Professional Documents

Culture Documents

IPAMC6367_10096834_PortFolioFactSheet6020CT (6)

IPAMC6367_10096834_PortFolioFactSheet6020CT (6)

Uploaded by

kryadavifs50 ratings0% found this document useful (0 votes)

1 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageIPAMC6367_10096834_PortFolioFactSheet6020CT (6)

IPAMC6367_10096834_PortFolioFactSheet6020CT (6)

Uploaded by

kryadavifs5Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

ICICI Prudential Asset Management Company Limited

As of: 20/05/2024

Portfolio Manager: ICICI Prudential AMC Ltd Portfolio Holdings

Sr. Security Quantity Cost Mkt Value%Assets

Strategy: ICICI Prudential PMS Contra Strategy

Account: 10096834 - DI96834A - MUSKAN GUPTA 1 ICICI Bank Ltd 225 253,736 254,419 6.25%

Inception Date: 10/04/2024 2 Tata Steel Ltd 1,191 198,722 199,969 4.91%

Investment Objective 3 State Bank of India 234 189,337 192,114 4.72%

4 Larsen & Toubro Ltd 53 183,219 183,603 4.51%

5 VEDANTA LIMITED 346 148,457 158,676 3.90%

Sector Allocation 6 Power Finance Corporation Ltd 340 154,732 158,423 3.89%

7 Bharti Airtel Ltd 116 153,010 156,339 3.84%

8 Vardhman Textiles Ltd 279 128,453 129,428 3.18%

9 NTPC Ltd 321 116,285 117,582 2.89%

10 Indian Bank 203 108,624 109,630 2.69%

11 SBI Life Insurance Company Limited 75 108,168 107,989 2.65%

12 Jindal Stainless Ltd 141 98,747 99,285 2.44%

13 Indusind Bank Ltd 69 99,041 97,794 2.40%

14 Apollo Tyres Ltd 191 93,268 94,087 2.31%

15 Jindal Steel and Power Ltd 83 82,061 84,382 2.07%

16 Coromandel International Ltd 67 83,091 83,777 2.06%

Samvardhana Motherson International 596 76,162 77,450 1.90%

17

Limited

18 Aurobindo Pharma Ltd 64 74,339 76,954 1.89%

19 Ambuja Cements Ltd 122 75,295 75,518 1.86%

HDFC Asset Management Company 19 71,284 71,945 1.77%

20

Limited

Portfolio Summary 21 Equitas Small Finance Bank Limited 754 72,008 70,763 1.74%

Since 10/04/2024 Amount(INR) 22 Bank Of Baroda 259 68,156 67,988 1.67%

Capital Invested 4,034,392 23 TVS Motor Company Ltd 30 64,786 65,745 1.62%

Withdrawal 0 24 Usha Martin Ltd 169 59,748 60,477 1.49%

Net Capital Invested 4,034,392 25 MEDPLUS HEALTH SERVICES LIMITED 79 54,648 55,024 1.35%

Total Gain/Loss 39,834 26 Bharti Hexacom Limited 32 28,463 30,755 0.76%

Total Income 0 27 Sarda Energy and Minerals Ltd 84 21,743 22,655 0.56%

Total Expenses 4,409 28 Brigade Enterprises Ltd 10 9,839 11,953 0.29%

Portfolio Value(20/05/2024) 4,069,817 29 Avenue Supermarts Limited 2 8,955 9,341 0.23%

30 Tata Communications Ltd 5 9,906 9,038 0.22%

Performance(TWRR) 31 InterGlobe Aviation Limited 2 7,572 8,733 0.21%

MTD QTD YTD Since 32 Cash 1,127,984 1,127,984 1,127,984 27.72%

10/04/24 Total 4,029,838 4,069,817 100%

Portfolio -0.28% - - 1.82%

S&P BSE 500 TRI 0.85% - - 1.75%

Portfolio returns are after management fees and other expenses. Return over 1 year

period are annualised.

Sebi Registration NO: INP000000373 For further queries related to the portfolio please contact: Mr. Nimesh Shah | email: feedbackpms@icicipruamc.com

ICICI Prudential Asset Management Company Limited, One BKC, 13th Floor, Bandra Kurla Complex, Bandra (East)-400051,Mumbai | Tel:9122-26525000

You might also like

- 7 CMA FormatDocument22 pages7 CMA Formatzahoor80100% (2)

- Summer Internship Project Report On Marketing ResearchDocument27 pagesSummer Internship Project Report On Marketing Researchharasankhbutru71% (14)

- Exam Paper 2012 ZAB CommentariesDocument35 pagesExam Paper 2012 ZAB Commentariesamna666No ratings yet

- Post Confrence Note - 2024Document139 pagesPost Confrence Note - 2024ArunNo ratings yet

- List of Highest Dividend Paying Stocks in India 2019Document4 pagesList of Highest Dividend Paying Stocks in India 2019arjunNo ratings yet

- Low_PE_StocksDocument4 pagesLow_PE_StocksRajendra PrasadNo ratings yet

- 100-200 ET 500 Company List 2022Document6 pages100-200 ET 500 Company List 20220000000000000000No ratings yet

- 200-300 ET 500 Company List 2022Document6 pages200-300 ET 500 Company List 20220000000000000000No ratings yet

- Fiscf Franklin India Smaller Companies Fund: PortfolioDocument1 pageFiscf Franklin India Smaller Companies Fund: PortfolioRtsu PtNo ratings yet

- Rank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCADocument6 pagesRank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCA0000000000000000No ratings yet

- ET 500 Companies ListDocument22 pagesET 500 Companies ListKunal SinghalNo ratings yet

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- PPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)Document13 pagesPPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)TunirNo ratings yet

- Nifty 50 Quarterly Estimates Q4FY23Document9 pagesNifty 50 Quarterly Estimates Q4FY23gann wolfNo ratings yet

- Cresent CottonDocument6 pagesCresent CottonIhsan danishNo ratings yet

- Form 4 Sep21Document1 pageForm 4 Sep21rohan.explorerNo ratings yet

- India Consumer Fund PortfolioDocument1 pageIndia Consumer Fund PortfolioNitish KumarNo ratings yet

- PPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)Document13 pagesPPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)TunirNo ratings yet

- Angel Top Picks-140311Document2 pagesAngel Top Picks-140311assuredgainNo ratings yet

- Small Cap FundDocument1 pageSmall Cap Fundshailendra.goswamiNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- TopDividendYieldStocks 15march2023Document4 pagesTopDividendYieldStocks 15march2023Dwaipayan MojumderNo ratings yet

- PPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)Document12 pagesPPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)TunirNo ratings yet

- NIFTY Midcap Select Jan2022Document1 pageNIFTY Midcap Select Jan2022Arati DubeyNo ratings yet

- Dividend Yield Stocks 18th July 2020Document1 pageDividend Yield Stocks 18th July 2020Krishna PaladuguNo ratings yet

- Sharekhan Morning Tiger (Pre Market Insight) 06 June 2022Document7 pagesSharekhan Morning Tiger (Pre Market Insight) 06 June 2022Kishor PrajapatiNo ratings yet

- Call Success IDEA2ACT CraftsmanDocument2 pagesCall Success IDEA2ACT Craftsmanvikalp123123No ratings yet

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNo ratings yet

- Arihant Capital Pre Conference Note Bharat Rising Star Summit 2023Document114 pagesArihant Capital Pre Conference Note Bharat Rising Star Summit 2023bhanurathi1998No ratings yet

- Life Insurance IndustryDocument78 pagesLife Insurance Industryvikas5kumarNo ratings yet

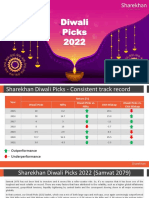

- DiwaliPicks2022 131022Document22 pagesDiwaliPicks2022 131022tranganathanNo ratings yet

- Equirus 3 Year Top Ideas Note 15.09.2022Document96 pagesEquirus 3 Year Top Ideas Note 15.09.2022Harshika MehtaNo ratings yet

- Merchant Banker PerformanceDocument18 pagesMerchant Banker PerformanceMilin RaijadaNo ratings yet

- Monthly-Portfolio February 2018Document6 pagesMonthly-Portfolio February 2018Razerx99No ratings yet

- 4614 A Fact SheetDocument1 page4614 A Fact SheetAatish TNo ratings yet

- Equity 2019-2020Document1 pageEquity 2019-2020Sandeep SharmaNo ratings yet

- Sales Volume q1 Fy 24Document1 pageSales Volume q1 Fy 24Vishnu PatidarNo ratings yet

- Top5 Fund BasketDocument18 pagesTop5 Fund Basketgargassociates98.3No ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- TFM Term Report - Rough DraftDocument6 pagesTFM Term Report - Rough Draftont12522No ratings yet

- Ultratech Sales VolumeDocument1 pageUltratech Sales VolumePankaj SinhaNo ratings yet

- Tracing Missing ShareholdersDocument19 pagesTracing Missing Shareholdersmrpatel121152No ratings yet

- Q4FY23 Investor PresentationDocument49 pagesQ4FY23 Investor PresentationAradhyaNo ratings yet

- Book 1Document64 pagesBook 1poojaguptainida1No ratings yet

- 5.Off-Balance Sheet CommitmentsDocument2 pages5.Off-Balance Sheet CommitmentsAbdelkebir BelkhayNo ratings yet

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasNo ratings yet

- Specificic Requested Info For NED - ReviewedDocument4 pagesSpecificic Requested Info For NED - ReviewedRaphael MashapaNo ratings yet

- NRB KFI-Ashwin-2079 PDFDocument1 pageNRB KFI-Ashwin-2079 PDFLikesh ShresthaNo ratings yet

- Fundamental Analysis On Auto Ancillary SectorDocument10 pagesFundamental Analysis On Auto Ancillary SectorHarsh parasher (PGDM 17-19)No ratings yet

- Motilal Oswal Asset Management Company Limited: Half-Yearly Portfolio Statement As On March 31, 2019Document22 pagesMotilal Oswal Asset Management Company Limited: Half-Yearly Portfolio Statement As On March 31, 2019Jennifer NievesNo ratings yet

- Swapna - TechScan1Document1 pageSwapna - TechScan1phaniNo ratings yet

- Annexure - 2 (A) - IDocument12 pagesAnnexure - 2 (A) - IUttamJainNo ratings yet

- Abhishek Enterprise Sales & Commn STTMDocument1 pageAbhishek Enterprise Sales & Commn STTMabhishekNo ratings yet

- Inbound 6600940802045398443Document9 pagesInbound 6600940802045398443தமிழன் இராமசாமிNo ratings yet

- MFIN Q2 FY20 Investor PresentationDocument68 pagesMFIN Q2 FY20 Investor PresentationNikunj AgrawallaNo ratings yet

- Best Stocks To Buy in India For Long Term in 2017 - GetMoneyRichDocument4 pagesBest Stocks To Buy in India For Long Term in 2017 - GetMoneyRichPalanisamy BalasubramaniNo ratings yet

- Diwali Picks October - Fundamental DeskDocument16 pagesDiwali Picks October - Fundamental DeskSenthil KumarNo ratings yet

- Universal Cables LTDDocument3 pagesUniversal Cables LTDRavi TamrakarNo ratings yet

- wpTop100RetailAsia-v0 3Document36 pageswpTop100RetailAsia-v0 3Pedro Ramos DiasNo ratings yet

- Irp Adani FinalDocument4 pagesIrp Adani Finalharsh kaushikNo ratings yet

- London NPL Offcycle Internship Job DescriptionDocument1 pageLondon NPL Offcycle Internship Job DescriptionHitesh JainNo ratings yet

- ICICIDocument4 pagesICICIFernandes RudolfNo ratings yet

- Final Report (Renata Limited) RYA FIN440Document51 pagesFinal Report (Renata Limited) RYA FIN440Prince AhmedNo ratings yet

- Rastapaper: #1 Cannabis Crypto Ecosystem That Will Be Providing A Bridge Between Traditional Market and CryptoDocument14 pagesRastapaper: #1 Cannabis Crypto Ecosystem That Will Be Providing A Bridge Between Traditional Market and CryptoAlex Justino Da SilvaNo ratings yet

- Forms of Finance - Case Study Corrections: Martín AlbujaDocument3 pagesForms of Finance - Case Study Corrections: Martín AlbujaMartin AlbujaNo ratings yet

- How To Survive A Crypto CycleDocument3 pagesHow To Survive A Crypto CyclefikgangNo ratings yet

- More Than Values-VFDocument9 pagesMore Than Values-VFPatricia GarciaNo ratings yet

- Cash Flows From Investing ActivitiesDocument1 pageCash Flows From Investing Activitiesarmor.coverNo ratings yet

- An Overview of Changing Financial Service Sector: Peter S. RoseDocument22 pagesAn Overview of Changing Financial Service Sector: Peter S. RoseShameel IrshadNo ratings yet

- Sapm TextDocument460 pagesSapm TextAkash BNo ratings yet

- Summarize of Chapter 2Document2 pagesSummarize of Chapter 2An DoNo ratings yet

- MIDTERM EXAM BUSCOM (Not Included Prob Solving)Document6 pagesMIDTERM EXAM BUSCOM (Not Included Prob Solving)Justine FloresNo ratings yet

- Business Finance: Golden West CollegesDocument11 pagesBusiness Finance: Golden West CollegesAple BalisiNo ratings yet

- Directors ReportDocument51 pagesDirectors ReportEllis ElliseusNo ratings yet

- Scenario Summary: Changing CellsDocument10 pagesScenario Summary: Changing Cellsjerrynguyen291No ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- Lecture Notes - Dash 1 Oct 23Document16 pagesLecture Notes - Dash 1 Oct 23だみNo ratings yet

- Management of Financial Services and Institutions: Topic:-SIDBI (Small Industrial Development Bank of India)Document15 pagesManagement of Financial Services and Institutions: Topic:-SIDBI (Small Industrial Development Bank of India)seemagupta_11118018No ratings yet

- Shareholders Equity With AnswersDocument4 pagesShareholders Equity With AnswersJillian Faye Doria100% (3)

- Stock ValuationDocument8 pagesStock Valuationgabby209No ratings yet

- Notice: Investment Company Act of 1940: National Association of Securities Dealers, Inc.Document3 pagesNotice: Investment Company Act of 1940: National Association of Securities Dealers, Inc.Justia.comNo ratings yet

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocument9 pagesChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Mapping DatabaseDocument378 pagesMapping DatabaseHaseebAshfaqNo ratings yet

- Paper 1-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 1 - UnlockedDocument19 pagesPaper 1-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 1 - UnlockedHirak Jyoti Das100% (2)

- XXXXX MFDocument24 pagesXXXXX MFpratik0909No ratings yet

- Reading 9 Employee Compensation - Post-Employment and Share-Based - AnswersDocument21 pagesReading 9 Employee Compensation - Post-Employment and Share-Based - Answerstristan.riolsNo ratings yet

- PB China Pacific Equity Fund (Pbcpef)Document5 pagesPB China Pacific Equity Fund (Pbcpef)Nik Hairi OmarNo ratings yet