Professional Documents

Culture Documents

aecc7af9-f0e3-4577-8eb7-a8b772881ec3[1]

aecc7af9-f0e3-4577-8eb7-a8b772881ec3[1]

Uploaded by

Lillian AwtCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

aecc7af9-f0e3-4577-8eb7-a8b772881ec3[1]

aecc7af9-f0e3-4577-8eb7-a8b772881ec3[1]

Uploaded by

Lillian AwtCopyright:

Available Formats

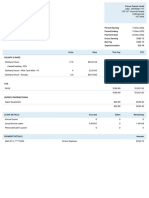

EARNINGS STATEMENT

SFR3 RENOVATION LLC ADVICE OF DEPOSIT

(Legal Address)

228 Park Avenue South, Suite 73833

K

New York, NY 10003 PAY PERIOD:

C

Phone: 9294702797 05/18/2024 - 05/31/2024

(Work address)

2657 Laburnum Dr

Birmingham, AL 35235

CH E PAY DATE:

Phone: 9294702797

OT A 06/07/2024

N

GROSS PAY:

I S

PAID TO: $2,532.23

Migel Gardiner

2657 Laburnum Dr

Birmingham, AL 35235 TH I S NET PAY:

$2,732.38

SSN: ...8092

TIME OFF USED (HOURS) ACCRUED (HOURS) BALANCE (HOURS) DEDUCTIONS CURRENT EMP. CURRENT CO. YTD EMP. YTD CO.

DEDUCTION CONTRIBUTION DEDUCTION CONTRIBUTION

Bereavement Policy 0.00 0.00 0.00

Medical $0.00 $371.29 $0.00 $4,084.19

PTO Field 0.00 3.08 17.25 Deductions

Paternity Leave 0.00 6.15 98.44 Dental Deductions $0.00 $85.78 $0.00 $943.53

Unpaid Time Off 0.00 - Unlimited Vision Deductions $9.65 $0.00 $106.10 $0.00

Policy(Unpaid)

Voluntary Life $20.55 $0.00 $226.00 $0.00

Deductions

EARNINGS RATE HOURS CURRENT YTD 401K $151.93 $0.00 $1,777.81 $0.00

Base Pay $28.50 80.00 $2,280.00 $25,432.00

Overtime $42.75 5.90 $252.23 $252.23 SUMMARY CURRENT YTD

Bonus - - $0.00 $3,291.00 Gross Pay $2,532.23 $30,543.23

PTO Hours $28.50 - $0.00 $1,568.00 Reimbursements $668.10 $4,497.91

Mileage - PE - - $668.10 $4,497.91 Deductions $182.13 $2,109.91

Taxes $285.82 $3,591.84

TAXES WITHHELD CURRENT YTD Net Pay $2,732.38 $29,339.39

Medicare $36.58 $441.33 Acct# ...838 Trace: $2,732.38

021000021557661

Social Security $156.40 $1,887.09

State Withholding - AL $92.84 $1,263.42

Paystub generated by PAYSTUB ID: 663642408d085db990a2ccad www.rippling.com

You might also like

- RPMS With MOVs and AnnotationsDocument123 pagesRPMS With MOVs and AnnotationsXyza95% (21)

- Pay Stub Portal3Document1 pagePay Stub Portal3cwhite2150No ratings yet

- Walmart Pay Stub Online VersionDocument5 pagesWalmart Pay Stub Online VersionLily NguyenNo ratings yet

- Adp Pay Stub Template 1Document1 pageAdp Pay Stub Template 1Candy ValentineNo ratings yet

- Pay Stub Portal2Document1 pagePay Stub Portal2cwhite2150No ratings yet

- 4:30:21 PaystubDocument1 page4:30:21 PaystubRhoderlande JosephNo ratings yet

- Dan Bank StatementDocument3 pagesDan Bank StatementJessica FullerNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- CheckStub - 2020-11-06 v3.6Document1 pageCheckStub - 2020-11-06 v3.6dijaje865No ratings yet

- Quess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P MDocument1 pageQuess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P Msagar janiNo ratings yet

- Paystub Golden Limousine, Inc 20210906 20210919Document2 pagesPaystub Golden Limousine, Inc 20210906 20210919Alexander Weir-WitmerNo ratings yet

- Endocrinology - Polyuria - SOAP Note - Jeanette GoguenDocument3 pagesEndocrinology - Polyuria - SOAP Note - Jeanette GoguenFrancieudo SampaioNo ratings yet

- Direct Deposit Advice This Is Not A CheckDocument1 pageDirect Deposit Advice This Is Not A CheckAlex RoofNo ratings yet

- Natalie Ruth Grace Payslip 1Document2 pagesNatalie Ruth Grace Payslip 1bonnie zhuNo ratings yet

- List of The PhobiaDocument8 pagesList of The PhobiaRjvm Net Ca FeNo ratings yet

- Paystub Resilience Lab Medical PC 20231001 20231015Document1 pagePaystub Resilience Lab Medical PC 20231001 20231015samantha.vasquezNo ratings yet

- Paystub 2 DanielleDocument1 pagePaystub 2 DanielleKristina Mosley-FryeNo ratings yet

- Paystub Golden Limousine, Inc 20210906 20210919Document2 pagesPaystub Golden Limousine, Inc 20210906 20210919Alexander Weir-WitmerNo ratings yet

- Riopel, Breanna Jul 30, 21Document1 pageRiopel, Breanna Jul 30, 21wadewilliamsperling1992No ratings yet

- PayslipDocument1 pagePaysliphienvvuNo ratings yet

- Payment StubDocument1 pagePayment Stub4gbvqp5hmrNo ratings yet

- 251677202212salaryslip - PDF DecDocument2 pages251677202212salaryslip - PDF Decsaurabhm12343No ratings yet

- Sep 15-Pay StatementDocument1 pageSep 15-Pay Statementmahak.gupta1902No ratings yet

- Paystub Golden Limousine, Inc 20210906 20210919Document2 pagesPaystub Golden Limousine, Inc 20210906 20210919Alexander Weir-WitmerNo ratings yet

- Mbaraka HamisDocument1 pageMbaraka HamisMbaraka HamisNo ratings yet

- 6670 Alexis 12-30-2022Document1 page6670 Alexis 12-30-2022Nego da NagaNo ratings yet

- RPT Pay Slip YTDDocument1 pageRPT Pay Slip YTDTomola BlessingNo ratings yet

- Oct. 28-Declaración de PagoDocument1 pageOct. 28-Declaración de Pagochristianseda26No ratings yet

- PaySlip JanDocument1 pagePaySlip JanUChaSM LiveNo ratings yet

- PPCPL MAY 2024 18503 PayslipDocument1 pagePPCPL MAY 2024 18503 PayslipSolanki SahilNo ratings yet

- 13 19 Nov (Recovered)Document1 page13 19 Nov (Recovered)Kikky Sirinin WachumNo ratings yet

- Earnings: Hourly Ot Bonus Cctips Mealper Prempay RetailcomDocument1 pageEarnings: Hourly Ot Bonus Cctips Mealper Prempay Retailcomalfredo velezNo ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Dateanjali daveNo ratings yet

- Epayslip 2022-07-25 10369847Document1 pageEpayslip 2022-07-25 10369847aida.bungcasan.2020No ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- Toronto Metro Hall 2Document2 pagesToronto Metro Hall 2Lily NguyenNo ratings yet

- Deaconess Homecare Inc: Payroll Advice OnlyDocument4 pagesDeaconess Homecare Inc: Payroll Advice OnlyDREE DREENo ratings yet

- Screenshot 2023-10-01 at 8.44.35 PMDocument2 pagesScreenshot 2023-10-01 at 8.44.35 PManthonyriddell75No ratings yet

- Auprecedadata PAY1 TOLF80 Payslips 9455479904493 Sessionid PG0 V1 D5 T8Document1 pageAuprecedadata PAY1 TOLF80 Payslips 9455479904493 Sessionid PG0 V1 D5 T8Eggy PalangatNo ratings yet

- Statement CooperDocument4 pagesStatement CooperyeshakbirNo ratings yet

- Payment Date: 10/15/2020 Payment #: Payment Amt: $0.00 Home State Health 11720 Borman Drive St. Louis, MO 63146 1-855-694-4663Document2 pagesPayment Date: 10/15/2020 Payment #: Payment Amt: $0.00 Home State Health 11720 Borman Drive St. Louis, MO 63146 1-855-694-4663Daya AnandaNo ratings yet

- Billing Detail: Late PaymentDocument1 pageBilling Detail: Late Paymenttheodore moses antoine beyNo ratings yet

- Migial Delmonico Dean Dec 18 2022 Dec 31 2022Document1 pageMigial Delmonico Dean Dec 18 2022 Dec 31 2022JerichoNo ratings yet

- PP May 2022Document1 pagePP May 2022Jhob MertensNo ratings yet

- Runi 1816Document1 pageRuni 1816Harsh JasaniNo ratings yet

- OWNERSHIP STATEMENT #25 - Kareema Taki & Dheyaa Ali: MR Kareema Taki 13 Manna Way Mill Park, Vic, 3082Document2 pagesOWNERSHIP STATEMENT #25 - Kareema Taki & Dheyaa Ali: MR Kareema Taki 13 Manna Way Mill Park, Vic, 3082Dheyaa AliNo ratings yet

- Paycheck - 2022 09 18 - 2022 09 24Document1 pagePaycheck - 2022 09 18 - 2022 09 24Sandra RíosNo ratings yet

- Gayla Poole PaystubDocument1 pageGayla Poole Paystubwadewilliamsperling1992No ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- Jason Matheson Paystub 2Document1 pageJason Matheson Paystub 2wadewilliamsperling1992No ratings yet

- M/S Lucky Nursing Bureau: Balance Sheet As On 31/3/08 Liabilities Amount Amount Assets Amount AmountDocument3 pagesM/S Lucky Nursing Bureau: Balance Sheet As On 31/3/08 Liabilities Amount Amount Assets Amount Amountkumarjmt7427No ratings yet

- Paycheckstub AllDocument3 pagesPaycheckstub AllMyt WovenNo ratings yet

- Cipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Document2 pagesCipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Dhruv RanaNo ratings yet

- Neeraj SirDocument2 pagesNeeraj SirMeditest DNo ratings yet

- March 2023 CapgeminiDocument1 pageMarch 2023 CapgeminimanojkallemuchikkalNo ratings yet

- NEWDocument1 pageNEWbstockman90No ratings yet

- 7 TSSCP000520409612 R 19144799836 F521Document1 page7 TSSCP000520409612 R 19144799836 F521cruzernesto3645No ratings yet

- Paystub 2Document2 pagesPaystub 2heaven.edwards2No ratings yet

- Mio SoulDocument1 pageMio SoulWel GadayanNo ratings yet

- 08 - 05 - 2021 Foods Off Cycle 119644 Supplemental PDFDocument1 page08 - 05 - 2021 Foods Off Cycle 119644 Supplemental PDFVictoria ChevalierNo ratings yet

- Pay SlipDocument1 pagePay Slipnatabejarano.19.96No ratings yet

- SafariDocument2 pagesSafaribighit.printingNo ratings yet

- Harold Johnson Jr Work Excuse HCADocument1 pageHarold Johnson Jr Work Excuse HCALillian AwtNo ratings yet

- Tierra Ashley Bi-Weekly Stub 2Document1 pageTierra Ashley Bi-Weekly Stub 2Lillian AwtNo ratings yet

- Yasmonda Howard Declaration PaperDocument1 pageYasmonda Howard Declaration PaperLillian AwtNo ratings yet

- Abiola Folarin Apr 28 - May 29 BOA Bank StatementDocument12 pagesAbiola Folarin Apr 28 - May 29 BOA Bank StatementLillian AwtNo ratings yet

- Abiola Folarin Apr 28 - May 29 BOA Bank StatementDocument12 pagesAbiola Folarin Apr 28 - May 29 BOA Bank StatementLillian AwtNo ratings yet

- Tierra Ashley Bi-Weekly Stub 2Document1 pageTierra Ashley Bi-Weekly Stub 2Lillian AwtNo ratings yet

- Harold Johnson Jr Work Excuse HCADocument1 pageHarold Johnson Jr Work Excuse HCALillian AwtNo ratings yet

- Zilyn Jackson BOA Statement OctDocument4 pagesZilyn Jackson BOA Statement OctLillian AwtNo ratings yet

- Tiffani Faust Dismissal Case LetterDocument1 pageTiffani Faust Dismissal Case LetterLillian AwtNo ratings yet

- TIFFANI FAUST 6 Panel Test LetterDocument1 pageTIFFANI FAUST 6 Panel Test LetterLillian AwtNo ratings yet

- Addriena Overstreet Bank of America Bank Statement Aug - NovDocument7 pagesAddriena Overstreet Bank of America Bank Statement Aug - NovLillian AwtNo ratings yet

- Amelia Barnes ReciptDocument1 pageAmelia Barnes ReciptLillian AwtNo ratings yet

- Adreanna De'Nae Williams Work ExcuseDocument1 pageAdreanna De'Nae Williams Work ExcuseLillian AwtNo ratings yet

- AgreementDocument2 pagesAgreementLillian AwtNo ratings yet

- Bernice Lyons PPD Test ReadingsDocument1 pageBernice Lyons PPD Test ReadingsLillian AwtNo ratings yet

- Landlord Affidavit of Residence LetterDocument2 pagesLandlord Affidavit of Residence LetterLillian AwtNo ratings yet

- Ilee Guidroz Work ExcuseDocument1 pageIlee Guidroz Work ExcuseLillian AwtNo ratings yet

- Barbera Riley Employment Letter 2Document1 pageBarbera Riley Employment Letter 2Lillian AwtNo ratings yet

- Al'Kedra E Williams Bank Statement JanDocument1 pageAl'Kedra E Williams Bank Statement JanLillian AwtNo ratings yet

- Kiara Jamison Progressive InsuranceDocument2 pagesKiara Jamison Progressive InsuranceLillian AwtNo ratings yet

- Prepare and Cook Meat: Cookery 10 School Year 2019 - 2020Document43 pagesPrepare and Cook Meat: Cookery 10 School Year 2019 - 2020Alodie Dela Raiz AsuncionNo ratings yet

- Who Was St. Maximilian Kolbe, and What Were His Contributions, Works of Mercy, and CharismDocument2 pagesWho Was St. Maximilian Kolbe, and What Were His Contributions, Works of Mercy, and CharismMark Erwin SalduaNo ratings yet

- 12 Chemistry Notes ch02 Solutions PDFDocument5 pages12 Chemistry Notes ch02 Solutions PDFSahilGuptaNo ratings yet

- Rti Brochure Searox Products Solutions - Int - en PDFDocument32 pagesRti Brochure Searox Products Solutions - Int - en PDFAnh Le NgocNo ratings yet

- The Workmen's Compensation Act, 1923Document12 pagesThe Workmen's Compensation Act, 1923dua tanveerNo ratings yet

- Dal Fry RecipeDocument2 pagesDal Fry RecipejunkyardNo ratings yet

- Esmee Sabina 19-5372 PDFDocument3 pagesEsmee Sabina 19-5372 PDFEsme SabinaNo ratings yet

- FDSS CARES Meals Assistance Gift Card Application FormDocument1 pageFDSS CARES Meals Assistance Gift Card Application FormFauquier NowNo ratings yet

- Expansion ValvesDocument19 pagesExpansion ValvesMostafa ZaytounNo ratings yet

- Public Health Aspects of Cream-Filled Pastries. A Review: Frankl. BryanDocument8 pagesPublic Health Aspects of Cream-Filled Pastries. A Review: Frankl. BryanChristine Joy PanlilioNo ratings yet

- Module 2 AnswersDocument6 pagesModule 2 AnswersJoy A. VisitacionNo ratings yet

- AP GIS GO NO 131 W.E.F Oct 2018 - 30-06-2019Document6 pagesAP GIS GO NO 131 W.E.F Oct 2018 - 30-06-2019Sivareddy50% (2)

- Container Type Linear Dimensions (Base Width / Overall Width × Depth × Height) RemarksDocument2 pagesContainer Type Linear Dimensions (Base Width / Overall Width × Depth × Height) RemarksBablu JiNo ratings yet

- What Exactly Is Adrenal FatigueDocument3 pagesWhat Exactly Is Adrenal FatiguejhNo ratings yet

- Dsh220 Marenga Counseling Individual AssignmentDocument8 pagesDsh220 Marenga Counseling Individual AssignmentBeauty Indrah MarengaNo ratings yet

- Agua Mineral NaturalDocument4 pagesAgua Mineral NaturalSara SánNo ratings yet

- MK Thrombotic Disorders PDFDocument10 pagesMK Thrombotic Disorders PDFMoses Jr KazevuNo ratings yet

- Jadwal PM JanuariDocument3 pagesJadwal PM JanuariZulkarnain HNo ratings yet

- Entry Level English AssessmentDocument16 pagesEntry Level English AssessmentRosa-Marie RamkissoonNo ratings yet

- MeconiumDocument46 pagesMeconiumМаnal AlJobranNo ratings yet

- Product Information Clip-On Extensometer 5025-1, 8040-1 and 7537-1Document3 pagesProduct Information Clip-On Extensometer 5025-1, 8040-1 and 7537-1Diego AvendañoNo ratings yet

- CAD - Model of DiscDocument5 pagesCAD - Model of DiscAshokkumar VelloreNo ratings yet

- AUBF - Lec Chapter 3 4 5 COMPLETE - Transes 1Document18 pagesAUBF - Lec Chapter 3 4 5 COMPLETE - Transes 1Princess Eve OlowanNo ratings yet

- Taconic Road Runners Summer 08 NewsletterDocument29 pagesTaconic Road Runners Summer 08 NewslettergregorydcohenNo ratings yet

- Economicsof Chilli Productionin IndiaDocument5 pagesEconomicsof Chilli Productionin IndiaABHINAV VIVEKNo ratings yet

- Vysotsky Pharmacology PDFDocument311 pagesVysotsky Pharmacology PDFAntonPurpurovNo ratings yet

- Orbino, Frances Anne N. 4th Rot FdarDocument2 pagesOrbino, Frances Anne N. 4th Rot FdarFrances OrbinoNo ratings yet