Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsNIKE COMPANY5

NIKE COMPANY5

Uploaded by

62010159Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Financial Position and Performance of FirstGroup PLC.Document17 pagesFinancial Position and Performance of FirstGroup PLC.Mohammad MollaNo ratings yet

- Zambian Breweries Report 2018Document8 pagesZambian Breweries Report 2018Mumbi MwansaNo ratings yet

- Presentacion CapitalDocument11 pagesPresentacion CapitalLiliana Martínez LiraNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Im Acco 20203 AccountingDocument107 pagesIm Acco 20203 AccountingTong Kennedy0% (1)

- PQ2Document2 pagesPQ2alellieNo ratings yet

- Financial Management Mid-Term Exam 2022Document9 pagesFinancial Management Mid-Term Exam 2022ahmadbinowaidhaNo ratings yet

- Dwnload Full Fundamentals of Corporate Finance 4th Edition Berk Solutions Manual PDFDocument35 pagesDwnload Full Fundamentals of Corporate Finance 4th Edition Berk Solutions Manual PDFbrumfieldridleyvip100% (13)

- Tutorial 7 FAT SolutionDocument13 pagesTutorial 7 FAT SolutionAhmad FarisNo ratings yet

- Atlas CycleDocument8 pagesAtlas Cyclepriyacharan5454No ratings yet

- Case Study 1 Muhammad JanjuaDocument6 pagesCase Study 1 Muhammad JanjuaAmeer Hamza JanjuaNo ratings yet

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- MINI CASE CH 9Document7 pagesMINI CASE CH 9Samara SharinNo ratings yet

- Ics CW 1Document7 pagesIcs CW 1RAVEENA DEVI A/P VENGADESWARA RAONo ratings yet

- Diploma in Business and Management (AB101) Financial Management (PFN1223) TopicDocument35 pagesDiploma in Business and Management (AB101) Financial Management (PFN1223) TopicARIANEE BINTI AHMAD SAINI (BG)No ratings yet

- A. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Document6 pagesA. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Phạm Thu HuyềnNo ratings yet

- Soal Latihan Pertemuan KelimaDocument7 pagesSoal Latihan Pertemuan KelimaErvian RidhoNo ratings yet

- Assignment FinalDocument10 pagesAssignment FinalJamal AbbasNo ratings yet

- Year 2018 2019 2020: Task 1Document9 pagesYear 2018 2019 2020: Task 1Prateek ChandnaNo ratings yet

- FIN7101 - FIN. BUSINESS - TEST - 01 (PBS 21101107) AzdzharulnizzamDocument6 pagesFIN7101 - FIN. BUSINESS - TEST - 01 (PBS 21101107) AzdzharulnizzamAzdzharulnizzam AlwiNo ratings yet

- 1BSA Final ExamDocument11 pages1BSA Final ExamcamillaNo ratings yet

- AFD Practice Questions Mock (3399)Document7 pagesAFD Practice Questions Mock (3399)AbhiNo ratings yet

- Financial Accounting - Starbucks CaseDocument14 pagesFinancial Accounting - Starbucks CaseHạnh TrầnNo ratings yet

- Updated FileDocument16 pagesUpdated Fileshubham agarwalNo ratings yet

- 16 Consolidation Subsequent To The Date of AcquisitionDocument3 pages16 Consolidation Subsequent To The Date of AcquisitionMila Casandra CastañedaNo ratings yet

- Complete Task - Buderim GingerDocument9 pagesComplete Task - Buderim GingerOne OrgNo ratings yet

- Pset 3Document4 pagesPset 3Assassin Panda14No ratings yet

- Group PresentationDocument22 pagesGroup PresentationMohamed Al RemeithiNo ratings yet

- Thal LTDDocument8 pagesThal LTDZameer AbbasiNo ratings yet

- Activity RatioDocument2 pagesActivity RatioOlivia RinaNo ratings yet

- Financial Analysis AppleDocument10 pagesFinancial Analysis AppleEléa LeconteNo ratings yet

- Nestle AnanlysisDocument18 pagesNestle AnanlysisSLUG GAMINGNo ratings yet

- Chapter 2 Revision Exercises + SolutionsDocument12 pagesChapter 2 Revision Exercises + SolutionsSanad RousanNo ratings yet

- Fin2001 Pset4Document10 pagesFin2001 Pset4Valeria MartinezNo ratings yet

- Accounting and Finance WDocument10 pagesAccounting and Finance WWanambisi JnrNo ratings yet

- Business Management Assignment 1Document7 pagesBusiness Management Assignment 1sphesihlemkhize1204No ratings yet

- LectureDocument29 pagesLectureatharNo ratings yet

- Tugas AulaDocument5 pagesTugas AulaZuriafNo ratings yet

- Gross Profit Margin: MeaningDocument7 pagesGross Profit Margin: Meaningthai hoangNo ratings yet

- Lecture 3 - Assignment - Jaimin PandyaDocument10 pagesLecture 3 - Assignment - Jaimin PandyajaiminNo ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernancehNo ratings yet

- Assignment 01Document18 pagesAssignment 01Md. Real MiahNo ratings yet

- Revison Lecture - Q1 Q2Document28 pagesRevison Lecture - Q1 Q2pes60804No ratings yet

- FABM2-Analysis and Interpretation of Financial StatementsDocument7 pagesFABM2-Analysis and Interpretation of Financial StatementsGerlen MendozaNo ratings yet

- Quiz Acctng 603Document10 pagesQuiz Acctng 603LJ AggabaoNo ratings yet

- 3.5 ExercisesDocument13 pages3.5 ExercisesGeorgios MilitsisNo ratings yet

- Ratio AnalysisDocument29 pagesRatio AnalysisatharNo ratings yet

- N1227106 Busi48901 261123Document11 pagesN1227106 Busi48901 261123malisiddhant2602No ratings yet

- Sol-Lecture Ques - MOODLEDocument15 pagesSol-Lecture Ques - MOODLERami RRKNo ratings yet

- Tata Motors .Document14 pagesTata Motors .Shweta MaltiNo ratings yet

- Report Fin GroupDocument10 pagesReport Fin GroupFATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- FM Testbank Ch03Document18 pagesFM Testbank Ch03David LarryNo ratings yet

- My Life at 6ft BelowDocument1 pageMy Life at 6ft Belowvasquez.jabezraphael308129No ratings yet

- Finance Cheat SheetDocument13 pagesFinance Cheat SheetVasundhra KalaimaranNo ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- Advanced Financial Management May 2017 Past Paper and Suggested Answers ViujprDocument19 pagesAdvanced Financial Management May 2017 Past Paper and Suggested Answers ViujprkaragujsNo ratings yet

- 2024 FMA300 Unit 3 Learning GuideDocument24 pages2024 FMA300 Unit 3 Learning GuideSeneliso NyathiNo ratings yet

- Whirlpool Financial AnalysisDocument5 pagesWhirlpool Financial AnalysisuddhavkulkarniNo ratings yet

- B1.nov 2022 AnsDocument12 pagesB1.nov 2022 AnsAndrea NyerereNo ratings yet

- Problem BankDocument10 pagesProblem BankSimona NistorNo ratings yet

- Introduction To Financial Statement AnalysisDocument7 pagesIntroduction To Financial Statement AnalysisAJ NovallascaNo ratings yet

- Chapter Three: General Fund & Special Revenue Funds 3.1 General Fund IsDocument41 pagesChapter Three: General Fund & Special Revenue Funds 3.1 General Fund IsTamirat BashaaNo ratings yet

- SAP Year End Closing ActivitiesDocument9 pagesSAP Year End Closing ActivitiesVijay RamNo ratings yet

- General Journal: Description Post Ref Dr. Cr. DateDocument14 pagesGeneral Journal: Description Post Ref Dr. Cr. DateRizki MuhammadNo ratings yet

- Accounting For Business: Chapter 4: The Statement of Cash FlowsDocument40 pagesAccounting For Business: Chapter 4: The Statement of Cash FlowsegNo ratings yet

- FINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Document44 pagesFINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Srinivas Muchantula100% (5)

- The Accounting Cycle: Step 1: Analyze Business TransactionsDocument4 pagesThe Accounting Cycle: Step 1: Analyze Business TransactionsUnkownamousNo ratings yet

- Assignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Document4 pagesAssignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Ivy KwokNo ratings yet

- AFAR Preweek (B44) - HIGHLIGHTEDDocument31 pagesAFAR Preweek (B44) - HIGHLIGHTEDMARIA VERNADETTE SHARISSE LEGASPINo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- Week 4 Tutorial QuestionsDocument5 pagesWeek 4 Tutorial QuestionsJess XueNo ratings yet

- AASB 116 Property, Plant and Equipment: Fact SheetDocument2 pagesAASB 116 Property, Plant and Equipment: Fact SheetShipNo ratings yet

- Venture Valuation MethodsDocument2 pagesVenture Valuation MethodsEmily HackNo ratings yet

- CIMA Case Study-IIT GuwahatiDocument24 pagesCIMA Case Study-IIT GuwahatiPrachi AgarwalNo ratings yet

- Signed FS Inocycle Technology Group TBK 2018 PDFDocument74 pagesSigned FS Inocycle Technology Group TBK 2018 PDFmichele hazelNo ratings yet

- Summary of Pas 36Document5 pagesSummary of Pas 36Elijah MontefalcoNo ratings yet

- Book Keeping & Accountancy March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperDocument5 pagesBook Keeping & Accountancy March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperBhavin MamtoraNo ratings yet

- FMJ2 Carryover of Open ItemsDocument20 pagesFMJ2 Carryover of Open ItemsAKNo ratings yet

- Meija KariukiDocument2 pagesMeija KariukiPeter Kibelesi KukuboNo ratings yet

- 4 Accounting For Legal Liqudation PresentationDocument40 pages4 Accounting For Legal Liqudation PresentationMeselech Girma100% (1)

- Lecture 3 Ratio AnalysisDocument59 pagesLecture 3 Ratio AnalysisJiun Herng LeeNo ratings yet

- MBA Project Report On Ratio AnalysisDocument19 pagesMBA Project Report On Ratio Analysislatest infoNo ratings yet

- Lufthansa Report 2009Document234 pagesLufthansa Report 2009riverofgiraffesNo ratings yet

- PT Vale Indonesia TBK Financial Statements 9M21Document54 pagesPT Vale Indonesia TBK Financial Statements 9M21Seputar InfoNo ratings yet

- Roadmap Statement of Cash FlowsDocument134 pagesRoadmap Statement of Cash FlowsNabil BouraïmaNo ratings yet

- Cfas ReviewerDocument4 pagesCfas ReviewerFerb CruzadaNo ratings yet

- 12ENTREP Q2 Module 8 Terminal Report of Business OperationsDocument10 pages12ENTREP Q2 Module 8 Terminal Report of Business OperationsJM Almaden AbadNo ratings yet

- Change in PSR 1 PDFDocument6 pagesChange in PSR 1 PDFNavya jainNo ratings yet

- Annual-Report-2020 FKSDocument12 pagesAnnual-Report-2020 FKSHalizasnNo ratings yet

NIKE COMPANY5

NIKE COMPANY5

Uploaded by

620101590 ratings0% found this document useful (0 votes)

2 views10 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views10 pagesNIKE COMPANY5

NIKE COMPANY5

Uploaded by

62010159Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 10

NIKE COMPANY

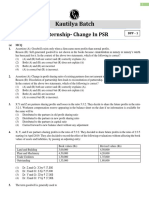

Net Operating Working Capital:

( Current asset – Excess cash) – ( Current liability – Notes Payable)

NOWC 2021:

(26,291,000 – 9,889,000) – (9,674,000 – 2000)

= 6,730,000

NOWC 2020:

(20,556,000 – 8,348,000) – (8,284,000 – 248,000)

= 4,172,000

▲NOWC = NOWC 2021 – NOWC 2020

= 6,730,000 – 4,172,000

= 2,558,000

Financial Ratios

1. Liquidity Ratios

a. Current Ratio = Current Assets / Current Liability

Current ratio 2021 = 26,291,000 / 9,674,000 = 2.72

Current ratio 2020 = 20,556,000 / 8,284,000 = 2.48

b. Quick Ratio = (Current Assets - Inv.) / Current Liability

Quick ratio 2021 = (26,291,000- 6,854,000) / 9,674,000 = 2

Quick ratio 2020 = (20,556,000-7,367,000) / 8,284,000 = 1.59

2021 2020 Ind

Current ratio 2.72x 2.48x 2.70x

Quick ratio 2.00x 1.59x 1.00x

2. Asset Management Ratios

a. Inventory turnover = Sales / Inventories

Inventory turnover 2021 = 44,538,000 / 6,854,000 = 6.50

Inventory turnover 2020 = 37,403,000 / 7,367,000 = 5.08

b. DSO = Receivables / (Annual Sales / 365)

DSO 2021 = 4,463,000 / (44,538,000 / 365 ) = 36.58

DSO 2020 = 2,749,000 / (37,403,000 / 365 ) = 26.83

c. FA Turnover = Sales / Net Fixed Assets

FA Turnover 2021 = 44,538,000 / 8,017,000 = 5.56

FA Turnover 2020 = 37,403,000 / 7,963,000 = 4.70

d. TA Turnover = Sales / Total Assets

TA Turnover 2021 = 44,538,000 / 37,740,000 = 1.18

TA Turnover 2020 = 37,403,000 / 31, 342,000 = 1.19

2021 2020 Ind

Inv. Turnover 6.50x 5.08x 6.10x

DSO 36.58x 26.83 32.00x

FA Turnover 5.56x 4.70x 7.00x

TA Turnover 1.18x 1.19x 2.60x

3. Debt Management Ratios

a. Debt to Capital = Total debt / Total invested capital

Total debt = Notes Payable + Long Term Debt

Total invested capital = Total debt + Total Equity

Debt to capital ratio 2021 = 9,415,000 / 22,182,000 = 42.44%

Debt to capital ratio 2020 = 9,654,000 / 17,709,000 = 54.51%

b. TIE = EBIT / Interest

Interest = Interest income (expense)

TIE 2021 = 6,937,000 / -262,000 = -26.48

TIE 2020 = 3,115,000 / -14,000 = -222.5

2021 2020 Ind

Debt to Capital 42.44% 54.51% 40.00%

TIE -26.48x -222.5x 6.20x

4. Profitability Ratios

a. Operating margin = EBIT / Sales

Operating margin 2021= 6,937,000 / 44,538,000 = 15.85%

Operating margin 2020 = 3,115,000 / 37,403,000 = 8.33%

b. Profit Margin = Net income / Sales

Profit margin 2021 = 5,727,000 / 44,538,000 = 12.86%

Profit margin 2020 = 2,539,000 / 37,403,000 = 6.79%

c. Basic Earning Power = EBIT / Total Assets

Basic Earning Power 2021 = 6,937,000 / 37,740,000 = 18.38%

Basic Earning Power 2020 = 3,115,000 / 31,342,000 = 9.94%

2021 2020 Ind

Operating margin 15.58% 8.33% 7.30%

Profit Margin 12.86% 6.79% 3.50%

Basic Earning Power 18.38% 9.94% 19.10%

Appraising Profitability Ratios

a. ROA = Net income / Total Assets

ROA 2021 = 5,727,000 / 37,740,000 = 15.17%

ROA 2020 = 2,539,000 / 31,342,000 = 8.10%

b. ROE = Net income / Total Common Equity

ROE 2021 = 5,727,000 / 12,767,000 = 44.86%

ROE 2020 = 2,539,000 / 8,055,000 = 31.52%

c. ROIC = EBIT ( 1 - T ) / Total invested Capital

ROIC 2021 = 6,937,000 ( 1- 0.4 ) / 22,182,000 = 18.76%

ROIC 2020 = 3,115,000 ( 1- 0.4 ) / 17,709,000 = 10.55%

2021 2020 Ind

ROA 15.17% 8.10% 9.10%

ROE 44.86% 31.44% 18.20%

ROIC 18.76% 10.55% 14.50%

Analysis of Nike company

Statement of cash flow

i. First, the net cash from operations equals to

6,657,000 which is a good point for the company.

ii. Second, net change in cash for this company equals

to 1,541,000 which means that they have a profit.

Liquidity Ratios

i. We know that quick ratio is an indicator for the

company it can pay back the creditors. In 2020, it is

below the industry average which is risky, but in

2021 it becomes good because it is above the

industry.

ii. Liquidity position is good.

Asset management Ratios

i. Inventory turnover for this company is doing

good in 2021 because it is above the industry

standard, but in 2020, it was not good because

it is far below the industry standard. Maybe

there was a stock of inventory they can’t sell.

ii. DSO for this company was somehow good

because the collection is being made quickly,

but in 2021, it is not good. It means the

collection is late 4 days, so it should be

improved.

iii. FA turnover for this company is not good

because it is below the industry average. They

buy assets, but there is no improvement is

sales for both years.

iv. TA turnover is bad for both years. It means that

once you start to go to the industry average,

this performance should be improved.

Debt Management Ratios

i. Debt-to-capital ratio (the lesser the better) for

this company is somehow bad. It is true that

they have improved their situation in terms of

debt. In 2020, they took a debt by 54%, but this

debt is decreasing to 42% in 2021. However,

this is still above the industry average which is

bad for the company.

ii. TIE (the higher the better because it is an

expense) for this company too bad because it is

far below the industry standard.

Profitability Ratios

i. Operating margin for this company is looking

good because it is above the industry average.

ii. Profit margin for this this company is also good

because it is above the industry average.

iii. Basic Earning Power for this company was bad.

In 2020, it is far below the industry standard,

but in 2021, there is an improvement but it is

still below the industry average.

Appraising Profitability Ratios

i. ROA(Return of Asset) for this company was

bad in 2020 because it is below the industry

standard, but in 2021, it becomes good

because there is an improvement which

makes it above the industry average.

ii. ROE(Return of Equity) for this company is

good for both years because it is above the

industry average.

iii. ROIC(Return on invested capital) for this

company was bad in 2020 because it is

below the industry standard, but in 2021, it

becomes good because there is an

improvement which makes it above the

industry average.

Done BY :- Azam Tawfiq Mohammed Al-Qadasi

ID :- 62030186

Section :- C

Dr. Ibrahim Alshutbi

You might also like

- Financial Position and Performance of FirstGroup PLC.Document17 pagesFinancial Position and Performance of FirstGroup PLC.Mohammad MollaNo ratings yet

- Zambian Breweries Report 2018Document8 pagesZambian Breweries Report 2018Mumbi MwansaNo ratings yet

- Presentacion CapitalDocument11 pagesPresentacion CapitalLiliana Martínez LiraNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Im Acco 20203 AccountingDocument107 pagesIm Acco 20203 AccountingTong Kennedy0% (1)

- PQ2Document2 pagesPQ2alellieNo ratings yet

- Financial Management Mid-Term Exam 2022Document9 pagesFinancial Management Mid-Term Exam 2022ahmadbinowaidhaNo ratings yet

- Dwnload Full Fundamentals of Corporate Finance 4th Edition Berk Solutions Manual PDFDocument35 pagesDwnload Full Fundamentals of Corporate Finance 4th Edition Berk Solutions Manual PDFbrumfieldridleyvip100% (13)

- Tutorial 7 FAT SolutionDocument13 pagesTutorial 7 FAT SolutionAhmad FarisNo ratings yet

- Atlas CycleDocument8 pagesAtlas Cyclepriyacharan5454No ratings yet

- Case Study 1 Muhammad JanjuaDocument6 pagesCase Study 1 Muhammad JanjuaAmeer Hamza JanjuaNo ratings yet

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- MINI CASE CH 9Document7 pagesMINI CASE CH 9Samara SharinNo ratings yet

- Ics CW 1Document7 pagesIcs CW 1RAVEENA DEVI A/P VENGADESWARA RAONo ratings yet

- Diploma in Business and Management (AB101) Financial Management (PFN1223) TopicDocument35 pagesDiploma in Business and Management (AB101) Financial Management (PFN1223) TopicARIANEE BINTI AHMAD SAINI (BG)No ratings yet

- A. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Document6 pagesA. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Phạm Thu HuyềnNo ratings yet

- Soal Latihan Pertemuan KelimaDocument7 pagesSoal Latihan Pertemuan KelimaErvian RidhoNo ratings yet

- Assignment FinalDocument10 pagesAssignment FinalJamal AbbasNo ratings yet

- Year 2018 2019 2020: Task 1Document9 pagesYear 2018 2019 2020: Task 1Prateek ChandnaNo ratings yet

- FIN7101 - FIN. BUSINESS - TEST - 01 (PBS 21101107) AzdzharulnizzamDocument6 pagesFIN7101 - FIN. BUSINESS - TEST - 01 (PBS 21101107) AzdzharulnizzamAzdzharulnizzam AlwiNo ratings yet

- 1BSA Final ExamDocument11 pages1BSA Final ExamcamillaNo ratings yet

- AFD Practice Questions Mock (3399)Document7 pagesAFD Practice Questions Mock (3399)AbhiNo ratings yet

- Financial Accounting - Starbucks CaseDocument14 pagesFinancial Accounting - Starbucks CaseHạnh TrầnNo ratings yet

- Updated FileDocument16 pagesUpdated Fileshubham agarwalNo ratings yet

- 16 Consolidation Subsequent To The Date of AcquisitionDocument3 pages16 Consolidation Subsequent To The Date of AcquisitionMila Casandra CastañedaNo ratings yet

- Complete Task - Buderim GingerDocument9 pagesComplete Task - Buderim GingerOne OrgNo ratings yet

- Pset 3Document4 pagesPset 3Assassin Panda14No ratings yet

- Group PresentationDocument22 pagesGroup PresentationMohamed Al RemeithiNo ratings yet

- Thal LTDDocument8 pagesThal LTDZameer AbbasiNo ratings yet

- Activity RatioDocument2 pagesActivity RatioOlivia RinaNo ratings yet

- Financial Analysis AppleDocument10 pagesFinancial Analysis AppleEléa LeconteNo ratings yet

- Nestle AnanlysisDocument18 pagesNestle AnanlysisSLUG GAMINGNo ratings yet

- Chapter 2 Revision Exercises + SolutionsDocument12 pagesChapter 2 Revision Exercises + SolutionsSanad RousanNo ratings yet

- Fin2001 Pset4Document10 pagesFin2001 Pset4Valeria MartinezNo ratings yet

- Accounting and Finance WDocument10 pagesAccounting and Finance WWanambisi JnrNo ratings yet

- Business Management Assignment 1Document7 pagesBusiness Management Assignment 1sphesihlemkhize1204No ratings yet

- LectureDocument29 pagesLectureatharNo ratings yet

- Tugas AulaDocument5 pagesTugas AulaZuriafNo ratings yet

- Gross Profit Margin: MeaningDocument7 pagesGross Profit Margin: Meaningthai hoangNo ratings yet

- Lecture 3 - Assignment - Jaimin PandyaDocument10 pagesLecture 3 - Assignment - Jaimin PandyajaiminNo ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernancehNo ratings yet

- Assignment 01Document18 pagesAssignment 01Md. Real MiahNo ratings yet

- Revison Lecture - Q1 Q2Document28 pagesRevison Lecture - Q1 Q2pes60804No ratings yet

- FABM2-Analysis and Interpretation of Financial StatementsDocument7 pagesFABM2-Analysis and Interpretation of Financial StatementsGerlen MendozaNo ratings yet

- Quiz Acctng 603Document10 pagesQuiz Acctng 603LJ AggabaoNo ratings yet

- 3.5 ExercisesDocument13 pages3.5 ExercisesGeorgios MilitsisNo ratings yet

- Ratio AnalysisDocument29 pagesRatio AnalysisatharNo ratings yet

- N1227106 Busi48901 261123Document11 pagesN1227106 Busi48901 261123malisiddhant2602No ratings yet

- Sol-Lecture Ques - MOODLEDocument15 pagesSol-Lecture Ques - MOODLERami RRKNo ratings yet

- Tata Motors .Document14 pagesTata Motors .Shweta MaltiNo ratings yet

- Report Fin GroupDocument10 pagesReport Fin GroupFATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- FM Testbank Ch03Document18 pagesFM Testbank Ch03David LarryNo ratings yet

- My Life at 6ft BelowDocument1 pageMy Life at 6ft Belowvasquez.jabezraphael308129No ratings yet

- Finance Cheat SheetDocument13 pagesFinance Cheat SheetVasundhra KalaimaranNo ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- Advanced Financial Management May 2017 Past Paper and Suggested Answers ViujprDocument19 pagesAdvanced Financial Management May 2017 Past Paper and Suggested Answers ViujprkaragujsNo ratings yet

- 2024 FMA300 Unit 3 Learning GuideDocument24 pages2024 FMA300 Unit 3 Learning GuideSeneliso NyathiNo ratings yet

- Whirlpool Financial AnalysisDocument5 pagesWhirlpool Financial AnalysisuddhavkulkarniNo ratings yet

- B1.nov 2022 AnsDocument12 pagesB1.nov 2022 AnsAndrea NyerereNo ratings yet

- Problem BankDocument10 pagesProblem BankSimona NistorNo ratings yet

- Introduction To Financial Statement AnalysisDocument7 pagesIntroduction To Financial Statement AnalysisAJ NovallascaNo ratings yet

- Chapter Three: General Fund & Special Revenue Funds 3.1 General Fund IsDocument41 pagesChapter Three: General Fund & Special Revenue Funds 3.1 General Fund IsTamirat BashaaNo ratings yet

- SAP Year End Closing ActivitiesDocument9 pagesSAP Year End Closing ActivitiesVijay RamNo ratings yet

- General Journal: Description Post Ref Dr. Cr. DateDocument14 pagesGeneral Journal: Description Post Ref Dr. Cr. DateRizki MuhammadNo ratings yet

- Accounting For Business: Chapter 4: The Statement of Cash FlowsDocument40 pagesAccounting For Business: Chapter 4: The Statement of Cash FlowsegNo ratings yet

- FINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Document44 pagesFINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Srinivas Muchantula100% (5)

- The Accounting Cycle: Step 1: Analyze Business TransactionsDocument4 pagesThe Accounting Cycle: Step 1: Analyze Business TransactionsUnkownamousNo ratings yet

- Assignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Document4 pagesAssignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Ivy KwokNo ratings yet

- AFAR Preweek (B44) - HIGHLIGHTEDDocument31 pagesAFAR Preweek (B44) - HIGHLIGHTEDMARIA VERNADETTE SHARISSE LEGASPINo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- Week 4 Tutorial QuestionsDocument5 pagesWeek 4 Tutorial QuestionsJess XueNo ratings yet

- AASB 116 Property, Plant and Equipment: Fact SheetDocument2 pagesAASB 116 Property, Plant and Equipment: Fact SheetShipNo ratings yet

- Venture Valuation MethodsDocument2 pagesVenture Valuation MethodsEmily HackNo ratings yet

- CIMA Case Study-IIT GuwahatiDocument24 pagesCIMA Case Study-IIT GuwahatiPrachi AgarwalNo ratings yet

- Signed FS Inocycle Technology Group TBK 2018 PDFDocument74 pagesSigned FS Inocycle Technology Group TBK 2018 PDFmichele hazelNo ratings yet

- Summary of Pas 36Document5 pagesSummary of Pas 36Elijah MontefalcoNo ratings yet

- Book Keeping & Accountancy March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperDocument5 pagesBook Keeping & Accountancy March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperBhavin MamtoraNo ratings yet

- FMJ2 Carryover of Open ItemsDocument20 pagesFMJ2 Carryover of Open ItemsAKNo ratings yet

- Meija KariukiDocument2 pagesMeija KariukiPeter Kibelesi KukuboNo ratings yet

- 4 Accounting For Legal Liqudation PresentationDocument40 pages4 Accounting For Legal Liqudation PresentationMeselech Girma100% (1)

- Lecture 3 Ratio AnalysisDocument59 pagesLecture 3 Ratio AnalysisJiun Herng LeeNo ratings yet

- MBA Project Report On Ratio AnalysisDocument19 pagesMBA Project Report On Ratio Analysislatest infoNo ratings yet

- Lufthansa Report 2009Document234 pagesLufthansa Report 2009riverofgiraffesNo ratings yet

- PT Vale Indonesia TBK Financial Statements 9M21Document54 pagesPT Vale Indonesia TBK Financial Statements 9M21Seputar InfoNo ratings yet

- Roadmap Statement of Cash FlowsDocument134 pagesRoadmap Statement of Cash FlowsNabil BouraïmaNo ratings yet

- Cfas ReviewerDocument4 pagesCfas ReviewerFerb CruzadaNo ratings yet

- 12ENTREP Q2 Module 8 Terminal Report of Business OperationsDocument10 pages12ENTREP Q2 Module 8 Terminal Report of Business OperationsJM Almaden AbadNo ratings yet

- Change in PSR 1 PDFDocument6 pagesChange in PSR 1 PDFNavya jainNo ratings yet

- Annual-Report-2020 FKSDocument12 pagesAnnual-Report-2020 FKSHalizasnNo ratings yet