Professional Documents

Culture Documents

JOM_06_02_033

JOM_06_02_033

Uploaded by

Gita KnowledgeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JOM_06_02_033

JOM_06_02_033

Uploaded by

Gita KnowledgeCopyright:

Available Formats

Journal of Management (JOM)

Volume 06, Issue 2, March-April 2019, pp.293–301, Article ID: JOM_06_02_033

Available online at http://www.iaeme.com/jom/issues.asp?JType=JOM&VType=6&IType=2

Journal Impact Factor (2019): 5.3165 (Calculated by GISI) www.jifactor.com

ISSN Print: 2347-3940 and ISSN Online: 2347-3959

DOI: 10.34218/JOM.6.2.2019.033

© IAEME Publication

PERCEPTION OF YOUTH TOWARDS MOBILE

BANKING USAGE INTENTION – AN

EMPIRICAL STUDY

Sanuja Shree P.N

PhD Research Scholar, Department of Commerce,

University of Madras, Chennai, India

Dr. S. Gurusamy

Professor & Head, Department of Commerce,

University of Madras, Chennai, India

P. Balaji

Assistant Professor, Department of Commerce,

Guru Nanak College (Autonomous), Chennai, India

ABSTRACT

Purpose of This Paper: The main aim of this empirical study is to examine the

mobile banking usage intention among the youth customers of public and private sector

banks in India.

Research Methodology: The empirical research design was adopted by employing

survey method to collect responses from target population through convenience

sampling method. The primary data collected were subjected to analysis using SPSS

Version 23.0 and the statistical tools such as, percentage analysis, Correlation analysis,

Factor analysis and multiple regression analysis.

Major Findings: Statistical evidences exhibit that mobile banking usage intention

variables have been reduced to five independent factors namely, Convenience Factor

(CF), Benefits Factor (BF), Deliberation Factor (DF), Safety Factor (SF) and Trust

Factor (TF) in their order of dominance and occupational status is most significant

influence of total mobile banking usage intention, followed by major source to

information about mobile banking service.

Practical Implications: User friendliness and Users Awareness of Mobile Banking

at large has to be thrusted at every branch banking units to digitally promote awareness

of Government Schemes such as, Jan Dhan Yojana, Digital India, Licensing Small

Finance Banks/Payment Banks, Aadhaar Enrollment and etc.

Originality of the Paper: This research paper aims in exploring the youth customer

behaviour and usage intention towards mobile banking in the Chennai city.

Key word: Mobile Banking, Usage Intention, Convenience, Safety and Trust.

http://www.iaeme.com/JOM/index.asp 293 editor@iaeme.com

Sanuja Shree P.N, Dr. S. Gurusamy and P. Balaji

Cite this Article: Sanuja Shree P.N, Dr. S. Gurusamy and P. Balaji, Perception of Youth

Towards Mobile Banking Usage Intention – An Empirical Study, Journal of

Management, 6 (2), 2019, pp. 293–301.

http://www.iaeme.com/JOM/issues.asp?JType=JOM&VType=6&IType=2

1. INTRODUCTION

Banking is life blood for Indian financial system. In the recent years, due to technological

growth and change in Government policies are made Indian banking industry as versatile and

dynamic in nature. India is one of the countries which were more physical cash dependent

economy due to volume of cash transactions in every day. The demonetization of Rs.500 and

Rs.1,000 currency notes in India in the month of November 2016 was announced by the

Government of India to eradicate the black money economy, mitigate the terrorism funding into

the country and also to eliminate fake currency notes in circulation among peoples of the nation.

Instead, it paved a way for digital transformation of the country, especially, the banking industry

(Zhu, K., & et al., 2004; Alt, R., & Puschmann, T. 2012; Dapp, T., & et al., 2004). Peoples are

shown positive intend towards the usage of digital cash transactions in their day-to-day life

rather than physical cash transactions (Amin, H. 2008; See-To, E. W., & et al., 2014). Indian

banking industry has undergone tremendous changes due to technological growth, internet

accessibility and considerable enhancement in the socio-economic conditions of the peoples.

According to IAMAI Report 2017, the number of mobile phone users in India from 2013 to

2019. For 2017 the number of mobile phone users in India is raised to 730.7 million. In this

same year the number of smartphone users in India is reached 340 million and could expected

to reach almost 468 million by 2021. This clearly exhibit the potential opportunities for the

banks in India to target and focus on the youth customers to move the nation towards digital

economy.

2. REVIEW OF LITERATURE

Suma Vally and Hema Divya (2018) have made an attempt to understand the Digital Payment

in India with the perspective of consumer’s adoption. In addition, authors have aimed to be

evaluated the impact of customers education on usage and the impact of customers income

status on the usage of Digital Payments. The study adopted the descriptive techniques to analyse

the perspective of consumer’s adoption of digital payment. Finally, the authors have concluded

that the deployment of technology for digital payment has improved the performance of the

banking sector.

Siddhartha Dasgupta and et al., (2011) have discussed the factors affecting behavioural

intention towards mobile banking usage. The authors have investigated the antecedents of the

behavioural intentions of Indian customers and to identify the nature and impact of these

antecedent’s relationship with behavioural intention. The authors have applied multivariate

techniques such as, factor analysis and regression analysis to determine the behavioural

intention on mobile banking usage and all the variables with respect to Perceived usefulness,

Perceived image, Perceived Ease of Use, Perceived Risk, Perceived value, self-efficacy and

Tradition influence the Behavioural intention on Mobile banking usage among Indian

customers. The author found in the study that the except Perceived risk all other factors have a

positive impact on Behavioural Intention of Mobile banking users. Finally, the authors have

concluded that customer dependency will be unique when it comes to mobile banking.

Therefore, Perceived Risk factor have a negative impact on Mobile banking users.

Tiago Oliveira and et al., (2016) have made an attempt to understand the determinants of

customer adoption and intention to recommend the technology of mobile payment among the

customer in Portugal. The authors have applied UTAUT model to identify the various

http://www.iaeme.com/JOM/index.asp 294 editor@iaeme.com

Perception of Youth Towards Mobile Banking Usage Intention – An Empirical Study

dimensions such as Performance Expectancy, Effort Expectancy, Social Influence, facilitating

conditions, Hedonic motivation, Price value that influence the Behavioural intention to adopt

and to recommend the Mobile Payment technology. The authors have discussed that the extent

to which the adoption of Mobile Payment provides benefits in performing the payment tasks.

Finally, the authors have concluded that factors that significantly influence the adoption and

intention of Mobile Payment technology have not yet been comprehensively assessed.

Sarika and vasantha (2018) have made an attempt to determine the influence of trust on

mobile wallet adoption and its effect on users’ satisfaction. This study aimed at the trust of

mobile wallet adoption and its effect on user satisfaction. The author critically reviewed the

trust of Mobile wallet adoption and its influence on user satisfaction. The researchers have

adopted the various existing studies related to the adoption of the consumer day to day adoption.

The author proposed an antecedent trust between the actual usages of M-wallet by user

satisfaction. Further, the author discussed the modern application practices by the Indian

consumer. Finally, the author concludes that trust is the main factor affecting the user's

satisfaction and its impact on actual usage of Mobile wallets.

Rajanna (2018) have entitled the study on customer perception and awareness towards the

cashless transaction. The author focused on the response towards a cashless economy in

Karnataka. The author recommended that a security system should have high-speed responses

and the Reserve Bank of India suggested that banks provide an online alert for all card

transactions. Finally, the author concluded that customer perception and awareness of the

customer are agreed with the government on the usefulness of the cashless economy.

3. SCOPE OF THE STUDY

This present study was limited to select bank customers those who are residing in the Chennai

city of Tamil Nadu. Bank Customers possess smartphone and carried mobile banking practices

in their day-to-day life are alone selected for the study. The Primary data were collected only

from the age group of only eighteen years to thirty years. The perception of bank customers

with respect to usage intention of mobile banking only focused by the researcher in this present

study.

4. OBJECTIVES OF THE STUDY

• To understand the socio-economic and banking profile of the mobile banking customers in

Chennai city.

• To identify underlying dominant dimensions of mobile banking usage intention variables.

• To explore the influence of socio-economic and banking profile of the customers with respect

to mobile banking usage intention.

5. RESEARCH METHODOLOGY

The present research study was descriptive and empirical in nature. The researchers adopted

survey method to gather information in the form of primary data from bank customers residing

in Chennai through a well-designed and structured questionnaire by applying convenience

sampling technique. The data collected were subjected to pilot study to explore the reliability

and validity of the instrument and Cronbach’s Alpha Reliability Co-efficient value of 0.896

proves that the scale is more consistent and highly reliable in nature. The total of 160

questionnaires was distributed to bank customers in the selected study areas and only 148

completely filled questionnaires were returned by the respondents. The sample of 128 responses

were finalized for the study.

http://www.iaeme.com/JOM/index.asp 295 editor@iaeme.com

Sanuja Shree P.N, Dr. S. Gurusamy and P. Balaji

6. QUESTIONNAIRE DESIGN

Structured Questionnaire with two different sections were finalized for the survey method of

data collection among the mobile banking customers in the Chennai city. Section one deals

with the personal and banking profile such as, age, gender, marital status, nature of family,

marital status, educational qualification, occupational status, monthly family income (in Rs.),

nature of bank account, frequency of mobile banking usage and major source of information

about mobile banking service are measured in the appropriate nominal and interval scales.

Section two consists of eighteen customer perception variables related to the usage intention of

mobile banking in daily life.

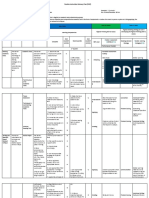

7. RESULTS AND DISCUSSION

Percentage analysis and descriptive statistics has been applied to understand the personal and

banking profile of the respondents such as gender, marital status, nature of family, educational

qualification, occupational status, monthly family income (Rs.), frequency of mobile banking

usage, nature of bank account and major source to know about mobile banking and the results

are shown in annexure table 1

Table 1 Personal and Banking Profile of the Respondents

Demographic Characteristics (N = 128) Frequency Percentage (%)

Gender

Male 88 68.8

Female 40 31.2

Marital Status

Married 17 13.3

Unmarried 111 86.7

Nature of Family

Nuclear/Small Family 99 77.3

Joint Family 29 22.7

Educational Qualification

Upto HSC 9 7.0

Graduate 48 37.5

Post-Graduate 70 54.7

Professionals 1 0.8

Occupational Status

Student 25 19.5

Salaried 87 68.0

Self-Employed 11 8.6

Professionals 3 2.3

Home-Makers 2 1.6

Monthly Family Income (Rs.)

Less Than 15K 37 28.9

15K-30K 51 39.8

30K-45K 28 21.9

Above 45K 12 9.4

Frequency of Mobile Banking Usage

Hourly 16 12.5

Daily 31 24.2

Weekly 50 39.1

Monthly 31 24.2

Nature of Bank Account

Public Sector Bank 68 53.1

Private Sector Bank 26 20.3

Both 34 26.6

Major Source of Information About Mobile Banking Service

http://www.iaeme.com/JOM/index.asp 296 editor@iaeme.com

Perception of Youth Towards Mobile Banking Usage Intention – An Empirical Study

Demographic Characteristics (N = 128) Frequency Percentage (%)

Banks 26 20.3

Newspapers 27 21.5

Official Websites 20 15.6

Magazines 12 09.0

Social Networks 28 21.9

Others 15 11.7

Age (Years)

Mean 23.31

Std. Deviation 2.477

Minimum 18

Maximum 30

Table 1 indicates that majority of the respondents are males (68.8%), Singles (86.7%),

hailing from nuclear families (77.3%), Post-Graduates (54.7%) and Salaried (68.0) employees.

The sizeable portion of the respondents is earning monthly family income of Rs.15, 000 to

30,000. Majority of the respondents are customers of Public sector banks and maximum

number of respondents are using mobile banking at least on weekly (39.1%) basis and they

opined that social network sites are the major source to know about the mobile banking

facilities. The average age of the respondents is 23.31 years with the standard deviation value

of 2.477. The age of the respondents ranges from 18 years to 30 years respectively.

The factor analysis has been applied to understand the underlying dimensions of eighteen

Mobile Banking Usage Intention (MBUI) Variables and reduce them into a limited number of

manageable and independent factors. The Principal Component Analysis of Extraction Method

and Rotation Method of Varimax with Kaiser Normalisation has been used in the factor analysis

and the results are shown in the Table 1

Table 2 Factorisation of Mobile Banking Usage Intention (MBUI) Variables

Variance

Factor Mean

Mobile Banking Usage Intention Variables Communalities (Eigen Loadings Reliability

Names (SD)

Value)

Becoming skillful at using mobile banking is 3.73

0.603 0.766

Convenience Factor

easy for me (1.195)

Using mobile banking would improve my 3.53

0.559 0.745

performance (1.094)

(CF)

4.09 14.585%

I would find mobile banking useful 0.594 0.724 0.747

(0.996) (2.625)

I will always try to use mobile banking in my 3.83

0.700 0.595

daily life (0.923)

3.83

I would find mobile banking is easy to use (1.095)

0.563 0.578

3.97

Interaction with mobile banking is easy for me 0.695 0.811

Benefits Factor

(0.939)

4.23

Using mobile banking would save my time (0.935)

0.535 0.712

(BF)

13.335%

0.718

My living environment supports me to use 3.80 (2.400)

0.547 0.700

mobile banking (1.116)

3.92

Learning to use mobile banking is easy for me (1.039)

0.565 0.639

3.18

Using mobile Banking is very entertaining 0.682 0.803

Deliberation

(1.038)

3.09

Factor

Using mobile banking is fun 0.589 0.726

(DF)

(1.116) 11.243%

0.574

3.27 (2.024)

I must use mobile banking (1.090)

0.450 0.468

2.95

I am addicted to using mobile banking (1.376)

0.542 0.433

3.43 10.948%

Saf

ety

cto

Fa

F)

(S

I believe that mobile banking is trustworthy 0.689 0.790 0.612

r

(1.070) (1.971)

http://www.iaeme.com/JOM/index.asp 297 editor@iaeme.com

Sanuja Shree P.N, Dr. S. Gurusamy and P. Balaji

I believe that mobile banking keeps users’ 3.40

0.596 0.767

interests in mind (0.975)

The use of mobile banking has become a habit 3.19

0.427 0.523

for me (1.234)

I intend to continue using mobile banking in 4.69

0.671 0.792

Factor

Trust

(0.514)

(TF)

the future 9.114%

0.50

I believe that mobile banking keeps its 3.33 (1.641)

0.655 0.564

promises (1.058)

Total Variance = 59.225% - Meaningfully Extracted into 5 Dimensions

Cronbach’s Alpha Value = 0.756 of 18 items

KMO and Bartlett's Test

Kaiser-Meyer-Olkin Measure of Sampling Adequacy = 0.649

(Bartlett's Test of Sphericity Approx. Chi-Square : 632.650; Df = 153;P-Value = <0.001)

Tables 2 shows that the range of communalities of the eighteen mobile banking usage

intention variables is from 0.427 to 0.700 with KMO measure of Sampling Adequacy Value of

0.649 and Chi-Square value of 632.650 at d.f of 153 with P-Value of <0.001 in Barlett'sTest of

Sphericity supports that factor analysis is applicable for factorization of mobile banking usage

intention variables. Five factors have been extracted and they explain 59.225% of the variance

in the eighteen mobile banking usage intention variables.Thus all the mobile banking usage

intention variables have been reduced to five independent factors and the most dominant factor

is Convenience Factor (CF)followed by, BenefitsFactor (BF), Deliberation Factor (DF), Safety

Factor (SF)and TrustFactor (TF) in their order of dominance.

8. RELATIONSHIP OF MOBILE BANKING USAGE INTENTION

FACTORS

Correlation analysis has been applied to understand the relationship between the five dominant

factors of Mobile Banking Usage Intention variables namely Convenience Factor (CF) Benefits

Factor (BF), Deliberation Factor (DF), Safety Factor (SF) and Motivation Factor (MF) and

results are shown in table 3.

Table 3 Relationship of Mobile Banking Usage Intention Factors

Dimensions Mean (SD) F1 F2 F3 F4 F5

Convenience

19.00 (3.75) 1

Factor (CF)

Benefits 0.270**

15.93 (2.97) 1

Factor (BF) (0.002)

Deliberation 0.078 0.091

12.48 (3.08) 1

Factor (DF) (0.384) (0.310)

Safety 0.211* 0.231** 0.374**

10.02 (2.47) 1

Factor (SF) (0.017) (0.009) (0.000)

Motivation 0.204* 0.196* 0.392** 0.179*

8.02 (1.30) 1

Factor (MF) (0.021) (0.026) (<0.001) (0.043)

Table 3 indicates that all the mobile banking usage intention factors have significant

relationship between other factors except, Deliberation Factor (DF). Deliberation Factor (DF)

does not significant relationship with other mobile banking usage intention factors.

http://www.iaeme.com/JOM/index.asp 298 editor@iaeme.com

Perception of Youth Towards Mobile Banking Usage Intention – An Empirical Study

9. INFLUENCE OF PERSONAL AND BANKING PROFILE OF THE

RESPONDENTS ON MOBILE BANKING USAGE INTENTION

The Multiple Regression Analysis has been applied to study the significance of influence of

personal and banking profile of the respondents, on total Mobile Banking Usage Intention

(MBUI) and the results are shown in Table 4.

Table 4 Influence of Personal and Banking Profile of the Respondents on Mobile Banking Usage

Intention

F- β

Dependent Significant Mean Adjust P-

Valu R R2 (t-

Variable Predictors (SD) ed R2 Value

e Value)

Mobile

Banking 65.44 12.5 0.4 0.1

0.154

Usage (8.40) 91 09 68

Intention

-0.308

Occupational 1.50 <0.001

Status (0.869) (- **

3.780)

Major Source

of Information 0.269

3.25 <0.001

About Mobile (3.300

(1.734) **

Banking )

Service

Constant with t value of 35.044 at P Value of <0.001* - (Age (Years) (β = 0.038; t-value =

0.399; Sig = 0.691), Gender (β = 0.114; t-value = 1.397; Sig = 0.165), Marital Status (β = -

0.003; t-value = -0.035; Sig = 0.972), Nature of Family (β = -0.068; t-value = -0.802; Sig =

0.424), Educational Qualification (β = 0.106; t-value = 1.256; Sig = 0.212), Monthly Family

Income (Rs.) (β = -0.156; t-value = -1.885; Sig = 0.062), Nature of Bank Account (β = 0.085; t-

value = 1.035; Sig = 0.303), Frequency of Mobile Banking Usage (β = 0.031; t-value = 0.372;

Sig = 0.710) are Not significantly influencing the MBUI)

Notes: ** Significant @ 1% level

Tables 4 reveal that OLS Model has a goodness of fit for multiple regression analysis {F =

12.591, p<0.001}. Occupational status is most significant influence of total mobile banking

usage intention, followed by major source to information about mobile banking service and

they together account for 16.8% variation in it. Professionals and self-employed have higher

usage intention towards mobile banking compared to student and salaried employees and those

who opine social networks as a major source to know about mobile banking have higher mobile

banking usage intention compared to other sources. Other personal and banking profiles such

as, age, gender, marital status, nature of family, educational qualification, monthly family

income (Rs.), nature of bank account and frequency of mobile banking usage have no

significant influence on mobile banking usage intention.

10. MAJOR FINDIGS OF THE STUDY

• Majority of the respondents are males (68.8%), Singles (86.7%), hailing from nuclear families

(77.3%), Post-Graduates (54.7%) and Salaried (68.0) employees. The sizeable portion of the

respondents is earning monthly family income of Rs.15, 000 to 30, 000. Majority of the

respondents are customers of Public sector banks and maximum number of respondents are

using mobile banking at least on weekly (39.1%) basis and they opined that social network sites

are the major source to know about the mobile banking facilities.

http://www.iaeme.com/JOM/index.asp 299 editor@iaeme.com

Sanuja Shree P.N, Dr. S. Gurusamy and P. Balaji

• The average age of the respondents is 23.31 years with the standard deviation value of 2.477.

The age of the respondents ranges from 18 years to 30 years respectively.

• Mobile banking usage intention variables have been reduced to five independent factors and the

most dominant factor is Convenience Factor (CF)followed by, BenefitsFactor (BF),

Deliberation Factor (DF), Safety Factor (SF)and Trust Factor (TF) in their order of dominance.

• Occupational status is most significant influence of total mobile banking usage intention,

followed by major source to information about mobile banking service. Professionals and self-

employed have higher usage intention towards mobile banking compared to student and salaried

employees and those who opine social networks as a major source to know about mobile

banking have higher mobile banking usage intention compared to other sources.

11. IMPLICATIONS AND CONCLUSION

After the perusal of major findings of the study, it offers many suggestions and ideas to extend

the benefit to various beneficiaries in the Indian banking sector. The present study was aimed

at exploring the usage intention of mobile banking in the Chennai city. This exploratory study

exhibit customer perception with respect to usage intention on mobile banking.

This present study explores that bank customers have higher usage intention with respect to

mobile banking due to the growth of technology, internet connectivity and enhancement in the

socio-economic conditions of the customers. The regulatory authorities are suggested to

implement the new technological upgradation and block chain technology in delivering mobile

banking services to their customers to create safer and secure banking transactions (Alkhaldi,

A. N. 2017; Renu, D. P., & Singh, K. 2019). Banks are suggested to create awareness among

the customers to promote mobile banking through handsets and installation of live

demonstration counters at selected branches to adopt various promotional activities for

enhancement in digital literacy and financial inclusion along with other government schemes.

User friendliness and Users Awareness of Mobile Banking at large has to be thrusted at every

branch banking units to digitally promote awareness of Government Schemes such as, Jan Dhan

Yojana, Digital India, Licensing Small Finance Banks/Payment Banks, Aadhaar Enrollment

and etc. Banks can devise a new low-cost Android handset that can facilitate only

mobilebanking and deliver to all its customers as a part of Account opening kit. Banks must

create awareness among the smart phone users to use various mobile payment applications like,

BHIM, PhonePe, etc., to carry banking on their own palms.

To conclude, banks in India should design their services for the purpose of meeting their

needs and wants of the customers. Today’s customers are not afraid of technological adoption

due to the enhancement in the digital literacy and internet connectivity in their day-to-day life.

The customers are primarily use mobile banking for Convenience, Various Benefits of mobile

banking, Safety and Trust to make payments with better accessibility, connectivity and

controllability. Therefore, banks in India should come out with banking mobile application

which offers convenience, benefits, safety and security for the purpose of building the customer

loyalty and trust in adoption of mobile banking. Simultaneously, RBI should take necessary

steps to avoid various cyber crime frauds to create higher usage intention among the customers.

12. LIMITATIONS AND FUTURE DIRECTIONS FOR RESEARCH

Owing to time and cost constraint this research was restricted to its sample size to 128 mobile

banking customers in Chennai city of Tamil Nadu. Consumer behavioral researches are cannot

give long lasting and enduring findings over a period of time due to behavioral, cultural and

socio-economical changes among the society. This study was conducted among only the

customers of public and private sector banks of India. This study is adopted convenience

http://www.iaeme.com/JOM/index.asp 300 editor@iaeme.com

Perception of Youth Towards Mobile Banking Usage Intention – An Empirical Study

sampling for the study. convenience sampling cannot yield valid representation for the target

population.

This research can be extended for customer adoption towards various digital banking

practices in their day-to-day life. This study may be conducted among only private bank

customers or public sector customers or even comparative study between private and public

sector customers and their usage intention differences can be explored in the near future.

REFERENCES

[1] Zhu, K., Kraemer, K. L., & Dedrick, J, Information technology payoff in e-business

environments: An international perspective on value creation of e-business in the financial

services industry. Journal of management information systems, 21(1), 2004, pp 17-54.

[2] Alt, R., & Puschmann, T, The rise of customer-oriented banking-electronic markets are

paving the way for change in the financial industry. Electronic Markets, 22(4), 2012, pp

203-215.

[3] Dapp, T., Slomka, L., AG, D. B., & Hoffmann, R, Fintech–The digital (r) evolution in the

financial sector. Deutsche Bank Research”, Frankfurt am Main, 2014

[4] See-To, E. W., Papagiannidis, S., & Westland, J. C, The moderating role of income on

consumers’ preferences and usage for online and offline payment methods. Electronic

Commerce Research, 14(2), 2014, pp 189-213.

[5] Amin, H, Factors affecting the intentions of customers in Malaysia to use mobile phone

credit cards. Management Research News, 31(7), 2008, pp 493-503.

[6] Chakravarthi, N. (20th July, 2015). “India on the go – Mobile Internet Vision Report 2017”.

IAMAI & KPMG Report, 2015. URL: http://iamai.in/ media/details/3679.

[7] P. Sarika & S. Vasantha, Review on Influence of Trust on Mobile Wallet Adoption and its

Effect on Users’ Satisfaction. International Journal of Management, Technology And

Engineering, 8(12), 2018, pp 1731-1744.

[8] Rajanna, D. K, Perception and awareness of Customer towards cashless Transaction; a case

study. International Journal of Application or Innovation in Engineering and Management,

7(3), 2018, pp 33-38.

[9] Oliveira, T., Thomas, M., Baptista, G., & Campos, F, Mobile payment: Understanding the

determinants of customer adoption and intention to recommend the technology. Computers

in Human Behavior, 61, 2016, pp 404-414.

[10] Dasgupta, SIDDHARTHA. Paul, RIK., & Fuloria, Sanjay, Factors affecting behavioral

intentions towards mobile banking usage: Empirical evidence from India. Romanian journal

of marketing, (1), 6, 2011

[11] K. Suma Vally and K. Hema Divya, A Study on Digital Payments in India with Perspective

of Consumer’s Adoption. International Journal of Pure and Applied Mathematics, 2018

[12] Alkhaldi, A. N, An empirical examination of customers’ mobile phone experience and

awareness of mobile banking services in mobile banking in Saudi Arabia. Interdisciplinary

Journal of Information, Knowledge, and Management, 12, 2017, pp 283-308.

[13] Renu, D. P., & Singh, K, The Impact of E-Banking on the use of Banking Services and

Customers Satisfaction. International Journal of Trend in Scientific Research and

Development, Volume-3(Issue-4), 2019, p 20–23. doi:10.31142/ijtsrd23559

http://www.iaeme.com/JOM/index.asp 301 editor@iaeme.com

You might also like

- Mathscape 10 Ext PRELIMSDocument8 pagesMathscape 10 Ext PRELIMSHad Moe50% (4)

- Literature ReviewDocument4 pagesLiterature Reviewdivya100% (2)

- Afl Resource File - Tute NotesDocument22 pagesAfl Resource File - Tute Notesapi-443327549No ratings yet

- Reflection Paper For Module 2Document2 pagesReflection Paper For Module 2Allan Jr Pancho100% (13)

- Lab Name: Demonstration and Operation of 5KW Steam Power PlantDocument14 pagesLab Name: Demonstration and Operation of 5KW Steam Power PlantFarhan EdwinNo ratings yet

- The Lord of The Flies Week 1 PacketDocument14 pagesThe Lord of The Flies Week 1 Packetapi-260262236No ratings yet

- Ages and Timelines Lesson 1 RevisedDocument3 pagesAges and Timelines Lesson 1 Revisedapi-279405366No ratings yet

- Visual Research Method: Marcus BanksDocument3 pagesVisual Research Method: Marcus Banksnu_01001110100% (1)

- The Influence of Perceived Ease of Use (Case Study Bni Kcu Jakarta Pusat)Document14 pagesThe Influence of Perceived Ease of Use (Case Study Bni Kcu Jakarta Pusat)galangaNo ratings yet

- Paper 14Document5 pagesPaper 14VDC CommerceNo ratings yet

- Review of LiteratureDocument4 pagesReview of Literaturemaha lakshmiNo ratings yet

- I J M E R: Issn: I F: Ic V: Isi VDocument5 pagesI J M E R: Issn: I F: Ic V: Isi VNassyiwa Dwi KesyaNo ratings yet

- E PaymentDocument59 pagesE PaymentRajesh BathulaNo ratings yet

- Research Proposal ReportDocument5 pagesResearch Proposal ReportMEERA JOSHY 1927436No ratings yet

- The Perception of Trustworthiness That Influence Customer's Intention To UseDocument8 pagesThe Perception of Trustworthiness That Influence Customer's Intention To UseaijbmNo ratings yet

- Jurnal Ekononomi & Keuangan IslamDocument6 pagesJurnal Ekononomi & Keuangan IslamJEKINo ratings yet

- A Quantitative Research Determining The Consumers Awareness and Attitude Toward 1Document7 pagesA Quantitative Research Determining The Consumers Awareness and Attitude Toward 1roilesatheaNo ratings yet

- THE FACTORS INFLUENCING CUSTOMER USAGE OF MOBILE BANKING (Jordan) PDFDocument18 pagesTHE FACTORS INFLUENCING CUSTOMER USAGE OF MOBILE BANKING (Jordan) PDFCandra PelitaNo ratings yet

- The Intention oDocument12 pagesThe Intention onn58329No ratings yet

- 7175-Article Text-13093-1-10-20210522Document7 pages7175-Article Text-13093-1-10-20210522DIAZ, JHOESEIL S.No ratings yet

- A Comparative Study On Motives of Online and Offline Banking Consumers: A Case Study of Udaipur CityDocument5 pagesA Comparative Study On Motives of Online and Offline Banking Consumers: A Case Study of Udaipur Citybittu sahaNo ratings yet

- A Study On Customers Attitude Towards Mobile Banking in Kollam DistrictDocument10 pagesA Study On Customers Attitude Towards Mobile Banking in Kollam DistrictSebi JohnnNo ratings yet

- M 310106115Document10 pagesM 310106115aijbmNo ratings yet

- Perception of Youths About Ewallet (WDDocument6 pagesPerception of Youths About Ewallet (WDbarathssb21No ratings yet

- Exploring The Role of Trust in Mobile-Banking Use by Indonesian Customer Using Unified Theory of Acceptance and Usage TechnologyDocument10 pagesExploring The Role of Trust in Mobile-Banking Use by Indonesian Customer Using Unified Theory of Acceptance and Usage TechnologyNaveed AhmadNo ratings yet

- Determinants of Customers' AdoptionDocument27 pagesDeterminants of Customers' AdoptionKomeil GholamiNo ratings yet

- Nisha Rupinder M ServicesinIndia A Study On Mobile Banking and ApplicationsDocument9 pagesNisha Rupinder M ServicesinIndia A Study On Mobile Banking and Applicationskalpesh bhNo ratings yet

- Awareness of Customer With Reference To Mobile Banking Services in Bengaluru CityDocument6 pagesAwareness of Customer With Reference To Mobile Banking Services in Bengaluru CityTJPRC PublicationsNo ratings yet

- BSSS Journal of Commerce, Volume - XII, Issue-I (A Study of Bank Customer Experience in Relation To Technology Innovation in Banking)Document19 pagesBSSS Journal of Commerce, Volume - XII, Issue-I (A Study of Bank Customer Experience in Relation To Technology Innovation in Banking)pinky rajwaniNo ratings yet

- Conclusion, Implication, Limitation, and Suggestion For Further ResearchDocument38 pagesConclusion, Implication, Limitation, and Suggestion For Further ResearchDewa KagamineNo ratings yet

- Investigating Consumer Preference in Banking Services - A Conjoint Analysis StudyDocument11 pagesInvestigating Consumer Preference in Banking Services - A Conjoint Analysis StudyNahid Md. AlamNo ratings yet

- A Study of Consumer Behavior Towards E-Banking Services in Faridabad CityDocument9 pagesA Study of Consumer Behavior Towards E-Banking Services in Faridabad CityNguyễn Ngọc Đoan DuyênNo ratings yet

- A Study of Consumer Behavior Towards E-Banking Services in Faridabad CityDocument9 pagesA Study of Consumer Behavior Towards E-Banking Services in Faridabad CityNguyễn Ngọc Đoan DuyênNo ratings yet

- Determinant of Cashless in MalaysiaDocument11 pagesDeterminant of Cashless in MalaysiaHBC ONE SOLUTIONNo ratings yet

- Impact of E-Banking in India: Presented By-Shouvik Maji PGDM - 75Document11 pagesImpact of E-Banking in India: Presented By-Shouvik Maji PGDM - 75Nilanjan GhoshNo ratings yet

- A Study On Customer Satisfaction On Sbi Yono With Reference To Stonehouse Pet, Nellore.Document27 pagesA Study On Customer Satisfaction On Sbi Yono With Reference To Stonehouse Pet, Nellore.mohdmujeebahmed01No ratings yet

- Determinants of Intention To Use Islamic Mobile Banking: Evidence From Millennial GenerationDocument10 pagesDeterminants of Intention To Use Islamic Mobile Banking: Evidence From Millennial GenerationJEKINo ratings yet

- Mobile Banking AdoptionDocument28 pagesMobile Banking AdoptionOSAMA SHAKEEL 16300No ratings yet

- Journal AComparativeStudyontheUsageandConsumerDocument7 pagesJournal AComparativeStudyontheUsageandConsumerSakina Khatoon 10No ratings yet

- REVIEW OF LITERATURE On Mobile BankingDocument5 pagesREVIEW OF LITERATURE On Mobile Bankingirshad irshu50% (2)

- Factors Influencing The Usage of MobileDocument20 pagesFactors Influencing The Usage of MobileSofi KetemaNo ratings yet

- Factors Influencing The Usage of MobileDocument20 pagesFactors Influencing The Usage of Mobilemanoj kumarNo ratings yet

- Impact of Mobile Banking On Customers' Satisfaction: ArticleDocument10 pagesImpact of Mobile Banking On Customers' Satisfaction: ArticleOmar AlshamestiNo ratings yet

- Analysis of Perception of The Customers Towards Digitization of Banking SectorDocument11 pagesAnalysis of Perception of The Customers Towards Digitization of Banking SectorHARSH MALPANINo ratings yet

- DeodrantsDocument58 pagesDeodrantsriyazmaideen17No ratings yet

- Determinants of Intention To Adopt Mobile Banking Among Accounting StudentsDocument6 pagesDeterminants of Intention To Adopt Mobile Banking Among Accounting StudentsGJ MendozaNo ratings yet

- Emerging Trends in Banking Financial Services of Banking Sector in India With Respect To State Bank of IndiaDocument16 pagesEmerging Trends in Banking Financial Services of Banking Sector in India With Respect To State Bank of IndiaarcherselevatorsNo ratings yet

- SSRN Id3768429Document20 pagesSSRN Id3768429Rama SulaksanaNo ratings yet

- Customer Satisfaction in Selected Nationalized and Private Sector Banks in IndiaDocument12 pagesCustomer Satisfaction in Selected Nationalized and Private Sector Banks in IndiaNiranjan MurthyNo ratings yet

- Market Research Proposal AssignmentDocument4 pagesMarket Research Proposal AssignmentShadat Hossain ShakibNo ratings yet

- Factors Influencing The Adoption of Mobile Banking Services in BangladeshDocument36 pagesFactors Influencing The Adoption of Mobile Banking Services in Bangladeshtariqul21No ratings yet

- Safety and Security of Digital Transactions of Banking Sector: An Analytical StudyDocument12 pagesSafety and Security of Digital Transactions of Banking Sector: An Analytical StudyKartik KNo ratings yet

- ALSHIFA BankingsectoreDocument11 pagesALSHIFA Bankingsectoretebogoo chiveseNo ratings yet

- M-Banking Literature - FinalDocument6 pagesM-Banking Literature - FinalBalakrishna DammatiNo ratings yet

- The Role of Mobile Payment Apps in Inclusive Financial GrowthDocument23 pagesThe Role of Mobile Payment Apps in Inclusive Financial GrowthBabugi Ernesto Antonio ObraNo ratings yet

- Research Proposal On Mobile Banking - PDF 2 PDFDocument12 pagesResearch Proposal On Mobile Banking - PDF 2 PDFCRING VEDIONo ratings yet

- Research Proposal On Mobile Banking PDFDocument12 pagesResearch Proposal On Mobile Banking PDFKhalid de CancNo ratings yet

- Business Research Methods: Research On Awareness and Preference For Mobile WalletsDocument18 pagesBusiness Research Methods: Research On Awareness and Preference For Mobile WalletsPriyank agarwalNo ratings yet

- Thesis 1Document19 pagesThesis 1Marielou Cruz ManglicmotNo ratings yet

- Factors Affecting Mobile Banking Adoption Behavior PDFDocument25 pagesFactors Affecting Mobile Banking Adoption Behavior PDFAsnake MekonnenNo ratings yet

- Research Proposal On "Measuring Customer's Perception To MobileDocument10 pagesResearch Proposal On "Measuring Customer's Perception To MobileArif HossainNo ratings yet

- Paper - A Study On Mobile Banking Usage Pattern of ICICI Bank Customers1Document16 pagesPaper - A Study On Mobile Banking Usage Pattern of ICICI Bank Customers1Mallikarjun DNo ratings yet

- Wjarr 2024 0993Document7 pagesWjarr 2024 0993mcvallespinNo ratings yet

- 108am - 2.epra Journals 5833Document5 pages108am - 2.epra Journals 5833roilesatheaNo ratings yet

- About e WalletDocument8 pagesAbout e WalletSavitha VjNo ratings yet

- BEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYFrom EverandBEHAVIOURAL INFLUENCE OF SELF-SERVICE TECHNOLOGY IN MANAGING INTERFACE IN THE AVIATION INDUSTRYNo ratings yet

- 2013 Specimen Paper 1Document14 pages2013 Specimen Paper 1vijthorNo ratings yet

- English Month ScriptDocument1 pageEnglish Month ScriptFortune Angel BonotanNo ratings yet

- Speech 001 Persuasive SpeechDocument9 pagesSpeech 001 Persuasive Speechapi-263312360100% (1)

- File Imo Sample Papers Class 2 1569924248Document20 pagesFile Imo Sample Papers Class 2 1569924248navinthgokul100% (4)

- OPSM501 - S23 SyllabusDocument9 pagesOPSM501 - S23 SyllabuskartalNo ratings yet

- WBUT Affiliation Process PDFDocument62 pagesWBUT Affiliation Process PDFAniruddha GuptaNo ratings yet

- 2016 - 2017 Precalculus and Honors Precalculus Pacing GuideDocument20 pages2016 - 2017 Precalculus and Honors Precalculus Pacing GuideFady HerminaNo ratings yet

- Flexible Instruction Delivery Plan (FIDP) : F A A FAA F L S FLSDocument8 pagesFlexible Instruction Delivery Plan (FIDP) : F A A FAA F L S FLSaira lizaNo ratings yet

- Christina Pellegrino: ObjectiveDocument2 pagesChristina Pellegrino: Objectiveapi-269473546No ratings yet

- Article Teyl Habiib MaulanaaDocument7 pagesArticle Teyl Habiib MaulanaaHabib Maulana OnceNo ratings yet

- Placement Review - FinalDocument62 pagesPlacement Review - FinalRavi ShankarNo ratings yet

- Rica Mhel Joy L. Degamo Lll-Jupiter A Short History of ProbabilityDocument1 pageRica Mhel Joy L. Degamo Lll-Jupiter A Short History of ProbabilityAlfred ReyesNo ratings yet

- Paramedical E-BrochureDocument4 pagesParamedical E-BrochureMohil DaveraNo ratings yet

- Motivation LetterDocument2 pagesMotivation Letterfida ullahNo ratings yet

- Intervention For Communication DisorderDocument2 pagesIntervention For Communication DisordersinghsanyaNo ratings yet

- CORDIS UK-Israeli Academic Ties DatabaseDocument202 pagesCORDIS UK-Israeli Academic Ties DatabasestudentpalestineconfNo ratings yet

- Reading7th 2 - Ready D Complete and AdptedDocument3 pagesReading7th 2 - Ready D Complete and AdptedRosa Maria Sá RibeiroNo ratings yet

- 1803 5561 3 PBDocument8 pages1803 5561 3 PBGlenn Vincent Octaviano GuanzonNo ratings yet

- ABM Applied Economics CGDocument5 pagesABM Applied Economics CGrichkeaneNo ratings yet

- Advt. No. 7-2019 - 0Document10 pagesAdvt. No. 7-2019 - 0Aneel kumarNo ratings yet

- CartexDocument30 pagesCartexRasaraj DasaNo ratings yet

- Grade 6 Social Studies Curriculum PDFDocument8 pagesGrade 6 Social Studies Curriculum PDFhlariveeNo ratings yet

- Deepak Bisaria 11th HouseDocument4 pagesDeepak Bisaria 11th HousebhaumiksauravNo ratings yet