FinalDocument14 pagesPR1 Covid 19 FinalaaaaaNo ratings yet

- Ocak DeryaDocument102 pagesOcak DeryaMátyás SüketNo ratings yet

- Intelsat 21 at 58Document4 pagesIntelsat 21 at 58Antonio ÁlcarezNo ratings yet

- Welch v. Brown - Supreme Court PetitionDocument160 pagesWelch v. Brown - Supreme Court PetitionEquality Case FilesNo ratings yet

- CHN ReviewerDocument10 pagesCHN ReviewerAyessa Yvonne PanganibanNo ratings yet

- Important QuestionsDocument6 pagesImportant QuestionsNaveen Royal's100% (2)

- Communication QuestionsDocument4 pagesCommunication QuestionsAmit Kumar JhaNo ratings yet

- KAPILA User Guide 2023-24Document12 pagesKAPILA User Guide 2023-24SUTHANRAJ K SEC 2020No ratings yet

- Gimbel-Implementation of PotsdamDocument29 pagesGimbel-Implementation of PotsdammemoNo ratings yet

- Pound-Jefferson and or MussoliniDocument125 pagesPound-Jefferson and or MussoliniTrad AnonNo ratings yet

- Indicator 8 Ljubljana 2016Document14 pagesIndicator 8 Ljubljana 2016Sugirtha NamachivayamNo ratings yet

- Business Office Manager Administrator in NYC Resume M Crawford GardnerDocument3 pagesBusiness Office Manager Administrator in NYC Resume M Crawford GardnerMCrawfordGardnerNo ratings yet

- Microsoft 365 Security Office 365 Security O365 WorldwideDocument1,525 pagesMicrosoft 365 Security Office 365 Security O365 WorldwideSushil SainiNo ratings yet

- Packet TracerDocument11 pagesPacket TracerFauzan FiqriansyahNo ratings yet

- Hand Grinder IncidentDocument1 pageHand Grinder IncidentMohammedNo ratings yet

- 1MS Pre-Sequence Days MonthsDocument6 pages1MS Pre-Sequence Days Monthssabrina's worldNo ratings yet

- Lawrence Kohlberg For SPDocument13 pagesLawrence Kohlberg For SPBea RamosNo ratings yet

- List of Optional Subject For Semester - VI - 2021-22 As On 09.05.2022Document19 pagesList of Optional Subject For Semester - VI - 2021-22 As On 09.05.2022dipnarayan pandeyNo ratings yet

- Production and Cost AnalysisDocument140 pagesProduction and Cost AnalysisSiddharth MohapatraNo ratings yet

- Tajweed TerminologyDocument2 pagesTajweed TerminologyJawedsIslamicLibraryNo ratings yet

Chapter 2 Supply Under GST

Chapter 2 Supply Under GST

Uploaded by

anon_996890467Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 Supply Under GST

Chapter 2 Supply Under GST

Uploaded by

anon_996890467Copyright:

Available Formats

www.escholars.

in

CHAPTER-2

Supply Under GST

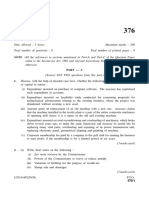

S. No. Questions and Answers

Simple Level

1. Assuming that all the activities given below are undertaken for a consideration, state

which of the following is not a supply of service?

(a) Renting of commercial office complex

(b) An employee agreeing to not work for the competitor organization after leaving the

current employment

(c) Repairing of mobile phone

(d) Provision of services by an employee to the employer in the course of employment

Ans. (d) Provision of services by an employee to the employer in the course of employment

Description: Based on the provisions of Schedule III

2. Goods as per section 2(52) of the CGST Act, 2017 includes:

(i) Actionable claims

(ii) Growing crops attached to the land agreed to be severed before supply.

(iii) Money

(iv) Securities

(a) (i) and (iii)

(b) (iii) and (iv)

(c) (i) and (ii)

(d) (ii) and (iii)

Ans. (c) (i) and (ii)

Description: Based on the provisions of section 2(52) of the CGST Act, 2017

Medium Level

3. Which of the following activities/transactions are considered as supply of goods?

(a) lease, tenancy, easement, licence to occupy land

(b) Renting of immovable property

(c) Goods forming part of assets of any business carried on by a person who ceases to be a

taxable person, shall be deemed to be supplied by him, in the course or furtherance of

his business, immediately before he ceases to be a taxable person.

(d) Temporary transfer or permitting use or enjoyment of any intellectual property right

Ans. (c) Goods forming part of assets of any business carried on by a person who ceases to be a

taxable person, shall be deemed to be supplied by him, in the course or furtherance of his

business, immediately before he ceases to be a taxable person.

Description: Based on the provisions of Schedule II

4. Which of the following activities shall be treated neither as supply of goods nor as

supply of services?

(i) Permanent transfer of business assets where input tax credit has been availed on such

assets

(ii) Temporary transfer of intellectual property right

(iii) Transportation of the deceased

(iv) Services provided by an employee to the employer in the course of employment

(a) (i) & (iii)

(b) (ii) & (iv)

(c) (i) & (ii)

(d) (iii) & (iv)

Ans. (d) (iii) & (iv)

Description: Based on the provisions of Schedule III

888 888 0402 support@escholars.in 1

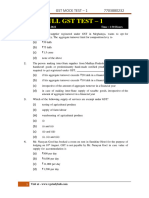

www.escholars.in

5. Which of the following activities/transactions are considered as supply of services?

(a) Transfer of title in goods

(b) Transfer of title in goods under an agreement which stipulates that property in goods

shall pass at a future date upon payment of full consideration as agreed

(c) Goods forming part of business assets are transferred or disposed off by or under

directions of person carrying on the business so as no longer to form part of those

assets

(d) Renting of immovable property

Ans. (d) Renting of immovable property

Description: Based on the provisions of Schedule II

6. Which of the following amounts to supply under GST law?

(a) Services by an employee to the employer in the course of or in relation to his

employment.

(b) Services by any court or Tribunal established under any law for the time being in force.

(c) Lottery, betting and gambling

(d) Sale of land

Ans. (c) Lottery, betting and gambling

Description: Based on the provisions of Section 7 read with Schedule I, II and III

7. Which of the following activities is a supply of services?

(i) Transfer of right in goods/ undivided share in goods without transfer of title in goods

(ii) Transfer of title in goods

(iii) Transfer of title in goods under an agreement which stipulates that property shall pass

at a future date upon payment of full consideration as agreed.

(a) (i)

(b) (iii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Ans. (a) (i)

Description: Based on the provisions of Schedule II

8. Which of the following activities are not treated as supply even if made without

consideration?

(a) Permanent transfer or disposal of business assets where ITC has been availed on such

assets.

(b) Supply of goods by a principal to his agent where the agent undertakes to supply such

goods on behalf of the principal.

(c) Import of services by a person from a related person outside India for his personal use.

(d) Supply of goods between related persons made in the course or furtherance of business

Ans. (c) Import of services by a person from a related person outside India for his personal use.

Description: Based on the provisions of Schedule I

9. Which of the following is not considered as ‘goods under the CGST Act, 2017?

(i) Ten-paisa coin having sale value of Rs.100.

(ii) Shares of unlisted company

(iii) Lottery tickets

(a) (i)

(b) (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

Ans. (b) (ii)

Description: Based on the provisions of section 2(52) of the CGST Act, 2017

888 888 0402 support@escholars.in 2

www.escholars.in

Difficult Level

10. Which of the following statements is true under GST law?

(a) Grand-parents are never considered as related persons to their grand-son/grand-

daughter

(b) Grand-parents are always considered as related persons to their grand-son/grand-

daughter

(c) Grand-parents are considered as related persons to their grand-son/grand-daughter

only if they are wholly dependent on their grand-son/grand-daughter

(d) Grand-parents are considered as related persons to their grand-son/grand-daughter

only if they are not dependent on their grand-son/grand-daughter

Ans. (c) Grand-parents are considered as related persons to their grand-son/grand-daughter

only if they are wholly dependent on their grand-son/grand-daughter

Description: Based on the provisions of explanation to section 15 with section 2(49) of

the CGST Act, 2017.

11. Determine which of the following independent transactions even if made without

consideration in terms of Schedule I of the CGST Act, 2017, will be deemed as supply?

(i) AB & Associates transfers stock of goods from its Mumbai branch to Kolkata depot for

sale of such goods at the depot.

(ii) Mr. Raghuveer, a dealer of air-conditioners permanently transfers the motor vehicle

free of cost. ITC on said motor vehicle was blocked and therefore, was not availed.

(iii) Mrs. Riddhi, an employee of Sun Ltd., received gift from her employer on the occasion of

Diwali worth ₹ 21,000.

(a) (i)

(b) (ii)

(c) (iii)

(d) Both (i) and (ii)

Ans. (a) (i)

Description: Schedule I

12. Which of the following services received, in the course or furtherance of business,

without consideration amount to supply?

(i) Import of services by a person in India from his son well- settled in USA

(ii) Import of services by a person in India from his brother well-settled in Germany

(iii) Import of services by a person in India from his brother (wholly dependent on such

person in India) in France

(iv) Import of services by a person in India from his daughter (wholly dependent on such

person in India) in Russia

(a) i, iii and iv

(b) ii, iii and iv

(c) ii and iii

(d) i and ii

Ans. (a) i, iii and iv

Description: Based on the provisions of Para 4 of Schedule I

13. When a consumer buys a television set and he also gets mandatory warranty and a

maintenance contract with the TV, _.

(a) this is a composite supply

(b) this is a mixed supply

(c) these supplies are individual supplies

(d) this is either a mixed supply or a composite supply.

Ans. (a) this is a composite supply

Description: Based on the provisions of section 8 of the CGST Act, 2017

888 888 0402 support@escholars.in 3

www.escholars.in

14. Determine which of the following independent transactions even if made without

consideration in terms of Schedule I of the CGST Act, 2017, will be deemed as supply?

(i) AB & Associates transfers stock of goods from its Mumbai branch to Kolkata depot for

sale of such goods at the depot.

(ii) Mr. Raghuveer, a dealer of air-conditioners permanently transfers the motor vehicle

free of cost. ITC on said motor vehicle was blocked and therefore, was not availed.

(iii) Mrs. Riddhi, an employee of Sun Ltd., received gift from her employer on the occasion of

Diwali worth Rs.21,000.

(a) (i)

(b) (ii)

(c) (iii)

(d) Both (i) and (ii)

Ans. (a) (i)

Description: Based on the provisions of Schedule I

888 888 0402 support@escholars.in 4

You might also like

- Being The Principal Powerpoint Ead 501Document15 pagesBeing The Principal Powerpoint Ead 501api-337555351100% (9)

- General JournalDocument2 pagesGeneral JournalJacob SnyderNo ratings yet

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- Chinese Creation MythDocument4 pagesChinese Creation MythprominusNo ratings yet

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Supply Under GSTDocument6 pagesSupply Under GSTpujitha vegesnaNo ratings yet

- CH 2 Supply Under GSTDocument8 pagesCH 2 Supply Under GSTRudra JhaNo ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- SUPPLY Past Papers INTERDocument10 pagesSUPPLY Past Papers INTERKaylee WrightNo ratings yet

- Bos 59410Document23 pagesBos 59410Bharath Krishna MVNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument5 pages© The Institute of Chartered Accountants of IndiaRahul ToshanNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- MCQs of GST Book 1Document136 pagesMCQs of GST Book 1AnjuRoseNo ratings yet

- Paper11 Set1 MTP Dec 23Document9 pagesPaper11 Set1 MTP Dec 23avani.patel.smollanNo ratings yet

- MCQ ch2 Supply Under GSTDocument13 pagesMCQ ch2 Supply Under GSTAman AgarwalNo ratings yet

- Idt QDocument10 pagesIdt QriyaNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- CA Final DT Q MTP 2 Nov23 Castudynotes ComDocument10 pagesCA Final DT Q MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Paper11 Set1Document8 pagesPaper11 Set1mvsvvksNo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- MCQ's IDTDocument45 pagesMCQ's IDTangadsharmaNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- GSTDocument193 pagesGSTdevikrish897No ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- Case Studies On GST - CA Kamal GargDocument309 pagesCase Studies On GST - CA Kamal Gargvaishnav isaiNo ratings yet

- 21 53 Solved Scanner Cs Executive Programme Module II Economic and Labour Law Part A June 2009Document10 pages21 53 Solved Scanner Cs Executive Programme Module II Economic and Labour Law Part A June 2009mbeadarshNo ratings yet

- Mock Test Cma June 20 Set 2 PDFDocument7 pagesMock Test Cma June 20 Set 2 PDFamit jangraNo ratings yet

- NOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question PaperDocument8 pagesNOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question Papersheena2saNo ratings yet

- Full Syllabus GST Test - 1 Without AnswersDocument19 pagesFull Syllabus GST Test - 1 Without Answersrajbhanushali3981No ratings yet

- Intermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)Document12 pagesIntermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)AnjaliNo ratings yet

- Paper-2 International Tax Practice-NOV 20Document22 pagesPaper-2 International Tax Practice-NOV 20dhawaljaniNo ratings yet

- Multiple Choice QuestionsDocument25 pagesMultiple Choice Questionsqwerty qwertNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- Tax MCQ 5Document17 pagesTax MCQ 5siddhant.gupta.delhiNo ratings yet

- Paper7 Set1 AnsDocument21 pagesPaper7 Set1 AnsPranjal BariNo ratings yet

- Formatted Legal Regulatory Aspects of Banking LRB 5Document6 pagesFormatted Legal Regulatory Aspects of Banking LRB 5Suraj ThakurNo ratings yet

- GST Post Q 20 May PDF - 29979560Document4 pagesGST Post Q 20 May PDF - 29979560priya02sharma22No ratings yet

- Pub-Sec Practice QsnsDocument4 pagesPub-Sec Practice QsnstatendaNo ratings yet

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 6Document17 pagesIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 6JOLLYNo ratings yet

- GSTDocument13 pagesGSTpriyababu4701No ratings yet

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationDocument6 pagesMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationvijaykumartaxNo ratings yet

- GST For Ca Nov 21Document23 pagesGST For Ca Nov 21shruti guptaNo ratings yet

- Direct Tax or Indirect TaxDocument8 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxNo ratings yet

- GST Full Length QPDocument7 pagesGST Full Length QPJyoti ManwaniNo ratings yet

- Deemed ExportsDocument6 pagesDeemed ExportsA B cNo ratings yet

- MTP 20 46 Answers 1712895168Document12 pagesMTP 20 46 Answers 1712895168gauravsurana87935No ratings yet

- b2-c1 Grande Finale Solving 2023 May (Set 2)Document17 pagesb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82No ratings yet

- Input Tax Credit One Question One SolutionDocument8 pagesInput Tax Credit One Question One Solutionhitendrapatil6778No ratings yet

- Place of SupplyDocument66 pagesPlace of SupplydataprotaxNo ratings yet

- GST - Ch. 6, 8 - 13 - NS - Dec. 23Document2 pagesGST - Ch. 6, 8 - 13 - NS - Dec. 23Madhav TailorNo ratings yet

- Paper7 Set2 AnsDocument21 pagesPaper7 Set2 Ansmonukroy1234No ratings yet

- Final Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDocument13 pagesFinal Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDiwakar GiriNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- RFQ10644 7 AbhishekhcliccDocument19 pagesRFQ10644 7 Abhishekhcliccncgohil78No ratings yet

- Indirect Tax and GST - Unit IIIDocument43 pagesIndirect Tax and GST - Unit IIIPRATIK JAINNo ratings yet

- Cma RTP Dec 18Document34 pagesCma RTP Dec 18amit jangraNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- How To Perfectly Hide IP Address in PC and SmartphoneDocument17 pagesHow To Perfectly Hide IP Address in PC and SmartphoneFulad AfzaliNo ratings yet

- The Eleusinian MysteriesDocument104 pagesThe Eleusinian MysteriesKieran McKennaNo ratings yet

- KasambahayDocument7 pagesKasambahayJanice Dulotan CastorNo ratings yet

- Prudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Document13 pagesPrudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Ebbe DyNo ratings yet

- Lesson Plan in Teaching Mapeh 8Document9 pagesLesson Plan in Teaching Mapeh 8Kimverly zhaira DomaganNo ratings yet

- Lgbtqi DefinitionsDocument2 pagesLgbtqi Definitionsapi-90812074No ratings yet

- PR1 Covid 19 FinalDocument14 pagesPR1 Covid 19 FinalaaaaaNo ratings yet

- Ocak DeryaDocument102 pagesOcak DeryaMátyás SüketNo ratings yet

- Intelsat 21 at 58Document4 pagesIntelsat 21 at 58Antonio ÁlcarezNo ratings yet

- Welch v. Brown - Supreme Court PetitionDocument160 pagesWelch v. Brown - Supreme Court PetitionEquality Case FilesNo ratings yet

- CHN ReviewerDocument10 pagesCHN ReviewerAyessa Yvonne PanganibanNo ratings yet

- Important QuestionsDocument6 pagesImportant QuestionsNaveen Royal's100% (2)

- Communication QuestionsDocument4 pagesCommunication QuestionsAmit Kumar JhaNo ratings yet

- KAPILA User Guide 2023-24Document12 pagesKAPILA User Guide 2023-24SUTHANRAJ K SEC 2020No ratings yet

- Gimbel-Implementation of PotsdamDocument29 pagesGimbel-Implementation of PotsdammemoNo ratings yet

- Pound-Jefferson and or MussoliniDocument125 pagesPound-Jefferson and or MussoliniTrad AnonNo ratings yet

- Indicator 8 Ljubljana 2016Document14 pagesIndicator 8 Ljubljana 2016Sugirtha NamachivayamNo ratings yet

- Business Office Manager Administrator in NYC Resume M Crawford GardnerDocument3 pagesBusiness Office Manager Administrator in NYC Resume M Crawford GardnerMCrawfordGardnerNo ratings yet

- Microsoft 365 Security Office 365 Security O365 WorldwideDocument1,525 pagesMicrosoft 365 Security Office 365 Security O365 WorldwideSushil SainiNo ratings yet

- Packet TracerDocument11 pagesPacket TracerFauzan FiqriansyahNo ratings yet

- Hand Grinder IncidentDocument1 pageHand Grinder IncidentMohammedNo ratings yet

- 1MS Pre-Sequence Days MonthsDocument6 pages1MS Pre-Sequence Days Monthssabrina's worldNo ratings yet

- Lawrence Kohlberg For SPDocument13 pagesLawrence Kohlberg For SPBea RamosNo ratings yet

- List of Optional Subject For Semester - VI - 2021-22 As On 09.05.2022Document19 pagesList of Optional Subject For Semester - VI - 2021-22 As On 09.05.2022dipnarayan pandeyNo ratings yet

- Production and Cost AnalysisDocument140 pagesProduction and Cost AnalysisSiddharth MohapatraNo ratings yet

- Tajweed TerminologyDocument2 pagesTajweed TerminologyJawedsIslamicLibraryNo ratings yet