Professional Documents

Culture Documents

FPC_T247583972023_12ADeCastroMaAnnaKatrina-2

FPC_T247583972023_12ADeCastroMaAnnaKatrina-2

Uploaded by

katrinaanna209Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FPC_T247583972023_12ADeCastroMaAnnaKatrina-2

FPC_T247583972023_12ADeCastroMaAnnaKatrina-2

Uploaded by

katrinaanna209Copyright:

Available Formats

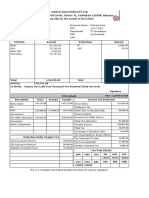

24/7 Customer Philippines, Inc Final Pay Computation November, 2023

Employee Code T24758397 Employee Name De Castro,Ma Anna Katrina Camilon

Location TIN

SSS No PhilHealth No

HDMF No Date of Leaving 11/10/2023

Date Of Joining 9/4/2023 Department

Taxable Earnings Hours/Day Amount NonTaxable Earnings Hours/Day Amount PHP Deductions Amount PHP

s PHP s

Leave Without Pay 4.5 -3827.58 13th month pay 2408.19 liquidated Damages 18500.00

Regular ND - 20% 30.72 653.25 Clothing Subsidy One Time -82.76

Regular OTND - 20% .94 19.99 Laundry Subsidy OneTime -62.07

Reg OT1 - 100% .94 99.95 Rice Subsidy One Time -310.34

Spec Hol in WD ND - 26% 11.26 311.27 SIL Amount -740

TARDINESS 1.65 -175.43 Transpo Subsidy OneTime -165.52

Regular OT ND - 25% 2.06 54.76

Regular OT - 125% 2.06 273.78

Special Hol x's of 8-169% 1.18 212.03

Spec Hol x's 8 ND-33.8% 1.18 42.41

Special Holiday - 30% 16.38 522.47

TOTAL TAXABLE INCOME -1813.10 TOTAL NON-TAXABLE INCOME 1047.50 TOTAL DEDUCTIONS: 18500.00

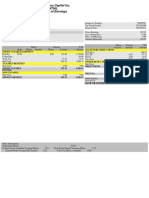

Tax Computaion sheet November, 2023 Amount Total Net Pay Amount PHP

Gross Pay YTD 36,794.01 NET SALARY -19265.60

Gross Pay Current Period -1,813.10

90K_NTAXPAID YTD 2,408.19

Net Taxable Income 37,389.10

Pagibig deducted till date 200.00

Philhealth deducted till date 740.00

SSS deducted till date 1,890.00

EXEMPT_90K 2,408.19

Total Exemption 5,238.19

Net Taxable Income 32,150.91

Taxable income after Exemption 32,150.91

You might also like

- Walmart Pay Stub Online VersionDocument5 pagesWalmart Pay Stub Online VersionLily NguyenNo ratings yet

- Scientific Glass ExcelDocument13 pagesScientific Glass ExcelSakshi ShardaNo ratings yet

- Novice HedgeDocument130 pagesNovice HedgeAnujit Kumar100% (6)

- 01-18-2020 Payslip PDFDocument1 page01-18-2020 Payslip PDFCarla ZanteNo ratings yet

- Payslip: Employee Details Payment & Leave DetailsDocument2 pagesPayslip: Employee Details Payment & Leave DetailsKushal Malhotra100% (3)

- Franchise ContractDocument3 pagesFranchise Contractedward tablazon100% (2)

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- Jerry PayDocument1 pageJerry PaydoxingrusNo ratings yet

- PaySlip December2022 3Document1 pagePaySlip December2022 3pankaj kumarNo ratings yet

- Franklyn Solano Cruz: Earnings StatementDocument1 pageFranklyn Solano Cruz: Earnings StatementFranky CruzNo ratings yet

- Remitence reportMMJ 4.21.23Document1 pageRemitence reportMMJ 4.21.23blackson knightsonNo ratings yet

- Remitence Report 4.21.23Document1 pageRemitence Report 4.21.23blackson knightsonNo ratings yet

- Remitence Report 5.19.23Document1 pageRemitence Report 5.19.23blackson knightsonNo ratings yet

- Paystub 1Document1 pagePaystub 1PeterJamesNo ratings yet

- Remitence Report 5.8x.23Document1 pageRemitence Report 5.8x.23blackson knightsonNo ratings yet

- MayDocument1 pageMayravikumarmalirmNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- MarchDocument1 pageMarchravikumarmalirmNo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income Detailsbktsuna0201No ratings yet

- Payslip Nov 2023Document1 pagePayslip Nov 2023VarshaNo ratings yet

- Pay Is inDocument2 pagesPay Is inJo YelleNo ratings yet

- Mar 2024Document2 pagesMar 2024Tuneer SahaNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Feb 2024Document2 pagesFeb 2024Tuneer SahaNo ratings yet

- Pay Slip OctDocument1 pagePay Slip Octchahalnikita7No ratings yet

- Get PayslipDocument1 pageGet PayslipCyrill FaustoNo ratings yet

- Soria Twinkle R. FPCDocument1 pageSoria Twinkle R. FPCJack Daniel BalbuenaNo ratings yet

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Earnings Taxable Non Taxable Hours Total: OvertimeDocument1 pageEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNo ratings yet

- Brian Tai - Pay Slip 00002Document1 pageBrian Tai - Pay Slip 00002Brian TaiNo ratings yet

- Tata Business Support Services LTD: 00150785 Amir KhanDocument2 pagesTata Business Support Services LTD: 00150785 Amir KhanAamir KhanNo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income Detailsbktsuna0201No ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- UntitledDocument1 pageUntitleddefxsoulNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- PayslipDocument1 pagePayslipMaureen D. FloresNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- ST Lukes Predominance TestDocument12 pagesST Lukes Predominance TestCARLO JOSE BACTOLNo ratings yet

- Common Size Analysis: Hul Profit and Loss StatementDocument7 pagesCommon Size Analysis: Hul Profit and Loss Statementamlan dasNo ratings yet

- Payslip May 2024Document1 pagePayslip May 2024ravi.ramana64No ratings yet

- Payslip 10-03-23Document1 pagePayslip 10-03-23gmelenamuNo ratings yet

- Pay Slip FinalDocument1 pagePay Slip FinalMohit ChahalNo ratings yet

- Vision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Document1 pageVision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Pravin KhopadeNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- November 2022 16 - 30 PayslipDocument1 pageNovember 2022 16 - 30 PayslipRRF Construction Co.No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- MindtreeDocument18 pagesMindtreeAkash DidhariaNo ratings yet

- SalaryslipDocument2 pagesSalaryslipredxyzzzz5500No ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Paystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFDocument8 pagesPaystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFLuis MartinezNo ratings yet

- Salary For Sep - 2022Document1 pageSalary For Sep - 2022narottam.ojhaNo ratings yet

- Sal Copy 5Document9 pagesSal Copy 5Prateek MohapatraNo ratings yet

- Keywords Asia Private Limited: PayslipDocument1 pageKeywords Asia Private Limited: PayslipAaronn RaphaaNo ratings yet

- Tata Consultancy ServicesDocument6 pagesTata Consultancy ServicesHarshad PawarNo ratings yet

- Fiserv December SalaryDocument1 pageFiserv December SalarySiddharthNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLgamersingh098123No ratings yet

- FormDocument1 pageFormRahul GaurNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Tax Treatment of GiftsDocument17 pagesTax Treatment of Giftssreyans banthiaNo ratings yet

- Analisa Beli Via BankDocument19 pagesAnalisa Beli Via Bankalim pujiantoNo ratings yet

- Microeconomics 2Nd Edition Karlan Solutions Manual Full Chapter PDFDocument37 pagesMicroeconomics 2Nd Edition Karlan Solutions Manual Full Chapter PDFbushybuxineueshh100% (13)

- AP Macro WorkbookDocument346 pagesAP Macro WorkbookLynn Hollenbeck Breindel100% (5)

- Luisa Fernanda Henao: Accounting TechnicianDocument2 pagesLuisa Fernanda Henao: Accounting TechnicianLuisa Fernanda HenaoNo ratings yet

- Rent ReceiptDocument1 pageRent ReceiptSasi NimmakayalaNo ratings yet

- AppliedEconomics Q3 M3 Market-StructureDocument25 pagesAppliedEconomics Q3 M3 Market-Structure•LAZY SHEEP•No ratings yet

- General Ledger ListingDocument1 pageGeneral Ledger ListingNursyakira HasmiezaNo ratings yet

- 856 EconomicsDocument4 pages856 Economicsayushii kapurNo ratings yet

- Bayes For Beginners: Luca Chech and Jolanda Malamud Supervisor: Thomas Parr 13 February 2019Document41 pagesBayes For Beginners: Luca Chech and Jolanda Malamud Supervisor: Thomas Parr 13 February 2019Angelito Antivo Jr.No ratings yet

- Duplicated RecordsDocument12 pagesDuplicated RecordsOğuzhan DaşkayaNo ratings yet

- ChatDocument12 pagesChatBhanu GarapatiNo ratings yet

- Introduction To Descriptive Statistics: K S DeepikaDocument9 pagesIntroduction To Descriptive Statistics: K S DeepikaPrajwalNo ratings yet

- Arid Agriculture University, Rawalpindi: Final Exam / Spring 2021 (Paper Duration 12 Hours) To Be Filled by TeacherDocument9 pagesArid Agriculture University, Rawalpindi: Final Exam / Spring 2021 (Paper Duration 12 Hours) To Be Filled by TeacherNoor MughalNo ratings yet

- Design Mix DDocument8 pagesDesign Mix DCHRISTIE GRACE GUMAHINNo ratings yet

- (15 Jan) Income Inequality in ASEAN Countries - by Rajah RasiahDocument12 pages(15 Jan) Income Inequality in ASEAN Countries - by Rajah Rasiahupnm 1378No ratings yet

- VOEN Setup EnglishDocument30 pagesVOEN Setup EnglishEugeniu GudumacNo ratings yet

- Est May 2021Document5 pagesEst May 2021Laiq Ur RahmanNo ratings yet

- C05 Krugman 11eDocument82 pagesC05 Krugman 11eKumar Ak100% (2)

- Servico Company Profile v5Document20 pagesServico Company Profile v5George DahrNo ratings yet

- Mr. Phiri's Final DissertationDocument63 pagesMr. Phiri's Final DissertationGM-Kasuba P MbuloNo ratings yet

- Full Download PDF of Marketing For Hospitality and Tourism 7th Edition Kotler Test Bank All ChapterDocument30 pagesFull Download PDF of Marketing For Hospitality and Tourism 7th Edition Kotler Test Bank All Chapteracistaqasih100% (6)

- Apml Bosmp222315505Document2 pagesApml Bosmp222315505Ridha GuptaNo ratings yet

- Heichala Dream Enterprise (Ns0262486-H) : InvoiceDocument1 pageHeichala Dream Enterprise (Ns0262486-H) : InvoiceEmir NazrenNo ratings yet

- Test Bank For Managerial Economics Applications Strategies and Tactics 13th EditionDocument6 pagesTest Bank For Managerial Economics Applications Strategies and Tactics 13th EditionJamesJohnsonqxcej100% (28)

- Automatic Wooden Cutlery Spoons Making MachineDocument9 pagesAutomatic Wooden Cutlery Spoons Making MachineRuturaj Sinh RauljiNo ratings yet

- AEAI Cina RE Invest Indonesia 2022 - TenggaraDocument33 pagesAEAI Cina RE Invest Indonesia 2022 - TenggaraIfnaldi SikumbangNo ratings yet