Professional Documents

Culture Documents

TMF Garage Stub

TMF Garage Stub

Uploaded by

amatobertrum0 ratings0% found this document useful (0 votes)

0 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views1 pageTMF Garage Stub

TMF Garage Stub

Uploaded by

amatobertrumCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

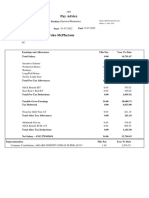

TMF Garage

5071 Austell Powder Springs Rd Clarkdale, GA 30111 678-503-2846

Statement of Earnings and Deductions

Name: DENNIS SESHIE Pay period: 06/02/2023 - 06/15/2023

Address: 1906 VELMA STREET SE Payroll in: 11104650000064

ATLANTA, GA 30315 Paydate: 06/21/2023

Payroll: Hourly Advice NO.: 20967

Check Amount = Gross - Tax Exempt Ded - Taxes - Non Tax Exempt

6,125.87 7,692.00 0.00- 1,512.63- 26.75

EARNINGS AND DEDUCTIONS

CATEGORY Retro Rate Hours This Period Total YTD Amount

Amount

EARNINGS

Plant Bonus 0.00 0.00

Vacation 96.15 0.00 0.00

75% STD 0.00 0.00

Regular Hours 96.15 80.00 7,692.00 7,692.00 99,996.00

OT: Premium 1.20 0.00 0.00 0.00 1700.00

Shift Differential 1.20 0.00 0.00 0.00 4020.40

Holiday 0.00 0.00

Earnings Total 7,692.00 7,692.00 105,716.40

PRE-TAX DEDUCTIONS

EE 401K Basic 6.00% 0.00- 0.00- 904.50-

Health Savings Account 0.00- 0.00- 820.00-

Total 0.00- 0.00- 1,724.50-

PRE-TAX DEDUCTIONS

401K Loan 24.60- 24.60- 24.60-

EE Critical Care 2.15- 2.15- 2.15-

Total 26.75- 26.75- 26.75-

TAXES

Federal

FED 627.59- 627.59- 8,158.67-

TX EE Social Security 454.60- 454.60- 5,909.80-

TX EE Medicare Tax 103.53- 103.53- 1,355.89-

State GA

GA Withholding Tax 326.91- 326.91- 4,249.83-

Total 1,512.63- 1,512.63- 19,664.19-

OTHER INFORMATION

RIA Eligible Earning 6,125.87 6,125.87 84300.96

EE GTLI Taxable 0.00 0.00 904.50

ER 401k Contribution 0.00 0.00 820.00

PAYMENT DETAILS

Method Detail Check No. Amount Currency

HR Payroll Bank Transfer WELLS FARGO BANK N.A 000000000000000 6,125.87 USD

7164

You might also like

- WellsFargo Bank Statement MarchDocument5 pagesWellsFargo Bank Statement MarchamatobertrumNo ratings yet

- Workday 1Document1 pageWorkday 1raheemtimo1No ratings yet

- Walmart Pay Stub Online VersionDocument5 pagesWalmart Pay Stub Online VersionLily NguyenNo ratings yet

- Pay Stub 4022018-4152018Document1 pagePay Stub 4022018-4152018lilian hutsilNo ratings yet

- SSPOFADVDocument1 pageSSPOFADVKaren OHareNo ratings yet

- Earnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Document1 pageEarnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Miquel JonesNo ratings yet

- July PAY STUB 03Document1 pageJuly PAY STUB 03enudo SolomonNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- Pclaw 10: User GuideDocument364 pagesPclaw 10: User GuideHaroon RashidNo ratings yet

- Nollet 2015 - Handbook of Food Analysis PDFDocument1,531 pagesNollet 2015 - Handbook of Food Analysis PDFემილი ონოფრე100% (3)

- Concept MapDocument1 pageConcept MapLesley Joy T. BaldonadoNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchShunui SonodaNo ratings yet

- Sspusadv PDFDocument1 pageSspusadv PDFKIMNo ratings yet

- Establish Kinder Garden School - Develope Project ManagerDocument25 pagesEstablish Kinder Garden School - Develope Project ManagerVõ Thúy Trân0% (1)

- Sample 2017Document1 pageSample 2017scribd.recent479No ratings yet

- JJCSCP000810000000 R 19180 C8 AD2 A8621Document2 pagesJJCSCP000810000000 R 19180 C8 AD2 A8621andinoman13No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- Dezhao Li: Earnings StatementDocument1 pageDezhao Li: Earnings StatementAnna LiNo ratings yet

- Amedisys Holding, LLC: Plan Description Starting Balance Earned Taken Adjustments Available BalanceDocument1 pageAmedisys Holding, LLC: Plan Description Starting Balance Earned Taken Adjustments Available BalanceMETRO PACNo ratings yet

- Paystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFDocument8 pagesPaystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFLuis MartinezNo ratings yet

- Check 0805Document2 pagesCheck 080576xzv4kk5vNo ratings yet

- DirectDeposit 2021 08 31 1424Document1 pageDirectDeposit 2021 08 31 1424Holliday L RuffinNo ratings yet

- 07 10 Notting Hill Operating ReportDocument3 pages07 10 Notting Hill Operating ReportoakmontemgrNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchJonathan Diane SasisNo ratings yet

- 31 Jan 2024Document2 pages31 Jan 2024vikzNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchAngelo Mark Ordoña PorgatorioNo ratings yet

- Helen Zulu FinalDocument45 pagesHelen Zulu FinalSimon KimathiNo ratings yet

- For Stub Home DepotDocument1 pageFor Stub Home Depotraheemtimo1No ratings yet

- OCTOBER 2021: PT. Shopee Internasional IndonesiaDocument1 pageOCTOBER 2021: PT. Shopee Internasional IndonesiaRifka FitrotuzzakiaNo ratings yet

- OVERVIEW THRU OCT 21 (Version 1)Document1 pageOVERVIEW THRU OCT 21 (Version 1)Kathleen DearingerNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument2 pagesSutherland Global Services Philippines, Inc. - Philippine BranchJonathan Diane SasisNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedArul Mhmmd10No ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Earnings Taxable Non Taxable Hours Total: OvertimeDocument1 pageEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNo ratings yet

- Punam Devi: Adhikar Micro Finance (P) LTDDocument1 pagePunam Devi: Adhikar Micro Finance (P) LTDPUNAM DEVINo ratings yet

- Your Pay Advice For Pay Ending 31 07 2022Document1 pageYour Pay Advice For Pay Ending 31 07 2022iqbal.shahid0374No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedArul Mhmmd10No ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- Paystub 1Document1 pagePaystub 1PeterJamesNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nitu SinghDocument1 pageEmployee Details Payment & Working Days Details Location Details Nitu SinghRohit raagNo ratings yet

- Payslip 1Document4 pagesPayslip 1Leo MagnoNo ratings yet

- SSPCNADVDocument1 pageSSPCNADVChristopher WongNo ratings yet

- 7 Aacb 8 FCDocument1 page7 Aacb 8 FCAmaryNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Employee Details Payment & Working Days Details Location Details Neha KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Neha KumariRohit raagNo ratings yet

- DownloadDocument1 pageDownloadCriselda DelafuenteNo ratings yet

- AdrianDocument1 pageAdrianGuadalupe PerezNo ratings yet

- Wells Fargo International Solutions Private Limited: Employee Pay History For The Period JAN-2021 To DEC-2021Document1 pageWells Fargo International Solutions Private Limited: Employee Pay History For The Period JAN-2021 To DEC-2021Sourabh PunshiNo ratings yet

- Tata Business Support Services LTD: 00110283 KhushbuDocument1 pageTata Business Support Services LTD: 00110283 KhushbuKhushbu SinghNo ratings yet

- SSPOFADVDocument1 pageSSPOFADVfreddieaddaeNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- FF PayslipDocument1 pageFF PayslipYviie VANo ratings yet

- March 2023 Jagadeesh - SuraDocument1 pageMarch 2023 Jagadeesh - SuraJagadeesh SuraNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- July Stub 001Document1 pageJuly Stub 00176xzv4kk5vNo ratings yet

- Sspofadv 2Document1 pageSspofadv 2freddieaddaeNo ratings yet

- PAYSLIPDocument3 pagesPAYSLIPFoxtrot LimaNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- Paycheckstub AllDocument3 pagesPaycheckstub AllMyt WovenNo ratings yet

- FDD 47 DFBDocument1 pageFDD 47 DFBAmaryNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Payslip For Stub Home DepotDocument1 pagePayslip For Stub Home DepotOlorunfemi AdewaleNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Storage Invoice 1Document1 pageStorage Invoice 1amatobertrumNo ratings yet

- SO Wells 1Document4 pagesSO Wells 1amatobertrumNo ratings yet

- Fargo 2Document4 pagesFargo 2amatobertrumNo ratings yet

- Storage InvoiceDocument1 pageStorage InvoiceamatobertrumNo ratings yet

- Ny Bill - Free Power LLCDocument2 pagesNy Bill - Free Power LLCamatobertrumNo ratings yet

- Xcel Energy BillDocument4 pagesXcel Energy BillamatobertrumNo ratings yet

- Monzo 1Document4 pagesMonzo 1amatobertrumNo ratings yet

- Duke Energy Ohio BillDocument3 pagesDuke Energy Ohio BillamatobertrumNo ratings yet

- Greendot Statement March 2024Document3 pagesGreendot Statement March 2024amatobertrumNo ratings yet

- Greendot Statement FebrauaryDocument3 pagesGreendot Statement Febrauaryamatobertrum0% (1)

- # Pembagian Kelas Alkes Per KategoriDocument41 pages# Pembagian Kelas Alkes Per KategoriR.A.R TVNo ratings yet

- Quotation - ABS 2020-21 - E203 - Mr. K Ramesh ReddyDocument1 pageQuotation - ABS 2020-21 - E203 - Mr. K Ramesh ReddyairblisssolutionsNo ratings yet

- Literary Devices DefinitionsDocument2 pagesLiterary Devices DefinitionsAlanna BryantNo ratings yet

- R1100 1150 Catalogue 20102011Document55 pagesR1100 1150 Catalogue 20102011Jose Manuel Ramos CamachoNo ratings yet

- ISquare - Setup Guide For Fresh UsersDocument12 pagesISquare - Setup Guide For Fresh UsersWQDNo ratings yet

- CHAVEZ 2017 Data Driven Supply Chains Manufacturing Capability and Customer SatisfactionDocument14 pagesCHAVEZ 2017 Data Driven Supply Chains Manufacturing Capability and Customer SatisfactionRodolfo StraussNo ratings yet

- Will or Going To 90069Document2 pagesWill or Going To 90069Dragana ZafirovskaNo ratings yet

- HDPR Cluster Resolution No. 1, S. 2012 - RH Bill - FinalDocument2 pagesHDPR Cluster Resolution No. 1, S. 2012 - RH Bill - FinalMaria Amparo WarrenNo ratings yet

- Testi I Pare YlberiDocument6 pagesTesti I Pare YlberiAhmetNo ratings yet

- Brooklyn Mitsubishi Petition Notice To Respondents Schedules A-GDocument98 pagesBrooklyn Mitsubishi Petition Notice To Respondents Schedules A-GQueens PostNo ratings yet

- KSH PDFDocument6 pagesKSH PDFPranav DalaviNo ratings yet

- Transmission System Pressure TestDocument3 pagesTransmission System Pressure TestFerdinand FernandezNo ratings yet

- Amy Gaines - Amigurumi Matryoshka Dolls (C)Document7 pagesAmy Gaines - Amigurumi Matryoshka Dolls (C)John Eduardo Henriquez BorbonNo ratings yet

- Ch13. Flexible Budget-AkmDocument44 pagesCh13. Flexible Budget-AkmPANDHARE SIDDHESHNo ratings yet

- Adavantages of Historical ResearchDocument2 pagesAdavantages of Historical ResearchClemence JeniferNo ratings yet

- JD Edwards Enterpriseone Tools: Form Design Aid Guide Release 9.1.XDocument530 pagesJD Edwards Enterpriseone Tools: Form Design Aid Guide Release 9.1.XGaurav SahuNo ratings yet

- The Return of JesusDocument5 pagesThe Return of JesusMick AlexanderNo ratings yet

- Me TurnoverDocument2 pagesMe TurnoverAparna ShajiNo ratings yet

- Fahira's PaperDocument95 pagesFahira's PaperRekaJuliantiNo ratings yet

- Neb Grade XiiDocument20 pagesNeb Grade XiiSamjhana LamaNo ratings yet

- Lab 6 Shouq PDFDocument10 pagesLab 6 Shouq PDFreemy100% (1)

- Alzheimer's - Alzheimer's Disease - Kaj Blennow, Mony J de Leon, Henrik ZeterbergDocument17 pagesAlzheimer's - Alzheimer's Disease - Kaj Blennow, Mony J de Leon, Henrik ZeterbergCatinean DanielaNo ratings yet

- Bsl6 Qual Spec 11-12 FinalDocument35 pagesBsl6 Qual Spec 11-12 FinalBSLcourses.co.ukNo ratings yet

- Karur Vysya Bank Employees' Union: 11th Bipartite Arrears Calculation Package - ClerkDocument10 pagesKarur Vysya Bank Employees' Union: 11th Bipartite Arrears Calculation Package - ClerkDeepa ManianNo ratings yet

- Ahad NaamahDocument2 pagesAhad NaamahedoolawNo ratings yet

- 100 To 1 in The Stock Market SummaryDocument28 pages100 To 1 in The Stock Market SummaryRamanReet SinghNo ratings yet