Professional Documents

Culture Documents

Hospitality-Accounting-I

Hospitality-Accounting-I

Uploaded by

bxsqb7g4yrCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hospitality-Accounting-I

Hospitality-Accounting-I

Uploaded by

bxsqb7g4yrCopyright:

Available Formats

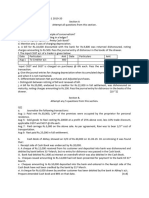

RAJDHANI MODEL COLLEGE i.

Acquired the articles of incorporation and three shareholders introduced

Full Marks: 30

Rs.1,00,000 each in exchange for shares.

Old Baneshwor, Kathmandu Pass Marks: 15 ii. Purchase the office building for Rs.1,50,000 in cash and building is valued

PRE-BOARD EXAMINATION-2023 Time: 1.5Hrs. at Rs.1,00,000 and remainder as land.

BHM/ III ACC125: Hospitality Accounting I(Set-A) iii. Signed a three-year promissory note at the bank for Rs.1,25,000.

iv. Purchased office equipment at a cost of Rs.50,000 paying Rs.10,000 as

Candidates are required to give their answers in their own words as far as down payment and agreeing to repay the remainder in 10 days.

practicable. The figures in the margin indicate full marks. v. Paid wages and salaries of Rs.1,30,000 for the first half of the month.

Group 'A' vi. Paid the balance due on the office equipment.

Very short answer questions vii. Sold Rs.24,000 of advertising during the first month. Customers have until

Attempt all questions. (10x2=20) the 15th of the following month to pay their bills.

1. What do you mean by hotel accounting? Required:

2. Who are the users of accounting information? a. Journal Entries

3. What do you understand by financial statements? b. T- accounts and

4. Write any two differences between capital expenditure and revenue c. Trial balance

expenditure. 14. The following transactions pertaining to January of ABC Pvt. Ltd. are given to

5. List out any two limitations of ratio analysis. you:

6. Define cash flow statement. Jan 1: Opening cash balance of Rs.1,20,000 and bank balance of Rs.70,000.

Jan 5: Payment made to creditors Rs.13,000 in cash, Rs.15,000 through cheque

7. What is annual report?

in full settlement of Rs.30,000.

8. The following information is provided to you:

Jan 7: Sold goods on credit Rs.20,000.

Sales Rs.12,00,000 Jan 10: Purchased furniture of Rs.50,000 and paid through cash.

Cost of goods sold Rs.4,50,000 Jan 15: Cash withdrawn from bank Rs.30,000 for office use and Rs.10,000 for

Selling expenses Rs.60,800 personal use.

General and administrative expenses Rs.75,000 Jan 22: Sold goods for Rs.30,000 where Rs.4,000 received as cash and balance

Required: Determine the amount of gross profit and net profit margin. amount is received through cheque and discount allowed of Rs.1,000.

9. Calculate Cash Flow from Operating Activities. Jan 25: Received from debtors Rs.19,500 in full settlement of his account of 7th

Sales for the year Rs.5,00,000 January.

Increase in debtors Rs.5,000 Jan 30: Received through cheque Rs.28,500 after deducting 5% discount.

Increase in creditors Rs.3,000 Jan 31: Paid salary and wages for the month Rs.20,000 by cheque.

10. Calculate inventory turnover ratio from the following information: Required: Triple Column Cash Book

Opening stock Rs.2,50,000 Carriage Rs.5,000 15. The following information is provided by XYZ Company as the year ended

inwards December 31, 2013.

Purchase of Rs.1,40,000 Closing stock Rs.35,000 Particulars Amount Particulars Amount (Rs.)

merchandise (Rs.)

Purchase return Rs.10,000 Account Receivable 2,000 Land 20,000

Advertising expenses 4,000 Purchase return 1,000

"Group 'B'

Building 59,500 Purchase 51,000

Descriptive answer questions. Capital stock 50,000 Retained earnings 8,500

Attempt any six questions. (6x10= 60) Cash 5,000 Salaries expenses 20,000

11. Define GAAP. Explain in brief the various principles of GAAP. Depreciation expenses 500 Salaries payable 3,000

12. What is annual report? Explain the components of annual report. Dividend paid 1,000 Sales 92,000

13. Himalayan Service Company started business on January 1, 2018. The Income tax expenses 750 Sales commission 4,500

following transactions occurred during the first month of operation: Income tax payable 750 Utilities expenses 3,000

Rent expenses 1,000 Bonds payable 20,000

Stock on Jan 1 6,000 Account payable 5,000 Total 11,00,000 Total 11,00,000

Sales return 2,000 Required:

Additional information: Stock on Dec 31 is Rs.2,000. a. Inventory turnover ratio

Required: b. Debtor turnover ratio

a. Multi-Step Income Statement c. Average collection period

b. Statement of Retained Earnings d. Assets turnover ratio

c. Classified Balance Sheet e. Capital employed turnover ratio

16. Following is the income statement and balance sheet of Lakeside Handicraft 17. The following income statement and balance sheet of ABC Company is

Company Ltd. provided for the year ended December 31, 2018.

Lakeside Handicraft Company Ltd. Particulars Amount (Rs.)

Income Statement Sales revenue 12,50,000

For the year ended 31st December 2017 Less: Cost of goods sold 7,00,000

Particulars Amount (Rs.) Gross profit 5,50,000

Sales (50% Credit) 12,00,000 Less: Operating expenses 1,50,000

Less: Cost of goods sold 6,10,000 Income before interest and 4,00,000

Gross profit 5,90,000 tax

General and administrative 80,000 Less: Interest expenses 25,000

expenses Income before tax 3,75,000

Depreciation expenses 40,000 Less: Income tax expenses 1,50,000

Establishment expenses 30,000 Net income after tax 2,25,000

Selling expenses 65,000

Total expenses and losses 2,15,000 Comparative Balance sheet

Income before interest and tax 3,75,000 As on 31st December

Less: Interest expenses 30,000 Capital and 2018 2017 Assets 2018 2017

Income before tax 3,45,000 Liabilities (Rs.) (Rs.) (Rs.) (Rs.)

Less: Income tax expenses 10,000 Accounts 1,30,000 1,48,000 Cash 52,000 90,000

Net income after tax 3,35,000 payable

Outstanding 68,000 63,000 Accounts 1,80,000 1,30,000

Balance sheet expenses receivable

As on 31st December 2017 Income tax 90,000 110,000 Inventory 2,30,000 2,00,000

Particulars Amount(Rs.) Particulars Amount(Rs.) payable

Share capital 4,00,000 Machinery 5,72,000 Long-term 3,50,000 3,00,000 Prepaid 15,000 25,000

Share premium 1,00,000 Equipment 2,00,000 bank loan expenses

Reserve and surplus 40,000 Furniture 50,000 Common 5,50,000 4,00,000 Land 7,50,000 6,00,000

Debentures 3,00,000 Inventory 65,000 stock

Bank overdraft 35,000 Debtors 60,000 Retained 4,89,000 3,24,000 Plant and 7,00,000 5,00,000

Sundry creditors 1,10,000 Cash in hand 50,000 earnings equipment

Outstanding expenses 25,000 Marketable 45,000 Accumulated (2,50,000) (2,00,000)

securities depreciation

P/L appropriation account 90,000 Preliminary 18,000 Total 16,77,000 13,45,000 Total 16,77,000 13,45,000

expenses

Goodwill 40,000 Additional information:

a. Dividends of Rs.60,000 were declared and paid during the year. a. Current ratio f. Assets turnover ratio

b. Operating expenses include Rs.50,000 of depreciation. b. Quick ratio g. Return on assets

Required: Cash Flow Statement for 2018 using direct method c. Inventory turnover ratio h. Return on shareholders’ equity

d. Debtor turnover ratio i. Earnings per share

Group ‘C’ e. Average collection period j. No. of shares issue

Case analysis

18. Read the case situation given below and answer the questions that follow:

[20]

Following are the financial statements of Salesways Pvt. Ltd.

Income statement

For the year ended 31st December 2018

Particulars Amount (Rs.)

Sales revenue 2,00,000

Less: Cost of goods sold 60,000

Gross profit 1,40,000

General and administrative 80,000

expenses

Depreciation expenses 40,000

Income before interest and tax 20,000

Less: Interest expenses 5,000

Income before tax 15,000

Less: Income tax expenses 10,000

Net income after tax 5,000

Balance sheet

As on 31st December 2018

Liabilities and capital Amount Assets Amount

(Rs.) (Rs.)

Common shares @ Rs.100 40,000 Land 50,000

each

Preference shares 30,000 Plant & Machinery 20,000

Reserve & Surplus 10,000 Furniture 15,000

Debentures 30,000 Stock 25,000

Bank overdraft 5,000 Accounts 7,000

receivable

Sundry creditors 10,000 Cash and bank 5,000

Outstanding expenses 5,000 Prepaid expenses 5,000

Profit & Loss app. Account 5,000 Preliminary 8,000

expenses

Total 1,35,000 Total 1,35,000

Required:

You might also like

- PC228 PDFDocument928 pagesPC228 PDFJoão Guilherme Andretto Balloni100% (6)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Different Classification of FeedstuffDocument13 pagesDifferent Classification of FeedstuffNiño Joshua Ong Balbin67% (6)

- Precipitation ProcessesDocument2 pagesPrecipitation ProcessesThembi Matebula100% (1)

- Module 1 People and The Earths EcosystemDocument8 pagesModule 1 People and The Earths EcosystemRalph PanesNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- SPLK-1001: Number: SPLK-1001 Passing Score: 800 Time Limit: 120 Min File Version: 1Document36 pagesSPLK-1001: Number: SPLK-1001 Passing Score: 800 Time Limit: 120 Min File Version: 1abhishek_singh10272No ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Corporate Account IIDocument7 pagesCorporate Account IIalphadark72No ratings yet

- Xi Accounting Set 1Document6 pagesXi Accounting Set 1aashirwad2076No ratings yet

- Fundamentals of Accounting 2021Document4 pagesFundamentals of Accounting 2021mariyabenny223No ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- Thirty Questions For Thirty Minutes Only. Maintain The TimeDocument3 pagesThirty Questions For Thirty Minutes Only. Maintain The TimeANo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Xi Accounting Set 4Document8 pagesXi Accounting Set 4aashirwad2076No ratings yet

- 1bba FOA Prep QPDocument2 pages1bba FOA Prep QPSuhail AhmedNo ratings yet

- Financial Accounting Model Question PaperDocument4 pagesFinancial Accounting Model Question Paperfarzeen khNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Accountancy Three SetDocument10 pagesAccountancy Three Setrt6043663No ratings yet

- Accounts Paper Class 11 Sem 1 2019Document4 pagesAccounts Paper Class 11 Sem 1 2019samarthj.9390No ratings yet

- Karnataka Ist PUC Accountcancy Sample Question Paper 4 PDFDocument4 pagesKarnataka Ist PUC Accountcancy Sample Question Paper 4 PDFNeha BaligaNo ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- Delhi Pubic School, Nacharam Accountancy - Xi Question BankDocument9 pagesDelhi Pubic School, Nacharam Accountancy - Xi Question BanklasyaNo ratings yet

- AC PaperDocument2 pagesAC Paperpiyush kumarNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- MB 104 Basics of Accounting and FinanceDocument3 pagesMB 104 Basics of Accounting and FinancerajeshpatnaikNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- Fundamentals of Accounting 2020Document4 pagesFundamentals of Accounting 2020sreehari dineshNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- 4 MarksDocument4 pages4 MarksEswari GkNo ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- Incomplete Records QDocument34 pagesIncomplete Records Qcharliedry1920No ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- BM102TDocument25 pagesBM102TMariamma KuriakoseNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- 2015 Bcom Iisem AfaDocument4 pages2015 Bcom Iisem AfaSanthosh KumarNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- 11-Acc PP1Document11 pages11-Acc PP1adityatiwari122006No ratings yet

- Ugmbcc04 - Business AccountingDocument4 pagesUgmbcc04 - Business AccountingShreya MitraNo ratings yet

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Document5 pagesSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Financial Accounting Punjab University: Question Paper 2018Document4 pagesFinancial Accounting Punjab University: Question Paper 2018aneebaNo ratings yet

- Business AccountingDocument3 pagesBusiness AccountingMaha RachithaNo ratings yet

- Finl Exm Et 2, 2024Document6 pagesFinl Exm Et 2, 2024Vishavpreet SinghNo ratings yet

- MB0025 Financial and Management AccountingDocument4 pagesMB0025 Financial and Management AccountingsanthoshaliasNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- FINANCIAL - 22UCOS304 - Corrected - 23N528Document5 pagesFINANCIAL - 22UCOS304 - Corrected - 23N528aswathvignessNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Sample Paper For Class 11 Accountancy Set 1 QuestionsDocument6 pagesSample Paper For Class 11 Accountancy Set 1 Questionsrenu bhattNo ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- BHM-IVDocument1 pageBHM-IVbxsqb7g4yrNo ratings yet

- Ratio-Analysis-2Document13 pagesRatio-Analysis-2bxsqb7g4yrNo ratings yet

- BHM-4th-SEMESTER-PRACTICAL-GROUP-1Document1 pageBHM-4th-SEMESTER-PRACTICAL-GROUP-1bxsqb7g4yrNo ratings yet

- Slidesgo Maximizing Profitability a Strategic Approach to Revenue Management 20240625030841tau2Document8 pagesSlidesgo Maximizing Profitability a Strategic Approach to Revenue Management 20240625030841tau2bxsqb7g4yrNo ratings yet

- Character Analysis of Lyubov Andreyevna RanevskayaDocument4 pagesCharacter Analysis of Lyubov Andreyevna RanevskayaAnnapurna V GNo ratings yet

- ABC - Suggested Answer - 0Document8 pagesABC - Suggested Answer - 0pam pamNo ratings yet

- 1998 McCurdy KenmareDocument8 pages1998 McCurdy Kenmarerodrigues_luisalbertoNo ratings yet

- Foam Cushioning Instapak SpeedyPacker BrochureDocument4 pagesFoam Cushioning Instapak SpeedyPacker BrochureRodrigo BeltranNo ratings yet

- NMKV - WikipediaDocument17 pagesNMKV - WikipediaNUTHI SIVA SANTHANNo ratings yet

- Anatomy Questions Hip and ThighDocument11 pagesAnatomy Questions Hip and Thighmohamed mowafeyNo ratings yet

- 01 - Manish Sharma Timilsina - Conduction Heat Transfer Beyond Fourier LawDocument10 pages01 - Manish Sharma Timilsina - Conduction Heat Transfer Beyond Fourier LawShrestha RishavNo ratings yet

- Electronic Reservation Slip IRCTC E-Ticketing Service (Agent)Document2 pagesElectronic Reservation Slip IRCTC E-Ticketing Service (Agent)Prashant PatilNo ratings yet

- The Psychological Aspects of Cinematography and Its ImpactDocument21 pagesThe Psychological Aspects of Cinematography and Its Impactanastasiapiven7No ratings yet

- Persistent System Feedback 2018Document2 pagesPersistent System Feedback 2018sunikesh shuklaNo ratings yet

- RMO 2016 Detailed AnalysisDocument6 pagesRMO 2016 Detailed AnalysisSaksham HoodaNo ratings yet

- Icest2030 AzureDocument4 pagesIcest2030 AzureJorge RoblesNo ratings yet

- Basmati Rice Code of PracticeDocument6 pagesBasmati Rice Code of PracticeayanasserNo ratings yet

- Degenerate Hyperbola.: Conic Sections Geometric Properties of CurvesDocument2 pagesDegenerate Hyperbola.: Conic Sections Geometric Properties of CurvesJohn Renzo ErfeloNo ratings yet

- Runner of Francis Turbine:) Cot Cot (Document5 pagesRunner of Francis Turbine:) Cot Cot (Arun Kumar SinghNo ratings yet

- Amstar StaffingDocument14 pagesAmstar StaffingSunil SNo ratings yet

- First Quarterly Assessment Intle7: School Year 2021-2022Document3 pagesFirst Quarterly Assessment Intle7: School Year 2021-2022marjorie rochaNo ratings yet

- JD - Part Time Online ESL Teacher - Daylight PDFDocument2 pagesJD - Part Time Online ESL Teacher - Daylight PDFCIO White PapersNo ratings yet

- Features of Edpuzzle PDFDocument5 pagesFeatures of Edpuzzle PDFLailaniNo ratings yet

- Fee Payment Method: Bank Islam Malaysia BerhadDocument1 pageFee Payment Method: Bank Islam Malaysia BerhadmerlinNo ratings yet

- LIT - Sullair S-Energy 25-40hp Brochure - SAPSEN2540201904-6 - ENDocument8 pagesLIT - Sullair S-Energy 25-40hp Brochure - SAPSEN2540201904-6 - ENKrist San QNo ratings yet

- Standard CVDocument3 pagesStandard CVSurzo Chandra DasNo ratings yet

- Common Service Data Model (CSDM) 3.0 White PaperDocument31 pagesCommon Service Data Model (CSDM) 3.0 White PaperЕвгения МазинаNo ratings yet

- Marcopolo Is A Leading Brazilian Bus Body ManufacturerDocument4 pagesMarcopolo Is A Leading Brazilian Bus Body ManufacturerCH NAIRNo ratings yet

- TCL022150e Theory Past Paper 2019 May A - Grade 3Document8 pagesTCL022150e Theory Past Paper 2019 May A - Grade 3Andrea Price100% (1)