Professional Documents

Culture Documents

CTG Entitlements

CTG Entitlements

Uploaded by

vysakhCopyright:

Available Formats

You might also like

- Cae Writing GuideDocument60 pagesCae Writing Guideelisadp95% (20)

- Rokka No Yuusha Volume 4 - Chapter 1 - 5 Part 3Document176 pagesRokka No Yuusha Volume 4 - Chapter 1 - 5 Part 3Bins SurNo ratings yet

- 11 Service Costing FTDocument10 pages11 Service Costing FTnsm2zmvnbbNo ratings yet

- Analysis and Recommendations: Mileage Allowance For Journeys by RoadDocument3 pagesAnalysis and Recommendations: Mileage Allowance For Journeys by RoadYELLAMANDA SANKATINo ratings yet

- PracticeExam JUTCDocument7 pagesPracticeExam JUTCkadenemills22No ratings yet

- Delhi Traffic PoliceDocument2 pagesDelhi Traffic Policeakshgill86No ratings yet

- Bangalore Elevated Highway From Silk Board To ATTIBELE (KM 8/765 TO KM 33/130) of NH - 7Document9 pagesBangalore Elevated Highway From Silk Board To ATTIBELE (KM 8/765 TO KM 33/130) of NH - 7Manoj KumarNo ratings yet

- Operating Costing Test QuestionsDocument5 pagesOperating Costing Test Questionschandrakantchainani606No ratings yet

- CNG Economics TrivandrumDocument7 pagesCNG Economics TrivandrumUJJWALNo ratings yet

- Cost and Management Accounting 02 - Class NotesDocument125 pagesCost and Management Accounting 02 - Class NotessaurabhNo ratings yet

- Conti Travels (37-1000PM-14) : Carlson Wagonlit TravelDocument1 pageConti Travels (37-1000PM-14) : Carlson Wagonlit TravelMagesh WaranNo ratings yet

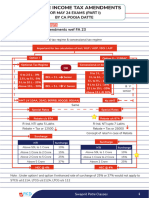

- IT Amendments For May 24 (Part 1) - 1Document22 pagesIT Amendments For May 24 (Part 1) - 1Siddhi ShahNo ratings yet

- The AnnexureDocument7 pagesThe AnnexureVinay AchutuniNo ratings yet

- Ta - Da LTC Sta BDocument67 pagesTa - Da LTC Sta BShashankSharmaNo ratings yet

- Calcutta State Transport Corporation: OrderDocument2 pagesCalcutta State Transport Corporation: OrderAbhishek MukhopadhyayNo ratings yet

- StickMob & StickMotor - Deck 2022Document21 pagesStickMob & StickMotor - Deck 2022kwokNo ratings yet

- Hand Book On Benefits To Serving EmployeesDocument98 pagesHand Book On Benefits To Serving Employeessiddharth pradhanNo ratings yet

- CSR CalculationDocument8 pagesCSR CalculationALISA ASIFNo ratings yet

- Destination Zone General Cargo Freight Rate / KG ZoneDocument2 pagesDestination Zone General Cargo Freight Rate / KG ZoneVivek PadoleNo ratings yet

- SCM 2Document17 pagesSCM 2M JIYAD SHAIKH Supply Chain PodcastNo ratings yet

- Breakdown of Light Vehicle Fees 1 July 2023Document6 pagesBreakdown of Light Vehicle Fees 1 July 2023chrissherriff308No ratings yet

- Service CostingDocument9 pagesService Costingakash borseNo ratings yet

- Travel Agency Model CaseDocument4 pagesTravel Agency Model Caseudaywal.nandiniNo ratings yet

- Case Solution 6Document3 pagesCase Solution 6Shrutika RuiaNo ratings yet

- Ash Road Security RoomDocument40 pagesAsh Road Security Roomk v rajeshNo ratings yet

- 1500Kw Old Wind Turbine (Running Condition) For Sale Details in GujaratiDocument1 page1500Kw Old Wind Turbine (Running Condition) For Sale Details in GujaratiHaresh Eng Service WorksNo ratings yet

- Quotation DotZotDocument3 pagesQuotation DotZotGaurav singh BishtNo ratings yet

- MeldharDocument91 pagesMeldharborntowin08No ratings yet

- Quote - New - RateDocument3 pagesQuote - New - RateStaff-ISK Muhammad GhaziNo ratings yet

- CityLink Toll Pricing July September 2018Document2 pagesCityLink Toll Pricing July September 2018Away ThrowNo ratings yet

- 10) Service CostingDocument3 pages10) Service Costingtanzim094No ratings yet

- Transfer TA BillDocument24 pagesTransfer TA Billxen pescoNo ratings yet

- Sri Lanka Customs National Import Tariff Guide Section VII - Chapter 39 - Page 18Document1 pageSri Lanka Customs National Import Tariff Guide Section VII - Chapter 39 - Page 18Rantharu AttanayakeNo ratings yet

- Vidhan - Round2 - DMS WarrirosDocument15 pagesVidhan - Round2 - DMS WarrirosSureshNo ratings yet

- CSP Latest Commission Structure PDFDocument12 pagesCSP Latest Commission Structure PDFjjmehra420No ratings yet

- Standard Rate Analysis For Site Specific Items 24.11.2023Document29 pagesStandard Rate Analysis For Site Specific Items 24.11.2023RVNL GoaNo ratings yet

- D' Earth /mooram: Add 15% C.P. (+) Rs.84.15Document1 pageD' Earth /mooram: Add 15% C.P. (+) Rs.84.15Hemam PrasantaNo ratings yet

- Tariff Schedule Fy 2019-20Document8 pagesTariff Schedule Fy 2019-20Sharma ShiviNo ratings yet

- COA - Lecture Sheet # 22 - BCAS 30 - Service CostingDocument13 pagesCOA - Lecture Sheet # 22 - BCAS 30 - Service Costingrumelrashid_seuNo ratings yet

- Single Page Rev Motor 16.06Document1 pageSingle Page Rev Motor 16.06Lochan PhogatNo ratings yet

- Re 2Document1 pageRe 2Hemam PrasantaNo ratings yet

- Operating Costing Assignment SolutionsDocument9 pagesOperating Costing Assignment Solutionsayesha parveenNo ratings yet

- TQUJPR10938Document1 pageTQUJPR10938DeshrajNo ratings yet

- Service Costing QuestionDocument5 pagesService Costing Questionagnusswapna2003No ratings yet

- StatDocument1 pageStatarvindNo ratings yet

- B2C QuotationDocument5 pagesB2C QuotationSANSKAR AGRAWALNo ratings yet

- Abridged Motor Tariff With Revised TP Premium W.E.F. 01-04-2016Document2 pagesAbridged Motor Tariff With Revised TP Premium W.E.F. 01-04-2016nasireddyNo ratings yet

- 5 - D1 - S2 - Impl of E Buses - Ahmedabad - Deepak TrivediDocument23 pages5 - D1 - S2 - Impl of E Buses - Ahmedabad - Deepak TrivediSutanu PatiNo ratings yet

- Wa0022.Document10 pagesWa0022.Joshua StarkNo ratings yet

- AIK Rates ForDocument1 pageAIK Rates ForShubham TyagiNo ratings yet

- Rate PJ Pipe2Document8 pagesRate PJ Pipe2SUSHEEL KUMAR KANAUJIYANo ratings yet

- BESCOM Tariff Order Summary and Savings Calculation 2023-24Document3 pagesBESCOM Tariff Order Summary and Savings Calculation 2023-24Harsh Singh100% (1)

- Night Owl Service: Ventra CardDocument2 pagesNight Owl Service: Ventra CardJls23 L DNo ratings yet

- Ta Journal November 2022Document1 pageTa Journal November 2022Chiranjit GhoshNo ratings yet

- Rly Allowances BookDocument146 pagesRly Allowances Bookshivshanker tiwariNo ratings yet

- Transport Mode ComparisonDocument1 pageTransport Mode ComparisonAhmed AlhakimyNo ratings yet

- Data Umum Uptd Bus Trans AntahDocument8 pagesData Umum Uptd Bus Trans AntahShofia MegawatiNo ratings yet

- Screenshot 2022-01-25 at 21.20.11Document1 pageScreenshot 2022-01-25 at 21.20.11Alif Affandi Nor RahmatNo ratings yet

- TranspratecontDocument73 pagesTranspratecontShaon majiNo ratings yet

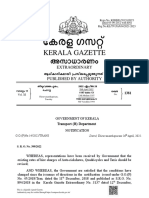

- Fare Revision of Auto, TaxiDocument4 pagesFare Revision of Auto, TaxidoniamuttamNo ratings yet

- The Swiss Village PRICELISTDocument1 pageThe Swiss Village PRICELISTshailabhNo ratings yet

- Icon DLL EcosystemDocument2 pagesIcon DLL EcosystemCarla Christine Coralde100% (1)

- Analysis of Irregular Multistorey Buildings With and Without Floating Columns Under Seismic LoadingDocument8 pagesAnalysis of Irregular Multistorey Buildings With and Without Floating Columns Under Seismic Loadingnxdpm6td5gNo ratings yet

- DIGITAL MARKETING (Unit 4)Document9 pagesDIGITAL MARKETING (Unit 4)sharmapranav780No ratings yet

- Knowledge L3/E Comprehension L4/D Application L5/C Analysis L6/B Synthesis L7/A Evaluation L8/ADocument2 pagesKnowledge L3/E Comprehension L4/D Application L5/C Analysis L6/B Synthesis L7/A Evaluation L8/AWaltWritmanNo ratings yet

- 2.2 Evaluating Economic PerformanceDocument12 pages2.2 Evaluating Economic PerformanceMissDangNo ratings yet

- Landslides Causes EffectsDocument9 pagesLandslides Causes EffectsDaljeet SidhuNo ratings yet

- MOHAN RESUME FinalDocument4 pagesMOHAN RESUME Finalyeluru mohanNo ratings yet

- FAGL TcodesDocument3 pagesFAGL TcodesRahul100% (2)

- IRDocument4 pagesIRBenny JohnNo ratings yet

- Mutiple Choice Question For Satellite CommunicationDocument4 pagesMutiple Choice Question For Satellite CommunicationRaja Pirian67% (3)

- Strasser The Rational Basis of Trademark Protection RevisitedDocument58 pagesStrasser The Rational Basis of Trademark Protection RevisitedfedericosilvaNo ratings yet

- Detergent Powder: Project Report ofDocument15 pagesDetergent Powder: Project Report ofOSG Chemical Industry LLP 'A Cause For Cleanliness'67% (3)

- Chapter 8 - Memory Storage Devices Question AnswersDocument4 pagesChapter 8 - Memory Storage Devices Question AnswersAditya MalhotraNo ratings yet

- Test 12Document2 pagesTest 12Boki BokiNo ratings yet

- Mendelssohn Op. 19 Nr. 1 Analyse ENDocument2 pagesMendelssohn Op. 19 Nr. 1 Analyse ENLianed SofiaNo ratings yet

- FITT 1 ReviewerDocument5 pagesFITT 1 ReviewerIsley CamarinesNo ratings yet

- Raj'a (Returning) : Sermon of Amir Ul-MomineenDocument3 pagesRaj'a (Returning) : Sermon of Amir Ul-Momineentausif mewawalaNo ratings yet

- Medicinal Plants MasterDocument490 pagesMedicinal Plants MasterNguyen Le Xuan BachNo ratings yet

- Adhesive Capsulitis (Frozen Shoulder)Document5 pagesAdhesive Capsulitis (Frozen Shoulder)erikaNo ratings yet

- Information On The Desired Degree CourseDocument4 pagesInformation On The Desired Degree CourseAdewumi GbengaNo ratings yet

- Topic 06 - Introduction To Differential Calculus - Cake TinDocument4 pagesTopic 06 - Introduction To Differential Calculus - Cake Tinmmi0% (1)

- C Engleza Scris Var 02Document4 pagesC Engleza Scris Var 02M MmNo ratings yet

- B.SC Fashion Design R2018 C&SDocument85 pagesB.SC Fashion Design R2018 C&SvivekNo ratings yet

- The Power of Faith Confession & WorshipDocument38 pagesThe Power of Faith Confession & WorshipLarryDelaCruz100% (1)

- Gien-Genesis Brochure en GB v1Document9 pagesGien-Genesis Brochure en GB v1Hood RockNo ratings yet

- Office of The Punong Barangay Barangay Certification of AcceptanceDocument1 pageOffice of The Punong Barangay Barangay Certification of AcceptanceMah Jane DivinaNo ratings yet

- Operating, Maintenance & Parts Manual: Rated LoadsDocument48 pagesOperating, Maintenance & Parts Manual: Rated LoadsAmanNo ratings yet

- Procedures For Rapid Deployment, Redeployment, and Retrograde Small ArmsDocument24 pagesProcedures For Rapid Deployment, Redeployment, and Retrograde Small ArmsC.A. MonroeNo ratings yet

CTG Entitlements

CTG Entitlements

Uploaded by

vysakhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CTG Entitlements

CTG Entitlements

Uploaded by

vysakhCopyright:

Available Formats

COMPOSITE TRANSFER GRANT (CTG)

Pay-Level entitlements for CTG Claim

Personal effects

Rate for Transportation

Sl. Composite Transfer Rate for

Level by Road w.e.f.01.04.2024

No. Grant By Train / Steamer Transportation by as DA @ 50%

Road

6000 Kg by goods train / 4 50 x 25% = 12.5 =

80% of last month's

1 12 and above Wheeler Wagon / 1 50 per Km 50 + 12.5 = 62.5

Basic Pay

double container 63 per Km

6000 Kg by goods train / 4 50 x 25% = 12.5 =

80% of last month's

2 06 to 11 Wheeler Wagon / 1 50 per Km 50 + 12.5 = 62.5

Basic Pay

Single container 63 per Km

25 x 25% = 6.25 =

80% of last month's

3 05 3000 Kg 25 per Km 25 + 6.25 = 31.25

Basic Pay

31 per Km

15 x 25% = 3.75 =

80% of last month's

4 04 and below 1500 Kg 15 per Km 15 + 3.75 =18

Basic Pay

19 per Km

Note:-

* Composite Transfer Grant (CTG) equals to 80% of last month's Basic Pay; No other add-ons should be allowed in Basic

Pay while calculating CTG. (Not admissible if no change of residence in involved even where the distance between the two

stations is more than 20 Kms). For transfer to and from the island teritorries of Andaman, Nicobar and Lakshadweep, CTG

may continue to be paid at 100%.

* The concession should be availed by the employee during the Leave Preparatory to Retirement or within one year from the

date of his Retirement.

* Advances may be sanctioned only when the journey is perfomed during Leave Preparatory to Retirement. Advance will be

limited to the amount to which the employee may be entitled under the rules, and will be adjusted in full on submission of the

T.A. Bill. No Advance is admissible when the journey is performed after Retirement.

compiled by Mr. Anwar, AA 'A'

EMU (R&D), Hyd.

You might also like

- Cae Writing GuideDocument60 pagesCae Writing Guideelisadp95% (20)

- Rokka No Yuusha Volume 4 - Chapter 1 - 5 Part 3Document176 pagesRokka No Yuusha Volume 4 - Chapter 1 - 5 Part 3Bins SurNo ratings yet

- 11 Service Costing FTDocument10 pages11 Service Costing FTnsm2zmvnbbNo ratings yet

- Analysis and Recommendations: Mileage Allowance For Journeys by RoadDocument3 pagesAnalysis and Recommendations: Mileage Allowance For Journeys by RoadYELLAMANDA SANKATINo ratings yet

- PracticeExam JUTCDocument7 pagesPracticeExam JUTCkadenemills22No ratings yet

- Delhi Traffic PoliceDocument2 pagesDelhi Traffic Policeakshgill86No ratings yet

- Bangalore Elevated Highway From Silk Board To ATTIBELE (KM 8/765 TO KM 33/130) of NH - 7Document9 pagesBangalore Elevated Highway From Silk Board To ATTIBELE (KM 8/765 TO KM 33/130) of NH - 7Manoj KumarNo ratings yet

- Operating Costing Test QuestionsDocument5 pagesOperating Costing Test Questionschandrakantchainani606No ratings yet

- CNG Economics TrivandrumDocument7 pagesCNG Economics TrivandrumUJJWALNo ratings yet

- Cost and Management Accounting 02 - Class NotesDocument125 pagesCost and Management Accounting 02 - Class NotessaurabhNo ratings yet

- Conti Travels (37-1000PM-14) : Carlson Wagonlit TravelDocument1 pageConti Travels (37-1000PM-14) : Carlson Wagonlit TravelMagesh WaranNo ratings yet

- IT Amendments For May 24 (Part 1) - 1Document22 pagesIT Amendments For May 24 (Part 1) - 1Siddhi ShahNo ratings yet

- The AnnexureDocument7 pagesThe AnnexureVinay AchutuniNo ratings yet

- Ta - Da LTC Sta BDocument67 pagesTa - Da LTC Sta BShashankSharmaNo ratings yet

- Calcutta State Transport Corporation: OrderDocument2 pagesCalcutta State Transport Corporation: OrderAbhishek MukhopadhyayNo ratings yet

- StickMob & StickMotor - Deck 2022Document21 pagesStickMob & StickMotor - Deck 2022kwokNo ratings yet

- Hand Book On Benefits To Serving EmployeesDocument98 pagesHand Book On Benefits To Serving Employeessiddharth pradhanNo ratings yet

- CSR CalculationDocument8 pagesCSR CalculationALISA ASIFNo ratings yet

- Destination Zone General Cargo Freight Rate / KG ZoneDocument2 pagesDestination Zone General Cargo Freight Rate / KG ZoneVivek PadoleNo ratings yet

- SCM 2Document17 pagesSCM 2M JIYAD SHAIKH Supply Chain PodcastNo ratings yet

- Breakdown of Light Vehicle Fees 1 July 2023Document6 pagesBreakdown of Light Vehicle Fees 1 July 2023chrissherriff308No ratings yet

- Service CostingDocument9 pagesService Costingakash borseNo ratings yet

- Travel Agency Model CaseDocument4 pagesTravel Agency Model Caseudaywal.nandiniNo ratings yet

- Case Solution 6Document3 pagesCase Solution 6Shrutika RuiaNo ratings yet

- Ash Road Security RoomDocument40 pagesAsh Road Security Roomk v rajeshNo ratings yet

- 1500Kw Old Wind Turbine (Running Condition) For Sale Details in GujaratiDocument1 page1500Kw Old Wind Turbine (Running Condition) For Sale Details in GujaratiHaresh Eng Service WorksNo ratings yet

- Quotation DotZotDocument3 pagesQuotation DotZotGaurav singh BishtNo ratings yet

- MeldharDocument91 pagesMeldharborntowin08No ratings yet

- Quote - New - RateDocument3 pagesQuote - New - RateStaff-ISK Muhammad GhaziNo ratings yet

- CityLink Toll Pricing July September 2018Document2 pagesCityLink Toll Pricing July September 2018Away ThrowNo ratings yet

- 10) Service CostingDocument3 pages10) Service Costingtanzim094No ratings yet

- Transfer TA BillDocument24 pagesTransfer TA Billxen pescoNo ratings yet

- Sri Lanka Customs National Import Tariff Guide Section VII - Chapter 39 - Page 18Document1 pageSri Lanka Customs National Import Tariff Guide Section VII - Chapter 39 - Page 18Rantharu AttanayakeNo ratings yet

- Vidhan - Round2 - DMS WarrirosDocument15 pagesVidhan - Round2 - DMS WarrirosSureshNo ratings yet

- CSP Latest Commission Structure PDFDocument12 pagesCSP Latest Commission Structure PDFjjmehra420No ratings yet

- Standard Rate Analysis For Site Specific Items 24.11.2023Document29 pagesStandard Rate Analysis For Site Specific Items 24.11.2023RVNL GoaNo ratings yet

- D' Earth /mooram: Add 15% C.P. (+) Rs.84.15Document1 pageD' Earth /mooram: Add 15% C.P. (+) Rs.84.15Hemam PrasantaNo ratings yet

- Tariff Schedule Fy 2019-20Document8 pagesTariff Schedule Fy 2019-20Sharma ShiviNo ratings yet

- COA - Lecture Sheet # 22 - BCAS 30 - Service CostingDocument13 pagesCOA - Lecture Sheet # 22 - BCAS 30 - Service Costingrumelrashid_seuNo ratings yet

- Single Page Rev Motor 16.06Document1 pageSingle Page Rev Motor 16.06Lochan PhogatNo ratings yet

- Re 2Document1 pageRe 2Hemam PrasantaNo ratings yet

- Operating Costing Assignment SolutionsDocument9 pagesOperating Costing Assignment Solutionsayesha parveenNo ratings yet

- TQUJPR10938Document1 pageTQUJPR10938DeshrajNo ratings yet

- Service Costing QuestionDocument5 pagesService Costing Questionagnusswapna2003No ratings yet

- StatDocument1 pageStatarvindNo ratings yet

- B2C QuotationDocument5 pagesB2C QuotationSANSKAR AGRAWALNo ratings yet

- Abridged Motor Tariff With Revised TP Premium W.E.F. 01-04-2016Document2 pagesAbridged Motor Tariff With Revised TP Premium W.E.F. 01-04-2016nasireddyNo ratings yet

- 5 - D1 - S2 - Impl of E Buses - Ahmedabad - Deepak TrivediDocument23 pages5 - D1 - S2 - Impl of E Buses - Ahmedabad - Deepak TrivediSutanu PatiNo ratings yet

- Wa0022.Document10 pagesWa0022.Joshua StarkNo ratings yet

- AIK Rates ForDocument1 pageAIK Rates ForShubham TyagiNo ratings yet

- Rate PJ Pipe2Document8 pagesRate PJ Pipe2SUSHEEL KUMAR KANAUJIYANo ratings yet

- BESCOM Tariff Order Summary and Savings Calculation 2023-24Document3 pagesBESCOM Tariff Order Summary and Savings Calculation 2023-24Harsh Singh100% (1)

- Night Owl Service: Ventra CardDocument2 pagesNight Owl Service: Ventra CardJls23 L DNo ratings yet

- Ta Journal November 2022Document1 pageTa Journal November 2022Chiranjit GhoshNo ratings yet

- Rly Allowances BookDocument146 pagesRly Allowances Bookshivshanker tiwariNo ratings yet

- Transport Mode ComparisonDocument1 pageTransport Mode ComparisonAhmed AlhakimyNo ratings yet

- Data Umum Uptd Bus Trans AntahDocument8 pagesData Umum Uptd Bus Trans AntahShofia MegawatiNo ratings yet

- Screenshot 2022-01-25 at 21.20.11Document1 pageScreenshot 2022-01-25 at 21.20.11Alif Affandi Nor RahmatNo ratings yet

- TranspratecontDocument73 pagesTranspratecontShaon majiNo ratings yet

- Fare Revision of Auto, TaxiDocument4 pagesFare Revision of Auto, TaxidoniamuttamNo ratings yet

- The Swiss Village PRICELISTDocument1 pageThe Swiss Village PRICELISTshailabhNo ratings yet

- Icon DLL EcosystemDocument2 pagesIcon DLL EcosystemCarla Christine Coralde100% (1)

- Analysis of Irregular Multistorey Buildings With and Without Floating Columns Under Seismic LoadingDocument8 pagesAnalysis of Irregular Multistorey Buildings With and Without Floating Columns Under Seismic Loadingnxdpm6td5gNo ratings yet

- DIGITAL MARKETING (Unit 4)Document9 pagesDIGITAL MARKETING (Unit 4)sharmapranav780No ratings yet

- Knowledge L3/E Comprehension L4/D Application L5/C Analysis L6/B Synthesis L7/A Evaluation L8/ADocument2 pagesKnowledge L3/E Comprehension L4/D Application L5/C Analysis L6/B Synthesis L7/A Evaluation L8/AWaltWritmanNo ratings yet

- 2.2 Evaluating Economic PerformanceDocument12 pages2.2 Evaluating Economic PerformanceMissDangNo ratings yet

- Landslides Causes EffectsDocument9 pagesLandslides Causes EffectsDaljeet SidhuNo ratings yet

- MOHAN RESUME FinalDocument4 pagesMOHAN RESUME Finalyeluru mohanNo ratings yet

- FAGL TcodesDocument3 pagesFAGL TcodesRahul100% (2)

- IRDocument4 pagesIRBenny JohnNo ratings yet

- Mutiple Choice Question For Satellite CommunicationDocument4 pagesMutiple Choice Question For Satellite CommunicationRaja Pirian67% (3)

- Strasser The Rational Basis of Trademark Protection RevisitedDocument58 pagesStrasser The Rational Basis of Trademark Protection RevisitedfedericosilvaNo ratings yet

- Detergent Powder: Project Report ofDocument15 pagesDetergent Powder: Project Report ofOSG Chemical Industry LLP 'A Cause For Cleanliness'67% (3)

- Chapter 8 - Memory Storage Devices Question AnswersDocument4 pagesChapter 8 - Memory Storage Devices Question AnswersAditya MalhotraNo ratings yet

- Test 12Document2 pagesTest 12Boki BokiNo ratings yet

- Mendelssohn Op. 19 Nr. 1 Analyse ENDocument2 pagesMendelssohn Op. 19 Nr. 1 Analyse ENLianed SofiaNo ratings yet

- FITT 1 ReviewerDocument5 pagesFITT 1 ReviewerIsley CamarinesNo ratings yet

- Raj'a (Returning) : Sermon of Amir Ul-MomineenDocument3 pagesRaj'a (Returning) : Sermon of Amir Ul-Momineentausif mewawalaNo ratings yet

- Medicinal Plants MasterDocument490 pagesMedicinal Plants MasterNguyen Le Xuan BachNo ratings yet

- Adhesive Capsulitis (Frozen Shoulder)Document5 pagesAdhesive Capsulitis (Frozen Shoulder)erikaNo ratings yet

- Information On The Desired Degree CourseDocument4 pagesInformation On The Desired Degree CourseAdewumi GbengaNo ratings yet

- Topic 06 - Introduction To Differential Calculus - Cake TinDocument4 pagesTopic 06 - Introduction To Differential Calculus - Cake Tinmmi0% (1)

- C Engleza Scris Var 02Document4 pagesC Engleza Scris Var 02M MmNo ratings yet

- B.SC Fashion Design R2018 C&SDocument85 pagesB.SC Fashion Design R2018 C&SvivekNo ratings yet

- The Power of Faith Confession & WorshipDocument38 pagesThe Power of Faith Confession & WorshipLarryDelaCruz100% (1)

- Gien-Genesis Brochure en GB v1Document9 pagesGien-Genesis Brochure en GB v1Hood RockNo ratings yet

- Office of The Punong Barangay Barangay Certification of AcceptanceDocument1 pageOffice of The Punong Barangay Barangay Certification of AcceptanceMah Jane DivinaNo ratings yet

- Operating, Maintenance & Parts Manual: Rated LoadsDocument48 pagesOperating, Maintenance & Parts Manual: Rated LoadsAmanNo ratings yet

- Procedures For Rapid Deployment, Redeployment, and Retrograde Small ArmsDocument24 pagesProcedures For Rapid Deployment, Redeployment, and Retrograde Small ArmsC.A. MonroeNo ratings yet