Professional Documents

Culture Documents

PRE ENGAGEMENT EXERCISE

PRE ENGAGEMENT EXERCISE

Uploaded by

Thandoe DubeCopyright:

Available Formats

You might also like

- Keystone Church Bond ProposalDocument77 pagesKeystone Church Bond ProposalwatchkeepNo ratings yet

- F8. Short CasesDocument10 pagesF8. Short CasesMuhammad TahaNo ratings yet

- Chapter 14 - Test BankDocument13 pagesChapter 14 - Test Bankgilli1trNo ratings yet

- AC 205 Group Assignment 2022 - 23Document5 pagesAC 205 Group Assignment 2022 - 23Tonie NascentNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- Rating Action - Moodys-downgrades-InfraBuilds-ratings-to-Caa1-outlook-negative - 08dec21Document5 pagesRating Action - Moodys-downgrades-InfraBuilds-ratings-to-Caa1-outlook-negative - 08dec21vulture212No ratings yet

- BYJUS Case StudyDocument18 pagesBYJUS Case Studyshaleen bansalNo ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- ACCA AAA (UK) Past Papers - B1bf. Typical Threats - ACOWtancy TextbookDocument9 pagesACCA AAA (UK) Past Papers - B1bf. Typical Threats - ACOWtancy TextbookDavid JohnNo ratings yet

- MCPCR - Individual Assignment - Akshay Lal - GS23NS010Document13 pagesMCPCR - Individual Assignment - Akshay Lal - GS23NS010akshaylal911No ratings yet

- Audit QuestionsDocument7 pagesAudit QuestionsTanya TanyaNo ratings yet

- Aa Ma 2022Document5 pagesAa Ma 2022M Kazi ShuvoNo ratings yet

- Term PaperDocument12 pagesTerm PapersakilahmedrezaofficialNo ratings yet

- AUDIT AND ASSURANCE - ND-2021 - Suggested AnswersDocument12 pagesAUDIT AND ASSURANCE - ND-2021 - Suggested AnswersMehedi Hasan TouhidNo ratings yet

- Audited Financials With Auditors Report EKC International FZE FY 2018 19Document34 pagesAudited Financials With Auditors Report EKC International FZE FY 2018 19nader elsayedNo ratings yet

- Af210 - Major Assignment Essay 2023Document17 pagesAf210 - Major Assignment Essay 2023Avashnita ElakshiNo ratings yet

- Reverse MergerDocument24 pagesReverse MergerOmkar PandeyNo ratings yet

- Factiva 20230109 1309Document6 pagesFactiva 20230109 1309david kusumaNo ratings yet

- Auditing and AssuranceDocument15 pagesAuditing and AssuranceWanambisi JnrNo ratings yet

- Law T4Document8 pagesLaw T4Badhrinath ShanmugamNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document18 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Suryanarayan RajanalaNo ratings yet

- July 2021 Suggested AnswersDocument18 pagesJuly 2021 Suggested Answersamanpanjwani28No ratings yet

- Suggested Answers Compiler May 2018 To July 2021Document113 pagesSuggested Answers Compiler May 2018 To July 2021rabin067khatriNo ratings yet

- CA Inter Audit Suggested Answer May 2022Document18 pagesCA Inter Audit Suggested Answer May 2022Henry RobinsonNo ratings yet

- Ford Rhodes Parks Co LLP: Chartered AccountantsDocument14 pagesFord Rhodes Parks Co LLP: Chartered Accountantsadipawar2824No ratings yet

- Mode of Entry Into BangladeshDocument10 pagesMode of Entry Into BangladeshMonir ZamanNo ratings yet

- PP Ga Module 2 Dec 2023Document82 pagesPP Ga Module 2 Dec 2023Sakshi GuptaNo ratings yet

- CPB Newsletter No. 12 - Dec 2022Document7 pagesCPB Newsletter No. 12 - Dec 2022Kavish SobronNo ratings yet

- CF 9Document7 pagesCF 9gitabem380No ratings yet

- Suggested Answer of Case Study (CS)Document19 pagesSuggested Answer of Case Study (CS)FarhadNo ratings yet

- ResearchDocument77 pagesResearchSakshi GuptaNo ratings yet

- Update - The Independent Directors-Dawn of A New Era Vis-à-Vis Opportunities For ProfessionalsDocument15 pagesUpdate - The Independent Directors-Dawn of A New Era Vis-à-Vis Opportunities For ProfessionalsAnil GurmukhaniNo ratings yet

- Fin MG Ass 3Document6 pagesFin MG Ass 3Immanuel KadziweNo ratings yet

- Management and Financial Accounting Assignment 1Document17 pagesManagement and Financial Accounting Assignment 1Aretha MwaleNo ratings yet

- 2023 AFRM1 Question BankDocument8 pages2023 AFRM1 Question BankKieu Anh Bui LeNo ratings yet

- To Take Into Account 2Document12 pagesTo Take Into Account 2Anii HurtadoNo ratings yet

- ISQM 1 TutorialDocument7 pagesISQM 1 TutorialThandoe DubeNo ratings yet

- AuditingDocument2 pagesAuditingfbicia218No ratings yet

- Session 04 Eco AnswDocument3 pagesSession 04 Eco AnswParvathaneni KarishmaNo ratings yet

- Shree Gautam Construction Co. Ltd.Document7 pagesShree Gautam Construction Co. Ltd.Tanya SNo ratings yet

- The Bombay Dyeing & Manufacturing Company LimitedDocument5 pagesThe Bombay Dyeing & Manufacturing Company LimitedvaishnaviNo ratings yet

- 247 Customer Private LimitedDocument7 pages247 Customer Private Limitednayabrasul208No ratings yet

- MGT507 Company Law AssignmentDocument51 pagesMGT507 Company Law AssignmentWaiMan Tham100% (2)

- Wbhidco Kolkata TenderDocument24 pagesWbhidco Kolkata Tendershafaquesameen2001No ratings yet

- 6 Corporate Laws and Practices ND2020Document4 pages6 Corporate Laws and Practices ND2020Srikrishna DharNo ratings yet

- Bmo Business Plan FeesDocument8 pagesBmo Business Plan FeesexllctqvfNo ratings yet

- AAA Assignment 1Document3 pagesAAA Assignment 1asif rahmatNo ratings yet

- CitiDocument168 pagesCitiandre.torresNo ratings yet

- SHri FY20Document28 pagesSHri FY2053crx1fnocNo ratings yet

- Aditya Goswami: Black Box LimitedDocument16 pagesAditya Goswami: Black Box LimitedMannu SinghNo ratings yet

- ICAB Application Level Audit Assurance May Jun 2016Document4 pagesICAB Application Level Audit Assurance May Jun 2016Bizness Zenius HantNo ratings yet

- COVID Impact On StartupsDocument6 pagesCOVID Impact On StartupsNAVYASHREE B 1NC21BA050No ratings yet

- Assignment 2 BACC205 - 2022Document3 pagesAssignment 2 BACC205 - 2022tawandaNo ratings yet

- Joint Forum of Unions and Association of Employees & Officers in Public Sector General Insurance Companies (Jftu - Psgics)Document5 pagesJoint Forum of Unions and Association of Employees & Officers in Public Sector General Insurance Companies (Jftu - Psgics)Raj singhNo ratings yet

- AUDIT & ASSURANCE - ND-2023 - QuestionDocument6 pagesAUDIT & ASSURANCE - ND-2023 - QuestionusmanbfaizNo ratings yet

- Lse PLS 2018Document85 pagesLse PLS 2018gaja babaNo ratings yet

- Study of The Insolvency and Bankruptcy Code 2016Document15 pagesStudy of The Insolvency and Bankruptcy Code 2016Devansh DoshiNo ratings yet

- MOBILYDocument18 pagesMOBILYAnis RushamNo ratings yet

- HW Chap 1 - Thuong NguyenDocument3 pagesHW Chap 1 - Thuong NguyenThuong NguyenNo ratings yet

- HW Chap 1 - Thuong NguyenDocument3 pagesHW Chap 1 - Thuong NguyenThuong NguyenNo ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Total Quality notes -WPS OfficeDocument2 pagesTotal Quality notes -WPS OfficeThandoe DubeNo ratings yet

- Cresent FCF SolutionDocument3 pagesCresent FCF SolutionThandoe DubeNo ratings yet

- 7 Lease vs BuyDocument12 pages7 Lease vs BuyThandoe DubeNo ratings yet

- Substantive Procedures-Payroll CycleDocument2 pagesSubstantive Procedures-Payroll CycleThandoe DubeNo ratings yet

- Introduction To Financial Sytem and Financial MarketDocument9 pagesIntroduction To Financial Sytem and Financial MarketshanksNo ratings yet

- Fria and Amla CasesDocument3 pagesFria and Amla CasesdingNo ratings yet

- Role and Impact of Fiis On Indian Capital MarketDocument78 pagesRole and Impact of Fiis On Indian Capital MarketFarhan KhanNo ratings yet

- Groww Stock Account Opening FormDocument21 pagesGroww Stock Account Opening FormNikhilNo ratings yet

- CV AltmanDocument24 pagesCV AltmanbrieNo ratings yet

- Knit Gallery India Private Limited: Rating AdvisoryDocument9 pagesKnit Gallery India Private Limited: Rating AdvisoryKarthikeyan RK SwamyNo ratings yet

- Foreign Investment 1991 RA 7042Document44 pagesForeign Investment 1991 RA 7042MikhailFAbzNo ratings yet

- Satyasai Pressure Vessels Limited - DRHP - 20190315113804Document412 pagesSatyasai Pressure Vessels Limited - DRHP - 20190315113804SubscriptionNo ratings yet

- MakalahDocument16 pagesMakalahLisa LalisaNo ratings yet

- SFP Tech Holdings 20230814 HLIBDocument4 pagesSFP Tech Holdings 20230814 HLIBkim heeNo ratings yet

- Equity Strategy Brazil 20210526Document4 pagesEquity Strategy Brazil 20210526Renan Dantas SantosNo ratings yet

- Askri BankDocument17 pagesAskri Bankanon_772670No ratings yet

- JVG ScamDocument2 pagesJVG ScamAditi AgrawalNo ratings yet

- Capital Market ManagementDocument28 pagesCapital Market ManagementJenina Rose SalvadorNo ratings yet

- Banking and Financial InstitutionDocument48 pagesBanking and Financial InstitutionMylene Orain SevillaNo ratings yet

- Chapter 01 - A Modern Financial System An OverviewDocument49 pagesChapter 01 - A Modern Financial System An OverviewEdden CloudNo ratings yet

- ETFS Fact Sheet-Gold Bullion SecuritiesDocument2 pagesETFS Fact Sheet-Gold Bullion SecuritiesamethystNo ratings yet

- Car FinanceDocument32 pagesCar FinanceAshish V Meshram0% (1)

- Consolidated2010 FinalDocument79 pagesConsolidated2010 FinalHammna AshrafNo ratings yet

- Debt MarketDocument26 pagesDebt Marketamitsingla19100% (1)

- Bcom Professional Semester V To Vi GnduDocument63 pagesBcom Professional Semester V To Vi GnduAnkx Gagan JaitewaliaNo ratings yet

- Securities & Exchange Board of IndiaDocument16 pagesSecurities & Exchange Board of Indiashivakumar NNo ratings yet

- CISI Exemptions Policy: Section 1 - Introduction 2Document4 pagesCISI Exemptions Policy: Section 1 - Introduction 2Jayjay FNo ratings yet

- Fundamentals of Accounting, Business and Management 2Document86 pagesFundamentals of Accounting, Business and Management 2Derek Jason DomanilloNo ratings yet

- SHA FormatDocument32 pagesSHA Formatajay khandelwalNo ratings yet

- CIMB - DaybreakDocument10 pagesCIMB - DaybreakThomas Lau100% (3)

- Report On Sumeru Securities PVT LTD 3Document29 pagesReport On Sumeru Securities PVT LTD 3sagar timilsinaNo ratings yet

- 1 Mutual FundDocument5 pages1 Mutual FundPerez Heart LynnNo ratings yet

PRE ENGAGEMENT EXERCISE

PRE ENGAGEMENT EXERCISE

Uploaded by

Thandoe DubeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PRE ENGAGEMENT EXERCISE

PRE ENGAGEMENT EXERCISE

Uploaded by

Thandoe DubeCopyright:

Available Formats

PRE-ENGAGEMENT ACTIVITIES CLASS EXERCISE

All amounts exclude VAT unless otherwise stated

Blue Limited (hereafter “Blue") is a technology company incorporated in terms of the

Companies and Other Business Entities Act in Zimbabwe. It sets out to comply with all

regulations passed by the government and its main regulatory body is the Securities and

Exchange Commission (SEC). It was initially formed by Mr. Blue, who is still the majority

shareholder, to establish and operate a central securities depository (CSD) for the Zimbabwe

securities industry and has been doing so since its inception in 2009.

A CSD is a specialised financial organisation holding securities like shares in either certified or

uncertified forms and operates an electronic book entry system to record and maintain

securities and to register their transfer. They allow ownership of securities to be easily

transferred in the book-entry form as opposed to physically just like how money is kept in the

form of electronic credits in any bank account. In a CSD system, ownership will be changed as

soon as securities move from one investor account to another. The system is purely a

settlement vehicle for transactions that have been traded on a registered securities exchange.

Blue then charges a fee for holding the securities and for each transfer done. The Blue CSD is

currently used on both the Zimbabwe Stock Exchange (ZSE) and Victoria Falls Stock Exchange

(VFEX).

Though the current Zimbabwe economic climate has become turbulent with an incessant rise

in inflation, people have resorted to alternate investment platforms which have seen the

growing demand for Blue’s products. With the lucrative nature of the securities industry, more

companies have been formed that offer similar services. Though the companies are small, and

Blue has an established market share, the threat of competition is believed to be high as their

projected growth in 2022 has been stalled. From preliminary assessments that have been

made Blue’s projected growth in 2022 has stalled because of the growth in competition.

To combat the threat, Blue is in the process of obtaining a loan to boost its cash reserves and

make capital investments to improve the speed and efficiency of its product sales across the

country. Blue would want to adopt their current Vision application this a trading platform

which will be able to allow users and CSD holders to be able to trade on the application

instantly. They would also want to accommodate the new derivatives and forwards

© Chartered Accountants Academy 2023 P a g e | 1 of 7

PRE-ENGAGEMENT ACTIVITIES CLASS EXERCISE

introduced on the ZSE. Management of Blue is eager to get the ball rolling with the project

and has appointed a small audit firm called Batista Chartered Accountants (BCA) to perform

their audit so they can complete their loan application.

BCA is headed by the sole and lead partner Mr. Batista, Chartered Accountant Zimbabwe

(CA(Z)). It was formed 3 years ago, and Mr. Batista has been using his industry experience to

gain access to clients he once worked with before. He had once been the senior accountant at

one of the companies owned by Mr. Blue, Top Freezers which is outside the Blue group of

companies. You are a supervisor at BCA and have worked at the firm since its inception after

successfully passing your Certificate in the Theory of Accounting. The following information

has been documented for you to begin your audit for the 30 June 2022 year-end.

1. Understanding the business and Operating Environment of Blue

To access the loan, Blue is required to produce audited financial statements. Blue had last been

audited in 2020. The last auditors of Blue were Rendall Keagan Owen Chartered Accountants

(RKO) and they had audited Blue from its inception. RKO had been told to stop the audit in the

mid-2020 year of assessment as new management in the form of theappointed Chief Executive

Officer (CEO), Ms Nyarai Blue (daughter of the majority shareholderof Blue) had said there was

no benefit from an audit. Ms Nyarai had just finished her master’sdegree in Communication

Studies when she was appointed to the helm of the company. Newspaper reports have

revealed some shareholders disputed the move but were outmuscledby Mr. Blue’s influence.

Blue has thus requested BCA auditors to be their auditors and to auditjust the 2022 year of

assessment results. Blue management has stressed the importance of completing the audit in

3 weeks as they would want to get their loan as soon as possible and meet deadlines for

payments for the goods they had paid a deposit for.

BCA made a 6-member team comprising of two 1st year trainees, a 2nd-year supervisor,

yourself, 1 manager, Ms Lola CA(Z) and the partner of BCA, Mr. Batista CA(Z). For the 2

trainees, this will be their first audit as they recently joined the firm after completing their

undergraduate studies at a local university. Mr. Batista was excited about the coming in of

Blue to his portfolio as he was also an investor on the ZSE and VFEX. The inside information he

would likely get from being able to see the inner workings of the company would get him

© Chartered Accountants Academy 2023 P a g e | 2 of 7

PRE-ENGAGEMENT ACTIVITIES CLASS EXERCISE

access to privileged information he could use on his trades. Mr. Batista had instructed Ms Lola

to sign the engagement letter and complete the rest of the client acceptance process as he

was occupied with the finalisation of their previous client. Ms Lola expressed her reservations

about starting the audit when everything was not in order, but Mr. Batista explicitly stated

that there was a reason he was a partner and her still a manager.

The current recruitment strategy for Blue is to tie employees into long-term contracts when

they are still students. Students will sign binding contracts which stipulate that they will have

to work for Blue 5 years post graduating. This is mostly done for coders and finance graduates

that work within Blue. The employees also have a restraint of trade which limits their

movement to work for other companies immediately after completing their 5-year terms. They

are paid below market average salaries and work excessive hours so that Blue can boost its

bottom line and shareholder value with ease.

In an emergency board meeting held in July 2022 it was discovered that the security patch

from the firewall for the Blue database had been compromised. The board had last met to

discuss information technology (IT) related issues in 2020. The Blue database stores all client

information. The IT department proposed two solutions to the board:

1. One which was capital intensive and would lead to an instant fix of the breach, or

2. A series of patches that would be done over the coming year and would gradually

close the breach.

The patches solution would be safe if there was no advanced hacker to the system.

Additionally, as part of the IT policy, all physical computer hardware of the company is

collected and destroyed and burnt at a landfill to confirm all data is adequately erased and no

one can reuse it.

2. Proposed Auditors Compensation

The audit of Blue would be ZWL2.5 billion. For the year-to-date BCA had already made ZWL11

billion from other engagements and was not looking to work on any other clients for the rest

of the year due to resource constraints. On top of the ZWL2.5 billion payable to BCA, they

© Chartered Accountants Academy 2023 P a g e | 3 of 7

PRE-ENGAGEMENT ACTIVITIES CLASS EXERCISE

would also get 0.5% of the loan amount as a bonus provided the audited financials grant Blue

the loan.

The contract with Blue also granted BCA, the job/assignment to perform the IFRS 16 and IFRS

9 updates for Blue. This would be done by a separate two-man team within BCA. The partners

and the audit team would also be granted an all-expense paid trip to Kingdom Hotel in Victoria

Falls at the end of the audit which is the same week of the annual general meeting at Blue so

that the partner would have an excuse for not attending the annual general meeting.

In a bid to build the expertise of their employees, BCA also struck an irrevocable deal that

would grant the firm audit status until the end of the 8 years and that Blue would second some

of their staff to BCA so they will become more well-versed with preparing for an audit. Batista

was very happy with the secondment option as it would help increase the resources, he has

access to.

3. Directors Loans

Ms Becky the Vision business unit managing director was granted a loan by Blue to go to the

Bahamas for an all-expense paid trip with her family. She had cited that she needed to refresh

so she could work at her best ability. The loan was granted at a meeting held on the 1st of July

2021 during a golf tournament where the Blue finance director Mr. Dolph CA(Z) and blue

operations director Mr. Lashley were present. It was granted in July 2021 and is still payable

at year-end.

At the same tournament, Mr. Lashley discussed his intentions to purchase additional shares

within Blue, but he lacked the funding. Mr. Dolph made the loan to Mr. Lashley using Blue

funds in March 2022. The loan is still unpaid, and no paperwork has been drawn up.

4. The Vision Business Unit

To utilise synergies within different industries and to grow the company Blue has also

purchased several subsidiaries. Blue also established an app development Strategic Business

Unit (SBU) that creates a mobile app. The flagship application is called Vision which facilitates

© Chartered Accountants Academy 2023 P a g e | 4 of 7

PRE-ENGAGEMENT ACTIVITIES CLASS EXERCISE

cryptocurrency1 trades for Zimbabweans and allows them access to the diverse and growing

cryptocurrency market. Zimbabweans deposit their money into their account and the Vision

would link the buyer to a seller of cryptocurrency with ease. The Vision app also allows money

transfer within Zimbabwe where users can collect transferred money with any registered

supermarket in Zimbabwe as they have a standing agreement and have invested in collection

booths across the country.

On 18 June 2022, the Reserve Bank of Zimbabwe released an overnight announcement stating

that they had with immediate effect banned the use of cryptocurrency in the country as they

posed major risks to the Zimbabwean populace and the global prices of the currency were on

an unstoppable downfall reducing Zimbabweans investments to nothing. It was unregulated

and unsafe. The following information was availed concerning the Vision business unit.

The Vision business unit consists of the following assets and liabilities which represent the

smallest group of assets that generate cash flows independently from other assets. The Vision

has 3 assets and 1 liability listed below as of 18 June 2022:

Vision Application

The Vision application was internally generated and had cost Blue ZWL800 million in the

research of the project and ZWL1.2 billion to develop. This was done and completed on 30

June 2020 and the asset was estimated to have a useful life of 10 years. Technology is

disruptive and this estimate of 10 years was revised to 8 years on 30 June 2021.

Goodwill

Goodwill arose from a business combination where Blue acquired 100% of Stone-Cold

Developers for ZWL10 billion which resulted in goodwill of ZWL250 million. Management has

determined that the Vision is attributable to 58% of the said goodwill.

1

Cryptocurrency is a digital currency designed to work as a medium of exchange through a computer network

that is not reliant on any central authority, such as a government or bank, to uphold or maintain it

© Chartered Accountants Academy 2023 P a g e | 5 of 7

PRE-ENGAGEMENT ACTIVITIES CLASS EXERCISE

Servers

The Servers were bought on 10 January 2018 for ZWL460 million from Wanda Technology. The

special nature of the servers’ batteries requires them to be recycled to avoid damage to the

environment as stated in the Zimbabwe National Policy for Information and Communications

Technology. The recycling will cost Blue ZWL47 million in 2030.

Trade Payables

These constitute chip suppliers and other small goods suppliers worth ZWL220 million.

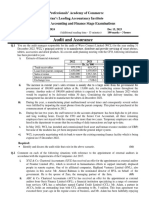

Below are the different computations for the recoverable amount of the Vision CGU that have

been done. The recoverable amounts do not include the effects of any liabilities that have

been recognised.

Pre-tax discount rate Risk-adjusted Cash flows Risk-adjusted Cash flows

including future excluding future

enhancements to Vision enhancements to Vision

11% - factoring risk ZWL 1.6 billion ZWL1.79 billion

adjustment

9% - excluding risk ZWL1.8 billion ZWL1.95 billion

adjustment

5. Email extract from junior auditor just before the year-end

After the company’s year-end but before the financial statements were authorised for

issue Mr. Dolph CA(Z) was presented with the urgent findings from the Blue Monitoring

Committee. It was uncovered through an anonymous tip that the Committee found

that Mr. Lashley had been making payments to Mr. Taker a compliance officer of the

SEC. The payments were being made to a company named Shellax which was found to

be wholly owned by Mr. Taker. Blue had been making payments to Shellax Limited for

several years and the payment requisitions made weredescribed as computer chips that

are now outdated in Blue’s operations. The paymentsappear to be for Blue’s license

renewal as this was one of the key

© Chartered Accountants Academy 2023 P a g e | 6 of 7

PRE-ENGAGEMENT ACTIVITIES CLASS EXERCISE

responsibilities of Mr. Lashley’s office. Mr. Lashley had in prior years been awarded

bonuses for how he always ensured Blue’s operations always received their license well

in time. The Committee verified the information in the tip-off and has brought theissue

to your office for assistance.

Additional information

• All companies account for Property Plant and Equipment and Intangible Assets using

the cost model of IAS 16 and IAS 38 respectively.

• Income tax is levied as per the Income tax Act at 24.72%. Capital Gains tax is levied as

per the CGT Act and the Finance Act. Value added tax is levied as per the VAT Act.

• Assume a pre-tax discount rate of 10% if it is not specifically stated.

Marks

REQUIRED Sub-

Total

total

A. Describe the factors that need to be considered by BCA before

accepting Blue as an audit client. 14

• Exclude information from the audit compensation section.

Communication Skills – Clarity of expression 1 15

© Chartered Accountants Academy 2023 P a g e | 7 of 7

You might also like

- Keystone Church Bond ProposalDocument77 pagesKeystone Church Bond ProposalwatchkeepNo ratings yet

- F8. Short CasesDocument10 pagesF8. Short CasesMuhammad TahaNo ratings yet

- Chapter 14 - Test BankDocument13 pagesChapter 14 - Test Bankgilli1trNo ratings yet

- AC 205 Group Assignment 2022 - 23Document5 pagesAC 205 Group Assignment 2022 - 23Tonie NascentNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- Rating Action - Moodys-downgrades-InfraBuilds-ratings-to-Caa1-outlook-negative - 08dec21Document5 pagesRating Action - Moodys-downgrades-InfraBuilds-ratings-to-Caa1-outlook-negative - 08dec21vulture212No ratings yet

- BYJUS Case StudyDocument18 pagesBYJUS Case Studyshaleen bansalNo ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- ACCA AAA (UK) Past Papers - B1bf. Typical Threats - ACOWtancy TextbookDocument9 pagesACCA AAA (UK) Past Papers - B1bf. Typical Threats - ACOWtancy TextbookDavid JohnNo ratings yet

- MCPCR - Individual Assignment - Akshay Lal - GS23NS010Document13 pagesMCPCR - Individual Assignment - Akshay Lal - GS23NS010akshaylal911No ratings yet

- Audit QuestionsDocument7 pagesAudit QuestionsTanya TanyaNo ratings yet

- Aa Ma 2022Document5 pagesAa Ma 2022M Kazi ShuvoNo ratings yet

- Term PaperDocument12 pagesTerm PapersakilahmedrezaofficialNo ratings yet

- AUDIT AND ASSURANCE - ND-2021 - Suggested AnswersDocument12 pagesAUDIT AND ASSURANCE - ND-2021 - Suggested AnswersMehedi Hasan TouhidNo ratings yet

- Audited Financials With Auditors Report EKC International FZE FY 2018 19Document34 pagesAudited Financials With Auditors Report EKC International FZE FY 2018 19nader elsayedNo ratings yet

- Af210 - Major Assignment Essay 2023Document17 pagesAf210 - Major Assignment Essay 2023Avashnita ElakshiNo ratings yet

- Reverse MergerDocument24 pagesReverse MergerOmkar PandeyNo ratings yet

- Factiva 20230109 1309Document6 pagesFactiva 20230109 1309david kusumaNo ratings yet

- Auditing and AssuranceDocument15 pagesAuditing and AssuranceWanambisi JnrNo ratings yet

- Law T4Document8 pagesLaw T4Badhrinath ShanmugamNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document18 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Suryanarayan RajanalaNo ratings yet

- July 2021 Suggested AnswersDocument18 pagesJuly 2021 Suggested Answersamanpanjwani28No ratings yet

- Suggested Answers Compiler May 2018 To July 2021Document113 pagesSuggested Answers Compiler May 2018 To July 2021rabin067khatriNo ratings yet

- CA Inter Audit Suggested Answer May 2022Document18 pagesCA Inter Audit Suggested Answer May 2022Henry RobinsonNo ratings yet

- Ford Rhodes Parks Co LLP: Chartered AccountantsDocument14 pagesFord Rhodes Parks Co LLP: Chartered Accountantsadipawar2824No ratings yet

- Mode of Entry Into BangladeshDocument10 pagesMode of Entry Into BangladeshMonir ZamanNo ratings yet

- PP Ga Module 2 Dec 2023Document82 pagesPP Ga Module 2 Dec 2023Sakshi GuptaNo ratings yet

- CPB Newsletter No. 12 - Dec 2022Document7 pagesCPB Newsletter No. 12 - Dec 2022Kavish SobronNo ratings yet

- CF 9Document7 pagesCF 9gitabem380No ratings yet

- Suggested Answer of Case Study (CS)Document19 pagesSuggested Answer of Case Study (CS)FarhadNo ratings yet

- ResearchDocument77 pagesResearchSakshi GuptaNo ratings yet

- Update - The Independent Directors-Dawn of A New Era Vis-à-Vis Opportunities For ProfessionalsDocument15 pagesUpdate - The Independent Directors-Dawn of A New Era Vis-à-Vis Opportunities For ProfessionalsAnil GurmukhaniNo ratings yet

- Fin MG Ass 3Document6 pagesFin MG Ass 3Immanuel KadziweNo ratings yet

- Management and Financial Accounting Assignment 1Document17 pagesManagement and Financial Accounting Assignment 1Aretha MwaleNo ratings yet

- 2023 AFRM1 Question BankDocument8 pages2023 AFRM1 Question BankKieu Anh Bui LeNo ratings yet

- To Take Into Account 2Document12 pagesTo Take Into Account 2Anii HurtadoNo ratings yet

- ISQM 1 TutorialDocument7 pagesISQM 1 TutorialThandoe DubeNo ratings yet

- AuditingDocument2 pagesAuditingfbicia218No ratings yet

- Session 04 Eco AnswDocument3 pagesSession 04 Eco AnswParvathaneni KarishmaNo ratings yet

- Shree Gautam Construction Co. Ltd.Document7 pagesShree Gautam Construction Co. Ltd.Tanya SNo ratings yet

- The Bombay Dyeing & Manufacturing Company LimitedDocument5 pagesThe Bombay Dyeing & Manufacturing Company LimitedvaishnaviNo ratings yet

- 247 Customer Private LimitedDocument7 pages247 Customer Private Limitednayabrasul208No ratings yet

- MGT507 Company Law AssignmentDocument51 pagesMGT507 Company Law AssignmentWaiMan Tham100% (2)

- Wbhidco Kolkata TenderDocument24 pagesWbhidco Kolkata Tendershafaquesameen2001No ratings yet

- 6 Corporate Laws and Practices ND2020Document4 pages6 Corporate Laws and Practices ND2020Srikrishna DharNo ratings yet

- Bmo Business Plan FeesDocument8 pagesBmo Business Plan FeesexllctqvfNo ratings yet

- AAA Assignment 1Document3 pagesAAA Assignment 1asif rahmatNo ratings yet

- CitiDocument168 pagesCitiandre.torresNo ratings yet

- SHri FY20Document28 pagesSHri FY2053crx1fnocNo ratings yet

- Aditya Goswami: Black Box LimitedDocument16 pagesAditya Goswami: Black Box LimitedMannu SinghNo ratings yet

- ICAB Application Level Audit Assurance May Jun 2016Document4 pagesICAB Application Level Audit Assurance May Jun 2016Bizness Zenius HantNo ratings yet

- COVID Impact On StartupsDocument6 pagesCOVID Impact On StartupsNAVYASHREE B 1NC21BA050No ratings yet

- Assignment 2 BACC205 - 2022Document3 pagesAssignment 2 BACC205 - 2022tawandaNo ratings yet

- Joint Forum of Unions and Association of Employees & Officers in Public Sector General Insurance Companies (Jftu - Psgics)Document5 pagesJoint Forum of Unions and Association of Employees & Officers in Public Sector General Insurance Companies (Jftu - Psgics)Raj singhNo ratings yet

- AUDIT & ASSURANCE - ND-2023 - QuestionDocument6 pagesAUDIT & ASSURANCE - ND-2023 - QuestionusmanbfaizNo ratings yet

- Lse PLS 2018Document85 pagesLse PLS 2018gaja babaNo ratings yet

- Study of The Insolvency and Bankruptcy Code 2016Document15 pagesStudy of The Insolvency and Bankruptcy Code 2016Devansh DoshiNo ratings yet

- MOBILYDocument18 pagesMOBILYAnis RushamNo ratings yet

- HW Chap 1 - Thuong NguyenDocument3 pagesHW Chap 1 - Thuong NguyenThuong NguyenNo ratings yet

- HW Chap 1 - Thuong NguyenDocument3 pagesHW Chap 1 - Thuong NguyenThuong NguyenNo ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Total Quality notes -WPS OfficeDocument2 pagesTotal Quality notes -WPS OfficeThandoe DubeNo ratings yet

- Cresent FCF SolutionDocument3 pagesCresent FCF SolutionThandoe DubeNo ratings yet

- 7 Lease vs BuyDocument12 pages7 Lease vs BuyThandoe DubeNo ratings yet

- Substantive Procedures-Payroll CycleDocument2 pagesSubstantive Procedures-Payroll CycleThandoe DubeNo ratings yet

- Introduction To Financial Sytem and Financial MarketDocument9 pagesIntroduction To Financial Sytem and Financial MarketshanksNo ratings yet

- Fria and Amla CasesDocument3 pagesFria and Amla CasesdingNo ratings yet

- Role and Impact of Fiis On Indian Capital MarketDocument78 pagesRole and Impact of Fiis On Indian Capital MarketFarhan KhanNo ratings yet

- Groww Stock Account Opening FormDocument21 pagesGroww Stock Account Opening FormNikhilNo ratings yet

- CV AltmanDocument24 pagesCV AltmanbrieNo ratings yet

- Knit Gallery India Private Limited: Rating AdvisoryDocument9 pagesKnit Gallery India Private Limited: Rating AdvisoryKarthikeyan RK SwamyNo ratings yet

- Foreign Investment 1991 RA 7042Document44 pagesForeign Investment 1991 RA 7042MikhailFAbzNo ratings yet

- Satyasai Pressure Vessels Limited - DRHP - 20190315113804Document412 pagesSatyasai Pressure Vessels Limited - DRHP - 20190315113804SubscriptionNo ratings yet

- MakalahDocument16 pagesMakalahLisa LalisaNo ratings yet

- SFP Tech Holdings 20230814 HLIBDocument4 pagesSFP Tech Holdings 20230814 HLIBkim heeNo ratings yet

- Equity Strategy Brazil 20210526Document4 pagesEquity Strategy Brazil 20210526Renan Dantas SantosNo ratings yet

- Askri BankDocument17 pagesAskri Bankanon_772670No ratings yet

- JVG ScamDocument2 pagesJVG ScamAditi AgrawalNo ratings yet

- Capital Market ManagementDocument28 pagesCapital Market ManagementJenina Rose SalvadorNo ratings yet

- Banking and Financial InstitutionDocument48 pagesBanking and Financial InstitutionMylene Orain SevillaNo ratings yet

- Chapter 01 - A Modern Financial System An OverviewDocument49 pagesChapter 01 - A Modern Financial System An OverviewEdden CloudNo ratings yet

- ETFS Fact Sheet-Gold Bullion SecuritiesDocument2 pagesETFS Fact Sheet-Gold Bullion SecuritiesamethystNo ratings yet

- Car FinanceDocument32 pagesCar FinanceAshish V Meshram0% (1)

- Consolidated2010 FinalDocument79 pagesConsolidated2010 FinalHammna AshrafNo ratings yet

- Debt MarketDocument26 pagesDebt Marketamitsingla19100% (1)

- Bcom Professional Semester V To Vi GnduDocument63 pagesBcom Professional Semester V To Vi GnduAnkx Gagan JaitewaliaNo ratings yet

- Securities & Exchange Board of IndiaDocument16 pagesSecurities & Exchange Board of Indiashivakumar NNo ratings yet

- CISI Exemptions Policy: Section 1 - Introduction 2Document4 pagesCISI Exemptions Policy: Section 1 - Introduction 2Jayjay FNo ratings yet

- Fundamentals of Accounting, Business and Management 2Document86 pagesFundamentals of Accounting, Business and Management 2Derek Jason DomanilloNo ratings yet

- SHA FormatDocument32 pagesSHA Formatajay khandelwalNo ratings yet

- CIMB - DaybreakDocument10 pagesCIMB - DaybreakThomas Lau100% (3)

- Report On Sumeru Securities PVT LTD 3Document29 pagesReport On Sumeru Securities PVT LTD 3sagar timilsinaNo ratings yet

- 1 Mutual FundDocument5 pages1 Mutual FundPerez Heart LynnNo ratings yet