Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsready reckoner for non management employees (mktg)

ready reckoner for non management employees (mktg)

Uploaded by

Bharani Yandamoorinonmgmt

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Property Attack OutlineDocument28 pagesProperty Attack OutlineBrady Williams100% (3)

- Brand Lift Questions - One Sheeter (Updated)Document1 pageBrand Lift Questions - One Sheeter (Updated)Claire SantiagoNo ratings yet

- SAP Design Thinking QuestionsDocument5 pagesSAP Design Thinking QuestionsSiddharth SinhaNo ratings yet

- NIACL-Officer Benefits & HR Orientation BookletDocument48 pagesNIACL-Officer Benefits & HR Orientation BookletSumit SelokarNo ratings yet

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingNo ratings yet

- Cashpor ProfileDocument4 pagesCashpor Profileamartya tiwariNo ratings yet

- Updated One Pager SPL - Dsa-1Document1 pageUpdated One Pager SPL - Dsa-1Vishal BawaneNo ratings yet

- GIPSA HR Material 2018Document123 pagesGIPSA HR Material 2018shravan workNo ratings yet

- Income-Tax-withholding-card-2024-25-Finance-Bill-2024-pakistanDocument1 pageIncome-Tax-withholding-card-2024-25-Finance-Bill-2024-pakistanredumw100No ratings yet

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarNo ratings yet

- Budget, 2010 Amendment at A Glance: Compiled By: PAMS & AssociatesDocument15 pagesBudget, 2010 Amendment at A Glance: Compiled By: PAMS & Associatespawanagrawal83No ratings yet

- GIPSA HRM Benefits-1Document1 pageGIPSA HRM Benefits-1shravan workNo ratings yet

- Advertisement For WebsiteDocument12 pagesAdvertisement For Websitesandeep patilNo ratings yet

- Page 1 of 11: General Manager - P&ADocument11 pagesPage 1 of 11: General Manager - P&Aramkumardotg_5807772No ratings yet

- Page 1 of 14: General Manager - P&ADocument14 pagesPage 1 of 14: General Manager - P&ASelect MaidNo ratings yet

- Pre-Promotion Training: Promotion Exercise 2019-20 For Officers - January 2019Document127 pagesPre-Promotion Training: Promotion Exercise 2019-20 For Officers - January 2019Gautam KumarNo ratings yet

- Powergrid SalaryDocument10 pagesPowergrid SalaryRaj AshishNo ratings yet

- IoclDocument2 pagesIoclMohd Asif RazaNo ratings yet

- Compensation Rules and Salary Design GuidelinesDocument6 pagesCompensation Rules and Salary Design GuidelinesDivya NatarajanNo ratings yet

- Income Tax Rates Slabs From A.Y 2001-02 To ADocument7 pagesIncome Tax Rates Slabs From A.Y 2001-02 To ACa T.SANKARAMURTHYNo ratings yet

- Schedule of Charges - English - July To DecemberDocument15 pagesSchedule of Charges - English - July To DecemberBurairNo ratings yet

- Employee Tax Benefits - FinalDocument18 pagesEmployee Tax Benefits - FinalsrijainsravakcharitabletrustNo ratings yet

- Keyword For Medical WordsDocument2 pagesKeyword For Medical WordsAsheeth S. RayaprolNo ratings yet

- Excel Numeric EntryDocument2 pagesExcel Numeric Entrysandeep satalkarNo ratings yet

- One Pager For Channel & Sales - Jun'22Document4 pagesOne Pager For Channel & Sales - Jun'22Gaurav SinghNo ratings yet

- Dashboard 23.XlsmDocument3 pagesDashboard 23.XlsmCristiane RezendeNo ratings yet

- Tata Capital Latest 1 PAGER POLICYDocument2 pagesTata Capital Latest 1 PAGER POLICYPRIYANKA DASNo ratings yet

- Module 1 Tax DR BRR 2018Document7 pagesModule 1 Tax DR BRR 2018Prajwal kumarNo ratings yet

- 2 Tax RatesDocument15 pages2 Tax RatesragerahulNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Pay and Allowances: Page - 340Document28 pagesPay and Allowances: Page - 340Gaurav SahotaNo ratings yet

- Income Tax Card 2023-24 (Finance Act 2023)Document1 pageIncome Tax Card 2023-24 (Finance Act 2023)shahidNo ratings yet

- Rate List NewDocument2 pagesRate List NewKuldeep NamaNo ratings yet

- Advertisement For The Post of GM Finance GM Civil DGM Civil DGM Architect AM Civil AM Town Planner JE Civil Legal Assistant 1Document7 pagesAdvertisement For The Post of GM Finance GM Civil DGM Civil DGM Architect AM Civil AM Town Planner JE Civil Legal Assistant 1RiyazulSamadBinMohammadNo ratings yet

- The Canara Bank Officers Association (Regd)Document8 pagesThe Canara Bank Officers Association (Regd)Arun RamNo ratings yet

- Hr-Personnel & Vigilance 12.1 Core Benefits A. Class-I Pay Scales (Basic Pay)Document49 pagesHr-Personnel & Vigilance 12.1 Core Benefits A. Class-I Pay Scales (Basic Pay)Neelima SappidiNo ratings yet

- Effective From: January 01, 2023 To June 30, 2023Document25 pagesEffective From: January 01, 2023 To June 30, 2023Shujauddin QureshiNo ratings yet

- Taxation PresentationDocument10 pagesTaxation Presentationgaurav daveNo ratings yet

- Professional Tax in India Professional Tax Is Levied by The StateDocument4 pagesProfessional Tax in India Professional Tax Is Levied by The StateVinoth KumarNo ratings yet

- 2 Tax RatesDocument15 pages2 Tax Rates1407345No ratings yet

- Rules For Statutory Deductions Exemptions Perquisites-PayrollDocument4 pagesRules For Statutory Deductions Exemptions Perquisites-PayrollSiba MishraNo ratings yet

- Payroll Accounting 7 QuesDocument6 pagesPayroll Accounting 7 QuesIshan sharmaNo ratings yet

- Income Tax Slab Fy 2020-21Document1 pageIncome Tax Slab Fy 2020-21Nabhya's FamilyNo ratings yet

- TA Rules 15-16Document43 pagesTA Rules 15-16sravanveldiNo ratings yet

- Module 1 Direct Tax DR BRR 2022 StudentsDocument9 pagesModule 1 Direct Tax DR BRR 2022 StudentsDr. Batani Raghavendra RaoNo ratings yet

- Establishment Rules & ProceduresDocument19 pagesEstablishment Rules & ProceduresAmrita Pal100% (1)

- Sol - PTP 29 11 2018Document6 pagesSol - PTP 29 11 2018riyagoel12329dspsNo ratings yet

- RepresentationDocument2 pagesRepresentationNikhil SharmaNo ratings yet

- Sub: Regarding Payment of PRP For FY 2018-19 - Non - Unionized Supervisors and LowerDocument5 pagesSub: Regarding Payment of PRP For FY 2018-19 - Non - Unionized Supervisors and LowerChandan KumarNo ratings yet

- Costing For Different HR Management Software in BangladeshDocument3 pagesCosting For Different HR Management Software in Bangladeshআমিনুল আসফীNo ratings yet

- Sol 1Document1 pageSol 1alex breymannNo ratings yet

- P6mys 2015 Dec QDocument13 pagesP6mys 2015 Dec QMERINANo ratings yet

- Income Tax Slabs 2007-08 To 2010-11Document4 pagesIncome Tax Slabs 2007-08 To 2010-11Manoj ThuthijaNo ratings yet

- Lecture Meeting Budget 2014 2015Document10 pagesLecture Meeting Budget 2014 2015birju668No ratings yet

- SOC Jul Dec 2023 EnglishDocument21 pagesSOC Jul Dec 2023 EnglishClasherNo ratings yet

- AY 20-21 Tax RatesDocument4 pagesAY 20-21 Tax Ratesashim1No ratings yet

- Interest Rate Chart: 3 Months MCLR (%) One Year MCLR (%)Document1 pageInterest Rate Chart: 3 Months MCLR (%) One Year MCLR (%)akrmbaNo ratings yet

- Head OfficeDocument9 pagesHead Officeyogesh pandeyNo ratings yet

- Income From SalaryDocument5 pagesIncome From Salarydbgdemo6No ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- Tax SlabDocument3 pagesTax Slabmuneerpp78No ratings yet

- ADM Salary Restructure 2020Document11 pagesADM Salary Restructure 2020vishal sukhwalNo ratings yet

- Medical Certificate - MH - BOE - A S PrasanthDocument1 pageMedical Certificate - MH - BOE - A S PrasanthBharani YandamooriNo ratings yet

- CANDBLeaveApp PDFDocument1 pageCANDBLeaveApp PDFBharani YandamooriNo ratings yet

- 2-AptitudeTest 1Document38 pages2-AptitudeTest 1Bharani YandamooriNo ratings yet

- L) (OA) or One Leg and One Arm Affected (OLA) or Cerebral Palsy (CP) or LeprosyDocument16 pagesL) (OA) or One Leg and One Arm Affected (OLA) or Cerebral Palsy (CP) or LeprosyBharani YandamooriNo ratings yet

- CWC Shimla NotificationDocument1 pageCWC Shimla NotificationBharani YandamooriNo ratings yet

- Temp RecruitDocument3 pagesTemp RecruitBharani YandamooriNo ratings yet

- Photography Session - Contract TemplateDocument4 pagesPhotography Session - Contract TemplateRoxinaNo ratings yet

- PBRXDocument29 pagesPBRXMoe EcchiNo ratings yet

- Banca Takaful and Its DistributionDocument4 pagesBanca Takaful and Its DistributionAfifah NabilahNo ratings yet

- SAS BASE A00 211 Sample QuestionsDocument33 pagesSAS BASE A00 211 Sample QuestionsKarthik594 SasNo ratings yet

- Trading Spreads and SeasonalsDocument15 pagesTrading Spreads and Seasonalstpman2004-misc67% (3)

- Project Risk ManagementDocument15 pagesProject Risk ManagementCătă Mikachikatakito Andrei0% (1)

- Mba 2nd Sem Result 2010 AdmittedDocument22 pagesMba 2nd Sem Result 2010 AdmittedAnonymous nTxB1EPvNo ratings yet

- f2p9g - Egac Cab AgreementDocument4 pagesf2p9g - Egac Cab AgreementAles esaamNo ratings yet

- Senior Vice President Human Resources in Washington DC Baltimore MD Resume Tom MirgonDocument3 pagesSenior Vice President Human Resources in Washington DC Baltimore MD Resume Tom MirgonTomMirgonNo ratings yet

- Depilacion Jumbo YenniDocument51 pagesDepilacion Jumbo YenniDanny Xavier HerreraNo ratings yet

- Chap013.ppt Scheduling OperationsDocument23 pagesChap013.ppt Scheduling OperationsSaad Khadur Eilyes100% (1)

- CV Karntimon - YDocument4 pagesCV Karntimon - Yichigosonix66No ratings yet

- BMGT 220 Final Exam - Fall 2011Document7 pagesBMGT 220 Final Exam - Fall 2011Geena GaoNo ratings yet

- Aviation Sector in IndiaDocument66 pagesAviation Sector in Indiasrpvicky100% (1)

- Accounting Practices The New Zealand Context 3rd Edition Mcintosh Solutions Manual Full Chapter PDFDocument36 pagesAccounting Practices The New Zealand Context 3rd Edition Mcintosh Solutions Manual Full Chapter PDFEdwardBishopacsy100% (12)

- Triumph TR6 HandbookDocument77 pagesTriumph TR6 HandbooksteinhansenNo ratings yet

- Ujian Penilaian 1 - English Paper 2Document4 pagesUjian Penilaian 1 - English Paper 2Syikin NorizanNo ratings yet

- Anu Nirma Nirma StoryDocument16 pagesAnu Nirma Nirma StoryPandey AmitNo ratings yet

- About Pos Malaysia BerhadDocument2 pagesAbout Pos Malaysia BerhadWilliam Vong75% (4)

- The Overwurked American Juliet B. SchurDocument34 pagesThe Overwurked American Juliet B. SchurCarlos Gen WarashiNo ratings yet

- Lakme West Bengal (India) Beauty Adviser - 1 Year (2018 - 2019)Document2 pagesLakme West Bengal (India) Beauty Adviser - 1 Year (2018 - 2019)Majid AliNo ratings yet

- Push and Pull Strategy 1Document6 pagesPush and Pull Strategy 1kiranaishaNo ratings yet

- Assignment 1Document2 pagesAssignment 1Rajesh VijayNo ratings yet

- Future Generali Brochure PDFDocument19 pagesFuture Generali Brochure PDFSangeeta LakhoteNo ratings yet

- Bank and Secrecy Law in The PhilippinesDocument18 pagesBank and Secrecy Law in The PhilippinesBlogWatchNo ratings yet

- Postal Ballot Form FormatDocument4 pagesPostal Ballot Form FormatGaurav Kumar SharmaNo ratings yet

ready reckoner for non management employees (mktg)

ready reckoner for non management employees (mktg)

Uploaded by

Bharani Yandamoori0 ratings0% found this document useful (0 votes)

1 views1 pagenonmgmt

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnonmgmt

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageready reckoner for non management employees (mktg)

ready reckoner for non management employees (mktg)

Uploaded by

Bharani Yandamoorinonmgmt

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

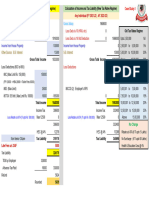

Ready Reckoner for NON-Management Employees

Salary Grade Payscale (R.) Stagnation pay @ 3% of the Basic Pay

M0 20000-25000 Employees in S/G M11 are eligible for a maximum of 3 Stagnation Increments.

M1 23000-30000 1st Stagnation Increment will be on completion of 6 Yrs and susequent 2 stagnation increments will be on

M2 23250-40000 completion of 5 Yrs each subject to meeting the required criteria.

M3 23500-50000 Promotional Incrrement

M4 23750-71000 3% of Basic Pay will be paid in case of promotion from one grade to another

M5 24000-76500 City wise HRA Entitlement

M6 24250-80000 X Class City Population 50 lakhs & above 27 % of Basic

M7 24500-90000 Y Class City Population 5 to 50 lakhs 18 % of Basic

M8 25000-100000 Z Class City Population < 5 lakhs 9% of Basic

M9 26000-110000 HRA will be revised to 30%, 20%, 10% for X, Y, Z Cities respectively as and when DA crosses 50%

M10 27000-120000 Business Travel - Bhatta PME Entitlement

M11 28000-139500 Away from Headquarters Bhatta Upto 40 yrs (Male &Female)- 4000

Note: No progression of Basic pay beyond maximum of the Scale >12 hours Full 40-50 Male-5000, Female-6000

Annual Increment ( 3% of Basic) - Eligibility Conditions 6 hours to 12 hrs Half > 51 Male - 5000, Female-6000

Admin Office- Working of Minimum 150 days, excluding all leaves,weekly Offs, Holidays The above PME entitlement is as per

Field Locations- Working of Min. 180 days, excluding all leaves,weekly offs, holidays Cirular dtd.01-Nov-2023 applicable for

<6 hours 1/4th

Minimum Satisfactory rating, Clean Record, Unauthorised Absence <15 days employees which is madatory as per

the age criterion

Working Hours Business Travel : Hotel Stay (exclusive of Taxes) Max. Limits Excluding Periodicity

Admin Locations- 40 hours/week excluding lunch break Taxes upto 40 Once in 3 yrs

Field Locations- 48 hours/week excluding lunch break Mumbai & Delhi 4500/- 40-50 Once in 2 yrs

Proportionate Annual Increment X Class City 3200/- >50 Every year

During probation period, no annual increment will be paid. Y Class City 2400/- Plant Locations Every year

Proportionate Increment will be paid from date of joining till Dec during Z Class City 1400/- Dental : 35000 per year

the next increment cycle @0.25% per month Class of Travel- All Grades- Train- II AC/I Class/ CC Denture - Actual(once in life)

Stagnation Increment Local Conveyance- All Grades Maternity

3% of the revised basic pay on reaching maximum of basic. Max. of three. X Class City Rs. 500/- per day Normal Rs.60000/-

1st stagnation is payable 2 yrs after reaching max. of scale and subsequetly after 2 yrs each Y & Z Class City Rs. 400/- per day Cesarean Rs.120000/-

Stagnation Inc. will be processed sub. to meeting eligibility condns. in Annual Increment. Bhatta Hearing Aid:Rs.100000/-

Promotion from Labour to Clerical Category eff.09.01.2021 Upto Basic Rs.70,000 X City Rs.1000/ per day (once in 2 yrs)

Promotion in same grade (L to C), i.e M08 to M08, M09 to M09, Hospital Room Charges:

there is no financial benefit and date for next promotion will be reckoned Upto Basic Rs.70,000 Y & Z City Rs.865/- per day For Metro Cities - Rs 4750/-

from the date of grant of grant of date in Labour Category. For Non - Metro City - Rs.3000/-

Promotion (L to C), M07 to M08, Normal Promotional Increment + Future Progression will be in Basic >Rs.70,000 X City Rs.1175/- per day Rs.40/- per day will be deducted

line in with Cluster C Workmen Basic > Rs.70,000 Y & Z City Rs.1025 per day fromBhatta while settling the TES

Promotion (L to C), from M01 to M06, directly to S/GM08 Normal Promotional Increment +2% Residential programs (where lodging/boarding facilities provided) 25% of the bhatta

Additional Benefit on pre-revised basic as of 30.09.2018 & future progression in line with Cluster Training programs/ Meetings within city Conveyance Reimbursement on actuals upto

C. Max Rs. 500/- day till 30.09.2028.

Medical Limit

ERP Compensation Frozen as on pre-revised basic as on 30-09-2018

Annual Limit Lifetime Limit Lifetime(Dep.Children)

Leave 4 Lakhs 21.5 Lakhs 9.0 Lakhs

PL 8 Days per quarter Eye Treatment Cafeteria Allowance

CL 12 Days per year Cataract and Glaucoma Rs.75000/- (each eye) 35% of Basic + Stagnation Pay

SL 12 Days per year Other surgicals treatment At Actuals Shift Compensation

Festival/National Holidays 10 Days+ 2 Optional Holidays Spectacles Rs.7000/- every year Morning/Evening- Rs.120/- per shift

Purhase of Blood Pressure

Instrument , Glucometer or any Rs 5000/- once in a block of 2 Yrs Night- Rs. 170/- per shift

Surrogacy Leave 84 Days other medical instruments (Current Block:2024-2026)

Maternity

Transportation Allowance

(work 80 days in prev 12 months) 182 days

Miscarriage/Abortion 6 weeks Employees not having own vehicle will be paid Rs.1000/- per month, loaded in cafeteria

Child age below 3 months - 84 days and between 3

Transportation Reimbursement

Adoption Leave months and 5 months - 60 days.

Child Care Leave

Employees having own vehicle will be reimbused Rs.2400/- pm and Rs. 1000/- pm will be loaded in cafeteria

(up to age of 5 yrs of child) 730 Days

SCDO(48 hrs per week ) 9/Qtr for min. 50 days wrkng Bus/ Transport Recovery

SCDO(48 hrs per week 8/Qtr for min. 45 days wrkng Employee availing company transportation, an amount of Rs.1400/- pm will be recovered.

Paternity Leave ( max for two children) 15 Calendar days Additional recovery, if any as per location level agreement will continue

This is in addition to the cafeteria loading of Rs.1000/- pm

Joining Leave (to be availed within 3 months of reporting at new location)

Acting Compensation (Inter-cluster Acting)

Admin Locations 5 days Rs. 250/ per shift per day from 01-10-23 to 30-09-28 (subject to max. Rs.2500 pm)

Field Locations 6 days Acting Compensation will not be paid during overtime

Unauthorized Absence Overtime

Unauthorized Absence for more than 15 days in a year will disentitle employee for Annual Components for Calculation of Overtime will be Basic + Stagnation Pay + VDA.

Increment/ CDP Promotion/ Stagnation Relief Increment The denominator will be 208.

Absenting on Loss Of Pay after exhausting all leaves on account of sickness and duly approved

by CMA will not be treated as unauthorised absence. Contributions towards retireral benefits SBFS/ PRMB/ Gratuity - Max 30% of (BP + DA)

Retirement Benefits (To be claimed within 6 months of retirement) SBFS contribution shall be reckoned after adjusting contributions made towards PF, Gratuity & PRMB within a

In case an employee settles down at a place,other than his last place of posting max. ceiling of 30% of Basic Pay and DA.

Travel/Bhatta:Expenses incurred on Travel for Self, Spouse, Dependent Children and Dependent Gratuity Ceiling is 20 Lakhs. Whenever, the DA rises to 50%, the gratuity shall inc by 25%.

Parents who are wholly dependent and residing with employee from location of last posting to The total contribution will be within the ceiling of 30% of Super Annuation benefits.

LOCAL CONVEYANCE : Employee shall be eligible for reimbursement of actual expenses on retirement towards conveyance between residence and the railway station at the place of posting and from Railway

Station to Residence at the place of Settlement depending on Class of City ( place of Posting and place where the employee settles down),subject to maximum amount as follows : X Class City : Rs.500/- ; Y/Z

Class City : Rs.400/-

30 days daily allowance as applicable to the place of settlement, as per the rates (per day ) given below Settling Allowance

Class of City Basic upto Rs.70,000 Basic Rs.70,001 & above 2 months Basic + DA (Last Drawn)

Resettlement Expenses

X Class City Rs.1000/- Rs.1175/- Insurance Premium

Y & Z Class City Rs.865/- Rs.1025/- Upto Max. of Rs.2,000/-

Transportation of Personal Effects Employee can claim expenses incurred for transportation of personal effects for one rail wagon or one truck load Loadng/Unloading/Packing Chrgs

By Rail Employee

Employee is eligible

will for reimbursement

be reimbursed of actual railway freight

cost of transportation Upto Max. of Rs. 10,000/-

based on the below criteria In case an employee settles down at

Distance Slab Normal Locations (Rs/ km) Far Flung Locations (Rs/ km) the place of his last posting involving

First 200 km 66 82.5 change of residence -Employee shall

By Road

Next 201<500 kms 48 60 be eligible for lump sum payment of

Next 501<1000 kms 30 37.5 Rs.5,000 for transportation of

More than 1001 kms 24 30 personal effects /household goods on

production of satisfactory proof

Disclaimer: Although every effort has been made to maintain the accuracy of the data, employees are requested to refer Personnel Manual/LTS for detailed

Settling Allowance One Month Basic

information. Compiled by: Team-HR, NCZ

Salary + DA (Last drawn)

You might also like

- Property Attack OutlineDocument28 pagesProperty Attack OutlineBrady Williams100% (3)

- Brand Lift Questions - One Sheeter (Updated)Document1 pageBrand Lift Questions - One Sheeter (Updated)Claire SantiagoNo ratings yet

- SAP Design Thinking QuestionsDocument5 pagesSAP Design Thinking QuestionsSiddharth SinhaNo ratings yet

- NIACL-Officer Benefits & HR Orientation BookletDocument48 pagesNIACL-Officer Benefits & HR Orientation BookletSumit SelokarNo ratings yet

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingNo ratings yet

- Cashpor ProfileDocument4 pagesCashpor Profileamartya tiwariNo ratings yet

- Updated One Pager SPL - Dsa-1Document1 pageUpdated One Pager SPL - Dsa-1Vishal BawaneNo ratings yet

- GIPSA HR Material 2018Document123 pagesGIPSA HR Material 2018shravan workNo ratings yet

- Income-Tax-withholding-card-2024-25-Finance-Bill-2024-pakistanDocument1 pageIncome-Tax-withholding-card-2024-25-Finance-Bill-2024-pakistanredumw100No ratings yet

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarNo ratings yet

- Budget, 2010 Amendment at A Glance: Compiled By: PAMS & AssociatesDocument15 pagesBudget, 2010 Amendment at A Glance: Compiled By: PAMS & Associatespawanagrawal83No ratings yet

- GIPSA HRM Benefits-1Document1 pageGIPSA HRM Benefits-1shravan workNo ratings yet

- Advertisement For WebsiteDocument12 pagesAdvertisement For Websitesandeep patilNo ratings yet

- Page 1 of 11: General Manager - P&ADocument11 pagesPage 1 of 11: General Manager - P&Aramkumardotg_5807772No ratings yet

- Page 1 of 14: General Manager - P&ADocument14 pagesPage 1 of 14: General Manager - P&ASelect MaidNo ratings yet

- Pre-Promotion Training: Promotion Exercise 2019-20 For Officers - January 2019Document127 pagesPre-Promotion Training: Promotion Exercise 2019-20 For Officers - January 2019Gautam KumarNo ratings yet

- Powergrid SalaryDocument10 pagesPowergrid SalaryRaj AshishNo ratings yet

- IoclDocument2 pagesIoclMohd Asif RazaNo ratings yet

- Compensation Rules and Salary Design GuidelinesDocument6 pagesCompensation Rules and Salary Design GuidelinesDivya NatarajanNo ratings yet

- Income Tax Rates Slabs From A.Y 2001-02 To ADocument7 pagesIncome Tax Rates Slabs From A.Y 2001-02 To ACa T.SANKARAMURTHYNo ratings yet

- Schedule of Charges - English - July To DecemberDocument15 pagesSchedule of Charges - English - July To DecemberBurairNo ratings yet

- Employee Tax Benefits - FinalDocument18 pagesEmployee Tax Benefits - FinalsrijainsravakcharitabletrustNo ratings yet

- Keyword For Medical WordsDocument2 pagesKeyword For Medical WordsAsheeth S. RayaprolNo ratings yet

- Excel Numeric EntryDocument2 pagesExcel Numeric Entrysandeep satalkarNo ratings yet

- One Pager For Channel & Sales - Jun'22Document4 pagesOne Pager For Channel & Sales - Jun'22Gaurav SinghNo ratings yet

- Dashboard 23.XlsmDocument3 pagesDashboard 23.XlsmCristiane RezendeNo ratings yet

- Tata Capital Latest 1 PAGER POLICYDocument2 pagesTata Capital Latest 1 PAGER POLICYPRIYANKA DASNo ratings yet

- Module 1 Tax DR BRR 2018Document7 pagesModule 1 Tax DR BRR 2018Prajwal kumarNo ratings yet

- 2 Tax RatesDocument15 pages2 Tax RatesragerahulNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Pay and Allowances: Page - 340Document28 pagesPay and Allowances: Page - 340Gaurav SahotaNo ratings yet

- Income Tax Card 2023-24 (Finance Act 2023)Document1 pageIncome Tax Card 2023-24 (Finance Act 2023)shahidNo ratings yet

- Rate List NewDocument2 pagesRate List NewKuldeep NamaNo ratings yet

- Advertisement For The Post of GM Finance GM Civil DGM Civil DGM Architect AM Civil AM Town Planner JE Civil Legal Assistant 1Document7 pagesAdvertisement For The Post of GM Finance GM Civil DGM Civil DGM Architect AM Civil AM Town Planner JE Civil Legal Assistant 1RiyazulSamadBinMohammadNo ratings yet

- The Canara Bank Officers Association (Regd)Document8 pagesThe Canara Bank Officers Association (Regd)Arun RamNo ratings yet

- Hr-Personnel & Vigilance 12.1 Core Benefits A. Class-I Pay Scales (Basic Pay)Document49 pagesHr-Personnel & Vigilance 12.1 Core Benefits A. Class-I Pay Scales (Basic Pay)Neelima SappidiNo ratings yet

- Effective From: January 01, 2023 To June 30, 2023Document25 pagesEffective From: January 01, 2023 To June 30, 2023Shujauddin QureshiNo ratings yet

- Taxation PresentationDocument10 pagesTaxation Presentationgaurav daveNo ratings yet

- Professional Tax in India Professional Tax Is Levied by The StateDocument4 pagesProfessional Tax in India Professional Tax Is Levied by The StateVinoth KumarNo ratings yet

- 2 Tax RatesDocument15 pages2 Tax Rates1407345No ratings yet

- Rules For Statutory Deductions Exemptions Perquisites-PayrollDocument4 pagesRules For Statutory Deductions Exemptions Perquisites-PayrollSiba MishraNo ratings yet

- Payroll Accounting 7 QuesDocument6 pagesPayroll Accounting 7 QuesIshan sharmaNo ratings yet

- Income Tax Slab Fy 2020-21Document1 pageIncome Tax Slab Fy 2020-21Nabhya's FamilyNo ratings yet

- TA Rules 15-16Document43 pagesTA Rules 15-16sravanveldiNo ratings yet

- Module 1 Direct Tax DR BRR 2022 StudentsDocument9 pagesModule 1 Direct Tax DR BRR 2022 StudentsDr. Batani Raghavendra RaoNo ratings yet

- Establishment Rules & ProceduresDocument19 pagesEstablishment Rules & ProceduresAmrita Pal100% (1)

- Sol - PTP 29 11 2018Document6 pagesSol - PTP 29 11 2018riyagoel12329dspsNo ratings yet

- RepresentationDocument2 pagesRepresentationNikhil SharmaNo ratings yet

- Sub: Regarding Payment of PRP For FY 2018-19 - Non - Unionized Supervisors and LowerDocument5 pagesSub: Regarding Payment of PRP For FY 2018-19 - Non - Unionized Supervisors and LowerChandan KumarNo ratings yet

- Costing For Different HR Management Software in BangladeshDocument3 pagesCosting For Different HR Management Software in Bangladeshআমিনুল আসফীNo ratings yet

- Sol 1Document1 pageSol 1alex breymannNo ratings yet

- P6mys 2015 Dec QDocument13 pagesP6mys 2015 Dec QMERINANo ratings yet

- Income Tax Slabs 2007-08 To 2010-11Document4 pagesIncome Tax Slabs 2007-08 To 2010-11Manoj ThuthijaNo ratings yet

- Lecture Meeting Budget 2014 2015Document10 pagesLecture Meeting Budget 2014 2015birju668No ratings yet

- SOC Jul Dec 2023 EnglishDocument21 pagesSOC Jul Dec 2023 EnglishClasherNo ratings yet

- AY 20-21 Tax RatesDocument4 pagesAY 20-21 Tax Ratesashim1No ratings yet

- Interest Rate Chart: 3 Months MCLR (%) One Year MCLR (%)Document1 pageInterest Rate Chart: 3 Months MCLR (%) One Year MCLR (%)akrmbaNo ratings yet

- Head OfficeDocument9 pagesHead Officeyogesh pandeyNo ratings yet

- Income From SalaryDocument5 pagesIncome From Salarydbgdemo6No ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- Tax SlabDocument3 pagesTax Slabmuneerpp78No ratings yet

- ADM Salary Restructure 2020Document11 pagesADM Salary Restructure 2020vishal sukhwalNo ratings yet

- Medical Certificate - MH - BOE - A S PrasanthDocument1 pageMedical Certificate - MH - BOE - A S PrasanthBharani YandamooriNo ratings yet

- CANDBLeaveApp PDFDocument1 pageCANDBLeaveApp PDFBharani YandamooriNo ratings yet

- 2-AptitudeTest 1Document38 pages2-AptitudeTest 1Bharani YandamooriNo ratings yet

- L) (OA) or One Leg and One Arm Affected (OLA) or Cerebral Palsy (CP) or LeprosyDocument16 pagesL) (OA) or One Leg and One Arm Affected (OLA) or Cerebral Palsy (CP) or LeprosyBharani YandamooriNo ratings yet

- CWC Shimla NotificationDocument1 pageCWC Shimla NotificationBharani YandamooriNo ratings yet

- Temp RecruitDocument3 pagesTemp RecruitBharani YandamooriNo ratings yet

- Photography Session - Contract TemplateDocument4 pagesPhotography Session - Contract TemplateRoxinaNo ratings yet

- PBRXDocument29 pagesPBRXMoe EcchiNo ratings yet

- Banca Takaful and Its DistributionDocument4 pagesBanca Takaful and Its DistributionAfifah NabilahNo ratings yet

- SAS BASE A00 211 Sample QuestionsDocument33 pagesSAS BASE A00 211 Sample QuestionsKarthik594 SasNo ratings yet

- Trading Spreads and SeasonalsDocument15 pagesTrading Spreads and Seasonalstpman2004-misc67% (3)

- Project Risk ManagementDocument15 pagesProject Risk ManagementCătă Mikachikatakito Andrei0% (1)

- Mba 2nd Sem Result 2010 AdmittedDocument22 pagesMba 2nd Sem Result 2010 AdmittedAnonymous nTxB1EPvNo ratings yet

- f2p9g - Egac Cab AgreementDocument4 pagesf2p9g - Egac Cab AgreementAles esaamNo ratings yet

- Senior Vice President Human Resources in Washington DC Baltimore MD Resume Tom MirgonDocument3 pagesSenior Vice President Human Resources in Washington DC Baltimore MD Resume Tom MirgonTomMirgonNo ratings yet

- Depilacion Jumbo YenniDocument51 pagesDepilacion Jumbo YenniDanny Xavier HerreraNo ratings yet

- Chap013.ppt Scheduling OperationsDocument23 pagesChap013.ppt Scheduling OperationsSaad Khadur Eilyes100% (1)

- CV Karntimon - YDocument4 pagesCV Karntimon - Yichigosonix66No ratings yet

- BMGT 220 Final Exam - Fall 2011Document7 pagesBMGT 220 Final Exam - Fall 2011Geena GaoNo ratings yet

- Aviation Sector in IndiaDocument66 pagesAviation Sector in Indiasrpvicky100% (1)

- Accounting Practices The New Zealand Context 3rd Edition Mcintosh Solutions Manual Full Chapter PDFDocument36 pagesAccounting Practices The New Zealand Context 3rd Edition Mcintosh Solutions Manual Full Chapter PDFEdwardBishopacsy100% (12)

- Triumph TR6 HandbookDocument77 pagesTriumph TR6 HandbooksteinhansenNo ratings yet

- Ujian Penilaian 1 - English Paper 2Document4 pagesUjian Penilaian 1 - English Paper 2Syikin NorizanNo ratings yet

- Anu Nirma Nirma StoryDocument16 pagesAnu Nirma Nirma StoryPandey AmitNo ratings yet

- About Pos Malaysia BerhadDocument2 pagesAbout Pos Malaysia BerhadWilliam Vong75% (4)

- The Overwurked American Juliet B. SchurDocument34 pagesThe Overwurked American Juliet B. SchurCarlos Gen WarashiNo ratings yet

- Lakme West Bengal (India) Beauty Adviser - 1 Year (2018 - 2019)Document2 pagesLakme West Bengal (India) Beauty Adviser - 1 Year (2018 - 2019)Majid AliNo ratings yet

- Push and Pull Strategy 1Document6 pagesPush and Pull Strategy 1kiranaishaNo ratings yet

- Assignment 1Document2 pagesAssignment 1Rajesh VijayNo ratings yet

- Future Generali Brochure PDFDocument19 pagesFuture Generali Brochure PDFSangeeta LakhoteNo ratings yet

- Bank and Secrecy Law in The PhilippinesDocument18 pagesBank and Secrecy Law in The PhilippinesBlogWatchNo ratings yet

- Postal Ballot Form FormatDocument4 pagesPostal Ballot Form FormatGaurav Kumar SharmaNo ratings yet