Professional Documents

Culture Documents

CAMELS FRAMEWORK

CAMELS FRAMEWORK

Uploaded by

VIPLAV SRIVASTAVCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAMELS FRAMEWORK

CAMELS FRAMEWORK

Uploaded by

VIPLAV SRIVASTAVCopyright:

Available Formats

CAMELS FRAMEWORK

CAMELS is an international rating system used by regulatory banking authorities to

rate financial institutions. The acronym CAMELS stands for the following six factors

that examiners use to rate financial institutions

1. Capital adequacy,

2. Asset quality,

3. Management,

4. Earnings,

5. Liquidity, and

6. Sensitivity.

The rating system is on a scale of one to five, with one being the best rating and five

being the worst rating. (Just keep in mind that a lower rating is better, indicating a

more financially stable, less at-risk bank.)

Capital adequacy assesses an institution’s compliance with regulations on the

minimum capital reserve amount. Regulators establish the rating by assessing the

financial institution’s capital position currently and over several years. Future capital

position is predicted based on the institution’s plans for the future, such as whether

they are planning to give out dividends or acquire another company.

Assets: This category assesses the quality of a bank’s assets. Asset quality is

important, as the value of assets can decrease rapidly if they are high risk. For

example, loans are a type of asset that can become impaired if money is lent to a high-

risk individual. The prime motto is to ascertain component of NPA as a percentage of

total assets. In other words, asset quality indicates the type of debtors the bank is

having.

MANAGEMENT CAPABILITY: Management capability measures the ability of an

institution’s management team to identify and then react to financial stress. The

category depends on the quality of a bank’s business strategy, financial performance,

and internal controls. In the business strategy and financial performance area, the

CAMELS examiner looks at the institution’s plans for the next few years. It includes

the capital accumulation rate, growth rate, and identification of the major risks.

EARNINGS: A bank's ability to produce earnings to be able to sustain its activities,

expand, and remain competitive is a key factor in rating its continued viability. The

examiner specifically looks at the stability of earnings, return on assets (ROA), net

interest margin (NIM), and future earnings prospects under harsh economic

conditions.

LIQUIDITY: For banks, liquidity is especially important, as the lack of liquid capital

can lead to a bank run. This category of CAMELS examines the interest rate risk and

liquidity risk. Interest rates affect the earnings from a bank’s business segment. If the

exposure to interest rate risk is large, then the institution’s investment and loan

portfolio value will be volatile. Liquidity risk is defined as the risk of not being able to

meet present or future cash flow needs without affecting day-to-day operations.

SENSIVITY: Sensitivity is the last category and measures an institution’s sensitivity to

market risks. Sensitivity reflects the degree to which earnings are affected by interest

rates, exchange rates, and commodity prices etc.

Q: Explain CAMELS framework.

The CAMELS framework is a method used to assess the financial health and

performance of banks. Each letter in "CAMELS" represents a different aspect of the

evaluation:

1. C - Capital Adequacy: This evaluates how well a bank can cover its risks and

potential losses. A bank with sufficient capital is better equipped to withstand

economic downturns.

2. A - Asset Quality: This assesses the quality of a bank's loans and investments. A

bank with a high-quality asset portfolio is less likely to face significant losses.

3. M - Management Quality: This looks at the competence and effectiveness of the

bank's management team. Skilled and responsible management is crucial for a bank's

success.

4. E - Earnings Strength: This evaluates the bank's ability to generate profits over

time. Consistent and sustainable earnings are indicators of a healthy financial

institution.

5. L - Liquidity Position: This examines how easily a bank can meet its short-term

financial obligations. A bank with good liquidity can quickly convert assets into cash if

needed.

6. S - Sensitivity to Market Risk: This assesses how well a bank can manage risks

related to changes in interest rates, exchange rates, and other market factors. A bank

with effective risk management practices is better prepared for external fluctuations.

By analyzing these six key components, regulators and stakeholders can gain a

comprehensive understanding of a bank's overall condition and make informed

decisions about its stability and soundness.

You might also like

- Tape Reading 101 BookDocument62 pagesTape Reading 101 BookScott Tran88% (8)

- Pearl and CamelDocument5 pagesPearl and CamelJean Javier AbillarNo ratings yet

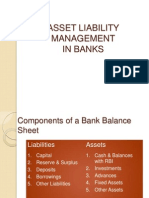

- Asset Liability ManagementDocument18 pagesAsset Liability Managementmahesh19689No ratings yet

- What Is The CAMELS Rating System?Document11 pagesWhat Is The CAMELS Rating System?poojaNo ratings yet

- Camels ReportDocument5 pagesCamels ReportMATIN SINDHINo ratings yet

- Camel Framework in Banks - Indian ScenarioDocument3 pagesCamel Framework in Banks - Indian Scenarioanjusawlani86No ratings yet

- Camel Rating FrameworkDocument3 pagesCamel Rating FrameworkAmrita GhartiNo ratings yet

- Camels RatingDocument12 pagesCamels RatingImtiaz AhmedNo ratings yet

- CAMELS Analysis - Breaking Down FinanceDocument3 pagesCAMELS Analysis - Breaking Down FinanceOlmedo FarfanNo ratings yet

- Final Ok Work1111Document33 pagesFinal Ok Work1111Ramu KhandaleNo ratings yet

- Camel: C - Capital AdequacyDocument2 pagesCamel: C - Capital AdequacybinduNo ratings yet

- Final ProjectDocument90 pagesFinal ProjectdgpatNo ratings yet

- CB AssignmentDocument6 pagesCB AssignmentVaishnavi khotNo ratings yet

- Camels RatingDocument2 pagesCamels RatingKobir HossainNo ratings yet

- CamelDocument21 pagesCamelSiva SankariNo ratings yet

- What Is The 'CAMELS Rating System'Document2 pagesWhat Is The 'CAMELS Rating System'Evita Rafaela GabineteNo ratings yet

- Camels Model of Performance Evaluation of Banks: By, Tripura, Sishira.P, S.Neha, Mythili.MDocument30 pagesCamels Model of Performance Evaluation of Banks: By, Tripura, Sishira.P, S.Neha, Mythili.MMythili MadapatiNo ratings yet

- CAMELSDocument4 pagesCAMELSRnzljy CnnynNo ratings yet

- Camels RatingDocument30 pagesCamels RatingAbhishek BarmanNo ratings yet

- FIN441 Assignment 2Document4 pagesFIN441 Assignment 2MahiraNo ratings yet

- CAMELSDocument3 pagesCAMELSImjamul HassanNo ratings yet

- Aashi Gupta (FE1702) - Prakhar Sikka (FE1730)Document12 pagesAashi Gupta (FE1702) - Prakhar Sikka (FE1730)Suprabha GambhirNo ratings yet

- CAMELS Rating SystemDocument3 pagesCAMELS Rating SystemrajchalNo ratings yet

- CAMELDocument30 pagesCAMELnguyentrinh.03032003No ratings yet

- Credit Risk Management and Performance of Banks in GhanaDocument8 pagesCredit Risk Management and Performance of Banks in GhanaHeber A.No ratings yet

- CAMELS Rating SystemDocument13 pagesCAMELS Rating SystemAbdu MohammedNo ratings yet

- "CAMEL" Rating: A Literature Review: Assignment OnDocument11 pages"CAMEL" Rating: A Literature Review: Assignment OnabrarNo ratings yet

- Camel 1Document7 pagesCamel 1Papa PappaNo ratings yet

- 3.0. Performance Measurement of Banking SectorDocument15 pages3.0. Performance Measurement of Banking SectorFarzana Akter 28No ratings yet

- How Regulators Monitor BanksDocument4 pagesHow Regulators Monitor BanksEhsanul HamidNo ratings yet

- A Study On CAMEL Concept of The Co Operative Bank SoceityDocument31 pagesA Study On CAMEL Concept of The Co Operative Bank SoceityJustin AyersNo ratings yet

- Commercial Banking System and Role of RBI - Assignment April 2023 BZesppk7IEDocument7 pagesCommercial Banking System and Role of RBI - Assignment April 2023 BZesppk7IERohit GambhirNo ratings yet

- BM 5 Bank Fund ManagementDocument11 pagesBM 5 Bank Fund ManagementKawsar Ahmed BadhonNo ratings yet

- CAMELDocument7 pagesCAMELKhanal NilambarNo ratings yet

- Chap006 Com CamelsDocument10 pagesChap006 Com CamelsDivesh SubramanyaNo ratings yet

- Camel RatingDocument12 pagesCamel RatingRaquibul HasanNo ratings yet

- Executive SummaryDocument56 pagesExecutive SummaryMurali Balaji M CNo ratings yet

- A Study of Performance Evaluation OF Top 6 Indian BanksDocument12 pagesA Study of Performance Evaluation OF Top 6 Indian BanksKeval PatelNo ratings yet

- Performance Evaluation of A Bank (CBM)Document34 pagesPerformance Evaluation of A Bank (CBM)Vineeth MudaliyarNo ratings yet

- Literature Review of Camels RatingDocument4 pagesLiterature Review of Camels Ratingea8142xb100% (1)

- CAMEL Model With Detailed Explanations and Proper FormulasDocument4 pagesCAMEL Model With Detailed Explanations and Proper FormulasHarsh AgarwalNo ratings yet

- Conceptual Framework of Camel Analysis: Chapter-1Document11 pagesConceptual Framework of Camel Analysis: Chapter-1poojaNo ratings yet

- Commercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Document8 pagesCommercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Dhruti BhatiaNo ratings yet

- CAMELS LiveOakBancsharesIncDocument20 pagesCAMELS LiveOakBancsharesIncSean BursonNo ratings yet

- Camels RatingDocument22 pagesCamels Ratingmaryam rajputtNo ratings yet

- Department of Commerce (PG) Aigs CHAPTER 1: Introduction DefinitionsDocument12 pagesDepartment of Commerce (PG) Aigs CHAPTER 1: Introduction DefinitionsRanjitha NNo ratings yet

- CAMELSDRAFTVIJAIDocument49 pagesCAMELSDRAFTVIJAIMurali Balaji M CNo ratings yet

- Camels Rating System Appendix ADocument12 pagesCamels Rating System Appendix AMuhammad AlsabriNo ratings yet

- What Is Asset and Liability ManagementDocument18 pagesWhat Is Asset and Liability ManagementRuhi KapoorNo ratings yet

- Performance Evaluation of JP Morgan Chase Bank: Sadia ZamanDocument17 pagesPerformance Evaluation of JP Morgan Chase Bank: Sadia ZamanAjith VNo ratings yet

- MonBank by KC Law 199804Document18 pagesMonBank by KC Law 199804Ka Chung Law100% (1)

- Bank SupervisionDocument91 pagesBank Supervisionabdalla osmanNo ratings yet

- MagggggiDocument24 pagesMagggggiGaniya MeghanaNo ratings yet

- Financial Analysis of A BankDocument7 pagesFinancial Analysis of A BankLourenz Mae AcainNo ratings yet

- January 2015 1420177010 13Document2 pagesJanuary 2015 1420177010 13poojaNo ratings yet

- Jhansi ProjectDocument57 pagesJhansi Projectniroshanirosha9956No ratings yet

- Kupiec 2016Document20 pagesKupiec 2016Yasir ShahzadNo ratings yet

- Term PaperDocument21 pagesTerm PaperPooja JainNo ratings yet

- Asset & Liability Management (ALCO)Document4 pagesAsset & Liability Management (ALCO)xeeeusNo ratings yet

- Literature ReviewDocument9 pagesLiterature ReviewAnkur Upadhyay0% (1)

- Implementing Fusion Erp AnalyticsDocument1,133 pagesImplementing Fusion Erp AnalyticsSreekumar SasikumarNo ratings yet

- Indo Swiss Chemicals LTDDocument1 pageIndo Swiss Chemicals LTDX Legend GamerzNo ratings yet

- Job Description Template - AccountantDocument2 pagesJob Description Template - AccountantBINGLHNo ratings yet

- Economics For 2nd PUC - ToPIC 6Document22 pagesEconomics For 2nd PUC - ToPIC 6Vipin Mandyam KadubiNo ratings yet

- Career Paths Accounting SB-22Document1 pageCareer Paths Accounting SB-22YanetNo ratings yet

- Chapter 2 - Capital Budgeting Under RiskDocument10 pagesChapter 2 - Capital Budgeting Under RiskAndualem ZenebeNo ratings yet

- Dpjain16 1 23escortDocument1 pageDpjain16 1 23escortPrashant PawadeNo ratings yet

- ExporterDocument138 pagesExporterMrutunjay PatraNo ratings yet

- Unlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 2 PDFDocument17 pagesUnlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 2 PDFAbhishek100% (2)

- CRAPAC Monthly JanDocument4 pagesCRAPAC Monthly JanJasonMortonNo ratings yet

- Loan Management SystemDocument28 pagesLoan Management SystemSrihari Prasad100% (1)

- Shashank Mhadnak: Regular Updating Technical KnowledgeDocument4 pagesShashank Mhadnak: Regular Updating Technical KnowledgeAmit KalsiNo ratings yet

- Internship Report On Digital BankingDocument44 pagesInternship Report On Digital BankingImran SakinNo ratings yet

- Estate Planning WorkBookDocument70 pagesEstate Planning WorkBookLyn100% (1)

- E BankingDocument19 pagesE BankingramyaNo ratings yet

- What Is Value Investing?Document10 pagesWhat Is Value Investing?Navaraj BaniyaNo ratings yet

- Dr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeDocument12 pagesDr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- Abnormal Returns From The Common Stock Investments of The U.S. Senate (2004) - Alan J. Ziobrowski, Ping Cheng, James W. Boyd, Brigitte J. ZiobrowskiDocument16 pagesAbnormal Returns From The Common Stock Investments of The U.S. Senate (2004) - Alan J. Ziobrowski, Ping Cheng, James W. Boyd, Brigitte J. ZiobrowskiAriela LuliardaNo ratings yet

- Tripleplay Interactive Network PVT - LTD.: CommentsDocument1 pageTripleplay Interactive Network PVT - LTD.: CommentsAjay KumarNo ratings yet

- Ece Er 22, 2 ST Epar e Natio A Stock Exchange Complex, Bandra East), 400 Symbol Zeel Eq Zeel P2Document8 pagesEce Er 22, 2 ST Epar e Natio A Stock Exchange Complex, Bandra East), 400 Symbol Zeel Eq Zeel P2Tejesh GoudNo ratings yet

- IBA - Syllabus - Financial Management Summer Semester 2022Document5 pagesIBA - Syllabus - Financial Management Summer Semester 2022susheel kumarNo ratings yet

- Final Report - BhoomitDocument70 pagesFinal Report - BhoomitShubham SuryavanshiNo ratings yet

- Finance Can Be A Noble Profession (Yes, Really)Document9 pagesFinance Can Be A Noble Profession (Yes, Really)ApurvaNo ratings yet

- sd1 EngDocument4 pagessd1 EngGZMO GroupNo ratings yet

- MPIPDocument46 pagesMPIPJesus MarinoNo ratings yet

- A021221078 - Akuntansi Dasar Pekan 5Document2 pagesA021221078 - Akuntansi Dasar Pekan 5Nazwa AuliaNo ratings yet

- FCH1 Display Check InformationDocument14 pagesFCH1 Display Check InformationJosimar SantosNo ratings yet

- Comprehensive Reviewer On AppraiserDocument15 pagesComprehensive Reviewer On AppraiserBelteshazzarL.CabacangNo ratings yet

- Topik-4 (A) Lembaga Keuangan Syariah-Prospek Dan KritikDocument73 pagesTopik-4 (A) Lembaga Keuangan Syariah-Prospek Dan KritikCepi Juniar PrayogaNo ratings yet