Professional Documents

Culture Documents

GSTR3B_27BTXPG8803J1Z0_062023

GSTR3B_27BTXPG8803J1Z0_062023

Uploaded by

AMAN AILSINGHANICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR3B_27BTXPG8803J1Z0_062023

GSTR3B_27BTXPG8803J1Z0_062023

Uploaded by

AMAN AILSINGHANICopyright:

Available Formats

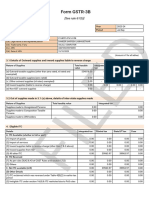

FORM GSTR-3B

[See rule 61(5)]

Year 2023-24

Period June

1. GSTIN 27BTXPG8803J1Z0

2(a). Legal name of the registered person ANNAPURNA PAVAN GUPTA

2(b). Trade name, if any SHREERAM PACKAGING

2(c). ARN AD2706230910164

2(d). Date of ARN 16-08-2023

3.1 Details of Outward supplies and inward supplies liable to reverse charge (other than those covered by Table 3.1.1)

Nature Of Supplies Total Taxable Value Integrated Tax Centeral Tax (₹) State/UT Tax (₹) Cess (₹)

(₹) (₹)

(a) Outward taxable supplies (other than zero 532991.75 0.00 47969.26 47969.26 0.00

rated, nil rated and exempted)

(b) Outward taxable supplies (zero rated) 0.00 0.00 - - 0.00

(c) Other outward supplies (Nil rated, exempted) 0.00 - - - -

(d) Inward supplies (liable to reverse charge) 0.00 0.00 0.00 0.00 0.00

(e) Non-GST outward supplies 0.00 - - - -

3.1.1 Details of Supplies notifed under section 9(5) of the CGST Act, 2017 and corresponding provisions in IGST/UTGST/SGST Acts

Nature Of Supplies Total Taxable Value Integrated Tax Centeral Tax (₹) State/UT Tax (₹) Cess (₹)

(₹) (₹)

(i) Taxable supplies on which electronic 0.00 0.00 0.00 0.00 0.00

commerce operator pays tax u/s 9(5) [to be

furnished by electronic commerce operator]

(ii) Taxable supplies made by registered person 0.00 - - - -

through electronic commerce operator, on which

electronic commerce operator is required to pay

tax u/s 9(5) [to be furnished by registered

person making supplies through electronic

commerce operator]

3.2 Out of supplies made in 3.1 (a) and 3.1.1 (i), details of inter-state supplies made

Nature Of Supplies Total Taxable Value (₹) Integrated Tax (₹)

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

4. Eligible ITC

Details Integrated Tax Centeral Tax (₹) State/UT Tax Cess (₹)

(₹) (₹)

A. ITC Available (whether in full or part)

(1) Import Of Goods 0.00 0.00 0.00 0.00

(2) Import Of Services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 126485.37 1614.97 1614.97 0.00

B. ITC Reversed

(1) As per rules 38, 42 and 43 of CGST Rules and sub-section (5) of 0.00 0.00 0.00 0.00

section 17

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 126485.37 1614.97 1614.97 0.00

D. Other Details

(1) ITC reclaimed which was reversed under Table 4(B)(2) in earlier 0.00 0.00 0.00 0.00

tax period

(2) Ineligible ITC under section 16(4) and ITC restricted due to PoS 0.00 0.00 0.00 0.00

provisions

5.Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter-State supplies (₹) Intra-State supplies (₹)

From a supplier under composition scheme, Exempt and Nil rated supply 0.00 0.00

Non-GST supply 0.00 0.00

5.1 Interest and Late fee

Details Integrated Tax (₹) Centeral Tax (₹) State/UT Tax (₹) Cess (₹)

Interest 0.00 0.00 0.00 0.00

Late Fee - 10.00 10.00 -

6.1 Payment of tax

Description Total tax Tax paid through ITC (₹) Tax paid Interest paid Late fee

payable (₹) in cash in cash (₹) paid in cash

Integrated Tax Central Tax State/UT Tax Cess

(₹) (₹)

(A) Other than reverse charge

Integrated Tax 0.00 0.00 0.00 0.00 - 0.00 0.00 -

Central Tax 47969.00 47969.00 0.00 - - 0.00 0.00 10.00

State/UT Tax 47969.00 47969.00 - 0.00 - 0.00 0.00 10.00

Cess 0.00 - - - 0.00 0.00 0.00 -

(B) Reverse charge

Integrated Tax 0.00 - - - - 0.00 - -

Central Tax 0.00 - - - - 0.00 - -

State/UT Tax 0.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

You might also like

- Business Plan Example Ammo ManufacturerDocument78 pagesBusiness Plan Example Ammo ManufacturerChris Leidlein60% (5)

- Day 1 SolutionsDocument6 pagesDay 1 SolutionsLiz KiNo ratings yet

- The 3D Printing Handbook - Technologies, Design and ApplicationsDocument347 pagesThe 3D Printing Handbook - Technologies, Design and ApplicationsJuan Bernardo Gallardo100% (7)

- Multigrade Lesson Plan in Science Grade 3 and 4Document3 pagesMultigrade Lesson Plan in Science Grade 3 and 4Mayumi Solatre100% (9)

- Ballet Arts Young Children: Classwork & Teaching Helps For The Ballet Teacher of Children Ages 4 & 5Document39 pagesBallet Arts Young Children: Classwork & Teaching Helps For The Ballet Teacher of Children Ages 4 & 5L100% (1)

- 2016 Book StochasticAndInfiniteDimension PDFDocument304 pages2016 Book StochasticAndInfiniteDimension PDFJhoan Sebastian Tenjo Garcia100% (1)

- GSTR3B_27BTXPG8803J1Z0_042023Document2 pagesGSTR3B_27BTXPG8803J1Z0_042023AMAN AILSINGHANINo ratings yet

- GSTR3B_27BTXPG8803J1Z0_072023Document2 pagesGSTR3B_27BTXPG8803J1Z0_072023AMAN AILSINGHANINo ratings yet

- GSTR3B_27BTXPG8803J1Z0_082023Document2 pagesGSTR3B_27BTXPG8803J1Z0_082023AMAN AILSINGHANINo ratings yet

- GSTR3B_27BTXPG8803J1Z0_032024Document2 pagesGSTR3B_27BTXPG8803J1Z0_032024AMAN AILSINGHANINo ratings yet

- GSTR3B_27BTXPG8803J1Z0_052023Document2 pagesGSTR3B_27BTXPG8803J1Z0_052023AMAN AILSINGHANINo ratings yet

- GSTR3B 27aarpb1922d1z2 022023Document2 pagesGSTR3B 27aarpb1922d1z2 022023AMAN AILSINGHANINo ratings yet

- UntitledDocument16 pagesUntitledAMAN AILSINGHANINo ratings yet

- GSTR3B 27aarpb1922d1z2 012023Document2 pagesGSTR3B 27aarpb1922d1z2 012023AMAN AILSINGHANINo ratings yet

- Form Gstr-3B: (See Rule 61 (5) )Document8 pagesForm Gstr-3B: (See Rule 61 (5) )AMAN AILSINGHANINo ratings yet

- GSTR3B 27abppl5741h1zb 092023Document2 pagesGSTR3B 27abppl5741h1zb 092023Sizzling VrajNo ratings yet

- GSTR3B 07bqqpa6547k1ze 022024Document3 pagesGSTR3B 07bqqpa6547k1ze 022024unitedcapitaladvisoryNo ratings yet

- April 3bDocument2 pagesApril 3bUjjwal GoyalNo ratings yet

- Form GSTR-3B: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse ChargeDocument4 pagesForm GSTR-3B: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse ChargeBHAVNABEN ROYNo ratings yet

- GSTR - 3b - POPPAT JAMALS ANNA NAGAR - 2021 - 2022 - 11Document2 pagesGSTR - 3b - POPPAT JAMALS ANNA NAGAR - 2021 - 2022 - 11annanagarstoreNo ratings yet

- Form GSTR-3B: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse ChargeDocument4 pagesForm GSTR-3B: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse Chargeanand nfzmjNo ratings yet

- GSTR3B 18afhpc0378r1zz 032020Document4 pagesGSTR3B 18afhpc0378r1zz 032020surendrasharmaofficeNo ratings yet

- GSTR3B - April-23 To June-23Document2 pagesGSTR3B - April-23 To June-23Vipasha SanghaviNo ratings yet

- JTTTTTTDocument2 pagesJTTTTTTpkrawat208No ratings yet

- GSTR3B 18acvpa7546a1zk 032023Document4 pagesGSTR3B 18acvpa7546a1zk 032023SUBHASH MOURNo ratings yet

- GSTR3B 27aaaca6166g1zr 032022Document4 pagesGSTR3B 27aaaca6166g1zr 032022MANISHA SINGHNo ratings yet

- GSTR3B 27aaypj1435a1zt 122022Document2 pagesGSTR3B 27aaypj1435a1zt 122022vijayjoshitempNo ratings yet

- GSTR3B 27aaypj1435a1zt 112022Document2 pagesGSTR3B 27aaypj1435a1zt 112022vijayjoshitempNo ratings yet

- GSTR3B 27aaypj1435a1zt 102022Document2 pagesGSTR3B 27aaypj1435a1zt 102022vijayjoshitempNo ratings yet

- GSTR3B 27aaypj1435a1zt 092022Document2 pagesGSTR3B 27aaypj1435a1zt 092022vijayjoshitempNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BArun SasidharanNo ratings yet

- GSTR3B April 2022Document2 pagesGSTR3B April 2022Ashtavinayak AutomobilesNo ratings yet

- GSTR3B - 22-23 MayDocument4 pagesGSTR3B - 22-23 MayLogesh Waran KmlNo ratings yet

- GSTR3B 07AAQCM3579H1ZW 122023 SystemGeneratedDocument9 pagesGSTR3B 07AAQCM3579H1ZW 122023 SystemGeneratedAshish SinhaNo ratings yet

- GSTR 3B 2018-19Document24 pagesGSTR 3B 2018-19vishnu teja reddyNo ratings yet

- 19jdaps4566m1zn - 082023 - GSTR-3B MDocument4 pages19jdaps4566m1zn - 082023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 122022 - GSTR-3B MDocument4 pages19blwph6736c1zo - 122022 - GSTR-3B MSheksNo ratings yet

- 23CAYPD4777M1ZX_GSTR3B_Feb2024Document3 pages23CAYPD4777M1ZX_GSTR3B_Feb2024kunalladji158No ratings yet

- 19blwph6736c1zo - 012023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 012023 - GSTR-3B MSheksNo ratings yet

- 10acapy9067d1zn - 0102023 - GSTR-3B MDocument4 pages10acapy9067d1zn - 0102023 - GSTR-3B MSheksNo ratings yet

- Form GSTR-3B (See Rule 61 (5) )Document2 pagesForm GSTR-3B (See Rule 61 (5) )GH MOHDNo ratings yet

- GSTR3B Excel Utility V4.8Document10 pagesGSTR3B Excel Utility V4.8Sandip ChakrabortyNo ratings yet

- GSTR3B 07aasfb3116c1zs 052023Document4 pagesGSTR3B 07aasfb3116c1zs 052023VIKRAMJEET SINGHNo ratings yet

- 24BHNPP5843B1ZB - 032019 - GSTR-3B MDocument4 pages24BHNPP5843B1ZB - 032019 - GSTR-3B MGST Range5 Division1No ratings yet

- 19kxcps4738e1zy - 0102023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 0102023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 062023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 062023 - GSTR-3B MSheksNo ratings yet

- 19kxcps4738e1zy - 032023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 032023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 022023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 022023 - GSTR-3B MSheksNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3Bhiteshmohakar15No ratings yet

- GSTR3B 03ajdpk8658g1z5 032023Document4 pagesGSTR3B 03ajdpk8658g1z5 032023SANJEEV KUMARNo ratings yet

- GSTR3B 08BYJPV8296H1ZF 122023 SystemGeneratedDocument9 pagesGSTR3B 08BYJPV8296H1ZF 122023 SystemGenerateddeepak9921.vscNo ratings yet

- Form Gstr-3B: (See Rule 61 (5) )Document2 pagesForm Gstr-3B: (See Rule 61 (5) )Suresh KumarNo ratings yet

- GSTR3B - 22-23 AprilDocument4 pagesGSTR3B - 22-23 AprilLogesh Waran KmlNo ratings yet

- 19blwph6736c1zo - 092022 - GSTR-3B MDocument4 pages19blwph6736c1zo - 092022 - GSTR-3B MSheksNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BkaranNo ratings yet

- 19blwph6736c1zo - 072023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 072023 - GSTR-3B MSheksNo ratings yet

- Gstr3b 27avhpk4246l1z8 052022 SystemgeneratedDocument7 pagesGstr3b 27avhpk4246l1z8 052022 SystemgeneratedRohit GoleNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BSankar GaneshNo ratings yet

- Form GSTR-3B (See Rule 61 (5) )Document6 pagesForm GSTR-3B (See Rule 61 (5) )Asma KhanNo ratings yet

- 19blwph6736c1zo - 032023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 032023 - GSTR-3B MSheksNo ratings yet

- GSTR3B 27AEKPA5006N1ZI 122022 SystemGeneratedDocument7 pagesGSTR3B 27AEKPA5006N1ZI 122022 SystemGeneratedGSTMS ANSARINo ratings yet

- 19kxcps4738e1zy - 082023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 082023 - GSTR-3B MSheksNo ratings yet

- GSTR3B 27CHHPP4347K1ZU 032021 SystemGeneratedDocument7 pagesGSTR3B 27CHHPP4347K1ZU 032021 SystemGeneratedShreenath AgarwalNo ratings yet

- GSTR3B 24cirpp4542d1z5 092020Document3 pagesGSTR3B 24cirpp4542d1z5 092020Bhaumik PatelNo ratings yet

- Goods and Services Tax - GSTR-3B Offline UtilityDocument14 pagesGoods and Services Tax - GSTR-3B Offline UtilitymayoorNo ratings yet

- GSTR3B_27BTXPG8803J1Z0_052023Document2 pagesGSTR3B_27BTXPG8803J1Z0_052023AMAN AILSINGHANINo ratings yet

- GSTR3B_27BTXPG8803J1Z0_042023Document2 pagesGSTR3B_27BTXPG8803J1Z0_042023AMAN AILSINGHANINo ratings yet

- Cleartax Gstr3b Multi Month 27algpk6074k1zpDocument7 pagesCleartax Gstr3b Multi Month 27algpk6074k1zpAMAN AILSINGHANINo ratings yet

- Allocation Apportion F2Document15 pagesAllocation Apportion F2AMAN AILSINGHANINo ratings yet

- Internship Offer LetterDocument1 pageInternship Offer LetterAMAN AILSINGHANINo ratings yet

- LCM105 LCM115 PDFDocument3 pagesLCM105 LCM115 PDFCABean1No ratings yet

- 6-9 Summer Happy LearningDocument8 pages6-9 Summer Happy Learningjairohith9711No ratings yet

- Errata Sheet 1.7 - Dropzone Commander Official Update: NEW ADDITIONS/ CHANGES FROM VERSION 1.6 Highlighted in RedDocument2 pagesErrata Sheet 1.7 - Dropzone Commander Official Update: NEW ADDITIONS/ CHANGES FROM VERSION 1.6 Highlighted in RedTecnocastoroNo ratings yet

- ScribdDocument66 pagesScribdyeyeu5No ratings yet

- Islamic Economics and The Islamic Sub EconomyDocument18 pagesIslamic Economics and The Islamic Sub EconomyNoerma Madjid Riyadi100% (1)

- Math9 q1 m4 FinalDocument16 pagesMath9 q1 m4 FinalRachelleNo ratings yet

- Squatting Should Not Be Illegal. in Fact, It Should Be EncouragedDocument2 pagesSquatting Should Not Be Illegal. in Fact, It Should Be EncouragedNguyen Trong Phuc (FUG CT)No ratings yet

- Lpo Birds NestDocument6 pagesLpo Birds Nestapi-265791946No ratings yet

- Student Handbook 2019-2020Document30 pagesStudent Handbook 2019-2020Gaetan HammondNo ratings yet

- Calculation and Analyzing of Braces ConnectionsDocument71 pagesCalculation and Analyzing of Braces Connectionsjuliefe robles100% (1)

- 3Rd Floor Plan: Schedule of Floor FinishesDocument1 page3Rd Floor Plan: Schedule of Floor FinishespolislimuelsundyNo ratings yet

- The Power of Faith Confession & WorshipDocument38 pagesThe Power of Faith Confession & WorshipLarryDelaCruz100% (1)

- Succession Cause 846 of 2011Document6 pagesSuccession Cause 846 of 2011kbaisa7No ratings yet

- Industrial Revolution: How It Effect Victorian Literature in A Progressive or Adverse WayDocument2 pagesIndustrial Revolution: How It Effect Victorian Literature in A Progressive or Adverse WaydjdmdnNo ratings yet

- Topic 6 - Part 2 - Week 4Document40 pagesTopic 6 - Part 2 - Week 4Teo Khim SiangNo ratings yet

- Mendelssohn Op. 19 Nr. 1 Analyse ENDocument2 pagesMendelssohn Op. 19 Nr. 1 Analyse ENLianed SofiaNo ratings yet

- Acts 13 New 2Document8 pagesActs 13 New 2fitsum tesfayeNo ratings yet

- Literature Book: The Poem Dulce Et Decorum Est by Wilfred Owen PDFDocument8 pagesLiterature Book: The Poem Dulce Et Decorum Est by Wilfred Owen PDFIRFAN TANHANo ratings yet

- Lecture Eight Analysis and Interpretation of Financial StatementDocument19 pagesLecture Eight Analysis and Interpretation of Financial StatementSoledad PerezNo ratings yet

- Ministry of Skill Development and Entrepreneurship: Trainee MarksheetDocument1 pageMinistry of Skill Development and Entrepreneurship: Trainee Marksheetrising ENTERPRISESNo ratings yet

- Chapter 13 Lecture 1 Career OptionsDocument24 pagesChapter 13 Lecture 1 Career OptionseltpgroupNo ratings yet

- Trinity Core Custom ScriptDocument2 pagesTrinity Core Custom ScriptvalakiakarkiNo ratings yet

- Detergent Powder: Project Report ofDocument15 pagesDetergent Powder: Project Report ofOSG Chemical Industry LLP 'A Cause For Cleanliness'67% (3)

- Photo Essay PDFDocument2 pagesPhoto Essay PDFMartha Glorie Manalo WallisNo ratings yet