Professional Documents

Culture Documents

Merchant-Terms_and_Conditions

Merchant-Terms_and_Conditions

Uploaded by

HasnaatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merchant-Terms_and_Conditions

Merchant-Terms_and_Conditions

Uploaded by

HasnaatCopyright:

Available Formats

TERMS & CONDITIONS

Avanza Premier Payment Services (APPS) and Merchant are hereinafter collectively

referred to as the “Parties” and individually as a “Party” as the context may

require.

The Terms & Conditions henceforth may be collectively referred to as “Agreement”

as the context may require.

1. OBLIGATION OF MERCHANT

1.1. The Merchant shall agree on a non-exclusive basis to accept the online

payments through the APPS Payment Gateway Service.

1.2 The Merchant shall observe all security measures prescribed by APPS

and/or the Merchant's internal security measures as they deem fit under prior

intimation to APPS, in respect of the acceptance of any Online Transaction

1.3 The Merchant shall ensure to display the logo of PayFast at its website(s)

all the time during the tenure of this agreement.

1.4 The Merchant shall deliver the good/service order to the relevant Customer

within defined number of Business Days from the date of Transaction authorization.

The Merchant shall promptly inform APPS of any security breach, suspected

fraudulent data or any suspicious activities that may be connected with attempts

to commit a security breach or to use fraudulent data at the Merchant’s Website.

1.5 provide evidence for delivering goods /services in connection with any

dispute raised by partner banks /Payment Scheme/acquiring bank. If failed to

provide the sufficient evidence for delivering goods /service then merchant shall

accept the charge back. Merchant shall pay any penalties imposed by a partner

banks /Payment Scheme/acquiring bank due to any valid Chargeback.

1.6 Merchant agrees to provide evidence for delivering goods /services in

connection with any dispute raised by partner banks /Payment Scheme/acquiring

bank. If failed to provide the sufficient evidence for delivering goods /service

then merchant shall accept the charge back. Super Merchant /Merchant agrees to

take the liability and pay any penalties imposed by a partner banks /Payment

Scheme/acquiring bank due to any valid Chargeback. Super Merchant/Merchant agrees

that penalty amount will be adjusted from the next settlement amount, otherwise

it will be paid in full by merchant within 3 – 4 working days of chargeback

notice.

1.7 Merchant warrants that it shall not engage or sell that are prohibited by

law of Pakistan/Acquiring Bank/ Payment Schemes or APPS:

• Firearms

• Alcoholic beverages

• Explosives

• Pornographic materials and services of any kind whatsoever

• Live animals

• Banned/illegal drugs or other controlled substances

• Fireworks or other pyrotechnic devices or supplies

• Hazardous materials, combustibles, corrosives

• Access or membership of pornographic or illegal sites

• Bulk email software or mailing lists

• Gambling transactions

• Multi-level marketing collection fees

• Matrix sites or sites using a matrix scheme approach

• Work-at-home information

• Wire transfer products

• Any product or service which is not in compliance with all applicable

laws and regulations whether federal, provincial or local laws of the

Islamic republic of Pakistan and regulation and rules of acquiring

bank/payment schemes.

2. SYSTEM

The Parties acknowledge that the setting-up, maintenance, upgrading, security

and integrity of the system (if applicable), and all costs thereof, and any other

matters related thereto, shall be borne by respective party.

3. WEBSITE REQUIREMENTS

3.1 All representations-contained in / on the Merchant's Website, as well as

the web pages therein, or any advertisement or printed matter relating to the

products or services offered therein shall be deemed to have been made solely by

the Merchant and APPS shall not in any way be liable for any claim whatsoever

arising therefrom.

The Merchant agrees to display at its website the following information:

• Accurate description of the goods and services provided

• Return Policy

• Privacy Policy

• Refund Policy

• Terms and Conditions

• FAQs

• Customer Service Number including electronic mail address

• Pricing should be in PKR

• Permanent Address should be mentioned on the website.

4. SETTLEMENT OF FUNDS

4.1 The Merchant shall agree on the commercial terms and select payment option

set forth and agreed with by APPS. The commercial terms may be revised by APPS

upon giving 30 days’ notice.

4.2 All payments made by APPS under this Agreement shall take into account any

applicable taxes and fee applicable for the transfer of funds which APPS may be

required by to deduct

4.3 APPS shall ensure that settlement amount will be paid to merchant within

the standard or agreed period with APPS as If the Merchant finds any discrepancy

in settlement amount. It shall raise the objection within three (3) business days

from date of settlement:

SETTLEMENT PERIOD

PAYMENT INSTRUMENT SETTLEMENT METHOD SETTLEMENT PERIOD

Funds Transfer Into T+2

Account With Settlement Second working day of

Account/Mobile Bank transaction

Wallet Based funds transfer into bank

T+3

Transactions account any other

Third working day of

schedule bank except

transaction

Settlement Bank

Funds Transfer Into T+3

Account With Settlement Third working day of

Bank transaction

Card Based

Transactions funds transfer into bank

T+4

account any other

Forth working day of

schedule bank except

transaction

Settlement Bank

5. REFUNDS AND REBATES

5.1 The merchant will refund, if customer is not satisfied with the quality of

goods/services, or goods/services not received aGer the lapse of delivery time.

6. DISPUTE RESOLUTION

6.1 Either party agrees to comply with the Standard Operating Procedures that

are integral part of this agreement and coordinate with each other to resolve

the dispute raise by customer.

7. SUSPICIOUS AND FRAUDULENT TRANSACTIONS

7.1 The Merchant shall monitor the pattern/trend of the Transactions,

constantly and shall immediately notify APPS in writing in the event of any

surge/abnormal increase or any other suspected Online Transactions. In case such

an abnormal increase is observed, the Merchant shall immediately inform APPS in

writing for advice.

7.2 APPS shall not be liable to pay the Transaction amount for any fraudulent

and/or unauthorized Online Transactions.

8. PRODUCTION/INSPECTION OF RECORDS

8.1 The Merchant shall permit the authorized representatives of APPS OR State

Bank of Pakistan official to carry out, with prior notice at a mutually agreed

time, physical inspections of the place(s) of business of the Merchant.

8.2 The Merchant, shall preserve all records pertaining to Online Transactions

for a period of at least two (02) years from the date thereof and provide to APPS

upon receiving the request.

9. TERMINATION

9.1 This Agreement shall come into effect on the Effective Date and shall

remain in force until terminated in accordance with the provisions of Clauses

9.2, 9.3 or 9.4 below.

9.2 Neither party will terminate this agreement within two years from effective

date except in the circumstances given in clause 9.5.

9.3 Either Party may terminate this Agreement after two years from effective

date without assigning any reason whatsoever by giving to the other Party [60]

days prior written notice and after the said [60] days period.

9.4 Notwithstanding anything mentioned in this Agreement, a Party (“Terminating

Party”) shall be entitled to terminate this Agreement forthwith by prior written

notice to the other Party (“Defaulting Party”) in case the Defaulting Party

commits a breach of any of its obligations under this Agreement or on the

occurrence of any of the following events:

9.5 Where proceedings are commenced or a resolution is passed for the winding

up or dissolution, whether voluntary or otherwise, of the Defaulting Party or

where proceedings are commenced for the administration or liquidation of the

Defaulting Party or a receiver or manager is appointed over the Defaulting Party

or any of its assets or distress or other execution is levied against the

Defaulting Party or any of its assets or the Defaulting Party enters into any

composition or arrangement with its creditors;

9.6 The Defaulting Party or any of its officers, employees and/or agents is or

is suspected by the Terminating Party to be involved in any fraudulent or unlawful

activity with regard to the arrangement under this Agreement or relating to any

Online Transaction.

9.7 Any termination of this Agreement shall not affect any accrued rights,

obligations and liabilities of either Party or the effectiveness or validity of

any Online Transactions processed by APPS prior to such termination.

9.8 Upon termination of this Agreement, the Merchant shall forthwith return to

APPS all items and/or equipment provided to the Merchant in connection with this

Agreement (if any) in good working order and condition (fair wear and tear

accepted).

10. CONFIDENTIALITY

10.1 Each Party acknowledges that the other Party claims its Confidential

Information as a special, valuable and unique asset. Each Party agrees to the

following: a receiving Party will not disclose the Confidential Information to

any third party or disclose to an employee, professional adviser or service

provider, unless such employee, professional adviser or service provider has a

need to know the Confidential Information and is subject to a binding and

enforceable confidentiality or nondisclosure agreement with receiving Party.

Receiving Party will use the Confidential Information only for the purpose of

the Agreement and will not use it for its own benefit. In no event shall the

receiving Party use less than the same degree of care to protect the Confidential

Information as it would employ with respect to its own information of like

importance, which it does not desire to have published or disseminated. If the

receiving Party faces legal action or is subject to legal proceedings requiring

disclosure of Confidential Information, then, prior to disclosing any such

Confidential Information, the receiving Party shall promptly notify the

disclosing Party and, upon the disclosing Party's request, shall cooperate with

the disclosing Party in contesting such request.

10.2 If any of the Parties is requested or required by law enforcement institutes

such as FBR, FIA and other to disclose any confidential information, it is agreed

that such Party shall disclose the required information.

11. REPRESENTATIONS AND WARRANTIES

APPS and the Merchant in their individual capacity, hereby represent and warrant

to the other as follows;

11.1 that this Agreement is authorized by their respective board of

directors/Owners and that they have the power to enter into the Agreement and

have by all appropriate and required corporate action, authorized the execution

of the Agreement;

11.2 neither the execution of the Agreement, nor the compliance by them with

the terms of the Agreement which apply to them individually, will constitute a

breach of or cause a default under any agreement or other undertaking, instrument

or obligation to which they are a party or which is binding upon them or any of

their assets to an extent or manner which might materially and adversely affect

their ability to perform their respective obligations under the Agreement.

12. GOVERNING LAW AND JURISDICTION

12.1 This Agreement shall be governed by and construed in accordance with the

laws of the Islamic Republic of Pakistan. In relation to any legal action or

proceedings arising out of or in connection with this agreement, each of the

Parties irrevocably submits to civil jurisdiction of the competent courts of

Pakistan.

12.2 This Agreement or any of its terms may be varied, amended, waived or

discharged only by mutual consent of the Parties in writing.

13. LICENSES AND APPROVAL

13.1 Either party will be responsible to take all necessary license and approvals

to perform the function define in this agreement.

14. DISPUTES, ARBITRATION AND GOVERNING LAW

14.1 All disputes, differences or questions with respect to any matter arising

out of or relating to this Agreement shall be resolved by both the Parties through

mutual negotiations in good faith. Either Party may inform the other Party about

any such dispute through a notice in writing specifying the issue in dispute or

the matter of difference. The Parties shall endeavor to settle the issue through

amicable negotiations within thirty (30) days of receipt of such a notice. In

case the issue raised through the notice cannot be settled within the period of

thirty (30) days from the date of receipt of notice, the issue or matter shall

be referred to arbitration as provided hereunder.

15. FORCE MAJEURE

15.1 Neither Party shall be liable for any delay or non-performance under this

Agreement caused by any event beyond its reasonable control, including, but not

limited to, an act of God, war, invasion, act of foreign enemies hostilities

(regardless of whether war is declared), Government restrictions, public

disorder, riots, epidemics, violent demonstrations, sabotage, civil war,

terrorism, military or usurped power of confiscation, nationalization, Government

sanction, strike, interruption, political unrest, interruption or failure of

electricity or telephone service, fire accident or other unforeseeable or

unavoidable circumstances against which reasonable precautions could not have

been taken (a “Force Majeure Event”) provided that the Party affected gives

prompt notice in writing to the other Party of such Force Majeure Event and uses

all reasonable endeavors to continue to perform its obligations under this

Agreement.

16. BUSINESS CONTINUITY PLANNING AND DISASTER RECOVERY

16.1 Either Party shall ensure business continuity planning and disaster

recovery processes at their side in such manner that shall meet disaster recovery

requirements.

You might also like

- The 3D Printing Handbook - Technologies, Design and ApplicationsDocument347 pagesThe 3D Printing Handbook - Technologies, Design and ApplicationsJuan Bernardo Gallardo100% (7)

- HSBC RTGS PDFDocument2 pagesHSBC RTGS PDFSamir Choudhry100% (2)

- ASTM - STP 425 - Stress Corrosion Testing 1967 PDFDocument390 pagesASTM - STP 425 - Stress Corrosion Testing 1967 PDFnarmathaNo ratings yet

- Payment Facilitator AgreementDocument14 pagesPayment Facilitator AgreementHerbert100% (1)

- HW Client AgreementDocument21 pagesHW Client Agreementfarman ali100% (1)

- Regulations and GuidelinesDocument17 pagesRegulations and GuidelinesGianfranco PieriniNo ratings yet

- NPBFX Regulations On Non Trading OperationsDocument8 pagesNPBFX Regulations On Non Trading OperationsUjangNo ratings yet

- Funds and TransfersDocument9 pagesFunds and TransfersWarren ChingovoNo ratings yet

- Nedbank Merchant AgreementDocument24 pagesNedbank Merchant AgreementSuunyNo ratings yet

- doc-client-agreement-en_240703_102931Document29 pagesdoc-client-agreement-en_240703_102931lordabdias9No ratings yet

- Additional Rights & Obligations (Voluntary)Document18 pagesAdditional Rights & Obligations (Voluntary)RuchikaGosainNo ratings yet

- Additional Rights & Obligations (Voluntary)Document17 pagesAdditional Rights & Obligations (Voluntary)BALACHITRANo ratings yet

- Client Agreement en PDFDocument25 pagesClient Agreement en PDFLiang LahadNo ratings yet

- Abu Dhabi Bank Merchant (No Fee Table) Terms-and-Conditions - ENGDocument17 pagesAbu Dhabi Bank Merchant (No Fee Table) Terms-and-Conditions - ENGAlejandroNo ratings yet

- Merchant AgreementDocument10 pagesMerchant AgreementYordanNo ratings yet

- Client Agreement enDocument28 pagesClient Agreement enAfif KunNo ratings yet

- Marketplace Contract Updated (Settlement)Document4 pagesMarketplace Contract Updated (Settlement)stamhaythamNo ratings yet

- GATEWAY AGREEMENT Updating DocsDocument11 pagesGATEWAY AGREEMENT Updating DocsFitsum DojuNo ratings yet

- MCA-Agreement EromnetDocument9 pagesMCA-Agreement EromnetAnkur VermaNo ratings yet

- EU Terms and ConditionsDocument13 pagesEU Terms and ConditionsAKSHAY CHANDROLANo ratings yet

- Standard Merchant Terms and Conditions v8Document7 pagesStandard Merchant Terms and Conditions v8Rahul SharmaNo ratings yet

- Carrier Enhanced Voip Service Agreement Terms and ConditionsDocument9 pagesCarrier Enhanced Voip Service Agreement Terms and ConditionsdondegNo ratings yet

- MPT Money Merchant Agreement (Template)Document22 pagesMPT Money Merchant Agreement (Template)zayar ooNo ratings yet

- General Terms and Conditions of Use For Payu MerchantsDocument31 pagesGeneral Terms and Conditions of Use For Payu MerchantsCentro turistico Los rosalesNo ratings yet

- Acceptance of ServiceDocument15 pagesAcceptance of ServiceMBOKO OTOKA Benny ShérifNo ratings yet

- Makro Terms and ConditionsDocument11 pagesMakro Terms and ConditionsCorey AcevedoNo ratings yet

- DCB RTGSDocument2 pagesDCB RTGSBharat VardhanNo ratings yet

- General Fees PolicyDocument30 pagesGeneral Fees PolicyvictordiasgratidaoNo ratings yet

- HW Client AgreementDocument20 pagesHW Client Agreementnawirla06No ratings yet

- Annexure-4 Guidance Note - Do'S and Don'Ts For The Clients Do'sDocument3 pagesAnnexure-4 Guidance Note - Do'S and Don'Ts For The Clients Do'smohanNo ratings yet

- Acceptance of ServiceDocument15 pagesAcceptance of Servicenia fejokwuNo ratings yet

- Funds and TransfersDocument11 pagesFunds and Transferskoketso fortunatteNo ratings yet

- Client Agreement: 1. General ProvisionsDocument12 pagesClient Agreement: 1. General Provisionsbasuki basukiNo ratings yet

- Client AgreementDocument12 pagesClient Agreementmbahmitro502No ratings yet

- BidSend Terms and ConditionsDocument5 pagesBidSend Terms and Conditionszaykay0808No ratings yet

- Consultancy MandateDocument4 pagesConsultancy MandateTanmay DeshpandeNo ratings yet

- CCAV AgreementDocument15 pagesCCAV AgreementAmandeep SinghNo ratings yet

- Ecs Nach Si Mandate FormDocument2 pagesEcs Nach Si Mandate FormSachinNo ratings yet

- HSBC Rtgs Form - 241109Document2 pagesHSBC Rtgs Form - 241109Kevin HillNo ratings yet

- MUS MandateDocument4 pagesMUS MandateOneMinuteVideosNo ratings yet

- Client Agreement en JF GlobalDocument28 pagesClient Agreement en JF GlobalAdhi YosephNo ratings yet

- Terms and Conditions: Effective DateDocument13 pagesTerms and Conditions: Effective DateNIHAR SHAHNo ratings yet

- Mobile Deposit Terms and Conditions Revised - Fees RemovedDocument7 pagesMobile Deposit Terms and Conditions Revised - Fees Removedjymlik6No ratings yet

- Terms and Conditions Eu PhoneDocument14 pagesTerms and Conditions Eu Phonelittle blingNo ratings yet

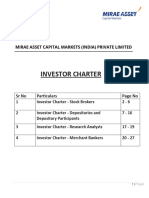

- Investor Charter - Stock Brokers: Page 1 of 5Document5 pagesInvestor Charter - Stock Brokers: Page 1 of 5Pranav SNo ratings yet

- 30 U 9 ST 9 Olri 17 MK 0Document31 pages30 U 9 ST 9 Olri 17 MK 0leticiasilva62783No ratings yet

- Application Form Merchant Agreement MMDocument5 pagesApplication Form Merchant Agreement MMAung ThantNo ratings yet

- Cbci Payment Center AgreementDocument16 pagesCbci Payment Center AgreementmrsjpendletonNo ratings yet

- SC Caa PDFDocument33 pagesSC Caa PDFLoveth BethelNo ratings yet

- 1 Yr Fixed Rate DepositDocument2 pages1 Yr Fixed Rate DepositEnifeni OlawaleNo ratings yet

- T and C Form Online EngDocument8 pagesT and C Form Online EngMd. Mahiuddin omorNo ratings yet

- Opening Bank Account Via Website Terms and ConditionsDocument6 pagesOpening Bank Account Via Website Terms and ConditionsusmanNo ratings yet

- SUB MERCHANT AGREEMENT StartUpProDocument14 pagesSUB MERCHANT AGREEMENT StartUpProSuryaChummaNo ratings yet

- Sub Merchant Agreement PrivilegeDocument14 pagesSub Merchant Agreement PrivilegeSuryaChummaNo ratings yet

- Promissory Note: First Digital Finance CorporationDocument5 pagesPromissory Note: First Digital Finance CorporationJL RangelNo ratings yet

- Investor CharterDocument27 pagesInvestor CharterDhrumil PatelNo ratings yet

- RIDE Terms and ConditionsDocument7 pagesRIDE Terms and Conditionsyosef bentiNo ratings yet

- PYU2Document2 pagesPYU2Adarsh SonkarNo ratings yet

- Account Opening Form - Gilanis Distributors LTD UpdatedDocument6 pagesAccount Opening Form - Gilanis Distributors LTD UpdatedkevinNo ratings yet

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeFrom EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Acts 13 New 2Document8 pagesActs 13 New 2fitsum tesfayeNo ratings yet

- Rogalsky - The Working Poor and What GIS Reveals About The Possibilities of Public Transit PDFDocument12 pagesRogalsky - The Working Poor and What GIS Reveals About The Possibilities of Public Transit PDFMiaNo ratings yet

- A Study in Satin I by TiggerDocument120 pagesA Study in Satin I by TiggerCereal69No ratings yet

- DISS Worksheet Week 5Document7 pagesDISS Worksheet Week 5Joanna Marie Mariscotes PalacioNo ratings yet

- Complete Each Sentence by Choosing The Correct Form:: Ell The Children To Tidy Their RoomDocument4 pagesComplete Each Sentence by Choosing The Correct Form:: Ell The Children To Tidy Their RoomIvana Slavevska-MarkovskaNo ratings yet

- Syllabi Econ 1CDocument2 pagesSyllabi Econ 1Challel jhon butacNo ratings yet

- Ch-8 Challeges To DemocracyDocument2 pagesCh-8 Challeges To DemocracySujitnkbpsNo ratings yet

- Structure and PoetryDocument13 pagesStructure and PoetrySherwinNo ratings yet

- Lecture Eight Analysis and Interpretation of Financial StatementDocument19 pagesLecture Eight Analysis and Interpretation of Financial StatementSoledad PerezNo ratings yet

- Sapiens A Brief History of HumankindDocument8 pagesSapiens A Brief History of HumankindAli GoharNo ratings yet

- Welcome To Good Shepherd Chapel: Thirty-Third Sunday in Ordinary TimeDocument4 pagesWelcome To Good Shepherd Chapel: Thirty-Third Sunday in Ordinary Timesaintmichaelpar7090No ratings yet

- Canon 8.02Document1 pageCanon 8.02Vin LacsieNo ratings yet

- What Is DiarrheaDocument4 pagesWhat Is Diarrheasanozuke02No ratings yet

- FAGL TcodesDocument3 pagesFAGL TcodesRahul100% (2)

- Lab ManualDocument17 pagesLab ManualMuhammad SaifuddinNo ratings yet

- Muhammad Azhar Bin Mat SaadDocument1 pageMuhammad Azhar Bin Mat Saadmuhammad azharNo ratings yet

- Unit 4-2-NonferrousDocument32 pagesUnit 4-2-NonferrousNisha JaiswalNo ratings yet

- B.SC Fashion Design R2018 C&SDocument85 pagesB.SC Fashion Design R2018 C&SvivekNo ratings yet

- Early Journal Content On JSTOR, Free To Anyone in The WorldDocument52 pagesEarly Journal Content On JSTOR, Free To Anyone in The Worldmarc millisNo ratings yet

- ELAC Spring 2013 ClassesDocument75 pagesELAC Spring 2013 Classes一気が変 ビースティーNo ratings yet

- Daksh Booklet - 26 PDF by Ankush LambaDocument35 pagesDaksh Booklet - 26 PDF by Ankush LambaSoham ChaudhuriNo ratings yet

- Event Management NotesDocument24 pagesEvent Management Notesatoi firdausNo ratings yet

- Knowledge L3/E Comprehension L4/D Application L5/C Analysis L6/B Synthesis L7/A Evaluation L8/ADocument2 pagesKnowledge L3/E Comprehension L4/D Application L5/C Analysis L6/B Synthesis L7/A Evaluation L8/AWaltWritmanNo ratings yet

- Handwritten Notes IP XII 2020 PYTHON - RPDocument37 pagesHandwritten Notes IP XII 2020 PYTHON - RPchaitanyanegi2004No ratings yet

- Simple Past Full ExercisesDocument6 pagesSimple Past Full Exercisespablo1130No ratings yet

- Jezza Mariz A. Alo Diane C. Dapitanon Atty. Debbie Love S. Pudpud Criselda Z. RamosDocument1 pageJezza Mariz A. Alo Diane C. Dapitanon Atty. Debbie Love S. Pudpud Criselda Z. RamosLeana ValenciaNo ratings yet

- Example of A Business Model Canvas Coconut Treat StandDocument2 pagesExample of A Business Model Canvas Coconut Treat StandSabrena FennaNo ratings yet

- Med Chem IV Sem Pre RuhsDocument1 pageMed Chem IV Sem Pre Ruhsabhay sharmaNo ratings yet