Professional Documents

Culture Documents

Corporate Bond (Taxable) - Secondary Offers (20)

Corporate Bond (Taxable) - Secondary Offers (20)

Uploaded by

Shubham AgrawalCopyright:

Available Formats

You might also like

- Upcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingDocument8 pagesUpcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingJames FranklinNo ratings yet

- Fortune Integrated Assets Finance Limited.: Statement of AccountDocument2 pagesFortune Integrated Assets Finance Limited.: Statement of AccountSanthosh SehwagNo ratings yet

- Build your own BOND Portfolio - Sample Portfolio with Yield workingDocument1 pageBuild your own BOND Portfolio - Sample Portfolio with Yield workingSMIT PATELNo ratings yet

- BondsDocument1 pageBondsМаниш НахтвандерерNo ratings yet

- Retail Bond Paper.Document1 pageRetail Bond Paper.dharam singhNo ratings yet

- 9.50% IDBI BANK LIMITED 2030 - The Fixed IncomeDocument3 pages9.50% IDBI BANK LIMITED 2030 - The Fixed Incomeqn7b7shm82No ratings yet

- Security List DetailsDocument1,948 pagesSecurity List Detailssriganesh07No ratings yet

- Ulip Disclosure - OCT 2021Document63 pagesUlip Disclosure - OCT 2021VISHNU THAKORNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- Security List DetailsDocument2,041 pagesSecurity List DetailsnarayanvarmaNo ratings yet

- Factsheet PAXWX.O 2021-08-24-12-15-26Document1 pageFactsheet PAXWX.O 2021-08-24-12-15-26Johnny FavouriteNo ratings yet

- Fixed Income ProductsDocument1 pageFixed Income ProductsMahesh SawantNo ratings yet

- Top Stories:: WED 12 JULY 2017Document7 pagesTop Stories:: WED 12 JULY 2017JNo ratings yet

- 8 P 0 DR TPLap Dlqe Eod 1 YZu WPSRV JHIi 77 Y9448 K ZyDocument132 pages8 P 0 DR TPLap Dlqe Eod 1 YZu WPSRV JHIi 77 Y9448 K Zybibek dhakalNo ratings yet

- Portfolio As On 30.11.2019Document275 pagesPortfolio As On 30.11.2019ishan bapatNo ratings yet

- DocumentsDocument2 pagesDocumentsupsc.bengalNo ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- Equity Pension Fund IIDocument1 pageEquity Pension Fund IISrigandh's WealthNo ratings yet

- CashFlow_INE148I07GK5Document2 pagesCashFlow_INE148I07GK5prazannarazNo ratings yet

- 91 SA Institutional Cautious Managed Fund Factsheet enDocument1 page91 SA Institutional Cautious Managed Fund Factsheet enXola Xhayimpi JwaraNo ratings yet

- ACC 102 Part (3) MUST New PDFDocument13 pagesACC 102 Part (3) MUST New PDFamr khaledNo ratings yet

- Statement of Account As On 17-Jan-2022: Bajaj Allianz Life Future Wealth Gain AccountDocument2 pagesStatement of Account As On 17-Jan-2022: Bajaj Allianz Life Future Wealth Gain AccountRajshekar RanjanagiNo ratings yet

- Screenshot_20240702_005308Document1 pageScreenshot_20240702_005308megamaxgasNo ratings yet

- 06 2012 MH07418Document1 page06 2012 MH07418ereeshaisaacsNo ratings yet

- Test Your Understanding# 5 CASE#1 Tokyo Plans To Hold Bond Until Redemption Date. (At Cost)Document3 pagesTest Your Understanding# 5 CASE#1 Tokyo Plans To Hold Bond Until Redemption Date. (At Cost)Muhammad Ali MalikNo ratings yet

- 21 22TR00616Document1 page21 22TR00616Nischal Singh RawatNo ratings yet

- Finals Audit of LiabiliteisDocument8 pagesFinals Audit of LiabiliteisReginald ValenciaNo ratings yet

- Early Cash: (Terms & Conditions Applied)Document2 pagesEarly Cash: (Terms & Conditions Applied)KetharanathanSaravananNo ratings yet

- General Journal GJ1 Date Particulars Debit ($) Credit ($)Document25 pagesGeneral Journal GJ1 Date Particulars Debit ($) Credit ($)Jennifer ChandraNo ratings yet

- EFSL - 7028011153 - NCD Oct'23 - Product NoteDocument6 pagesEFSL - 7028011153 - NCD Oct'23 - Product Notechandraprakash sharmaNo ratings yet

- 010401Document3 pages010401sudhakarnishad47No ratings yet

- Vinyl 2Document5 pagesVinyl 2Joulo YabutNo ratings yet

- Test Your Understanding# 5 CASE#1 Tokyo Plans To Hold Bond Until Redemption Date. (At Amortization Cost) Date Particulars Particulars DR ($) CR ($)Document3 pagesTest Your Understanding# 5 CASE#1 Tokyo Plans To Hold Bond Until Redemption Date. (At Amortization Cost) Date Particulars Particulars DR ($) CR ($)Muhammad Ali MalikNo ratings yet

- MR Refiloe J Katiba Joseph Likotsi Ha Tsiame Maseru 0000: Bbst1 000474Document1 pageMR Refiloe J Katiba Joseph Likotsi Ha Tsiame Maseru 0000: Bbst1 000474refiloekatiba77No ratings yet

- Lagrimas, Sarah Nicole S. - LeasesDocument9 pagesLagrimas, Sarah Nicole S. - LeasesSarah Nicole S. LagrimasNo ratings yet

- Online StatementDocument2 pagesOnline StatementM YNo ratings yet

- ABYT Independent Research Report 20071217Document16 pagesABYT Independent Research Report 20071217minihero0806No ratings yet

- Statement Tax Invoice: Ms S Daniels 8 Stag Street Gelvandale 6020Document1 pageStatement Tax Invoice: Ms S Daniels 8 Stag Street Gelvandale 6020ShandreNo ratings yet

- Quiz 10 - Audit of Investment (BASIC PROB - KEY)Document5 pagesQuiz 10 - Audit of Investment (BASIC PROB - KEY)Kenneth Christian WilburNo ratings yet

- DownloadDocument1 pageDownloadAnimesh JenaNo ratings yet

- Sri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - BondsupermartDocument5 pagesSri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - Bondsupermartsaliyarumesh2292No ratings yet

- Medium Term Bond PDFDocument5 pagesMedium Term Bond PDFGNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- UTI Monthly Income Scheme - Growth - June 2017Document2 pagesUTI Monthly Income Scheme - Growth - June 2017yaglarNo ratings yet

- Mutual Fund: MARCH, 2020Document60 pagesMutual Fund: MARCH, 2020RAJ STUDY WIZARDNo ratings yet

- Jkload 3Document3 pagesJkload 3Jay OsloNo ratings yet

- APOD - A Sample of The ReportDocument1 pageAPOD - A Sample of The ReportJames R Kobzeff100% (1)

- Loan Account Statement For LPCAL00041651130Document3 pagesLoan Account Statement For LPCAL00041651130Arijit DasNo ratings yet

- Category: Psu Bonds Coupon Security Maturity IP RatingDocument18 pagesCategory: Psu Bonds Coupon Security Maturity IP RatingkrishnaNo ratings yet

- qk51 310821Document1 pageqk51 310821raju modiNo ratings yet

- Ne 13708Document1 pageNe 13708Fariyad AnsariNo ratings yet

- Top Stories:: THU 17 SEP 2020Document8 pagesTop Stories:: THU 17 SEP 2020JajahinaNo ratings yet

- GUINTO - Activity 1 - Loans and Impairment ReceivableDocument4 pagesGUINTO - Activity 1 - Loans and Impairment ReceivableGUINTO, DAN FRANCIS B.No ratings yet

- SBNY Signature Bank Annual Balance Sheet - WSJDocument1 pageSBNY Signature Bank Annual Balance Sheet - WSJSanchit BudhirajaNo ratings yet

- Top Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearDocument4 pagesTop Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearJNo ratings yet

- Top Story:: WED 14 DEC 2016Document5 pagesTop Story:: WED 14 DEC 2016JajahinaNo ratings yet

- Security List DetailsDocument1,795 pagesSecurity List Detailssantosh0% (1)

- MONTHLY - PORTFOLIO - AXISMF-Oct 2019Document117 pagesMONTHLY - PORTFOLIO - AXISMF-Oct 2019Gopal PenjarlaNo ratings yet

- Security List Details PDFDocument1,795 pagesSecurity List Details PDFsantoshNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Risk Financial Management Construction IntroDocument18 pagesRisk Financial Management Construction IntrotsuakNo ratings yet

- Chapter 01Document25 pagesChapter 01Wardah Naili UlfahNo ratings yet

- KIID FR0010135103 en LUDocument2 pagesKIID FR0010135103 en LUPushkar GuptaNo ratings yet

- Vault Guide Asia Pacific Banking EmployeesDocument339 pagesVault Guide Asia Pacific Banking EmployeesmcarimNo ratings yet

- IandF CA11 201704 Exam PDFDocument4 pagesIandF CA11 201704 Exam PDFSaad MalikNo ratings yet

- NP EX19 4b JinruiDong 2Document8 pagesNP EX19 4b JinruiDong 2Ike DongNo ratings yet

- Salient Features of Canara Lap (Loan Against Property)Document3 pagesSalient Features of Canara Lap (Loan Against Property)Amit KumarNo ratings yet

- Case 2 Environgard CorporationDocument5 pagesCase 2 Environgard CorporationutsavNo ratings yet

- The 3 Best Ways To Invest In: A Special Report by Jeff Clark, Editor ofDocument12 pagesThe 3 Best Ways To Invest In: A Special Report by Jeff Clark, Editor ofKanza KhanNo ratings yet

- Solved Sixteen Years Ago Ms Cole Purchased A 500 000 Insurance PolicyDocument1 pageSolved Sixteen Years Ago Ms Cole Purchased A 500 000 Insurance PolicyAnbu jaromiaNo ratings yet

- Merchant Banking NotesDocument24 pagesMerchant Banking NotesSharada KadurNo ratings yet

- Series-VII-Securities Operations and Risk Management-Ver-Jan 2024Document224 pagesSeries-VII-Securities Operations and Risk Management-Ver-Jan 2024christous p kNo ratings yet

- Bond Solution ProblemsDocument7 pagesBond Solution ProblemsNojoke1No ratings yet

- S F M - New Syllabus - Study MaterialDocument455 pagesS F M - New Syllabus - Study MaterialTummu SureshNo ratings yet

- Nifty 50: Index MethodologyDocument16 pagesNifty 50: Index MethodologyObhiejitNo ratings yet

- HSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementDocument13 pagesHSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementStephen BgoyaNo ratings yet

- Closure of A CompanyDocument6 pagesClosure of A CompanyanoushkaNo ratings yet

- Gains or Losses in Dealings in PropertyDocument6 pagesGains or Losses in Dealings in PropertyRussel RuizNo ratings yet

- Aabss 49-57Document9 pagesAabss 49-57Martha MagallanesNo ratings yet

- Introduction To Business Finance: Sir Faisal Siddique Uzair Qayyum (200468)Document11 pagesIntroduction To Business Finance: Sir Faisal Siddique Uzair Qayyum (200468)Uzair QayyumNo ratings yet

- 100 PipsDocument8 pages100 PipsAminurrashid IbrahimNo ratings yet

- Trading Life Level in Forex Trading. PDFDocument16 pagesTrading Life Level in Forex Trading. PDFMREACE ElijahNo ratings yet

- An Overview of Changing Financial Service Sector: Peter S. RoseDocument22 pagesAn Overview of Changing Financial Service Sector: Peter S. RoseShameel IrshadNo ratings yet

- Jensen (1967) - The Performance of Mutual Funds in The Period 1945-1965Document37 pagesJensen (1967) - The Performance of Mutual Funds in The Period 1945-1965pvbrandaoNo ratings yet

- Systematic and Unsystematic RiskDocument11 pagesSystematic and Unsystematic RiskRam MintoNo ratings yet

- Lecture6 - RPGT Class Exercise QDocument4 pagesLecture6 - RPGT Class Exercise QpremsuwaatiiNo ratings yet

- Advance Accounting Two Chapter One Part One: True or FalseDocument5 pagesAdvance Accounting Two Chapter One Part One: True or FalsetemedebereNo ratings yet

- Option Trading SecretsDocument21 pagesOption Trading Secretsgelu0406100% (1)

- CAIIB ABFM Memory Based Questions EveDocument2 pagesCAIIB ABFM Memory Based Questions EveAyush KumarNo ratings yet

- File Câu Hỏi Self - Study 1Document5 pagesFile Câu Hỏi Self - Study 1Nguyễn Thị Xuân MaiNo ratings yet

Corporate Bond (Taxable) - Secondary Offers (20)

Corporate Bond (Taxable) - Secondary Offers (20)

Uploaded by

Shubham AgrawalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Bond (Taxable) - Secondary Offers (20)

Corporate Bond (Taxable) - Secondary Offers (20)

Uploaded by

Shubham AgrawalCopyright:

Available Formats

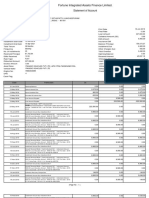

Corporate Bonds ‐ Listed ‐ Taxable ‐ Secondary Offers

Coupon Coupon FV per YTC/YTM/XIRR

Security Name ISIN No. Type Credit Rating Call/Final Maturity Offer Rate

Rate p.a. Frequency Bond %

10.85 Satin Finserv Ltd. 2026 INE03K307033 10.85% Monthly 1,00,000 Secured, Listed A‐ by CARE 24‐Jan‐29 98.50 12.23

12.00 Annapurna Finance Pvt. Ltd. 2030 INE515Q08267 12.00% Monthly 1,00,000 Unsecured, Listed A‐ by CARE 24‐Jan‐30 12.05

8.88 Edelweiss Retail Finance Ltd. 2028 INE528S07110 8.88% Monthly 1,000 Secured, Listed A+ by ICRA 22‐Mar‐28 12.00

AA/Stable CRISIL

8.85 Indiabulls Housing Fin. Ltd. 2026 INE148I07GK5 8.85% Annual 1,000 Secured, Listed

& ICRA

26‐Sep‐26 11.85

10.40 Satin Creditcare Network Ltd. 2027 INE836B07857 10.40% Quarterly 1,00,000 Secured, Listed A/Stable by ICRA 30‐Apr‐27 97.75 11.83

A‐(Positive

10.50 Aye Finance Pvt. Ltd. 2026 INE501X07588 10.50% Monthly 1,00,000 Secured, Listed

Outlook) by IND

17‐Nov‐26 98.50 11.81

A+/Stable by

10.45 Edelweiss Financial Ser. Ltd. 2033 INE532F07DZ1 10.45% Monthly 1,000 Secured, Listed

CRISIL

21‐Jul‐33 93.00 11.73

10.00 Nido Home Finance Ltd. 2026 A by CARE, AA‐ by

(Formerly known as Edelweiss Housing Fin.Ltd.)

INE530L07228 10.20% Annual 1,000 Secured, Listed

BRICKWORK

19‐Jul‐26 97.25 11.57

Semi Tier ‐ 2, Unsecured,

11.00 ESAF Small Finance Bank Ltd. 2030 INE818W08123 11.00%

Annu.

1,00,000

Listed

A/Stable by CARE 20‐Apr‐30 99.25 11.47

10.50 Navi Finserv 2027 INE342T07494 10.50% Monthly 1,00,000 Secured, Listed A/Stable by IND 18‐Jun‐27 99.50 11.24

A+ /Stable by

9.90 Muthoot Capital Ser. Ltd. 2026 INE296G07168 9.90% Monthly 1,00,000 Secured, Listed

CRISIL

12‐Jun‐26 99.25 10.83

8.20 IIFL Home Finance Ltd. 2027 INE477L07AN9 8.20% Monthly 1,000 Secured, Listed AA‐ by CRISIL 03‐Jan‐27 95.50 10.70

A+/Stable by

9.39 Edelweiss Financial Ser. Ltd. 2026 INE532F07BM3 9.39% Monthly 1,000 Secured, Listed

CRISIL

08‐Jan‐26 99.00 10.53

AA by Acuite &

10.03 IIFL Samasta Finance Ltd. 2029 INE413U07301 10.03% Monthly 1,000 Secured, Listed

AA‐ by CRISIL

21‐06‐2029 100.00 10.50

AA‐/Stable by

9.57 MAS Financial Ser. Ltd. 2027 INE348L07209 9.57% Monthly 1,00,000 Secured, Listed

CARE

21‐Jun‐27 99.65 10.15

10.00 ARKA Fincap Ltd. 2028 AA‐/Positive by

INE03W107223 10.00% Annual 1,000 Secured, Listed

CRISIL

27‐Dec‐28 99.75 10.03

(Subsidiary of Kirloskar Oil Engines Ltd.)

AA‐/Stable by

9.55 Muthoot Fincorp Ltd. 2030 INE549K07DU6 9.55% Monthly 1,000 Secured, Listed

CRISIL

30‐Apr‐30 99.90 10.00

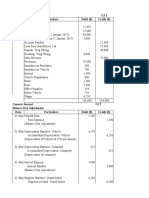

INE248U07FI4 9.44%

AA/Stable by

12‐Jun‐34 100.00 9.85

360 One Prime Ltd. Monthly 1,000 Secured, Listed

CRISIL & ICRA

INE248U07FF0 9.21% 12‐Jun‐29 100.00 9.60

AA‐/Stable by Call: 13 June 2025

9.35 A K Capital Finance Ltd. INE197P07334 9.35% Annual 1,00,000 Secured, Listed

CARE Maturity: 13‐May‐2027

99.50 YTC: 9.89

Call: 29‐Oct‐2026

Star Health and Allied Insurance Co.Ltd. INE575P08040 8.75% Annual 10,00,000 Unsecured, Listed AA‐/Stable by IND

Maturity: 27‐Oct‐2028

98.26 YTC: 9.50

INE658F08094 Unsecured, 22‐Dec‐31

Kerala Infrastructure AA(CE)/Stable by

8.95% Quarterly 1,00,000 Listed, State IND & ACUITE 99.90

Investment Fund Board INE658F08128 Guaranteed 22‐Dec‐28

Kerala Financial Corporation AA by Infomerics

INE818F07286 8.89% Quarterly 1,00,000 Secured, Listed

& Acuite

13‐Mar‐34 100.25

(State Owned PSU Co.)

9.62 Andhra Pradesh State Beverages

INE0M2307198 AA+(CE)/Stable by 28‐Nov‐31

Corpo. Ltd. 2031

9.62 Andhra Pradesh State Beverages

9.62% Quarterly 10,00,000 Secured, ACUITE, AA

(CE)/Stable by IND

8.90

INE0M2307107 Listed, 31‐May‐32

Corpo. Ltd. 2032

State

9.75 UPPCL 2026 INE540P07251 9.75% A+(CE) BY CRISIL & 20‐Oct‐26 9.00

Quarterly 10,00,001

Guaranteed IND RATINGS &

9.95 UPPCL 2031 INE540P07509 9.95% AA‐(CE) BY BWR 31‐Mar‐31 8.90

7.95 Aditya Birla Finance Ltd. 2026 INE860H07IC0 7.95% Annual 10,00,000 Secured, Listed AAA by IND 16‐Mar‐26 100.00 7.93

AAA by CRISIL &

7.10 HDFC Bank Ltd. 2031 INE040A08831 7.10% Annual 10,00,000 Unsecured, Listed

ICRA

12‐Nov‐31 96.25 7.77

> Mentioned offered rates are subject to market Fluctuations. Confirm rates as well as availability of Securities before finalizing the deal.

> Investments in debt / municipal debt / securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.

You might also like

- Upcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingDocument8 pagesUpcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingJames FranklinNo ratings yet

- Fortune Integrated Assets Finance Limited.: Statement of AccountDocument2 pagesFortune Integrated Assets Finance Limited.: Statement of AccountSanthosh SehwagNo ratings yet

- Build your own BOND Portfolio - Sample Portfolio with Yield workingDocument1 pageBuild your own BOND Portfolio - Sample Portfolio with Yield workingSMIT PATELNo ratings yet

- BondsDocument1 pageBondsМаниш НахтвандерерNo ratings yet

- Retail Bond Paper.Document1 pageRetail Bond Paper.dharam singhNo ratings yet

- 9.50% IDBI BANK LIMITED 2030 - The Fixed IncomeDocument3 pages9.50% IDBI BANK LIMITED 2030 - The Fixed Incomeqn7b7shm82No ratings yet

- Security List DetailsDocument1,948 pagesSecurity List Detailssriganesh07No ratings yet

- Ulip Disclosure - OCT 2021Document63 pagesUlip Disclosure - OCT 2021VISHNU THAKORNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- Security List DetailsDocument2,041 pagesSecurity List DetailsnarayanvarmaNo ratings yet

- Factsheet PAXWX.O 2021-08-24-12-15-26Document1 pageFactsheet PAXWX.O 2021-08-24-12-15-26Johnny FavouriteNo ratings yet

- Fixed Income ProductsDocument1 pageFixed Income ProductsMahesh SawantNo ratings yet

- Top Stories:: WED 12 JULY 2017Document7 pagesTop Stories:: WED 12 JULY 2017JNo ratings yet

- 8 P 0 DR TPLap Dlqe Eod 1 YZu WPSRV JHIi 77 Y9448 K ZyDocument132 pages8 P 0 DR TPLap Dlqe Eod 1 YZu WPSRV JHIi 77 Y9448 K Zybibek dhakalNo ratings yet

- Portfolio As On 30.11.2019Document275 pagesPortfolio As On 30.11.2019ishan bapatNo ratings yet

- DocumentsDocument2 pagesDocumentsupsc.bengalNo ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- Equity Pension Fund IIDocument1 pageEquity Pension Fund IISrigandh's WealthNo ratings yet

- CashFlow_INE148I07GK5Document2 pagesCashFlow_INE148I07GK5prazannarazNo ratings yet

- 91 SA Institutional Cautious Managed Fund Factsheet enDocument1 page91 SA Institutional Cautious Managed Fund Factsheet enXola Xhayimpi JwaraNo ratings yet

- ACC 102 Part (3) MUST New PDFDocument13 pagesACC 102 Part (3) MUST New PDFamr khaledNo ratings yet

- Statement of Account As On 17-Jan-2022: Bajaj Allianz Life Future Wealth Gain AccountDocument2 pagesStatement of Account As On 17-Jan-2022: Bajaj Allianz Life Future Wealth Gain AccountRajshekar RanjanagiNo ratings yet

- Screenshot_20240702_005308Document1 pageScreenshot_20240702_005308megamaxgasNo ratings yet

- 06 2012 MH07418Document1 page06 2012 MH07418ereeshaisaacsNo ratings yet

- Test Your Understanding# 5 CASE#1 Tokyo Plans To Hold Bond Until Redemption Date. (At Cost)Document3 pagesTest Your Understanding# 5 CASE#1 Tokyo Plans To Hold Bond Until Redemption Date. (At Cost)Muhammad Ali MalikNo ratings yet

- 21 22TR00616Document1 page21 22TR00616Nischal Singh RawatNo ratings yet

- Finals Audit of LiabiliteisDocument8 pagesFinals Audit of LiabiliteisReginald ValenciaNo ratings yet

- Early Cash: (Terms & Conditions Applied)Document2 pagesEarly Cash: (Terms & Conditions Applied)KetharanathanSaravananNo ratings yet

- General Journal GJ1 Date Particulars Debit ($) Credit ($)Document25 pagesGeneral Journal GJ1 Date Particulars Debit ($) Credit ($)Jennifer ChandraNo ratings yet

- EFSL - 7028011153 - NCD Oct'23 - Product NoteDocument6 pagesEFSL - 7028011153 - NCD Oct'23 - Product Notechandraprakash sharmaNo ratings yet

- 010401Document3 pages010401sudhakarnishad47No ratings yet

- Vinyl 2Document5 pagesVinyl 2Joulo YabutNo ratings yet

- Test Your Understanding# 5 CASE#1 Tokyo Plans To Hold Bond Until Redemption Date. (At Amortization Cost) Date Particulars Particulars DR ($) CR ($)Document3 pagesTest Your Understanding# 5 CASE#1 Tokyo Plans To Hold Bond Until Redemption Date. (At Amortization Cost) Date Particulars Particulars DR ($) CR ($)Muhammad Ali MalikNo ratings yet

- MR Refiloe J Katiba Joseph Likotsi Ha Tsiame Maseru 0000: Bbst1 000474Document1 pageMR Refiloe J Katiba Joseph Likotsi Ha Tsiame Maseru 0000: Bbst1 000474refiloekatiba77No ratings yet

- Lagrimas, Sarah Nicole S. - LeasesDocument9 pagesLagrimas, Sarah Nicole S. - LeasesSarah Nicole S. LagrimasNo ratings yet

- Online StatementDocument2 pagesOnline StatementM YNo ratings yet

- ABYT Independent Research Report 20071217Document16 pagesABYT Independent Research Report 20071217minihero0806No ratings yet

- Statement Tax Invoice: Ms S Daniels 8 Stag Street Gelvandale 6020Document1 pageStatement Tax Invoice: Ms S Daniels 8 Stag Street Gelvandale 6020ShandreNo ratings yet

- Quiz 10 - Audit of Investment (BASIC PROB - KEY)Document5 pagesQuiz 10 - Audit of Investment (BASIC PROB - KEY)Kenneth Christian WilburNo ratings yet

- DownloadDocument1 pageDownloadAnimesh JenaNo ratings yet

- Sri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - BondsupermartDocument5 pagesSri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - Bondsupermartsaliyarumesh2292No ratings yet

- Medium Term Bond PDFDocument5 pagesMedium Term Bond PDFGNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- UTI Monthly Income Scheme - Growth - June 2017Document2 pagesUTI Monthly Income Scheme - Growth - June 2017yaglarNo ratings yet

- Mutual Fund: MARCH, 2020Document60 pagesMutual Fund: MARCH, 2020RAJ STUDY WIZARDNo ratings yet

- Jkload 3Document3 pagesJkload 3Jay OsloNo ratings yet

- APOD - A Sample of The ReportDocument1 pageAPOD - A Sample of The ReportJames R Kobzeff100% (1)

- Loan Account Statement For LPCAL00041651130Document3 pagesLoan Account Statement For LPCAL00041651130Arijit DasNo ratings yet

- Category: Psu Bonds Coupon Security Maturity IP RatingDocument18 pagesCategory: Psu Bonds Coupon Security Maturity IP RatingkrishnaNo ratings yet

- qk51 310821Document1 pageqk51 310821raju modiNo ratings yet

- Ne 13708Document1 pageNe 13708Fariyad AnsariNo ratings yet

- Top Stories:: THU 17 SEP 2020Document8 pagesTop Stories:: THU 17 SEP 2020JajahinaNo ratings yet

- GUINTO - Activity 1 - Loans and Impairment ReceivableDocument4 pagesGUINTO - Activity 1 - Loans and Impairment ReceivableGUINTO, DAN FRANCIS B.No ratings yet

- SBNY Signature Bank Annual Balance Sheet - WSJDocument1 pageSBNY Signature Bank Annual Balance Sheet - WSJSanchit BudhirajaNo ratings yet

- Top Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearDocument4 pagesTop Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearJNo ratings yet

- Top Story:: WED 14 DEC 2016Document5 pagesTop Story:: WED 14 DEC 2016JajahinaNo ratings yet

- Security List DetailsDocument1,795 pagesSecurity List Detailssantosh0% (1)

- MONTHLY - PORTFOLIO - AXISMF-Oct 2019Document117 pagesMONTHLY - PORTFOLIO - AXISMF-Oct 2019Gopal PenjarlaNo ratings yet

- Security List Details PDFDocument1,795 pagesSecurity List Details PDFsantoshNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Risk Financial Management Construction IntroDocument18 pagesRisk Financial Management Construction IntrotsuakNo ratings yet

- Chapter 01Document25 pagesChapter 01Wardah Naili UlfahNo ratings yet

- KIID FR0010135103 en LUDocument2 pagesKIID FR0010135103 en LUPushkar GuptaNo ratings yet

- Vault Guide Asia Pacific Banking EmployeesDocument339 pagesVault Guide Asia Pacific Banking EmployeesmcarimNo ratings yet

- IandF CA11 201704 Exam PDFDocument4 pagesIandF CA11 201704 Exam PDFSaad MalikNo ratings yet

- NP EX19 4b JinruiDong 2Document8 pagesNP EX19 4b JinruiDong 2Ike DongNo ratings yet

- Salient Features of Canara Lap (Loan Against Property)Document3 pagesSalient Features of Canara Lap (Loan Against Property)Amit KumarNo ratings yet

- Case 2 Environgard CorporationDocument5 pagesCase 2 Environgard CorporationutsavNo ratings yet

- The 3 Best Ways To Invest In: A Special Report by Jeff Clark, Editor ofDocument12 pagesThe 3 Best Ways To Invest In: A Special Report by Jeff Clark, Editor ofKanza KhanNo ratings yet

- Solved Sixteen Years Ago Ms Cole Purchased A 500 000 Insurance PolicyDocument1 pageSolved Sixteen Years Ago Ms Cole Purchased A 500 000 Insurance PolicyAnbu jaromiaNo ratings yet

- Merchant Banking NotesDocument24 pagesMerchant Banking NotesSharada KadurNo ratings yet

- Series-VII-Securities Operations and Risk Management-Ver-Jan 2024Document224 pagesSeries-VII-Securities Operations and Risk Management-Ver-Jan 2024christous p kNo ratings yet

- Bond Solution ProblemsDocument7 pagesBond Solution ProblemsNojoke1No ratings yet

- S F M - New Syllabus - Study MaterialDocument455 pagesS F M - New Syllabus - Study MaterialTummu SureshNo ratings yet

- Nifty 50: Index MethodologyDocument16 pagesNifty 50: Index MethodologyObhiejitNo ratings yet

- HSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementDocument13 pagesHSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementStephen BgoyaNo ratings yet

- Closure of A CompanyDocument6 pagesClosure of A CompanyanoushkaNo ratings yet

- Gains or Losses in Dealings in PropertyDocument6 pagesGains or Losses in Dealings in PropertyRussel RuizNo ratings yet

- Aabss 49-57Document9 pagesAabss 49-57Martha MagallanesNo ratings yet

- Introduction To Business Finance: Sir Faisal Siddique Uzair Qayyum (200468)Document11 pagesIntroduction To Business Finance: Sir Faisal Siddique Uzair Qayyum (200468)Uzair QayyumNo ratings yet

- 100 PipsDocument8 pages100 PipsAminurrashid IbrahimNo ratings yet

- Trading Life Level in Forex Trading. PDFDocument16 pagesTrading Life Level in Forex Trading. PDFMREACE ElijahNo ratings yet

- An Overview of Changing Financial Service Sector: Peter S. RoseDocument22 pagesAn Overview of Changing Financial Service Sector: Peter S. RoseShameel IrshadNo ratings yet

- Jensen (1967) - The Performance of Mutual Funds in The Period 1945-1965Document37 pagesJensen (1967) - The Performance of Mutual Funds in The Period 1945-1965pvbrandaoNo ratings yet

- Systematic and Unsystematic RiskDocument11 pagesSystematic and Unsystematic RiskRam MintoNo ratings yet

- Lecture6 - RPGT Class Exercise QDocument4 pagesLecture6 - RPGT Class Exercise QpremsuwaatiiNo ratings yet

- Advance Accounting Two Chapter One Part One: True or FalseDocument5 pagesAdvance Accounting Two Chapter One Part One: True or FalsetemedebereNo ratings yet

- Option Trading SecretsDocument21 pagesOption Trading Secretsgelu0406100% (1)

- CAIIB ABFM Memory Based Questions EveDocument2 pagesCAIIB ABFM Memory Based Questions EveAyush KumarNo ratings yet

- File Câu Hỏi Self - Study 1Document5 pagesFile Câu Hỏi Self - Study 1Nguyễn Thị Xuân MaiNo ratings yet