Professional Documents

Culture Documents

f1065sk1

f1065sk1

Uploaded by

vigneshsakthi2013Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

f1065sk1

f1065sk1

Uploaded by

vigneshsakthi2013Copyright:

Available Formats

651123

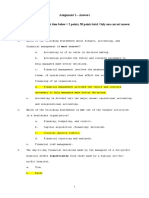

Final K-1 Amended K-1 OMB No. 1545-0123

Schedule K-1

(Form 1065) 2023 Part III Partner’s Share of Current Year Income,

Deductions, Credits, and Other Items

Department of the Treasury 1 Ordinary business income (loss) 14 Self-employment earnings (loss)

Internal Revenue Service For calendar year 2023, or tax year

beginning / / 2023 ending / / 2 Net rental real estate income (loss)

Partner’s Share of Income, Deductions, 3 Other net rental income (loss) 15 Credits

Credits, etc. See separate instructions.

Part I Information About the Partnership 4a Guaranteed payments for services

A Partnership’s employer identification number

4b Guaranteed payments for capital 16 Schedule K-3 is attached if

checked . . . . .

B Partnership’s name, address, city, state, and ZIP code

4c Total guaranteed payments 17 Alternative minimum tax (AMT) items

5 Interest income

C IRS center where partnership filed return:

D Check if this is a publicly traded partnership (PTP) 6a Ordinary dividends

Part II Information About the Partner

E Partner’s SSN or TIN (Do not use TIN of a disregarded entity. See instructions.) 6b Qualified dividends 18 Tax-exempt income and

nondeductible expenses

F Name, address, city, state, and ZIP code for partner entered in E. See instructions. 6c Dividend equivalents

7 Royalties

G General partner or LLC Limited partner or other LLC 8 Net short-term capital gain (loss)

member-manager member 19 Distributions

H1 Domestic partner Foreign partner 9a Net long-term capital gain (loss)

H2 If the partner is a disregarded entity (DE), enter the partner’s:

TIN Name 9b Collectibles (28%) gain (loss)

I1 What type of entity is this partner? 20 Other information

I2 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here . 9c Unrecaptured section 1250 gain

J Partner’s share of profit, loss, and capital (see instructions):

Beginning Ending 10 Net section 1231 gain (loss)

Profit % %

Loss % % 11 Other income (loss)

Capital % %

Check if decrease is due to:

Sale or Exchange of partnership interest. See instructions.

K1 Partner’s share of liabilities: 12 Section 179 deduction 21 Foreign taxes paid or accrued

Beginning Ending

Nonrecourse . . $ $ 13 Other deductions

Qualified nonrecourse

financing . . . $ $

Recourse . . . $ $

K2 Check this box if item K1 includes liability amounts from lower-tier partnerships

K3 Check if any of the above liability is subject to guarantees or other

payment obligations by the partner. See instructions . . . . . 22 More than one activity for at-risk purposes*

L Partner’s Capital Account Analysis 23 More than one activity for passive activity purposes*

Beginning capital account . . . $ *See attached statement for additional information.

Capital contributed during the year . . $

Current year net income (loss) . . . $

For IRS Use Only

Other increase (decrease) (attach explanation) $

Withdrawals and distributions . . . $( )

Ending capital account . . . . $

M Did the partner contribute property with a built-in gain (loss)?

Yes No If “Yes,” attach statement. See instructions.

N Partner’s Share of Net Unrecognized Section 704(c) Gain or (Loss)

Beginning . . . . . . . . $

Ending . . . . . . . . . $

For Paperwork Reduction Act Notice, see the Instructions for Form 1065. www.irs.gov/Form1065 Cat. No. 11394R Schedule K-1 (Form 1065) 2023

You might also like

- ICAB Manual - Tax Planning & Compliance (2020)Document584 pagesICAB Manual - Tax Planning & Compliance (2020)Tasmia Binte Habib100% (5)

- Assignment 1 - Answers A. Multiple Choices (Each Item Below 2 Points, 50 Points Total. Only One Correct Answer To Each Question)Document12 pagesAssignment 1 - Answers A. Multiple Choices (Each Item Below 2 Points, 50 Points Total. Only One Correct Answer To Each Question)KateNo ratings yet

- 2009-11-02 095434 Julies Maid Cleaning ServiceDocument17 pages2009-11-02 095434 Julies Maid Cleaning ServiceabenazerNo ratings yet

- D.light DesignDocument11 pagesD.light DesignSonali100% (1)

- AFAR-01 (Partnership Formation & Operation)Document6 pagesAFAR-01 (Partnership Formation & Operation)Jezzie Santos100% (1)

- 2019 Schedule K-1 (Form 1065)Document2 pages2019 Schedule K-1 (Form 1065)danielNo ratings yet

- Form - 1065 - Schedule - k1 PDFDocument2 pagesForm - 1065 - Schedule - k1 PDFHazem El SayedNo ratings yet

- Craig Hayward - 2021 - 1065 - K1 3Document6 pagesCraig Hayward - 2021 - 1065 - K1 3Craig HaywardNo ratings yet

- 70 Kevin Lin PDFDocument8 pages70 Kevin Lin PDFKenneth LinNo ratings yet

- Schedule K-1 (Form 1120S) : Shareholder's Share of Current Year Income, Deductions, Credits, and Other ItemsDocument2 pagesSchedule K-1 (Form 1120S) : Shareholder's Share of Current Year Income, Deductions, Credits, and Other ItemsAnonymous JqimV1ENo ratings yet

- US Internal Revenue Service: f8865sk1 - 2004Document2 pagesUS Internal Revenue Service: f8865sk1 - 2004IRSNo ratings yet

- SCH k-1 of 1120s Case StudyDocument1 pageSCH k-1 of 1120s Case StudyHimani SachdevNo ratings yet

- U.S. Return of Income For Electing Large Partnerships: Taxable Income or Loss From Passive Loss Limitation ActivitiesDocument5 pagesU.S. Return of Income For Electing Large Partnerships: Taxable Income or Loss From Passive Loss Limitation ActivitiesIRSNo ratings yet

- US Internal Revenue Service: f8865sk1 - 2005Document2 pagesUS Internal Revenue Service: f8865sk1 - 2005IRSNo ratings yet

- US Internal Revenue Service: f1065 - 1991Document4 pagesUS Internal Revenue Service: f1065 - 1991IRSNo ratings yet

- ICOIN, INC (Gov)Document1 pageICOIN, INC (Gov)je987164No ratings yet

- 1065-Entity 1-Investor 001-2021Document18 pages1065-Entity 1-Investor 001-2021nerminm16No ratings yet

- US Internal Revenue Service: f1065sk1 - 2003Document2 pagesUS Internal Revenue Service: f1065sk1 - 2003IRSNo ratings yet

- US Internal Revenue Service: F1120a - 1992Document2 pagesUS Internal Revenue Service: F1120a - 1992IRSNo ratings yet

- US Internal Revenue Service: F1120a - 1995Document2 pagesUS Internal Revenue Service: F1120a - 1995IRSNo ratings yet

- Amar Talati - 2021 - 1120S - K1Document4 pagesAmar Talati - 2021 - 1120S - K1a_a_talatiNo ratings yet

- US Internal Revenue Service: F1120a - 2000Document2 pagesUS Internal Revenue Service: F1120a - 2000IRSNo ratings yet

- 2010 Blank IRS Form 1065Document5 pages2010 Blank IRS Form 1065Nick PechaNo ratings yet

- U.S. Income Tax Return For Estates and Trusts: For Calendar Year 2018 or Fiscal Year Beginning, 2018, and Ending, 20Document2 pagesU.S. Income Tax Return For Estates and Trusts: For Calendar Year 2018 or Fiscal Year Beginning, 2018, and Ending, 20Lauren100% (2)

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13Ahmad GaberNo ratings yet

- US Internal Revenue Service: F1120a - 1996Document2 pagesUS Internal Revenue Service: F1120a - 1996IRSNo ratings yet

- US Internal Revenue Service: f1065 - 1995Document4 pagesUS Internal Revenue Service: f1065 - 1995IRSNo ratings yet

- US Internal Revenue Service: f5227 - 1999Document4 pagesUS Internal Revenue Service: f5227 - 1999IRSNo ratings yet

- Module 35 Taxes: Partnerships:: 'S CC G C C Se e I 7 .E., o Co - Es Y. S CDocument2 pagesModule 35 Taxes: Partnerships:: 'S CC G C C Se e I 7 .E., o Co - Es Y. S CEl Sayed AbdelgawwadNo ratings yet

- AB Limited Form Schedule K-1 DonDocument1 pageAB Limited Form Schedule K-1 Donsarah.gleasonNo ratings yet

- Copy A: Publicly Traded Partnership CorrectedDocument3 pagesCopy A: Publicly Traded Partnership CorrectedIRSNo ratings yet

- US Internal Revenue Service: f5227 - 1995Document4 pagesUS Internal Revenue Service: f5227 - 1995IRSNo ratings yet

- Tax Session IV - Taxation of Partnership IncomeDocument11 pagesTax Session IV - Taxation of Partnership IncomebrightkeysNo ratings yet

- US Internal Revenue Service: F990ez - 1999Document2 pagesUS Internal Revenue Service: F990ez - 1999IRSNo ratings yet

- Topic 7 - Partnership (R)Document38 pagesTopic 7 - Partnership (R)michael krueseiNo ratings yet

- US Internal Revenue Service: f990pf - 1997Document12 pagesUS Internal Revenue Service: f990pf - 1997IRSNo ratings yet

- US Internal Revenue Service: F1120ric - 2001Document4 pagesUS Internal Revenue Service: F1120ric - 2001IRSNo ratings yet

- NYSE - BX. Dear Unit Holder - PDFDocument9 pagesNYSE - BX. Dear Unit Holder - PDFEugene FrancoNo ratings yet

- US Internal Revenue Service: f8865sk1 - 2000Document2 pagesUS Internal Revenue Service: f8865sk1 - 2000IRSNo ratings yet

- Form 1100Document1 pageForm 1100Hï FrequencyNo ratings yet

- Annex This Schedule To The Return of Income If You Have Income From SalariesDocument18 pagesAnnex This Schedule To The Return of Income If You Have Income From SalariessajedulNo ratings yet

- US Internal Revenue Service: f2438 - 1998Document2 pagesUS Internal Revenue Service: f2438 - 1998IRSNo ratings yet

- US Internal Revenue Service: f990 - 1995Document6 pagesUS Internal Revenue Service: f990 - 1995IRSNo ratings yet

- 2015 - 990EZ - Teachers Without BordersDocument18 pages2015 - 990EZ - Teachers Without BordersFred MednickNo ratings yet

- US Internal Revenue Service: f990 - 1999Document6 pagesUS Internal Revenue Service: f990 - 1999IRSNo ratings yet

- US Internal Revenue Service: f1065 - 2000Document4 pagesUS Internal Revenue Service: f1065 - 2000IRSNo ratings yet

- US Internal Revenue Service: I1065bskDocument11 pagesUS Internal Revenue Service: I1065bskIRSNo ratings yet

- U.S. Income Tax Return For Estates and Trusts: For Calendar Year 2022 or Fiscal Year Beginning, 2022, and Ending, 20Document3 pagesU.S. Income Tax Return For Estates and Trusts: For Calendar Year 2022 or Fiscal Year Beginning, 2022, and Ending, 20dizzi dagerNo ratings yet

- US Internal Revenue Service: F1120rei - 2001Document4 pagesUS Internal Revenue Service: F1120rei - 2001IRSNo ratings yet

- US Internal Revenue Service: F1120pol - 2000Document6 pagesUS Internal Revenue Service: F1120pol - 2000IRSNo ratings yet

- US Internal Revenue Service: f990t - 1994Document4 pagesUS Internal Revenue Service: f990t - 1994IRSNo ratings yet

- US Internal Revenue Service: I1065bsk - 2001Document10 pagesUS Internal Revenue Service: I1065bsk - 2001IRSNo ratings yet

- US Internal Revenue Service: f1065sm3 AccessibleDocument3 pagesUS Internal Revenue Service: f1065sm3 AccessibleIRSNo ratings yet

- US Internal Revenue Service: f1120 - 1996Document4 pagesUS Internal Revenue Service: f1120 - 1996IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 1999Document4 pagesUS Internal Revenue Service: F1120rei - 1999IRSNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document9 pagesAttention:: WWW - Irs.gov/form1099jahnayesullivanNo ratings yet

- Ch.18-Dividend Decisions-ModelingDocument19 pagesCh.18-Dividend Decisions-ModelingHatem MohammedNo ratings yet

- Return of Private FoundationDocument36 pagesReturn of Private FoundationKaycey JoNo ratings yet

- US Internal Revenue Service: I1065bsk - 2002Document10 pagesUS Internal Revenue Service: I1065bsk - 2002IRSNo ratings yet

- Unit 3 Accounting For Division of Profits & LossesDocument8 pagesUnit 3 Accounting For Division of Profits & LossesIsha Aguilar100% (1)

- US Internal Revenue Service: F1120ric - 2000Document4 pagesUS Internal Revenue Service: F1120ric - 2000IRSNo ratings yet

- US Internal Revenue Service: f2438 - 2001Document3 pagesUS Internal Revenue Service: f2438 - 2001IRSNo ratings yet

- f1040seDocument2 pagesf1040seikechi.mikeNo ratings yet

- Bir Form 1603Document3 pagesBir Form 1603Nava NavarreteNo ratings yet

- Ayala Corporation and Subsidiaries SEC17Q September 2019-2 PDFDocument87 pagesAyala Corporation and Subsidiaries SEC17Q September 2019-2 PDFJohanna Lindsay CapiliNo ratings yet

- Self SufficiencyDocument14 pagesSelf SufficiencyErica Joy EstrellaNo ratings yet

- SDNEA2024001Document42 pagesSDNEA2024001Joao MatosNo ratings yet

- Establishing Strategic Pay Plans HRMDocument22 pagesEstablishing Strategic Pay Plans HRMBarby Angel100% (2)

- The Tiger Roars PDFDocument23 pagesThe Tiger Roars PDFRitish AdhikariNo ratings yet

- Solutions To Multiple Choice Questions, Exercises and ProblemsDocument30 pagesSolutions To Multiple Choice Questions, Exercises and ProblemsJan SpantonNo ratings yet

- Tugas PA Bab 16Document7 pagesTugas PA Bab 16Adrian BatubaraNo ratings yet

- Itemized DeductionsDocument10 pagesItemized Deductionsdarlene floresNo ratings yet

- Chapter 10Document36 pagesChapter 10Urtio Das AntumNo ratings yet

- Ch2-Budget Constraints N ChoicesDocument76 pagesCh2-Budget Constraints N ChoicesthutrangleNo ratings yet

- A New Finance Script - Docx (2023 - 07 - 17 11 - 10 - 11 UTC)Document3 pagesA New Finance Script - Docx (2023 - 07 - 17 11 - 10 - 11 UTC)Sumit KumarNo ratings yet

- All About Annual Information Statement (AIS)Document79 pagesAll About Annual Information Statement (AIS)NEERAJ MAURYANo ratings yet

- GPF Interest CalculatorDocument5 pagesGPF Interest CalculatorSushma VermaNo ratings yet

- Module 3 FranchisingDocument8 pagesModule 3 FranchisingericaNo ratings yet

- Rice Company Was Incorporated On January 1Document6 pagesRice Company Was Incorporated On January 1Marjorie PalmaNo ratings yet

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- Diversion of IncomeDocument11 pagesDiversion of IncomeSrivathsan NambiraghavanNo ratings yet

- One Page Summary Millionaire FastLaneDocument9 pagesOne Page Summary Millionaire FastLaneHisfan NaziefNo ratings yet

- Global and Caribbean Tourism and Its Contribution To The Global EconomyDocument25 pagesGlobal and Caribbean Tourism and Its Contribution To The Global EconomyDre's Graphic DesignsNo ratings yet

- Real Estate - U.S. Real Estate and Inflation - ENDocument9 pagesReal Estate - U.S. Real Estate and Inflation - ENTianliang ZhangNo ratings yet

- 1663 - Jawaban Soal 2 Financial StatementsDocument2 pages1663 - Jawaban Soal 2 Financial StatementsRezekiro IrmNo ratings yet

- Chips Not DoneDocument42 pagesChips Not DoneKrestyl Ann GabaldaNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Scope of Rural MarketingDocument2 pagesScope of Rural MarketingpiyuskankaneNo ratings yet

- Yekokeb Berhan ES Implementation Guidelines (REVISED-All in One)Document96 pagesYekokeb Berhan ES Implementation Guidelines (REVISED-All in One)LambadynaNo ratings yet