Professional Documents

Culture Documents

Maq Fall02 Costallocation-PDF

Maq Fall02 Costallocation-PDF

Uploaded by

lakshmikanth.raCopyright:

Available Formats

You might also like

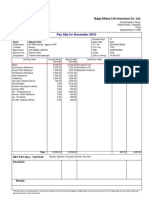

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Cost and Management Accounting: Paper 7Document31 pagesCost and Management Accounting: Paper 7Atukwatse PamelaNo ratings yet

- A Learning Plan in Grade 8 PersuasiveDocument6 pagesA Learning Plan in Grade 8 PersuasiveYannah Jovido50% (2)

- Tiny Tweaks James WedmoreDocument31 pagesTiny Tweaks James WedmoreErise Global100% (1)

- Overheads CostingDocument10 pagesOverheads CostingOlivier IrengeNo ratings yet

- Cost&management OverheadsDocument16 pagesCost&management OverheadsAlexa KintuNo ratings yet

- EMBA 5412 Cost and Revenue AllocationDocument62 pagesEMBA 5412 Cost and Revenue AllocationKalkayeNo ratings yet

- Chapter5, Cost AllocationDocument8 pagesChapter5, Cost AllocationWegene Benti UmaNo ratings yet

- F2 Management Accounting: Eagles Business SchoolDocument10 pagesF2 Management Accounting: Eagles Business SchoolCourage KanyonganiseNo ratings yet

- Chapter5, Cost AllocationDocument8 pagesChapter5, Cost AllocationÄjú Bíñt ŹãhŕãNo ratings yet

- Solutions Chapter 8 Support Dept CostsDocument12 pagesSolutions Chapter 8 Support Dept CostsChris Pasram0% (1)

- Chapter 5 Service Department Cost AllocationsDocument48 pagesChapter 5 Service Department Cost AllocationsMulugeta GirmaNo ratings yet

- Support Department Cost (Notes)Document6 pagesSupport Department Cost (Notes)funkpopsicleNo ratings yet

- Syllabus (Notes & Tut QS) - FMDocument62 pagesSyllabus (Notes & Tut QS) - FMFrank El NinoNo ratings yet

- Ca 2Document37 pagesCa 2bm36omdNo ratings yet

- Chapter 7 - Manufacturing Overhead - Departmentalization Need For DepartmentalizationDocument11 pagesChapter 7 - Manufacturing Overhead - Departmentalization Need For DepartmentalizationKhai Ed PabelicoNo ratings yet

- Chapter 3Document11 pagesChapter 3Arun Kumar SatapathyNo ratings yet

- EMBA 5412 Cost and Revenue AllocationDocument62 pagesEMBA 5412 Cost and Revenue AllocationDean Craig100% (1)

- Chapter - Service DPT Cost Allocation 2010Document13 pagesChapter - Service DPT Cost Allocation 2010Kiya AbdiNo ratings yet

- Chapter 6Document7 pagesChapter 6Genanew AbebeNo ratings yet

- Cost & Mgt. Acct - I, Lecture Note - Chapter 5 & 6Document14 pagesCost & Mgt. Acct - I, Lecture Note - Chapter 5 & 6ተዋህዶ 23 - Tewahedo 23No ratings yet

- Typeof CostDocument12 pagesTypeof CostZazaNo ratings yet

- Chapter 3, Cost AllocationDocument9 pagesChapter 3, Cost AllocationDEREJENo ratings yet

- (C-4.1) 5. Overheads - FormattedDocument30 pages(C-4.1) 5. Overheads - FormattedSam KingNo ratings yet

- Cost U4Document29 pagesCost U4firaolmosisabonkeNo ratings yet

- Assigning Service Department CostsDocument23 pagesAssigning Service Department CostsjtpmlNo ratings yet

- Chapter 7 Departmentalization of Overhead and Allocation of Service Departments' CostDocument3 pagesChapter 7 Departmentalization of Overhead and Allocation of Service Departments' CostApril Joy InductaNo ratings yet

- Accounting For OverheadsDocument53 pagesAccounting For Overheadsfbicia218No ratings yet

- OverheadsDocument13 pagesOverheadsHamis Mohamed50% (2)

- 02-08-2022 CRC-ACE - AFAR - Week 05 - Factory OverheadDocument14 pages02-08-2022 CRC-ACE - AFAR - Week 05 - Factory Overheadjohn francisNo ratings yet

- Week 5 (To Be Discussed) AnswersDocument3 pagesWeek 5 (To Be Discussed) AnswersThirusha balamuraliNo ratings yet

- Chapter Five Cost AllocationDocument7 pagesChapter Five Cost AllocationHaymanot AyalewNo ratings yet

- Lesson 8 Overhead CostsDocument14 pagesLesson 8 Overhead CostsstcatherinehighmentorsNo ratings yet

- OverheadsDocument35 pagesOverheadsoaziz66No ratings yet

- EduMine Course - Maintenance ManagementDocument9 pagesEduMine Course - Maintenance ManagementdiabalziabNo ratings yet

- Departmentalization of Factory OverheadDocument3 pagesDepartmentalization of Factory OverheadPaolo Immanuel OlanoNo ratings yet

- Notes On End of Chapter QuestionsDocument31 pagesNotes On End of Chapter Questionsduong duongNo ratings yet

- AC3097 Management Accounting: Notes On The End-Of-Chapter QuestionsDocument30 pagesAC3097 Management Accounting: Notes On The End-Of-Chapter QuestionsPei TingNo ratings yet

- Ch08 Cost AllocationDocument46 pagesCh08 Cost AllocationRavikumar Sampath100% (1)

- Solutions To Even ProblemsDocument26 pagesSolutions To Even ProblemsAndrey HcivokramNo ratings yet

- Unit 5 - Accounting For OverheadsDocument19 pagesUnit 5 - Accounting For OverheadsAayushi KothariNo ratings yet

- Costing Machine Hour RateDocument27 pagesCosting Machine Hour RateAjay SahooNo ratings yet

- Manufacturing OverheadDocument21 pagesManufacturing OverheadErlinda NavalloNo ratings yet

- Overheads Allocation and ApportionmentDocument60 pagesOverheads Allocation and ApportionmentNesto Yohana SadukaNo ratings yet

- AF3112 Lec 4 Allocation of Service Department CostsDocument15 pagesAF3112 Lec 4 Allocation of Service Department CostsRoseNo ratings yet

- Accountancy ProjectDocument15 pagesAccountancy ProjectShruti GargNo ratings yet

- Lecture-7 Overhead (Part 4)Document38 pagesLecture-7 Overhead (Part 4)Nazmul-Hassan SumonNo ratings yet

- Cost Benefit PDFDocument11 pagesCost Benefit PDFYashNo ratings yet

- Chap 15Document31 pagesChap 15Ahmed Mohamed100% (1)

- UEU Akuntansi Biaya Pertemuan 8910Document84 pagesUEU Akuntansi Biaya Pertemuan 8910hardyputra46No ratings yet

- Cost Estimation Meaning of CostDocument9 pagesCost Estimation Meaning of CostMatinChris KisomboNo ratings yet

- Week 1 Introduction and ActivitiesDocument4 pagesWeek 1 Introduction and ActivitiesrahimNo ratings yet

- Cost Model For Data Management CenterDocument63 pagesCost Model For Data Management CenterÁtila FernandesNo ratings yet

- Cost PresentationDocument8 pagesCost PresentationMJ jNo ratings yet

- Allocation of Support-Department CostsDocument18 pagesAllocation of Support-Department CostsBobNo ratings yet

- Cost Model For Data Management Center (DMC) Main MenuDocument63 pagesCost Model For Data Management Center (DMC) Main Menukrds chidNo ratings yet

- Cost Model For Data Management Center (DMC) Main MenuDocument63 pagesCost Model For Data Management Center (DMC) Main MenuGeovanny Hernández0% (1)

- OverheadsDocument32 pagesOverheadsLay TekchhayNo ratings yet

- Lecture 3-Accounting For OverheadsDocument10 pagesLecture 3-Accounting For OverheadsddmaheshslNo ratings yet

- Case StudyDocument6 pagesCase StudyVishal RajputNo ratings yet

- Foh PDFDocument10 pagesFoh PDFZaheer SwatiNo ratings yet

- Simple ABC ModelDocument65 pagesSimple ABC Modelalfaroq_almsryNo ratings yet

- Support/downloads or Scan Above QR Code For Detailed Policy WordingDocument10 pagesSupport/downloads or Scan Above QR Code For Detailed Policy Wordingraj VenkateshNo ratings yet

- Title of Project:-Military Hospital Report Management SystemDocument4 pagesTitle of Project:-Military Hospital Report Management SystemAkbar AliNo ratings yet

- GraphsDocument18 pagesGraphssaloniNo ratings yet

- Title DefenseDocument3 pagesTitle DefenseLiezl Sabado100% (1)

- 2018 Weekly CalendarDocument3 pages2018 Weekly CalendarFabian FebianoNo ratings yet

- Astm A 1011 2005Document8 pagesAstm A 1011 2005gao yanminNo ratings yet

- BGR AnuualReport 2022-23Document88 pagesBGR AnuualReport 2022-23Rk SharafatNo ratings yet

- Christmas Vigil MassDocument106 pagesChristmas Vigil MassMary JosephNo ratings yet

- Ent Secretory Otitis MediaDocument3 pagesEnt Secretory Otitis MediaIrena DayehNo ratings yet

- Gl04 FM Tam 019 FsefDocument4 pagesGl04 FM Tam 019 FsefManish TiwariNo ratings yet

- FijiTimes - Feb 17 2012 Web PDFDocument48 pagesFijiTimes - Feb 17 2012 Web PDFfijitimescanadaNo ratings yet

- In Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDocument7 pagesIn Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDanielNo ratings yet

- Borneo Sporenburg Final-Ilovepdf-CompressedDocument55 pagesBorneo Sporenburg Final-Ilovepdf-Compressedapi-417024359No ratings yet

- Wa0004.Document15 pagesWa0004.Sudhir RoyNo ratings yet

- Genuine Eaton Vicker HidrauDocument28 pagesGenuine Eaton Vicker HidrauJenner Volnney Quispe ChataNo ratings yet

- Cell Theory Refers To The Idea That: MicrographiaDocument5 pagesCell Theory Refers To The Idea That: MicrographiadeltasixNo ratings yet

- Explosion Protection - E PDFDocument7 pagesExplosion Protection - E PDFAPCANo ratings yet

- Local Winds: Land and Sea BreezesDocument8 pagesLocal Winds: Land and Sea Breezesravi rathodNo ratings yet

- Error Message Reference: Oracle® Hyperion Tax GovernanceDocument6 pagesError Message Reference: Oracle® Hyperion Tax GovernanceAbayneh AssefaNo ratings yet

- Beginner's Guide To SoloDocument12 pagesBeginner's Guide To SoloTiurNo ratings yet

- Grade 7 Lesson: ReproductionDocument4 pagesGrade 7 Lesson: ReproductionJoedelyn Wagas100% (2)

- Action ResearchDocument10 pagesAction ResearchNacion EstefanieNo ratings yet

- Quick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedDocument20 pagesQuick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedРоманКочневNo ratings yet

- Jambajuicelv-Application-0618 1Document2 pagesJambajuicelv-Application-0618 1api-526082107No ratings yet

- DLL Mother TongueDocument41 pagesDLL Mother TongueMarxPascualBlancoNo ratings yet

- (Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Document355 pages(Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Carlos Roberto JúniorNo ratings yet

Maq Fall02 Costallocation-PDF

Maq Fall02 Costallocation-PDF

Uploaded by

lakshmikanth.raCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maq Fall02 Costallocation-PDF

Maq Fall02 Costallocation-PDF

Uploaded by

lakshmikanth.raCopyright:

Available Formats

Cost Allocation—

VOL.4 NO.1

Fall From the Simple to

2002

the Sublime

B Y J A M E S B . S T I N S O N , P H . D . , C PA

SPREADSHEET TOOLS ADD EFFICIENCY AND ACCURACY.

rganizational units generally can be catego- departments. Such a cost-based system allows service

O rized as production departments, which are

directly involved in producing and distrib-

uting outputs, and service departments,

whose primary activity is providing service

to other organizational units. Service departments gen-

erate costs that must be covered by the production

departments. They do not produce revenues or profits

department costs to be included in the costing and

pricing decisions for the final product. Organizations

that establish prices on a cost-plus basis should include

both direct and service activities in the cost of their out-

put. Otherwise, profit margins will be overstated, and

the relative profitability of final products that use differ-

ing amounts of service department activities will be

directly because their outputs are not sold outside the distorted.

organization. Examples of service activities include Service department costs are allocated to other

information technology, maintenance, utilities, human departments based on some measure that represents

resources, housekeeping, and administration. Service the usage of the service activity. Ideally, a direct mea-

departments often provide support to other service sure of service department output could be used.

departments as well as to production departments. For Examples include actual time incurred by maintenance

example, a maintenance department might maintain department personnel, actual computer time provided,

housekeeping department equipment. and actual kilowatt-hours of electrical power. In most

Although they often are considered to be costly activ- instances, however, a less direct surrogate measure must

ities that reduce income, service departments are just as suffice. For example, square footage would result in a

necessary to the production of final outputs as those less accurate but more cost effective allocation than an

departments directly involved in revenue generation. A actual measure of the amount of time spent in produc-

good budgeting and accounting system should provide tion departments by the housekeeping staff. Similarly,

incentives for the efficient and effective use of service the additional accuracy achieved by measuring the

department activities by managers of production de- actual time expended by the human resources staff

partments. It also should provide performance incen- most likely would not be worth the incremental cost

tives for service department managers. above that of a simple allocation based on the number

Typically, the charges for the use of service activities of production employees served.

are based on the budgeted or actual costs of these Once the various allocation bases have been deter-

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 1 FALL 2002, VOL.4, NO. 1

mined, a method to apportion service department costs when the number of allocations is large. Finally,

must be selected. Three common methods are: (1) the because matrix algebra is required, the reciprocal

direct method, (2) the step (or sequential) method, and method is not practical without computer assistance.

(3) the reciprocal method. The direct method is the Fortunately, spreadsheet software handles matrix

simplest, the step method sacrifices some simplicity but manipulations quite nicely.

offers an opportunity for improved accuracy, and the

reciprocal method is the most accurate but also the EXAMPLE DATA

most complex. The examples of each allocation method that follow are

The purpose of this article is to illustrate how stan- presented using data from a hypothetical healthcare

dard spreadsheet application software (Microsoft Excel facility. Enterprise Memorial Hospital (EMH) has two

for Windows in particular) can assist with all three production departments and three service departments.

methods of cost allocation. First, computational errors Because the example data are based on a healthcare

that often occur with manual calculations can be avoid- facility, production departments are called patient care

ed. Second, spreadsheets afford greater efficiency by departments, and service departments are called support

eliminating the need to reenter repetitive information departments. The patient care departments are patient

(e.g., allocation bases, allocation formulas, labels, titles, rooms, diagnosis, and treatment. The support depart-

etc.) when allocations are performed regularly for the ments are administration, housekeeping, and mainte-

preparation of periodic financial statements. Third, nance. Cost and service data are shown in Table 1.

spreadsheets can quickly perform what otherwise could These data will be used to apportion the costs of the

be a prohibitively cumbersome set of computations support departments to the patient care departments

Table 1: Cost and Service Data

Costs

Department Costs Allocation Base

Administration $ 2,000,000 Average number of employees

Housekeeping 900,000 Area (square feet)

Maintenance 400,000 Number of requisitions

Patient Rooms 5,000,000 ——

Diagnosis & Treatment 9,000,000 ——

Total $17,300,000

Activity

Average Number Area Number

Department of Employees (square feet) of Requisitions

Administration 50 20% 40,000 16% 80 8%

Housekeeping 30 12% 10,000 4% 120 12%

Maintenance 10 4% 20,000 8% 0 0%

Patient Rooms 120 48% 120,000 48% 500 50%

Diagnosis & Treatment 40 16% 60,000 24% 300 30%

Total 250 100% 250,000 100% 1,000 100%

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 2 FALL 2002, VOL. 4, NO. 1

Figure

Figure1: 1:Relationships

RelationshipsAmong Revenue

Between and Non-revenue

Revenue- Producing Departments

and Nonrevenue-Producing Departments

12%

4% Housekeeping Maintenance 0%

8%

48% 24% 16%

8% 30% 50%

12% 4%

Administration

48% 20% 16%

Diagnosis &

Patient Rooms

Treatment

using all three allocation techniques. port departments are shown in Figure 1. Outgoing

The objective is to arrive at a more complete and arrows represent service provided by the support

accurate set of costs for the patient care areas by allocat- departments to other areas. Incoming arrows represent

ing the costs of the three support departments to them. service received. Percentages of service provided are

In this example, EMH can use the direct method of indicated in the boxes on each outgoing arrow. Notice

allocation for internal management and control pur- that the sum of the percentages for arrows leaving each

poses but must select either the step method or the support department equals 100%. Also, administration

reciprocal method for Medicare reimbursement as and housekeeping self-consume a portion of their own

required by law. services as indicated by the arrows that both exit and

As shown in Table 1, administrative costs are allocat- enter the same box. In this example, housekeeping

ed based on the average number of employees working and administration self-consume, but maintenance

in each department, housekeeping costs are allocated does not.

based on the area of each department, and maintenance

costs are allocated based on the number of requisitions THE DIRECT METHOD: KEEPING IT SIMPLE

submitted by each department. Regardless of the The direct method of allocation is the simplest. As the

method used, the costs of the patient rooms plus diag- name implies, the costs associated with each support

nostics and treatment should total $17.3 million after department are allocated directly to the two patient care

the allocations. departments without regard for reciprocal services and

The relationships among the patient care and sup- self-consumption. For example, the entire $2,000,000 of

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 3 FALL 2002, VOL. 4, NO. 1

administrative cost is added directly to the costs for allocation base, $1,500,000 of the administrative cost is

patient rooms and diagnosis and treatment. None of the allocated to patient rooms and $500,000 to diagnosis

administrative cost is allocated to housekeeping or main- and treatment. The calculations are 120/(120+40) x

tenance, even though administrative services are pro- $2,000,000 = $1,500,000 and 40/(120+40) x

vided to both. Also, self-consumption is not included in $2,000,000=$500,000.

the calculations. Likewise, the costs of housekeeping The cell formulas access information contained in

and maintenance are added only to the costs of the two the data section and perform the necessary calculations.

patient care departments. The formula in cell E14 is =C6/(C6+C7)*I3. The for-

The spreadsheet for the direct method is shown in mula in cell F14 is =C7/(C6+C7)*I3. Cell B14 is for pre-

Table 2. The variable data for allocation bases and costs sentation purposes only. It contains = I3*-1 to show that

are entered in the top section. These data are arranged the entire $2,000,000 of administrative cost has been

together because they are likely to change from period allocated. As a check, cell G14 is a sum of cells B14

to period, and they are referenced by the allocation cal- through F14 and must equal zero.

culations below. The average number of employees, the Housekeeping costs are allocated in the same man-

number of requisitions, and, of course, costs incurred ner, using area as the allocation base. The calculations

during the period are particularly susceptible to change. are 120,000/(120,000+60,000) x $900,000 = $600,000 and

Department areas also could change due to rearrange- 60,000/(120,000+60,000) x $900,000 = $300,000. The

ments and additions. formula in cell E15 is =E6/(E6+E7)*I4. The formula in

The bottom section contains the cost allocations. cell F15 is =E7/(E6+E7)*I4. Again, cell C15 is for pre-

The first row of data in this section repeats the costs by sentation, and row 15 must sum to zero.

referencing the cells in column I. This is for presenta- Likewise, maintenance costs are allocated using the

tion purposes only. The next three lines contain the number of requisitions as the allocation base. The cal-

cost allocations. Notice the simplicity of the direct culations are 500/(500+300) x $400,000 = $250,000 and

method. The $2,000,000 administrative costs, $900,000 300/(500+300) x $400,000 = $150,000. The formula in

housekeeping costs, and $400,000 maintenance costs cell E16 is =G6/(G6+G7)*I5. The formula in F16 is

are split directly between the two patient care depart- =G7/(G6+G7)*I5. Cell D16 is for presentation, and row

ments. Using the average number of employees as the 16 must sum to zero. Row 17 shows that the patient

Table2:2:Spreadsheet

Table Spreadsheetforfor the

the Direct

Direct Method

Method of Cost

of Cost Allocation

Allocation

A B C D E F G H I

1 DATA Employees Area Requisitions

2 Department Avg. No. Percent Ft.2 Percent No. Percent Costs

3 Administration 50 20% 40,000 16% 80 8% $ 2,000,000

4 Housekeeping 30 12% 10,000 4% 120 12% 900,000

5 Maintenance 10 4% 20,000 8% 0 0% 400,000

6 Patient Rooms 120 48% 120,000 48% 500 50% 5,000,000

7 Diagnosis & Treatment 40 16% 60,000 24% 300 30% 9,000,000

8 Totals 250 100% 250,000 100% 1,000 100% $ 17,300,000

9

11 ALLOCATIONS Diagnosis

12 Administration Housekeeping Maintenance Patient Rooms & Treatment Totals

13 Costs $ 2,000,000 $ 900,000 $ 400,000 $ 5,000,000 $ 9,000,000 $ 17,300,000

14 Allocations (2,000,000) 1,500,000 500,000 -

15 (900,000) 600,000 300,000 -

16 (400,000) 250,000 150,000 -

17 Totals $ - $ - $ - $ 7,350,000 $ 9,950,000 $ 17,300,000

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 4 FALL 2002, VOL. 4, NO. 1

Table

Table3:3:The

TheStep

StepMethod

Methodof Cost Allocation

of Cost Allocation

A B C D E F G H I

1 DATA Employees Area Requisitions

2 Department Avg. No. Percent Ft.2 Percent No. Percent Costs

3 Administration 50 20% 40,000 16% 80 8% $ 2,000,000

4 Housekeeping 30 12% 10,000 4% 120 12% 900,000

5 Maintenance 10 4% 20,000 8% 0 0% 400,000

6 Patient Rooms 120 48% 120,000 48% 500 50% 5,000,000

7 Diagnosis & Treatment 40 16% 60,000 24% 300 30% 9,000,000

8 Totals 250 100% 250,000 100% 1,000 100% $ 17,300,000

9

11 ALLOCATIONS Diagnosis

12 Administration Housekeeping Maintenance Patient Rooms & Treatment Totals

13 Costs $ 2,000,000 $ 900,000 $ 400,000 $ 5,000,000 $ 9,000,000 $ 17,300,000

14 Allocations (2,000,000) 300,000 100,000 1,200,000 400,000 -

15 (1,200,000) 120,000 720,000 360,000 -

16 (620,000) 387,500 232,500 -

17 Totals $ - $ - $ - $ 7,307,500 $ 9,992,500 $ 17,300,000

care areas contain the entire $17,300,000 after the allo- sequent steps. Thus, the step method only partially rec-

cation. The cost associated with patient rooms is ognizes the reciprocal relationships among service

$7,350,000, and the cost associated with diagnosis and departments. Also, it ignores self-consumption.

treatment is $9,950,000. The spreadsheet for the step method is shown in

To summarize, the major advantage of the direct Table 3. The data section is identical to the direct

method is its simplicity. Formulas in spreadsheet cells method spreadsheet (Table 2). The allocation section is

can easily access the basic data to perform the necessary very similar to the direct method but includes one

allocation calculations and information presentations. important difference—allocations among service depart-

The major disadvantage is that the direct method does ments. As in this example, often it is difficult to com-

not include consideration of reciprocal services and pare services provided (i.e., square feet of area

self-consumption. compared with number of requisitions). The approach

taken by EMH is to use costs to determine the order of

THE STEP METHOD: INCLUDING allocation from most to least. Administrative costs are

RECIPROCAL SERVICES allocated first, followed by housekeeping and mainte-

The step method is a more accurate approach because nance. Notice that the spreadsheet has been organized

it includes at least partial consideration of reciprocal ser- so that the allocation sequence proceeds from left to

vices. It is slightly more complicated because it requires right. Although not required, it does make the steps

a sequence of allocations and reallocations conducted in easier to follow.

a stepwise fashion. The order usually is based on the In the first step, administrative costs are allocated to

level of service provided by the service departments to both the housekeeping and maintenance departments,

each other, starting with the department that provides as well as to patient rooms and diagnosis and treat-

the most service to the others. An alternative is to allo- ment. The new total for housekeeping includes costs

cate costs in descending order based on the amount. unique to housekeeping plus the allocation of adminis-

Unlike the direct method, service department costs trative costs received in the first step. This new total

are allocated to other service departments. Once costs ($1,200,000) is then allocated to maintenance, patient

are allocated, however, none are allocated back in sub- rooms, and diagnosis and treatment in the second step.

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 5 FALL 2002, VOL. 4, NO. 1

Table 4: Step Method Allocation Calculations and Cell Formulas

Administration costs are allocated in the first step based on average number of employees:

Calculations

To housekeeping: 30/(30+10+120+40) x $2,000,000 = $ 300,000

To maintenance: 10/(30+10+120+40) x $2,000,000 = $ 100,000

To patient rooms: 120/(30+10+120+40) x $2,000,000 = $1,200,000

To diagnosis & treatment: 40/(30+10+120+40) x $2,000,000 = $ 400,000

Cell formulas

To housekeeping: C14: =C4/(C4+C5+C6+C7) * I3

To maintenance: D14: =C5/(C4+C5+C6+C7) * I3

To patient rooms: E14: =C6/(C4+C5+C6+C7) * I3

To diagnosis & treatment: F14: =C7/(C4+C5+C6+C7) * I3

Housekeeping costs are allocated in the second step based on area served:

Calculations

To maintenance: 20K/(20K+120K+60K) x $1,200,000 = $120,000

To patient rooms: 120K/(20K+120K+60K) x $1,200,000 = $720,000

To diagnosis & treatment: 60K/(20K+120K+60K) x $1,200,000 = $360,000

Cell formulas

To maintenance: D15: =E5/(E5+E6+E7)*C15*-1

To patient rooms: E15: =E6/(E5+E6+E7)*C15*-1

To diagnosis & treatment: F15: =E7/(E5+E6+E7)*C15*-1

Maintenance costs are allocated in the third and final step based on the number of

requisitions:

Calculations

To patient rooms: 500/(500+300) x $620,000 = $387,500

To diagnosis & treatment: 300/(500+300) x $620,000 = $232,500

Cell formulas

To patient rooms: E16: =G6/(G6+G7)*D16*-1

To diagnosis & treatment: F16: =G7/(G6+G7)*D16*-1

Likewise, the final step allocates the new maintenance Notice that costs are not allocated back to previous

cost total ($620,000) to patient rooms and diagnosis and departments. For example, housekeeping costs are not

treatment. Calculations and cell formulas are shown in allocated back to administration even though house-

Table 4. keeping provides service to administration. To do so

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 6 FALL 2002, VOL. 4, NO. 1

Table

Table5:5:Spreadsheet

Spreadsheetforfor

the Reciprocal

the Method

Reciprocal Method

A B C D E F G H I

1 DATA Employees Area Requisitions

2 Department Avg. No. Percent Ft.2 Percent No. Percent Costs

3 Administration 50 20% 40,000 16% 80 8% $ 2,000,000

4 Housekeeping 30 12% 10,000 4% 120 12% 900,000

5 Maintenance 10 4% 20,000 8% 0 0% 400,000

6 Patient Rooms 120 48% 120,000 48% 500 50% 5,000,000

7 Diagnosis & Treatment 40 16% 60,000 24% 300 30% 9,000,000

8 Totals 250 100% 250,000 100% 1,000 100% $ 17,300,000

9

10

11 ALLOCATIONS

12 Service Matrix (A) From

13 Identity Matrix (I) To Admin House Maint

14 1 0 0 Admin 20% 16% 8%

15 0 1 0 House 12% 4% 12%

16 0 0 1 Maint 4% 8% 0%

17

18 I-A (I - A)-1 B

19 0.80 -0.16 -0.08 1.29 0.23 0.13 $ 2,000,000

20 -0.12 0.96 -0.12 0.17 1.08 0.14 $ 900,000

21 -0.04 -0.08 1.00 0.07 0.10 1.02 $ 400,000

22

-1

23 P (I-A) x B = S PxS=C

24 48% 48% 50% 2,836,288 $ 2,330,501

25 16% 24% 30% 1,369,917 $ 969,499

26 623,045

27

28 POST ALLOCATION TOTALS

29 Patient Rooms $ 5,000,000 + 2,330,501 = $ 7,330,501

30 Diagnosis & Treatment $ 9,000,000 + 969,499 = $ 9,969,499

31 Totals $ 14,000,000 + 3,300,000 = $ 17,300,000

would result in a continuous loop of allocations. Notice consumption of services by the same department.

also that the procedure for the final step of a step Allowing for these complexities requires the application

method allocation is the same as for a direct method of more sophisticated allocation techniques, such as

allocation. matrix algebra. In fact, the allocation of any reasonably

While the step method offers improved accuracy realistic number of service departments is not at all

over the direct method, it includes only partial consid- practical without the assistance of the computer. Fortu-

eration of reciprocal services and no consideration of nately, most spreadsheet software packages include

self-consumption. The reciprocal method solves both user-friendly matrix manipulation tools. This section

shortcomings. provides a relatively simple and straightforward recipro-

cal allocation procedure that requires only a basic

THE RECIPROCAL METHOD understanding of matrix manipulations. The computer

The reciprocal method includes consideration of both will do the rest.

reciprocal services among service departments and self- The spreadsheet for the reciprocal method is shown

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 7 FALL 2002, VOL. 4, NO. 1

in Table 5. The data section is the same as for the box will appear. Enter a name of your choice (e.g., I,

direct and step methods. The allocation section is sub- Identity, Identity Matrix, etc.). Click Add, then OK.

stantially different. The initial objective is to solve Repeat the process for the service matrix. In this exam-

S = (I - A)-1 x B, where S is the matrix of support ple, the identity matrix is named I, and the service

department costs after reciprocal allocations, I is the matrix is named A.

identity matrix, A is the matrix of services provided ● The third step is to subtract the A matrix from the

among the support departments, and B is the matrix of I matrix. Again, this is simple with the help of the com-

service costs to be allocated. Then P, the matrix of ser- puter. First, highlight a range of cells to receive the

vice percentages provided to the patient care depart- results. As these are 3 x 3 matrices, the range also

ments, will be multiplied by S to arrive at C, the final should be 3 x 3 in size. In our example, cells A19:C21

matrix of support department costs allocated to the will receive the results of the subtraction. With the

patient care areas. While this may appear formidable, it recipient cell range highlighted, enter the two ranges of

is very easy with the help of the computer. Here’s how. cells that are to be subtracted into the formula bar. In

● The first step is to construct I, the identity matrix. our example, the entry is =I-A (an alternative is to omit

An identity matrix is nothing more than a grid with naming the matrices and use cell ranges instead:

ones entered along the upper left to lower right diago- =A14:C16-G14:H16). Then press Ctrl+Shift+Enter

nal and zeroes everywhere else, as shown in Table 5. (simply pressing Enter will not suffice because ranges

The identity matrix always is square and of the size of cells are being subtracted rather than individual

D x D, where D equals the number of service depart- cells). The results of the I-A subtraction appear in

ments. The identity matrix for EMH is 3 x 3 because cells A19:C21.

there are three support departments (administration, ● The fourth step is to invert the I-A matrix to cre-

housekeeping, maintenance) providing service to the ate the inverse of I-A, or (I-A)-1. Again, no math skills

patient care areas. are required because the computer will do it for you.

● The second step is to create A, the matrix of ser- First, using the procedure described above, name the

vice department percentages, by referencing the data in I-A matrix. The name used in this example is IminusA

the first section of the spreadsheet. Notice that the A (According to the Excel naming rules, “I-A” is not

matrix contains percentages provided from the support acceptable because of the minus sign). Next, select the

departments to each other, including self-consumption, range of cells to receive the results. As the I-A matrix is

to provide a common measure of service. It is very 3 x 3 in size, the inverse of I-A also will be 3 x 3 in size.

important to place the percentages in the proper cells in In our example, cells E19:G21 receive the results. To

order to represent the correct to/from relationships. perform the inversion, enter =MINVERSE(IminusA)

This can easily be accomplished by referencing the first into the formula bar and then press Ctrl+Shift+Enter.

three rows of percentages in each column of the data The results of the inversion appear as shown in Table 5.

(i.e., average number of employees represents the ser- ● The fifth step is to perform the multiplication

vice provided by administration, square feet of area rep- (I-A)-1 x B = S. Begin by naming cells E19:G21

resents the service provided by housekeeping, and IminusAinverse. Then create B, the matrix of service

number of requisitions represents the service provided costs to be allocated, by referencing the costs in

by maintenance). Thus, the cell formulas in the A column I of the data section at the top of the spread-

matrix are F14: =D3, F15: =D4, F16: =D5; G14: =F3, sheet (I19: =I3, I20: =I4, I21: =I5), and name it B.

G15: =F4, G16: =F5; and H14: =H3, H15: =H4, Highlight the cells to receive the results, enter

and H16: =H5. =MMULT(IminusAinverse,B), and press Ctrl+

● Next name the matrices. To name a matrix, first Shift+Enter. The =MMULT function multiplies the

highlight the cells of the matrix. For example, highlight two cell ranges in the parentheses.

cells A14:C16 for the identity matrix. Then click Insert The results of the multiplication will appear, provid-

on the Excel menu, then Name, then Define. A text ed some simple rules of matrix algebra are followed.

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 8 FALL 2002, VOL. 4, NO. 1

Table 6: A Quick Guide to Reciprocal Allocation with Microsoft Excel

1. Create a D x D identity matrix, I.

a) D = number of service departments.

b) Ones along the left-to-right-down diagonal, zeroes everywhere else.

c) Optional: name I and all subsequent matrices using Insert, Name, Define, Add, OK.

2. Create the A matrix of service percentages provided among the service departments.

a) Reference the allocation data.

b) Observe correct from/to relationships.

3. Create the I-A matrix by subtracting the service matrix from the identity matrix.

a) Select the cells to receive the results.

b) Type =(I-A), the press Ctrl+Shift+Enter.

4. Create the (I - A)-1 matrix by using the spreadsheet matrix inverse function.

a) Select the cells to receive the results.

b) Type =MINVERSE(I-A), then press Ctrl+Shift+Enter.

5. Create the B matrix of service costs to be allocated.

a) Reference the allocation data.

b) Observe proper row x column arrangement.

6. Create the S matrix: (I - A)-1 x B = S.

a) Select the cells to receive the results.

b) Type =MMULT(IminusAinverse,B), then press Ctrl+Shift+Enter.

c) Order is important.

7 Create the P matrix of service percentages provided to the production departments.

a) Reference the allocation data.

b) Observe proper row x column arrangement.

8. Calculate the C matrix of final cost allocations: P x S = C.

a) Select the cells to receive the results.

b) Type =MMULT(P,S), then press Ctrl+Shift+Enter.

c) Order is important.

9. Add the final cost allocations to the production department costs.

Matrices are described as having size r x c, where r is require that the number of columns in the first matrix

the number of rows and c is the number of columns. equals the number of rows in the second matrix. The

Make sure to observe matrix multiplication rules, which (I-A)-1 matrix is a 3 x 3 matrix with three rows and three

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 9 FALL 2002, VOL. 4, NO. 1

columns, and B is a 3 x 1 matrix with three rows and required to perform a reciprocal method cost allocation

one column. The multiplication (I-A)-1 x B = S will using the matrix manipulation capabilities of Microsoft

result in a 3 x 1 matrix: (3 x 3)(3 x 1) = (3 x 1). The mul- Excel. Although the basic steps will be the same, the

tiplication is possible because the middle two numbers specific procedures required to perform the mathemati-

are the same. Multiplying B x (I-A)-1 is not possible cal manipulations may differ with other spreadsheet

because the middle two numbers of (3 x 1)(3 x 3) are software. If you are using software other than Microsoft

not the same. Order is important! Excel, consult the application manual and/or the help

● The final step is the calculation of the allocated feature.

costs. This requires a P matrix (which stands for pro-

duction) of services provided to the patient care depart- THREE CHOICES: FROM THE SIMPLE

ments by the support departments. Again, creating the TO T H E SUBLIME

P matrix is a simple matter of referencing the appropri- The three methods of cost allocation range from the rel-

ate cells in the data section of the spreadsheet. The cell atively simple to what many would consider quite com-

formulas are A24: =D6, A25: =D7, B24: =F6, B25: =F7, plex. If simplicity is your goal, then the direct method

C24: =H6, and C25: =H7. Name the matrix P, and then is your best bet. It is both the simplest to perform and

multiply it by S to arrive at the final C matrix of allocat- the easiest to explain. If the greatest possible accuracy

ed service department costs. Note again that P x S = C is required, then use the reciprocal method, although it

is possible because the middle numbers of (2 x 3)(3 x 1) is somewhat more difficult to perform than the other

are the same. The resulting dimensions of the C matrix methods, and it is much harder to explain. The step

will be (2 x 3)(3 x 1)=(2 x 1). A multiplication of S x P is method offers something of a compromise. It is more

not possible because the middle numbers of (3 x 1)(2 x accurate than the direct method because it includes par-

3) are not the same. As before, highlight the cells to tial consideration of reciprocal services. Remember,

receive the results (G24:G25), enter =MMULT(P,S), however, that it ignores self-consumption.

and press Ctrl+Shift+Enter. Regardless of the method you select, make sure to

As shown in Table 5, patient rooms receive choose allocation bases with an eye toward appropriate,

$2,330,501 of allocated support department cost, and accurate, and readily available data. Also, remember to

diagnosis and treatment receives $969,499. These allo- give your spreadsheet a thorough quality check before

cations include consideration for both reciprocal and putting it into production. ■

self-consumed support services.

The bottom section of Table 5 summarizes the costs James B. Stinson, Ph.D., CPA, has been employed in the

for the two patient care departments. Included are the private sector by FMC Corporation, Cooper Industries, and

costs unique to each department and those allocated NL Industries in manufacturing management, accounting,

from the support areas. This section of the spreadsheet and corporate strategic planning positions in Houston and

references cells in the data and allocation sections to Dallas. He currently is a member of the faculty of the

provide the final cost totals. It also provides a conve- Department of Accountancy and Taxation in the C.T. Bauer

nient check of the allocation procedure by summing the College of Business at the University of Houston. He can be

allocated costs ($2,330,501+$969,499=$3,300,00), which contacted by e-mail at jimstinson@sbcglobal.net.

should equal the sum of the costs to be allocated

($2,000,000+$900,000+$400,000=$3,300,000). Also, the

total costs of the five departments before the allocation

must equal the sum of the costs of the two patient care

departments after the allocation ($2,000,000+$900,000+

$400,000+$5,000,000+$9,000,000=$17,300,000=

$7330,501+$9,969,499).

Table 6 provides a quick summary of the steps

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 10 FALL 2002, VOL. 4, NO. 1

You might also like

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Cost and Management Accounting: Paper 7Document31 pagesCost and Management Accounting: Paper 7Atukwatse PamelaNo ratings yet

- A Learning Plan in Grade 8 PersuasiveDocument6 pagesA Learning Plan in Grade 8 PersuasiveYannah Jovido50% (2)

- Tiny Tweaks James WedmoreDocument31 pagesTiny Tweaks James WedmoreErise Global100% (1)

- Overheads CostingDocument10 pagesOverheads CostingOlivier IrengeNo ratings yet

- Cost&management OverheadsDocument16 pagesCost&management OverheadsAlexa KintuNo ratings yet

- EMBA 5412 Cost and Revenue AllocationDocument62 pagesEMBA 5412 Cost and Revenue AllocationKalkayeNo ratings yet

- Chapter5, Cost AllocationDocument8 pagesChapter5, Cost AllocationWegene Benti UmaNo ratings yet

- F2 Management Accounting: Eagles Business SchoolDocument10 pagesF2 Management Accounting: Eagles Business SchoolCourage KanyonganiseNo ratings yet

- Chapter5, Cost AllocationDocument8 pagesChapter5, Cost AllocationÄjú Bíñt ŹãhŕãNo ratings yet

- Solutions Chapter 8 Support Dept CostsDocument12 pagesSolutions Chapter 8 Support Dept CostsChris Pasram0% (1)

- Chapter 5 Service Department Cost AllocationsDocument48 pagesChapter 5 Service Department Cost AllocationsMulugeta GirmaNo ratings yet

- Support Department Cost (Notes)Document6 pagesSupport Department Cost (Notes)funkpopsicleNo ratings yet

- Syllabus (Notes & Tut QS) - FMDocument62 pagesSyllabus (Notes & Tut QS) - FMFrank El NinoNo ratings yet

- Ca 2Document37 pagesCa 2bm36omdNo ratings yet

- Chapter 7 - Manufacturing Overhead - Departmentalization Need For DepartmentalizationDocument11 pagesChapter 7 - Manufacturing Overhead - Departmentalization Need For DepartmentalizationKhai Ed PabelicoNo ratings yet

- Chapter 3Document11 pagesChapter 3Arun Kumar SatapathyNo ratings yet

- EMBA 5412 Cost and Revenue AllocationDocument62 pagesEMBA 5412 Cost and Revenue AllocationDean Craig100% (1)

- Chapter - Service DPT Cost Allocation 2010Document13 pagesChapter - Service DPT Cost Allocation 2010Kiya AbdiNo ratings yet

- Chapter 6Document7 pagesChapter 6Genanew AbebeNo ratings yet

- Cost & Mgt. Acct - I, Lecture Note - Chapter 5 & 6Document14 pagesCost & Mgt. Acct - I, Lecture Note - Chapter 5 & 6ተዋህዶ 23 - Tewahedo 23No ratings yet

- Typeof CostDocument12 pagesTypeof CostZazaNo ratings yet

- Chapter 3, Cost AllocationDocument9 pagesChapter 3, Cost AllocationDEREJENo ratings yet

- (C-4.1) 5. Overheads - FormattedDocument30 pages(C-4.1) 5. Overheads - FormattedSam KingNo ratings yet

- Cost U4Document29 pagesCost U4firaolmosisabonkeNo ratings yet

- Assigning Service Department CostsDocument23 pagesAssigning Service Department CostsjtpmlNo ratings yet

- Chapter 7 Departmentalization of Overhead and Allocation of Service Departments' CostDocument3 pagesChapter 7 Departmentalization of Overhead and Allocation of Service Departments' CostApril Joy InductaNo ratings yet

- Accounting For OverheadsDocument53 pagesAccounting For Overheadsfbicia218No ratings yet

- OverheadsDocument13 pagesOverheadsHamis Mohamed50% (2)

- 02-08-2022 CRC-ACE - AFAR - Week 05 - Factory OverheadDocument14 pages02-08-2022 CRC-ACE - AFAR - Week 05 - Factory Overheadjohn francisNo ratings yet

- Week 5 (To Be Discussed) AnswersDocument3 pagesWeek 5 (To Be Discussed) AnswersThirusha balamuraliNo ratings yet

- Chapter Five Cost AllocationDocument7 pagesChapter Five Cost AllocationHaymanot AyalewNo ratings yet

- Lesson 8 Overhead CostsDocument14 pagesLesson 8 Overhead CostsstcatherinehighmentorsNo ratings yet

- OverheadsDocument35 pagesOverheadsoaziz66No ratings yet

- EduMine Course - Maintenance ManagementDocument9 pagesEduMine Course - Maintenance ManagementdiabalziabNo ratings yet

- Departmentalization of Factory OverheadDocument3 pagesDepartmentalization of Factory OverheadPaolo Immanuel OlanoNo ratings yet

- Notes On End of Chapter QuestionsDocument31 pagesNotes On End of Chapter Questionsduong duongNo ratings yet

- AC3097 Management Accounting: Notes On The End-Of-Chapter QuestionsDocument30 pagesAC3097 Management Accounting: Notes On The End-Of-Chapter QuestionsPei TingNo ratings yet

- Ch08 Cost AllocationDocument46 pagesCh08 Cost AllocationRavikumar Sampath100% (1)

- Solutions To Even ProblemsDocument26 pagesSolutions To Even ProblemsAndrey HcivokramNo ratings yet

- Unit 5 - Accounting For OverheadsDocument19 pagesUnit 5 - Accounting For OverheadsAayushi KothariNo ratings yet

- Costing Machine Hour RateDocument27 pagesCosting Machine Hour RateAjay SahooNo ratings yet

- Manufacturing OverheadDocument21 pagesManufacturing OverheadErlinda NavalloNo ratings yet

- Overheads Allocation and ApportionmentDocument60 pagesOverheads Allocation and ApportionmentNesto Yohana SadukaNo ratings yet

- AF3112 Lec 4 Allocation of Service Department CostsDocument15 pagesAF3112 Lec 4 Allocation of Service Department CostsRoseNo ratings yet

- Accountancy ProjectDocument15 pagesAccountancy ProjectShruti GargNo ratings yet

- Lecture-7 Overhead (Part 4)Document38 pagesLecture-7 Overhead (Part 4)Nazmul-Hassan SumonNo ratings yet

- Cost Benefit PDFDocument11 pagesCost Benefit PDFYashNo ratings yet

- Chap 15Document31 pagesChap 15Ahmed Mohamed100% (1)

- UEU Akuntansi Biaya Pertemuan 8910Document84 pagesUEU Akuntansi Biaya Pertemuan 8910hardyputra46No ratings yet

- Cost Estimation Meaning of CostDocument9 pagesCost Estimation Meaning of CostMatinChris KisomboNo ratings yet

- Week 1 Introduction and ActivitiesDocument4 pagesWeek 1 Introduction and ActivitiesrahimNo ratings yet

- Cost Model For Data Management CenterDocument63 pagesCost Model For Data Management CenterÁtila FernandesNo ratings yet

- Cost PresentationDocument8 pagesCost PresentationMJ jNo ratings yet

- Allocation of Support-Department CostsDocument18 pagesAllocation of Support-Department CostsBobNo ratings yet

- Cost Model For Data Management Center (DMC) Main MenuDocument63 pagesCost Model For Data Management Center (DMC) Main Menukrds chidNo ratings yet

- Cost Model For Data Management Center (DMC) Main MenuDocument63 pagesCost Model For Data Management Center (DMC) Main MenuGeovanny Hernández0% (1)

- OverheadsDocument32 pagesOverheadsLay TekchhayNo ratings yet

- Lecture 3-Accounting For OverheadsDocument10 pagesLecture 3-Accounting For OverheadsddmaheshslNo ratings yet

- Case StudyDocument6 pagesCase StudyVishal RajputNo ratings yet

- Foh PDFDocument10 pagesFoh PDFZaheer SwatiNo ratings yet

- Simple ABC ModelDocument65 pagesSimple ABC Modelalfaroq_almsryNo ratings yet

- Support/downloads or Scan Above QR Code For Detailed Policy WordingDocument10 pagesSupport/downloads or Scan Above QR Code For Detailed Policy Wordingraj VenkateshNo ratings yet

- Title of Project:-Military Hospital Report Management SystemDocument4 pagesTitle of Project:-Military Hospital Report Management SystemAkbar AliNo ratings yet

- GraphsDocument18 pagesGraphssaloniNo ratings yet

- Title DefenseDocument3 pagesTitle DefenseLiezl Sabado100% (1)

- 2018 Weekly CalendarDocument3 pages2018 Weekly CalendarFabian FebianoNo ratings yet

- Astm A 1011 2005Document8 pagesAstm A 1011 2005gao yanminNo ratings yet

- BGR AnuualReport 2022-23Document88 pagesBGR AnuualReport 2022-23Rk SharafatNo ratings yet

- Christmas Vigil MassDocument106 pagesChristmas Vigil MassMary JosephNo ratings yet

- Ent Secretory Otitis MediaDocument3 pagesEnt Secretory Otitis MediaIrena DayehNo ratings yet

- Gl04 FM Tam 019 FsefDocument4 pagesGl04 FM Tam 019 FsefManish TiwariNo ratings yet

- FijiTimes - Feb 17 2012 Web PDFDocument48 pagesFijiTimes - Feb 17 2012 Web PDFfijitimescanadaNo ratings yet

- In Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDocument7 pagesIn Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDanielNo ratings yet

- Borneo Sporenburg Final-Ilovepdf-CompressedDocument55 pagesBorneo Sporenburg Final-Ilovepdf-Compressedapi-417024359No ratings yet

- Wa0004.Document15 pagesWa0004.Sudhir RoyNo ratings yet

- Genuine Eaton Vicker HidrauDocument28 pagesGenuine Eaton Vicker HidrauJenner Volnney Quispe ChataNo ratings yet

- Cell Theory Refers To The Idea That: MicrographiaDocument5 pagesCell Theory Refers To The Idea That: MicrographiadeltasixNo ratings yet

- Explosion Protection - E PDFDocument7 pagesExplosion Protection - E PDFAPCANo ratings yet

- Local Winds: Land and Sea BreezesDocument8 pagesLocal Winds: Land and Sea Breezesravi rathodNo ratings yet

- Error Message Reference: Oracle® Hyperion Tax GovernanceDocument6 pagesError Message Reference: Oracle® Hyperion Tax GovernanceAbayneh AssefaNo ratings yet

- Beginner's Guide To SoloDocument12 pagesBeginner's Guide To SoloTiurNo ratings yet

- Grade 7 Lesson: ReproductionDocument4 pagesGrade 7 Lesson: ReproductionJoedelyn Wagas100% (2)

- Action ResearchDocument10 pagesAction ResearchNacion EstefanieNo ratings yet

- Quick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedDocument20 pagesQuick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedРоманКочневNo ratings yet

- Jambajuicelv-Application-0618 1Document2 pagesJambajuicelv-Application-0618 1api-526082107No ratings yet

- DLL Mother TongueDocument41 pagesDLL Mother TongueMarxPascualBlancoNo ratings yet

- (Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Document355 pages(Human Behavior and Environment 8) Carol M. Werner, Irwin Altman, Diana Oxley (Auth.), Irwin Altman, Carol M. Werner (Eds.) - Home Environments-Springer US (1985)Carlos Roberto JúniorNo ratings yet