Professional Documents

Culture Documents

Adobe Scan Jul 08, 2024 (2)

Adobe Scan Jul 08, 2024 (2)

Uploaded by

sahaanshu385Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adobe Scan Jul 08, 2024 (2)

Adobe Scan Jul 08, 2024 (2)

Uploaded by

sahaanshu385Copyright:

Available Formats

r

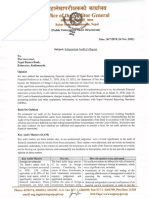

Sanima Bank Ltd.

Position

Statement of Financial

Condensed Consolidated ended 32nd Ashad 2079 Amount ro NPR

For the qua rter

Group Bank

Ashad End 2078 Ashad End 2078

_______

_ _____

E d' (A

.;.._a_rt_cr_ n_ m~g ___,...

Th '•s...Qu ,_u_d•_·te_d.;.) ._ _ This Qu

arter Ending

-----....;,;;.___

(Audited)

- 4,823,295 ,539 4,225,275,09 3 4,771,140,480

-U74,490,79I

6,053, 731,274 13,516,139;617 6,05 3,731,274

•it«'I'

· ~ cash equivalent 13, 516 ,139,617

1,740,708,397

1,797,708,397 371 ,162 ,744

:ash[ro!U Nepal Rastra Bank Institutions

401 ,162,744 16,016,111

uue ienl with Bank and Financ

ial 16,016, 111

ts

'al .nstrurnen 395 ,193 ,477 500,726,317 224,408,989

pJaCf fl 609,344,862

periram·e financ1 , 5,167,865,708 4,094,023,666

4,094,023 ,666

"'~- ,r,Jding assets 5,167,865 ,708

137,161 ,371 ,311 119,071 ,400 ,724

;n•~ adrances to B/Fls 137,161,694,973 119,071,770,255

27,682 ,843 ,909 20,922,507,357

Loans and ad\'8nces to custom

ers 21,004 ,670,454

27,767,152,579

Iuresnnent securities 250,000 ,000 250 ,000 ,000

('unenl tax assets

Iuresunent in subsidiaries 72,932 ,294

Iuresunent in associates 72, 932 ,294 1,343.307,074 1.196.388,539

1m-estment property 1,206,818, 328 48,082,940

1,361,715, 366 56.002.636

48,412 ,478

Property and equipment 56,078,464 69,432,118

ts

Goodwill and Intangible asse 60,393 ,516 2,073,470,587 2,362,175,691

Deferred tax assets 2,295,653 ,2 13 160,750,584,166

2.029,572,582 192,490,529,408

160,807,293,191

Other assets 192,578,543,497

Total Assets

2,614,422 ,138 4,920,874,273

4,920,874,273 J ,6"51 ;303 ,839

Liab ilities 2,614,422,138 4,096,650,775

Institutions ·J,6"5l;:m3,8J 9

Due to Bank and Financial 4,096,650;775 52,394,722

Due to Nepal Ras tra "Ba nk 52,394 ,722 128.425,867, 181

ents 128,226,612, 165 157,518,535,239

Derivative financial instrum 157,345,663,047 1,279,000.000 l,i8 7,250,0iJO

ers 1,279,000,000 I,787,250,000 62,454,562

Deposits from custom 62,881 ,734

67,594 ,039 51,762,791 31,374,632

Borrowing 48,699,778

48,699 ,778 31 ,374,632

Current Tax Liabilities 42,066,575

72,760 ,678

Provisions 2,892,655 ,514 2.134,263.725

3,039,956,005 2,243,584.960

Deferred tax liabilities 6.819,816 ,000

4,771 ,716,000

6,819,816,000 4,771,716,000

Other liabilities

De.bt securities issued 175,385,055,901

145,827,170,788

!._ubordinated Liabilities l 75,364,196,504 145,757,239,339

~ta l liabilities 9,681,519.08 2

9,681 ,519.082 11,327,377 ,326

Equitv 11,327,377 ,326

Share ~i tal 1,737,199,687

1,833,150,63 3 1,46 9.986, 145

Share premium 1,550,593,544 3,504,694,608

3,535,384 ,136 4,308,l 10,0 36

Retained earnings 4,336,376,122 14,923,413,378

15,050,0SJ,851 l 7,105,47J,508

Reserves 17,214,346,993

le to equity holders

Total equity attributab 1,1,913 ,413 .378

Non-controlling interes

t

15,050,053,851 17,105,473,508

17,214,346,993 160,750,584,J 66

Total Equity

.

160,80 7,293,191 192,490,529,408

ties and Equ ity 192,578,543,497

Tot aJ Lia bili

Sanima Bank Ltd.

Condensed Consolidated Statement of Cash Flows

For the Quarter ended 31st Ashad 2080 Amount In NPR

Grou p Bank

Corresponding Corresponding

Upto This Quar ter Previous Year Upto Thi~ Qn11rter Previous Y("llr Upto

Upto This Quarter This Quarter

FLOWS FROM OPERATING ACTIVITIES 14,400 ,194,201 20,572 ,133,494 14,386,372,605

4sH 20.587.166,324

tere5t receirni ·1:-ns:"5 lJ3,434 1,089,546,097 ·1,026,690,747 986,479,675

and other income received 2,810 ,965 497,892

-,~dend received 273.013,868 367,203,866 272,571 ,894 359,237,214

ipts from other operating activities (14,882.792 ,976) (1U,16Y,UU8 ,UU5) (14,908,Y38 ,5U3) (IU,183 ,144,438)

tereSI patd (263,261 ,793) (150,823 ,608) (260,862,404) (148,361 ,763)

ission and fees paid (1,650 ,621 , l 42) (i ,568,407,217) (i,6i9,296,474) (i,533 ,4i5,847)

· payment to empioyees (999,758,874) (586,718,29 7) (970,803,60 7) (583,2 02,989)

er expense paid

ating cash flows before changes in operating 4,.202;059;806 3,382,4-84;930 4;111,495,147 3,283;964,457

sets and liabiliti~

ncrease)/Decrease in operatin2 assets 3,148,043,261 (7,462,408,343) 3.148 .043.261 (7,462 ,408.343)

e fT1.1m Nepal Rastra Rank (715,408,789) 1,410,545,652 (685:4oS:789) 1,369,545:652·

lacement with bank and financial institutions 80,120,981 (215,996,357) 87,387,832 (237,054,892)

er trading assets 722,704,736 (1,073,842,042) 722,704,736 (1,073 ,842,042)

an and adrnnces to bank and financial institutions (9,915 ,7-14,-158) (-1-8;000,985,949) (9,915 ,782,757) (18,001,031 ,8! 8)

l!IIS and advances to customers (I 46,766,025) (526,618,07 7) (146.182,552 )

(527,755,593)

f er assets

~ crease/(Decrease) in operating liabilities 2,579,088,424 (2,306,452,136) 2,579,088,424 (2,306 ,452,136)1

- to bank and financial institutions 445 ,346,936 (4,024,564,678) 445,346,936

(4,024,564,678)

fr;: :::~:1< 17,924,813,542

1,350.000,000

29,105,050,882

(508,250,000)

1,267,937,879

18,124,5ll,567

1,350,000,000

(128,986,592)

29,092 ,668,058

(508,250,000)

1,288,541 ,489

(138,171.925)

liabilities 14,841,870,074 5,744,8.U,809

14,685,155,607 5,896,665,428

flow from operating activities before tax paid (l ,233,887,476 ) (882,927,767)

( 1.263,641.192) (906,854,954)

Income taxes paid 13,607,982,598 4,861,917,o.tJ

13,421,514,•HS 4,989,810,474

Net wb flow from operating activities

S

CASH FLOWS FROM fNVESTING ACTIVITIE (27,535,541 ,910) (5,874 ,490,354)

of investm ent securities (27.561 ,215,853) (5,888,359,795)

Purch ase 11,M0,3"92,500

iJu:ceipts -,,_. ·'lie ofinvestment securities l l ,!S4U,392,5UU (524,839,688)

(536,883,007) (185 ,121 ,049)

y and equipment (189,728,317) 30,714,473

33,085 ,028 15,236,263

e of property and equipment 16,664,045 (40.i84,89iJ

(40,184,891) (6i,783,096)

pbie assets (6i,783,096)

sale of intangible assets

ent properties (72,932.294)

(72,932,294) (117,242,085)

the

ItII "

sale of investment properties (117,242,085)

'ved 138,150,274

150.306,118 78,795 ,103

86,276,490 (6,343,582,481 )

(6,354,968,841 ) (15,971,264,275)

(15,992,636,315)

S

::AS~ FLO~S FROM FINANCING ACTIVITIE 2,952,500,000

2,033 ,100,000

lece1pt from issue of debt securities 2,952,500,000 2,033 ,100,000

(370,000,000)

leJ>ayment oc ifebt securities (37U,UUU,U00)

f6Pt from issue of subordinated liabilities

q>a~ment of subordinated liabilities

F,1Pt from issue of shares 200,000,000 (86,624, I I 8)

(111 ,008,298)

'-vidends paid (150,481 ,982) (149,124,118)

iterest paid 11 ,234,677

(42 334 337 1,935,241,204

(42,348,702 1127 9738

2,429,157,365

11clivitics 2,589,669,316 1,872,696,144

453,575,766

. aJents

(decrease) in cash and cash equiv 65,875,688

507,537,777 4,771 ,140,4K0

18,547,416 5,224 ,716,246

n cash equivalents at Sawan I 5,330,833,316 4,823 ,295,539

ect of exchange Ie fl uctuah.ons on cash and cash

. nl ra 5,224,716,246

v ents held

5,290,591,934

p.tand cash equivalents at period end 5,349,380,732 5,330,833,316

You might also like

- Quarterly Highlights 2nd Quarter FY 2079-80 (Published)Document5 pagesQuarterly Highlights 2nd Quarter FY 2079-80 (Published)baijumuskan417No ratings yet

- Q4 - Interim Financial StatementsDocument20 pagesQ4 - Interim Financial Statementsshresthanikhil078No ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- Quarter Report April 20 2022Document29 pagesQuarter Report April 20 2022Binu AryalNo ratings yet

- Interim Financial Statement Ashwin End 2077Document37 pagesInterim Financial Statement Ashwin End 2077Manoj mahatoNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- RBB Report at End of Ashadh 2080Document4 pagesRBB Report at End of Ashadh 2080ashurajsah123No ratings yet

- Quarter Report May 12Document27 pagesQuarter Report May 12Babita neupaneNo ratings yet

- Financial in WebsiteDocument38 pagesFinancial in WebsiteJay prakash ChaudharyNo ratings yet

- BSRM Steels Limited Balance Sheet (Unaudited)Document4 pagesBSRM Steels Limited Balance Sheet (Unaudited)azadbdNo ratings yet

- Rastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Document3 pagesRastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Sagar ThakurNo ratings yet

- Unaudited Second Quarter 2022 - 23Document42 pagesUnaudited Second Quarter 2022 - 23Mahan KhanalNo ratings yet

- Rastriya Banijya Bank Limited: Interim Financial StatementsDocument30 pagesRastriya Banijya Bank Limited: Interim Financial StatementsNepal LoveNo ratings yet

- 1715509623799Document8 pages1715509623799pokhrelsuman165No ratings yet

- Q4-Ashadh-Document31 pagesQ4-Ashadh-r56408456No ratings yet

- First Quarter 2080-81Document39 pagesFirst Quarter 2080-81Bikesh DahalNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- Q4 Unaudited Financial FY 2079 - 80Document25 pagesQ4 Unaudited Financial FY 2079 - 80shresthanikhil078No ratings yet

- Fourth Quater Financial Report 2075-76-2Document27 pagesFourth Quater Financial Report 2075-76-2Manish BhandariNo ratings yet

- Interim Financial Statements For Quarter Ended 30th Chaitra 2080 98558b97dcDocument20 pagesInterim Financial Statements For Quarter Ended 30th Chaitra 2080 98558b97dcghanshyamdhami302No ratings yet

- UntitledDocument81 pagesUntitledArjun kumar ShresthaNo ratings yet

- Select Under Armour, Except Per: Exhibit Financial Data (In Thousands, Share Amounts)Document1 pageSelect Under Armour, Except Per: Exhibit Financial Data (In Thousands, Share Amounts)Alex DarlingNo ratings yet

- 4th Quarter of Fiscal Year 2077-078 (2020-2021)Document24 pages4th Quarter of Fiscal Year 2077-078 (2020-2021)shresthanikhil078No ratings yet

- Second Quarter Financial ResultDocument8 pagesSecond Quarter Financial Resultminitashakya70No ratings yet

- Proforma Balance SheetDocument24 pagesProforma Balance SheetBarbara YoungNo ratings yet

- Interim Financial Statement Fourth Quarter1628837418Document34 pagesInterim Financial Statement Fourth Quarter1628837418Apex BasnetNo ratings yet

- Thesis For Bba 4th YearDocument30 pagesThesis For Bba 4th YearDipen BhattaraiNo ratings yet

- UBL Annual Report 2018-168Document1 pageUBL Annual Report 2018-168IFRS LabNo ratings yet

- Biraj Suppliers Depo Gokarneshor, Kathmandu: Provisional Balance SheetDocument1 pageBiraj Suppliers Depo Gokarneshor, Kathmandu: Provisional Balance Sheetsakwo TaxNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- Agricultural Development Bank Limited: Interim Financial Statements As On Chaitra End 2077Document25 pagesAgricultural Development Bank Limited: Interim Financial Statements As On Chaitra End 2077Shubhash ShresthaNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- Revised Alfalah Solar Financing - Mr. JahanzaibDocument3 pagesRevised Alfalah Solar Financing - Mr. JahanzaibChaudhary Muhammad Suban TasirNo ratings yet

- Disscor Budget 2020 FDocument114 pagesDisscor Budget 2020 FRicardo DelacruzNo ratings yet

- Interim Financial Statements As On Chaitra End 2075Document30 pagesInterim Financial Statements As On Chaitra End 2075Mendel AbiNo ratings yet

- Projection ReportDocument12 pagesProjection ReportCA Ananta BhandariNo ratings yet

- BBK 2020-Q1-ResultsDocument1 pageBBK 2020-Q1-ResultsManil UniqueNo ratings yet

- 3 Casale SfinancieroDocument5 pages3 Casale Sfinancierodavid llanaNo ratings yet

- BS As On 23-09-2023Document28 pagesBS As On 23-09-2023Farooq MaqboolNo ratings yet

- Rastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09Document1 pageRastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09gonenp1No ratings yet

- Citi - QTR 3 Report'23Document14 pagesCiti - QTR 3 Report'23chamzaa258No ratings yet

- 1674645183FINANCIAL_FOR_WEBSITEDocument17 pages1674645183FINANCIAL_FOR_WEBSITEKrishna BhattaraiNo ratings yet

- Future Image 2022Document7 pagesFuture Image 2022sadman.kabir.37757No ratings yet

- Interim Financial StatementsDocument22 pagesInterim Financial StatementsShivam KarnNo ratings yet

- BPPL Holdings PLCDocument15 pagesBPPL Holdings PLCkasun witharanaNo ratings yet

- 4th Quarter Report FY7980Document1 page4th Quarter Report FY7980balkrishna4000No ratings yet

- EBL 2016 - L&A Note (7.b.10)Document1 pageEBL 2016 - L&A Note (7.b.10)Anindita SahaNo ratings yet

- Final Project BSAF ADocument7 pagesFinal Project BSAF Aعصام المحمودNo ratings yet

- UBL Annual Report 2018-144Document1 pageUBL Annual Report 2018-144IFRS LabNo ratings yet

- Annexure II 5Document76 pagesAnnexure II 5ahsen.raheemNo ratings yet

- ط§ظƒط³ظ„ ط´ظٹطھ ط±ط§ط¦ط¹ ظپظٹ ط§ظ„طھطظ„ظٹظ„ ط§ظ„ظ…ط§ظ„ظٹDocument143 pagesط§ظƒط³ظ„ ط´ظٹطھ ط±ط§ط¦ط¹ ظپظٹ ط§ظ„طھطظ„ظٹظ„ ط§ظ„ظ…ط§ظ„ظٹaliNo ratings yet

- Chapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchDocument5 pagesChapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchAcchu RNo ratings yet

- FS 12 2020 DecemberDocument6 pagesFS 12 2020 DecemberkunyangNo ratings yet

- (FM) AssignmentDocument7 pages(FM) Assignmentnuraini putriNo ratings yet

- Navana CNG Limited (AutoRecovered)Document18 pagesNavana CNG Limited (AutoRecovered)HridoyNo ratings yet

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- Sweet Beginnings Co. Projected Cash Budget For 20X6: Cash Receipts From CollectionDocument3 pagesSweet Beginnings Co. Projected Cash Budget For 20X6: Cash Receipts From CollectionValerie Amor Salabao91% (11)

- UBL Annual Report 2018-129Document1 pageUBL Annual Report 2018-129IFRS LabNo ratings yet

- South Africa’s Renewable Energy IPP Procurement ProgramFrom EverandSouth Africa’s Renewable Energy IPP Procurement ProgramNo ratings yet

- 100 Cloze Test by Vishal SirDocument29 pages100 Cloze Test by Vishal SirAnukaran Pandey0% (1)

- Chapter 1 Introduction To Mechanical and Electrical Systems, Sustainable Design, and Evaluating OptionsDocument8 pagesChapter 1 Introduction To Mechanical and Electrical Systems, Sustainable Design, and Evaluating OptionsJenny VarelaNo ratings yet

- Mon CompetDocument9 pagesMon CompetsettiNo ratings yet

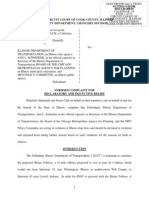

- OPENLANDS V ILLINOIS DEPT OF TRANSPORTATIONDocument51 pagesOPENLANDS V ILLINOIS DEPT OF TRANSPORTATIONsjacobsen09No ratings yet

- 2022 Top 30 Most Profitable Macedonian CompaniesDocument1 page2022 Top 30 Most Profitable Macedonian CompaniesAleksandar JordanovNo ratings yet

- Budget Template With ChartsDocument1 pageBudget Template With ChartsAli ErlanggaNo ratings yet

- Integrated Models of Location and RoutingDocument288 pagesIntegrated Models of Location and RoutingPawan JudgeNo ratings yet

- As Built Sin Cambios: MQ13-02-DR-4120-IN4001Document18 pagesAs Built Sin Cambios: MQ13-02-DR-4120-IN4001JOSE CASTRONo ratings yet

- The Contemporary World Module 1Document3 pagesThe Contemporary World Module 1Michael Anthony EnajeNo ratings yet

- Departure Type Destination ViaDocument2 pagesDeparture Type Destination Viaramnath86No ratings yet

- DHL Express Rate Transit Guide PH enDocument25 pagesDHL Express Rate Transit Guide PH enJulie Neay AfableNo ratings yet

- John Meewella BioDocument3 pagesJohn Meewella BioJojje OlssonNo ratings yet

- WSA Construction Risk ManagementDocument39 pagesWSA Construction Risk Managementsaravana_ravichandraNo ratings yet

- Chapter-I: The Term Human Resources Are Used To Describe The Individuals Who CompriseDocument27 pagesChapter-I: The Term Human Resources Are Used To Describe The Individuals Who CompriseMukulNo ratings yet

- What's Your Investing IQDocument256 pagesWhat's Your Investing IQAmir O. OshoNo ratings yet

- G-11-eco-worksheet-unit-6-Economic Growth and Economic DevelopmentDocument6 pagesG-11-eco-worksheet-unit-6-Economic Growth and Economic DevelopmentKifle BerhaneNo ratings yet

- Gary Sitohang: 4 October 1994 - Male - Single - Christian Advent - IndonesianDocument2 pagesGary Sitohang: 4 October 1994 - Male - Single - Christian Advent - IndonesianMay Velyn DinaNo ratings yet

- Cap 12 Imperfect Competition Social Cost of MonopolyDocument3 pagesCap 12 Imperfect Competition Social Cost of MonopolyLuis QuinonesNo ratings yet

- Sultan Omar Ali Saifuddin IIIDocument14 pagesSultan Omar Ali Saifuddin IIISekolah Menengah Rimba100% (3)

- InvocieDocument1 pageInvociepankajsabooNo ratings yet

- Green Living: Statistics From Planet GreenDocument5 pagesGreen Living: Statistics From Planet Greenamitjain310No ratings yet

- Paseo Realty & Development Corporation vs. Court of AppealsDocument12 pagesPaseo Realty & Development Corporation vs. Court of AppealsMp CasNo ratings yet

- Ipr 1948-1990Document10 pagesIpr 1948-1990Vijaykumar EttiyagounderNo ratings yet

- P2p Risk by DeloitteDocument16 pagesP2p Risk by Deloittevijaya lakshmi Anna Srinivas100% (1)

- Fianna Fáil European Election ManifestoDocument20 pagesFianna Fáil European Election ManifestoFFRenewal100% (1)

- AndDocument12 pagesAndJanus MariNo ratings yet

- New Microsoft Office Word DocumentDocument9 pagesNew Microsoft Office Word Documentarchanamishra1411No ratings yet

- CH 22 e Asia Under Challenge HoDocument4 pagesCH 22 e Asia Under Challenge Hoapi-552283469No ratings yet

- GtoG Handbook Best PracticesDocument51 pagesGtoG Handbook Best PracticesMichael SantNo ratings yet

- Coal Mines Regulation 2017Document121 pagesCoal Mines Regulation 2017Kumar SanjayNo ratings yet