Professional Documents

Culture Documents

IT-000155722510-2024-11 Nov-23

IT-000155722510-2024-11 Nov-23

Uploaded by

Arsalan BhattiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT-000155722510-2024-11 Nov-23

IT-000155722510-2024-11 Nov-23

Uploaded by

Arsalan BhattiCopyright:

Available Formats

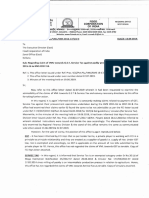

INCOME TAX PAYMENT CHALLAN

For 1-Bill Payment through member PSID # : 178389383

bank please add prefix 999999 with PSID

RTO ISLAMABAD 6 1 2024

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year 11 23

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 153(1)(a) Payment for Goods u/s 153(1)(a) @0.25% Payment Section Code 64060082

(Section) (Description of Payment Section) Account Head (NAM) B01105

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

NTN CNIC/Reg./Inc. No.

Taxpayer's Name Status

Business Name

Address

FOR WITHHOLDING TAXES ONLY

NTN/FTN of Withholding agent 8933989-4 CNIC/Reg./Inc. No.

Name of withholding agent AJMI DISTRIBUTION NETWORK

Total no. of Taxpayers 1 Total Tax Deducted 105,831

Amount of tax in words: One Hundred Five Thousand Eight Hundred Thirty One Rupees Rs. 105,831

And No Paisas Only

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 ADC (e- 105,831 No Branch

payment)

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor

Name of Depositor AJMI DISTRIBUTION NETWORK

Date

Stamp & Signature

PSID-IT-000155722510-112024

Prepared By : 8933989 - AJMI DISTRIBUTION NETWORK Date: 20-May-2024 04:16 PM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

You might also like

- 4133104Document1 page4133104Ann BenjaminNo ratings yet

- IT-000155721272-2024-08 Aug-23Document1 pageIT-000155721272-2024-08 Aug-23Arsalan BhattiNo ratings yet

- IT-000155720866-2024-07 July-23Document1 pageIT-000155720866-2024-07 July-23Arsalan BhattiNo ratings yet

- IT-000155721931-2024-09 Sept-23Document1 pageIT-000155721931-2024-09 Sept-23Arsalan BhattiNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- It 000156777531 2024 06Document1 pageIt 000156777531 2024 06Zeshan SajidNo ratings yet

- It 000142942160 2024 09Document1 pageIt 000142942160 2024 09tayyabNo ratings yet

- It 000144418085 2024 10Document1 pageIt 000144418085 2024 10Sheeraz AhmedNo ratings yet

- It 000136741219 2023 05Document1 pageIt 000136741219 2023 05wali khelNo ratings yet

- It 000154519556 2024 04Document1 pageIt 000154519556 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000157244353 2024 06Document1 pageIt 000157244353 2024 06Muhammad Umair FakharNo ratings yet

- It 000154377267 2024 04Document1 pageIt 000154377267 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000157243385 2024 06Document1 pageIt 000157243385 2024 06Muhammad Umair FakharNo ratings yet

- It 000154590025 2024 04Document1 pageIt 000154590025 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000156777456 2024 06Document1 pageIt 000156777456 2024 06Zeshan SajidNo ratings yet

- It 000156079778 2024 04Document1 pageIt 000156079778 2024 04Saad TahirNo ratings yet

- It 000154491423 2024 04Document1 pageIt 000154491423 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000144378527 2022 00Document1 pageIt 000144378527 2022 00حنفیت اور شیعت مقلدNo ratings yet

- It 000144914729 2024 11Document1 pageIt 000144914729 2024 11MUHAMMAD TABRAIZNo ratings yet

- It 000157243994 2024 06Document1 pageIt 000157243994 2024 06Muhammad Umair FakharNo ratings yet

- It 000157243833 2024 06Document1 pageIt 000157243833 2024 06Muhammad Umair FakharNo ratings yet

- It 000154519744 2024 04Document1 pageIt 000154519744 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000154735387 2023 00Document1 pageIt 000154735387 2023 00MUHAMMAD TABRAIZNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Income Tax Payment Challan: PSID #: 175921882Document1 pageIncome Tax Payment Challan: PSID #: 175921882taxhouse.kasur786No ratings yet

- It 000143652629 2024 10Document1 pageIt 000143652629 2024 10MUHAMMAD TABRAIZNo ratings yet

- It 000156086061 2024 04Document1 pageIt 000156086061 2024 04Saad TahirNo ratings yet

- It 000154491467 2024 04Document1 pageIt 000154491467 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000148938139 2024 01Document1 pageIt 000148938139 2024 01abdulraufattari69No ratings yet

- Adjustable Tax-PSIDDocument1 pageAdjustable Tax-PSIDWaris Corp.No ratings yet

- It 000156777207 2024 06Document1 pageIt 000156777207 2024 06Zeshan SajidNo ratings yet

- It 000156777657 2024 06Document1 pageIt 000156777657 2024 06Zeshan SajidNo ratings yet

- Income Tax Payment Challan: PSID #: 165866486Document1 pageIncome Tax Payment Challan: PSID #: 165866486Ashok KumarNo ratings yet

- It 000154377321 2024 04Document1 pageIt 000154377321 2024 04MUHAMMAD TABRAIZNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- It 000144773140 2024 10Document1 pageIt 000144773140 2024 10hizbullahjantankNo ratings yet

- It 000157307875 2024 06Document1 pageIt 000157307875 2024 06kometo7741No ratings yet

- It 000154735501 2023 00Document1 pageIt 000154735501 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000144041855 2024 10Document1 pageIt 000144041855 2024 10MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 172247415Document1 pageIncome Tax Payment Challan: PSID #: 172247415fast fbrNo ratings yet

- It 000156638880 2023 00Document1 pageIt 000156638880 2023 00hizbullahjantankNo ratings yet

- Goga 2.5Document1 pageGoga 2.5advocateyaqootNo ratings yet

- It 000154270899 2024 04Document1 pageIt 000154270899 2024 04MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 173203210Document1 pageIncome Tax Payment Challan: PSID #: 173203210Muhammad QayyumNo ratings yet

- It 000154491319 2018 04Document1 pageIt 000154491319 2018 04MUHAMMAD TABRAIZNo ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- It 000154264298 2023 00Document1 pageIt 000154264298 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000157128851 2023 00Document1 pageIt 000157128851 2023 00Nanak Pur GHSNo ratings yet

- It 000147370616 2024 12Document1 pageIt 000147370616 2024 12Revenue sectionNo ratings yet

- It 000131724287 2022 00Document1 pageIt 000131724287 2022 00adnan.khawaja893No ratings yet

- It 000144761478 2024 10Document1 pageIt 000144761478 2024 10hizbullahjantankNo ratings yet

- It 000154735437 2023 00Document1 pageIt 000154735437 2023 00MUHAMMAD TABRAIZNo ratings yet

- DirectTaxesPaymentPSID UpdateNatureDocument1 pageDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhNo ratings yet

- It 000125297494 2023 08Document1 pageIt 000125297494 2023 08MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- It 000155993978 2023 00Document1 pageIt 000155993978 2023 00maaz khanNo ratings yet

- It 000153285706 2023 00Document1 pageIt 000153285706 2023 00Muhammad AneesNo ratings yet

- It 000141614736 2022 00Document1 pageIt 000141614736 2022 00Shahbaz MuhammadNo ratings yet

- It 000156090054 2024 04Document1 pageIt 000156090054 2024 04Saad TahirNo ratings yet

- It 000157130050 2023 00Document1 pageIt 000157130050 2023 00xabimoviesNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- Budget DeficitDocument6 pagesBudget Deficityamikanimapwetechere23No ratings yet

- Fabm 2 Module 10 Vat OptDocument5 pagesFabm 2 Module 10 Vat OptJOHN PAUL LAGAONo ratings yet

- Opt 1Document5 pagesOpt 1Bridget Zoe Lopez BatoonNo ratings yet

- Et Q Liqgsa: CFT/RQDocument2 pagesEt Q Liqgsa: CFT/RQvikash KumarNo ratings yet

- AMAN BILL & Invoice FormatDocument27 pagesAMAN BILL & Invoice FormatManpreet SachdevaNo ratings yet

- Bafm U Vkwa Y Dkwikszjs'Ku Fyfevsm Bafm U Vkwa Y Dkwikszjs'Ku Fyfevsm Bafm U Vkwa Y Dkwikszjs'Ku Fyfevsm Bafm U Vkwa Y Dkwikszjs'Ku FyfevsmDocument1 pageBafm U Vkwa Y Dkwikszjs'Ku Fyfevsm Bafm U Vkwa Y Dkwikszjs'Ku Fyfevsm Bafm U Vkwa Y Dkwikszjs'Ku Fyfevsm Bafm U Vkwa Y Dkwikszjs'Ku FyfevsmAman ThakurNo ratings yet

- Econ Analysis Report 2016Document340 pagesEcon Analysis Report 2016zinveliu_vasile_florinNo ratings yet

- Tax Policy Center Briefing Book - 2018.1Document561 pagesTax Policy Center Briefing Book - 2018.1lucasrsv1No ratings yet

- CIR V General FoodsDocument2 pagesCIR V General FoodsNelsonPolinarLaurdenNo ratings yet

- Tax Lumbera Income Tax TranscriptDocument4 pagesTax Lumbera Income Tax Transcriptchibi_carolNo ratings yet

- TAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanDocument6 pagesTAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanPatrick GuetaNo ratings yet

- Week 3 Tax 2 - Assignment - MIPRANUM, RJAYDocument2 pagesWeek 3 Tax 2 - Assignment - MIPRANUM, RJAYAileen Mifranum IINo ratings yet

- PNOC vs. CADocument2 pagesPNOC vs. CACaliNo ratings yet

- AC405 Assignment R185840RDocument3 pagesAC405 Assignment R185840RDiatomspinalcordNo ratings yet

- TAX Review - GP Ex-2Document4 pagesTAX Review - GP Ex-2duguitjinky20.svcNo ratings yet

- Quiz 405Document3 pagesQuiz 405Shaika HaceenaNo ratings yet

- Ack Afcpy3063l 2021-22 163749600170721Document1 pageAck Afcpy3063l 2021-22 163749600170721Rakesh SinghNo ratings yet

- Chapter 1 - Fundamental Principles: TAXATION - The Process by Which The Sovereign, Through Its Law-Making BodyDocument11 pagesChapter 1 - Fundamental Principles: TAXATION - The Process by Which The Sovereign, Through Its Law-Making BodyLiRose SmithNo ratings yet

- Brief of Dtls of Direct Selling and PlanDocument2 pagesBrief of Dtls of Direct Selling and PlanKangen WaterNo ratings yet

- Wsa 40Document219 pagesWsa 40Rizal PerdanaNo ratings yet

- Alka MedicalDocument1 pageAlka MedicalKamlesh PrajapatiNo ratings yet

- Kerala Budget Analysis 2022-23Document7 pagesKerala Budget Analysis 2022-23Shakti MishraNo ratings yet

- Remittance VoucherDocument2 pagesRemittance VoucherЕвгений БулгаковNo ratings yet

- TK468554860 V 69Document2 pagesTK468554860 V 69sunny9876369671No ratings yet

- Bir Form 2551Q (2018)Document2 pagesBir Form 2551Q (2018)Obin Tambasacan Baggayan33% (3)

- Financial ProblemDocument4 pagesFinancial ProblemndutaNo ratings yet

- Fakhr Wood Handicarfts: 7 PO0000 Paid 8223Document2 pagesFakhr Wood Handicarfts: 7 PO0000 Paid 8223Sunil PatelNo ratings yet

- Caculation of IT Tax (INDIA)Document11 pagesCaculation of IT Tax (INDIA)aks1296No ratings yet