Professional Documents

Culture Documents

PDFFile5b4f2040cb0ac2.89146612

PDFFile5b4f2040cb0ac2.89146612

Uploaded by

dpjzktswb7Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDFFile5b4f2040cb0ac2.89146612

PDFFile5b4f2040cb0ac2.89146612

Uploaded by

dpjzktswb7Copyright:

Available Formats

Accounting

1120

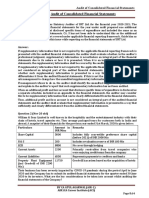

Other Comprehensive Income: A New

Concept in India

The concept of “Other Comprehensive Income (OCI)” is not new in the international accounting

frameworks such as in International Financial Reporting Standards (IFRS) and US GAAP. However,

in India, under existing Accounting Standards notified under Companies (Accounting Standards)

Rules, 2006 (CASR, 2006), there is no concept of OCI. Indian Accounting Standards (Ind ASs)

converged with IFRS contain the requirements relating to OCI which will be a new concept in India.

Internationally, OCI is a hot topic of debate. Questions like the necessity of OCI are being raised and

discussed at various international accounting forums. There are other issues related to OCI which

are also being discussed at international fora. The article introduces the concept of OCI and other

aspects relating to OCI in Ind AS.

Why OCI? or decreases of liabilities that result in

To understand the concept of OCI, it is imperative increases in equity, other than those

to know the need for OCI. The Framework for relating to contributions from equity

the Presentation and Preparation of Financial participants.”

Statements (Framework) issued by the Institute From the above definition, it is understood

of Chartered Accountants of India (ICAI) defines that any increase in economic benefits due to

‘Income’ as: enhancements of assets or decreases of liabilities

“Income is increase in economic benefits other than those relating to contributions from

during the accounting period in the form equity participants is income. Let us understand

of inflows or enhancements of assets the above definition by an example. In case a fixed

asset is revalued, there is an increase in economic

benefit due to enhancement of the asset. Therefore,

the increase in the value of fixed asset due to

revaluation meets the definition of income.

CA. Sanjeev Maheshwari However, such an increase is not recognised in the

(The author is a member of the Institute. He statement of profit and loss. Under the existing

can be reached at casanjeevmaheshwari@ accounting standards notified under CASR, 2006,

gmail.com)

such an increase is credited to revaluation reserve

84 THE CHARTERED ACCOUNTANT february 2015 www.icai.org

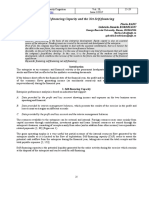

Accounting

1121

considered as a dumping ground for items which are

To make the requirements of accounting standards considered controversial and with regard to which

consistent with the definition of ‘income’ contained there is inability to reach an acceptable solution by

in the Framework and to avoid the impact of gains the standard-setter.

or losses on account of fluctuations in the fair value In an attempt to address this issue, in July 2013,

of fixed asset on the profit or loss, the need for OCI the IASB issued a Discussion Paper on ‘A Review of

arises.

the Conceptual Framework for Financial Reporting’

which, inter alia, discusses the purpose of the

as per the requirements of Accounting Standard statement of profit or loss and OCI. The IASB at its

(AS) 10, Accounting for Fixed Assets. The treatment meetings in June and July 2014 deliberated on the

prescribed in AS 10 is, however, not consistent with proposals in the Discussion Paper and the comments

the definition of ‘income’ given in the Framework. received on those proposals and arrived at the

The reserve is a part of equity and only transactions following tentative decisions:

with equity participants should be directly recognised (i) The Conceptual Framework should require

in equity as per the said definition. To make the profit or loss as a subtotal as at present.

requirements of accounting standards consistent (ii) The Conceptual Framework should describe

with the definition of ‘income’ contained in the profit or loss as the primary source of

Framework and to avoid the impact of gains or losses information about an entity’s performance for

on account of fluctuations in the fair value of fixed the period, but emphasise that it is not the only

asset on the profit or loss, the need for OCI arises. source of such information. For example, items

Accordingly, such gains and losses are recognised included in OCI also provide information about

in OCI component of the statement of profit and an entity’s performance.

loss; the conventional profit or loss being the other (iii) The Conceptual Framework should describe the

component (see Ind AS 1, Presentation of Financial dual objectives for profit or loss depicting the

Statements). The corresponding debit/credit of such return that an entity has made on its economic

items is the appropriate component of equity, such as, resources during the period, and providing

Revaluation Reserve. OCI, thus, brings into accounts information that is helpful in assessing

the economist’s perspective of income. The objective prospects for future cash flows.

of any business is maximisation of wealth to its (iv) The Conceptual Framework should include a

shareholders. One argument in favour of OCI is that rebuttable presumption that all items of income

profit or loss focuses on the accountant’s concept and expense should be included in profit or

of income whereas OCI fills the gap for the wealth loss unless the IASB concludes in a particular

creation objective which is evident from the above standard that including an item of income or

definition of income. Thus, the economist’s concept expense–or a component of such an item - in

of income is the sum of the accountant’s concept of OCI would enhance the relevance of profit or

income, namely, profit or loss and the OCI. In Ind AS, loss as the primary source of information about

this sum is termed as ‘Total Comprehensive Income’ an entity’s performance for the period. This

which meets the definition of the term ‘income’ in presumption cannot be rebutted for items of

the Framework. income and expense that arise when cost-based

measures are used for assets and liabilities. The

Which items to be recognised in OCI? Conceptual Framework should also propose

While, from the perspective of the definition of that the presumption for including items of

the term ‘income’ in the Framework, OCI bridges income and expense in profit or loss can only

the gap by recognising certain items in OCI, it be rebutted for changes in current measures of

gives rise to various other issues which have vexed assets and liabilities, and only if including those

the standard-setters including the IASB over the changes-or components of those changes - in

years. The most significant and important issue is OCI enhances the relevance of profit or loss

which items should be recognised in profit or loss as the primary source of information about

and which items should be recognised in OCI. The an entity’s performance for the period. It

IASB has come under considerable criticism as it has should be emphasised that including items of

been felt by various stakeholders that OCI has been income and expense resulting from changes

www.icai.org THE CHARTERED ACCOUNTANT february 2015 85

Accounting

1122

in current measures of assets and liabilities- (vii) For particular liabilities, designated at fair

or components of those changes-in OCI is an value through profit or loss, the amount of the

application of the classification, aggregation change in fair value attributable to changes in

and disaggregation principle for presentation the liability’s credit risk as per IFRS 9, Financial

and disclosure, designed to provide effective Instruments.

communication of financial information and to (viii) Changes in the value of the time value of options

make that information more understandable. when separating the intrinsic value and time

(v) The Conceptual Framework should specify value of an option contract and designating

that where the measurement of an item in as the hedging instrument only the changes

balance sheet differs from the measurement of in the intrinsic value as per IFRS 9, Financial

the related item in profit or loss, the difference Instruments.

would be reported in OCI. (ix) Changes in the value of the forward elements of

forward contracts when separating the forward

Under IFRS, the following items are presently element and spot element of a forward contract

recognised in OCI: and designating as a hedging instrument only

(i) Fair value changes on revaluation of property, the changes in the spot element, and changes in

plant and equipment and intangible assets as the value of the foreign currency basis spread of

per IAS 16, Property, Plant and Equipment and a financial instrument when excluding it from

IAS 38, Intangible Assets. the designation of that financial instrument as

(ii) Remeasurements of employee defined benefit the hedging instrument as per IFRS 9, Financial

plans, e.g., actuarial gains and losses, as per IAS Instruments.

19, Employee Benefits. Under Ind AS, apart from the items listed above,

(iii) Gains and losses arising from translating the Ind AS 103, Business Combinations requires that

financial statements of a foreign operation if there exists a clear evidence of the underlying

as per IAS 21, Effects of Changes in Foreign reasons for classifying the business combination as a

Exchange Rates. bargain purchase, the gain is recognised in OCI and

(iv) Gains and losses from investments in equity with a corresponding recognition as ‘capital reserve’.

instruments designated at fair value through In case, no clear evidence exists of underlying

other comprehensive income as per IFRS 9, reasons for classifying a business combination as a

Financial Instruments. bargain purchase, the excess is recognised directly in

(v) Gains and losses of financial assets having capital reserve as a component of equity. IFRS 3 does

specified payment of principal and interest held not make such distinctions and requires recognition

to collect contractual cash flows and to sell as of the bargain purchase gain in profit or loss. The

per IFRS 9, Financial Instruments. reason for the carve out in Ind AS 103 is that at the

(vi) The effective portion of gains and losses on time of business combination the assets and liabilities

hedging instruments in a cash flow hedge and acquired and the purchase consideration are all

the gains and losses on hedging instruments valued at fair value and, accordingly, it is felt that

that hedge investments in equity instruments the resulting gain should not be recognised in profit

measured at fair value through other or loss but should be recognised in equity either by

comprehensive income as per IFRS 9, Financial routing it through OCI or directly in equity as stated

Instruments. above. It may also be noted that where there is no

clear evidence of underlying reasons for classifying

business combinations as a bargain purchase, the

gain directly recognised in capital reserve does

The reason for the carve out in Ind AS 103 is that at not meet the definition of ‘income’ as has been the

the time of business combination the assets and objective of introducing the concept of OCI.

liabilities acquired and the purchase consideration

are all valued at fair value and, accordingly, it is felt Reclassification/Recycling of items of OCI

that the resulting gain should not be recognised in

Another issue which has been much debated at the

profit or loss but should be recognised in equity either

by routing it through OCI or directly in equity. international fora is that while at initial recognition,

the items recognised in OCI are generally unrealised

86 THE CHARTERED ACCOUNTANT february 2015 www.icai.org

Accounting

1123

gains or unrealised losses, whether on realisation, periods since the inception of the entity would

the resulting gain or loss on such items should be the same when all other comprehensive

be recognised in profit or loss or the same should income items are recycled. On the other hand,

remain in OCI. Under Ind AS, while certain items if any other comprehensive income item is not

are re-classified or re-cycled into profit or loss on recycled, some of the cash flows would never be

realisation, there are certain other items which reflected in profit or loss, which would change

remain in OCI even on realisation. Such adjustments the fundamental characteristic of profit or loss

in OCI are termed as ‘re-classification adjustments’, and impair the usefulness of profit or loss as an

which are defined in Ind AS 1, Presentation of overall measure of performance.

Financial Statements, as follows: • Recycling of other comprehensive income is

“Reclassification adjustments are amounts necessary from the viewpoint of stewardship.

reclassified to profit or loss in the current From the viewpoint of stewardship, profit or

period that were recognised in other loss should be all-inclusive and, therefore,

comprehensive income in the current or even the effects of non-recurring transactions

previous periods”. or events should be included in profit or loss

Of the nine items recognised in OCI as mentioned because they may affect the assessment of the

in an earlier paragraph, the relevant Ind AS prohibit capability of management.

the recycling of such items into profit or loss in the In view of the above, it may be interesting to

following cases: note that the ASBJ decided to make ‘deletions or

(i) Fair value changes on revaluation of property, modifications’ to the Standards issued by the IASB

plant and equipment and intangible assets as to eliminate all of the non-recycling requirements

per Ind AS 16, Property, Plant and Equipment and to require the recycling of all items included in

and Ind AS 38, Intangible Assets. other comprehensive income in principle, except for

(ii) Re-measurements of employee defined benefit revaluation surplus under the revaluation model on

plans as per Ind AS 19, Employee Benefits. property, plant and equipment and intangible assets,

(iii) Gains and losses from investments in equity considering that it appears to have aspects different

instruments designated at fair value through from other non-recycling items in that there is

other comprehensive income as per Ind AS 109, a conceptual debate as to whether revaluation

Financial Instruments. surplus is based on the concept of physical capital

(iv) For financial liabilities designated at fair value maintenance.

through profit or loss, the amount of the As far as the ICAI is concerned, no carve-outs

change in fair value attributable to changes in to the treatment of items in OCI have been made in

the entity’s own credit risk as per Ind AS 109, Ind AS. The argument of ASBJ that the revaluation

Financial Instruments. of fixed assets is based on physical concept of

Under Ind AS 103, it has not been specified capital is debatable. The revaluation gains and

whether the bargain purchase gain recognised in losses represent unrealised gains and losses due to

OCI should be re-classified in profit or loss or not. market fluctuations that represent the economist’s

It is presumed that this would continue in OCI. perspective of income and expenses. Even on

Apart from the items listed above, the other items sale, any balance left in revaluation surplus is an

recognised in OCI get re-classified in profit or loss unrealised gain and hence should not be recycled to

on realisation thereof. profit or loss. With regard to the re-measurements

One argument against reclassification is that of defined benefit liabilities (assets) which ASBJ

reclassification from OCI in profit or loss amounts

to recognition of the same income twice. The

proponents of this belief, e.g., Accounting Standards Under Ind AS, while certain items are re-classified

Board of Japan (ASBJ) argue that profit or loss should or re-cycled into profit or loss on realisation, there

be an all-inclusive measure and, thus, all items are certain other items which remain in OCI even on

included in OCI should be subsequently recycled to realisation. Such adjustments in OCI are termed as

profit or loss, because of the following reasons. ‘re-classification adjustments’, which are defined in

• The accumulated total profit or loss and the Ind AS 1, Presentation of Financial Statements.

accumulated total cash flows over all accounting

www.icai.org THE CHARTERED ACCOUNTANT february 2015 87

Accounting

1124

decided to be allocated and reclassified from OCI

to profit or loss over the remaining working lives of

The Conceptual Framework project of the IASB has

employees as it feels that recycling on the basis of decided tentatively that the Framework should

actual payment to individual employees would make include a rebuttable presumption that all items

the financial statements more relevant. However, it of income and expense included in OCI should be

is felt that as the defined benefit liability (asset) is recycled to profit or loss. In which situation, the

determined for all the employees covered in the plan, presumption is to be rebutted as to be left to the

it is almost impossible to identify the movement in Standard-setter, namely, the IASB.

liability (asset) for each employee. Using a proxy for

recycling based on actual payments to individual

employees will make the financial statements not (b) will be reclassified subsequently to profit or loss

only less relevant but also less reliable. It may be when specific conditions are met.

noted that such a recycling provision was there in An entity is required to disclose the amount of

IAS 19 before 2013 and was scrapped in the revised income tax relating to each item of OCI, including

standard after due consideration on its relevance and reclassification adjustments either in the statement

reliability. Further, the decision of ASBJ to permit of profit and loss or in the notes. Therefore, the

recycling of gains and losses on equity instruments presentation of items of OCI may be either:

recognised in OCI brings into existence the IAS 39 (i) net of related tax effects; or

category of “Available for Sale” and the issues related (ii) before related tax effects with one amount

to it which would defeat the very reason for removing shown for the aggregate amount of income tax

that category in IFRS 9 (Ind AS 109). Also, the relating to those items.

requirement of ASBJ to test such equity instruments Where an entity elects alternative (ii) above,

for impairment on the basis of incurred loss model the total tax pertaining to items of OCI is required

once again defeats the very purpose of introducing to be allocated between the items that might be

Expected Loss Model of Impairment in IFRS 9 (Ind reclassified subsequently to the profit or loss section

AS 109). Similarly, recycling of changes in fair value and those that will not be reclassified subsequently

of a liability due to own credit risk to profit or loss to profit or loss section. Ind AS 1 further requires the

would defeat the very purpose of requiring such reclassification adjustments relating to components

changes to OCI. In view of these reasons, the ICAI of other comprehensive income to be disclosed

has decided to go along with the requirements of separately. It may be noted that where a standard

IFRS issued by IASB. specifies “disclose”, it means disclosure in the notes

The Conceptual Framework project of the IASB and where a standard specifies “present”, it means

has decided tentatively that the Framework should presentation on the face of the financial statements,

include a rebuttable presumption that all items of viz., balance sheet, statement of profit and loss,

income and expense included in OCI should be statement of cash flows and statement of changes

recycled to profit or loss. In which situation, the in equity. Ind AS 1 provides an option to present

presumption is to be rebutted as to be left to the reclassification adjustments either in the statement

Standard-setter, namely, the IASB. of profit or loss or in the notes. If the entity presents

reclassification adjustments in the notes, the items

Presentation of OCI items of OCI presented in the statement of profit and loss

The nature of items to be classified or not to be will be after any related reclassification adjustments.

classified into profit or loss in OCI has necessitated

that the Ind AS 1, Presentation of Financial Conclusion

Statements, requires that under the OCI section, For the time being, we can gather that the concept of

line items for amounts of OCI in the period are OCI is going to remain. The Conceptual Framework

presented, classified by nature (including share of being developed by IASB may reduce controversies

the OCI of associates and joint ventures accounted related to which items should be recognised in OCI

for using the equity method) and grouped into those and which of those should be recycled. However,

that, in accordance with other Ind ASs: since this aspect will be addressed in the individual

(a) will not be reclassified subsequently to profit or standards, there may be occasions when all

loss; and concerned may not agree with the final outcome.

88 THE CHARTERED ACCOUNTANT february 2015 www.icai.org

You might also like

- Financial Accounting AnalysisDocument13 pagesFinancial Accounting AnalysisNikhil Agrawal88% (8)

- Biologicalassets PDFDocument135 pagesBiologicalassets PDFCeline GalvezNo ratings yet

- Retained Earnings PDFDocument9 pagesRetained Earnings PDFDehradun MootNo ratings yet

- What Differentiates Profit or Loss From Other Comprehensive IncomeDocument3 pagesWhat Differentiates Profit or Loss From Other Comprehensive IncomeWei MaoNo ratings yet

- EBOOK6131f1fd1229c Unit 5 Company Financial Statements PDFDocument36 pagesEBOOK6131f1fd1229c Unit 5 Company Financial Statements PDFYaw Antwi-AddaeNo ratings yet

- FrameworkDocument2 pagesFrameworkKwaku BoatengNo ratings yet

- Guidance Note (Revaluation Reserve) PDFDocument5 pagesGuidance Note (Revaluation Reserve) PDFCma Saurabh AroraNo ratings yet

- Asset Liability ApproachDocument16 pagesAsset Liability ApproachJanitscharenNo ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- Decoding Mergers and Amalgamations Wake Up Call For Advisors and Investors Jan17Document5 pagesDecoding Mergers and Amalgamations Wake Up Call For Advisors and Investors Jan17Pankaj Kumar Gautam SirNo ratings yet

- Framework PDFDocument2 pagesFramework PDFPahlawan Revolusi100% (1)

- Framework For The Preparation and Presentation of Financial StatementsDocument2 pagesFramework For The Preparation and Presentation of Financial StatementsErnesto PedroNo ratings yet

- Profit, Loss and Other Comprehensive IncomeDocument5 pagesProfit, Loss and Other Comprehensive IncomeSahin AydinNo ratings yet

- Framework - For - Preparation - Presentation - of - FS CH-2Document12 pagesFramework - For - Preparation - Presentation - of - FS CH-2lucifersdevil68No ratings yet

- Principles of Accounting IIDocument10 pagesPrinciples of Accounting IIEnusah AbdulaiNo ratings yet

- Financial Accounting & Reporting 1Document232 pagesFinancial Accounting & Reporting 1Its Ahmed100% (1)

- F7 ACCA Summary + Revision Notes 2017Document89 pagesF7 ACCA Summary + Revision Notes 2017aynkaransenthilkumaranNo ratings yet

- As Discussed in Chapter 1 The International Accounting Standard PDFDocument1 pageAs Discussed in Chapter 1 The International Accounting Standard PDFAnbu jaromiaNo ratings yet

- Chapter 10: Regulation and The Conceptual Framework: Discussion QuestionsDocument8 pagesChapter 10: Regulation and The Conceptual Framework: Discussion QuestionswainikitiraculeNo ratings yet

- Arupa 2nd Mid PreparationDocument2 pagesArupa 2nd Mid PreparationMd. Borhan UddinNo ratings yet

- SBR Revision NotesDocument294 pagesSBR Revision NotesRipon DasNo ratings yet

- Iasb'S Conceptual Framework For Financial Reporting: Relevant To Papers F7 and P2Document3 pagesIasb'S Conceptual Framework For Financial Reporting: Relevant To Papers F7 and P2babylovelylovelyNo ratings yet

- Final SummaryDocument6 pagesFinal SummaryAkanksha singhNo ratings yet

- Ap5b Fice Presentation of Financial LiabilitiesDocument13 pagesAp5b Fice Presentation of Financial LiabilitiesKreshen ShunmugamNo ratings yet

- Audit of Consolidated Financial StatementsDocument7 pagesAudit of Consolidated Financial StatementsDheeraj VermaNo ratings yet

- Deegan5e SM Ch20Document23 pagesDeegan5e SM Ch20Rachel TannerNo ratings yet

- Financial Reporting 1 BACT 303Document33 pagesFinancial Reporting 1 BACT 303emeraldNo ratings yet

- Reading-1_CLO 1_Framework of Financial StatementsDocument21 pagesReading-1_CLO 1_Framework of Financial Statementsaman malhotraNo ratings yet

- Chapter 11 GA Consolidated BSDocument50 pagesChapter 11 GA Consolidated BSswarna dasNo ratings yet

- ACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsDocument5 pagesACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsNatalie Laurent SiaNo ratings yet

- IAS Ch02Document19 pagesIAS Ch02d.pagkatoytoyNo ratings yet

- Module 010 Week004-Finacct3 Statement of Comprehensive IncomeDocument6 pagesModule 010 Week004-Finacct3 Statement of Comprehensive Incomeman ibeNo ratings yet

- Chapter 9 Revenue LO 1. Revenue DefinedDocument3 pagesChapter 9 Revenue LO 1. Revenue DefinedMartha UliNo ratings yet

- The Self-Financing Capacity and The Net Self-Financing: WWW - Ugb.ro/etcDocument5 pagesThe Self-Financing Capacity and The Net Self-Financing: WWW - Ugb.ro/etcLIOUAEDDINE HASSANNo ratings yet

- Lecture Two ContDocument39 pagesLecture Two ContIsaacNo ratings yet

- ACMA Unit 2Document47 pagesACMA Unit 2Subhodeep Roy ChowdhuryNo ratings yet

- Financial-Accounting-Analysis Dec2021Document11 pagesFinancial-Accounting-Analysis Dec2021Chief MaxNo ratings yet

- Accounting STDDocument168 pagesAccounting STDChandra ShekharNo ratings yet

- AF210 Group AssignmentDocument11 pagesAF210 Group AssignmentShikha ChandNo ratings yet

- COVID-19 Impact by Accounting Standard: Reporting UpdateDocument17 pagesCOVID-19 Impact by Accounting Standard: Reporting UpdateFuad Al KhatibNo ratings yet

- Framework For Preparation and PresentationDocument12 pagesFramework For Preparation and PresentationnatsuheartfiliaaaNo ratings yet

- No. 2016-01 January 2016: Financial Instruments-Overall (Subtopic 825-10)Document232 pagesNo. 2016-01 January 2016: Financial Instruments-Overall (Subtopic 825-10)Iván PinedaNo ratings yet

- MUCLecture 2022 51643431Document15 pagesMUCLecture 2022 51643431gold.2000.dzNo ratings yet

- 74705bos60485 Inter p1 cp7 U2Document14 pages74705bos60485 Inter p1 cp7 U2jdeconomic06No ratings yet

- Auditing in Specialized Industries (Notes)Document10 pagesAuditing in Specialized Industries (Notes)Jene LmNo ratings yet

- Master of Valuation Real Estate-II Unit-12 Page 255 To 271Document17 pagesMaster of Valuation Real Estate-II Unit-12 Page 255 To 271Udit TiwariNo ratings yet

- Assuranc Unit 1Document10 pagesAssuranc Unit 1hyojin YUNNo ratings yet

- Understanding Financial Statements For Non-AccountantsDocument5 pagesUnderstanding Financial Statements For Non-AccountantsAngella RiveraNo ratings yet

- Caf 5 Far1 STDocument568 pagesCaf 5 Far1 STIan BellNo ratings yet

- Framework For Preparation and Presentation of FS'sDocument51 pagesFramework For Preparation and Presentation of FS'sDarshan BhansaliNo ratings yet

- 7360 Advanced Financial AccountingDocument11 pages7360 Advanced Financial AccountingSIMON BUSISANo ratings yet

- Relevant To ACCA Qualification Papers F7 and P2: Iasb'S Conceptual Framework For Financial ReportingDocument4 pagesRelevant To ACCA Qualification Papers F7 and P2: Iasb'S Conceptual Framework For Financial ReportingHoJoJoNo ratings yet

- Financial Accounting & AnalysisDocument10 pagesFinancial Accounting & Analysisdeval mahajanNo ratings yet

- Project 2Document22 pagesProject 2Dipanjan MukherjeeNo ratings yet

- Deegan 5e Ch20 - CFDocument23 pagesDeegan 5e Ch20 - CFVenessa YongNo ratings yet

- Cfas Chapter 7Document2 pagesCfas Chapter 7danielisaiahasdNo ratings yet

- Financial Accounting & AnalysisDocument16 pagesFinancial Accounting & AnalysisMohit ChaudharyNo ratings yet

- Financial Accounting and Analysis AssignmentDocument13 pagesFinancial Accounting and Analysis Assignmentbhaskar paliwalNo ratings yet

- Investment AnalysisDocument16 pagesInvestment Analysis53Ni Kadek Arisya PutriNo ratings yet

- College of Accountancy: Lesson 1 - Concepts of CapitalDocument4 pagesCollege of Accountancy: Lesson 1 - Concepts of Capitalfirestorm riveraNo ratings yet

- TRUST CHALLENGES. IN INDIADocument6 pagesTRUST CHALLENGES. IN INDIAdpjzktswb7No ratings yet

- CA Ketan Vajani- Appeal before CIT and Art of RepresentationDocument49 pagesCA Ketan Vajani- Appeal before CIT and Art of Representationdpjzktswb7No ratings yet

- E-assessments and E-appeals under Income Tax Act1961Document33 pagesE-assessments and E-appeals under Income Tax Act1961dpjzktswb7No ratings yet

- Sales accounting process(1)Document1 pageSales accounting process(1)dpjzktswb7No ratings yet

- Non Financial Liabilities Provision and Contingencies.v2Document44 pagesNon Financial Liabilities Provision and Contingencies.v2Angelica Mingaracal RosarioNo ratings yet

- IFRS vs. IFRS For SMEsDocument33 pagesIFRS vs. IFRS For SMEsLohraine DyNo ratings yet

- Accounting For Business Combination - CompressDocument17 pagesAccounting For Business Combination - CompressRonan Ian DinagtuanNo ratings yet

- Ia Multiple ChoiceDocument3 pagesIa Multiple Choicecamilleescote562No ratings yet

- Teori Akuntansi Aset Dan KewajibanDocument36 pagesTeori Akuntansi Aset Dan KewajibanCharis SubiantoNo ratings yet

- Retained EarningsDocument3 pagesRetained EarningsKyla RequironNo ratings yet

- Can Gaap Vs IfrsDocument25 pagesCan Gaap Vs Ifrsdebra322No ratings yet

- Week 11 - Course Material For Intermediate Accounting 1Document16 pagesWeek 11 - Course Material For Intermediate Accounting 1Carl MarceloNo ratings yet

- I Cap If Rs QuestionsDocument34 pagesI Cap If Rs QuestionsUsmän MïrżäNo ratings yet

- Lecture Notes - IAS 40Document5 pagesLecture Notes - IAS 40Muhammed NaqiNo ratings yet

- Chapter 10 Power PointDocument50 pagesChapter 10 Power PointdarerofdreamsNo ratings yet

- Test Bank MillanDocument55 pagesTest Bank MillanBusiness MatterNo ratings yet

- Islamic Accounting Case StudyDocument9 pagesIslamic Accounting Case StudyRabeeka SiddiquiNo ratings yet

- Adv Accounts - Question - PaperDocument11 pagesAdv Accounts - Question - Papernavyabearad2715No ratings yet

- Solutions Manual: Company Accounting 10eDocument36 pagesSolutions Manual: Company Accounting 10eLSAT PREPAU1100% (1)

- Test Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikDocument8 pagesTest Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy Doupnikacetize.maleyl.hprj100% (52)

- Caf 5 Far1 STDocument568 pagesCaf 5 Far1 STIan BellNo ratings yet

- FAR Preweek Materials May 2022 BatchDocument22 pagesFAR Preweek Materials May 2022 BatchCovi LokuNo ratings yet

- Deferred Tax Ias 12Document22 pagesDeferred Tax Ias 12Jawad Akbar KhanNo ratings yet

- Assignment Classification Table: Topics Brief Exercises Exercises ProblemsDocument95 pagesAssignment Classification Table: Topics Brief Exercises Exercises ProblemsMtl AndyNo ratings yet

- 1a. Investment in Associate - LectureDocument14 pages1a. Investment in Associate - Lecturekyle GipulanNo ratings yet

- ACCA P2 Revision Mock June 2013 ANSWERS Version 6 FINAL at 24 Feb PDFDocument19 pagesACCA P2 Revision Mock June 2013 ANSWERS Version 6 FINAL at 24 Feb PDFPiyal HossainNo ratings yet

- 05 - Ta - Measurement TheoryDocument37 pages05 - Ta - Measurement TheoryPriska OctwentyNo ratings yet

- Financial Instruments - IllustrationsDocument12 pagesFinancial Instruments - Illustrationszynga1457No ratings yet

- Module 13 - BusCom - Forex. - StudentsDocument13 pagesModule 13 - BusCom - Forex. - StudentsLuisito CorreaNo ratings yet

- PDF Afa CH 2 - CompressDocument60 pagesPDF Afa CH 2 - CompressAbdi Mucee TubeNo ratings yet

- CHAPTER 8 The Consolidated Statement of Financial Position - STUDENTDocument48 pagesCHAPTER 8 The Consolidated Statement of Financial Position - STUDENTCon CậnNo ratings yet

- Module 1 & 2 Accounting For Special TransactionsDocument19 pagesModule 1 & 2 Accounting For Special TransactionsLian MaragayNo ratings yet

- Cfasmc 3040Document13 pagesCfasmc 3040Ahmadnur JulNo ratings yet