Professional Documents

Culture Documents

6.Test 6 SOCIE

6.Test 6 SOCIE

Uploaded by

Basit MehrCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6.Test 6 SOCIE

6.Test 6 SOCIE

Uploaded by

Basit MehrCopyright:

Available Formats

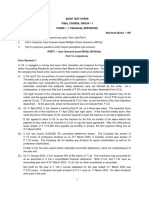

Certificate in Accounting and Finance Stage Examination

2024

30 minutes

18 marks

Additional reading time – 10 minutes

Financial Accounting and Reporting-I

Instructions to examinees:

(i) Answer all questions.

(ii) Answer in black pen only.

(iii) Multiple Choice Questions must be answered in answer script only.

Statement of Changes in equity

Question 1

Following information have been extracted from the financial statements of Fakhr Limited (FL) for the year ended 31

December 2019:

(i)

2019 2018 2017

Draft Audited Audited

------Rs. In Million----

Net Profit 84 98 72

(ii) Share capital and reserves as at 1 January:

2018 2017

---Rs. In million---

Share capital (Rs. 10 each) 300 300

Retained earnings 348 276

(iii) On 1 March 2018, FL declared a final cash dividend of 10% for the year ended 31December 2017. On 1 November

2018, FL issued 40% right shares to its ordinary shareholders at Rs. 24 per share. On 1 August 2019, an interim

bonus of 15% was declared.

Following information needs to be incorporated in the draft financial statements of FL:

On 1.1.2019 company changed the method of valuation of subsequent measurement of property plant and equipment

from cost model to a revaluation model.

Useful life Cost Acc. Depreciation Revalued Amount

-------Rs. In million------

Factory Buildings 30 years 300 75 280

On 31.8.2019, one of the factory buildings having written down value of Rs 20.5875 million and revalued amount of

Rs.25.65 million on 01.01.2019 was sold for Rs.22 million.

The cost of disposal was 0.5 million.

On 31.12.2019 remaining factory buildings were revalued at Rs.205 million.

There is no change in the estimated useful life and company transfers maximum amount of revaluation surplus to

retained earnings on annual basis.

Required:

Prepare FL’s statement of changes in equity (including comparative figures) for the year ended 31 December 2019.

(‘Total’ column is not required) (18)

You might also like

- Pac All CAF Mocks With Solutions Compiled by Saboor AhmadDocument144 pagesPac All CAF Mocks With Solutions Compiled by Saboor AhmadRao Ali CA100% (2)

- Larrys Bicycle Shop - Annual Financial Statements - Original HardcodedDocument4 pagesLarrys Bicycle Shop - Annual Financial Statements - Original HardcodedLarry MaiNo ratings yet

- Texas Public School Construction CostsDocument20 pagesTexas Public School Construction CostsTexas Comptroller of Public Accounts100% (1)

- Financial Accounting and Reporting-IDocument7 pagesFinancial Accounting and Reporting-IWasim SajadNo ratings yet

- MFR203 FAR-4 AssignmentDocument5 pagesMFR203 FAR-4 Assignmentgillian soonNo ratings yet

- CAF1 ModelPaperDocument7 pagesCAF1 ModelPaperahmedNo ratings yet

- PAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadDocument132 pagesPAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadHadeed HafeezNo ratings yet

- Mock Exam 2Document7 pagesMock Exam 2ZahidNo ratings yet

- Advanced Accounting and Financial ReportingDocument5 pagesAdvanced Accounting and Financial ReportingYasin ShaikhNo ratings yet

- IAS-40 testDocument1 pageIAS-40 testBasit MehrNo ratings yet

- Past Paper FAR1Document116 pagesPast Paper FAR1Daniyal AhmedNo ratings yet

- Final Mock by TSB CFAP6 S2020Document5 pagesFinal Mock by TSB CFAP6 S2020Umar FarooqNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Far1 Artt Ias 8 & 33 Test QPDocument1 pageFar1 Artt Ias 8 & 33 Test QPHassan TanveerNo ratings yet

- Financial Accounting and Reporting I: Additional Practice QuestionsDocument34 pagesFinancial Accounting and Reporting I: Additional Practice Questionsalia khanNo ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Crescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadDocument124 pagesCrescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadAr Sal AnNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- FRK201 Nov2019Document11 pagesFRK201 Nov2019Alex ViljoenNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Financial Reporting Paper 2.1nov 2019Document25 pagesFinancial Reporting Paper 2.1nov 2019e.asafu-adjayeNo ratings yet

- Lecture # 43Document2 pagesLecture # 43HussainNo ratings yet

- CAF 1 FAR1 Spring 2023Document6 pagesCAF 1 FAR1 Spring 2023haris khanNo ratings yet

- Cfap 1 Afr Winter 2020Document5 pagesCfap 1 Afr Winter 2020ANo ratings yet

- Financial Accounting & Reporting II: Certificatein Accountingand Finance Stage ExaminationsDocument3 pagesFinancial Accounting & Reporting II: Certificatein Accountingand Finance Stage ExaminationsWaseim khan Barik zaiNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIZahidNo ratings yet

- Past Paper FAR1Document105 pagesPast Paper FAR1Hamza VirkNo ratings yet

- Quarter Test 2 QPDocument7 pagesQuarter Test 2 QPOmair HasanNo ratings yet

- FAR-2 Mock September 2021 FinalDocument8 pagesFAR-2 Mock September 2021 FinalMuhammad RahimNo ratings yet

- FAR2 ModelpaperDocument7 pagesFAR2 ModelpaperSaif SiddNo ratings yet

- Financial Accounting and Reporting: Page 1 of 4Document4 pagesFinancial Accounting and Reporting: Page 1 of 4ebshuvoNo ratings yet

- Cib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1Document8 pagesCib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1lilliananne5051No ratings yet

- Fa May June - 2019Document5 pagesFa May June - 2019xodic49847No ratings yet

- Aafr Ifrs 5 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 5 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- FA Dec 2019Document6 pagesFA Dec 2019Shawn LiewNo ratings yet

- CAF 1 FAR1 Spring 2024Document7 pagesCAF 1 FAR1 Spring 2024khalidumarkhan1973No ratings yet

- FR MTP-1 May-24Document11 pagesFR MTP-1 May-24chandrakantchainani606No ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- Crescent All CAF Mocks With Solutions Compiled by Saboor AhmadDocument123 pagesCrescent All CAF Mocks With Solutions Compiled by Saboor AhmadsheldonjabrazaNo ratings yet

- CAF 1 FAR1 Autumn 2023Document6 pagesCAF 1 FAR1 Autumn 2023z8qcsqfj8dNo ratings yet

- Final MockDocument5 pagesFinal MockAbdullahSaqibNo ratings yet

- AARS Test 4 Q.paper FinalDocument3 pagesAARS Test 4 Q.paper FinalShahzaib VirkNo ratings yet

- Financial Accounting and Reporting-IIDocument6 pagesFinancial Accounting and Reporting-IISYED ANEES ALINo ratings yet

- May 2021 Path SkillsDocument139 pagesMay 2021 Path Skillsbusolajuliet601No ratings yet

- Facr Numerical Mcqs AllDocument88 pagesFacr Numerical Mcqs Alluroojfatima21299No ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- Pathfinder May 2018 SkillsDocument155 pagesPathfinder May 2018 SkillsOgunmola femiNo ratings yet

- 304.AUDP - .L III Question CMA June 2021 Exam.Document3 pages304.AUDP - .L III Question CMA June 2021 Exam.Md Joinal AbedinNo ratings yet

- Group Assignments Acc 217Document4 pagesGroup Assignments Acc 217Phebieon MukwenhaNo ratings yet

- SKANS School of Accountancy Financial Accounting and Reporting-IIDocument11 pagesSKANS School of Accountancy Financial Accounting and Reporting-IImaryNo ratings yet

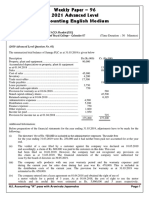

- Accounting English Medium: Weekly Paper - 96 2021 Advanced LevelDocument2 pagesAccounting English Medium: Weekly Paper - 96 2021 Advanced LevelMalar SrirengarajahNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Corporate Reporting Paper 3.1 July 2023Document32 pagesCorporate Reporting Paper 3.1 July 2023Prof. OBESENo ratings yet

- Ita MockDocument8 pagesIta MockAyyan SheikhNo ratings yet

- Term Test-1 FAR-1Document6 pagesTerm Test-1 FAR-1Dua FarmoodNo ratings yet

- Suggested Answer Paper CAP III Dec 2019Document146 pagesSuggested Answer Paper CAP III Dec 2019Ankit Jung RayamajhiNo ratings yet

- FA Sample PaperDocument10 pagesFA Sample PaperThe ShiningNo ratings yet

- Revalution Test Abbas LimitedDocument2 pagesRevalution Test Abbas LimitedMudassar AliNo ratings yet

- Suggested Answers CAP III - Dec 2018 PDFDocument144 pagesSuggested Answers CAP III - Dec 2018 PDFsarojdawadiNo ratings yet

- Sir Kahlil Far 1 Batch 4Document6 pagesSir Kahlil Far 1 Batch 4Asim MahmoodNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- ABC costing test q.pDocument1 pageABC costing test q.pBasit MehrNo ratings yet

- IAS-40 testDocument1 pageIAS-40 testBasit MehrNo ratings yet

- Solution CMA Test 1Document4 pagesSolution CMA Test 1Basit MehrNo ratings yet

- QM Formula Sheets by JahanzaibDocument6 pagesQM Formula Sheets by JahanzaibBasit MehrNo ratings yet

- IFF Global Financial IntegrityDocument78 pagesIFF Global Financial IntegritycorruptioncurrentsNo ratings yet

- Chapter 1 PresentationDocument39 pagesChapter 1 PresentationSagni Oo ChambNo ratings yet

- List of Updated TN MinistersDocument6 pagesList of Updated TN MinistersM.s. KalirajNo ratings yet

- Base Method-FI AADocument4 pagesBase Method-FI AAGanesh RameshNo ratings yet

- Finalised Kathi Junction Business Loan 19-5-19Document5 pagesFinalised Kathi Junction Business Loan 19-5-19Allserv TechnologiesNo ratings yet

- Stock-Market-Basics 30715 PDFDocument27 pagesStock-Market-Basics 30715 PDFAdam Basrindu100% (2)

- Talwalkars Better Value Fitness LTDDocument4 pagesTalwalkars Better Value Fitness LTDAnonymous T8VqeaNo ratings yet

- Government Initiatives For Rural Banking: An OverviewDocument9 pagesGovernment Initiatives For Rural Banking: An OverviewharshNo ratings yet

- Mgt401solvedsubjectivefinalterm PDFDocument13 pagesMgt401solvedsubjectivefinalterm PDFengr_alihussain02No ratings yet

- Formatof Indenity BondDocument2 pagesFormatof Indenity BondSudhir SinhaNo ratings yet

- AIAC 2018 Standard FormDocument97 pagesAIAC 2018 Standard FormFawwaz ShuibNo ratings yet

- 8 - Your Loan Has Been SoldDocument2 pages8 - Your Loan Has Been SoldJoe Esquivel100% (2)

- Performance ManagementDocument100 pagesPerformance ManagementBasavanagowda GowdaNo ratings yet

- Account Assignmeent SajjalDocument30 pagesAccount Assignmeent Sajjalsuraj banNo ratings yet

- Jun 16 Bill-AnandDocument1 pageJun 16 Bill-AnandanandNo ratings yet

- Feb Salary SlipDocument2 pagesFeb Salary SlipNithish Kumar. NNo ratings yet

- OTS Indonesia Application Form 2018-2019Document3 pagesOTS Indonesia Application Form 2018-2019Kajian Remaja BaiturrahmahNo ratings yet

- The Credit Repair Handbook Everything You Need To Know (DR - Soc)Document241 pagesThe Credit Repair Handbook Everything You Need To Know (DR - Soc)sssNo ratings yet

- Regent Markets Group v. Credit SuisseDocument5 pagesRegent Markets Group v. Credit SuissePriorSmartNo ratings yet

- Ad - Tender - Doc HIMS 115092015 2Document59 pagesAd - Tender - Doc HIMS 115092015 2Horain ChaudhryNo ratings yet

- Forex Smart Learning 2018Document52 pagesForex Smart Learning 2018Kino AgyenaNo ratings yet

- Chapter 17Document15 pagesChapter 17Monalisa SethiNo ratings yet

- Shri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesDocument1 pageShri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesSangram SinghNo ratings yet

- Tugas Ekonomi Teknik Universitas IndonesiaDocument6 pagesTugas Ekonomi Teknik Universitas IndonesiaInna Ihsani NisaNo ratings yet

- KellogDocument2 pagesKellogDhruv Gupta100% (1)

- Bernardo vs. CADocument5 pagesBernardo vs. CALaura MangantulaoNo ratings yet

- Newhouse: Furniture Save Every Sealy MattressDocument36 pagesNewhouse: Furniture Save Every Sealy MattressCoolerAdsNo ratings yet

- BC P3 Payment TermsDocument137 pagesBC P3 Payment Termswimjam100% (1)