Professional Documents

Culture Documents

P2Nov09peg

P2Nov09peg

Uploaded by

Satvir KaurCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P2Nov09peg

P2Nov09peg

Uploaded by

Satvir KaurCopyright:

Available Formats

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

General Comments

The overall performance was similar to that seen during the last few years. Unfortunately the

improvement witnessed in the May 2009 sitting has not been maintained. The paper

examined key syllabus topics including Activity Based Costing, linear programming and

investment appraisal. The inclusion of these topics, which have been examined several times

during the last few years, would greatly advantage those candidates who took the advice

given in previous Post Exam Guides (PEGs) and practised answering past questions. A

careful read through previous PEGs would also allow candidates to identify the common

types of error that are made by candidates when these topics are examined.

It is sad to report that a significant proportion of scripts displayed a lack of understanding of

fundamental aspects of management accounting. It was also apparent from the quality of

answers to several questions that many candidates adopted a ‘cherry picking’ approach to

their studies and their revision, in that they did not cover the whole syllabus. This is a risky

approach, especially when the majority of syllabus topics are covered in every paper.

Answers to numerical questions were generally good but the standard of many candidates’

presentation was poor. Many marks were forgone due to lack of clarity, poor layout and

workings that were not referenced, or were completely illegible. This point has been raised in

many previous PEGs.

Answers to discursive questions were generally poor, mainly due to candidates simply not

addressing the question asked. (See question 4).

The quality of handwriting of many candidates was poor. With some scripts marks could not

be awarded because the markers could not read the answers. Very few answers showed

evidence of an answer plan, another point that has been made in several previous PEGs.

The following advice should be noted by candidates when reflecting on the paper just taken,

and especially when preparing for future examinations:

1. Candidates sitting the P2 examination are advised to examine the syllabus of the

Fundamentals of Management Accounting paper to ensure they have a sound

understanding of basic aspects of management accounting that will be tested in the P2

paper.

2. Present answers in a clear and logical fashion . For example use clear and legible

handwriting and refer clearly to the workings.

3. Relate discursive answers to the question scenario. On many occasions general

answers are submitted that attract few marks.

4. Make full use of the 20 minutes allowed for planning.

5. Read the rubric of the paper carefully and plan the examination time accordingly. In

particular relate the time allotted to each question to the marks available for that

particular question.

6. In preparing for the exam, practise regularly using past CIMA questions and compare

the answers to the examiner’s suggested answers. This will allow candidates to

measure their own progress. They will also gain an understanding of the correct layout

for quantitative questions and of the depth of answers required for discursive questions.

7. Study and revise the entire syllabus and ignore suggestions put forward in accounting

journals which indicate the topics ‘likely’ to be examined.

The Chartered Institute of Management Accountants Page 1

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Section A – 20 marks

Question 1.1

In the context of quality costs, the cost of removing damaged goods from a customer’s premises is an

example of:

A Prevention Cost

B Appraisal Cost

C Internal Failure Cost

D External Failure Cost

(2 marks)

The answer is D

Question 1.2

When making a decision between manufacturing a component or outsourcing its production, the

information required is:

(i) the internal variable manufacturing cost per component

(ii) the monthly volume of components required

(iii) the internal fixed overhead absorption rate per component

(iv) the monthly specific fixed cost total for the component

(v) the purchase price of the component from the external supplier

A (i) and (v) only

B (i), (iii), and (v) only

C (i), (ii), (iv), and (v) only

D (i), (ii), (iii), and (v) only

(2 marks)

The answer is C

The Chartered Institute of Management Accountants Page 2

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Question 1.3

A company has predicted that its fixed and variable costs for the forthcoming period, and their associated

probabilities, could be as follows:

Variable production costs

$4 per unit 35%

$5 per unit 40%

$6 per unit 25%

Fixed production costs per month

$100,000 20%

$120,000 50%

$150,000 30%

Calculate the expected total monthly cost of producing 10,000 units.

(2 marks)

Workings

($4 x 0·35) + ($5 x 0·40) + ($6 x 0·25) = $4·90

10,000 units x $4·90 $49,000

($100,000 x 0·2) + ($120,000 x 0·5) + ($150,000 x 0·3) = $125,000

Total $174,000

Question 1.4

A project requires an initial investment of $450,000 and has a post tax net present value (NPV) of

$80,000. The post tax present value of sales revenues is $630,000.

Calculate the sensitivity of the investment decision to changes in the value of sales revenues.

(2 marks)

Workings

$80,000 / $630,000 = 12·7%

The Chartered Institute of Management Accountants Page 3

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

The following data is to be used to answer questions 1.5 to 1.7

The following details relate to an investment project which involves purchasing a machine for

$260,000 in year 0 and selling it for $20,000 in year 4.

Year Post Tax Cash flow

$

0 (260,000)

1 120,000

2 150,000

3 80,000

4 60,000

Question 1.5

Calculate the discounted payback period of the investment to the nearest 0·01 years, assuming the post

tax cost of capital is 12%.

(2 marks)

Workings

Year Present value Cumulative

($) present value ($)

1 120,000 x 0·893 = 107,160

2 150,000 x 0·797 = 119,550 226,710

3 80,000 x 0·712 = 56,960 283,670

4 60,000 x 0·636 = 38,160 321,830

Discounted payback occurs in year 3 after 2 plus (260,000 – 226,710) / 56,960 years = 2·58 years

Question 1.6

Calculate the Accounting Rate of Return (ARR) of the investment.

(3 marks)

Workings

$

Total cash flow 150,000

Add back net capital cash outflows 240,000

390,000

Lifetime Depreciation 240,000

Lifetime Profit 150,000

Average annual profit 37,500

ARR = $37,500 / $140,000 = 26·8%

The Chartered Institute of Management Accountants Page 4

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Question 1.7

Calculate the Internal Rate of Return (IRR) of the investment.

(3 marks)

Workings

NPV at 12% = 321,830 – 260,000 = $61,830

Using 18%:

Year $ $

1 120,000 x 0·847 = 101,640

2 150,000 x 0·718 = 107,700 209,340

3 80,000 x 0·609 = 48,720 258,060

4 60,000 x 0·516 = 30,960 289,020

NPV at 18% = 289,020 – 260,000 = $29,020

IRR = 18% + ((29,020 / (61,830 - 29,020)) x 6%) = 23%

Question 1.8

A bakery company is considering how often it should replace its ovens. The company’s post tax cost of

capital is 7% per annum and it has already determined the present value of the relevant cash

outflows for the three possible replacement cycles as follows:

2 year replacement cycle $178,000

3 year replacement cycle $245,000

4 year replacement cycle $310,000

Prepare calculations to show the optimum replacement cycle and recommend which replacement

cycle the bakery should adopt and why.

(4 marks)

Workings

1.8 2 years = 178,000 / 1·808 = 98,451

3 years = 245,000 / 2·624 = 93,369

4 years = 310,000 / 3·387 = 91,526

Answer = 4 year cycle because it has the lowest annual equivalent cost.

The Chartered Institute of Management Accountants Page 5

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Examiner’s comments

The overall average mark for Section A was slightly lower than in previous diets. The presentation of

answers was generally good with no particular question being omitted.

Question 1.5 specifically asked for the discounted payback period to be shown to the nearest 0.01 years.

Many candidates ignored this instruction and gave answers such as 2.6 years and 2 years 6 months.

Candidates submitting such answers deprived themselves of two marks.

Question 1.6 a large percentage of candidates did not know either of the two acceptable approaches that

would have earned marks. Several incorrect, alternative approaches were submitted.

Question 1.8 many candidates were awarded two marks for correct calculations of annual equivalent

costs. Unfortunately, many answers then suggested that the two year cycle was the best option rather

than the four year cycle. The expected values related to costs therefore the lowest figure should have

been selected. Other candidates selected the correct option but failed to explain why.

Common Errors

1. Failure to present the answer as requested (question1.5)

2. Failure to answer the question fully (question 1.8)

3. Poor layout of answers (question 1.7)

The Chartered Institute of Management Accountants Page 6

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Section B – 30 marks

ANSWER ALL THREE QUESTIONS

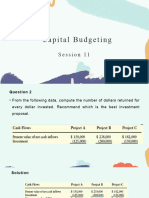

Question 2

(a) Calculate the values to be inserted in the table at the points marked a, b, and c.

(3 marks)

(b) Explain how the values in the data table can be used by the management of the cinema and

recommend whether or not the movie should be hired.

(7 marks)

(Total for Question Two = 10 marks)

Rationale

This question tests candidates’ ability to analyse risk and uncertainty. It addresses learning outcome C(iii):

analyse risk and uncertainty by calculating expected values and standard deviations together with

probability tables and histograms.

Suggested Approach

Carefully read the scenario provided and identify the combinations of Customers & Customer

contributions represented by the letters a, b, and c.

Calculate the values to be inserted in the table.

Explain the values in the table.

Recommend whether or not the movie should be hired.

Marking Guide Marks

(a)

One mark for each value 3 marks

(b)

Range of outcome values 1 mark

Distribution of positive / negative results 2 marks

Application of probabilities 1 mark

Skew of distribution 1 mark

Risk of negative result 1 mark

Repetition of outcomes 1 mark

Recommendation 1 mark

Max 7

Examiner’s Comments

The attempts at this question were generally below the expected standard. Part (a) required three quick

calculations which would have gained three marks. A large proportion of candidates earned only one

mark.

Part (b) required an explanation of how the values could be used by the management of the cinema, but

most answers were general in nature and were not supported by calculations, for example of the number

of positive/negative results.

The Chartered Institute of Management Accountants Page 7

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Common Errors

1. Inability to make three quick calculations (part a)

2. Providing only general answers (part b)

3. Presenting only one or two sentences as a complete answer for seven available marks

4. Failing to make a recommendation (part b)

The Chartered Institute of Management Accountants Page 8

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Question 3

(a) Calculate the total time required for the first 40 batches of production.

(2 marks)

(b) Calculate the total time required for the first 60 batches of production.

(4 marks)

(c) Explain the likely effect of recruiting new employees on the time required for batches

numbered 61 to 90.

(4 marks)

Note: The 80% learning index = -0·3219

(Total for Question Three = 10 marks)

Rationale

This question tests candidates’ ability to calculate the effects of the learning curve. It addresses learning

outcome D(iv): explain and apply learning and experience curves to estimate time and cost for new

products and services.

Suggested Approach

Carefully read the scenario to identify the key factors associated with the rate of learning and the

length of the learning period.

Calculate the total time for the first 40 batches of production

Calculate the total time for the first 39 batches of production

Calculate the time for the 40th batch

Calculate the time for the first 60 batches

Explain the likely effect on the time required of recruiting new employees.

Marking Guide Marks

(a)

Correct answer 2 marks

(b)

Total time for 39 batches 1 mark

Time for 40th batch 1 mark

Total time for batches 41-60 1 mark

Total time for 60 batches 1 mark

c)

New employees need to learn 1 mark

Existing employees may slow down to train 1 mark

Time per batch will increase 1 mark

Rate of learning may be faster than 80% due to skill transfer 1 mark

The Chartered Institute of Management Accountants Page 9

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Examiner’s Comments

Parts (a) and (b) simply required candidates to use the learning curve formula to generate the answers.

The major problem that cost candidates between one and three marks was incorrect rounding. For

examples marks were not awarded to candidates who rounded 179.868 to 180, or who rounded 3.132 to

3.

Part (c) was poorly answered. The question did not request a description of the learning curve and in

which circumstances it is most applicable. Candidates were requested to explain ‘the likely effect of

recruiting new employees’.

Common Errors

1. Inability to apply the learning curve formula

2. Incorrect roundings. Two decimal places is an absolute minimum

3. Not answering the question (part c)

The Chartered Institute of Management Accountants Page 10

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Question 4

(i) Explain how a JIT production system differs from the company’s existing manufacturing

system.

(ii) Explain why quality control systems are particularly important in a JIT environment.

(Total for Question Four = 10 marks)

Rationale

This question tests candidates’ ability to apply the principles of JIT to a scenario. It addresses learning

outcome D(ii): evaluate the impacts of just in time production, the theory of constraints and total quality

management on efficiency, inventory and cost

Suggested Approach

Read the scenario carefully to identify the key factors of the company’s existing manufacturing

system

Explain how a JIT production system differs from the company’s existing manufacturing system

Explain why quality control systems are particularly important in a JIT environment

Marking Guide Marks

Existing system - constant activity levels, adjust for expected seasonality of demand or 1 mark

resource level changes

JIT - customer driven / zero inventory 1 mark

Detailed points 2 marks

Cost changes 2 marks

Quality problems equals lost sales 2 marks

Lost reputation 2 marks

Examiner’s Comments

In general this question was poorly answered. In part (i) candidates were asked to explain how a JIT

system differed from the existing system. Those candidates who scored high marks provided

comparisons or explained differences, as opposed to writing everything they knew about JIT. Some

candidates wrote a four page answer but earned very few marks.

Part (ii) was also poorly answered. Many candidates simply repeated items already covered in (i),

whereas others used (ii) as a continuation to (i) and wrote all they knew about JIT.

Common Errors

1. Not answering the question

2. Failure to set out an answer plan

3. In some cases extremely poor handwriting making it difficult to award marks

The Chartered Institute of Management Accountants Page 11

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Section C – 50 marks

ANSWER TWO QUESTIONS OUT OF THREE

Question 5

(a) Prepare calculations to determine the production plan that will maximise the profits of

Company C in November 2009.

(5 marks)

(b) For December 2009 only:

(i) Use graphical linear programming to calculate the optimal production plan for the month.

(10 marks)

(ii) Calculate the value of the monthly financial penalty at which the company would be

indifferent between supplying products X and Y under the Company D contract or selling

them in the general market.

(5 marks)

(iii) Calculate the maximum price per kg that should be paid to an alternative supplier to obtain

additional material B.

(5 marks)

(Total for Question Five = 25 marks)

Rationale

This question tests candidates’ ability to analyse the data provided and solve a scarce resource problem.

It addresses learning outcome A(viii): discuss the meaning of “optimal” solutions and show how linear

programming methods can be employed for profit maximising, revenue maximising, and satisfying

objectives.

Suggested Approach

(a)

Read the scenario carefully to identify direct labour hours as the scarce resource

Calculate the contribution from each product per direct labour hour

Rank the products based on their contribution per direct labour hour

Calculate the direct labour hours required to meet the contracted demand

Calculate the optimum use of the remaining labour hours based on the product rankings

(b)

Calculate the resources available after meeting the contracted demand

Derive the equalities for each of these resources

Calculate the co-ordinates of each resource and plot on the graph

Plot the demand constraints

Identify the feasible region

Calculate the optimal solution

Compare the value from the resources used to meet the contract with their alternative use value,

and thereby determine the penalty value at which the company would be indifferent

Calculate the contribution that could be earned from additional supplies of material B and thereby

calculate the maximum price that should be paid for additional units of material B.

The Chartered Institute of Management Accountants Page 12

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Marking Guide Marks

(a)

Product ranking based on contribution per direct labour hour 2 marks

Contract resource requirements 1 mark

Allocation of remaining resource 1 mark

Production plan 1 mark

(b) (i)

Resource constraints – one mark each 3 marks

Plotting of resource and demand constraints 5 marks

Identify solution from graph 2 marks

(b)(ii)

Resources released 1 mark

Use of resources released 2 marks

Compare contract v market contribution 2 marks

(b) (iii)

Calculate existing position 1 mark

Calculate revised position 1 mark

Compare contributions 1 mark

Calculate maximum price (1 for premium; 1 for original) 2 marks

Examiner’s Comments

Part (a) was simply a single limiting factor exercise and most candidates gained the majority of the marks

available. The main reason for lost marks was poor answer layout.

Part (b)(i) was a typical linear programming question that needed a graph (on graph paper or sketched) to

generate the answer. Many candidates chose not to attempt a graph, while others put forward extremely

poor attempts. Marks were also lost by, or could not be awarded to, candidates who ignored, in whole or

in part, the demand for products X and Y. Very few candidates took the time to prove their readings from

the graph by solving the simultaneous equations of the two binding constraints. As a result some strange

answers were put forward which gained few or no marks.

Part (b)(ii) was either poorly attempted, or not attempted at all. In fact there were a number of routes that

would have given the correct answer, but many candidates seemed unclear as to what was required.

Method marks were available for incorrect answers but very few could be awarded as the method used

was often unclear or incorrect.

Part (b)(iii) was attempted by very few candidates. The few attempts that were put forward indicated a

complete lack of understanding of how to calculate a shadow price. This could indicate that candidates do

not study and revise a topic in its entirety.

Common Errors

1. Poor layout

2. Unclear workings

3. Inability to construct a graph, and extremely poor graphs

4. Lack of understanding of shadow pricing

The Chartered Institute of Management Accountants Page 13

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Question 6

(a) Distinguish between the four categories of cost identified above, giving one example of

each in your explanation.

(8 marks)

(b) Calculate the production and sales of products A, B and C required in order to maximise

the monthly profit from each product. Assume that sufficient resources are available within

the existing cost structures to produce up to 7,000 units of each product per month.

(4 marks)

(c) Calculate the production and sales of products A, B and C in order to maximise the profit

for next month. Assume that product sustaining costs are not avoidable.

(9 marks)

(d) Explain, in detail, how you would calculate the shadow prices of machine hours for next

month. No calculations are required.

(4 marks)

(Total for Question Six = 25 marks)

Rationale

This question tests candidates’ ability to explain the cost categories of activity based costing and then to

apply the data provided to solve a practical product pricing problem. It addresses the learning outcomes

A(iii): apply an approach to pricing based on profit maximisation in imperfect markets and evaluate the

financial consequences of alternative pricing strategies and D(v): apply the techniques of activity based

management in identifying cost drivers/activities and explain how process re-engineering can be used to

eliminate non-value adding activities and reduce activity costs.

Suggested Approach

(a)

Distinguish between the four categories of cost

Give an example of each cost category

(b)

Read the scenario carefully to determine the demand / price relationship of each product

Calculate the variable cost of each product

Calculate the lowest selling price at which there is a positive contribution from each product

(c)

Calculate the incremental contribution from each product for each block of incremental machine

hours

Identify the optimum use of each block of incremental machine hours until no further machine

hours are available or there is no further incremental contribution

Explain the meaning of shadow prices and how to calculate the shadow price of the machine

hours in this scenario by identifying the incremental contribution from any further machine hours

The Chartered Institute of Management Accountants Page 14

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Marking Guide Marks

(a)

For each category:

Explanation – one mark max 8

Example – one mark marks

(b)

Unitised costs per product 1 mark

Identifying positive contribution levels for each product 3 marks

(c)

Calculate marginal contributions / hour – up to two marks per product 5 marks

Allocate machine hours 3 marks

Production plan 1 mark

(d)

Explain shadow price 1 mark

Usage of additional resource by ranking of products 2 marks

Multiple shadow prices 1 mark

Examiner’s Comments

This question was the least popular of the optional questions. Part (a) was well answered but

unfortunately most answers to parts (b), (c) and (d) were extremely poor with very few candidates gaining

any marks.

Part (b) was much more straightforward than most candidates realised and the four marks available were

a fair reward for the effort that was required to generate the answer.

Part (c) required a marginal approach but the few attempts made simply used a weighted average

method. Most attempts did not put forward realistic figures. This highlights the point made in previous

PEGs which advised candidates to ensure that the figures in their answers are in the context of the

question i.e. that their answers are sensible.

Part (d) produced very few meaningful answers. This could indicate that the topic of the shadow price is

being overlooked when studying and revising.

Common Errors

1. Poor layout (parts b and c)

2. Lack of understanding (part d)

The Chartered Institute of Management Accountants Page 15

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Question 7

(a) Calculate the net present value of the cash flows arising from the investment and

recommend to the hotel group whether or not to proceed with the purchase of the hotel.

(14 marks)

(b) Calculate the sensitivity of the investment to a change in the value of “other fixed costs”.

(6 marks)

(c) Explain Pareto Analysis and how the hotel group could improve its profits by combining

Pareto Analysis with Activity Based Costing.

(5 marks)

(Total for Question Seven = 25 marks)

Rationale

This question tests candidates’ ability in part (a) to analyse the data provided to determine the relevant

cash flows of an investment, in part (b) to calculate the sensitivity of the solution to a change in one of the

input variables and in part (c) to explain how Pareto analysis may be combined with activity based costing.

The question addresses learning outcomes B(vi): evaluate project proposals using the techniques of

investment appraisal and D(xi): apply Pareto analysis as a convenient technique for identifying key

elements of data and in presenting the results of other analyses, such as activity-based profitability

calculations.

Suggested Approach

(a)

Read the scenario carefully and identify the relevant cash flows of the investment

Apply the inflation indices to the appropriate cash flows

Prepare a cash flow analysis

Discount each year’s net cash flows and calculate the net present value of the investment

Recommend whether to proceed with the investment

(b)

Calculate the present value of the “other fixed costs”

Calculate the sensitivity of the investment decision to a change in the value of these costs

(c)

Explain Pareto analysis

Explain activity based costing in the context of a hotel

Explain how the hotel group’s profits could be improved by combining these techniques.

The Chartered Institute of Management Accountants Page 16

Paper P2 – Management Accounting – Decision Management

Post Exam Guide

November 2009 Exam

Marking Guide Marks

(a)

Capital outflow & inflow 1 mark

Guest revenue (volume & inflation) 2 marks

Fixed costs 1 mark

Variable costs (volume & inflation) 2 marks

Tax on cash flow (amount & timing) 2 marks

Tax depreciation (amount & timing) 2 marks

Discounting 1 mark

Correct years 2 marks

Recommendation 1 mark

(b)

Inflation adjustment 1 mark

Tax adjustment (amount & timing) 2 marks

Discounting 1 mark

Sensitivity calculation 2 marks

(c)

Explanation of principle 1 mark

Application to scenario 2 marks

Management of costs / profits 2 marks

Examiner’s Comments

This proved to be the most popular of the optional questions and most candidates achieved good marks,

especially for part (a). Unfortunately the quality of answer layouts put forward by a significant number of

candidates was poor and figures within the main answer were not supported by clear, legible workings.

Marks could not be awarded to many candidates who seemed to be unable to adjust figures (e.g. the

revenues) for two situations, i.e. volume changes and inflation.

Part (b) was fairly well answered but the majority of candidates did not appreciate that the ‘other fixed

costs’ figure needed to be adjusted for inflation and tax before being discounted.

Part (c) was again fairly well answered but most candidates applied the 80/20 rule to revenues as

opposed to costs. This confused the marking team as the question asked candidates to link Pareto

analysis with activity based costing. Very few candidates suggested ideas about how management could

take action and control those activities that cause the costs.

Common Errors

1. Poor layouts (part a)

2. Unclear workings (part a)

3. No reference to workings (part a)

4. Not relating Pareto analysis to ABC and to the scenario in the question (part c).

The Chartered Institute of Management Accountants Page 17

You might also like

- ICAEW MI - Question BankDocument350 pagesICAEW MI - Question BankDương NgọcNo ratings yet

- Assign 4 Jones MDocument18 pagesAssign 4 Jones Mflatkiller222100% (1)

- SBL The Event AnswerDocument15 pagesSBL The Event AnswerTlalane HamoreNo ratings yet

- Take Home Final Exam1Document4 pagesTake Home Final Exam1Sindura RamakrishnanNo ratings yet

- Shrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisDocument12 pagesShrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisHayat Omer Malik100% (1)

- The Investment Detective Case StudyDocument3 pagesThe Investment Detective Case StudyItsCj100% (1)

- The Investment DetectiveDocument10 pagesThe Investment Detectivewiwoaprilia100% (1)

- Chapter 1 Feasibility Study For Dance StudioDocument9 pagesChapter 1 Feasibility Study For Dance StudioAlexander100% (1)

- HRM732 Final Exam Review Practice Questions SUMMER 2022Document12 pagesHRM732 Final Exam Review Practice Questions SUMMER 2022Rajwinder KaurNo ratings yet

- Sample Question Paper Level 5 Effective Financial ManagementDocument4 pagesSample Question Paper Level 5 Effective Financial ManagementTheocryte SergeotNo ratings yet

- Module Code FIN 7001 Module Title: Financial ManagementDocument9 pagesModule Code FIN 7001 Module Title: Financial ManagementTitinaBangawaNo ratings yet

- 6.3. Net Present Value TablesDocument6 pages6.3. Net Present Value TablesTemoteo L Pupa IIINo ratings yet

- 2203 BIZ201 Assessment 3 BriefDocument8 pages2203 BIZ201 Assessment 3 BriefAkshita ChordiaNo ratings yet

- P1 March2014 AnswersDocument14 pagesP1 March2014 AnswersGabriel KorleteyNo ratings yet

- BHMH2113 - Question Paper - Take - Home ExamDocument7 pagesBHMH2113 - Question Paper - Take - Home Examwd edenNo ratings yet

- Financial Reporting II ACC 402/602, Section 1001-1002 Practice Exam 1Document12 pagesFinancial Reporting II ACC 402/602, Section 1001-1002 Practice Exam 1Joel Christian MascariñaNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)asdsadsaNo ratings yet

- FM PT1 - Q&A AS2023 - May23Document12 pagesFM PT1 - Q&A AS2023 - May232017963155No ratings yet

- 1a. MEMO MAY 2010Document6 pages1a. MEMO MAY 2010Nobukho NjenjeNo ratings yet

- Mock Assesmentba2Document54 pagesMock Assesmentba2Bokang Junior KgariNo ratings yet

- General Comments: The Chartered Institute of Management AccountantsDocument25 pagesGeneral Comments: The Chartered Institute of Management AccountantsSritijhaaNo ratings yet

- Strategic Case For IT InvestmentDocument64 pagesStrategic Case For IT Investmentjackson fooNo ratings yet

- CIMA p1 March 2011 Post Exam GuideDocument18 pagesCIMA p1 March 2011 Post Exam GuidearkadiiNo ratings yet

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- IFM - Assignment FinalDocument31 pagesIFM - Assignment FinalDglNo ratings yet

- Bangladesh University of Professionals: Faculty of Business StudiesDocument3 pagesBangladesh University of Professionals: Faculty of Business StudiesRahman NiloyNo ratings yet

- Corporate Finance Tutorial 4 - SolutionsDocument22 pagesCorporate Finance Tutorial 4 - Solutionsandy033003No ratings yet

- ANS 2016 SEPTEMBER Financial - Accounting - and - Reporting - Fundamentals - September - 2016 - English - MediumDocument19 pagesANS 2016 SEPTEMBER Financial - Accounting - and - Reporting - Fundamentals - September - 2016 - English - MediumJahanzaib ButtNo ratings yet

- PREP COF Sample Exam QuestionsDocument10 pagesPREP COF Sample Exam QuestionsLNo ratings yet

- Review For Midterm (Project Mana) 102021Document37 pagesReview For Midterm (Project Mana) 102021Tam MinhNo ratings yet

- BMP6015 FRM - Exam PaperDocument7 pagesBMP6015 FRM - Exam PaperIulian RaduNo ratings yet

- University of Mauritius: Faculty of Information, Communication and Digital TechnologiesDocument5 pagesUniversity of Mauritius: Faculty of Information, Communication and Digital Technologiesmy pcNo ratings yet

- Report Dairy Milk Management SystemDocument44 pagesReport Dairy Milk Management SystemSathishNo ratings yet

- SHGDocument93 pagesSHGNitinNo ratings yet

- Advanced Financial Management May 2017 Past Paper and Suggested Answers ViujprDocument19 pagesAdvanced Financial Management May 2017 Past Paper and Suggested Answers ViujprkaragujsNo ratings yet

- Pinto pm5 Inppt 03Document31 pagesPinto pm5 Inppt 03alakhliNo ratings yet

- Topic 3: Project SelectionDocument31 pagesTopic 3: Project Selectionayushi kNo ratings yet

- Managerial Level: May 2007 ExaminationsDocument31 pagesManagerial Level: May 2007 ExaminationsJadeNo ratings yet

- Mid I ACT 411Document3 pagesMid I ACT 411hosnearanazninNo ratings yet

- Institute of Actuaries of India: December 2022 ExaminationDocument9 pagesInstitute of Actuaries of India: December 2022 ExaminationVasudev PurNo ratings yet

- EPM 1123 - Unit 1-Project Identification and Selection-Part 1Document14 pagesEPM 1123 - Unit 1-Project Identification and Selection-Part 1jonathanjoseph.deguzmanNo ratings yet

- Financial Analysis & Tools For Product ManagementDocument33 pagesFinancial Analysis & Tools For Product ManagementFarrukh JunaidNo ratings yet

- 5533-Financial AccountingDocument9 pages5533-Financial Accountingharoonsaeed12No ratings yet

- CH 10Document76 pagesCH 10Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- P1 - Performance OperationsDocument20 pagesP1 - Performance OperationsshibluNo ratings yet

- FR MJ21 Examiner's ReportDocument24 pagesFR MJ21 Examiner's ReportnaginomangalNo ratings yet

- ANS SEP 2015 Financial - Accounting - Reporting - Fundamentals - Sept - 2015 - Eng - NewDocument15 pagesANS SEP 2015 Financial - Accounting - Reporting - Fundamentals - Sept - 2015 - Eng - NewJahanzaib ButtNo ratings yet

- Final Exam, s2, 2019-FINALDocument13 pagesFinal Exam, s2, 2019-FINALReenalNo ratings yet

- FR SD20 Examiner's ReportDocument21 pagesFR SD20 Examiner's Reportngoba_cuongNo ratings yet

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- Mcr004a B T2 2022 FexDocument10 pagesMcr004a B T2 2022 FexAreej AhmedNo ratings yet

- Peg Sept11 p1Document18 pagesPeg Sept11 p1patriciadouceNo ratings yet

- Corpuz, Aily-Bsbafm2-2-Final Practice ProblemDocument7 pagesCorpuz, Aily-Bsbafm2-2-Final Practice ProblemAily CorpuzNo ratings yet

- P2 May 09Document35 pagesP2 May 09rk_19881425No ratings yet

- ANS 2017 MARCH Financial - Accounting - Reporting - Fundamentals - March - 2017 - English - MediumDocument20 pagesANS 2017 MARCH Financial - Accounting - Reporting - Fundamentals - March - 2017 - English - MediumJahanzaib ButtNo ratings yet

- Sample Mark Scheme Level 5 Effective Financial Management: Section A - 20 MarksDocument12 pagesSample Mark Scheme Level 5 Effective Financial Management: Section A - 20 MarksTheocryte SergeotNo ratings yet

- ANS 2016 MARCH - Financial - Accounting - Reporting - Fundamentals - March - 2016 - English - MediumDocument16 pagesANS 2016 MARCH - Financial - Accounting - Reporting - Fundamentals - March - 2016 - English - MediumJahanzaib ButtNo ratings yet

- Strategic Case For IT InvestmentDocument64 pagesStrategic Case For IT Investmentjackson fooNo ratings yet

- Dfa6233 2017 2 PT PDFDocument6 pagesDfa6233 2017 2 PT PDFmy pcNo ratings yet

- P1.PROO - .L Question CMA September 2022 ExaminationDocument7 pagesP1.PROO - .L Question CMA September 2022 ExaminationS.M.A AwalNo ratings yet

- SA - Syl12 - Jun2015 - P8 (1) FDocument16 pagesSA - Syl12 - Jun2015 - P8 (1) FMuhamed Muhsin PNo ratings yet

- Assignment_DBB2203_BBA 4_SET 1&2_April 2024Document4 pagesAssignment_DBB2203_BBA 4_SET 1&2_April 2024hazilmohamed990No ratings yet

- HI5020Document13 pagesHI5020takeshiru000No ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- CF Chap027Document16 pagesCF Chap027AgnesNo ratings yet

- Topic 6-Cash Flow in Capital BudgetingDocument61 pagesTopic 6-Cash Flow in Capital BudgetingBaby KhorNo ratings yet

- Chapter 2. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 2. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- SRI5307 st20213548Document36 pagesSRI5307 st20213548Sandani NilekaNo ratings yet

- Advanced Valuation Concepts and Methods - BLK - 1Document72 pagesAdvanced Valuation Concepts and Methods - BLK - 1Kim GeminoNo ratings yet

- Module 2 - Financial ManagementDocument30 pagesModule 2 - Financial ManagementSyazliana KasimNo ratings yet

- SHORT NOTES (Got It Pass)Document124 pagesSHORT NOTES (Got It Pass)HossainAmzadNo ratings yet

- Business Decision Making Payback Period and Net Present Value EvaluationDocument6 pagesBusiness Decision Making Payback Period and Net Present Value Evaluationnawal zaheerNo ratings yet

- 340 - Resource - 10 (F) Learning CurveDocument19 pages340 - Resource - 10 (F) Learning Curvebaby0310100% (2)

- Baidu Valuation Workbook March 6 2019Document7 pagesBaidu Valuation Workbook March 6 2019Michał MalewiczNo ratings yet

- Bleaching PowderDocument19 pagesBleaching PowderKroya Hun100% (1)

- Moodys Approach To Rating The Petroleum Industry PDFDocument32 pagesMoodys Approach To Rating The Petroleum Industry PDFMujtabaNo ratings yet

- MBS Corporate Finance 2023 Slide Set 3Document104 pagesMBS Corporate Finance 2023 Slide Set 3PGNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Chapter 6 - Investment Decisions - Capital BudgetingDocument21 pagesChapter 6 - Investment Decisions - Capital BudgetingYasir ShaikhNo ratings yet

- Tài Chính Công Ty Nâng CaoDocument8 pagesTài Chính Công Ty Nâng CaoTrái Chanh Ngọt Lịm Thích Ăn ChuaNo ratings yet

- Determination of An Ultimate Pit Limit Utilising Fractal Modelling To Optimise NPVDocument329 pagesDetermination of An Ultimate Pit Limit Utilising Fractal Modelling To Optimise NPVtamanimoNo ratings yet

- Pinky Dey Batch 17 PM Assignment: (Rs. in 000)Document14 pagesPinky Dey Batch 17 PM Assignment: (Rs. in 000)PINKY DEYNo ratings yet

- Capital Budgeting With AnswersDocument9 pagesCapital Budgeting With AnswersishikiconsultancyNo ratings yet

- Multiple Choice Questions: Top of FormDocument96 pagesMultiple Choice Questions: Top of Formchanfa3851No ratings yet

- FIN303 Exam-Type Questions For Final Exam: $2.00 6% $40.00 Capital Gains Yield 6.00%Document10 pagesFIN303 Exam-Type Questions For Final Exam: $2.00 6% $40.00 Capital Gains Yield 6.00%Lovely De CastroNo ratings yet

- PMP 6 Edition Questions & Answer: Page 1 of 15Document15 pagesPMP 6 Edition Questions & Answer: Page 1 of 15Prakash SelvarajNo ratings yet

- Capital BudgetingDocument65 pagesCapital Budgetingarjunmba119624No ratings yet

- FM6 - Capital BudgetingDocument22 pagesFM6 - Capital BudgetingFelicia CarissaNo ratings yet

- Absorption CostingDocument76 pagesAbsorption CostingMustafa KamalNo ratings yet