Professional Documents

Culture Documents

Chap 11_Corporation_Part I

Chap 11_Corporation_Part I

Uploaded by

amnaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 11_Corporation_Part I

Chap 11_Corporation_Part I

Uploaded by

amnaCopyright:

Available Formats

Chapter 11 | Corporations: Organization, Share Transactions, and Equity

Learning Objectives:

1) Discuss the major characteristics of a corporation.

2) Explain the accounting for ordinary, preference, and treasury shares.

3) Explain how to account for cash dividends, share dividends, and share

splits.

4) Discuss how equity is reported and analysed.

Corporation and its Classification

Separate Entity Principle – Corporate is a legal entity which is distinctly separate from its

owners/ shareholders

Types | Classification

1) By Purpose 2) By Ownership

a) Not-for-Profit – section 42 companies a) Publicly held – large number of shareholders

and includes NGOs, Trusts, Charities (general public); includes national and multi-

etc. national big businesses

b) For Profit – includes all commercial - Public companies may be listed (on stock

businesses with the aim to earn profit exchange)

b) Privately held – one or few limited individual

ownership

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Characteristics of a Corporation

Characteristics that distinguish corporations from proprietorships and partnerships.

1) Separate Legal Existence | Corporate will have its unique name different from its owners

2) Limited Liability of Shareholders | limited to their investment in the business

Advantages

3) Transferable Ownership Rights | Shareholders may sell their shares

4) Ability to Acquire Capital | Corporate can obtain capital through issuance of shares

5) Continuous Life | Continuance as a going concern is not affected by the withdrawal,

death, or incapacity of a shareholder, employee, or officer.

6) Corporate Management | Separation of ownership and management prevents owners

Disadvantages

from having an active role in managing the company.

7) Government Regulations |Regulations are designed to protect the (minority) owners of

the Corporation.

8) Additional Taxes | Corporations pay income taxes as a separate legal entity and in

addition, shareholders pay taxes on cash dividends.

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Corporation | Organogram OR Organizational Structure

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Corporation and Shareholders’ Rights

• Corporates are formed /enacted under the Companies Act issued by Securities & Exchange

Commission of the country.

• Corporates issue shares in the name of shareholders and the shares have face value (may be

traded at different price on stock exchange) and stamp of the company.

Shareholders have the right to

1) Vote in election of board of directors and on actions that require shareholder approval.

2) Share the corporate earnings through receipt of dividends

3) Keep the same percentage ownership when new shares are issued (preemptive right*).

4) Share in assets upon liquidation in proportion to their holdings – called a residual claim.

*The right of first offer (ROFO) If a corporation intends to increase its capital; first it will offer shares to

existing shareholders; thus protecting their shareholding from dilution.

If an existing shareholder intends to sell his shares; first right to refuse or

**The right of first refusal (ROFR) accept those shares lies with existing shareholders; if they refuse then it is

offered to public / new shareholder.

Share Issue Considerations

▪ Memorandum of Association (MOA) and Article of Association (AOA) are two legal documents drawn up at the

time of formation of a Corporate.

▪ MOA mainly outlines the nature of business, key shareholders, registered office, authorized capital while AOA

tells about how the company will operate, issued capital, responsibilities of directors and so on.

▪ Number of authorized shares is reported in the equity section of the company | No formal accounting entry

Issuance of Shares: Corporation can issue ordinary shares directly to investors or indirectly through

an investment banking firm / Financial Consulting companies.

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Factors in setting price for a new issue of shares:

✓ Company’s anticipated future earnings.

✓ Expected dividend rate per share

✓ Current financial position.

✓ Current state of the economy.

✓ Current state of the capital market.

Market Price of Shares: www.psx.com.pk

▪ Shares of publicly held companies is traded on SE.

▪ Interaction between buyers and sellers determines the prices per share.

▪ Prices tend to follow the trend of a company’s earnings and dividends.

▪ Factors beyond a company’s control may cause day-to-day fluctuations in market prices.

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Accounting for Ordinary Shares Issue

Mellow Industries Ltd. issues 1,000 ordinary shares of $10 par value for (a) $10 per share, (b) $12 per

share. The journal entry in the books of Mellow Industries would be:

a) Cash [1,000* $10] 10,000

Share Capital – Ordinary 10,000

[1,000* $10]

b) Cash [1,000* $12] 12,000

Share Capital - Ordinary 10,000

[1,000* $10]

Share Premium 2,000

[1,000* ($12-10)]

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Accounting for Ordinary Shares Issue

Assume that H&H legal advisors helped Mellow

Legal Expense 4,000

Industries to incorporate. They billed the company Share Capital – Ordinary 4,000

$4,000 for their services. They agree and accepted

400 shares of $10 par value shares in payment of

their bill. Record the transaction for Mellow Ind.

Share Premium =

Market value > Face value of share

Assume that shares (face value of $10/ share) of

Mellow Industries are traded on local bourse at Land [7,200* $12] 86,400

Share Capital - Ordinary 72,000

market value of $12. The company issues 7,200 [7,200* $10]

shares to acquire land recently advertised for sale Share Premium 14,400

[7,200* ($12-10)]

at $86,400. Record the transaction.

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Accounting for Treasury Shares

Treasury shares are a corporation’s own shares that it has reacquired from shareholders but not retired.

▪ Debit Treasury Shares for the price paid to reacquire the shares (cost method).

▪ Treasury Shares is a contra equity account (not an asset), so it reduces equity.

Corporations purchase their outstanding shares to: Mellow Industries

1) Increase earnings per share.

2) Enhance the share’s market value.

3) Reissue the shares to employees under bonus

and share compensation plans.

4) Have additional shares available for acquiring

stake in other companies through stock

transactions.

# of shares issued (100,000), outstanding (96,000), and

5) Buying back to eliminate hostile shareholders.

the # of shares held as treasury (4,000) are disclosed.

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

Disposal of Treasury Shares | Above OR Below Cost

▪ The disposal of Treasury shares results in both increase in asset and equity.

▪ A Company does not realize a gain or suffer a loss from share transactions with its own shareholders.

Above Cost [$325k/5,000 =$65]

Vision Ltd. purchases 5,000 shares of its $50 par value ordinary shares for $325,000 cash on July 1. It

will hold the shares in treasury until resold. On Nov. 1, the entity sells 1,500 treasury shares for cash at

$80 / share. Journalize the transaction.

Illustration Continues… Below Cost

Jul. 1

Treasury Shares 325,000 [$325k/5,000 =$65] On Dec. 25, Vision Ltd. sells remaining 3,500

Cash 325,000 treasury shares for cash at $50 per share.

Nov. 1

Cash 175,000

Cash 120,000 Limited to

Share Premium 22,500 bal. on hand

Treasury Shares [1,500*65] 97,500

Retained Earnings 30,000

Share Premium—Treasury 22,500

Treasury Shares 227,500

[3,500 *$65]

Prepared by Saira Rizwan for LUMS undergrad course ACCT-100

You might also like

- DDDDDocument21 pagesDDDDRed Rapture67% (3)

- Quiz in Corporation LawDocument8 pagesQuiz in Corporation LawPrincessAngelaDeLeon100% (3)

- Traditional Individual Retirement Account - Advisory Solutions Fund Model Custodian: Edward Jones Trust CompanyDocument8 pagesTraditional Individual Retirement Account - Advisory Solutions Fund Model Custodian: Edward Jones Trust CompanyMike BarnhartNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Share Capital-Issue+AlterationDocument98 pagesShare Capital-Issue+AlterationUKLead ServicesNo ratings yet

- Dividend Policy of Reliance Industries SwatiDocument24 pagesDividend Policy of Reliance Industries SwatiYashasvi KothariNo ratings yet

- Mathematics: Paper 2 (Calculator) Higher TierDocument20 pagesMathematics: Paper 2 (Calculator) Higher TieramnaNo ratings yet

- Chapter 13Document13 pagesChapter 13Mondy MondyNo ratings yet

- Chapter 13Document11 pagesChapter 13Maya HamdyNo ratings yet

- Corporations: Organization and Capital Stock Transactions: Weygandt - Kieso - KimmelDocument54 pagesCorporations: Organization and Capital Stock Transactions: Weygandt - Kieso - Kimmelkey aidanNo ratings yet

- IASSS16e Ch13.Ab - AzDocument28 pagesIASSS16e Ch13.Ab - AzLovely DungcaNo ratings yet

- POA Section 9 Part 1 CompaniesDocument10 pagesPOA Section 9 Part 1 Companieskxng ultimateNo ratings yet

- ch (14) جامعه الازهرDocument26 pagesch (14) جامعه الازهرmagdy kamelNo ratings yet

- Ii - CorporationsDocument4 pagesIi - Corporationsby ScribdNo ratings yet

- 12 Share CapitalDocument10 pages12 Share CapitalJiane SanicoNo ratings yet

- ch12 - Corporations-Shares, Dividends Retained EarningsDocument61 pagesch12 - Corporations-Shares, Dividends Retained EarningsMd.Shadid Ur RahmanNo ratings yet

- Chapter 17 1Document26 pagesChapter 17 1Diệu Linh NguyễnNo ratings yet

- Accounting For The Corporation Chapter 10Document51 pagesAccounting For The Corporation Chapter 10Rupesh PolNo ratings yet

- Csa Unit 2Document18 pagesCsa Unit 2arunvklplmNo ratings yet

- Finance Management 4Document26 pagesFinance Management 4charithNo ratings yet

- Chapter 2 Issue of Shares and RedemptionsDocument40 pagesChapter 2 Issue of Shares and RedemptionsEverjoice ChatoraNo ratings yet

- Accounting Capital+Stock+TransactionsDocument17 pagesAccounting Capital+Stock+TransactionsOckouri BarnesNo ratings yet

- Introduction To Accounting 2 Organization and Capital Stock TransactionsDocument17 pagesIntroduction To Accounting 2 Organization and Capital Stock Transactionsalice horanNo ratings yet

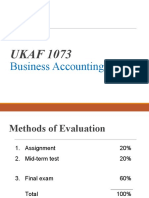

- UKAF 1073: Business Accounting IIDocument61 pagesUKAF 1073: Business Accounting IIalibabaNo ratings yet

- CAPE Recording Capital Stock & Reverses TransactionDocument49 pagesCAPE Recording Capital Stock & Reverses TransactionOckouri BarnesNo ratings yet

- Chapter 2 - Part 4 - Shares & Loan CapitalDocument24 pagesChapter 2 - Part 4 - Shares & Loan Capital2022885126No ratings yet

- Corporations: Organization, Stock Transactions, and DividendsDocument43 pagesCorporations: Organization, Stock Transactions, and Dividendsanon_355962815No ratings yet

- Advanced Accounting-2 Company: HoldingDocument20 pagesAdvanced Accounting-2 Company: HoldingTB AhmedNo ratings yet

- Company AccountingDocument7 pagesCompany AccountingMsuBrainBoxNo ratings yet

- Companies (Theory)Document10 pagesCompanies (Theory)Dayaan ANo ratings yet

- B326: Advance AccountingDocument11 pagesB326: Advance AccountingReham IbrahimNo ratings yet

- DividendsDocument12 pagesDividendsAhmed Abdelkader YossifNo ratings yet

- CorporationDocument12 pagesCorporationyaushsNo ratings yet

- Intermediate Accounting 3Document20 pagesIntermediate Accounting 3Gali jizNo ratings yet

- Far410 Chapter 3 Equity EditedDocument32 pagesFar410 Chapter 3 Equity EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Corpration Chapter FiveDocument19 pagesCorpration Chapter Fiveseneshaw tibebuNo ratings yet

- sheet 5 E1 ازهرDocument9 pagessheet 5 E1 ازهرmagdy kamelNo ratings yet

- Corporate Accounting PDFDocument193 pagesCorporate Accounting PDFK GanesanNo ratings yet

- CHAPTER 15 Corporations Share Capital Retained Earnings and Financial Reporting 1Document15 pagesCHAPTER 15 Corporations Share Capital Retained Earnings and Financial Reporting 1Gabrielle Joshebed AbaricoNo ratings yet

- Chapter Five-CorporationDocument6 pagesChapter Five-Corporationbereket nigussieNo ratings yet

- Equity Borrowings AssetsDocument12 pagesEquity Borrowings AssetssamuelNo ratings yet

- Solution Manual For Core Concepts of Accounting Raiborn 2nd EditionDocument18 pagesSolution Manual For Core Concepts of Accounting Raiborn 2nd EditionJacquelineFrancisfpgs100% (43)

- Equity FinancingDocument53 pagesEquity FinancingGaluh Boga KuswaraNo ratings yet

- Issue of Shares ProblemsDocument37 pagesIssue of Shares ProblemsgeddadaarunNo ratings yet

- CorporationDocument14 pagesCorporationWonde BiruNo ratings yet

- Far410 Chapter 4 EquityDocument34 pagesFar410 Chapter 4 EquityAQILAH NORDINNo ratings yet

- Chapter 13 SolutionsDocument45 pagesChapter 13 Solutionsaboodyuae2000No ratings yet

- Company Accounts Issue of Shares Par Premium DiscountDocument20 pagesCompany Accounts Issue of Shares Par Premium DiscountDilwar Hussain100% (1)

- Chapter 10 Equity Part 2Document27 pagesChapter 10 Equity Part 2LEE WEI LONGNo ratings yet

- Lecture 2 Intro To Business FinanceDocument45 pagesLecture 2 Intro To Business FinanceJoshua Marcaida BarbacenaNo ratings yet

- Acc-Presentation - 20240126 234036 0000Document22 pagesAcc-Presentation - 20240126 234036 0000Mahmudul SamiNo ratings yet

- Chapter 11 Review 11th EdDocument15 pagesChapter 11 Review 11th EdTin RanocoNo ratings yet

- Long Term Source FinalDocument43 pagesLong Term Source Finalsuparshva99iimNo ratings yet

- Share Capital and Its MaintenanceDocument78 pagesShare Capital and Its MaintenanceAtiraNo ratings yet

- Chapter 5: Accounting For CorporationsDocument36 pagesChapter 5: Accounting For CorporationsFeven WondayehuNo ratings yet

- Corporation: Stockholders ShareholdersDocument6 pagesCorporation: Stockholders ShareholdersKenya LevyNo ratings yet

- Dividend Policy-Lecture and ExercisesDocument6 pagesDividend Policy-Lecture and ExercisesRica RegorisNo ratings yet

- CF 2023 Class1Document18 pagesCF 2023 Class1Muskan PhogatNo ratings yet

- Company Accounts NotesDocument12 pagesCompany Accounts NotesRushda RaisNo ratings yet

- Share Capital and Basic Legal Documents of A CompanyDocument62 pagesShare Capital and Basic Legal Documents of A CompanyMuneebNo ratings yet

- Corporate ActionsDocument10 pagesCorporate Actionsdhanraj patadiaNo ratings yet

- SECRET SAUCE A2 - 2023. (FINAL VERSION) PDFDocument77 pagesSECRET SAUCE A2 - 2023. (FINAL VERSION) PDFkittyiqruNo ratings yet

- Lecture Notes Chap 11 (2022) - Student VerDocument40 pagesLecture Notes Chap 11 (2022) - Student VerThương ĐỗNo ratings yet

- Islamic CP Session 7Document1 pageIslamic CP Session 7amnaNo ratings yet

- CP Session 8Document1 pageCP Session 8amnaNo ratings yet

- CP Session 4Document1 pageCP Session 4amnaNo ratings yet

- CP Session 10Document1 pageCP Session 10amnaNo ratings yet

- Document 26Document2 pagesDocument 26amnaNo ratings yet

- Row ID Order ID Order Date Ship Date Ship Mode Customer IDDocument77 pagesRow ID Order ID Order Date Ship Date Ship Mode Customer IDamnaNo ratings yet

- Soliloquy Act 5 Scene 5Document1 pageSoliloquy Act 5 Scene 5amna100% (1)

- Adorno and HorkheimerDocument5 pagesAdorno and HorkheimeramnaNo ratings yet

- CH 14Document26 pagesCH 14amnaNo ratings yet

- TB Nurse Case Studies Training Tool 609505 7Document110 pagesTB Nurse Case Studies Training Tool 609505 7amnaNo ratings yet

- Porter SceneDocument2 pagesPorter SceneamnaNo ratings yet

- GCSE 1MA1 Paper 2H (Mock Set 2) PDFDocument24 pagesGCSE 1MA1 Paper 2H (Mock Set 2) PDFamnaNo ratings yet

- The Dagger SceneDocument2 pagesThe Dagger Sceneamna100% (1)

- Poetry Analysis 2 La BelleDocument3 pagesPoetry Analysis 2 La BelleamnaNo ratings yet

- GCSE 1MA1 Paper 3H (Mock Set 2)Document20 pagesGCSE 1MA1 Paper 3H (Mock Set 2)amnaNo ratings yet

- GCSE 1MA1 Paper 2H (Mock Set 2) PDFDocument24 pagesGCSE 1MA1 Paper 2H (Mock Set 2) PDFamnaNo ratings yet

- Mathematics: Pearson Edexcel Functional SkillsDocument20 pagesMathematics: Pearson Edexcel Functional SkillsamnaNo ratings yet

- Act 2 Scene 3 Lines 87 To 103Document1 pageAct 2 Scene 3 Lines 87 To 103amnaNo ratings yet

- Act 1 Scene 7 Macbeth SoliquyDocument2 pagesAct 1 Scene 7 Macbeth SoliquyamnaNo ratings yet

- Ibf Project-1 (Analysis Report)Document34 pagesIbf Project-1 (Analysis Report)Hassan AliNo ratings yet

- Request-Flagstar Bancorp - Special Meeting Notice and Proxy StatementDocument32 pagesRequest-Flagstar Bancorp - Special Meeting Notice and Proxy StatementDvNetNo ratings yet

- Ias 7Document3 pagesIas 7Anushkaa DattaNo ratings yet

- AC1103 Lesson 13 Discussion Questions PresentationDocument6 pagesAC1103 Lesson 13 Discussion Questions PresentationGAPNo ratings yet

- Rupeeseed Sales and Marketing B2B and B2C Sale of Rupeeseed OfferingsDocument33 pagesRupeeseed Sales and Marketing B2B and B2C Sale of Rupeeseed OfferingsGunadeep ReddyNo ratings yet

- Trade PayableDocument7 pagesTrade PayablemnhammadNo ratings yet

- 2013 S1 Solutions bfc2410Document17 pages2013 S1 Solutions bfc2410Lisa Kang100% (1)

- Financial instruments-IASDocument58 pagesFinancial instruments-IASReyad Al-WeshahNo ratings yet

- Silabus PA 2 2015 2016Document4 pagesSilabus PA 2 2015 2016AngelaMonalisaKurniawanNo ratings yet

- Uti ScamDocument7 pagesUti ScamAbhishek ChadhaNo ratings yet

- Chapter 6 TaxDocument17 pagesChapter 6 TaxAngelika OlarteNo ratings yet

- English Assignment: Name: Fioren Patricia Venesa Kaunang ID No. 19304036 Accounting A, Sem 3Document3 pagesEnglish Assignment: Name: Fioren Patricia Venesa Kaunang ID No. 19304036 Accounting A, Sem 3Fioren KaunangNo ratings yet

- 1 IAS 1 - Presentation of Financial StatementsDocument27 pages1 IAS 1 - Presentation of Financial Statementsjaylord pidoNo ratings yet

- Fin622 Solved Mcqs For Exam PreparationDocument9 pagesFin622 Solved Mcqs For Exam PreparationLareb ShaikhNo ratings yet

- Chapter 13Document11 pagesChapter 13Maya HamdyNo ratings yet

- Ca Inter FM Icai Past Year Q Ca Namir AroraDocument193 pagesCa Inter FM Icai Past Year Q Ca Namir AroraPankaj MeenaNo ratings yet

- Chapter 3 Financial Statements, Taxes, & Cash FlowDocument27 pagesChapter 3 Financial Statements, Taxes, & Cash FlowSweta Parvatha ReddyNo ratings yet

- Fsa 2014 18 PDFDocument242 pagesFsa 2014 18 PDFTuu TueNo ratings yet

- DRAFT JK Cements LTD Online InternshipDocument37 pagesDRAFT JK Cements LTD Online InternshipLIANo ratings yet

- BDO Unibank 2022 Annual ReportDocument72 pagesBDO Unibank 2022 Annual Reportchristian ReyesNo ratings yet

- FIX Group 5 Summary Accounting Theory 10th Meeting Chapter 11 Positive Theory of Accounting Policy and DisclosureDocument9 pagesFIX Group 5 Summary Accounting Theory 10th Meeting Chapter 11 Positive Theory of Accounting Policy and DisclosureEggie Auliya HusnaNo ratings yet

- 66 3 1Document23 pages66 3 1bhaiyarakeshNo ratings yet

- Computer AccountingDocument79 pagesComputer AccountingCamelia Yunika ElisabetNo ratings yet

- Cash Flow Statement (BBA)Document43 pagesCash Flow Statement (BBA)shrestha.aryxnNo ratings yet

- Guerrero Digests NuisanceDocument31 pagesGuerrero Digests NuisanceSALMAN JOHAYRNo ratings yet

- PT Surya Gemilang AinunDocument30 pagesPT Surya Gemilang AinunYuli Dhika DinaNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet